Re-registering a business to another person - is it possible?

Running a business on your own in the Russian Federation is quite difficult, because it requires a huge amount of physical effort and financial costs. Not every entrepreneur can handle such a load, which is why so many small companies, unable to keep up with the pace, cease to exist for various reasons. Absolutely every organization has equipment and property on its own balance sheet; they all have a staff of workers. In addition, many of them have debts, outstanding fines, and problems with the tax service, which are not an easy task to resolve. In such a situation, entrepreneurs begin to look for ways to solve their problems and often wonder how to re-register an individual entrepreneur to another person and whether this can be done in principle.

Is it possible to re-register an individual entrepreneur to another individual entrepreneur and what is needed for this?

If a businessman decides to transfer the business to another person, then re-registering the individual entrepreneur to another individual entrepreneur will not work. If we evaluate the situation legally, an individual entrepreneur is considered to be an individual who has successfully completed the registration procedure legally and who already has some form of enterprise. For this reason, any attempts to re-register a business with the tax service to another person will be contrary to the law. In this case, you will need to voluntarily liquidate the company, and after that, perhaps, draw up documents for another individual and register him as an individual entrepreneur. Attention: In any situation, before re-registering an individual entrepreneur to another individual, the current owner is obliged to close the case and provide data about this to the tax service. The next owner must collect a set of documents, go through the registration procedure as an individual entrepreneur and begin work.

Submission of documents

To implement a procedure of this type, it will be necessary to prepare a fairly large list of various documents.

The entrepreneur will need to submit the following documents to the registering institution:

| application in the form established by law | it is important to remember that at the moment the format adopted in 2013 is valid (the application must be stitched and numbered accordingly) |

| a copy of the first pages of the identity document | passports of a citizen of the Russian Federation, registration |

| copy of individual tax number | the businessman himself |

| in case the change of surname or other details occurred due to marriage | required to provide a marriage certificate |

| when re-registration is carried out when changing the last name, first name or patronymic | You will need a document confirming this information |

Special attention should be paid to copies of documents that confirm the very fact of registration of an individual as an individual entrepreneur.

The list of this type of documents today includes the following:

- extract from the Unified State Register of Legal Entities;

- certificate confirming the fact of state registration;

- notification that the entrepreneur has registered with the state.

After the expiration of the period allotted for the consideration of all documents submitted in this case, the entrepreneur will be given the following papers:

- an extract from the Unified State Register of Legal Entities confirming that all necessary amendments have been made;

- certificate confirming the fact that all required amendments have been made.

It is important to remember that there are a large number of different nuances directly related to the reason for re-registration. Depending on this, the list of documents required in a particular case, as well as other points, may change.

To register an individual entrepreneur for another person, you need to collect the following documents:

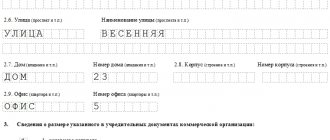

— an application to the tax service, drawn up in the prescribed form (can be sent electronically); — certificate of payment of the state duty for state registration; - a document about the location of the property or an address certificate. If the document is issued electronically, you must also enter your passport information. Important: Documentation can only be submitted to the department where the individual entrepreneur was registered, and only this department can make adjustments and deregister the case.

Things to keep in mind:

— if the previous owner of the enterprise (IP) has an outstanding debt (fine, penalty), the business cannot move to another IP; — a Russian must inform his creditors (debtors) and partners about all changes, including details; — the new individual entrepreneur is a completely different person, which means that it is necessary to re-register existing agreements with the introduction of additional agreements.

Don’t forget when changing your IP address

Re-register the cash register

Please note that you only need to re-register the online cash register if you are installing it in another location. That is, if you move, but the retail outlet with the cash register remains in the same place, re-registration is not necessary.

If you are moving the cash register to a new address, you need to submit an application using form KND1110021. Please attach an agreement with the fiscal data operator to your application.

Renew your license

Licensing authorities must be notified of the change of address. To do this, check with the government agency that issued the license whether there is a special application form for such a case. If not, make a free-form application. It must be submitted within 10 days after the change of address. Please attach a copy of your passport with a stamp confirming your new registration to your application.

Re-registration of an individual entrepreneur is a necessary measure if:

- the real owner of the individual entrepreneur has changed his place of residence and registration; — the current owner has changed his gender (one of the grounds for re-registration with the Federal Tax Service); - his last name, first name or patronymic have been changed; - he became a citizen of another country; — adjustments were made to the area of activity; — inaccuracies were discovered in the Unified State Register of Individual Entrepreneurs (incorrect address, information, etc.), not even through the fault of the person undergoing registration.

Attention: Data must be provided to the tax service within 3 days from the date of change of personal data. When transmitting data by mail, the countdown starts from the moment of sending. Otherwise, for failure to comply with the deadlines for providing documentation, penalties in the amount of 5 thousand rubles are provided (prices valid at the end of last summer).

All information indicated in the tax service register must be verified on site.

Check duration

Information about the registered individual entrepreneur is processed within 5 days. On the sixth day, the entrepreneur has the right to receive new documents that confirm the presence of various changes in the field of activity or personal information.

Which method do you prefer:

— go through the procedure yourself; — the law allows for the re-registration of a former individual entrepreneur to another individual with the involvement of third parties acting by proxy. In this case, the document must be notarized.

Important: If for some reason none of the methods is suitable, you can re-register the documents by sending them by mail. The letter is declared valuable and sent with accompanying notification. Before sending, all documentation is certified by a notary and listed in the inventory.

Other available business transfer methods

Change of tax office

Ideally, the change of tax office should be carried out no more than three weeks from the moment the registration was changed, and the Pension Fund of Russia body is only seven days longer geographically.

But, unfortunately, the expected time frame may extend over a longer period and tax registration in a new location will take extra time.

We recommend you study! Follow the link:

How to become an individual entrepreneur

Based on this, in order not to remain in limbo between funds and inspections, you should not provide a passport for “registration” to the FMS in a situation where the deadline for paying taxes and submitting all reports is already coming to an end. It is important to check that the date of making the changes coincides with the required one, as otherwise fines will be imposed.

But, when a citizen has already moved, and the time to pay contributions and taxes has already come, but the businessman is not registered with the Federal Tax Service and funds in the new location, it is not worth paying. Since it will be easier to pay the money, including penalties, after new details are given, than to try to return taxes already paid that went to the wrong place.

But you shouldn’t wait too long; the best solution would be to independently find out the details of why the data was not transferred to the relevant authorities. You should call periodically to find out whether the delivery has been registered.

The entrepreneur should know that if during the inspection it turns out that the registration of the individual entrepreneur at the specified address has changed, that is, he is no longer there, certain penalties will be applied, for example:

- refusal to deduct VAT;

- fines;

- blocking of accounts.

The registration address is changed when moving to a new one, which must be reported to the appropriate department of the Federal Tax Service, that is, at the place where the individual entrepreneur was registered earlier. After which the information is transferred for control to the department of the Federal Tax Service where the individual entrepreneur is now located.

It is advisable that the entrepreneur notify the Federal Tax Service about the re-registration of the individual entrepreneur in advance. This is simply necessary, since the transfer of all documentation will take a long time.

An automatic notification system about a businessman’s registration is also provided for the statistics office and for other funds. Based on the ninth paragraph of the Rules for Providing Information, all necessary data is transferred to the relevant authorities to the tax office, but the period for this is five days. It begins to be calculated a week after the corresponding entry is made in the Unified State Register of Individual Entrepreneurs about a change in the individual entrepreneur’s registration address.

Experts say that after twenty days from the moment the entrepreneur changed his registration, all government agencies will be notified, but as practice shows, it is better to do this yourself or try to control the entire process.

How else is it allowed to transfer IP to another person:

— as an alternative option (and also if for some reason it is impossible to re-register an individual entrepreneur), executing a purchase and sale transaction is suitable. To simplify the procedure, the company can be sold in parts. In this case, it is important to remember that if the alienated property (premises, cash registers, vehicles, equipment, which may have a fairly high cost) was purchased during marriage, the spouse must give consent to the transaction. Otherwise, the dissenter files a lawsuit and the property is transferred back to the claimant by judgment; - under a gift agreement.

Both options provide for documentation and entry into law.

So, it is impossible to simply re-register an individual entrepreneur to another person (even if the entrepreneur has died), however, there are alternative ways to transfer the business to another person. Every businessman makes an informed choice taking into account the current situation. At the same time, it is important to evaluate all the advantages and disadvantages of the chosen option so as not to be disappointed in the final result.

Can an individual entrepreneur move to another country?

What to do if an individual entrepreneur wants to leave Russia? In the case of other countries (be it the former USSR, Europe or North America), everything is a little more complicated than with moving from Moscow to St. Petersburg.

Why might there be difficulties? The thing is that state registration of an individual entrepreneur is carried out at his place of residence, and information about the actual address of the entrepreneur must be indicated in the Unified State Register of Entrepreneurs. And in this case, the problem with these simple rules is that when moving for permanent residence to another country, every Russian must be deregistered at his place of residence in Russia (“disregister”).

Consequently, when you officially move abroad, you will have to say goodbye to the status of an individual entrepreneur - if you are deregistered at your place of registration in the Russian Federation, you will not be able to remain registered as an individual entrepreneur in Russia.

Who can’t do without turnkey re-registration

This process is necessary for those who intend to give legal form to market activities in the easiest way. The advantage of this procedure is the ability to pay a single tax, which allows you to save on tax payments, thereby simplifying reporting. There is no need to have a legal address, a regular registration will suffice. There is also no requirement to have an authorized capital.

An individual entrepreneur, if there are problems, pays smaller fines to regulatory authorities than a legal entity. And the liquidation process for individual entrepreneurs is recognized as one of the simplest.

But it is worth knowing that the law also provides for restrictions on working capital for individual entrepreneurs. As a result of a losing enterprise, you will have to answer with all your existing property.

Foreign citizens can be registered as individual entrepreneurs, but only if they have permission to conduct business activities.

Possible difficulties

Changing a legal address is a difficult procedure in legal terms, since an entrepreneur will have to deal with some subtleties of legislation and legal practice when resolving this issue. Difficulties in the re-registration process:

- Change of tax office . The difficulty lies in the fact that the individual entrepreneur needs to reconcile the execution of all financial transactions.

- Double payments can occur as a result of the fact that documents left one branch, did not arrive at another, and were not officially transferred to a new address. Therefore, the next payment can be charged in 2 places.

- Changes in documentation . When changing the address, changes are made to the company's Charter and constituent documents.

- Delays in the transfer of registration data from one branch of the Federal Tax Service to another. This happens for objective reasons: the business of an individual entrepreneur has a multifaceted structure associated with the implementation of numerous financial transactions, so it is important not to miss the details during the transfer.

If an entrepreneur has registered an enterprise not at his residence address, but has purchased premises, then unpleasant misunderstandings may arise about the unreliability of the new address. Before purchasing, it is necessary to check whether the new address is on the “black” list of the Federal Tax Service, otherwise the re-registration of the company will be refused. There is a possibility that the tax inspectorate will take administrative penalties against the individual entrepreneur.

How to change the registration address of an individual entrepreneur (video)?

This video describes the procedure for changing the registration address of an entrepreneur, what documents will be required and what government services should be visited.

Thus, given the complexity and duration of the procedure for re-registration of an individual entrepreneur when changing the legal address, it is recommended to enlist the support of a qualified lawyer or resort to the help of a law firm that will perform redirection on a turnkey basis. Although you can carry out this procedure yourself, without outside help.

Features of re-registration in Crimea

After the adoption of Law No. 6-FKZ on March 21, 2014, Russia recognized the Republic of Crimea and the city of Sevastopol as part of its territory. From this moment on, registration of legal entities and individual entrepreneurs must occur in accordance with Russian legislation. It is possible to enter information into state registers - the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs. Until January 1, 2020, no state duty was charged when registering legal entities and individual entrepreneurs.

In the absence of documents confirming registration in Ukraine as a legal entity or individual entrepreneur, these persons must provide an extract from the Unified State Register of Ukraine. It is not possible to obtain it due to limited access to the registry. The Unified State Register is a nationwide database, so you can request the document of interest from any state registrar on the territory of Ukraine. However, in accordance with Law No. 124-FZ, adopted on May 5, 2014, the extract is not included in the list of documents required for re-registration of individual entrepreneurs in Crimea.