This story began on July 15, 2020. That day, languishing from the heat, I persistently looked through the fifteenth remote control.

Relentless statistics confirm that 98% of the debts of legal entities in the vastness of Russia are unsuitable for collection, “dummy”. Fourteen previous ones turned out to be such. Reading the terms of the next lot, I slowly sat up in my chair and couldn’t believe my eyes. A nugget loomed on the screen. My admiration and joy will be understood only by those who, for six months, selflessly shovel through thousands of lots, spit, give up analyzing, and scold with the last words the bankruptcy trustees (hereinafter referred to as CM), who put outright garbage at auction in order to somehow justify their salaries to the Council of Creditors.

I instantly sent a request to KU, to his email, and began to wait with the lust of a 17-year-old boy for an answer. Naturally, today my study and in-depth analysis of the remaining ninety-nine receivables is over.

I've been waiting a day, no answer. I'm waiting for the next one - the same result.

I always send a request to KU with the function of confirming that my letter has been read by the addressee. And I set a 5-day deadline for reminding me if there is no response to the letter.

Joy came on the third day of unbearable anticipation. I received confirmation of the liquidity of the lot.

Comprehensive analysis of accounts receivable

Without this point, buying remote control means pointing your finger at the sky and ultimately paying for a pig in a poke. This, as a rule, leads to the loss, at best, of the deposit for the lot, and in the worst case, the amount that you allocated for the lot. With the help of my website debtorki.rf, carry out a professional analysis of remote control and distribute liquid lots to a database of persons participating in the purchase of remote control over the past three years.

I know the need to conduct a preliminary study of liquidity, in other words, the future 100% possibility of debt collection.

Over the 4 years of its activity, it has developed liquidity criteria for the subsidiary, which allow us to hope for the future successful collection of the debt of a third-party LLC . I'm posting them for you.

Registering a business after making a positive decision

Having figured out how to get a subsidy to start a small business, it’s important to figure out what happens next.

After the business plan has been reviewed by the commission and a positive decision has been made to provide a government subsidy, you can proceed to registering your own small business. Just like with a business plan, you can do everything yourself or entrust the work to an outsourcing company specializing in these services.

We will register an individual entrepreneur or LLC for you: save time and money. The result is guaranteed!

Take the first step towards your own business

You have to register a business, obtain registration documents from the Federal Tax Service of Russia and open a bank account. After this, this package of documents will need to be provided to the employment center.

The subsidy funds will be transferred to the bank account of the individual entrepreneur or LLC within a few days after this.

After three months, you need to come back to the central control center with a report on the funds sold. Cash or sales receipts, bank statements, invoices and other documents are suitable for documentary evidence.

Free financial assistance from the state is possible provided that business activity has been carried out for at least a year. During this period, the business can be inspected by an interdepartmental commission of a government agency. If activities are suspended during this time, the subsidized funds will have to be returned.

Liquidity criteria for a legal entity's debt

A legal entity's financial assets must have the following liquidity parameters:

- Preferably a valid telephone number, postal address and company website;

- Information about the Debtor appears in search engines;

- The debtor is a going concern;

- The LLC must not be bankrupt;

- The LLC should not be in the process of liquidation or reorganization;

- Participation in existing government contracts is encouraged;

- The LLC must not have any debts to the tax office;

- The debtor must not have a legal address of mass registration;

- Its director is not in the “mass” category;

- The claim against the debtor must be categorized as “settled”;

An example of confirmation of debt liquidity as a result of a comprehensive analysis of a real lot

Open auction

Accounts receivable from GarantStroyExpert LLC—RUB 49,709.03. Region: Altai Territory

Claims against the debtor: RUB 39,539. 52 kopecks amount of unjust enrichment and 10,169 rubles. 51 kopecks interest for use.

Debtor: STROYGARANT LLC (TIN: 2222795753) (at EFRSB) Address: Altaisky, Barnaul, Krupskoy, 143 Region: Altai Territory Date of auction: 04/13/2018 08:00

About the company: Limited Liability Company "GarantStroyExpert"

1. Company details: TIN 2225091811 2. Legal address of the company 3. Actual address of the company: (matches the legal one) yes 4. Types of activity: Construction of residential and non-residential buildings. 5. Company registration date: Registered 01/30/2008, active+ 6. Taxation system used: uses the simplified tax system 7. Director: Director Maxim Aleksandrovich Rudnev 8. Number of employees 9. Telephone 10. Website: garant22.rf. 11. Founders of the company: Rudnev Maxim Aleksandrovich, also director 12. Relations with other companies: no 13. Branches of the company: no 14. Authorized capital (thousand rubles): 12

Financial Analysis: Projected Revenue Growth for 2020: +36%

Performance results for previous years:

Efficiency: high. The owner's income is above average (70 kopecks per invested ruble). The profitability of property (68%) is higher than the industry average (2%) for the Construction industry. Return on sales (292%) is higher than the industry average (6%) for the Construction industry.

Property status: normal. Management of current assets has become more economical: customer debts began to be collected 14% faster. Over the past year, property has grown by 36% (from 867 thousand rubles to 1182 thousand rubles), which increased the potential of the enterprise. No funds have been allocated for long-term development.

Financial situation: good. Solvency is high: current assets (sources of repayment of liabilities) exceed liabilities by 5273%. There is no threat of financial dependence: borrowed funds on the balance sheet (2%) do not exceed equity. The provision of current activities with own funds is good (98%> 30% of the amount of current assets)

Company reliability: above average. Courts (plaintiff, defendant, writs of execution): there are no enforcement proceedings.

Factors for successful recovery:

- Availability of a phone number and a website, which is very good for collection.

- Excellent economic indicators.

- Availability of state contracts.

- LLC reliability is above average.

- The claim against the debtor is ours alone.

Recommendations for purchasing private property: very high probability of collection.

Collection plan:

- Proposal to conclude a settlement agreement after the debt takeover procedure with a discount of 10% to 30%.

- Full recovery.

- Debtor's bankruptcy.

The receivables I selected fully met all of the listed debt liquidity criteria.

How to start your own business - make money on the Internet?

Let's first describe ways to make money. So, let's begin:

On clicks, registration of other people's resources in directories, and so on, the name of which is legion. It is impossible to earn any significant money in this way, even if you work for days.

Freelance work. The easiest way to work online, which does not require the user to have his own website. It consists of receiving and fulfilling orders for certain activities: drawings, web design, translation of texts from foreign languages, copywriting (creating completely unique texts) and rewriting (presenting a ready-made text in your own words so that it becomes unique). You can receive orders on the corresponding exchange sites.

Partnership programs. A very profitable way to earn money, if not for one “but”: to fully work in this direction, you need to have your own visited resource on the Internet. If someone, following these links to the store’s websites, buys the product offered there, then you receive your legal percentage, the size of which varies greatly among different customers.

Selling space for banners. Despite all the profitability, the disadvantage remains the same as with the previous method: you need to have your own website with high traffic, on which the cost of placing a banner will directly depend. This also includes contextual advertising, earnings from which depend on the number of clicks. To do this, you need to register in the appropriate system (for example, Google Adsense) and place the resulting code on your website.

Bookmakers and gambling. It is possible to make money in virtual Las Vegas, but this requires a significant amount of luck and some analytical skills. From a few dollars to tens of thousands

It’s 2020, the crisis, like many residents of our country, remains unemployed. I read a lot of information about employment, including how to properly write a resume to apply for a job, etc. Searches for vacancies were unsuccessful.

After months of unplanned “vacation”, I decided to turn to the help of pop-up advertising blocks on the Internet about making money.

The first thing I came across took the path of least resistance, so to speak, mail clicks. I registered on one of the web resources, registered an electronic wallet and started viewing advertisements. Click the links, see the banners and surf. After a day of grueling work, I earned $0.85!!! I immediately realized that such income on the Internet is not for me!

The second step was more exciting. I noticed my addiction to gambling a long time ago. But it was difficult to decide to play poker for money. I visited the website of a famous poker room. I went through a short training, testing, received a bonus $50 and started playing. Fortune did not smile for long, after winning $150 in a couple of hours, she began to lose game after game. As a result, the account has zero and the conclusion is that such earnings are real, but risky.

Similar to previous experience, I can say about Forex. Perhaps I did not have enough talent as a trader, perhaps “Black Monday” fell on the very day when I started trading with a bonus deposit on the foreign exchange exchange. One way or another, things didn’t go well here either.

On the third day of my job search, I came across an offer to make money online by writing articles. The work is not dusty, literacy, uniqueness and creativity are the main things that were required of me. As usual, I registered on the website and started taking orders. It is worth noting that in the first months there were “penny” orders, where payment sometimes barely reached 7 rubles per 1000 characters.

Soon, when the rating went up, many customers of texts on the exchange awoke in me. There was enough work, enough income to buy personal belongings. Over time, or, to be precise, a year later, I already got into the TOP 20 copywriters of the exchange. The average monthly income began to be $500,600. But I didn’t want to stop there. Now I was interested in much greater prospects. It's been six months already. During this time, she continued to engage in copywriting and writing articles on exchanges, with a total income of up to $2,000. Plus, independently or through my own orders of articles, I promoted 5 blogs and 3 websites.

Back to contents

Conclusion

Today, my total Internet earnings bring me 9.5 thousand dollars. But this is not a threshold for me either. When you have more money, you want to get even more, and if the Internet provides opportunities, why not take advantage of them?! The main thing is to start working officially, through the status of individual entrepreneur, LLC, etc.

Source – https://richpro.ru/ (Galina Yakovleva)

Back to contents

Buying a lot

An important phase of the transaction has arrived. Questions that are important to find answers to at this stage:

- At what price should I buy the lot?

- What is the public offering period?

- How can I prevent the auction organizer from finding out my price?

- And didn’t ruin the purchase?

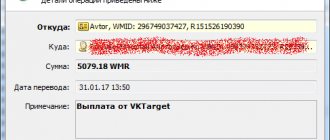

The experience I acquired over 4 years of activity in this field allowed me to make the right decisions and win the auction. I am posting the auction protocol for you:

However, victory in the auction is considered final only after the debt is collected.

Expenses for opening an individual entrepreneur

Costs at the stage of creating a business can be divided into mandatory and additional. Mandatory expenses include only state duty. This is the only payment without which it will be impossible to open an individual entrepreneur. Additional costs include the following:

- Notarial services.

- Post services.

- Purchasing an electronic digital signature.

- Services of professional registrars.

- Managing individual entrepreneurs (accountant services).

- Making a seal.

- Opening a current account.

- Purchasing an online cash register.

Let's take a closer look at each of the points to understand how much it costs to open an individual entrepreneur and what the price of registering a business consists of.

State duty for opening an individual entrepreneur

The state duty, as mentioned above, is the only mandatory payment, without which opening an individual entrepreneur is impossible. It is transferred to the details of the registration authority for reviewing the documents of the future entrepreneur. That is, the applicant does not pay for the fact of registration itself, but only for having his documents reviewed by the Federal Tax Service. Few people know that if registration is refused, the state duty is not refunded. The documents were studied, the decision was made (even if not in favor of the individual entrepreneur), the service was provided, which means there is nothing to return.

The fee for registering an individual entrepreneur in 2020 is 800 rubles. When submitting documents electronically through the State Services portal, the discounted fee will be 560 rubles. In addition, from January 1, 2019, you can open an individual entrepreneur completely free of charge. To do this, you need to issue an electronic signature and submit documents in electronic form through the website of the Federal Tax Service or State Services.

If the tax office still refuses to register an individual entrepreneur, he will have a chance to re-submit the documents without additional payment of state duty. But this only applies to those cases where the applicant was denied registration due to errors in the documents. The entrepreneur will have three months to correct the violations. The changes that approved this benefit came into force quite recently - on October 1, 2020. Previously, the state fee for registering an individual entrepreneur was paid regardless of the reason for the refusal.

Notarial services

These expenses are not mandatory, but may arise if the individual entrepreneur is unable to submit an application for registration on his own. This situation may arise if an entrepreneur lives in another city, is sick or does not have time to visit the tax office. In this case, he can send registration documents to the Federal Tax Service by mail or submit them through a representative. In both cases, you must pay for notary services:

- according to the assurance of application P21001 - from 500 to 1,200 rubles.

- upon certification of a copy of the passport - from 200 to 500 rubles.

- for drawing up a notarized power of attorney (if documents will be submitted through a representative) - from 500 to 1,500 rubles.

Thus, if an individual entrepreneur decides to submit documents by mail, he will need to pay the notary an average of 700 to 1,700 rubles. If through a representative, then the price of notarization services will cost the applicant in the amount of 1,200 to 3,200 rubles.

Post services

If the future entrepreneur decides to send documents to the registration authority by mail, then he will need to pay additionally for postal services, on average about 200 rubles.

Registration of an electronic digital signature

Registration of an individual entrepreneur when submitting documents to the tax office in electronic form will require an electronic digital signature. Its cost is about 3,000 – 3,500 rubles. It is not profitable to issue an electronic signature for registration alone, but it is worth doing if the individual entrepreneur will use it in the future. Especially when you consider that since 2019, electronic registration of individual entrepreneurs is exempt from paying state fees in general.

Professional registrar services

If a future entrepreneur does not have the time or desire to deal with the registration process, he can use the services of professional registrars. If specialists are involved in opening an individual entrepreneur, the cost of their services will range from 3,000 to 7,000 rubles. It all depends on what specific services they will provide: only advisory or “turnkey”. Registration of a turnkey individual entrepreneur is more expensive and, on average, its price ranges from 4,000 rubles excluding state fees.

All of the above expenses can be attributed to registration, that is, to those that the future entrepreneur incurs when registering.

Having considered what is needed to open an individual entrepreneur in 2020, we will reflect these costs in the form of a table.

Table No. 1. How much does it cost to open an individual entrepreneur. Cost of registration services

| Expenses | Price |

| State duty | 800 rubles – if documents are submitted on paper |

| 560 rubles – when submitting an application through the website of the Federal Tax Service and State Services | |

| 0 rubles – when submitting documents through the website of the Federal Tax Service and State Services if you have an electronic signature | |

| Notarial services | Certification of application and passport copy – from 700 to 1,700 rubles |

| Preparation of a power of attorney for a representative – from 1,200 to 3,200 rubles | |

| Post services | 200 rubles |

| Registration of digital signature | from 3,000 to 3,500 rubles |

| Registrar services | from 3,000 to 7,000 rubles |

Debt collection

No collection - no income from the entire transaction. At this stage, the hopes and dreams of 97% of participants in the purchase of other people's debts perish. Somehow, on the Internet, I read a letter from two cooks. They bought the debt of the LLC for a total amount of 12 million. They spent 500 thousand of the total money.

The LLC went bankrupt a month later. And the cooks naively asked the bankruptcy trustee to return them 500 thousand hard-earned money they had earned by the sweat of their brow. But these unfortunate half a million have already gone into the bankruptcy estate of the debtor. And there are countless such examples at bankruptcy auctions.

Conclusion: invest only with bankruptcy auction professionals.

Let's return to my story.

Accounting and bookkeeping

Full accounting for an individual entrepreneur is not necessary, but you need to keep a book of income and expenses (KUDiR) and submit reports in accordance with the chosen tax regime.

Individual entrepreneurs can also use special services to automate these processes or pay an accountant for consultations. Self-employed people do not need to keep reports and use an online cash register; it is enough to confirm their income with online checks, on the basis of which the tax office calculates the amount of payments to the budget. Checks are generated in the Sberbank Online application.

When working without registration, if you do not file an annual personal income tax return, there is, of course, no reporting. But you will also have to control your finances yourself: useful services for business are not available.