The concept of the address of a legal entity

In the Russian Federation, the concept of “location of a legal entity” is legally defined, which in turn is determined by the location of the executive body of the company - the general director.

(what is the Executive Body).

Beginning entrepreneurs should know that, according to paragraph 2 of the article. 54 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the location of a legal entity must coincide with its actual location. Violation of this clause is considered an administrative offense and is punishable by fines.

(who is an Entrepreneur)

Article 54, paragraph 2 of the Civil Code of the Russian Federation states

“The location of a legal entity is determined by the place of its state registration on the territory of the Russian Federation by indicating the name of the locality (municipal entity). State registration of a legal entity is carried out at the location of its permanent executive body, and in the absence of a permanent executive body - another body or person authorized to act on behalf of the legal entity by virtue of the law, another legal act or constituent document, unless otherwise provided by law. on state registration of legal entities."

Checking the accuracy of the address of a legal entity

In modern business, checking the address of the counterparty is of great importance. The need to exercise due diligence when choosing counterparties and conducting transactions makes it quite reasonable to want to check the accuracy of the address of a legal entity.

First of all, before concluding an agreement and, especially, before making payments, it is necessary to request from the counterparty the details of the enterprise, where its legal address should also be indicated. It should be checked with the information contained in the Unified State Register of Legal Entities; to do this, it is enough to order an extract from the register or use a special ]]>service]]> on the Federal Tax Service website, which provides information about legal entities online.

If the address matches, then it makes sense to check how real it is. First, you can conduct a remote check using various resources, for example, look on a map on the Internet to see what kind of building it is and what organizations are located in it. After this, all that remains is to go to the location and check that the required legal entity is actually located at this address.

The set of these measures is quite sufficient to establish the reliability of the legal address of a legal entity and avoid many problems in the future, from the inability to find a counterparty who owes money for goods, to the accrual of an additional amount of VAT due to a negligent supplier and failure to exercise due diligence.

Read also: Legal and actual address

The difference between registration addresses and location

It is important to understand the legislative subtleties, according to paragraph 1 of Art. 8.1 of the Civil Code of the Russian Federation, the registration address and the location of a legal entity are not the same - the concepts are not identical and interchangeable.

Legal entities as subjects of civil rights cannot have addresses, they only have a location. We clarify that in the current material we will use the concept of mass registration address in relation to mass addresses of the location of executive bodies.

Not to be confused with the postal address!

The executive body must be located at the registration address; it is not difficult for supervisory authorities to verify its location. The tax authorities have databases of mass registration addresses. In addition, many companies at the creation stage buy legal addresses, the reason for this is the inability to register the company at the actual address. An example would be a situation where the owner does not allow the company to be registered at the address of the premises in his possession and rented by the company.

Advantages and Disadvantages of Bulk Addresses

The main bonus is just the cost. It is lower than the amount a businessman pays for renting a real premises. There are many more disadvantages:

- problems with opening a current account - without it, the normal functioning of the enterprise is impossible;

- a decision may be made to suspend the company's work;

- inability to receive documents by mail;

- lack of opportunity to participate in tenders and cooperation with state companies;

- problems during proceedings that arise during the period of work - a legal entity will not be able to refer to the unreliability of the information specified in the Unified State Register of Legal Entities, since it is considered that they are a priori true;

- if false data indicated in the register caused losses suffered by other persons, then the businessman will be obliged to compensate everything in full;

- When issuing a refusal, the tax authorities will carefully examine all financial transactions of the applicant company.

Important: based on the results of an audit of an organization’s activities, its leader may be held accountable. The basis is Article 14.25 of the Code of Administrative Offenses of Russia.

Article 14.25 of the Code of the Russian Federation on Administrative Offenses “Violation of the legislation on state registration of legal entities and individual entrepreneurs”

Read also: simplified tax system in 2020

Why is a mass address dangerous?

There is no administrative liability for the use of “black” registration places. But there are other serious consequences:

- After fraud is detected, the head of the company at fault may receive a ban on creating new legal entities. Moreover, the restriction will be in effect for a long time - up to three years;

- A company that uses such “services” may ultimately be left without any money at all. This is possible if fraudsters use false documents to file a claim with an arbitration court demanding that funds be written off from the tenant’s account. The case can be considered in a simplified manner - without the presence of the parties.

Important: now some deputies are proposing to introduce criminal liability for such fraud.

What is a mass registration address

The concept of mass address registration can be interpreted as the registration of many companies at one address and office (room).

It is important to understand that business centers have their own legal address, and when concluding a lease agreement, one significant fact is added, such as the office or room number. It is the coincidence of these facts when registering many companies at one address indicating a room or office that is defined as the place of mass registration. It is logical to understand, for example, that it is impossible for 10 companies located at the same address to conduct their activities if the area of the premises is 12 square meters. A different understanding of the situation if the area of the room is 300 square meters. m., accordingly, the risks of falling under the consequences of recognizing a legal address as a mass registration address are minimized.

In addition, on July 30, 2013, the Supreme Arbitration Court of the Russian Federation adopted a resolution in which it clarified when the legal address indicated in the application for registration of an enterprise is unreliable, and also resolved other controversial issues that arise in practice.

The Supreme Court's position on mass addresses

Here is a brief excerpt from the resolution of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 on the features of a mass address:

- a large number of other legal entities have already been registered at the specified address, for which there is information that contact with them at this address is impossible;

- the specified address does not exist or the property located at this address is destroyed;

- the specified address is the conventional postal address of the unfinished construction site;

- authorities, military units and other institutions are located at the specified address, which does not allow the use of this address by a legal entity;

- an application has been submitted from the owner who refuses registration at the specified address;

- absence of a postal service agreement.

Important: Judicial practice does not give the Federal Tax Service the right, based on far-fetched or visible, but not legally established facts, to refuse registration of an LLC at the mass registration address, since the Federal Tax Service body had to prove the unreliability of the information provided by the applicant about the address of the legal entity being created (see Resolution dated March 10, 2020 in case No. A19-8568/2016).

At the same time, arbitration courts must take into account that the registering authority, on the basis of subparagraph “r” of paragraph 1 of Article 23 of Law N 129-FZ, has the right to refuse state registration if there is confirmed information about the unreliability of the information about the address of a legal entity provided by the applicant, that is that such an address was indicated without the intention of using it to communicate with the organization.

We interpret it this way: If at the time of submitting documents for registration, the address was checked against the database on the Federal Tax Service website and was not on the list, then this refusal can be challenged in court.

What are the dangers of a mass address?

Registration of a large number of organizations at one address is not in itself criminal.

If the company (or its division) is actually located at this address and is accessible for communication with it, then the only inconvenience will be the close attention of the tax authorities to this circumstance. Questions may also arise from counterparties who collect data about a partner and receive information about the mass nature of his registration address. If the organization is able to give reasonable explanations, supporting them with documents, then the problem is quickly resolved.

It is more difficult if the company (or its representative) is not present at the registration address. The following difficulties arise:

- Not receiving mail. It may be lost or received late, which in some cases will lead to negative consequences. For example, an organization will not receive a message from the Federal Tax Service requesting explanations for tax calculations, will not provide them and, as a result, will receive additional tax charges, penalties and a fine. Or he will not be notified in a timely manner about the consideration of the tax audit materials and will not be able to submit his objections to the act, which could affect the outcome of the audit. If letters from the Federal Tax Service Inspectorate sent to such an address are systematically returned as not received by the addressee, then it may consider such an address to be fictitious and hold the applicants accountable, and if the real address is not reported, attempt to liquidate the organization. Similar problems will occur when interacting with counterparties. For example, information about the counterparty’s claim will not be received, which will entail him going to court.

- Absence from registration address. This is of particular importance for situations where it is important to confirm the reality of the company's activities. For example, for VAT refund or obtaining a loan. Or when concluding an agreement with a new counterparty.

Read about the possibility of a visit from tax authorities during a VAT audit in the material “Desk tax audit on VAT: deadlines and changes in 2015”

Read about the rules for conducting an inspection of premises in the article “Inspection: rules for conducting and recording the results”

Tax authorities about mass registration addresses

The tax authorities interpret the concept of a mass registration address as follows: “designated as the address of a large number of other legal entities, in relation to all or a significant part of which there is information that contact with them at this address is impossible.” You can check the address for mass distribution on the Federal Tax Service website https://service.nalog.ru/addrfind.do

The court interprets it a little differently: “The address of an organization is considered unreliable if the registration authority establishes that the executive body of the company is not or cannot be located at the specified address, and the address itself is a “mass registration address.”

Since 2020, the Tax Service began to summon company directors on this issue.

Evidence of mass registration address

In particular, the following may indicate unreliability of information:

- The address indicated in the documents submitted during state registration, according to the Unified State Register of Legal Entities, is designated as the address of a large number of other legal entities, in relation to all or a significant part of which there is information that contact with them at this address is impossible (representatives of the legal entity at this address are not located and the correspondence is returned with the mark “the organization has left”, “after the expiration of the storage period”, etc.);

- the address indicated in the documents submitted during state registration does not actually exist or the property located at this address has been destroyed;

- the address indicated in the documents submitted during state registration is a conditional postal address assigned to the unfinished construction project;

- the address indicated in the documents submitted during state registration obviously cannot be freely used for communication with such a legal entity (addresses where government bodies, military units, etc. are located);

- there is a statement from the owner of the relevant property (another authorized person) that he does not allow the registration of legal entities at the address of this property.

If at least one of the listed circumstances exists, information about the address of a legal entity is considered unreliable, unless the applicant has submitted to the registration authority other information (documents) confirming that contact with the legal entity will be carried out at this address.

For example: Postal service agreement.

Conclusion from judicial practice

- The address of the company is considered unreliable if the registration authority establishes that the executive body of the company is not or cannot be located at the specified address, and the address itself is a “mass registration address,” i.e. 2 (two) conditions.

How it happens in practice

The prosecutor's office goes to a court of general jurisdiction with a request to recognize as unreliable information about the address (location) of legal entities: Luntik LLC, Tuzik LLC, etc. Provides calculations of the area per 1 employee of the company (director), evidence of advertising of a given address, an act on the absence of specified companies at the address, etc., well, and the court makes a decision to satisfy the claim, recognize the addresses of companies as unreliable and ban registration at this address actions.

Why do you need to check whether a legal address is widespread?

In theory, even if many companies are registered at the address, and the Federal Tax Service website shows that it is massive, this is still not a sign of fictitiousness for these companies. After all, we have already mentioned business and office centers, where in one huge building there is simply an incredible number of offices - fortunately, the “footage” allows. But in order to be prepared for possible troubles, it is still worth checking the legal address for mass distribution. And here's why.

Now let's determine what such a mass address entails:

State registration

To pass the mandatory state registration procedure, it is essential for a company to have a written confirmation by the owner of the office of the reality of the contractual relationship with the future tenant, and not the number of companies legalized at this address. The mass factor can have a significant adverse effect later, as a result of the company’s economic activities.

Banks

Here it must be said that in practice, not all banking institutions have the same negative attitude towards such mass addresses; there are also those that are indifferent to this indicator. There are quite a lot of bankers today who, without unnecessary or stupid questions, open current accounts for any legal entity. address, as long as the future client is solvent. But there are also those who, after checking the address and finding more than ten companies there, will not even talk to you.

As a rule, most bank clerks, having previously checked the address on the Federal Tax Service portal, organize a sudden on-site inspection, and therefore the decision on opening a current account or refusing to do so will depend on its results. Also, such surprises may happen in the future, after the Bank has made a positive decision and opened a current account. For example, when opening a loan.

If, based on the results of a preliminary check carried out by bank security services, it is discovered that there is no business at the address specified in the registration documents, then the result may be a refusal to lend, or a disconnection of the “Bank-Client” service. However, the bank will not have the right to close the current account on this basis.

Inspectorate of the Federal Tax Service

The tax service, like no one else, pays very close attention to companies legalized at mass addresses. The consequence of this may be a mandatory requirement to change the legal entity. address (and urgently), a whole series of unexpected and various checks, and even complete blocking of the current account. And recently the Federal Tax Service has made it a practice to notify banks about the absence of companies at such addresses.

Counterparties

A mass registration address may force a potential partner to refuse possible cooperation. This is due to fears that a company legalized at this address will soon turn out to be a “butterfly”, and this fact will affect not only its failure to fulfill its contractual obligations, but also the deterioration of its impeccable image, developed over the years, by the tax authorities. In addition, there is negative judicial practice for taxpayers, when companies were denied the right to deduct VAT and to account for expenses received from such entrepreneurs when the fiscal authorities detected signs of fictitiousness. One such sign is a mass address.

However, today, fortunately, there are many characteristics of legal entities. person, except for the address, which would indicate his trustworthiness. And business reputation plays an important role here. Moreover, in order to “hide the butterfly”, fraudsters have long stopped using such an obvious sign as a mass registration address.

Bulk Registration Address Advantage

The only advantage of a mass registration address is its cost, which is significantly lower than renting a premises and a white address. There are no other advantages.

Is it possible to register a company at a similar address?

The Federal Tax Service does not have the right to recognize or prohibit registration at these addresses; this is done by the prosecutor's office through a court decision. But in fact, the Federal Tax Service refuses if, according to its data, the address is problematic.

What to look for when choosing a registered address for a legal entity

- Check the address through the Federal Tax Service (What is the Federal Tax Service). This can be done on the website nalog.ru of the Federal Tax Service of Russia and the websites of the Tax Administrations of Russia for the constituent entities of the Russian Federation. List of tax authorities in Moscow.

- Go and see what is located at the proposed registration address.

- Low cost address. For example, at the beginning of 2020, no more than 15 thousand rubles. per year (1.25 thousand rubles per month) for Moscow and the Moscow region.

- Even if you bought the address at a low price, besides you, several thousand other companies did the same, 90% of them moved with tax problems.

- Obtain a certificate from the owner of the premises about companies registered at the address.

- Sign a lease agreement only with the company that owns the premises (no sublease).

It is important to understand that even with a positive conclusion for the address in question regarding mass registration, it cannot receive a similar status in a month or a year. These risks cannot be controlled if they are not specified in the lease agreement, for example: the landlord is prohibited from renting out the premises (part of the premises) to anyone without the written consent of the tenant.

When choosing a legal address, it is recommended to pay attention to the terms of the contract and the package of documents provided by the seller, as well as to the services offered additionally. Postal services must be provided, and secretarial services and the provision of a workplace can be considered an ideal option.

NEWFORMES.RF

In some cases, renting premises may not be practical. Purchasing a legal address frees you from the need to incur unnecessary expenses when the specifics of the business do not require a full-fledged office, and will also come in handy if the owner of the rented premises does not allow you to register an organization at your address. Some people prefer non-mass addresses for registration because they are not included in the database of mass addresses of the Federal Tax Service and, accordingly, there is no close attention to them from the tax authorities. On the other hand, you can save a considerable amount and purchase a mass address that has been verified by the registration of dozens of companies. In this article you will learn how to protect yourself when purchasing a legal address and how to check whether the address is mass.

- What is the address of mass registration of legal entities?

- When does an address become mass?

- Is it possible to register a company at a mass address?

- Is it worth paying extra for a non-mass address?

- What is the advantage of mass addresses?

- Why is a mass address dangerous?

- How to protect yourself when choosing a mass address?

- Mass address verification, mass address database.

What is the address of mass registration of legal entities?

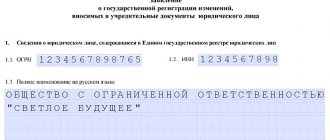

Addresses of mass registration of legal entities (mass addresses) are addresses indicated during state registration as the location of several legal entities.

When does an address become mass?

As a rule, the Federal Tax Service's database of mass addresses includes any address at which ten or more companies are registered.

Is it possible to register a company at a mass address?

If the address at which you want to register a company is included in the list of mass addresses, this does not mean that you will be denied registration. When registering a legal entity, the decisive factor is confirmation by the owner of the premises of his contractual relationship with the tenant organization, and not the number of companies registered at this address. The main arguments when registering for a mass address will be: a copy of the certificate of ownership of the premises, a letter of guarantee from the owner of the premises and, in the event of an inspection by the Federal Tax Service, verbal confirmation from the owner of the premises about the intention to enter into a lease agreement with your organization.

Is it worth paying extra for a non-mass address?

At the moment, the market is full of offers for the sale of legal addresses, while many organizations providing such services offer addresses at inflated prices, citing the fact that their address is not widespread. But you should understand that the non-mass address that you buy now may, after some time, turn into a mass address as a result of its subsequent use by new companies.

What is the advantage of mass addresses?

One of the main advantages of such addresses is their price. The price for mass addresses is tens of times lower than the cost of a legal address where no company has previously been registered and hundreds of times lower than the actual rental of premises. A large number of companies registered at one address, as a rule, indicates its reliability. This means that it has been audited by banks and the tax authority more than once.

Why is a mass address dangerous?

Initially, the database of mass registration addresses was created to combat fly-by-night companies. The Federal Tax Service pays especially close attention to companies registered at mass addresses. The consequence of such attention may be unscheduled inspections and even blocking of the account if the owner of the premises does not confirm the presence of the company at his address. When opening a current account, banks also show increased interest in companies that have mass addresses. To verify the real location of the company at the place of registration, bank employees conduct an on-site inspection. In this case, the owner of the mass address provides premises for inspection.

How to protect yourself when choosing a mass address?

To eliminate possible problems, it is worth enlisting the support of the owner of the premises in matters of interaction with the tax service and the bank. In case of an on-site inspection, the owner of the address provides premises for inspection and confirms the presence of a company at his address. Postal services must be provided, which involves receiving correspondence, storing it and transferring it to the actual address. If the tax inspectorate finds out that the letters it sends to the company’s legal address do not arrive, then the organization risks falling under suspicion, which will lead to unscheduled on-site inspections. An additional service can be the provision of a workplace, this means that the selling organization at a certain time or constantly allocates a workplace or a separate office. This service is aimed at creating the appearance that the location of the legal address coincides with the location of the executive body of the legal entity, which meets the requirements of the law.

If you are planning to register an LLC in Moscow or the Moscow region, use the services of our partner to find a suitable legal address. They will select the most convenient, profitable and trouble-free option for you in the shortest possible time.

Mass address verification, mass address database.

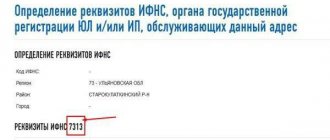

To check addresses for mass registration, the Federal Tax Service has opened a service that provides information about the addresses of mass registration of legal entities.

In order to check your address for mass registration, you must:

— fill out the request form presented above;

— send a request by clicking the “Find” button;

— if the address is mass, then the service will provide information about the number of legal entities registered at this address;

— if the address is not mass, the service will display the message “Information matching the search details was not found.”

Leave your comments and suggestions for improving this article in the comments.

What are the risks when registering at a mass registration address?

- Refusal to register a legal entity with the Federal Tax Service, incl. in making changes. A mass registration address is a fundamental feature of one-day companies, and in combination with a low rate of tax deductions (less than 0.5%) from turnover, such a company’s activities will be suspended.

- Tightening the attention of tax authorities to transactions performed, incl. suspension of account transactions and on-site inspections. To read: Reasons for tax audits in the context of the Criminal Code.

- Banks' refusal to open a current account. Since the 3rd quarter of 2015, this issue has become very relevant, as confirmed by the statistics of banks refusing to open a current account or its sudden blocking. Banks are afraid of falling under sanctions from the financial regulator and are ready to sacrifice clients. In the third quarter of 2016 alone, VTB 24 Bank refused to open a current account for approximately 4 thousand organizations (every fifth).

- Inability to receive correspondence, incl. loss of important correspondence.

- Refusal to cooperate with state and other companies, incl. on participation in auctions and tenders, since there is a position of the Federal Tax Service that the registration of a counterparty at the mass registration address indicates that the taxpayer has received an unjustified tax benefit (a sign of bad faith).

- When conducting an inspection of an enterprise, the Federal Tax Service has the right to hold the head of such a legal entity liable in accordance with Art. 14.25 Code of Administrative Offenses of the Russian Federation.

- New grounds have been added for refusal of state registration. Individuals who have already abused their civil rights once - were involved in violating the law, creating or operating fictitious companies, or deliberately entered false information into registers - will be limited in creating new legal entities. This restriction will be in effect for three years.

- Since 2020, the Federal Tax Service has often mentioned and began to clean data in the Unified State Register of Legal Entities for inconsistencies and other violations, therefore, if an already registered legal entity is identified at a mass registration address, there is a high probability of sanctions from the tax authorities.

- The most important thing is that fraudsters can file a claim in arbitration court against your company by submitting fake documents to the court and considering the case in a simplified manner without the presence of the parties, notifications are sent to your registered address, of course you have not received anything, but.... On the basis of the writ of execution, you will receive funds debited from your current account.

- State Duma deputy Yarovaya proposes to introduce criminal liability, which would include fines from 100,000 to 500,000 rubles or imprisonment for up to 3 (three) years with deprivation of the right to hold certain positions or other measures.

- Well, the main risk is being left without money in the company’s account, read the story of the center’s client: Fraud in the Moscow Arbitration Court.

The Supreme Court's position on mass addresses

When transferring documents necessary for registering a company, employees of the Federal Tax Service carry out an inspection.

If the information turns out to be “clean”, then any refusal to register can be challenged in court. Courts do not provide the opportunity to issue refusals due to apparent, but not documented, violations. Reason: Resolution of the Supreme Arbitration Court in case No. A19-8568/2016.

When considering disputes in an arbitration court, the decision made will be based on Federal Law No. 129 (Article 23, paragraph 1). That is, if the information about the “fakeness” of the enterprise is confirmed, the resulting refusal to register will be lawful.

Important: according to Supreme Arbitration Court Resolution No. 61 (clause 6), Federal Tax Service employees have the right to send a notice to the enterprise demanding that it provide reliable information. If the recipient ignores this order, a decision may be made to liquidate the organization.

What risks (consequences) does the lessor of mass addresses bear?

Administrative legislation does not contain liability for such an act, but we are sure that it will appear soon, so since 2020, the tax office began calling landlords to receive explanations: where they were accommodated, how they arrived, how they moved out, how they paid, and in general, where is there so much in such an area? firms, as well as issue requests for the provision of lease agreements and primary documents on them.

Failure to provide documents leads to an administrative fine and other problems of interaction with tax authorities.

How to check

When purchasing a company or registering it, you need to be absolutely sure that there are no risks and know how to find out the address of mass registration of legal entities, so as not to accidentally acquire a problem company or be refused to enter data about your own into the register. A list of such premises is maintained for each region separately. If there are no more than 40 of them in the entire Altai Territory, then in Moscow their number has long exceeded the limit of several hundred. If the founders or director of the company decide not to enter into a valid lease agreement, but to purchase a fictitious one, then its control is necessary. This will avoid all adverse consequences. It is completely free and takes a few minutes; you can do this on the website service.nalog.ru/addrfind.do by entering the region and district data in the form.