How to withdraw money from your phone to a card

Each mobile operator has its own algorithms for withdrawing cash from your account. Subscribers can withdraw money to wallets of electronic payment systems, bank cards, through Russian Post. A cellular user has the opportunity to top up the balance of another subscriber or pay for a purchase in an online store. More information about how to cash out money via a bank card:

| Operator | Transfer method | Size (rubles) | Commission (rubles) |

| MTS | transfer via SMS to number 6111 with the text: “card”, card number, amount |

| 4.3%, but not less than 60.00 4.3%, but not less than 60.00 |

| application My MTS service “Easy payment” | |||

| Beeline | USSD command: name of payment system (Maestro, Visa, MasterCard,) 1111222233334444, transfer amount | from 50.00 to 14000.00 | 50.00-1000.00 – commission 50.00, for a larger amount – 5.95% + 10.00 |

| SMS data command to number 7878 | |||

| Beeline official website in the “Payment, Finance” section – “Money transfers” – “Transfer from mobile to bank card” – “Transfer from website” | |||

| Megaphone | SMS to number 3116 with bank card details | from 50.00 to 15000.00 daily limit – 15000.00, monthly – 40000.00 | up to 4,999.00 –5.95% + 95.00; from 5,000 to 15,000.00 – 5.95% + 259.00 |

| through the official website in the “Transfer of Funds” tab – bank card |

Withdraw to bank card

Most mobile operators offer their customers the service of withdrawing funds from a personal account on a cell number. In this case, most often a fairly large commission is charged from the user’s account. If a subscriber wants to withdraw money to a plastic card, this service is provided by several Russian mobile operators:

- Beeline;

- MTS;

- Megaphone;

- Tele 2.

You should consider in more detail the withdrawal conditions of each cellular operator.

When withdrawing funds to a bank card, the subscriber can subsequently dispose of them at will, or subsequently credit them back to the telephone account. The operator does not impose restrictions on spending on his part. However, you must take into account the commission interest that is charged when completing the transaction.

Beeline: cashing method

Mobile operator Beeline offers withdrawal of funds to a bank card account using the following services:

- SMS to phone;

- translation using your personal account on the official website.

Each method has different conditions.

Via SMS message

In order to withdraw money from a Beeline mobile account to a bank card, you should:

- Open the field for dialing an SMS message and enter the short number 7878 in the telephone dialing window.

- Next, enter the name of the payment system to which the card is attached (MasterCard, Visa or Maestro), then, separated by a space, the card number itself (for example, 1234567890987654) and the amount of cash to withdraw (200). With this combination, the message to be sent will look like this: Master 1234567890123456 200. For Beeline subscribers using MasterCard and Maestro, the word “visa” must be replaced with “maestro” or “master”.

- After sending the SMS, a response message will be sent to the subscriber’s phone to confirm the operation, which will contain a verification code. It should also be sent to phone 7878 for the service to be activated successfully.

- If all data was entered successfully during registration, the funds should be debited from the account and credited to the bank card within 5-7 minutes (usually the transaction period does not exceed 1-2 minutes, depending on the quality of the mobile connection).

The minimum withdrawal amount in this way is 50 rubles, the maximum is 14,000 rubles. When withdrawing less than 1000 rubles, the operator’s commission will be 50 rubles, when withdrawing a larger amount - 5.95% + 10 rubles.

Transfer using Beeline Personal Account

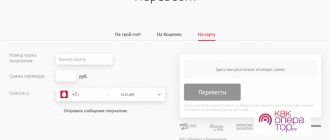

You can withdraw money from your mobile account using an account on the operator’s official website or directly from the operator’s website page. To do this you need:

- Go to your personal account and log into your account (if necessary, go through the registration procedure).

- Find the “Payment” tab, then go to the “Pay from your phone account” section. In the list of services that opens, find credit to your bank card account.

- A form window will open. In the appropriate fields, you must enter personal data, bank card, phone number from which the withdrawal will be made, as well as the withdrawal amount itself. The total write-off amount, including commission interest, will be shown in the lower corner of the form.

- Next, you should check the entered data, click “Ok” and wait for an SMS message from the operator with a transaction confirmation code (usually arrives within 60 seconds). The combination of numbers should be entered in the window that appears, and then wait for a notification confirming the transfer.

Typically, the time it takes to confirm a transaction and debit funds from an account does not exceed 5 minutes, and the time it takes for funds to be credited to a bank card is up to an hour.

MTS: Cash withdrawal

The MTS operator also provides the ability to withdraw funds from your phone. You can also perform this operation in two ways:

- via SMS message;

- through your Personal Account.

In both cases, the commission charged will be 4.3%, but not less than 60 rubles.

Via SMS message

In the SMS field, enter the word card, bank card number and the amount to be withdrawn from the account.

As a result, the message should look like this: card 1234567890123456 200. The payment system can be any (MasterCard, Visa or Maestro).

You should send this SMS to the short number 6111, wait for confirmation of the operation and enter the code from the SMS in the field for sending messages. Then wait for the funds to be credited to your account.

Transfer using your MTS personal account

If the user has access to the Internet, you can withdraw funds from your mobile balance using the MTS Personal Account or on the MTS special page - MTS Money. To do this you need:

- Open the official website of the account, go through the registration procedure or log in.

- Open the “Account Management” section, then “MTS Money”. Next in the general list you should open a credit to your bank card balance

- In the fields of the form that appears, you should enter the bank card number, user information, mobile number to be written off and the amount that will be written off from the account.

- After checking all entered data, you must confirm the operation and activate the service after entering the SMS code.

The daily withdrawal limit is 15,000 rubles, the minimum amount for making a transaction is 50 rubles. A user cannot make more than 5 transfers per day.

It should be noted that for registered users the commission will be less than for non-registered users.

Megafon: withdrawal of money

Withdrawing funds from a Megafon mobile account is possible using:

- Personal account;

- SMS messages.

In both cases, the operator offers uniform commission write-offs in the amount of:

| Conditions | Commission amount |

| From 50 rubles to 4,999 rubles | 5,95% + 95,00 |

| From 5000 rubles to 15000 rubles | 5,95% + 259,00 |

At the same time, the maximum transfer amount per day is 40,000 rubles, per month – 40,000, but not more than 15,000 for one transfer.

Transfer in your personal account

- Log in to your Personal Account or go through the registration procedure, after which you will need to open the “Transfers and Payments” section; you can also go through the process without registering on the MegaFon website. In the general list of services provided, you should find credit to a bank card and click on the appropriate link.

- A section will appear with empty fields to fill out. The user must indicate contact information, card number and phone number from which funds are planned to be debited and the amount that will be withdrawn from the account.

- After checking all the entered data and confirming the transfer yourself, you just need to wait for a message notifying you of activation.

Transfer via SMS

In order to transfer money from a mobile account to a card using messages, you should:

- Open the field for dialing an SMS message and enter the short number 3116 in the telephone dialing window.

- Next, enter your bank card details, the required payment amount (no less than 50 rubles, no more than 15,000 rubles), send a message and wait for the transaction to be confirmed.

Before performing a transaction, you should make sure the quality of your mobile connection.

Money transfers to Tele2

For Tele2 users, the operator also provides several methods for withdrawing funds to the card. The most popular include:

- use of your personal account;

- USSD request.

Via Personal Account

In order to withdraw money to your account through your Tele2 account, you must follow the algorithm:

- Go to the Tele2 Personal Account website and log in (if you didn’t have an account before, you will have to go through the registration procedure).

- Find the “Transfers and Payments” tab. In the list of services that opens, find the transfer to your bank card account. You can also go via a direct link.

- In the next section, you should enter personal contact information, the sender's phone number, bank card number and the amount that will need to be debited from the account.

- Next, you should check the entered data, click the checkbox next to the agreement with the terms and conditions and select “Transfer”. Next, wait for a notification of successful activation from the provider’s information center.

USSD request

In the dialing field, enter the combination of characters *159*bank card number*required withdrawal amount#. Then press the call button and wait for the operation to be confirmed.

The minimum Tele2 commission amount will be 5.75% of the amount.

How to transfer to Qiwi wallet

It is important to remember that money can be withdrawn from a mobile phone account via QIWI only from the balance of the number to which the account is registered in this payment system. The first thing you need to do is create a QIWI e-wallet, following the instructions on the website. Further algorithm of actions:

- Log in to your account.

- On the main page, find “Top up your wallet”.

- Select “All deposit methods” on the left.

- Next, open the “Mobile phone account” tab.

- Then select the desired operator.

Different mobile service providers have different transfer fees. Withdrawal of money from a mobile phone to a QIWI wallet is carried out by the following cellular providers:

| Operators | Commission amount (%) |

| MTS | 9,9 |

| Beeline | 8,95 |

| Megaphone | 8,5 |

| Tele 2 | 9,9 |

Ways to receive money from your phone

Mobile operators are not interested in the client’s desire to withdraw money from the account. They are afraid of losing profit and clients. This is often what happens. Have you decided to terminate your contract with the operator? You are required to pay funds from your balance. To do this, take the application for refusal of services to the operator’s office. Take your passport with you. The money will be returned immediately or over time.

Another way to receive money is withdrawal through wallets on the Internet (QIWI, Webmoney, Yandex.Money). You will also have to pay a wallet fee to withdraw money to the card. Gentle interest rates for withdrawals are provided to regular customers. Personal status allows you to link a bank card to an online wallet.

Of the minuses. There is no way to transfer money to a QIWI wallet from a Beeline card balance. According to the operator’s terms, money can be transferred within 3 days. Only working days are counted.

Many operators have the ability to issue plastic cards to customers. These cards have one account with the SIM card balance. You can pay with money on the card in partner stores of the mobile operator. But you cannot withdraw cash. ATMs refuse to accept such plastic cards. Although this option would be worth considering.

How to withdraw to Yandex wallet

Today this system is the most popular in Russia. To top up your wallet, follow these steps:

- On the Yandex-Money website, click “Top up” - “From mobile balance” and enter your mobile phone number.

- Wait for an SMS from the operator (wait from 1 to 20 minutes).

- Confirm the transfer with a reply SMS.

You can withdraw money from your phone only after linking it to the Yandex-Money system. The service is available to the following mobile operators:

| Operators | Commission |

| MTS | 10,86% + 10,00 |

| Beeline | 7,95% + 10,00 |

| Megaphone | 7,86% |

| Tele 2 | 15,86% |

"Yandex money"

Another popular and well-known payment system is Yandex.Money. It is common in Russia. Electronic wallets in this system are open to many citizens of our country. This is confirmed by statistical information. According to available data, at the beginning of 2017, there were about 30 million wallets in the payment system. Every day this figure increases by about 15 thousand.

Topping up your Yandex.Money wallet from the websites of mobile operators is not very convenient. Not all of them offer the service of cashing out money in this way. It’s much easier to log into your e-wallet and link your cell number to your account. And then here’s how you can cash out money from your mobile phone:

- in the electronic wallet, click the “Top up” button;

- select the “From mobile balance” method;

- indicate the required amount and wait for the SMS code to confirm the operation;

- enter code.

When transferring money, a commission is charged. Its size depends on the mobile operator:

- Beeline takes 7.95% and 10 rubles;

- MTS withdraws 10.86% and 10 rubles;

- Tele2 takes 15.86% of the top-up amount;

- Megafon removes 7.86%.

Transfer to WebMoney

First, you need to log into the WebMoney system using your account by entering your username and password, then link your phone number in the settings. To replenish the balance, the user must have a formal certificate or higher. It is easy to obtain by filling out the fields in the settings and sending scans of your passport. After confirmation, you can transfer money. Further actions:

- On the main page, find the option “Top up your wallet” - “From phone+”.

- Enter the amount in rubles in the window that appears (from 10.00 to 5000.00).

- An SMS will be sent to your phone number to confirm the transaction.

- Afterwards the money will be credited to your account.

Each cellular provider has its own commission percentage. It amounts to:

| Operators | Commission |

| MTS | 11,6% |

| Beeline | 9%+10,00 |

| Megaphone | 9% |

MTS

It turned out to be more difficult for everyone to find a service for transferring money from a phone on the MTS website. You must log in, i.e. go to your personal account. Then go down to the bottom and select “Transfer money”.

Next, you should fill out a standard form with account information, phone number and amount. Transfers are only possible to Visa and MasterCard cards.

Information on commissions and limits:

- Pay 4.3%, but not less than 60 rubles. + 10 rub. for carrying out the operation.

- After payment, the balance on your phone account should be at least 10 rubles. and higher.

- You can transfer no more than RUB 14,999 at a time.

- The operator allows you to transfer up to 30,000 rubles per day. (maximum 5 operations), and per month - up to 40,000 rubles.

Similar to other mobile operators, MTS makes it possible to transfer money via SMS. Use short number 6111. Message text: card [card number] [amount].

Money transfers

You can withdraw money from your phone using money transfer systems. Websites of mobile operators have special forms in which you must indicate:

- phone number;

- transfer amount;

- first name, patronymic, last name of the recipient;

- passport number and series (Beeline);

- sender details (Megafon).

Several money transfer systems are available to subscribers of mobile operators. Among the most popular:

| Mobile service provider | Unistream | Close | Contact | |||

| Translation | Commission | Translation | Commission | Translation | Commission | |

| MTS | from 1.00 to 15000.00 | 4,3% | from 10.00 to 15000.00 | 4,3% | from 10.00 to 15000.00 | 4,3% |

| Beeline | from 100.00 to 14000.00 | 5,95%+10,00 | Payment system not supported | from 1000.00 to 14000.00 | 5,95%+10,00 | |

| Megaphone | from 1.00 to 15000.00 | more than 9% | from 1.00 to 15000.00 | more than 9% | from 1.00 to 15000.00 | more than 9% |

How to withdraw money from Megafon

Subscribers of the Megafon operator can also withdraw funds from their mobile account. Withdrawal methods are similar to algorithms for other Russian operators.

Next we will talk in detail about the simplest and most accessible ones.

SMS message

You can withdraw money from Megafon to a bank card by sending an SMS to the number 3116.

The message itself contains the following information:

Card_bank card number_payment amount

- The minimum amount for withdrawal is standard – 50 rubles.

- The maximum is 15,000 rubles.

- If you transfer less than 5,000 rubles, then the commission amount is 5.95% + an additional 95 rubles for the transaction.

- If the transfer amount exceeds 5,000 rubles, then the additional fee increases - its amount is 259 rubles.

On the official site

Megafon also has its own Personal Account for all active subscribers of the mobile operator.

To withdraw money from your balance, follow these steps:

- Open the site and log in;

- Go to the “ Services and Options ” section;

- Click on the subsection “ Payments and transfers ”;

- Click on the tab “ Transfer from phone account to bank card ”;

- We indicate all the necessary details and submit the form.

Conditions:

- If you withdraw funds to a bank card, the minimum amount limit is 50 rubles, the maximum is 13,730 rubles.

- When withdrawing money to a bank account, you can send from 1 ruble, but the payment amount should not exceed 15,000 rubles.

- There is also a daily and monthly limit: no more than 40,000 rubles.

The commission amounts are similar to those established for transfers from a mobile account by sending an SMS message.

In addition, on the official Megafon website you can order cash pickup at Contact and Unistream points, as well as delivery through Russian Post.

Via Unistream

For the Unistream system in Megafon, withdrawal of funds is available by sending SMS. To do this you need to send a message to the system number 8900.

It should indicate the following information:

Unim_withdrawal amount_last name first name middle name

Funds can be received at the nearest Unistream service point.

Note! To receive cash at one of the Unistream points. You must present your passport. Without confirming your identity, funds will not be issued to you.

Megafon Map

Megafon has its own monetary system. It differs in that the mobile phone balance is used as a bank account and card. When you put money on your phone, the same amount appears on the card. Therefore, the Megafon payment system can be used to withdraw funds from your phone account. To do this, you just need to pay with a card in a store or withdraw money from any ATM.

- The minimum commission amount for withdrawing funds through an ATM is 100 rubles. Moreover, the total commission amount is 2.5%.

- When transferring money to accounts or cards of other banks, the operator’s commission is 1.99%.

Withdrawal via Russian Post

You can withdraw cash from your mobile phone through Russian Post. Cash withdrawal is carried out in the following way:

- Indicate your phone number and recipient information on the receipt.

- Write the amount you want to withdraw from your phone.

- Choose the most convenient post office.

The money is debited from the balance along with the commission. For different companies providing cellular communication services, it is:

| Operator | Commission amount |

| MTS | 4,2%+55,00 |

| Beeline | 2.6%+50.00 (post office) |

| 4.37%+80.00 (home delivery) | |

| Megaphone | 5,2% |

Transferring money to a card from your phone balance via SMS message

This method is even simpler, since it does not require visiting Internet resources. To transfer the excess amount, you just need to send an SMS with the data to a specific number and wait for confirmation. The operation looks like this:

- for Megafon subscribers - a message to number 8900 in the form of Card 0123456789123456 01 20 7000, where after the card number its validity period and the required amount for transfer are indicated;

- for Beeline subscribers - a message to number 7878 in the form of Card 0123456789123456 7000, that is, without indicating the expiration date of the plastic card.

Owners of an MTS SIM card can use a USSD request. To do this, dial *611*1234567891234567*3000# and press the call button. In response, you will receive information that the request has been accepted. The commission will be 4%.

Funds arrive on the card within a few minutes. However, MasterCard system plastic holders note that the transfer can take up to several days.

Receiving money from an ATM

You can withdraw money from your phone through an ATM. Only Beeline provides its subscribers with this opportunity. Algorithm of actions:

- Send a request to number 7878, indicate the amount you want to withdraw.

- Wait for an SMS indicating further actions.

- After completing all the requirements, you will receive another message with a PIN code, which you will need to withdraw money.

- Find the Beeline Money ATM, enter your phone number, PIN code and get cash.

How to transfer money from a cell phone balance to a virtual card

Mobile operators offer customers the opportunity to use virtual cards. They are issued to users free of charge. In the MTS company this is a virtual MasterCard card, called MTS Money. For transfers to them, a commission of 1.5% of the transaction value is charged. Megafon provides subscribers with virtual Visa cards linked directly to their phone balance. That is, the entire amount on the number’s account is also displayed on the card. Services are paid with a commission of 1.5% and an additional charge of 5 rubles.

To cash out funds from virtual plastic, you should go to the operator’s website and visit the Receive cash section or click the Transfer to Unistream tab. In the window that opens, enter information about the phone number, amount and personal data of the recipient of the funds. Money is cashed out at transfer issuing points after confirmation of the completed information.

Algorithms for withdrawing money from an account

Each cellular operator has its own algorithms used to successfully withdraw money from subscribers’ accounts. Users have the opportunity to transfer money to a bank card, e-wallet, and even receive their finances in cash. In addition, it is possible to top up the balance of other subscribers. You can also pay for services. For example, buy a movie ticket or pay off your housing and communal services debt. Let's take a closer look at how to withdraw money from your phone account in cash.

In a situation where there is a significant amount in your mobile account, it is quite possible to use a universal and very convenient and proven method - to terminate the contract between the mobile operator and the subscriber. As a result of such actions, all finances of the client who decided to terminate cooperation are returned directly to him. But what to do if you are satisfied with the quality of your connection? And this method will take too much time. How can you withdraw money quickly and without extra effort? There is a solution.

Transfer cash from Beeline

In order to transfer your funds from your Beeline mobile account, you must:

- go to the official website of the operator;

- then open the Beeline.Money section;

- then go to the pick-up point and select “Receive”;

- then we find “Across Russia”;

- We choose the most convenient method of transferring funds.

Among the proposed methods of transferring funds:

- directly from the site (in this case you will have to fill out a short form and then confirm your decision via SMS),

- using any “Contact” or “Unistream” money issuing point.

In the second option, the algorithm is as follows: to the short number 7878 we send an SMS of the following nature Cont or Uni (respectively, Contact or Unistream), then <country code> last name, first name and patronymic of the sender his passport number last name, first name and patronymic of the recipient the amount of the transfer. Literally in a minute or two you will receive a response SMS with data about the transfer and a request to confirm it. Accordingly, we send a confirmation message.

This method is quite comfortable, simple, fast and, most importantly, economical. The commission for the Russian Federation will be from 2.6%. Transfers from one hundred rubles are possible. And the operation itself will take no more than ten minutes.

In addition, subscribers of this operator can receive their funds in cash using the services of Russian Post. But in this case you will have to wait about five days.

Those subscribers who have a Mastercard, Visa, Maestro card have a unique opportunity to transfer funds immediately to a bank account. You can use this service directly on the official website by opening the menu of the Beeline.Money section.

Features of withdrawing funds from the accounts of various operators

Let's consider options for cashing out funds from the accounts of different mobile operators.

MTS

Bank card. A one-time withdrawal of no less than 1,700 and no more than 15 thousand rubles is possible. Per day - up to 5 transfers, with a total limit of 30 thousand, monthly limit - 40 thousand rubles. The minimum commission is 25 rubles, then 4% of the withdrawn amount.

Any system for fast money transfer can be chosen, the commission charged is 4%, the restrictions on the maximum cash withdrawal (one-time and within a month) are the same as when withdrawing funds to a card.

A virtual card is issued on the official website with a zero balance; topping up your account from your phone comes with a 1.5% commission.

To withdraw funds to the Yandex Money system, the algorithm is simple: open the pay.mts.ru page, where you select the appropriate logo, fill out a form indicating the phone number and the amount to be sent. The choice is confirmed by the “Next” option, after which an individual login and password are entered. The total “two-way” commission for the operation performed will be a considerable percentage (11.35% + 10 rubles per operation).

Beeline

Transfer to a bank plastic card is available in the range from 1300 to 15 thousand rubles, for one month no more than 40 thousand rubles. The commission will be 4.95% of funds withdrawn to the card.

Withdrawals to the fast money transfer system are available from 100 rubles to 15 thousand, the commission is less than when withdrawing money to a card, only 2.99% and 10 rubles “on top”.

Megaphone

A kind of “progressive scale” of commission fees has been introduced here for withdrawals to bank “plastic”. With a base commission of 5.95%, an additional 95 rubles are charged if the amount withdrawn is at least a ruble less than 5 thousand. From 5000 (inclusive) - 259 rubles are added to the same percentage. Any amount is available for withdrawal, ranging from one ruble (which is obviously unprofitable) to 15 thousand, per month - no more than 40 thousand.

The same conditions apply when withdrawing cash to the fast money transfer system (Unistream and others).

A special feature of the Megafon virtual card is that it has a single balance with your phone account (that is, you have the opportunity to make purchases on the Internet without paying additional fees, you just need to top up your own mobile phone account).

Withdrawing funds to electronic payment systems

It is very simple to withdraw money from your mobile account to Yandex.Money, WebMoney, Qiwi, provided that the number is linked to such wallets.

On kiwi

The steps are as follows:

- Go through authorization;

- Go to the Top up item;

- Choose the Online method;

- Specify the transfer amount;

- We confirm actions using SMS.

QIWI has several important advantages compared to other electronic payment systems. It has a fairly simple interface. The timing of crediting money to the account is prompt. It is equally important that there is a direct connection between the account and the mobile phone number.

WebMoney

The algorithm of actions is as follows:

- Select menu Top up / From mobile phone / MyPhone

- Next, indicate the replenishment amount

- Enter phone number

- Confirm actions via SMS

Important advantages of WebMoney are its high reliability thanks to multi-level protection against fraud, as well as high efficiency in depositing funds.

There are several ways to withdraw money from your phone. Which one will be more convenient, choose for yourself, taking into account individual characteristics.

Cash withdrawal from MTS SIM card

If you have money transferred to an MTS SIM card and you don’t need such a large amount, you can quickly withdraw cash at low interest rates. Funds can be withdrawn to any bank card, bank account and through a money transfer system. All withdrawal methods need to go to the MTS website in the My MTS application and go to the Payment Management section. Here you can choose any withdrawal method.

Money transfers

In the Money Transfers block, you can transfer money using your card number and send cash to the system’s point of issue: Unistream, Anelik, Contact, Blizko and Russian Post. Transfer by card number allows you to send funds not only to a card of any bank, but also to plastic cards such as Megafon, Kukuruza, Qiwi and others, from which you can withdraw cash from an ATM. Transfer by card number is carried out almost instantly.

To receive money at the point of issue of the money transfer system, you should go to the section Payment Management - Money Transfers - Cash Transfer on the MTS website and select the money transfer system, the point of issue of which is located in close proximity to you. You will then be asked to fill out a form. The total amount with commission is displayed under the entered transfer form. After the transfer, there should be 10 rubles left on your phone account.

Through the Unistream system, for example, you can also transfer money via SMS to number 3116. The commission in this case will be slightly higher - 6.95% (as opposed to 4% from the MTS website). To send cash to the money issuing point, you need to dial the following message: uni 100 Ivanov Nikita Ivanovich Sidorov Fedor Petrovich Passport 1234 567890 2005-05-12, where:

- uni - unchangeable Unistream code;

- then comes the amount;

- Sender's full name separated by a space;

- Recipient's full name;

- always Passport;

- passport Series;

- separated by a space, passport number;

- date of issue in Year-Month-Day format.

Loan repayment

MTS has one small nuance. If withdrawal to a card and cash withdrawal through money transfer systems is indicated in the Money transfers section, then you will not find withdrawal to a current account there. However, next to Money Transfers there is a Loan Repayment item and, using this option, you can safely transfer money to your account by entering the necessary data.

You only need to select the bank where you have an account (and MTS works with almost all banks) - Sberbank, Alfa Bank, Leto Bank, Otkritie, etc. By clicking on the icon of the desired bank, you will be taken to a page where you will be asked choose whether you want to transfer money to a current account or to a card of this bank. Thus, the function of transferring money by card number is implemented in MTS 2 times - simply by the card number in the Money transfers section and by the card number of a specific bank in the Loan repayment block. The money arrives in your bank account in about a day.

Available options

In order to use the funds accumulated on your telephone account by directing them to another purpose, you can use two options. First (option A): withdraw money to an external account and then transfer it into cash (this path involves paying significant commission interest). Second (option B): save cash by taking advantage of the payment and purchasing options that cellular operators provide more and more every year.

Option A

Let's take a closer look at option A. Available solutions in this direction:

- Withdrawal from a mobile account to a bank card. The timing is unpredictable, from a few minutes to 5 working days (transfers to the Master Card system take the longest). The number printed on the card must be no more than 16-digit; transfer is not possible on cards with a large number of digits in the number (such as, for example, Maestro cards issued by the Security Council of the Russian Federation).

- The use of services that provide fast money transfers to withdraw money from a mobile phone is available to Big Three subscribers. In the relevant sections on their official websites it is easy to select the system of interest (Leader, or Contact, or Unistream).

- A virtual card beneficial for advanced Internet users (details for online purchases without the usual “plastic”).

- For MTS users, withdrawal of funds to a Yandex wallet is open (with a “draconian” deduction of interest), and then cashing them out using a Yandex Money card at any ATM with the corresponding additional commission, or further transfer to any bank card.

- Perhaps a more profitable option would be an initial transfer to a mobile phone number of another operator (if the opportunities provided to you on the official website of your operator are small).

Option B

Option B also has an alternative:

- The goal - to save cash - is achieved by direct payments from a mobile phone account for the services provided (loans, monthly housing and communal services fees, closing fine receipts and paying government fees).

- An option to save cash (if there is appropriate interest) is to purchase full versions of Google Play applications, as well as Appstore, instead of free demo options with limited capabilities.

Sending money via Beeline

From a Beeline SIM card you can transfer not only to Russian numbers, but also to phones of CIS subscribers. There are three ways: through the provider’s website, using SMS and USSD command.

- To make payments through the website, follow the link https://moskva.beeline.ru/customers/how-to-pay/oplatit-so-scheta/#/, select “Mobile communications”, then the desired operator. In the top field, enter the recipient's number, below is your Beeline phone number (an SMS will be sent to it for confirmation) and the top-up amount (from 10 to 15,000 rubles).

The commission for MTS, Megafon, Tele2 numbers will be 7.95% + 10 rubles, for Beeline – 15 rubles (for payments from 30 to 200 rubles) and 3% + 10 rubles (from 201 to 5000 rubles).

- You can pay for communication services of other mobile operators using an SMS command.

To do this, you need to send a message in the format “recipient’s phone number (without transfer amount) to service number 7878”, in response you will receive an SMS asking you to confirm the action. Example: 9501574718 250

To do this, you need to send a message in the format “recipient’s phone number (without transfer amount) to service number 7878”, in response you will receive an SMS asking you to confirm the action. Example: 9501574718 250

For MOTIV and GoodLine operators, you need to write motiv or goodln at the beginning of the message (with a space after these words).

Commission for Russian numbers – from 4.95%, for foreign ones – 7.95% + 10 rubles.

- USSD command: *145*subscriber phone number*transfer amount# and call.

You can top up Beeline from a Sberbank bank card via mobile banking. To do this, you need to send an SMS to number 900 with the text: “TEL number amount.” In response, you will receive a digital code, which must also be sent to number 900 for confirmation.

To do this, you need to send a message in the format “recipient’s phone number (without transfer amount) to service number 7878”, in response you will receive an SMS asking you to confirm the action. Example: 9501574718 250

To do this, you need to send a message in the format “recipient’s phone number (without transfer amount) to service number 7878”, in response you will receive an SMS asking you to confirm the action. Example: 9501574718 250