Preparation for registration and documents

Before going to write an application for state registration of a new legal entity, the founder must take care of selecting its unique name, location address and areas of activity (which will need to be compared with the OKVED directory), as well as drawing up a charter, determining the size of the authorized capital, choosing a director and tax system that the organization will use. Without all this data, the registration procedure will not be possible.

Another important preparation point is collecting the necessary papers. The list of documents includes:

- decision to create a legal entity,

- receipt of payment of state duty,

- order for the appointment of a director or general director,

- premises rental agreement (or title deed),

- charter,

- passport,

- Applicant's Taxpayer Identification Number.

How difficult is it to register?

The procedure for registering a business is as follows:

- Come up with a company name (not necessary for individual entrepreneurs);

- Decide on the legal address of the company;

- Select activity codes from OKVED;

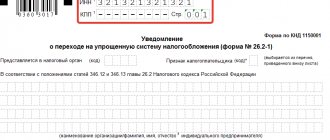

- Decide on the taxation system;

- Set the size of the authorized capital (relevant for legal entities);

- Prepare the necessary documents;

- Fill out an application;

- Pay the state fee;

- Contact the registration authority with all the documents.

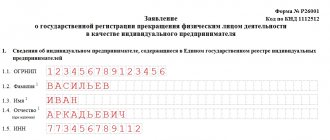

Business registration documents differ depending on the form of the enterprise. The application is not drawn up in any form - you need to fill out a formalized form:

- Form P11001 – for LLC;

- Form P21001 – for individual entrepreneurs.

For a legal entity, the following documents are needed: minutes of the meeting of founders, charter of the organization and agreement on establishment. Instead of a protocol, there may be a decision of the sole founder. In this case, no contract is required. All these documents are attached to the application and receipt of payment of the state fee.

In the case of an individual entrepreneur, for registration you need to submit the following documents to the Inspectorate of the Federal Tax Service (IFTS):

- Application (form P21001);

- Receipt for payment of the state fee of 800 rubles;

- Internal passport and its copy.

You can submit documents in person through the tax authority authorized for registration actions at your place of residence. An employee of the Federal Tax Service will accept documents in a special window and make sure that the application is filled out correctly.

Further, the business registration procedure does not depend on the applicant. After 3 working days from the date of submission of documents to the Federal Tax Service, the following will be issued:

- Record sheet;

- A copy of the charter with notes from the registering authority - for an LLC;

- Certificate of business registration and tax registration;

After this, the tax service must notify the local branch of the Russian Pension Fund, where the new entrepreneur is registered. The company can independently request a Notification from the Pension Fund of the Russian Federation and the Social Insurance Fund, which indicates that the person is registered with the fund at its location.

Methods for submitting an application

The application can be submitted in several ways. The first, classic and still most common is to come to the tax office in person and hand over a package of documents to an authority specialist. In this case, the fact that the application has been accepted will be indicated by a special counterfoil, which the inspector will give to the applicant (the time of receipt of the completed certificate will also be indicated there). You can also use multifunctional centers operating in almost all fairly large settlements of the Russian Federation in a similar manner.

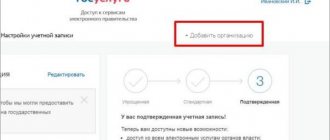

The second acceptable way: send the completed form and other papers by mail (by registered mail with notification) - it also guarantees receipt of the application by the addressee. And finally, the third, modern option, which significantly saves the applicant’s time and nerves, is to send an application and copies of all necessary documents through the tax service website or the State Services website.

General information about the application form

The application form has a unified form, so its completion is strictly regulated by law. But before moving on to the details, we note that today the form can be found on the official website of the tax service or the State Services website and filled out electronically at home or in the office, and then printed on a printer. It is also permissible to print out a blank form and enter information on it with a ballpoint pen of any dark color (preferably black or blue). In any case, the rule that must be observed is the presence of a “live” signature from the applicant.

Information in the document must be entered in capital letters, and any inaccuracies or errors are strictly unacceptable. For example, if information from a passport is entered into the form, then it must be indicated in full accordance with this document, otherwise the application will not be accepted.

The same applies to corrections: they should not be on the form, so even with the slightest blot, it is better to redo the document immediately.

The application is written in a single original copy.

Sample application for state registration of a legal entity upon creation

If you have decided to create a legal entity and need to draw up an application, look at the sample given here - with it in mind, you will probably be able to do this much faster and easier.

Let's start with the fact that the form has 24 sheets, but not all of them are required to be filled out - you only need to fill out those that relate to the specific features of your organization. In this example, the application is formed on behalf of the sole founder - an individual.

On the first page, write the name of the company being founded (full and short), as well as its location: postal code, region number and locality (if we are talking about Moscow or St. Petersburg, then you do not need to enter the city).

The second page includes information about the address at which the company will be registered (all official correspondence will be sent here in the future), as well as information about the form and amount of the founders’ contribution.

Next, enter information about the founder into the form (in the example under consideration, as mentioned above, this is an individual). It must exactly match the passport (or other identification document - their codes can be found on the tax website) and the TIN certificate.

On the next page, indicate in detail the place of residence of the founder - with zip code, region code, etc. (it must also correspond to some document). Below, again, indicate the share in the authorized capital (amount and percentage).

Another page of the application that must be filled out is information about the person who has the right to act on behalf of the newly created enterprise without a power of attorney: here enter his full name, tax identification number, date and place of birth, position (usually director or general director), information from an identity document.

The next sheet is a continuation of the previous one: enter here the address of the place of residence of an employee of the organization authorized to act without a power of attorney, as well as his contact telephone number for communication.

On the seventh page, reflect the activities that the registered company plans to engage in (main and additional) - they must be indicated in strict accordance with the codes of the OKVED directory. There can be any number of types of activities, there are no restrictions provided by the current law, their number does not affect taxes or any other deductions.

On the eighth page, again, provide information about the applicant (here you just need to tick the appropriate box).

And finally, the last sheet of the application - enter here the applicant’s full name, as well as how you would like to receive the completed documents (again by checking the required box). Finally, sign the form.

Filling out the basic data of form P11001.

In the window that opens , fill in :

- Information about the name of the Legal entity

- Information about the legal address of the Company

- Amount of the Company's authorized capital .

In the OPF (organizational legal form) column, select Limited Liability Companies .

Below we write the name of the company . The name can be full or abbreviated. If the name is long, it makes sense to indicate it in abbreviated form.

Example: Limited Liability Company “Legal Assistance to Business”

can be written as

PPB LLC.

In the PPDGR program, the name is filled in in capital letters. This requirement is established by Appendix No. 20. Requirements for the preparation of documents submitted to the registration authority by order of the Federal Tax Service dated January 25, 2012. No. ММВ-7-6/ [email protected]

Article 1.1: Printing of characters when using software to complete the application form must be in capital letters in 18-point Courier New font.

If filling out is done using forms in EXCEL format, compliance with this requirement is mandatory .

When filling out information about the name of the LLC, you must also remember about Article 1473, paragraph 4 of the Civil Code of the Russian Federation (Resolution of the Government of the Russian Federation No. 52 of February 3, 2010)

which

sets a restriction on the use of the words “Russia”, “Russian Federation” and derivatives such as “Ros” .

also restrictions on the use of names of other countries . For example – Shop on Italianskaya

. In this case, it is also necessary to obtain permission, otherwise the registration authority will refuse state registration.

After filling in the information about the name, we move on to the information about the legal address and information about the authorized capital.

The legal address is filled in completely in accordance with the lease agreement or letter of guarantee issued by the lessor.

- Abbreviations in the fields: HOUSE, BUILDING, APARTMENT are not allowed.

- If ROOMS is indicated instead of an apartment, then it is also filled in without abbreviations.

- Filling in information about the office or premises number is mandatory.

- Filling out the index is mandatory.

- Questions often arise if the address has this format.

- 19000, City of St. Petersburg, Nevsky Prospekt, building 1, building 100, letter 77, room 1, office 1

- In this case, fill in as shown below.

The minimum size of the authorized capital (authorized capital) is 10,000 rubles. You can set any size of the capital not lower than the minimum.

We choose the authorized capital and its size.

Information about the holder of the register of shareholders is filled out only for joint-stock companies. We don't fill it out.