The obligation to pay contributions to pension insurance (hereinafter referred to as PIP) currently affects all individual entrepreneurs, both those with and without employees, as well as organizations that use hired labor. Finding out the debt in the pension fund is not difficult.

For late payment of fixed insurance premiums for individual entrepreneurs, penalties are charged in the amount of 1/300 of the refinancing rate for the first 30 days of delay and 1/150 for each subsequent day starting from 31 days.

Delay in payment of insurance premiums for employees, non-payment or incomplete payment due to underestimation of the base for contributions, or errors in calculations will lead to a fine of 20% of the amount of the non-transferred payment, and in case of deliberate non-payment - up to 40% of the amount of the arrears.

Penalties are also provided for violation of the deadline for submitting reports on contributions for employees and errors in submitted calculations.

As a rule, the existence of arrears in insurance premiums becomes known directly from the regulatory authorities, but very often this information does not reach the entrepreneur or organization or arrives late.

Let us briefly consider the main ways to obtain information about debt on insurance premiums.

How to find out the debt to the Pension Fund of the insured person

An individual entrepreneur can find out about the existence of a debt to the state for fixed insurance premiums for compulsory health insurance in several ways:

- By requesting reconciliation of calculations with the budget from the Federal Tax Service;

- By personal contact to the territorial branch of the Pension Fund of Russia;

- By sending a written request to the Pension Fund;

- By accessing the information portal “State Services”;

- In your Personal Account on the Pension Fund website;

- In your Personal Account on the Federal Tax Service website;

- On the website of the Federal Bailiff Service (FSSP).

Reconciliation of settlements with the tax office

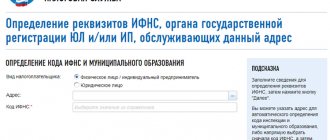

Since the Federal Tax Service is currently directly involved in the administration of insurance premiums, you can clarify the amount of debt for insurance premiums by requesting a reconciliation of settlements with the budget from the tax authority at the place of registration.

To do this, you need to submit an application to the Federal Tax Service for a joint reconciliation of calculations, wait for the reconciliation report and compare it with your data. If there are discrepancies in the data of the individual entrepreneur and the tax office, it is necessary to draw up a statement of disagreement and submit it to the Federal Tax Service along with documents confirming the legality of calculating the contributions of the individual entrepreneur.

Obligations of the entrepreneur to the pension fund

An individual entrepreneur, unlike a legal entity, encounters the pension fund less often - when submitting quarterly reports no later than the 15th day of the month following the reporting month and when transferring the pension payments themselves.

The amount of the insurance premium depends on several factors:

- types of activities according to OKVED (mainly the main one) in which the entrepreneur is legally engaged;

- the taxation system in force in the calendar year (patent, simplified tax, imputed income tax, agricultural tax or basic system);

- number of employees hired;

- presence of previous debts, late payments.

The first two points are closely interrelated. Thus, using the patent taxation system, it is possible to carry out a limited number of activities, but a number of business sectors are impossible if the entrepreneur has chosen the simplified tax system in this calendar year and, in the prescribed manner, notified the Federal Tax Service employees at the place of registration.

If an individual entrepreneur did not choose a patent form of work or an agricultural tax during registration, and also did not submit an application to switch to the simplified tax system or UTII in the first month after registration, the tax office automatically identifies him as a payer under the OSNO - the main tax system. OSNO requires three mandatory insurance payments: 22% for mandatory pension insurance without exceeding the tax base limit and 1% if it is exceeded; 5.1% for compulsory health insurance; 2.9% for insurance of citizens in case of disability, during pregnancy and childbirth.

We recommend you study! Follow the link:

How can an individual entrepreneur find out the debt on contributions to the Pension Fund and pay

An arrears or an error may occur if the individual entrepreneur took the wrong basis for the calculation or used invalid methodological tools. The deduction was made on time, but not in full, according to current legislation, and the entrepreneur unintentionally becomes a debtor.

In order to avoid unpleasant consequences, an entrepreneur who doubts the correctness of the calculations he has made can find out the debt to the pension fund for an individual entrepreneur in any way convenient for him. Online through specialized websites or in person by contacting the tax authority at the territorial point of business activity (if employees are permanently employed in another city, region, etc., you must contact the Pension Fund at their place of residence).

PFR website

Information about existing arrears of insurance premiums, fines and penalties can also be obtained online on the official website of the Pension Fund.

To enter your Personal Account on the Pension Fund website, you must first register in the Unified Identification and Authentication System (USIA). This process is quite long, taking several days.

First, you must enter all the necessary information into the registration form, then confirm it in one of the following ways:

- Having received a confirmation code by mail;

- By contacting one of the service centers;

- Using an electronic digital signature.

Once the account is confirmed, you will be able to use the services of the Personal Account of the insurance premium payer, which will reflect all the necessary information.

Offline check

To check debts to the Pension Fund, there are four services available on the official websites of departments:

- Pension Fund - always accurate information relevant to the current date;

- The Federal Tax Service administers insurance premiums, therefore it has accurate and reliable information about the presence or absence of debt;

- State Services is a portal that combines information from all official sources;

- FSSP - takes into account cases initiated by departmental structures and brought against the debtor. Most often, this method is used to test a potential partner.

Many individual entrepreneurs may not have enough free time to visit the tax office to identify shortfalls related to insurance premiums. For the convenience of employers, several ways to obtain information via the Internet have been developed.

Checking debt through the official website

Important! To obtain the information of interest on payments and contributions, you will need a TIN. It represents the taxpayer's personal identification number. Additionally, you will need other information about registering an individual entrepreneur.

On the Pension Fund website

You can find out the debt to the pension fund for individual entrepreneurs using the official website of the Pension Fund. To do this you need to perform several steps:

- Go to the page of the “Registration in the Unified Identification System” section and register in it.

- You need to create a personal account through which further actions will be performed. During registration, a new user will be presented with a form that must be filled in with accurate information.

- After completing registration, you need to choose a method for obtaining a unique method. This can be done by email, personal visit or phone call.

- After 10 days, specialists will check the specified data for accuracy and send a unique code. It must be entered in a special field, after which registration will be completed.

More on the topic Updating the safety data sheet of an object - registration of changes made with approval

Your personal account makes it possible to find out about debts that arise for pension payments.

Public services

You can find out the debt from an individual entrepreneur to the pension fund using the Taxpayer Identification Number (TIN) using the public services service. Registration process:

- Go to the official website of government services. On your first visit, a new window will appear in front of the new user in which you need to indicate your phone number, email address, first name, last name. A confirmation code will be sent to your phone number, and a special activation link will be sent to your email.

- After completing the initial registration stage, the system will redirect the user to another page. In the form that appears, you must provide detailed information about yourself and rewrite your passport details. If the data is entered correctly, you need to click on the “save” button at the bottom of the page.

- To check the specified information, the site administration will need a few minutes. After a short wait, an activation link or unique code will be sent to your phone number or email.

- To confirm registration, you must indicate the method - personal visit, Russian post, electronic signature. After choosing a method, you need to wait for the activation code. It is a combination of 20 digits. They must be entered into the empty field at the bottom of the completed form.

After registration, you can independently set up your personal account to receive information about contributions and payments.

Any taxpayer can find out about their debts through the official website of the tax service. To do this, you need to perform several steps:

- Go to the tax website, go to the “electronic services” section. After this, go to the payer’s account.

- A list of services will appear in front of the user, in which you need to select “find out your debt.”

- In the form that appears, you need to enter reliable information about yourself, individual entrepreneur registration, and indicate your TIN.

- After filling out the form, an activation code will be sent to the specified phone number, which must be entered into the empty field on the completed page.

All you have to do is click the “find” button, and then wait for a response from the tax inspector. If there is arrears in contributions, the user will be able to draw up a payment order.

Important! If the taxpayer does not know his TIN, he can obtain information on the tax service website, through the “find out TIN” function.

If an individual entrepreneur does not have the opportunity to access the Internet, or a person does not want to use the World Wide Web, you can obtain information in several ways. These include:

- Contact the Pension Fund directly. To do this, you need to prepare an INN, SNILS, insurance documents, and a passport.

- Make a phone call to PF. The operator needs to provide information related to registration. After this, you can obtain information about the existence of debts.

Personal visit to the Pension Fund

An offline check allows you to obtain additional information from consultants, which is problematic to do through official websites.

To do this, you need to send a written application to the Pension Fund. The application can be drawn up in any form, and then sent to the relevant authority at the place of registration.

More on the topic How to find out your water debt

State Services Portal

Before you can view your debt using the government services portal, you will need to create and verify an account.

To do this, you must enter information into the registration form and confirm it in one of the following ways:

- Having received a confirmation code by mail;

- By contacting one of the service centers;

- Using an electronic digital signature.

After activating your personal account, you will be able to clarify the debt for both insurance premiums and other payments. To obtain information about the presence of arrears in contributions, you must use the information available in the “Pension Fund of the Russian Federation” section.

Why do individual entrepreneurs have debts on insurance premiums?

Debt from an individual entrepreneur may arise for the following reasons:

- when he does not pay required insurance premiums, taxes and other fees, ignoring the law;

- pays late. It is extremely important to know exactly the acceptable time limits;

- having repaid the debt, leaves the penalty unpaid;

- incorrectly calculates taxes and insurance premiums;

- makes mistakes in payment documents;

- bankruptcy. In this case, debts are repaid after the sale of commercial assets.

Failure to pay debts on time may result in penalties.

After a citizen has become an individual entrepreneur with or without employees, he is required to pay contributions, insurance contributions, and submit reports for inspection by the tax service. Situations often arise when an individual entrepreneur does not have time to make contributions to the Pension Fund on time. To make payment, you need to know how to check the debt on insurance premiums of an individual entrepreneur.

Pension Fund Branch

To obtain the information of interest, an individual entrepreneur has several ways available:

- Using the Internet.

- By sending a written request or by contacting the Pension Fund in person.

We need to talk about each of the methods in more detail in order to avoid mistakes when obtaining information.

The most common situation due to which an individual entrepreneur has arrears in paying pension fund contributions is the closure of a company. After closing their own business, many former individual entrepreneurs forget to deregister themselves. For a long time, thoughts about insurance premiums completely disappear, but a notification about accumulated debt is sent to the mail. Because of this, you need to remember to deregister during the closure of the company so that penalties do not accumulate.

The occurrence of debt leads to unnecessary nerves and headaches

FSSP website

Another way to clarify the fact of the presence of debt on insurance premiums is the website of the bailiff service.

Please note that it will only be possible to obtain information on debt on this website if enforcement proceedings have been opened against the debtor. If the debt is not sent for collection, there will be no data in the specified resource.

To obtain information on the FSSP website, you only need to indicate the full name of the debtor and the territorial body of the Pension Fund.

Is there a statute of limitations for debts to the Pension Fund of Russia?

For some reason, a myth has taken hold among individual entrepreneurship that supposedly after three years from the moment the individual entrepreneur is closed, all debts on pension contributions are written off. In fact, the amount of debt is not written off even after 30-40 years from the date of closure of the organization. In addition, the debtor will be additionally charged a fine - however, in the amount of no more than 30% of the amount of the principal debt. However, with large debts, this thirty percent can add up to significant amounts.

You shouldn’t delay it so much: all assets and liabilities of enterprises are displayed by the state in the Tax Service, so it will not be possible to hide the fact of debt. In addition, large debts are fraught with forced collection, restrictions on travel abroad, unilateral withdrawal of money from the business owner’s accounts, and so on.