Translation methods

With the advent of new devices or things, you need to have as much information as possible about their functionality and what and how they can be replaced if necessary. To understand how to top up your card, you just need to remember what it is linked to and with what (or who) payment transactions are performed:

- Passport. When applying for a card, a mandatory condition is the presentation of a passport for personal identification.

- Bank tellers. The client’s agreement with the bank is drawn up and executed by the operator. He also explains how to use the card and where to go if you have questions.

- ATM. Almost any payment transaction can be performed using the terminal, and you can withdraw cash yourself only through it.

- The World Wide Web. All banking transactions take place via the Internet.

Using any of the above points, you can top up your “plastic” without having it.

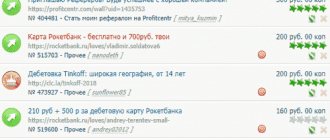

Other online services

You can also find other services on the Internet through which you can transfer money from a card to a mobile phone. These are commercial resources that charge a fee for conducting such transactions.

For example, you can use the Yandex Money service. It is not necessary to have an electronic wallet or the Yandex card itself; the operation can be performed from any means of payment. Enter the number and amount, the system immediately indicates the amount of payment with commission. It is small - only 3 rubles, regardless of the amount of the transaction. Click “Pay”, select a payment method from a bank card and enter its details.

Another similar service is CityCard. His commission for making a payment is 3% of the amount, but a minimum of 7 rubles. That is, for a payment of 100 rubles they will charge you 107 rubles, for 500 - 515 rubles.

How to put money on a Sberbank card without a card through a branch of a financial institution

Not so long ago, all payments, without exception, were made only with the help of a person. Even payments for utility services, where details are indicated in the form of multi-digit sets of numbers, were carried out by the operator of the financial institution.

Nowadays, there are automated payment systems everywhere, with the help of which people independently pay for goods and services, deposit and withdraw money. Such machines can also be located in bank branches. There is always an employee nearby who can be contacted for help if difficulties arise during the operation.

You can deposit money into an account without a card through a Sberbank office operator. True, for this you need a passport of a citizen of the Russian Federation and you will have to wait in line. Procedure for replenishing your account with the help of a Sberbank specialist:

- At the entrance to the branch there is a machine that issues coupons. To receive it, press the button on the monitor with the name of the banking transaction. In this case it is “Working with cards”. The check will contain a number in the form of a combination of letters and numbers.

- After the number indicated on the coupon lights up on the display above the window with the bank employee, you need to approach him.

- After presenting your passport, they explain the essence of the issue and provide money.

- After signing all the papers, the money is credited to the account.

Topping up your SB card through a bank branch.

To do this you need:

- Come to the department.

- Contact the operator.

- State the card number and full name of its owner.

Transferring through a bank cash desk is quite inconvenient in terms of the fact that you will have to waste time going to the bank, standing in line, and paying a commission, which is always higher than when using a terminal. This method will be appropriate if there is no payment terminal nearby, or it does not work, or there is no personal security card, or you need confirming information about the completed transfer in the form of a payment order.

Terminals and ATMs

The easiest way to top up a card without having one is to use an ATM. Unfortunately, it's not that simple. To deposit money through an ATM without a card, you need to know by heart its digital code, which is located on the front side.

Some take a photo of the code, which you can use if necessary. If it is possible to use the ATM of the bank that owns the card, then this should definitely be done. If this is not possible, you need to familiarize yourself with the conditions under which the operation will be carried out. If the ATM charges a large fee, then you should consider changing the way you top up your card.

You also need to make sure that the terminal accepts cash and is equipped with a bill acceptor. If everything is satisfactory and it is firmly decided that the card will be topped up using an ATM, to do this you need to perform the following steps:

- Find the “Main Menu” button on the TFT monitor and click on it.

- A large selection of different operations will appear on the screen. You should find either “Payments” or “Transfer of Funds”.

- After clicking the button, you will be prompted to enter your card number.

- After entering the digital code, click “Next”.

- The screen will light up with the words “Insert bills”.

- After depositing money, you must pick up the check and keep it until the funds arrive on the card.

This method allows you to top up your account at any time of the day.

Top up your card at the SB ATM.

This option is one of the simplest. For him, it is enough to have a personal SB card and know the plastic number of the receiving party. To send money through an ATM/terminal, you need:

- Insert your personal card into the ATM (in the terminal you can simply enter the recipient’s card number and deposit money).

- Select the transfer function to a plastic card by number.

- Enter plastic number

- Enter amount

- Confirm the transfer.

Funds will be credited almost instantly. If a transfer is made between cards issued in one branch, then no commission will be charged, and if cards are issued in different branches, then the commission fee for the transfer will be 1%, min. 50 rubles.

How can I put money on a card without a card via phone?

It is worth noting right away that this method is expensive and labor-intensive. The commission for different mobile operators varies from 4 to 8%. Plus it comes with a fixed amount ranging from 10 to 259 rubles.

In order to transfer money from your phone account, you must first top it up. If there are no ATMs, money can be deposited through Svyaznoy and Euroset communication shops. If you have access to the Internet, go to the personal account of your mobile operator. Transfer money from your phone to your card using the “Transfer of Funds” or “Mobile Bank” option. If there is no Internet, money can be credited via SMS.

Several other methods are used:

- "Megaphone". You can put money on plastic without a card by sending a message to number 3116. In the text field you need to enter CARD xxxx 12 21 2000, where xxxx is the card number, 12 21 is the card expiration date, and 2000 is the transfer amount.

- Beeline. Send an SMS to number 7878 with the text message: VISA xxxx 2000, where VISA is the payment system indicated on the card, xxxx is the card number, 2000 is the payment amount.

Cashless replenishment

We are gradually moving towards the fact that paper money is used less and less, and bank cards and accounts - more often. If previously there were card terminals only in large stores, now they are even in grocery stores.

Replenishing your wallet by bank transfer, in my opinion, is more convenient than cash. Firstly, you can do this absolutely free of charge, and secondly, without getting up from your computer or without letting go of your phone.

Online banking

I often use Sberbank Online, transfer money, pay for the Internet, mobile phone and utilities. I had to replenish my Yandex wallet several times. This is done quite simply and free of charge; in this case, no commission is charged.

Open the website online.sberbank.ru, enter your login, password and code from SMS to enter your personal account. Then we go to “Transfers and Payments”, there we find the section “To another person”, the type of operation “To an account in Yandex.Money”.

A form will appear in front of us in which we need to indicate the card or account for debiting funds, the wallet number for depositing them and the amount. Then you will need to enter the code again, which will be sent to your phone to confirm the operation.

The transfer is most often carried out instantly, but it is better to have at least a day in reserve, because there is always the possibility of unforeseen circumstances.

You can also use the online account at another bank where you are served. It can be:

- Alfa Bank,

- Russian Standard Bank,

- Home Credit Bank,

- VTB,

- Post Bank,

- Citibank,

- Tinkoff and others.

Most often, no commission is charged, but this will depend on your service tariff in a particular organization.

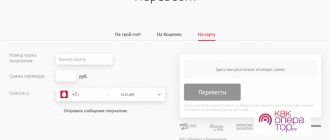

Transfer from a bank card

If you cannot or do not want to log into online banking at the moment, you can make a transfer from a card to an electronic wallet from the website money.yandex.ru. Go to the “Top up” section, fill in the data and confirm your action via SMS code.

This method allows you to quickly deposit money into your account. You can link your card once and make transfers even faster. But unlike the previous method, you will have to lose a commission of 1%.

Via WebMoney

If you work on the Internet, then most likely you receive money into your WebMoney account. In order to be able to transfer received funds to a Yandex wallet, you first need to link accounts in these two systems. In addition, there are other conditions for the operation:

- it is available only to Russian citizens;

- You must have a personal or identified account in Yandex.Money;

- in WebMoney you need to confirm your identity and obtain at least a formal certificate;

- The data in these two systems must match, including the phone number; you cannot withdraw funds from WebMoney to another person’s Yandex wallet.

These are the restrictions and obstacles that await us along the way. If all conditions are met, log in to WebMoney, go to the menu tab “Individuals”, “Withdraw”, “Electronic money”. You can transfer from 10 to 14,500 rubles, the commission is 2.1%.

To reduce costs, you can use another method of exchanging WebMoney for Yandex.Money. To do this, go to the website exchanger.money/emoney and select the appropriate section in the top line.

Now in the right column we select the appropriate amount and rate; by default, transactions are sorted from more profitable to less profitable. We click on the option we like, as shown in the screenshot.

Then we log in to WebMoney and see in front of us a form for making an exchange. We indicate the account number for debiting and crediting funds and click on the “Submit counter application” button. After that, wait until the exchange takes place. This may take 5 minutes, or it may take an hour or a day.

Hover your cursor over the letter “i” in the circle and you will see the time during which the applicant is ready to complete the transaction.

Via Qiwi wallet

If you use a Qiwi wallet, you can send funds that are in it. To do this, log into your account on qiwi.com and go to the “Transfers” tab.

In the new window, go down and find the option we need. Then we indicate the debit and credit account, as well as the amount. The transaction fee is 3%; a maximum of 15,000 rubles can be transferred at a time.

From a mobile phone

This is a fast and quite convenient method. It only works with a phone number linked to your Yandex.Money account. To make a transfer, go to the web resource money.yandex.ru, log in if necessary, go to the desired section and indicate the amount.

The main and rather significant drawback of this method is the commission, which currently amounts to almost 8%. This is one of the most unprofitable options for replenishing electronic money, and it is better to use it only in rare cases.

Microloan online

Owners of an identified account in Yandex.Money can replenish funds using loans from microfinance organizations:

- eCabbage,

- Turboloan,

- Zaimer,

- Webbanker,

- SmartCredit and others.

If you don’t have your own funds and need to urgently top up your account, you can register on the website of one of these companies and receive a microloan with a transfer to Yandex wallet.

To do this, your data specified on the financial institution’s website must match the information in the electronic money system. You will also have to wait for the loan to be approved, but within 24 hours you can get the desired amount.

This method, in my opinion, is only suitable for emergency cases, because microloans accrue quite impressive interest in the range from 0.5 to 3 per day. The loan size can range from 500 to 100,000 rubles, repayment terms can be up to 1 – 3 months. Carefully read the terms and conditions of a particular company to minimize your costs.

"Sberbank Online"

Sberbank was perhaps the only bank that for a very long time did not give clients the opportunity to carry out payment transactions independently online. But the miracle happened, and now every client can use the Sberbank Online application after installing it on their gadget (smartphone, tablet).

The application allows you to perform a wide variety of payment transactions, including transferring funds. Even those who have never encountered how to put money on a Sberbank card without a card will cope with this task without difficulty. To do this, do the following:

- First of all, log in to your personal account.

- By going to the “Payments and Transfers” section, activate the “Transfer to Sberbank client” link.

- Fill in the column “Card number” and “Amount”.

- The transaction is confirmed with a password that comes in an SMS message.

Please note that if the card is topped up to a recipient from another region, a commission fee of 1% of the transfer amount is charged.

How to return a payment?

If you made a mistake when transferring funds, you can use several methods to return the “lost” money.

Using the Sberbank Online system

Immediately after detecting an error, you will need to perform the following actions:

- Log in to the Sberbank Online service.

- Check the status of the incorrectly performed operation. If the payment is marked “In progress,” then the money is still on your card and you need to cancel the transaction immediately.

- If your payment has not yet been confirmed, first click on it, and then on the “Cancel” line. Next, you will need to press the “Confirm review” button.

- You can obtain information about your payment by logging into the transaction archive. Go to the specified section and see what mark is next to the operation you are interested in. If it has the status “Canceled”, then the payment was successfully cancelled.

If the operation has already been confirmed, then you will no longer be able to correct the situation on your own.

In this case, you will need to go to the bank and explain the situation to its employees, providing checks and other evidence. The sooner you do this, the better chance you have of having the payment reversed.

When you inform the operator about the problem, he will take the necessary measures. You can make sure that the operation is really rejected by logging into your personal account - an o should appear opposite the erroneous payment.

By phone

You can also return your funds by calling the bank's hotline at the phone number listed on the main page of the site.

Since the work of banking institutions involves preliminary thorough verification of completed transactions, clients have time to cancel erroneous payments.

A timely blocked transaction will prevent money from being written off from the card. As a rule, operators ask users several clarifying questions in order to confirm the identity of the bank card owner.

Please note: To speed up the process of returning erroneously debited funds, it is advisable to provide the operator with information regarding the transaction performed - payment amount, time, and transaction code.

If you transferred money from a terminal (ATM), then a saved receipt or check will help prove that you are right.

Under no circumstances should you delay visiting bank employees if your card has been used by fraudsters. The sooner you notify the bank about the theft, the greater the chance of a successful refund.

In the bank

To solve the problem, you can contact the bank branch. The actions of bank employees will depend on the cause of the error.

If the user incorrectly specified the details of a person who does not actually exist, then the funds will simply “hang” on the reserve account.

In this case, the problem is solved by writing an application addressed to the bank manager to cancel the payment. The period for consideration of such an application is three months.

If you specify the details of the real recipient, you will have to contact him personally. If the owner of the recharged phone refuses to return your money, you will need to go to court.

Mobile bank

The main convenience of the method is that it does not require Internet access, payment machines or other additional conditions. All you need is a phone number linked to your account.

Instructions on how you can transfer money without a card using Mobile Banking:

- An SMS is sent via telephone to the short number 900 (the number is the same for all telecom operators). Text of the message: “TRANSFER XXXX YYYY 1000”, where XXXX is the last four digits of the digital code of the sender’s card, YYYY is the last four digits of the recipient’s card number, and 1000 is the transfer amount.

- After the message is sent, you need to wait for a response confirming that the money has been delivered to the recipient. It is better to save it until you personally confirm receipt of funds.

Transferring money from a Beeline number

.

How to send money?

Dial the command *145# and follow the instructions or use the template *145*recipient's phone number*transfer amount#, for example, *145*9031234567*150#

Commissions:

Transfer from Beeline to Beeline:

- From 30 to 200 rubles – commission 15 rubles.

- From 201 to 5000 rubles – commission 3% + 10 rubles.

Transfer from Beeline to another operator – 7.95% + 10 rubles.

Restrictions:

- The subscriber must spend at least 150 rubles on this number before making the transfer.

- The amount of a one-time transfer is from 30 to 5000 rubles.

- The maximum transfer amount per day is 15,000 rubles.

- The minimum balance on your balance after the transfer is 50 rubles.

In addition, the transfer can be made on the official Beeline website: https://beeline.ru/customers/how-to-pay/oplatit-so-scheta/#/services/category-1

You can transfer money to Beeline Russia, Beeline Uzbekistan, MTS, Megafon, Tele2, Rostelecom, Motiv and Goodline.

Electronic payment systems

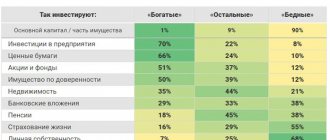

There are a lot of payment systems - both Russian and foreign. It is not prohibited by law to use the systems of other countries, but for convenience and lower commission costs, it is better to use domestic ones. Knowing how to put money on a card without a card using electronic payments, you can make payments not only between individuals, but also between financial and business organizations.

Such systems have a significant drawback - large commissions. Also, some payments can take up to three days (72 hours). Another disadvantage is that in case of failures, the money will be returned, but the commission may be retained.

Are you capable of this?

Before looking for specific recommendations, think for a minute whether you can get a guy to buy you gifts and expensive presents. Not all representatives of the fairer sex are able to simply ask a man for sponsorship. And the reasons may be as follows:

- pride does not allow;

- peculiarities of upbringing, when from a young age they were taught that such behavior was unacceptable;

- own opinion, which states that asking for money can scare off all potential gentlemen;

- a banal inability to give and receive gifts associated with an overly strict parenting style or even parental cruelty.

There is an interesting opinion that the stronger sex is more attached to those beauties who ask and gratefully accept expensive gifts than to those who claim that they love just like that, not for money.

If effort, time and money are invested in a girl, a man will not want to part with her, otherwise so many resources will be wasted.

If you want to deceive men, you need to change. First of all, internally. Tell yourself that you need material resources to become even better. That is, money is just a resource necessary for self-improvement.

In addition, in order to promote the stronger sex for money, you will have to get rid of not only embarrassment, but also some moral principles.

On the other hand, perhaps your wishes will only benefit him - he will earn even more, overcome difficulties and move up the career ladder!

"Yandex money"

According to some data, the Yandex.Money operator occupies about 80% of the Russian electronic payment market. Both Russian and foreign participants can deposit money onto a card without a card using this operator only in rubles.

At the end of 2012, Sberbank of Russia acquired a 75% stake in Yandex.Money LLC. This helps reduce commissions when carrying out payment transactions between financial organizations. To top up your card through the online payment service, you must take the following steps:

- Find the “Money Transfers” section and go into it.

- In the “Where” column, check the box next to “Bank card”.

- Enter the required amount in the column with the same name. The final figure including the commission will light up below. If you are not satisfied with the amount, then you do not need to click “Continue”. If everything is satisfactory, continue after pressing the button.

- Enter all the necessary details into the appropriate fields.

- A letter confirming the operation is immediately sent to your email.

Money will be sent to Tinkoff and Alfa Bank cards within 24 hours. For all other banks - about 1-3 days.

WebMoney

This electronic payment system is the second largest in terms of currency turnover after Yandex.Money. It’s not difficult to figure out how to deposit money to a Sberbank client without a card through WebMoney. The algorithm of actions is almost the same as on other services.

The commission will be 2.5% of the transfer amount + 45 rubles + insurance premium. The latter is returned if the transfer is confirmed within 2 days (a corresponding notification with instructions will be sent about this).

If you carefully read the terms of withdrawal of funds, it states that you can pay only 2% for a transfer to a card without other additional fees. To do this, you need to indicate not the digital code located on the front side of the card, but its current account. True, the money will arrive not in a day, but within three days.

The only problem you may encounter: WebMoney does not work with a Sberbank social card. By the way, this is not the only organization that does not work with the Maestro payment system.

What difficulties may arise

The most important thing here is to ensure that the number is dialed correctly, because if you make a mistake by even one digit, the money will go to another subscriber. Returning them is not easy, and sometimes even impossible - it all depends on the time, how quickly the user reacts to the error.

Don't forget about restrictions. So, the minimum possible payment is 10 rubles. You can send a maximum of 3,000 rubles per day to your number, and only half of this amount to another subscriber’s number. There is also a limit on the number of transactions - only 10 per day. All this was done solely for the safety of Sberbank clients, because in this case, scammers will not be able to withdraw many funds if they somehow take possession of the user’s phone.

Third party banks

All banks represent a single payment network. You can deposit money on Sberbank. without a card, both in the bank that issued the “plastic” and in any other. The procedure is simple, but requires a lot of additional time and money:

- You can top up your card at any bank with the help of an operator in the Card Operations department.

- The employee is presented with a passport and card details or only its number. If at least one number does not match, the money will go to someone else's account. They can only be returned by a court decision.

- The operator is given the required amount, taking into account the commission.

- After signing the papers, they keep one copy for themselves.

When replenishing the card through a third-party bank, the money will arrive within 10 business days.

Should the bank return the funds?

The law provides that in the event of an erroneous transfer, money no longer becomes the property of the sender, but of the person to whom it was transferred. In such cases, funds can only be confiscated through the courts.

Agreements drawn up by credit institutions initially stipulate that the holder is responsible for all operations with cards. This is especially true in cases where such operations were carried out using a PIN code.

Therefore, in order to avoid unpleasant problems when transferring funds, it is necessary to carefully check each figure and check the correctness of the entered details. Also, after completing the replenishment operation, you should not immediately throw away the receipt.

How to top up your card account through communication shops

Now all mobile operators offer to purchase a payment card from them. In terms of functionality, it is no different from banking. The only thing is that there is no cashback or interest on the balance, and there are also significantly fewer places where you can get discounts when using it. Is it possible to deposit money without a bank card, but with “plastic” from a mobile operator? Yes, you can, and in different ways:

- In a communication salon, providing the operator with a passport and an MTS, Megafon or any other card.

- Through the subscriber's personal account.

- Payment terminals.

Some banks, for example Tinkoff, have concluded agreements with telecom operators and retail chains Euroset and Svyaznoy. For bank clients, this makes it possible to top up a card without having one. The employee of the salon or network needs to present a passport, contract number (there are 2 times fewer numbers there, you can remember by heart) and the actual cash.

How to top up a card through Russian Post branches

Russian Post is one of the organizations against which there are many complaints. But she doesn’t care because she is a monopolist with government support. It can afford to reduce prices for a number of important services, since it is supported by the state, even if not completely. This is a good reason to use postal services.

The question of how to put money on a card without a card at the post office is primarily of interest to the older generation. They are used to the organization working properly, even if it takes a long time. For the younger generation, this method of replenishing the card is suitable as a last resort:

- At any branch, take a special form for transfers and fill it out yourself. It is important to do this in clear handwriting and without errors.

- The required amount is transferred to the operator. After this you will need to pay an additional commission. It varies for different banks - from 1.5 to 3%, except for Tinkoff, transfers to the card of this bank via mail within one and a half million are free.

- The money will arrive within 7 working days.

Limits and commission

Banks independently develop tariffs for various transactions and set limits for them. Typically, funds are credited to a card account by the issuer free of charge, regardless of the selected replenishment method. But third parties may charge their own fees.

Here are the most typical commission amounts for different replenishment methods:

- depositing cash through ATMs and bank tellers is free;

- depositing cash through third-party terminals – 1-5%, rarely – free;

- interbank transfer – from 10 rubles, sometimes free;

- Cash deposits at mobile phone stores and other partners are 1-2%.

There are usually no limits on depositing cash into the cash register. The ATM may have a limit on one transaction due to the ability to accept only a limited number of bills. When using other replenishment methods, the limits are set by third parties conducting the transaction, usually they have the following meanings:

- interbank transfer – up to 600 thousand rubles or without restrictions;

- transfer from card to card – up to 75-100 thousand rubles at a time and no more than 300-600 thousand rubles per month;

- depositing cash through third-party terminals – up to 15 thousand rubles at a time

Bank card

Deadline for crediting funds

The timing of crediting funds depends on many factors: the chosen method of replenishing the card, the rules of the recipient’s bank, etc. They must be taken into account if you need to make urgent purchases or when replenishing a credit card to pay off a debt.

We give in the table below the approximate terms for crediting funds, depending on the chosen method of replenishing the card.

| Replenishment method | Duration of the operation (approximate) |

| Cash via cash register | Until the end of the current day, but usually within 15-60 minutes |

| Cash at ATMs and terminals of the issuing bank | Usually a few seconds, less often - until the end of the day |

| Interbank transfer | Up to 3 days, but often the next business day or earlier |

| Transfer from card to card | Within 1 minute, but sometimes up to 3-5 days |

| In third-party terminals or in an affiliate network | Usually 1 business day, but sometimes instantly or up to 3 business days |

Topping up your card at the cash desk

The presence of many ways to replenish cards allows customers to use this payment instrument more conveniently. But the terms of service, available methods of depositing funds and tariffs may vary significantly in different banks and it is better to clarify all this information before carrying out the operation.