How to close an individual entrepreneur correctly

In accordance with the provisions of the law, in order to liquidate an individual entrepreneur in 2020, a businessman completes a package with the following papers:

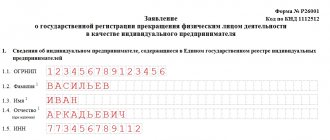

- an application for termination of commercial activities, drawn up in form P26001, provided for by the classification;

- a receipt confirming payment of the state fee;

- passports, SNILS certificates and TIN of the applicant.

To close an individual entrepreneur, an entrepreneur applies to the government agency that registers enterprises - the tax department.

Additionally, issues related to:

- contributions to the Pension Fund;

- repayment of budget debt to government bodies;

- additional commercial services.

When paying the state duty, you are required to provide information about the payer's details. The individual entrepreneur is liquidated within five days, excluding weekends, from the date of submission of documentation to the tax department. If the papers are submitted and the issues that arise are resolved, the applicant is given a document confirming the provision of the necessary information and the liquidation of the individual entrepreneur.

A preliminary request is submitted to the Pension Fund regarding the repayment of debt before the final cessation of the enterprise. If an individual entrepreneur has a debt to social services, the entrepreneur may be subject to a large fine, and the tax office will refuse to liquidate the enterprise.

General information

To terminate the activities of an individual entrepreneur, as well as to start a business, it is necessary to make a contribution to the state treasury. To pay, you don’t need a lot of money or enter into an agreement with someone: the state fee form for closing an individual entrepreneur P26001 can be paid off at any bank or online. The payment amount is 1/5 of the fee for opening an individual entrepreneur, specifically 160 rubles. This does not include contributions to the Pension Fund and other targeted payments.

Paying off a check online is quick and easy if the citizen is registered on the website of the Federal Tax Service. There is a “Payment of state duty” tool and a separate link to depositing funds for the liquidation of an individual entrepreneur. The portal has a proven scheme: the state duty form for closing an individual entrepreneur P26001 can be issued for cash or non-cash payment and is valid in both cases.

Since the main requirement for a contribution to the treasury is the absence of errors and typos, it is more reliable to carry out the procedure at the bank’s cash desk. The operator will check the data with the passport, and the citizen will be able to double-check the information about sending funds on the receipt. If a form downloaded from the Internet is submitted for payment at the bank, the state duty form for closing an individual entrepreneur P26001 should be checked to ensure that the details of not only the payer, but also the receiving party are up to date. The accounts and codes of different branches of the Federal Tax Service are different.

Sending documents by mail

If an entrepreneur cannot go to the tax office in person, the documentation is sent by mail. The papers are sent by registered mail with a mandatory description of the contents of the package.

In case of incomplete set or discrepancy of the submitted papers, the paid state duty is not refunded. The fee will have to be paid again. To avoid misunderstandings and additional financial expenses, you need to resolve all issues related to closing the enterprise in a timely manner, and collect documentation according to the list provided by law.

What to pay attention to

When visiting in person to liquidate an individual entrepreneur, you only need to bring with you a passport, an application, a certificate of registration of an individual entrepreneur and TIN. It is also possible to act by power of attorney, then the standard set of documents will need to be accompanied by a copy of the intermediary’s passport, a notarized power of attorney and an extract from the Unified State Register of Individual Entrepreneurs.

It is possible to close an individual entrepreneur remotely: by mail, through a courier service or via the Internet. In the first two cases, a package of papers, including the state duty form for closing IP P26001 and an application along with a list of the contents of the envelope, are sent by registered mail. Online liquidation of individual entrepreneurs is possible only for registered users of State Services with a confirmed electronic signature.

The procedure for terminating the status of an individual entrepreneur requires a minimum of effort, so there is no point in concluding an agreement with lawyers: the state duty form for closing an individual entrepreneur P26001 can be easily filled out in a couple of minutes, and the package of documents required by the Federal Tax Service is prepared on its own.

Receipt for closing an individual entrepreneur

The receipt form for payment of the state duty for closing an individual entrepreneur is filled out indicating:

- Full name and registration address;

- TIN code;

- bank with the applicant’s account number and details of the financial organization;

- details of the payment recipient, including account number, KBK, INN, KPP and OKTMO.

The receipt for closing an individual entrepreneur in 2020 consists of two parts, one of which is issued to the payer, the second remains in the bank where the operation was carried out. Each half indicates the date of payment and signature of the payer.

The paid receipt is attached to the set of papers submitted to the branch of the Federal Tax Service.

Receipt example

The payment receipt fits on one A4 sheet. In the upper left corner there is a barcode of the bank mark, in the upper left corner there is information about the individual entrepreneur (address, full name, telephone, checkpoint and tax identification number, current account number, BIC, KBK, and so on). Below this data are the date and signature fields, which are also filled out by the entrepreneur. In the second half of the page there is a table with the same data. One copy remains with the individual, and the second is submitted to the tax authorities along with the application for liquidation of the individual entrepreneur. By the way, in different regions, receipts may differ slightly in form, but the fields to fill out remain the same.

A receipt in electronic form does not differ in appearance from a regular paper receipt. It must be paid before filing an application for liquidation, and the remaining insurance premiums must be paid no later than 15 days from the date of recording the closure in the unified register. Information is usually entered by tax authorities. The amount of contributions is calculated in the traditional way, but not the full year is taken for calculations, but only those months in a given year when the individual entrepreneur still existed.

Note! Contributions to the Pension Fund are not taken into account in the amount of state duty. Pension insurance contributions are targeted and are paid separately in a different manner.

Payments made on a receipt with errors are quite difficult to correct. To avoid this time-consuming process, it is important to check the completed form for typos and whether the entered data corresponds to reality.

Payment through a Sberbank branch

One of the easiest ways to pay the state fee for closing an individual entrepreneur is to visit a Sberbank branch. It is important for the payer to correctly indicate his data and information about the recipient.

The tax service details included in the state duty payment receipt are individual for each department branch. An entrepreneur can check the data by calling the Federal Tax Service. If an error is made when specifying the details, the payment will have to be made again.

The entrepreneur must prove his identity by presenting his passport. If you have any questions about filling out the receipt, a representative of the financial institution will help. For a form filled out by a bank employee, you will need to pay an additional 20 rubles, which is confirmed by a separate check.

Liquidation procedure

Before closing an individual entrepreneur, it is necessary to submit current reports, carry out a reconciliation with tax structures, and pay the due amounts of taxes and contributions, fines.

It is required to terminate all types of contracts with:

- government agencies and funds;

- commercial organizations;

- health and social insurance funds;

- employees (Article 81 of the Labor Code of the Russian Federation);

- with banks (close current accounts).

Debts to creditors must be repaid, and debtors' debts must be collected (if necessary, by applying to an arbitration court).

The following is transmitted to the NS body:

- application (notarized);

- the applicant's identity card;

- TIN;

- extract from the Unified State Register of Individual Entrepreneurs and the pension fund;

- original receipt for payment of the closing fee.

Closing documents are submitted to the Federal Tax Service at the office of the registration authority (in person or by an authorized representative) or sent by mail (registered) with a mandatory description of the contents.

Payment through Sberbank online

Another convenient option for paying state fees for terminating activities is to contact the Sberbank online service. Payment is also possible through the official website of Sberbank.

To pay the state fee, you will need:

- Login to the site or application.

- Go to the tab with payments and transfers.

- In the name of the recipient structure, indicate the name of the tax department branch.

- Provide passport details and other information about the payer.

- Select the type of state duty.

If funds are transferred by non-cash method, the printed receipt must be certified at the branch of the financial institution.

The document is recognized as valid if it has the employee’s signature and the bank’s seal.

This you need to know: Reporting when closing an individual entrepreneur in 2020 - what reports to submit

Payment of the state fee for closing an individual entrepreneur in 2020

Registration of an application to terminate the operation of an enterprise will occur after payment of the fee for termination of the individual entrepreneur. The contribution is one-time and mandatory. After depositing funds, the businessman is completely exempt from the Pension Fund and other payments.

The fee for closing an individual entrepreneur in 2020 is the same for all applicants. It is equal to a fifth of the state fee for registering an individual entrepreneur - 160 rubles. The calculations do not include contributions from the Pension Fund because they are targeted payments. There are two ways to receive a receipt and deposit funds:

- At a bank branch. You must download the receipt of the state duty for closing an individual entrepreneur before visiting the branch;

- Through an online payment system, which will automatically issue a sample state fee for closing an individual entrepreneur with the entered details of an individual.

Online payment of state duty for termination of commercial activities

An entrepreneur can use the online service of the Federal Tax Service “Payment of state duties”. To do this you must be registered. In order for the fee to close an individual entrepreneur to be paid, select the item “State fee for registering the termination of an individual entrepreneur’s activities as an individual entrepreneur”, and then click “Next”.

Payment of state duty for liquidation of individual entrepreneurs through the online service of the Federal Tax Service

The system will prompt you to enter the personal data of the individual for whom the enterprise is registered. After checking all the parameters, select the payment method:

- Spot. You should pay at any bank;

- Cashless. Available for clients of partner banks (Alfa Bank, Sberbank, Promsvyazbank, KKB, ATB, Gazprombank, etc.).

Next, a payment document is generated with a PDF extension, which is easy to print out on paper. The payer must put his signature in the required places.

Receipt for closing an individual entrepreneur: payment at a bank branch

The main condition for paying the state duty receipt for closing an individual entrepreneur is the correct entry of details. Each region has individual parameters that should be checked with the tax office.

The form must be filled out without errors. In addition to the details, they must present a passport. If in doubt, you should study a sample receipt of the state duty for closing an individual entrepreneur in 2020:

If you have any difficulties filling out the receipt, you can contact a bank employee. For his services, he will additionally charge 20 rubles via a separate check.

The paid state duty for closing an individual entrepreneur is certified by the tax authority with signatures and seals . This is the main argument for the final cessation of the enterprise's existence.

Sending documents by mail

If it is impossible to personally visit the tax office, then the collected package of documents is sent by registered mail. An application for liquidation of a commercial activity must be notarized. The original receipt for closing the individual entrepreneur is attached to it.

It is important to fill out the applications correctly and provide all documents. If anything does not comply, the state duty when closing the individual entrepreneur is paid again. An inventory of the contents of the registered letter must be made.

If you follow the recommendations for terminating business activities, lengthy red tape will be eliminated: the liquidation procedure will help to avoid mistakes and additional financial losses.

Payment via MFC

Services for paying the state fee for closing an individual entrepreneur are provided by a network of MFCs opened in Moscow and other cities of the Russian Federation. Pre-registration on the official website will help you avoid wasting time in queues.

On the appointed date and time, you must go to the MFC with your passport and TIN. An employee of the center will perform the operation to pay the state duty. The procedure will take no more than ten minutes.

Documents can be sent to the MFC by mail if the entrepreneur does not have enough time to visit the authorities.

How does the procedure for closing an individual entrepreneur work?

Individual entrepreneurs, unlike legal entities, cannot have founders or co-owners. This means that the entrepreneur makes the decision to liquidate alone. As a rule, he also acts independently, taking various documents to the authorities and getting rid of property. The state fee for closing an individual entrepreneur must be paid in advance, before submitting the application. You can pay for it literally in 5 minutes, and you need to save the receipt to begin liquidation.

Liquidation of individual entrepreneurs

There are two ways to close an individual entrepreneur:

- On one's own;

- With the help of specialists who offer paid liquidation services.

The second method is good because all the necessary tax documents, documents to the Pension Fund of the Russian Federation, Unified State Register of Individual Entrepreneurs and other authorities will be submitted on time. Our specialists have experience and do not forget about every point when closing an individual entrepreneur; they accurately fill out the documentation and take on all the work themselves.

Note! This is beneficial for the entrepreneur: after all, for a relatively small fee, he can avoid bureaucratic delays and errors in documentation.

Before starting the liquidation procedure, the individual entrepreneur must pay all current contributions, taxes, fines, penalties and make all payments to employees or permanent employees. The dismissal of the entire workforce must be reflected on paper. In other words, the entrepreneur must end all financial transactions and financial relationships. According to the law, the above actions are sufficient to begin the liquidation procedure, but in practice it is better to do other operations in advance:

- Deregister all cash registers;

- Submit declarations to the Federal Tax Service (including for incomplete reporting periods);

- Deregister from the Social Insurance Fund;

- Close the individual entrepreneur's current account.

Next, you need to collect a package of documents for closing. This is, first of all, an application with a claim for closure and a receipt for payment of the state fee. All these documents must be submitted to the tax authority at the place of official registration of the individual entrepreneur.

The Federal Tax Service checks the submitted documents and the presence of unpaid debts. If everything is in order, then the individual entrepreneur is removed from the Unified State Register of Individual Entrepreneurs, officially considered closed, and the individual who was an entrepreneur receives a certificate of liquidation. And only after this the termination procedure can be considered officially completed.

Reference! It is not at all necessary to destroy the seal of an individual entrepreneur after its liquidation, but the entrepreneur will have to close the cash register. And he decides for himself what to do with the cash register equipment.

Liquidation of individual entrepreneurs through State Services

To pay the required state fee for closing an individual entrepreneur through State Services, you will need to first register on the resource. Having passed identification on the portal, the businessman creates a personal account, after logging in to which you will need:

- Click on the button to add an organization and indicate its affiliation with an individual entrepreneur.

- On the list.

- Select the electronic form for performing the operation and enter personal information.

- Attach the necessary documents.

- Send a request for registration to the Federal Tax Service.

If everything is done correctly, a confirmation of the closure of the enterprise will be sent to the applicant by e-mail within the five working days provided for by law.

Receipt: filling procedure and payment methods

If you want your payment to reach the addressee and not get lost, then carefully fill out the receipt. You can download a receipt for filling out yourself from the official website of Sberbank. You can find out the details for paying the receipt from the state tax authority where you will register or on the Federal Tax Service website (hereinafter referred to as https://service.nalog.ru/addrno.do). Also in the receipt you will have to indicate your full name, passport details, address, TIN, required amount, bank account number and abbreviated name of the tax office, budget classification code.

The last value changes annually and in 2020 it is 182 1 0800 110.

Payment Methods:

- at a Sberbank branch;

- via the Internet on the Sberbank website (for this you must be a client of the bank);

- on the Federal Tax Service website;

There are no payment deadlines, as well as the validity period of the receipt, but you must keep in mind that payment must be made first, even before submitting all documents.

Peculiarities

- The issue of paying the state fee to liquidate an individual entrepreneur must be taken seriously. Its absence will be grounds for considering that you have provided an incomplete package of documents. And the situations where this may be needed may be different.

- Once closed, you have the right to reopen.

- The right to tax holidays, which is granted to a newly created individual entrepreneur, is lost if you re-open.

- If you suddenly change your mind about closing and have made a payment, then you have the right to write an application for a refund of this amount.

- The period for closing an individual entrepreneur is 5 days. However, it will be real if you carry out all preliminary preparations properly, provide all reports, pay all payments. Do not delay in resolving these issues.

Cashless payment via the Internet

Online payment of the state duty for terminating the activities of an individual entrepreneur is carried out through the tax service portal.

Procedure:

- Log in to the official portal of the tax department.

- Select the section on payment of state duty.

- Place a dot opposite the line “due to termination of activity” with the amount of 160 rubles.

- Enter your full name, residential address and Taxpayer Identification Number - the last condition is mandatory if the fee is paid by transfer.

- After checking the entered data, the payment button is pressed.

- Select the method of transferring funds - by bank transfer.

- Click on the icon of Sberbank or other financial organization.

- Generate a receipt and make a payment by clicking the appropriate confirmation.

A payer who closes an individual entrepreneur and ceases business activities will receive a message on his mobile phone containing a special code. After entering this number, the payment will be processed.

An alternative option is to choose cash payment. In this case, an electronic form of receipt is generated, which should be printed and paid at any financial institution. In this case, you will not have to fill out the form. The businessman will only have to sign in the appropriate boxes, and the remaining information will be filled in automatically.

When choosing a financial organization through which funds are transferred to pay the state fee for closing an individual entrepreneur, the entrepreneur checks the icon of the desired structure.

Step-by-step instructions for filling out

The procedure itself will not take you long and is very simple, it does not pose any particular difficulty for anyone, all details will be inserted automatically, which will reduce the risk of error to a minimum. So, the receipt for closing an individual entrepreneur contains several columns that can be filled out by selecting the appropriate information from the drop-down lists.

- First you need to determine the number of the Federal Tax Service and OKATO. Those entrepreneurs who do not know the exact data of their Federal Tax Service can leave the field blank and move below, entering their own region and address. This option is suitable for those who are going to pay a fee and submit documents to the tax office to terminate the activities of an individual entrepreneur at their place of registration.

- If the documents are not submitted to the tax office that issued the individual entrepreneur registration certificate, then you need to clarify the specific Federal Tax Service code right here on the website, for example 7746 - MIFTS code No. 46 for Moscow. After inserting this information into the required field, all fields related to the address must be left blank.

- Now you should select the details for paying the state duty, as well as the form of payment - by bank transfer or in cash at a Sberbank branch. In the “Payment Type” field, enter “0” (payment of fee, tax, duty, contribution), then enter the budget classification code. In this case, the BCC of the state duty for closing an individual entrepreneur is as follows: 18210807010011000110. In the “Status of a person” field, you must select code “09” (taxpayer is an individual entrepreneur), and in the “Base of payment” field, “payments of the current year” must be entered and below in the “Tax period” field - the date of payment.

- You have entered all the details of the body responsible for collecting the state duty, now it is the turn of the individual entrepreneur’s own data. Everything is simple here: you need to indicate your TIN, first name, patronymic and last name, address and amount - 160 rubles.

- Be careful when filling out the fields: the details of different Federal Tax Service Inspectors also vary, and the slightest mistake can cost you the effort, time and money that you will need to go through the authorities and collect all the documents again.

Payment of this state duty during the liquidation procedure of an individual entrepreneur is regulated by the Tax Code of the Russian Federation; without paying it, you will not be able to complete the process if the decision to terminate the activity was made independently and voluntarily. If you are not sure that you are doing everything correctly, then you can entrust the process of collecting, processing and submitting documents to the tax office to professionals.

Keep in mind that if the state duty for closing an individual entrepreneur in 2020 is paid in full by you, but for some reason the tax authorities refuse to liquidate your individual entrepreneur, then this material damage (160 rubles) will not be reimbursed to you. In addition, when resolving the issues that have arisen and re-applying to the tax office, the entrepreneur will again have to pay the state duty and present a receipt.

Thus, to close an individual entrepreneur, an entrepreneur needs to fill out certain papers, submit all reporting documents to the tax authorities, correctly fill out an application on form P26001, which can also be done online on the Internet, and submit the original receipt for payment of the state duty to liquidate the form of ownership Individual entrepreneur with a note from a bank employee about payment.

Termination of business activities remotely

There are two ways to close an individual entrepreneur without a visit to the Federal Tax Service and the participation of intermediaries:

- Sending the application by mail.

- Submitting documents through the government services portal.

Via email

When sending documents by mail, additional costs are expected to pay for communication services (in particular, in Moscow, delivery of a registered letter with a return receipt and a list of attachments will cost around 200 rubles) and notarization of the signature on the application. Notary services to certify an entrepreneur's signature in Moscow cost from 700 rubles. You can find it cheaper in the regions.

Example of Moscow notary's prices for certification of signatures

Through the government services portal

To submit an application through the government services portal, an electronic digital signature of the individual entrepreneur is required. If the entrepreneur has it, this method will be optimal for him, since it involves a minimum of actions. After all, if he has one, he can fill out an application, attach scanned copies or photographs of his passport and pay the state fee from a bank card within a few minutes, without getting up from his computer. And for documents issued after the provision of public services, go to the tax office five working days after the acceptance of his application for work (he will receive a notification about this in his personal account). Or, as with a personal visit to the Federal Tax Service, order their delivery by mail.

To obtain an electronic digital signature (EDS), you need to contact a certification center with a set of necessary documents and pay for its services. For example, in one of these centers, a signature with the possibility of full use for commercial activities costs 6,500 rubles per year. But it is doubtful that it makes sense for an entrepreneur who needs an electronic signature to close down to incur such expenses.

Another mandatory condition for sending documents to close an individual entrepreneur through the public services portal is the presence of a separate account of an individual entrepreneur on it. An application cannot be submitted through an individual's account. Although if there is an electronic digital signature, it makes sense to create an account for an individual entrepreneur. It's free and doesn't take much time.

Closing an individual entrepreneur through the government services portal makes sense for those entrepreneurs who have an electronic digital signature

Closing an individual entrepreneur through intermediaries

This option will require the highest costs, which puts the feasibility of its choice into question.

However, if you are a very busy person, and every trip to a government agency is stressful for you, it makes sense to overpay.

It all depends on the situation in a particular Federal Tax Service. For example, in inspection No. 46 in Moscow there is an electronic queue, the premises are spacious, there are always enough free windows, there is somewhere to sit, men’s and ladies’ rooms are available, you can drink tea or coffee nearby. Therefore, you usually don’t have to wait long, and the waiting process itself is comfortable. And the specialists conducting the reception are, for the most part, competent and polite. But somewhere it may be different.

As for the price of the intermediary’s services (and this is the main component of the costs when choosing this option), it is determined by the set of services included in the price, the general price level in the region (in Moscow it will definitely cost more than, for example, in Ivanovo) and the appetites of the intermediary .

An example of intermediary prices for assistance in closing an individual entrepreneur (Moscow)

For example, in the capital, consultation and assistance in filling out an application, which an entrepreneur will have to take or send to the tax office on their own, will cost 1–2 thousand rubles. And “turnkey” options, where the kit includes all the necessary notarial actions (certification of the entrepreneur’s signature and execution of powers of attorney), deregistration in all extra-budgetary funds and submission of reports, are estimated at 8-10 thousand rubles. Whether there is any point in such an overpayment is up to everyone to decide.

Features of the individual entrepreneur liquidation procedure

In some cases, to liquidate an individual activity, papers can be sent with a declared value and an inventory of the contents by regular mail (if the tax authority is located far from the place of residence). Here, the day of receipt of the tax letter is taken as the date of filing the documents.

Some time ago, the liquidation of an individual entrepreneur required the entrepreneur to provide an extract from the Pension Fund confirming the repayment of all debts. Today the situation has changed. The Federal Tax Service itself sends a request for possible debt and does not prevent an individual entrepreneur from closing his business even if he has outstanding debts to the Pension Fund. The remaining debts must be repaid as soon as possible. If the debt is not repaid on its own, it will be collected through the bailiff service.