Bankruptcy procedure is an organizational, regulatory and legal process applicable to a debtor in order to declare him financially insolvent. The debtors themselves or their creditors can initiate bankruptcy proceedings. The process goes step by step:

- Observation.

- External control.

- Financial recovery.

- Competition proceedings.

- Settlement agreement (not in every case).

The bankruptcy procedure is designed to protect the interests of creditors and debtors at the regulatory level.

Features of bankruptcy of legal entities

The Arbitration Court's proceedings against the debtor enterprise begin if the organization's debts amount to more than 300 rubles. Before going through the bankruptcy procedure, the management of the enterprise must take all necessary actions to prevent this from happening. The arbitration court will begin the procedure for initiating bankruptcy if there are grounds for this prescribed by law. During the first meeting, the parties come to an agreement on financing the bankruptcy procedure (from the debtor company with deferred payments or from creditors).

The bankruptcy procedure can be initiated by the debtor company itself or by its creditors. The burden of bearing the costs of the bankruptcy procedure falls on the shoulders of its initiator. The subjects of bankruptcy proceedings are the debtor and all his creditors.

Before starting the bankruptcy procedure, the Arbitration Court makes sure that there are all signs of bankruptcy of the enterprise. The judiciary may delay starting the process if the debtor company is gradually paying off its debts, but over time the court may return to resuming bankruptcy proceedings.

Speaking about what kind of bankruptcy procedure a temporary manager carries out, it is worth noting financial recovery. At this stage, bankruptcy liquidation procedures are temporarily suspended. If the financial recovery is successful, the debtor enterprise will gradually reach the stage of completing the bankruptcy procedure and exiting it. After this, the Arbitration Court issues a certificate confirming the absence of bankruptcy proceedings.

Types of bankruptcy of an organization

Bankruptcy of an organization can be real, temporary, fictitious, or intentional. The administrative manager appointed by the Arbitration Court is obliged to find out which path the enterprise is taking during the bankruptcy procedure. If the bankruptcy procedure of a legal entity person is recognized as fictitious or deliberate, then the case is terminated, and the initiator of the procedure faces criminal prosecution.

What are the dangers of fictitious and deliberate bankruptcy? A huge fine or prison term.

Enterprise bankruptcy procedure

Before starting the bankruptcy procedure, you must independently collect documents (the list is specified in the judicial authorities) and write an application to the Arbitration Court. You can find out how to properly format and write an application from bankruptcy lawyers or financial managers. The Arbitration Court also talks about the conduct of the process.

The bankruptcy procedure itself for a cooperative, LLC, enterprise and other legal entities consists of several stages.

Observation

At the first stage, creditors are notified that the debtor company has launched and is conducting bankruptcy proceedings. At the observation stage, the insolvency practitioners draw up a profile of the debtor, analyze his financial condition, and be sure to clarify the requirements of creditors in accordance with the law within the framework of the convened meeting.

How long does the observation phase take? No more than 5-7 months from the date of acceptance of the application by the Arbitration Court.

Financial recovery

At the stage of financial recovery, various dubious transactions are appealed, expenses of the debtor company are reimbursed, its solvency is restored, bankruptcy lawyers try to find money to cover debts and restructure debt obligations.

All actions for the financial recovery of a debtor enterprise or individual entrepreneur are coordinated with the Arbitration Court (all information and information about the conduct of the case is transferred only to creditors, but not to third parties.). The duration of the stage is several months or years.

External control

If creditors demand, the Arbitration Court approves an external manager for the debtor enterprise in a short time. The duration of external management is no more than 1.5 years. According to the Insolvency Law, the debtor company at this stage cannot receive fines and penalties from creditors. The debtor is not declared bankrupt at this stage.

Bankruptcy proceedings

If the Arbitration Court has determined that the borrower is not able to restore its solvency, despite financial recovery and external management, then bankruptcy proceedings begin to satisfy the needs of creditors in proportionate amounts.

Simplified bankruptcy procedure

Some debtor enterprises, in order to become bankrupt faster, agree to a simplified bankruptcy procedure. It assumes the complete absence of stages of monitoring, financial recovery and external management. Therefore, the duration of the process is reduced several times.

Representation of interests and legal support of bankruptcy

Speaking about how the bankruptcy procedure of a debtor enterprise goes, it is worth noting that this is a multi-stage and lengthy process. Therefore, corporate bankruptcy and personal bankruptcy procedures are carried out with the help of specialized lawyers.

Bankruptcy lawyers check the customer’s documents, represent his interests in court, and communicate with creditors.

Where can I go for legal support for bankruptcy?

Legal support for bankruptcy is a common service offered by law firms. You need to contact specialists who deal specifically with bankruptcy, and not with general practice. It is necessary to study samples of work and read reviews, since you can recognize a good bankruptcy lawyer from the first consultation.

Where are bankrupt property sold?

Debtors' property is sold on special online trading portals - electronic trading platforms. The top five most popular sites include:

The seller is the bankruptcy trustee. To participate in the auction, you need to issue an electronic digital signature, register on the trading platform, select an object of interest, submit an application and make a deposit. The auction is carried out in three stages.

1 At the primary auction, the participant who offers the highest price compared to the initial price wins.

2 Secondary auctions are held if there are no people willing to participate in the primary ones. The initial price is reduced by 10%, from which bidding increases again.

3 If the property is not sold in the first two stages, a sale is announced through a public offer. This means that the price will decrease step by step until someone buys the property.

We have a separate large article on this topic that answers the following questions:

- What is bankruptcy bidding and how does it work?

- How to make money trading bankruptcy?

- Where to start public bidding (auctions) for bankruptcy?

- How to buy bankrupt property, equipment, cars?

The preparatory stage of the bankruptcy procedure for individuals. faces

Where to start the bankruptcy procedure? From collecting documents and drawing up an application. This work can be done independently or with the help of a bankruptcy lawyer. Bankruptcy procedures applied to debtors in order to ensure the safety of their property are carried out at the final stages of the process. The implementation of bankruptcy rehabilitation procedures occurs in coordination with the Arbitration Court and creditors.

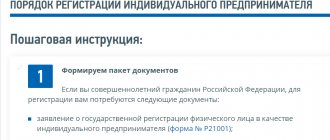

Collection of documents

The following documentation package is required:

- Copies of civil passport, marriage certificate, birth certificates of children.

- Copies of loan agreements, certificates of total debt.

- Notices from creditors about the accrual of penalties and fines.

- Copies of income certificates for the last 3 years.

- Certificate of absence or presence of an open individual entrepreneur.

- Copies of documents on bank accounts, deposits, etc.

- Copies of documents on transactions carried out over the last 3 years (if the amount exceeds 300 rubles).

- Copies of property ownership documents.

- Certificate of payment of state duty.

- Copies of other documents that confirm the inability to pay debts.

Drawing up an application for bankruptcy of an individual

The application being drawn up indicates the reasons for the insolvency, basic information about the debtor, and a list of bank accounts and deposits. The application accurately indicates the total debt, the list of creditors, and the presence of accrued fines. It is also necessary to indicate the name of the SRO of arbitration managers, which was chosen by the applicant to conduct the case.

Filing a bankruptcy petition for an individual. persons to court

It is necessary to file a bankruptcy petition with the Arbitration Court. To do this, the applicant must come to the office hours, submit documents, a description of his debts, and an application. To cancel the process within 5 days, you must inform the secretary of the Arbitration Court.

Consequences of bankruptcy

For legal entities

A bankrupt legal entity ceases operations and cannot reopen. Its founders are not liable, except in cases where bankruptcy is considered intentional. In such a situation, the owners of a bankrupt company bear subsidiary liability with all their property.

If the damage from deliberate bankruptcy is significant, the founder pays a fine of 500 to 800 minimum wages, and may be imprisoned for up to 6 years. For less serious guilt (concealment and withdrawal of assets, destruction of accounting documents), the punishment will be administrative, the fine will be from 40 to 50 minimum wages, and disqualification for up to 3 years is possible.

For individuals

For individuals who have undergone bankruptcy proceedings, the law introduces additional restrictions.

- For 5 years, each loan application must indicate the fact of personal bankruptcy.

- You can apply for personal bankruptcy a second time only five years after the first.

- For 3 years you cannot manage a legal entity either as a manager or as a member of the board of directors.

The procedure for selling property in case of bankruptcy of an individual

If the applicant is physically unable to pay off the debts even if they are restructured, then processes for the sale of his property are launched. The property is sold at auction, after which the proceeds are proportionally distributed among all creditors.

After this, the applicant receives bankrupt status and is completely freed from all debts. The next time he will be able to file for bankruptcy is only after 5 years.

Financial recovery as a bankruptcy procedure

The financial recovery process lasts no more than 24 months. The procedure is determined by Art. 80 No. 127-FZ. Upon financial recovery, the Arbitration Court receives a clear plan for securing the debts of the debtor enterprise.

During financial recovery, the debtor company is severely limited in its rights. All financial transactions are carried out with the permission of the Arbitration Manager, who acts in accordance with the drawn up plan. If the financial recovery process is successful, the company is not declared bankrupt and gradually pays off its debts.

Termination of bankruptcy proceedings due to lack of financing

The bankruptcy procedure may be terminated if there is no funding from the initiator of this procedure. The arbitration court terminates the bankruptcy procedure if the following conditions are met:

- The debtor company fully settles with its creditors, paying them the principal amount of the debt, fines and penalties.

- The debtor company and creditors enter into a settlement agreement, according to which they have no claims against each other (the agreements indicate the obligations imposed on the creditor on account of debt obligations).

If a creditor has initiated bankruptcy proceedings for a legal entity, but refuses to finance it, pay fees, or pay the services of a financial manager, then the Arbitration Court terminates the proceedings against the debtor company.

Main reasons for insolvency

A decrease in the liquidity indicators of an enterprise, gradually leading to insolvency, may occur under the influence of the following factors:

- A drop in the level of working capital and the inability of the company’s management to arrange financing in the amount necessary for normal operations. This happens when a legal entity has a small amount of current assets, and after repeated lending, the amount of borrowed capital begins to exceed the company’s own funds. Then financial institutions begin to consider such a borrower as a potential violator of deadlines and stop lending to him, thus depriving him of working capital, which immediately jeopardizes business.

- Quite a low volume of assets and unsatisfactory quality of cash flow. That is, a legal entity does not pay due attention to the reputation of product buyers, which as a result leads to an increase in overdue accounts receivable. This situation is typical for companies that enter the market and immediately want to occupy a large niche in it. To do this, they provide dealers or wholesalers with payment terms that are not entirely favorable to them (long deferred payment terms); as a result, the volume of working capital decreases and the company has nothing to operate its activities on.

- A sharp decline in solvency. For various reasons, a legal entity loses its financial stability: this may be due to a low level of business profitability or other reasons.

- Release of non-competitive products. The development of innovative technologies and their application in business leads to a reduction in the cost of production and, as a result, enterprises that do not invest money in improving their fixed assets can no longer compete in the market, since either the quality of their products is low or the cost of the goods is too high. high. As a result, this leads to a drop in demand for products and a gradual cessation of the manufacturer’s activities.

Management's influence on solvency

The decisions of its management have a great influence on the viability of the company, because it is they who directly manage the activities.

Therefore, the company’s prospects depend on the quality and correctness of the decisions made by management.

Among the main factors that reduce the solvency of an organization are the following:

- ineffective domestic budget policy. The lack of strategic planning does not allow for the correct distribution of future income and expenses, as a result, important decisions are made on the basis of distorted information;

- incorrect pricing of products. This can happen in case of errors in calculating the cost of products or due to a deliberate underestimation of its cost for the purpose of expansion in the market.