Definition under the Civil Code of the Russian Federation

In its activities, each limited partnership (another name is limited) is regulated by the rules and regulations written in Art.

66-68 and 82-86 Civil Code. So, in Art. 82 states that the law defines such a business entity as a partnership that is engaged in business . However, in such societies, 2 categories of people bear responsibility for losses incurred:

- full participants, or entrepreneurs conducting business affairs;

- investors, called limited partners, whose activities are limited only to contributing the authorized capital and making a profit.

According to civil law, a limited partner cannot interfere in the affairs of the organization. He is allowed to do this only if the full participant issues a power of attorney in his name. The law also does not allow investors to challenge the decisions of full members.

You can find out detailed information about this organizational and legal form from the following video:

Restriction on attracting participants

The law limits the number of possible limited partners to 20 participants. If there are more investors, then civil law rules oblige the reorganization procedure to be carried out within a year in the form of transformation into a limited liability company or joint stock company. If this civil law norm is violated, the partnership may be liquidated.

The reasons for this restriction are measures to prevent possible abuses in financial markets. Otherwise, their unscrupulous participants could attract contributions from an unlimited number of persons, imitating the signs of the partnership’s activities and avoiding control by regulators.

Another factor is the very nature of such an organization. Investors are expected to bear risks by understanding the organization's field of activity or by trusting the business qualities of a general partner, including due to personal or professional relationships.

Founders and constituent documents

To become one of the founders, a potential full participant must be a commercial organization and/or individual entrepreneur. Such an organization can be founded by at least 2 full comrades .

The fact of creation is confirmed by the constituent agreement, which all founders must sign. It contains the following information:

- name of the partnership;

- legal address;

- rules of conduct of business;

- the amount that each general partner must contribute to the authorized capital;

- procedure and terms for making deposits;

- procedure for changing the size of the share of full participants;

- the amount of contributions that future limited partners must make;

- the responsibility that participants will have to bear in case of violation of their duties.

In this document, the founders also determine the procedure for transferring property to the partnership and the rules for distributing income and losses.

Registration of a limited partnership: creation procedure, documents, purpose, application

Today, such formations as limited partnerships are quite rare, but they should also be of some interest for the development of the market.

Regulatory documents define the main positions on the basis of which a limited partnership is opened, registered, operates and is subject to the liquidation procedure.

And today we will look at the purpose and procedure (process) for creating and organizing a limited partnership, the cost of the fee for registering a limited partnership and other important points in this matter.

First of all, you should decide on what today is called a partnership of faith. This partnership differs from other business entities in a number of significant features:

- The participants of a limited partnership work in the field of commerce and entrepreneurship. They are necessarily liable for the partnership's obligations with the property they own. They are classified as full comrades.

- In addition to full-type partners, there is a category of investors. It is important to pay attention to the formation of the name of the partnership. It must contain information about general partners - their names and legal titles. Also a necessary requisite, which is regulated by regulatory documents, is the category contained in the name. Usually this is a limited partnership, a limited partnership, it is possible to use the name and title of the subject of the company - a general partner and a phrase that defines the type of company.

The regulatory framework in relation to such an organizational and legal norm for business entities today leaves much to be desired and is limited to the following documents:

- Federal Law of the Russian Federation No. 209, registered on July 24, 07 “On the development of small and medium-sized ...” in the current edition of 2020.

- Federal Law “Law on Enterprises” Art. 10

- Fundamentals of the Civil Law of the Russian Federation Art. 19 clause 3., clause 4 first paragraph.

- Civil Code Art. No. 71 – 80 pp. 2, 5.

The requirements are stipulated by Russian legislation and imply a set of rights and obligations. They are divided into two categories of participants.

Complementaries are delegated the rights to participate in the administration and management of the company, obtain information about the work and familiarize themselves with accounting reports, accounting documentation, personnel and other documentation.

Constituent documents - the Charter regulate the process of distribution of profits received, liquidation of the company and receipt of property that remains after payment of creditor obligations.

The mandatory range of conditions is limited to making deposits in accordance with the stipulated order, size, methods and deadlines, mandatory compliance with trade secrets and confidentiality conditions, and liability for obligations with property rights.

The scope of rights and obligations of investors is as follows. The commandant has the right to receive the profits due to him, study annual reports, balance sheets and tax reports. When the financial year has come to an end, the investor can leave the company with his share.

The agreement stipulates the transfer of the shareholding to other persons with subsequent withdrawal from the partnership.

Next, the state registration of a limited partnership is considered.

Registration of a limited partnership

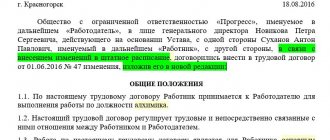

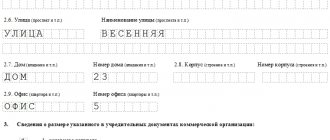

A limited partnership is organized, created and operates in accordance with the provisions of the main document, which is the constituent agreement. This legislative document is signed by all general partners. The main TnaV document consists of the following main sections.

- Full and abbreviated company name.

- Actual and legal address.

- Algorithm for management and administration.

- Volume and composition of storage assets and capital investments.

- Making changes in shares.

- Level, composition, and conditions for replenishment of inserts.

- Regulations on penalties for deviations from instructions for managing deposits.

- Determination of the limit on the total amount of deposits.

A company of this type has certain characteristics of its establishment. Thus, based on the results of the meeting of founders, a Protocol was drawn up, signed by the chairman and secretary elected during the meeting.

The document must be drawn up in a standard form.

It indicates all the data regarding the place and time of the meeting, the participants of the meeting, the results of each issue of the meeting, the composition of the counting commission, the participants who voted “for” and “against”.

Next, we will tell you what the package of documents is required for registering a limited partnership and about submitting the charter of a limited partnership to the Federal Tax Service for these purposes.

Required documents

Registration of a limited partnership is carried out in strict accordance with the norms regulated by Federal Law of the Russian Federation 129 of August 8, 2001 “On State Registration...”. The procedure is carried out by the authorized bodies of local self-government and the regional Federal Tax Service, within the time limits established by law.

State registration of a limited partnership is carried out on the basis of:

- submitted application filled out according to the standard form,

- certified copies of the Creation Decision,

- Minutes of the meeting of founders,

- the main constituent document is the Charter and payment documents confirming payment of the state duty in cash or non-cash form.

- If foreign companies take part in the partnership, then the package of documents must include an extract from the Register of the country of registration. The document may be replaced by other evidence of the status of the foreign founder.

The application can be drawn up by a founder authorized by the governing body or a third party who has been given a power of attorney to submit documents. The form established by the state must be filled out accurately, clearly, without inaccuracies or mistakes; corrections and blots are not allowed.

If the procedure for filling out and submitting documents is carried out by an authorized person, the document must contain a corresponding entry.

You can download the founding agreement of a limited partnership here.

Memorandum of association for a limited partnership

Constituent agreement of a partnership on faith - 1 Constituent agreement of a partnership on faith - 2 Constituent agreement of a partnership on faith - 3 Constituent agreement of a partnership on faith - 4 Constituent agreement of a partnership on faith - 5 Constituent agreement of a partnership on faith - 6 Constituent agreement of a partnership on faith - 7 Constituent agreement agreement of a partnership on faith - 8 Constituent agreement of a partnership on faith - 9 Constituent agreement of a partnership on faith - 10 Constituent agreement of a partnership on faith - 11 Constituent agreement of a partnership on faith - 12 Constituent agreement of a partnership on faith - 13

Read below about the procedure for registering a limited partnership (limited partnership).

Instructions

You can receive a certificate of registration of TnaV within no more than three working days only after completing all successive stages of registration. They are quite simple, but require agreement with all founders and investors:

- Choose a company name that meets the requirements of the legislation of the Russian Federation.

- Determine the legal address, check with the registration register of legal entities.

- Select standard OKVED codes, distributed by type of business, describing the full scope of activity of the new partnership.

- Determine the total share capital TnaV.

- Hold a meeting of the founders, draw up the Decision and Minutes.

- Prepare the Charter, the standard form of which is edited to suit the specifics of the company.

- Fill out the registration form according to the Federal Tax Service sample.

- Deposit the state fee into a special correspondent account.

- Prepare an application for a simplified taxation system.

- Check the compliance of the package of documents and submit it to the local fiscal service. Receive a receipt for the submission of documents to the Federal Tax Service.

Having become a full-fledged market participant, you can start working in your chosen direction.

This video will tell you about the important nuances of establishing a partnership of faith:

Source: https://pravo-urfo.ru/sotsialnaya-sfera/registraciya-tovarischestva-na-vere-poryadok-sozdaniya-dokumenty-cel-zayavlenie.html

Participants and their number

According to the law, commercial organizations, as well as individual entrepreneurs, are allowed to be participants in a limited partnership. There must be at least two . They are engaged in business activities. They are also held accountable by law for the performance of their duties.

Full comrades must:

- conduct activities without violating the constituent agreement;

- make the agreed amount of contribution within the period specified by the contract and law;

- keep confidential information secret;

- not to make transactions that do not relate to the activities of the organization if other members oppose it.

They are allowed:

- engage in entrepreneurial activities of this partnership;

- have access to all information relevant to the conduct of this activity;

- participate in the distribution of income;

- leave the company even without the consent of other members;

- receive part of the property or its value that will remain after the liquidation of the organization and settlements with creditors.

Investors, who are also called limited partners, can be part of such a company. Rights, as well as their responsibilities, are listed in Art. 85 Civil Code of the Russian Federation. To become one, you need to make a contribution to the authorized capital. The fact of depositing funds is confirmed by a certificate.

A legal entity or an individual is allowed to act as a depositor. He is prohibited from taking part in the conduct of the organization's affairs. A limited partner has the right:

- receive a profit, the amount of which is specified in the memorandum of association;

- leave the company at the end of the financial year;

- receive information about the balance sheet, as well as annual reports;

- transfer your own share to others.

The remaining obligations and rights of full participants and investors are listed in the memorandum of association.

Advantages and disadvantages

Partnership has both advantages and disadvantages. General advantages: ease of organization and raising capital, exemption of shareholders from double taxation (only income tax is paid). The advantages of this form of ownership also include the absence of restrictions on the minimum amount of capital.

The main disadvantage is limited opportunities during the period of business development, when additional investments are required. But there are other disadvantages: the likelihood of disagreements arising on issues of management and distribution of shares in profits.

Disadvantages for main participants:

- inability to participate in other partnership firms

- liability to property creditors

- limit on the number of depositors (minimum 2)

- membership restrictions (a private person cannot become a full participant)

- possibility of losing invested funds during liquidation

If, after paying off debts to creditors and shares of the limited partners, there are no funds left, you can lose your contribution and part of your own property.

Benefits for investors:

- opportunity to profit from savings

- low risk of losing your deposit

- easy exit and share return

- the opportunity to invest with various resources: money, securities, material property, computer programs, patents

- opportunity to invest in several partner businesses

- priority right to receive compensation upon liquidation

Commanders receive their contribution (or part) immediately after all debts of the enterprise are paid. The only drawback is the inability to participate in management.

Risks are reduced due to the legal status of the main shareholders. They are already engaged in business, so they become profitable counterparties due to increased responsibility. However, partnership-based enterprises are rare in Russia. The main reason is the need for participants to trust each other.

In the West, limited companies are more common. This is due to the long period of participation in market relations, which teach responsibility and trust. The most famous companies working on partnerships in Russia: “Investment-Real Estate and. The authorized capital of the first is 1 million rubles, the turnover of the second is 114 million rubles. Such achievements indicate that partnership-based business can be successful.

Top

Write your question in the form below

Controls

As stated above, only full partners have the legal right to conduct the affairs of the partnership. Each decision is considered adopted if more than 50% of the votes . One vote is allocated for each participant.

No member may prevent any member from viewing the partnership's records. Such actions are prohibited by law.

Members can engage in business jointly, but in this case the transaction cannot come into force unless all general partners agree to its conclusion. In addition, the responsibility for conducting the affairs of the organization may be assigned to one or two full members. In this case, he is required to have powers of attorney to conduct business in his name from the other members.

The concept and types of unitary enterprises are discussed in detail in this article. Read about how inventory is accounted for at an enterprise here.

Liquidation and reorganization

As can be seen from paragraph 1 of Art. 61 of the Civil Code of the Russian Federation, the duties and rights of all members after liquidation cannot be inherited by other persons. Domestic legislation allows voluntary or forced closure.

The reasons for dissolving such a partnership are listed below:

- all its members left (clause 1 of article 86 of the Civil Code of the Russian Federation);

- one of the full members left the lineup;

- one of the full participants has died or gone missing;

- one of them is recognized as partially or completely incompetent;

- bankruptcy;

- the reorganization or liquidation of an organization owned by one of the general partners has been announced;

- it was announced that the property, which is part of the authorized capital, was seized by one of the company members.

Such an organization can function even if it has only one member. This is stated in paragraph 1 of Art. 86 Civil Code. But if all investors leave the structure, general participants are allowed to reorganize into a general partnership.

If the reason for liquidation is bankruptcy, then the law provides depositors with the opportunity to be the first to receive their deposits. Full participants receive their proportional shares in the authorized capital only after the requirements of creditors have been met.

According to Art. 57 of the Civil Code, reorganization is carried out by:

- divisions;

- transformations;

- mergers;

- discharge;

- accession.

According to domestic legislation, after the transformation procedure, a limited partnership can become:

- joint-stock company;

- general partnership;

- a company that will have limited or additional liability;

- production cooperative.

If the founders decided to reorganize into a production cooperative, then each new participant, who will then be called a shareholder, will be forced to bear responsibility for their own property for two years. This obligation is provided for in paragraph 2 of Art. 68 Civil Code of the Russian Federation. The former participant will not be able to get rid of this, even if he completes the procedure for alienating his deposits (or shares).

According to paragraph 1 of Art. 68 of the Civil Code of the Russian Federation, it will not be possible to carry out a reorganization without holding a general constituent meeting.

Registration of a general partnership step-by-step instructions

persons, as well as the conditions on the basis of which the partners carry out their activities. In addition, the contract is intended to determine the terms under which anticipated profits and losses will be distributed.

the agreement also specifies how the procedure for joining and leaving the partnership will take place. Participants of the partnership, hereinafter referred to simply as general partners, are individual entrepreneurs and commercial organizations.

registration of a general partnership step by step instructions

results of research on each issue on the agenda; 4) information about the persons who carried out the count; 5) information about persons who opposed the decision of the meeting and demanded that this be recorded in the minutes.

A general partnership is created and operates on the basis of a constituent agreement. the constituent agreement is signed by all its participants.

a general partnership is subject to state registration with an authorized state body in the manner prescribed by the law on state registration of legal entities.

Submission of papers can occur through a personal visit to a government agency, sending documents by registered mail with its value established, or via the Internet communication network (if the company has a digital signature). The form of documents and the procedure for submitting them for registration of a legal entity was approved by order of the Federal Tax Service of Russia (federal tax service of the Russian Federation) No. mmv-7-6/25 “on approval of forms and requirements...” dated 01.25.12.

TSN registration

documentation packages: documents to the notary to certify the applicant’s signature and approval of the TSN:

- applicant's passport;

- minutes of the general meeting of owners.

- application form R 11001 for state registration of TSN;

documents for submission to the tax office (direct registration of the tax authority):

step-by-step instructions for registering a homeowners association

style=" float:="" left;="" margin:="" 0="" 10px="" 5px="" 0;"="" src="" alt="Registration complete step-by-step instructions">

General Partnership

The rest must be paid by the participant within the time limits established by the constituent agreement.

If this obligation is not fulfilled, the participant is obliged to pay the partnership ten percent per annum on the unpaid part of the contribution and compensate for the losses caused, unless other consequences are established by the constituent agreement; may bear other responsibilities provided for by its constituent documents (clause 2 of article 67 of the Civil Code of the Russian Federation)

Creating a partnership: instructions for use

After all, as the arbitrators noted, the fact that the counterparty company violated its obligations does not in itself constitute evidence that the company received an unjustified tax benefit (clause 10 of the Supreme Arbitration Court ruling of October 12, 2006

№ 53

“On the assessment by arbitration courts of the validity of taxpayers receiving tax benefits”

). In addition, the servants of Themis noted that the benefit can be recognized as unjustified only if the auditors prove that the enterprise acted without the necessary diligence and caution and it should have been aware of the violations of its counterparties.

Each participant in a general partnership has the right to act on behalf of the partnership, unless the constituent agreement establishes that all its participants conduct business jointly, or the conduct of business is entrusted to individual participants.

Each participant in the partnership, regardless of whether he is authorized to conduct business, has the right to familiarize himself with all documentation on the conduct of business.

Waiver of this right or its limitation, including by agreement of the participants of the partnership, is void.

What is the procedure for registering a general partnership and limited partnership

The rationale for this position is given below in the materials of the Lawyer System. In the cases provided for by this Code, a business company may be created by one person, who becomes its sole participant.

2. Business partnerships can be created in the form of a general partnership and limited partnership (limited partnership)*.

3. Business companies can be created in the form of a joint-stock company, a limited liability company or an additional liability company.

Opening a PJSC: its organizational features and characteristics

A mandatory position is non-disclosure of confidential information and trade secrets about the operation.

The range of rights and obligations may be somewhat expanded if provided for by the Charter. Now let's find out how to open a PJSC.

Source: https://yuridicheskayakonsulitatsiya.ru/registracija-polnogo-tovarischestva-poshagovaja-instrukcija-28149/

Profit distribution

In paragraph 1 of Art. 74 of the Civil Code of the Russian Federation states that any income and loss in a limited partnership must be distributed in proportion to contributions to the authorized capital among all full participants. They may approve a different profit distribution scheme in the memorandum of association.

If any of the full participants is limited in the right to receive income or repay losses, then such actions are considered illegal.

Clause 2 Art. 74 of the Civil Code of the Russian Federation states that in the event that, as a result of losses incurred, the value of net assets becomes less than the size of the authorized capital, none of the general partners will receive payments from income until the amount of net assets exceeds the required amount.

Advantages and disadvantages

The advantages of this form of doing business include:

- each full member is permitted to conduct the affairs of the organization on behalf of other such members unless prohibited by the articles of incorporation;

- a real opportunity to quickly invest money to make a profit in a short period of time;

- It is quite beneficial for creditors to cooperate with such organizations, since their participants have unlimited liability for all obligations;

- The memorandum of association provides for the presence of limited partners who increase the amount of the authorized capital.

If we talk about the disadvantages, it is worth remembering that:

- the partnership will not be able to function for a long time if there is no trust relationship between the full members;

- one member is not allowed to manage the affairs of such an organization;

- Each full member bears unlimited liability for all obligations.

Examples of organizations in Russia

One well-known example is the organization “Investment-Real Estate and Company”. It started its activities in July 1998. In 2007, she became a participant in the Affordable Housing program. At the moment, the amount of authorized capital exceeds 1 million rubles.

Another example is the construction company in Moscow “Limited Partnership SU-155 and Company”. It began its history back in 1954. In recent years, he has been engaged in the construction and modernization of enterprises in all regions of Russia. In 2013, its turnover exceeded 114 million rubles.