When and why to open a joint stock company

The organizational forms of legal entities differ from each other, the most common of them is considered to be JSC, that is, Joint Stock Company. The capital in it is divided depending on the value of the shares. Those who wish to deposit their funds and receive a number of papers that is proportional to the transferred amount. Shares are needed to share profits and losses between the parties to the transaction. The paper records the owner's contribution to the company's successes and failures, determining the level of his responsibility. By definition, a joint-stock company is a company whose capital is divided into shares, which are determined by the number of shares.

Advantages of JSC:

- unlimited validity period;

- raising funds from persons who do not interact with the company;

- the rights of participants are limited to the amount they contributed;

- shares can be sold;

- income is summed up from many shares;

- the opportunity to sell shares on unfavorable terms.

The company is managed at a meeting of shareholders. This provokes a conflict of interests, especially between owners of large and small shares.

Negative aspects of OJSC

The organizational form of an OJSC also has some disadvantages that appear during its activities. The most serious problem is double taxation. The fact is that an enterprise must pay income tax, and then transfer a percentage of dividends to the state budget. If tax rates are high, then the existence of a society is quite expensive.

A negative aspect of OJSC is also considered to be insufficient flexibility and efficiency in decision-making by the management of the enterprise, and even the possibility of transferring control over the company into the hands of competitors.

What is a public joint stock company

JSC is divided into PJSC and NJSC, that is, public and non-public companies. A public joint stock company places its shares in the public domain for trading. A non-public form of management allows you to change the shares of shareholders with their consent and does not oblige the company to put shares up for sale. A public joint stock company is:

- attracting investors;

- offering them a share;

- unlimited number of participants;

- the right of shareholders to alienate shares.

Until 2014, PJSC was called OJSC, that is, Open Joint Stock Company. Not only the name has changed, but also the responsibilities of the organization. PJSC differs from JSC in the following parameters:

- Activities of the board of directors. When the number of shareholders exceeded 50, it was necessary to create a board to make management decisions. In a PJSC, a council is always required (from 5 people).

- Charter The rights of shareholders of a PJSC are fully regulated by federal law, while the JSC allowed additional clauses to be prescribed in the charter.

- Data Disclosure. PJSC has the right to draw up documents with the Central Bank that will allow it to hide the shareholder’s data, despite the request. This was not the case at JSC.

- Certificates. A PJSC requires a document that confirms the decision made by the board of directors.

A PJSC can support different forms of ownership, but the key feature of the organization is the circulation of shares on financial markets.

What changes when a company becomes a PJSC instead of an OJSC?

The method of creating authorized capital will change. The governing bodies will have to work differently. There will be no visible changes for ordinary employees, only the entry in the contract will change.

Nothing except the names of documents will change for those who use the company’s services. So, if KAMAZ is now called PJSC, the operational characteristics of the trucks it produces will not improve.

If we consider the issue from a legal perspective, the differences between the concepts of PJSC and OJSC are expressed in several important points:

- Activities of the Board of Directors. For an OJSC, the presence of this governing body was mandatory when the number of its shareholders was above 50. For a PJSC, the presence of a Council was mandatory for any number of shareholders. According to the rules, this body includes at least 5 people.

In the absence of the Council, management functions were assumed by the General Meeting of Shareholders, which is much more difficult to organize than convening a meeting of the Council. Moreover, the holding of the General Meeting is regulated by the Federal Law on the activities of joint-stock companies.

- Articles of association. The charter of the OJSC stated that shareholders have preferential rights to purchase an additional issue of securities. PJSC references to special clauses of the charter are not allowed; all its activities are regulated by the Federal Law (federal legislation).

- Financial Disclosure . OJSCs were required to fully disclose information about their activities. Such information included financial statements, reports on meetings, reports on the activities of the company itself. Incomplete disclosure provided for administrative liability. With PJSC the situation is significantly different. The company may apply to the Central Bank for a temporary waiver of full disclosure of information. If the Central Bank finds grounds for this, the organization will be able not to disclose the information.

- Certification of decisions of the General Meeting. For the OJSC in this case, only the completed minutes of the meeting were sufficient. Identification has become mandatory for PJSC, without which all decisions made are not considered valid. The registrar must certify the decisions. This is a specialized organization whose main function is to maintain a register.

Important! Those JSCs that have not yet changed their name must already adhere to the legal norms provided for PJSCs. If the JSC becomes non-public, it will be able to prescribe in its charter also regulatory norms not provided for in the Federal Law.

When a JSC is recognized as public

Instead of the old concepts of “closed” and “open” society, new terms were introduced in 2014: “non-public”, “public”. The Civil Code states that a public joint stock company is one whose shares (or securities convertible into shares) are publicly traded and are available for unlimited access. Organizations that do not meet this requirement automatically receive “non-public” status. The “openness” of a society is defined as follows:

- The main condition for open circulation of shares is considered to be the presence of a plan, that is, a privatization prospectus, which regulates the issue of shares. The plan is officially registered.

- The presence in the plan of clauses on the free sale of securities indicates the publicity of the joint-stock company.

The above features of a PJSC are described in Art. 66 Civil Code. Compliance with these points makes the organization public. Public joint stock company:

- works openly;

- minimum capital of 100 thousand;

- a board of directors is required;

- full disclosure in normal cases;

- the data is confirmed by the registry holder;

- no one’s approval is required to alienate shares;

- shareholders do not receive bonuses when purchasing securities;

- there are no restrictions on the number of shares;

- It is impossible to place “special” paper when its cost is lower than the standard one.

Non-public joint stock company:

- works closed;

- minimum capital of 10 thousand;

- it is not necessary to assemble a board of directors;

- are not required to disclose data;

- the duties of a shareholder can be performed by a notary;

- consent to alienation is not required;

- the rights of shareholders are specified in the charter;

- restrictions are specified in the charter;

- placement of “special” shares even when their price is lower than the standard one.

Public joint stock companies must also change their name from OJSC to PJSC; for closed ones this requirement is not necessary.

Distinctive features of the JSC

All communities have their own distinctive features, including JSC. The form of ownership of this meeting is determined by the following points:

- Due to the fact that the sale of shares in such a community is possible only between its participants, as well as proxies, and the circle of these persons cannot exceed 50 people, the capital of the closed joint-stock company will be significantly less when compared with an open company, for example.

- In a closed joint stock company there is a rule that states that members of the community have the first right to purchase shares. The sale of securities to other persons is possible only if all shareholders have refused to purchase this package of documents. However, in order to make such a decision, it is necessary to hold a so-called quorum, at which the majority of holders of the company's shares will be present.

- There are only a few ways to increase the capital of a community such as a closed joint stock company. The first is possible additional contributions from shareholders. Capital may also increase if the property owned by the congregation increases in value. There is a third option, which suggests that it is possible to increase capital with the involvement of third parties, but this possibility must be spelled out in the charter of shareholders.

- The last thing is correct and constant legal support and execution of all documents of a closed joint stock company. The community needs this from its very creation until its liquidation.

Constituent documents and participants of PJSC

A PJSC must officially indicate the openness of the company. The main constituent document is the charter. It records:

- Name;

- shareholders' rights;

- size of the authorized capital;

- management structure and more.

The rights of PJSC participants include:

- receiving dividends;

- studying papers;

- be part of the governing body;

- control your securities;

- participate in the general meeting;

- claim part of the property upon liquidation of the PJSC.

At the same time, the participants of the Public Joint Stock Company pay its debts in accordance with the number of shares purchased. When a company is unable to repay its debt, its participants are obliged to do so, although the PJSC itself is not responsible for the debts of the latter.

Shares and property fund

According to Art. 66.3 of the Civil Code of the Russian Federation, shares of PJSC are in the public domain. Thus, when a NJSC decides to transform into a PJSC, it is necessary to change the work with the Central Bank. The par value of all shares is the same. When an organization is formed, all shares are registered and distributed among the founders. PJSC can place ordinary and preferred shares. However, the cost of the latter cannot exceed 25% of the charter capital of the PJSC.

The property fund of the PJSC is formed as a result of the turnover of the Central Bank and shares of the company. In addition, it may also include the company’s net profit received in the conduct of its activities.

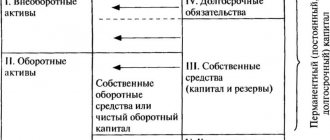

Authorized capital of PJSC

The authorized capital is formed when a new company is created. It is compiled when shares are sold to investors and shows the current state of affairs of the company. The PJSC forms the management company based on the securities purchased by the owners at the initial price determined at the time of issue. By definition, the management company is a contribution to the constituent organization in monetary and property equivalent. The minimum authorized capital of a PJSC is 100 thousand rubles. The amount is established by law and does not depend on the wishes of managers. The management company acts as insurance for investors who have invested money in the company.

CJSC and OJSC advantages and disadvantages

Brief description of types of joint stock companies

Today, two types of joint stock companies can be created in Russia: CJSC and OJSC. They have common features inherent in legal entities whose authorized capital is divided into shares, and also have certain features. Entrepreneurs will be able to choose a specific type of company after carefully studying the characteristics of both forms.

General characteristics of joint stock companies

The creation and operation of this type of legal entity is regulated by Federal Law 208-FZ. The founders of a joint stock company can be:

• Foreigners;

• persons with dual citizenship;

• citizens of Russia;

• stateless persons;

• legal entities (foreign, domestic);

• municipality or state.

The participation of certain owners affects the status of a legal entity. For example, when a foreign investor purchases more than 49% of shares, the company has some restrictions on land ownership. Inclusion of the state as an owner imposes special reporting rules and additional control measures.

The creation of any JSC is associated with the need to organize a general meeting of shareholders. A company with only one member is formed by issuing a written resolution. If there are several owners, an agreement is signed.

The main document of a joint stock company is the charter. It must indicate:

• areas of activity and goals of creating the company;

• name, as well as corporate symbols;

• rights and obligations of shareholders, including the possibility of issuing preferred securities;

• procedure for revision, audit;

• formation of management bodies and the scope of their powers;

• location (legal address);

• the amount of capital and the procedure for changing it;

• type of society (whether it is closed or recognized as open)

• and other provisions regulating the activities of the company and not contradicting current legislation.

After the charter is drawn up and approved, board members or a general director are appointed, and a staff is formed. Staffing is not required to register a company with the tax authorities, but it will be required for the actual organization of activities. We remind you that a joint stock company must engage a qualified accountant or apply for services to specialized organizations. A company can enter into labor relations and enter into transactions only after being assigned a OGRN.

A legal entity is vested with legal capacity from the moment data about it is entered into the Unified State Register of Legal Entities. Shareholders are liable for debts only to the extent of the actual value of the shares. An open subscription for securities is provided only for JSCs and is allowed from the date of full payment of the authorized capital. It should be noted that owners of preferred securities have the right to preferential receipt of profits, but cannot participate in the management of the company.

Advantages and disadvantages of CJSC

One of the main advantages of a closed joint stock company is the small minimum capital amount. The owners will need to transfer property or funds equal to 100 thousand rubles into the ownership of the company. A closed joint-stock company is not required to publish information about its financial activities, and participants cannot alienate their shares without the consent of other owners. The total number of shareholders in such a company should not exceed fifty. If the specified limit is exceeded, the legal entity is subject to reorganization or liquidation.

Advantages and disadvantages of OJSC

The owners of an open joint stock company are required to pay the authorized capital in the amount of at least one million rubles. Participants have the right to alienate their shares at their own discretion, under any conditions. The company in this organizational form is authorized to organize an open subscription for securities.

Having endowed the JSC with a wide range of rights, the legislator obliged organizations of this type to publish an annual report on the results of their activities. In addition, the company is required to report to shareholders at the general meeting, as well as comply with certain laws and regulations regarding the issue of securities.

Only an entrepreneur can determine the best option for running a business. The choice of the form of registration of a joint stock company should be made after a detailed analysis of the features of the direction, determination of the most favorable tax system and legal regime.