Document year: 2019

Document group: Help

Document type: Help

Download formats: DOC, EXCEL, PDF

An accounting certificate of wages is a sample of documentation that is used to confirm the income of an individual citizen. Depending on the location of the requirement and the template, the average earnings are calculated or the monthly value of the amount of income is given, including and without taxes.

Let's talk in more detail about the established forms of income certificates, what is reflected in the documents, how to write a salary sample for different structures, what legislative norms govern the certificate.

Read the article: at the end we’ll talk about common mistakes.

You can download the required salary certificate forms for free.

Why do you need a certificate?

A citizen may need to certify wages on paper in many cases. Basic:

- As part of the package of documents for obtaining a visa when applying to the consulate. Often, a sample certificate is made in free form, taking into account the requirements of the consulate. Salary values for the last three to six months are indicated, including and without taxes. The form itself also states the position of the visa applicant and the date from which he was officially employed by the company.

- For lending to banks and other financial companies. A salary certificate is one of the mandatory documents that proves the solvency and financial stability of the borrower. It may be required in three forms: standard 2-NDFL for individuals (for individual entrepreneurs, a sample salary certificate will be 3-NDFL), according to a banking sample (such as, for example, is available in Sberbank) and according to the sample of the employing company (requested least often ).

- To contact the Employment Center (ECC). The document is made according to the recommendation form of the Ministry of Labor, but other templates are also permitted in compliance with the requirements of the law. Therefore, a certificate on the employer’s letterhead is often used (all documents can be downloaded for free on the Internet). To register at the labor exchange, a salary certificate is not required. Information about the past income of an unemployed person will be needed to correctly calculate cash payments from the central payment center to those on the exchange. Therefore, it is in the interests of the person himself to request a certificate of previous income so as not to receive the minimum benefit.

- Certificate of actual earnings received for the last two years. The paper is handed over to the place of request to calculate the necessary payments from the new employer. A salary sample is issued on the day of dismissal from the previous employer using the unified form 182n.

- To handle court cases. For example, when assigning alimony payments. A certificate from the employer according to his form is suitable, but with the obligatory indication of details and seals.

- To calculate subsidies. Depending on the total family income, you can receive benefits for utility and rent payments. To confirm your total income, you need to bring papers on the income of all family members.

- Salary certificates from the place of work for obtaining installment plans for the purchase of goods, processing of commodity loans. Samples of papers from the employer are used, and the actual salary received for the last three or six months is calculated.

Dates of issue and validity

After the employee submits the application, management must return the completed form within a maximum of three days. The application must describe in detail the following characteristics:

- Type of design.

- How many copies?

- Links to articles of legislation on labor and taxes. There you can also find an explanation of what a certificate in form 2NDFL is.

The recipient must also indicate for what purpose he is asking for information about the funds paid to him. And the validity period is determined depending on the purpose and where exactly it is sent:

- For embassies. It all depends on the legislation of the country where the procedure is carried out. In many cases, current statements with information on bank accounts are sufficient. Typically the validity period is within 10-30 days. But there are also some exceptions. For example, to travel to France, proof of income for at least the last six months is required. It is better to contact the embassy staff in advance to clarify this issue. Then there will be a greater chance of avoiding misunderstandings and you will be able to find out exactly what rules to use to fill out an income certificate.

- To the tax service. In this case, there is simply no expiration date. They even accept information from previous years. The document is not urgent.

- If you contact bank employees. They talk in detail about how to fill out income certificates.

This is interesting! What is an apartment mortgage?

When applying for a loan, statements are valid for only one month. The deadline is tied to the date when the application was submitted. After all, the lender must receive the most reliable information about what funds have been received by the client recently. But there are exceptions. For example, some organizations say that information is only valid for 10 days.

Note! The sample for social protection and other authorities in most cases remains standard.

For what period is the document filled out?

The period for filling out depends on the form and requirements of the institution for which the certificate is being prepared.

Typically, the salary in the sample certificate is indicated for the last three or six months of work. This information will suffice:

- for creditors (banks, financial companies);

- to obtain a Schengen visa, contact foreign consulates;

- to register on the unemployment exchange.

A longer period is indicated in certificate 182n - two full years before dismissal. If an employee quit on July 18, 2020, then the certificate will include information about earnings for January-July 2020 and the previous two years: full 2020 and 2017.

Also, the documents may indicate different salary values. Again, it depends on the requirements of the place where the certificate is submitted.

Either this is a transfer of the amount of a citizen’s income for the last few months, or a calculation of average earnings. The latter is used to submit a certificate form to the Employment Center. In 2019, a sample recommended by the Ministry of Labor or a form with a company designation is used.

What the law says

The regulation of legal relations between an employee and an employer is carried out by the Labor Code of the Russian Federation (LC). There, for example, it is established that a sample certificate of average monthly salary is prepared in only three days. After this period, the paper must be given to the applicant.

Responsibility for failure to issue documents or provision of false information – by the Code of Administrative Offences.

Certain regulations establish certain forms and requirements for their completion and execution.

| Standard 2-NDFL | Order of the Federal Tax Service with amendments dated October 2, 2018 (changes take effect from January 1, 2020) Tax Code of the Russian Federation |

| Certificate in form 182n | Order of the Ministry of Labor and Social Protection of the Russian Federation of April 30, 2013 N 182n |

| Paper for digital signage | Letter from the Ministry of Labor of the Russian Federation on the establishment of a recommendation form for a certificate of average wages in the central labor center dated August 15, 2020 (it can be downloaded for free) |

| Local regulations of companies, regional regulations | Establishment of regional norms. |

In fact, the Legislation contains a lot of regulations that directly or indirectly regulate the process of issuing and issuing certificates.

What is it for?

It is created so that regulatory organizations can receive timely information regarding a citizen’s earnings. This is important, for example, for the taxation system.

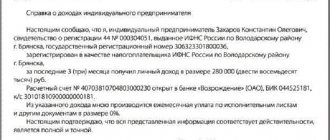

Such documents in our country have a special form, which is designated as 2NDFL. It is compiled on the basis of information related to the profit received by a particular person. It will not be difficult to obtain a form of this form.

In a standard situation, documents are issued by employers as soon as a corresponding request is received from employees. Salary information must be confirmed by the seal of the organization and the signature of the chief accountant. If this specialist is absent from the workplace, the employer performs the same function. He also issues an income certificate form and a sample to fill out.

Document requirements

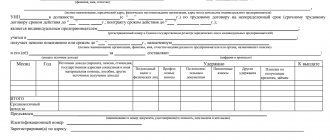

Regardless of the sample filling, any certificate of salary or average earnings indicates:

- details of the hiring company. Required: full name, legal address, taxpayer code and economic activity code;

- identification of the citizen whose income is indicated in the certificate. Here, your full name and date of birth are sufficient; you may need to indicate your Taxpayer Identification Number (TIN), and in rare cases, passport details and citizenship (in form 2-NDFL, for example);

- indication of income. For regular certificates, you can present the information in a tabular form: transfer of accrued salaries for each month, the amount of tax and income excluding income tax;

- signing of the certificate by the chief accountant and the manager. The free form sample also contains the artist’s details on the paper.

Specific requirements must be clarified in regulatory documents and directly with the institutions for which the certificate is being prepared.

Instructions for filling out a salary certificate

The certificate is often filled out by the company's payroll accountant. Therefore, the responsible executive is responsible for how to correctly write a salary certificate.

A sample salary certificate is filled out in the following order.

Indication of company details and taxpayer number. Information about the employer is written down in the header of the certificate; often the full name, organizational and legal form, and code of economic activity (without decoding) are enough.

Indication of the full name of the employee for whom the certificate is being drawn up. If this is provided for in the certificate form or requirements, passport data and citizenship information are also recorded.

The period of work of the employee and the date from which the employment agreement or contract was signed with him must be specified. So, in the recommendation form of a certificate from the Ministry of Labor, which indicates the salary for the last 3 months, you also need to indicate how many full weeks the employee worked over the last year.

In the salary information block, information about the employee’s income is recorded: one amount if the current average earnings are used for the calculation, 3 or 6 amounts if you need to indicate income for the last 3-6 months.

If a salary certificate is drawn up according to the recommendation form of the Ministry of Labor for the Labor Center, periods that are not included in the calculation are indicated at the end of the certificate.

The document is endorsed by the manager and chief accountant. A telephone number is provided for inquiries. If an accountant has questions, he can use a sample for filling out a salary certificate.

Preparation of data for reporting

Such information is often compiled for the entire enterprise in order to report to the tax service.

- For all individuals who made a profit during a particular reporting period.

- For each citizen from whose salary taxes were withheld according to the standard scheme. Then a certificate of income for 6 months is required, a sample of which will not be difficult to find.

In this case, filling out involves using the following information:

- Total income during the reporting period, as well as total data on fees to the budget and profits.

- Amount of tax deductions.

- Monthly income. The time taken into account is until taxes are written off from profits to the state budget.

- Information about the person to whom the individual entrepreneur’s income certificate is provided.

- General information regarding the enterprise.

When issuing such documents, only the Labor and Tax Codes are used as the legislative basis.

In any case, the main basis remains the employee’s written statement. It is acceptable to use a free form when drawing up applications and income certificates; samples will confirm this.

Official papers are issued either personally to the addressee, or by mail, indicating the address where a particular citizen lives.

Copies that do not bear the signature of an authorized person are considered invalid.

This is interesting! How to return loan insurance after repayment or early payment

Typical mistakes when filling out

Typical errors in salary certificate samples are related to the human factor:

- typos;

- spelling and other errors;

- confusion with TIN: often the contractor confuses the employer’s code with the employee’s code;

- lack of indication of the economic activity code or its incorrect indication;

- incorrect calculation of accrued wages and average earnings;

- using the wrong sample certificate (instead of 2-NDFL, the contractor provided the applicant with standard information on letterhead);

- not filling in all required details;

- absence of signatures of responsible persons from the employer.

The certificate may not be accepted if the document contains corrections and corrections, printing defects (if the paper is in printed form), or unreadable data (if the paper was filled out manually).

You can download the certificate for free: form for the Central Employment Tax Office on wages for 3 months, standard 2-NDFL, form 182n. Use templates for different life situations.

The article is over, but you still have questions? Ask them to our duty lawyer via chat.

Responsibility for evasion

In total, there are two positions for situations when an organization deliberately avoids issuing documentation:

- Administrative fines for responsible persons, as well as for the administration. Or the activities of the enterprise are frozen for a period of three months or more.

- Only an administrative fine for an official in the amount of 1-3 thousand rubles. A certificate in the bank form requires compliance with slightly different rules.

Inaccurate information provided may result in dismissal. But such consequences do not always appear.

In addition to other disciplinary measures, management may well limit itself to a reprimand or warning due to the lack of a free-form salary certificate at the enterprise.

If the manager is guilty, then such measures are applied in practice only after an appropriate on-site inspection has been carried out.

It is organized by the founding body of the enterprise. The basis for verification is the information that can be provided:

- through the media,

- government services that are responsible for the prevention of corruption and other offenses,

- law enforcement agencies and other institutions. They sometimes check the bank's certificate.

In practice, there are still cases when managers are fired due to the fact that inaccurate information was provided.

How to fill out an income certificate correctly