The need to increase the authorized capital arises in the following cases

- increase due to the monetary contribution of a new participant in the company. For example, an investor came to an LLC who wants to invest money in the authorized capital, thereby becoming a founder.

- increase due to cash contributions from existing LLC participants. For example, one of the founders of Romashka LLC decided to increase its share in the company by injecting its own funds

- It is possible to increase the authorized capital even if the requirement for this is dictated by law. For example, the company’s field of activity has changed dramatically (insurance or banking sector).

- It is also possible to increase the authorized capital for companies whose authorized capital is less than 10,000 rubles by virtue of the law (Federal Law No. 312 of December 31, 2008)

- increasing the authorized capital at the expense of the property of the LLC.

Let's talk in detail about each method.

Increasing the authorized capital at the expense of a new participant (investor)

This method is the most popular, let’s look at it in more detail.

Before completing this transaction, look at the company’s charter and make sure that this document does not contain a ban on making an additional contribution from the contribution of a new participant. If there is no such restriction, then the visiting participant needs to send an application to the company in free form. The application must set out: the full personal data of the person, the prescribed amount of the initial contribution of the new participant, the prescribed procedure and date for making the required amount, and indicate the desired percentage of the share of the authorized capital.

After the company has received this letter, the Company develops a protocol with the following agenda:

- entry of a new participant into the company and increase in capital at the expense of new funds;

- the amount and size of the share of the incoming new member;

- ongoing changes in the shares of company participants;

- resolving the issue of a new edition of the Charter.

A new participant can make a contribution to the management company no later than 6 months from the date of the decision to increase the authorized capital.

Procedure and preparation of documents.

A new participant writes an application to become a member of the company: “…..the application of a third party must indicate the size and composition of the contribution, the procedure and deadline for making it, as well as the size of the share that the company participant or third party would like to have in the authorized capital of the company . The application may also indicate other conditions for making contributions and joining the company.” Clause 2 of Article 19 of the Federal Law on LLC

Based on this statement, the participants make a decision, which is documented in the minutes of the general meeting of participants; the new participant must be present at the general meeting of participants.

Issues that must be considered at the general meeting of participants and reflected in the minutes of the general meeting:

1. Admission of a New Participant to the Company's Membership.

2. Increasing the authorized capital of the Company by making an additional contribution to the authorized capital by a new participant.

3. Distribution of shares in the authorized capital of the Company among the participants of the Company.

4. Adoption of a new version of the company's charter.

5. Appointment of a person responsible for registering adopted changes in all state authorities without exception. organs

6. The procedure for making a decision by the general meeting of the company’s participants and the composition of the company’s participants present at its adoption.

Article 19 of the Federal Law on “LLC” tells us this: “... a decision must be made to amend the company’s charter in connection with an increase in the authorized capital of the company, as well as a decision to increase the nominal value of the share of a company participant or the shares of company participants who submitted applications for making an additional contribution, and, if necessary, a decision to change the size of shares of company participants. Such decisions are made unanimously by all participants in society. At the same time, the nominal value of the share of each participant in the company who submitted an application for making an additional contribution"

You can read more about the minutes of the general meeting here.

Payment for a share of the company's authorized capital, as a rule, is paid immediately and a cash receipt order or a receipt for the transfer of funds to a bank account is sent to the Federal Tax Service. Although, the law provides for a six-month payment period for the share of the authorized capital.

In the set of documents, to complete the registration procedure, you need two copies of the charter in a new edition or changes, one copy certified by the tax office is returned upon receipt of the documents.

Increasing the authorized capital: step-by-step instructions

Now we will talk about increasing the company’s capital through additional investments of members, in proportion to their shares in the business. The size of the charter capital is fixed in the charter, so its increase must be made using application form P13001 with the creation of a new version of the charter.

Collection and preparation of documentation

To complete the registration, you need to prepare the following list of papers:

- Decision or protocol on increasing the authorized capital in the amount of 2 copies. Remember, the date of the decision must be the same or less than the deadline for making investments, but not more than 6 months. These documents must be officially certified by notaries;

Do not forget to indicate the date by which you need to make a contribution to the authorized capital. This payment can be made to a bank account or by deposit at the company cash desk. Within three working days, this documentation must be notarized and submitted to the tax authorities for registration;

- papers confirming the contribution of funds to the share of the authorized capital by new members of the company, or a receipt of payment through the accounting department of the LLC;

decision to approve the results in the amount of 2 copies. The number of the resolution should not be greater than the number of the resolution on increasing the authorized capital;

- a new version of the charter in 2 copies or a sheet of additional changes to the current charter, also in 2 copies;

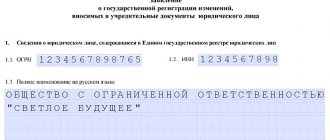

- application on form P13001;

- receipt of payment of the state duty for making changes in the amount of 800 rubles. This receipt is attached to all papers. You can pay the state duty through a terminal at the tax authorities. If the submission is made electronically using an electronic signature or the documents are sent to the Federal Tax Service with the help of a notary, then you do not need to pay this fee!

Certification of documentation by notaries

After the required package of documents has been collected in full, you need to sign these papers, with the exception of the application. No documentation is required. Application form P13001 is filed by a notary and signed by the applicant in his presence. The applicant in this case is the general director of the company; if there is a change of general directors, then a new director will be present for him. If the transfer and receipt of the necessary papers is carried out by authorized persons, then it is necessary to notarize the power of attorney for the right to perform these actions and a photocopy of the right to submit and receive these papers. Approximately notary services cost: certification of the required form - 2000 rubles, power of attorney -2400 rubles (for submitting and receiving documentation without your presence), 1500 rubles - notarization of a certificate of authenticity of a signature on a resolution, drawing up a protocol (if the company has several participants) - 8500 rubles

Submitting the necessary documentation to the tax authorities

Next, you go to the tax office, pay the state duty through the payment terminal available there, if you have not paid earlier, take a ticket for the queue and submit the documentation for registration of changes.

You provide the tax authorities with:

- application in form P13001;

- a notarized resolution or protocol on increasing the authorized capital, in addition, a photocopy of the notarized certificate issued upon certification of the protocol;

- decision to approve the results;

- application from a company member for additional contribution;

- a new version of the company's charter in the amount of 2 copies;

- checks for payment of obligatory payments;

- cash receipt orders (photocopies of payment slips with the bank’s mark on the execution or transfer of funds to the current account as payment for the authorized capital).

- After submitting the necessary documents, tax officials are required to issue you a receipt confirming their receipt of this package of papers.

Download application form P13001

You can download the application form P13001 for filling out yourself in Excel format using the link >>.

You can use the online service for filling out form P13001, as well as all additional documents (protocol, decision, application from a new participant, property valuation report, charter, etc.) by following the link >>

Increase the authorized capital

The formation of an authorized capital (AC) is a mandatory requirement when creating an LLC. But often the founders approach it formally and finance a minimum authorized capital of 10 thousand rubles or a little more. Therefore, this indicator will often be used in the future. Let's consider how to increase the authorized capital of an LLC and why this may be necessary.

Why increase the authorized capital

The authorized capital performs three main functions, from which arise the reasons for its increase:

- Financing the activities of the company.

Increasing the authorized capital, of course, gives the organization new resources for development. But if the owners simply want to “pour” additional funds into the company, then increasing the authorized capital is far from the best option.

As we will see below, this is a rather complicated procedure. Therefore, in order to “additionally finance” their LLC, it is better for owners to use other methods: issue a loan or contribute to the property .

- Distribution of shares between owners and, as a result, different opportunities for participation in business management.

Here, an increase in the authorized capital is possible in two cases:

A. A new member is accepted into the society.

B. One or more co-owners want to increase their “weight” in the management of the company.

- Guarantees for counterparties, banks and other creditors.

REDUCTION OF AUTHORIZED CAPITAL

A decrease in the authorized capital

can occur by a voluntary decision of the participants, or in cases provided for by law, for example, if the organization has not fully paid the authorized capital within a year after registration, if the amount of the organization’s net assets is less than the specified authorized capital.

The company is obliged, within thirty days from the date of the decision to reduce the authorized capital,

to notify in writing all creditors known to it about its new amount, and also to publish a notice in the press about the decision made.

It should be remembered that as a result of reducing the authorized capital,

the size of the balance should not be lower than the permissible limit.

Reducing the authorized capital of an LLC

can be carried out by reducing the value of the shares of all participants in the company, or by redeeming the shares belonging to the company. At the same time, the distribution of shares of the founders remains the same.

Reduce the size of the authorized capital of the joint-stock company

perhaps by reducing the par value of shares and reducing part of the outstanding shares from circulation.

The decision to reduce the authorized capital

must be made at a general meeting. State registration of changes to the charter of a joint-stock company is possible if there is evidence of notification of creditors about the reduction of the authorized capital.

Requirements for the authorized capital of an LLC

The law approved the main provisions for working with the initial fund:

- The minimum amount of financial resources required to open and register a company has been determined. This amount is 10,000 rubles.

- Participation provides for and allows for the investment in the authorized capital as a share of the founder’s investment in the LLC of various funds: monetary, material (equipment, transport or administrative base, Internet resources), or financial (shares, bonds, certificates).

- Before state registration with control and supervisory authorities, most of the statutory funds are paid.

- If the amount of capital exceeds the threshold of 20,000 rubles is established, a procedure for an objective independent assessment of the founders’ contribution is organized.

- The share investment is determined in the form of a mathematical fraction or a percentage is calculated.

- In case of exclusion (voluntary or forced) from the list of entrepreneurs of an LLC, the share of the invested share is subject to compensation. The refund period is 3 months. Compensation to a participant who has left the company is made from the remaining funds;

- The charter of the LLC approves and secures the documentary and mathematical significance of the initial capital investment.

- The charter of the LLC approves the procedure for the formation of capital, the principles of its use, distribution by main areas of activity, options for payment in the event of receiving profitable funds, the procedure for refusing to participate in business activities, and the possibility of changing the share investment.

Why do you need a large authorized capital?

Today, enterprises often refuse a large authorized capital, preferring to use a minimal one. This amount does not change over time, since the owners do not see the point in this. After some time, it turns out that a small amount of authorized capital indicates the company as an unattractive business partner.

Why does an LLC need a large authorized capital? There are a number of situations in which it is beneficial for a company to have a large authorized capital:

- Need a loan. The funds in question are a guarantee for the lender, because their volume indicates the financial situation of the borrower. Let us remind you that the company is liable for obligations in the amount of the authorized capital. This means that 10,000 rubles, which today most often serves as the authorized capital, does not give much chance of getting a loan.

- The company attracts serious partners/participates in tenders. Large customers, like lenders, demand reliability from their partners. Therefore, they need to see a large authorized capital, which speaks of financial guarantees and a certain image of the partner.

But it is not necessary to make the authorized capital large for a specific case - this change can be made at any time, as soon as the business owners consider it possible.

How to increase the authorized capital of an LLC

To increase the authorized capital, in addition to form P13001, certified by a notary, you will need to submit the charter of the LLC with an increased amount of authorized capital in two copies, a receipt confirming payment of the state duty in connection with amendments to the constituent documents, a decision (protocol) on increasing the authorized capital of the LLC and other documents, due to which the increase occurs. Let's take a closer look at them.

Required documents to complete the application

To fill out P13001, you will need a standard set of documents - OGRN and TIN certificates, a current extract from the Unified State Register of Legal Entities, passport details of participants, directors and their TINs.

Documents required by the notary

Depending on the notary, they may request all the LLC documents you have, or a standard set:

- OGRN and TIN certificates;

- Decision/protocol on the creation of an LLC;

- Decision/protocol on the appointment of a director (if it was changed after its creation);

- A current extract from the Unified State Register of Legal Entities (maximum two weeks, although notaries have access to the register and may not require it, you need to check);

- Current LLC charter.

And, of course, the decision/minutes on increasing the authorized capital and R13001 (since the charter is changing).