Functions of large enterprises

Large companies perform the following functions:

- Manufacturing of products and their sale to consumers.

- Providing raw materials, materials, equipment.

- Accounting for business and financial transactions.

- Management of all components of the production process and personnel.

Large companies also have additional functions:

- Scientific work and research.

- Close relations with the media and the public.

- Entrepreneurship support.

Large enterprises are presented in the following basic forms:

| Forms of large business | Characteristic |

| 1. Independent enterprise | An indivisible economic entity with a unified production structure. May consist of several legal entities, but the division is only nominal |

| 2. Company | 1) Several companies are united together. 2) They are connected by a similar type of activity.

4) Each component company is an independent unit. She has the right, if necessary, to work independently |

| 3. Integrated business group | Several companies with common owners. Businesses often belong to different industries |

Important! Large enterprises function not just as an element of the economic system. They have the power to change the surrounding space. Such enterprises influence the economic situation in the industry to which they belong.

When a communications organization is the largest taxpayer under the new rules

Federal Law dated October 26, 2002 N 127-FZ “On Insolvency (Bankruptcy)”); - tax administration (Order of the Ministry of Taxes of Russia dated April 16, 2004 N SAE-3-30/ “On organizing work on tax administration of the largest taxpayers and approving criteria for inclusion Russian organizations - legal entities to the largest taxpayers subject to tax administration at the federal and regional levels"); - payment of a recycling fee (Order of the Ministry of Industry and Trade of Russia dated February 18, 2016 N 406 "On approval of the Procedure for recognizing the payer specified in paragraph three of paragraph 3 of Article 24.1 of the Federal law of June 24, 1998. However, the norm in question is a reference and only indicates that the boundary values of this indicator are established by the Government of the Russian Federation. By Decree of the Government of the Russian Federation dated April 4, 2016 No. 265, the following maximum volumes of the profitable part of entrepreneurial activity for the past year were introduced from August 1, 2016 for SMEs:

- for microenterprises - 120 million rubles;

- for small enterprises - 800 million rubles;

- for medium-sized enterprises - 2 billion rubles.

The procedure for applying the criteria for small and medium-sized businesses In addition to the direct indicators by which the status of a person involved as an SME can be determined, Art. 4 of Law No. 209-FZ contains a number of rules explaining the procedure for applying these conditions (clauses 3–5 of Article 4):

- The group of SMEs is determined based on the value of one of the conditions given in Art.

This is interesting: What are the positions of a deputy director?

Federal Law (by income or by average number of employees).

- If an individual entrepreneur who did not have employees in the reporting (last) year applies for the status of a SME, small business criteria relating to the amount of income received are applied to determine ownership.

- Companies and individual entrepreneurs created and/or registered during the period from August 1 of the current year to July 31 of the following year (hereinafter referred to as newly created merchants) and individual entrepreneurs with a patent taxation system are classified as micro-enterprises.

- If a project partner of the Skolkovo Information Center is exempt from the obligation to submit tax reports, his group of belonging to SMEs is determined based on the average number of employees.

- Correction of the category of an SME entity occurs sequentially in the event of an increase or decrease in the maximum standards.

Large enterprises and SMEs. How to distinguish?

Large enterprises can be distinguished from SMEs based on the following criteria:

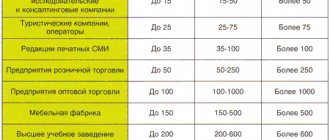

| Company | Average annual number | Maximum income, million rubles. | |

| from | before | ||

| Micro | 1 | 15 | 120 |

| Small | 15 | 100 | 800 |

| Average | 100 | 250 | 2000 |

| Large | 251 and above | More than 2000 | |

It would seem that it is easy to distinguish enterprises based on such criteria. To become large, it is necessary to fill the staff with at least 251 employees and bring income to a level that is more than two billion rubles. But there are industries in which the number of employees may be less than 250, but they belong to large ones:

What it is

A small enterprise is the most common form of entrepreneurship, chosen by most aspiring businessmen.

A medium business is a form of entrepreneurial activity that, compared to a small business, has a more impressive annual income and more extensive and varied resources for commercial activities.

Large business is a form of entrepreneurship that includes popular companies that cover an entire country or more than 2 countries of the world, and also have great demand among consumers.

Main characteristics of entrepreneurship

Each form of commercial activity - SME or large business - has its own characteristics, which is why they differ from each other.

Features of a small

Small businesses are not only individual entrepreneurs, but also companies whose average annual number of employees is at least 50 people .

The territorial activities of these companies are small, and the list of their areas of activity may include:

- the shops;

- firms with small production that produce small volumes of goods;

- companies with tourism activities;

- medical offices (dental, etc.);

- various training courses, etc.

For small businesses, the period for conducting inspections is reduced and is no more than 50 hours .

Until December 31, 2020, these businesses have been granted a two-year supervisory holiday, during which no supervision will be carried out. There will be no risk of visits from the Sanitary and Epidemiological Inspectorate and the fire inspectorate, and the activity license will not be checked.

According to Part 2 of Article 10 of the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control”, when complaints are received from consumers regarding violations of the law, an audit will be carried out.

In 2020, entrepreneurs who:

- register for the first time;

- carry out production, social or scientific activities;

- provide services to the population.

Small businesses do not need status confirmation . You only need to adhere to the above limits (income, number of employees and share in the authorized capital). If the limits were exceeded within 1 or 2 years, this is not grounds for loss of status. In this case, it will be retained for 3 calendar years.

Signs of average

Compared to a small enterprise, a medium-sized business includes entire networks of enterprises working for a large consumer audience . This entrepreneurial form can carry out its activities not only within the whole city, even within the region.

Compared to small businesses, where a large role is assigned to personnel, on average, the quality of goods (services) is put in the foreground . Since a medium-sized enterprise is small in size, it will not be difficult for it to adapt to changing market conditions.

Big or big business

Large businesses can spend money on advertising commercials for their products on the most popular television channels. In different cities and countries, this form of business has its own branches and representative bodies, employing hundreds of thousands of employees .

Large business entities are large companies that:

- engaged in the production of equipment: Apple, Bosch, Samsung, Lenovo, etc.;

- produce food products: MC.Donald, Nestle, Coca Cola, etc.;

- produce vehicles of automobile brands: Ferrari, Bogati, Alfa Romeo, BMW, etc.

The criteria are simple. In order to be a major entrepreneur you must meet the following:

- have at least 251 employees:

- receive an income of at least 2 billion rubles;

- Conduct timely inventory and revaluation of fixed assets.

Since 2020, a unified register of SMEs has been in operation, which contains enterprises that have received SME status.

These forms of entrepreneurship acquire the status of SMEs if they meet the criteria below:

- have a certain amount of income;

- have a certain number of employees;

- have a certain share of participation of other companies in the authorized capital.

| Criterion | Small | Average | Large |

| Income | Up to 800 million rubles. | Up to 2 million rubles. | More than 2 billion rubles |

| The number of employees | 100 employees | 101–250 employees | More than 250 employees |

| Share of participation of third parties in the authorized capital | For government participation organizations, as well as public, religious organizations and foundations, no more than 25% in total. For other legal entities persons (foreign and those who are not small and SME subjects) maximum 49% in the amount. If the organizations themselves are small and SME entities, then their share is not limited. | ||

- persons holding shares in the economic high-tech sector;

- persons participating in the Skolkovo project;

- companies that practically apply the latest technologies developed by their owners - budgetary and scientific institutions;

- companies whose founders are included in the government list of persons who provide state support for innovation activities.

If an individual entrepreneur does not have employees, then its status is determined by the criterion of their annual income. If individual entrepreneurs and LLCs were included in the unified register of SMEs for the first time, then their status should be determined by the criterion of the number of employees.

If an enterprise receives the status of an SME, it is provided with certain benefits, namely:

- you are given the right to keep as much money in the cash register as you want and no fine will be imposed for this.

- the ability to conduct simplified accounting. This does not apply to individual entrepreneurs, since they are not responsible for accounting. And companies are required to charge depreciation annually, and not once a month.

- are given an advantage in the purchase of state and municipal real estate, etc.

A list of enterprises that meet the specified criteria is compiled annually by the Ministry of Industry and Trade of the Russian Federation . This list is submitted to the Federal Tax Service of Russia, after which the tax authorities enter certain information in the register.

We bring to your attention a video that explains why big business wins.

How are the criteria applied?

The status of the largest taxpayers at the federal level, which are subject to tax administration in the interregional inspectorates of the Federal Tax Service of Russia for the largest taxpayers, is assigned to organizations whose total income received for the year (for any year of the previous three years, not counting the last reporting year) exceeded 35 billion rubles (clauses 1, 8 Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ). The amount of income is determined according to the Statement of Financial Results by summing the indicators of the following lines (Order of the Ministry of Finance dated July 2, 2010 No. 66n):

- 2110 “Revenue”;

- 2310 “Income from participation in other organizations”;

- 2320 “Interest receivable”;

- 2340 “Other income”.

The largest taxpayers, regardless of income, may include a credit organization, an insurance, reinsurance organization, a mutual insurance company, an insurance broker, a professional participant in the securities market, a non-state pension fund that have the appropriate licenses (clause 4 of the Criteria, approved by Order of the Federal Tax Service dated 16.05 .2007 No. MM-3-06/ [email protected] ).

If certain conditions are met, the organization that submitted an application for tax monitoring may be classified as the largest taxpayer (clause 5 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ).

If the amount of income an organization receives in a year is in the range from 10 to 35 billion rubles, then it belongs to the largest taxpayers at the regional level, i.e., it is subject to tax administration in the interdistrict inspectorate of the Federal Tax Service of Russia for the largest taxpayers (clause 6 of the Criteria, approved. By Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [email protected] ).

This is interesting: Dismissal due to staff reduction step-by-step instructions 2020

It is important to consider that organizations that apply special tax regimes are not recognized as major taxpayers.

Please also note that even those organizations that do not meet the criteria of the largest taxpayers can be recognized as such based on a decision of the Federal Tax Service (clauses 5.1, 6.1 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06/ [ email protected] ).

Organizations (with the exception of credit institutions), in respect of which an arbitration court decided to declare the debtor bankrupt and a bankruptcy procedure was introduced, cease to belong to the category of the largest taxpayers (clause 9 of the Criteria, approved by Order of the Federal Tax Service dated May 16, 2007 No. MM-3-06 / [email protected] ). It is also important to take into account that an interdependent entity of the largest taxpayer can also be classified as the largest and be subject to tax administration in the interregional (interdistrict) inspectorates of the Federal Tax Service of Russia for the largest taxpayers. At the same time, the own indicators of such an interdependent person no longer matter.

Main advantages

Both SMEs and large companies have their advantages and disadvantages.

The list of advantages of small business is as follows::

- the presence of a small need for initial capital;

- relatively low expenses during business activities;

- the ability to quickly respond to changes in the market;

- the presence of a relatively fast turnover of equity capital;

- there is a tendency for vacancies to increase, which has a beneficial effect on the increase in population employment.

The main advantages of medium-sized businesses include:

- creation of new employment opportunities;

- high productivity of capital investments;

- relatively high profitability;

- high ability to compete and mobility.

Large business is also endowed with positive qualities, namely:

- the ability to ensure economic stability in the country;

- ability to change the external business environment;

- the opportunity to save on production costs;

- introduction of modern technologies into business, etc.

Some important nuances

The most important question that interests most entrepreneurs is the following: for what period are the results of activities assessed and how quickly the right to small business benefits is lost if one of the criteria is not met?

We answer. Of course, performance results are assessed according to the tax return, as well as according to the company charter.

Regarding the right to benefits for an enterprise that was unable to comply with all requirements during the reporting period. Previously, based on the results of the reporting year, a legal entity lost its small status two years after the reporting period in which such a discrepancy was made. Now this period has been extended and is now three years.

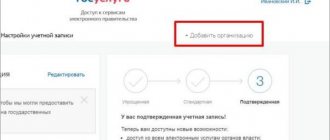

Also, not everyone knows, but there is a special register of small and medium-sized enterprises. Such a register is filled out by tax services, which evaluate such entities according to various criteria. An interesting point is that the owners themselves do nothing to register it as a small business entity. Access to such a register is free. It can be viewed on the Federal Tax Service website, where anyone can, by entering the appropriate details, understand whether there is such a legal entity or an individual. person-entrepreneur in the database or not.

Thus, in order to receive benefits in the form of no funds limit, receiving subsidies from the state, reduced time for inspections, etc., it is necessary to maintain the established limits for a year. Otherwise, you can lose this right in three years.

Similar articles

- Accounting statements of small businesses 2017

- Number of small businesses

- Composition of financial statements 2020 for small businesses

- Simplified balance sheet for simplified tax system 2020 example of filling

- Deflator coefficient for 2020 for UTII

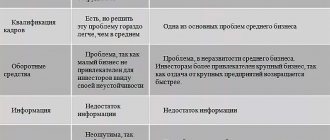

Cons and risks

In order to start building your business, an entrepreneur must become familiar with the main disadvantages of various enterprises. For example, a small business has the following negative aspects :

- relatively high level of risk;

- dependence on big business;

- the presence of a low professional level of managers;

- difficulties in obtaining loans and subsidies.

The size of the initial capital also matters. For example, if this size is large, then the company will be able to survive during the crisis period.

Medium-sized businesses also have certain disadvantages, namely:

- the presence of fierce competition and the threat of being swallowed up by large companies;

- the presence of barriers and difficulties in obtaining licenses and patents;

- frequent shortage of working capital;

- difficulties in obtaining loans due to mistrust of banks.

Big business is also not without problems. The main disadvantages of this business are the presence of :

- excessive economic concentration;

- localization of economic relations;

- blocking horizontal commercial ties that do not extend beyond the boundaries of a particular company.

Criteria for the largest taxpayers in 2020

Conducting affairs of legal entities with the status of the largest taxpayer takes place at the federal or regional level.

Organizations classified as major taxpayers (hereinafter referred to as CNs) are registered, depending on the federal (regional) level, with the interregional (interdistrict) inspectorate of the Federal Tax Service of the Russian Federation. These tax structures control the implementation of tax laws by CNs without direct participation.

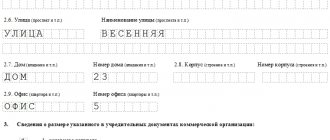

The procedure for registering organizations

The Federal Tax Service of Russia has defined a list of criteria , the presence of which allows an organization (legal entity) to be classified as a largest taxpayer.

What are these criteria:

- Markers of financial and economic activity (FED). The organization's reporting (tax, accounting) for the year is considered.

- The presence of interdependence. The taxpayer directly influences the functioning of interdependent entities and their economic results.

- A legal entity has a license or other permit allowing it to conduct a certain type of activity.

- Carrying out constant monitoring of tax activities.

Indicators of financial and economic activity

The time periods within which an organization can be classified as a CI are as follows: calculations using FED markers are carried out for any of the three previous years, with the exception of the reporting year .

CN status is retained for another two years after the year in which the organization began to fail to meet the accepted criteria.

In the event of reorganization of a corporate property, this status remains with the newly formed legal entity for another period of three years, counting the one when the reorganization took place.

Legal entities-debtors declared bankrupt in court lose their status as a corporate citizen. This rule does not apply to credit structures. Those of them that are administered as IPs at the federal level retain this status until they are forcibly liquidated.

CN status can be assigned even to non-profit organizations if they have any income that meets the criteria below.

Federal level

This level of tax administration implies that the organization in question meets a number of mandatory conditions directly related to the markers (financial, economic) of its activities.

- The total tax accruals must exceed 1 billion rubles. This figure is significantly reduced (over 300 million rubles) for organizations operating in the field of communication and transport services.

- The total amount of income received (reporting form No. 2, codes 2110, 2310, 2320, 2340) is more than 20 billion rubles.

- The total assets of the organization are more than 20 billion rubles.

In addition to these universal conditions, federal tax administration may apply to a number of organizations in certain areas of the country's economy.

In particular, such norms apply to structures and organizations of the military-industrial complex with the following indicators (exceeding one of them is enough):

- export contracts for strategic products, totaling more than 27 million rubles;

- the total revenue under these contracts is more than 20% of the total amount;

- the presence of more than 100 employees in the average headcount;

- government contribution exceeding 50%.

This is interesting: Metrological control of medical equipment

The presented figures are also valid for organizations that are on the list of enterprises, organizations, and societies that have strategic status.

Regional level

At this level, the conduct of affairs of legal entities is simplified. Benchmarking does not take into account what the company does.

Companies applying for the status of regional CNs must meet all of the following conditions simultaneously:

- have a total achieved income (reporting form No. 2) in the range of 2-20 billion rubles;

- average staff of more than 50 employees;

- have assets from 100 million rubles and not exceeding 20 billion rubles;

- have an accrued tax amount in the range of 75-1000 million rubles.

Interdependency and license

The concept of interdependence is taken into account when the influence of a particular taxpayer on the results or operating conditions of an organization with IP status is obvious. In accordance with the legally established criteria, such a taxpayer and his FED will be regarded by the tax authorities at the level of the tax liability associated with him.

There is also a special “caste” of taxpayers, whose FED is subject to federal control. In this case, the amount of taxes to be paid, the size of assets, the volume of revenue, the staff of employees and the presence of the fact of interdependence are completely unimportant.

We are talking about organizations that have received a license from the state to conduct a number of activities :

- banking operations;

- various types of insurance, reinsurance, broker intermediary services;

- professional participation in the stock market;

- pension insurance, provision (NPF).

Responsibilities of legal entities

Taxpayers provide information about any changes in their organizational structure to the representative offices of the tax authorities in the region where they are located.

A period of one month is provided for notifying the tax authorities if the taxpayer begins to participate in Russian or foreign organizations (except for business entities and LLCs).

The same period is given in cases where a legal entity registered in the Russian Federation creates separate divisions within the country (not branches or representative offices). This also applies to newly emerged changes in the information about the created units that were provided earlier.

A period of three days is given to legal entities to notify about the closure of those separate structures through which the organization operated within the Russian Federation. This norm applies to branches, representative offices, and other forms of separate divisions. Documents for download (free)

- Form No. S-09-2

- Form No. S-09-3-1

- Form No. S-09-3-2

- Form No. S-09-6

In full accordance with Article 55 of the Civil Code of the Russian Federation, the locations of a legal entity and its separate divisions do not coincide.

The Tax Code (Article 83, paragraph 1) prescribes mandatory tax registration for legal entities that have separate parts in their organizational structure in all regions and municipalities where these units are located.

Differences between each other

For a clear example of the differences between small medium and large businesses, the following table can be given.

| № | SME | Large |

| 1 | Difficulties in obtaining a loan | Simple process of obtaining a loan |

| 2 | Easier to adapt to market changes | It is more difficult to adapt to changing market conditions |

| 3 | I work up to 250 people | More than 205 employees work |

| 4 | Annual income reaches up to 2 million rubles | Annual income is more than 2 billion rubles |

| 5 | Great risk during a crisis period | Less risk during a crisis |

The basis of success

Despite the dependence on the external environment, small businesses can also be successful. Only the best employees in their field work here. The success of this business is determined by having a strategic plan for the development of the enterprise .

Medium-sized businesses can easily adapt to changing market conditions. Success also depends on having effective management .

The main success of a large enterprise is the presence of effective business models that are built in such a way that even after 10 years they continue to work, surviving crisis situations and generating huge income .

How to understand that you are a small business

Articles on the topic

Companies that meet the criteria for a small enterprise can count on financial support from federal and local authorities in 2020 under the Economic Development and Innovative Economy program. Business.ru tells you how to determine what type of business your organization is and whether you can qualify for subsidies.

Distinctive features of small and medium-sized enterprises

A Unified Register of Small and Medium Enterprises has been created on the website of the Federal Tax Service. As of March 10, more than 6 million enterprises were registered in the register, any of them can take advantage of benefits and privileges from the state.

Small and medium-sized enterprises in 2020 have a number of common criteria: by the number of employees and annual income. These include small companies engaged in a wide variety of business areas: from coffee shops and street kiosks to corrugated sheet manufacturers and cargo carriers. However, there are significant differences between these companies.

Let us examine the characteristic features by which a company receives the status of a microbusiness, small or medium-sized enterprise.

Small Business Criteria for 2020

The characteristic features of small and medium-sized businesses are prescribed in Federal Law No. 209-FZ. Article 4 contains a clear list of criteria by which a company receives status.

For convenience, we have compiled a table of criteria by which an organization is classified as a small enterprise in 2020.

Organizational and legal form of ownership

Limitations on founders' shares

Income limit

Maximum number of employees

Societies, partnerships, partnerships, cooperatives, individual entrepreneurs

Municipal and federal entities may be part of the shareholders and founders, but the share of their authorized capital or shares should not exceed 25%.

Large enterprises and foreign legal entities may be among the founders or shareholders, but the share of their authorized capital or the size of shares should not exceed 49%.

The amount of income received and the number of employees are determined based on the results of the previous year. If a company exceeds the permissible limit for 3 years, it receives a new status. A small enterprise employing 101 people becomes a medium-sized enterprise.

Determining your income on your own in order to understand whether to count on subsidies can be difficult. If a company is engaged in several types of activities, tax authorities calculate the total income. For example, an individual entrepreneur produces varnishes and paints, which he sells in his own network of retail stores. Over the past period, the entrepreneur received an income of 400 million rubles. from production and 500 million rubles. from retail trade. In 2020, according to the criteria of the past year, individual entrepreneurs will be classified as a medium-sized enterprise.

The most convenient option in this case is to seek help from specialists. If your company does not have an employee capable of taking on the work of determining status, use the help of outsourced specialists, for example, accountants from the Glavbukh Assistant service.

Criteria for microenterprises in 2020

Within small businesses, microenterprises are classified as a separate group. In many regions there are benefits designed exclusively for micro-business enterprises.

Regional authorities independently decide which groups of entrepreneurs fall under the benefit. For example, tax holidays are provided for startups, that is, start-up companies may not pay taxes for 2 years. In the Vladimir region, tax holidays can be used by individual entrepreneurs who have no more than 5 employees. In Moscow, the staff of an enterprise should not exceed 15 people.

Table of criteria for microenterprises in 2020

Organizational and legal form of ownership

Limitations on founders' shares

Income limit

Maximum number of employees

Societies, partnerships, partnerships, cooperatives, individual entrepreneurs

Municipal and federal entities may be part of the shareholders and founders, but the share of their authorized capital or shares should not exceed 25%.

Large enterprises and foreign legal entities may be among the founders or shareholders, but the share of their authorized capital or shares should not exceed 49%.

Criteria for medium-sized enterprises in 2020

Another category of organizations that can count on government support are medium-sized enterprises. They need to carefully monitor their compliance with the criteria: if they exceed the limit, they will be classified as a large business. Then they will lose the opportunity to participate in the state program “Economic Development and Innovative Economy.”

Table of criteria for medium-sized enterprises in 2019

Organizational and legal form of ownership

Limitations on founders' shares

Income limit

Maximum number of employees

Societies, partnerships, partnerships, cooperatives, individual entrepreneurs

Municipal and federal entities may be part of the shareholders and founders, but the share of their authorized capital or shares should not exceed 25%.

Large enterprises and foreign legal entities may be among the founders or shareholders, but the share of their authorized capital or shares should not exceed 49%.

101–250 people. An exception has been made for priority areas of light industry

Legal criteria

For business entities and partnerships, the legal criteria for classifying an enterprise as a small business are as follows.

| Form (features) of organization | Conditions | Note |

| Any LLC | Condition 1: 1a) The total share of participation of the Russian Federation, constituent entities of the Russian Federation, municipalities, public and religious organizations (associations), charitable and other funds (except for the total share of participation included in the assets of investment funds) in the authorized capital does not exceed 25%; 1b) the total share of participation of foreign organizations or organizations that are not SMEs does not exceed 49% | An LLC that satisfies Condition 1a) but does not satisfy Condition 1b) is recognized as an SMP if such LLC complies with Condition 4, 5 or 6 |

| Any JSC | Condition 2: Shares traded on an organized securities market are classified as shares of the high-tech (innovative) sector of the economy | — |

| Condition 3: Shareholders - the Russian Federation, constituent entities of the Russian Federation, municipalities, public and religious organizations (associations), charitable and other funds (except for investment funds) own no more than 25% of voting shares, and shareholders - foreign organizations or organizations that are not SMP own no more than 49% of voting shares | — | |

| Organizations-"intellectuals" | Condition 4: The activity consists of the practical application (implementation) of the results of intellectual activity (computer programs, inventions, breeding achievements, etc.), the exclusive rights to which belong to the founders (participants) | Founders (participants) are budgetary, autonomous scientific institutions or educational organizations of higher education that are budgetary, autonomous institutions. |

| Skolkovo organizations | Condition 5: Have Skolkovo status | — |

| Organizations with a “special” founder | Condition 6: Founders (participants) are JSC RUSNANO or the Fund for Infrastructure and Educational Programs | — |

Benefits for small and medium-sized businesses

Small and medium-sized enterprises currently produce a fifth of gross domestic product (GDP). By 2024, the government intends to increase their contribution to the country's economy to 40%. For this purpose, measures have been developed aimed at the development of small and medium-sized businesses.

- Subsidies and government programs. An entrepreneur developing a priority area can count on financial support from the state. Priority areas include medical services, farming, domestic tourism, preschool and school education.

- Preferential lending. An entrepreneur who meets the criteria for a small business can get a loan at a reduced rate in 2020. The difference between the bank's commercial rate and the preferential rate is covered from the regional budget.

- Tax holidays. Startups on a patent and simplified tax system may not pay taxes for the first 2 years. The benefit does not apply to pension contributions.

- Supervisory holidays. Until 2020, inspectors - firefighters, sanitary and epidemiological stations, labor inspectors - do not have the right to conduct scheduled inspections of small enterprises. An unscheduled inspection may be carried out if a complaint is received from a consumer or company employee.

- Preferential taxation systems and simplified accounting. Instead of filling out numerous statements, registers and accounts, small businesses can only maintain a ledger of income and expenses. Such work can be entrusted to a full-time employee or outsourced.

- Preferential rent. In some regions, entrepreneurs can rent municipal premises for free or below market price.

mb.jpg

Related publications

The criteria for classifying an enterprise as a small enterprise are regulated by law. Compliance with the entire set of mandatory requirements will allow a small business entity to take advantage of a wide range of benefits. The main regulatory act in regulating the work of small businesses is the Law on the Development of Small and Medium Businesses dated November 27, 2017 No. 209-FZ.

Read more: Car pledge agreement between individuals