Functions of the authorized capital of the organization

- Formative function. Authorized capital is funds to ensure the start of business: the purchase of goods, inventory, equipment, etc.

- Guarantee function. As a result of unprofitable activities, the authorized capital guarantees the payment of debts in its amount to creditors and investors.

- Reputational. A company with a large authorized capital is more attractive to business partners. The management company creates the image of the company and speaks of the stability of the company.

- Distribution. Secures the right of each founder to a share of profits. That is, if 2 participants invested the same amounts in the business, then the profit will be divided in half. If the share of one founder is greater, for example 80%, and the other 20%, then the profit will be distributed in proportion to these shares.

Concept and features

The authorized capital represents financial or other material contributions transferred by the founders of an economic entity in an amount that cannot be less than that established at the legislative level. Its value must be specified in the statutory documentation of the emerging organization during the registration procedures. The minimum amount of the authorized capital of an OJSC is a value strictly regulated at the federal level.

The significance of the management company is determined by the need to insure investments made by creditors to form a legal entity and acquire profit.

The legislation defines the following possibilities for the use of capital for the purposes of an economic entity:

- if credit funds were raised to develop the business, then capital funds can be used to pay off obligations

- The capital may be spent on the purchase of equipment, components, and materials required for production and business processes

- periodically, the founders of an economic entity redistribute profits among themselves in the ratio of deposits made in the management company

Consequently, after the registration procedure, the shareholders of the created legal entity can use a certain part of the capital for the needs of the company.

Amount of authorized capital

Business owners themselves decide what size the organization’s authorized capital will be. The law establishes a minimum amount , which depends on the legal form of the enterprise:

- Limited liability company (LLC) - 10 thousand rubles;

- Public joint-stock company (PJSC) - 100 thousand rubles;

- Credit organization (bank) - 300 million rubles;

- Insurance companies - 120 million rubles;

- Alcohol producers - 10 million rubles; vodka producers - 80 million rubles;

- Bookmakers - 100 million rubles;

- Microfinance organizations - 90 million rubles.

There is no maximum amount for the authorized capital. The founders of an organization can register an LLC with any amount of capital, but not less than 10 thousand rubles.

Similar article: Mandatory audit - who needs to undergo it? Criteria, penalties, answers to questions

At the same time, the Law states that 10 thousand rubles must be contributed in money, and the remaining amount can be contributed by any other property, securities or intellectual property rights.

Formation process

The organization's charter regulates the process of transferring property from the founders to a legal entity. For limited and additional liability companies, these actions are also stipulated in the constituent agreement. The documents establish the responsibility of the founders for late contributions of their shares to the general fund.

Authorized capital is property assessed by making a decision on its value at the general meeting of founders. This is done by an independent appraiser and is entered into the documentation after general agreement.

The transfer of values is carried out using an act of acceptance of the transfer. This document, together with the contributions reflected in the balance sheet of the legal entity, act as evidence of the payment of the authorized capital within the agreed time frame.

When paying off your share in the enterprise fund, proof of the contribution of the founder’s share is a certificate from the bank with the account of the legal entity.

What does the size of the charter capital affect?

Before deciding the amount of the authorized capital, it is necessary to provide for cases that may be affected by its size.

The greater the amount of the authorized capital, the greater the trust in the company. It is easier for a company with a large authorized capital to obtain a bank loan. It looks more attractive to investors and business partners.

Financial resources from the management company are used for the initial development of the company. This is start-up capital for the purchase of equipment, materials, goods and everything necessary.

The term and procedure for payment of the management company when creating an LLC

The founders of the organization must contribute the entire amount of the authorized capital no later than 4 months from the date of creation. The LLC formation document usually specifies the exact date by which all members must pay their share. Funds are deposited into the company's bank account or cash register.

If one of the founders does not pay his share on time, he loses it in the business and it goes to the company. Then, within a year, the remaining founders must decide what to do with it:

- Distribute among other participants;

- Reduce the authorized capital by this amount.

All transactions with shares must be reported to the tax authority and changes must be made to the Unified State Register of Legal Entities using application P14001.

Threshold indicators

The procedure for the formation of capital (authorized) is regulated by Federal legislation and is established for each type of organization on an individual basis. For example, the minimum size of a joint stock company is several times higher than the limit determined for a limited liability company.

OOO

In 2020, the minimum amount of capital (authorized) for an LLC is set at 10,000 rubles.

When it is formed, each founder personally pays his share. After registering an LLC and receiving the relevant documents, its owners can increase the capital capital by contributing property, cash or other assets. It is worth noting that any changes to the authorized capital are possible only with the participation of a notary.

In accordance with Article 90 of the Civil Code of the Russian Federation, when forming the authorized capital of an LLC, its proportions and size are established in advance. When carrying out state registration, the founders must make contributions of at least 50%. They are obliged to transfer the remaining assets into the ownership of the organization during the first year of its existence.

If the founders were unable to fully form the authorized capital, they either announce its reduction or begin the liquidation procedure.

Non-public JSC

The activities of non-public joint stock companies are regulated by the Civil Code of Russia.

Such a JSC cannot have more than 50 shareholders, and its name should not contain anything that indicates its publicity. The minimum size of the authorized capital of such a company is 10,000 rubles. The nominal capital in non-public joint stock companies is divided into a certain number of securities that cannot be publicly placed.

The charter documentation initially stipulates the share of bills that belong to each owner, as well as the number of votes granted to one security holder.

In this situation, the minimum authorized capital of a non-public joint-stock company must be at least 10,000 rubles.

Public JSC

The activities of public joint-stock companies are regulated not only by the Civil Code, but also by Federal Law No. 208 “On Joint-Stock Companies”. The authorized capital of such organizations is formed from shares that are purchased by the owners at the original cost determined at the time of issue.

During the operation of companies, their authorized capital may change to either a higher or lower value, depending on the existing situation in the financial market. In accordance with the regulations of Federal legislation, the minimum capital of public joint-stock companies must be at least 100,000 rubles.

Additional information about the authorized capital is in this video.

State enterprise

When creating state-owned enterprises, their founders must be guided by the Civil Code of the Russian Federation. In accordance with its regulations, the minimum authorized capital of such companies must be 5,000 minimum wages.

From January 1, 2020, the minimum wage is 12,130 rubles, the value was established by order of the Ministry of Labor of the Russian Federation dated August 9, 2020 No. 561n.

Municipal unitary enterprise

For municipal enterprises, Federal legislation establishes a minimum authorized capital of 10,000 minimum wages. They are created by local authorities and subsequently fully supervise the activities.

Newly opened bank and credit institution

The process of opening a bank involves a large number of activities.

Its founders must fulfill all the requirements of Federal legislation in order to obtain a license to carry out banking activities. In the process of creating a financial institution, they need to form an authorized capital, the minimum amount of which should be 300,000,000 rubles.

The founders will have to place this amount in special accounts of the Central Bank of Russia.

Where is the authorized capital kept?

Based on the original essence of the concept of a management company, there is no need to store the authorized capital in any special way.

If these are funds, then they are deposited into the cash register or into a current account and stored there until they are spent.

If the authorized capital is contributed by property, then the organization must ensure its safety, like all other material assets.

Capital assets in the form of intangible assets, namely intellectual property rights, are used for the further activities of the enterprise and to derive profit from them.

Similar article: Trade fee for the manufacture of custom-made furniture

Is it possible to spend the authorized capital

Many novice entrepreneurs think that authorized capital is an emergency reserve that should always be in a bank account. This is wrong. Money should work, and not lie dead weight.

After the owners have deposited the capital into the cash register or into the current account, it can be spent. Authorized capital is an initial investment in business development. This money can be used for any needs of the organization. For example:

- Purchase of materials, equipment, goods;

- Payment for rent of premises;

- Salaries of hired employees;

- Payment for services of third parties;

- Other expenses associated with the activities of the company.

Limited Liability Company

An LLC is a form of organization in which one or more founders participate; they are engaged in joint business activities with the creation of a legal entity. The authorized capital of the company consists of shares of each of them.

The process of registering an LLC is quite complex and lengthy, with a large amount of documentation being submitted to the government agency. In addition, with this form of business, unlike an individual entrepreneur, an authorized capital is required. Since 2020, its minimum amount is 10 thousand rubles. In addition, a bank account and a company seal are required, and this leads to additional costs.

There are also a number of “inconveniences” of this organizational form:

- division of profits between LLC participants at a certain time interval (once a quarter);

- regular accounting reporting to the relevant government agency;

- larger fines for administrative violations compared to individual entrepreneurs;

- a very long and complex process of closing an organization.

How does the actual value of a share differ from the nominal value?

When initially investing funds in the authorized capital, the nominal value of the share . For example, the authorized capital of an LLC is 10 thousand rubles. The two founders invested their funds in equal shares. The cost of each participant's nominal share is 5 thousand rubles.

As a result of commercial activities, the company receives profit, which is not distributed among the founders, but is invested in development. This money is used to purchase goods and materials. All this data is reflected in the company's balance sheet.

The actual value of the share will be equal to the net asset value on the balance sheet.

If the company is profitable, the actual value of the share will be greater than the nominal value.

In unprofitable operations, the actual value of the share may be negative. In this case, a participant who wishes to leave the founders of the organization will not receive even the nominal amount of his investments.

How to determine the amount of equity capital?

According to the balance sheet, the value of the organization’s equity capital corresponds to the balance of line 1300 “Total for Section III,” i.e., the total amount for Section III “Capital and Reserves” of the balance sheet (Order of the Ministry of Finance dated July 2, 2010 No. 66n, clause 66 of the Order of the Ministry of Finance dated July 29, 1998 No. 34n).

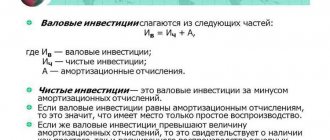

Let us recall that the balance of capital and reserves in the balance sheet is determined as follows:

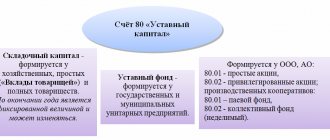

line 1310 “Authorized capital (share capital, authorized capital, contributions of partners)”

line 1320 “Own shares purchased from shareholders”

line 1340 “Revaluation of non-current assets”

line 1350 “Additional capital (without revaluation)”

line 1360 “Reserve capital”

line 1370 “Retained earnings (uncovered loss)”

It is from the organization's own capital that dividends are paid to participants. And upon termination of the organization’s activities, the size of its equity capital will show the amount of funds that is subject to distribution among participants. However, it is necessary to understand that equity can also be negative. This is possible in the case when the organization operates at a loss and its accumulated value exceeds the sum of other elements of equity capital (authorized, additional, reserve capital).

We talked in more detail about accounting for an organization's equity capital in a separate consultation.

Please note that if the calculation of equity is carried out to determine the maximum amount of interest taken into account in expenses on controlled debt, then the amount of equity will be equal to the sum of the balance of line 1300 and debt for taxes and fees (clause 4 of Article 269 of the Tax Code of the Russian Federation).

We talked in more detail about the use of the equity indicator when determining the interest on controlled debt taken into account in expenses here.

Changes to the Authorized Capital

As the business and activities of the company develop, situations arise when it is necessary to increase or decrease the size of the authorized capital. In this case, the shares of the owners may remain in the same proportion.

If only one of the participants contributes additional funds to increase the authorized capital, then his share becomes larger, and the shares of the other founders decrease.

Increase in capital

Cases when it is necessary to increase the authorized capital of an organization:

- The arrival of a new investor in the company who is ready to invest additional funds in an existing company;

- The organization has decided to engage in another type of activity for which the law requires a larger authorized capital;

- To create a positive image of the company. The size of the capital is an important indicator of the stability and size of the business. An authorized capital of 10 thousand rubles can scare away serious partners or cause a refusal of credit financing.

Related article: How to make an impression at a business meeting

Decrease in capital

Cases when it is necessary to reduce the authorized capital:

- If at the end of the year the company incurred a loss. The organization's net assets according to the balance sheet turned out to be less than the authorized capital.

- When one founder leaves the company. The company is obliged to pay the actual value of its share. In this case, net assets will become less than the authorized capital.

If the company (LLC) does not make changes to the tax inspectorate to reduce the authorized capital within 2 years, then it will be liquidated (Law No. 14-FZ of 02/08/1998, Article 30, paragraph 4).

A company whose capital is minimal, that is, 10 thousand rubles, cannot reduce it.

How to formalize a change in authorized capital

- A protocol is drawn up with a decision to change the authorized capital at the general meeting of founders;

- An application is filled out in form P13001;

- A new draft of the Charter is being drawn up;

- Documents are certified by a notary;

- A state duty of 800 rubles is paid;

- Documents are submitted to the tax office.

What is equity

In economic science and practice, there are two definitions of the essence of equity capital (SC):

- assets of an enterprise recorded without taking into account the obligations of the relevant entity;

- a set of indicators that make up the capital of an enterprise.

The approach based on the first definition is reflected in some legal acts. So, for example, in paragraph 3 of Art. 35 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ states that in banking and insurance organizations, as well as in non-state pension funds, equity capital is calculated instead of net assets. In paragraph 29 of the order of the Ministry of Agriculture of the Russian Federation dated January 20, 2005 No. 6, it is noted that the generally accepted understanding of the capital cost as the difference between the value of property and the company’s liabilities corresponds to the essence of the net value of property or net assets.

Thus, it is quite legitimate to consider the concepts of net assets and equity capital as interchangeable or as the same economic category, corresponding to the volume of a company's assets minus liabilities.

Now about the second definition of equity in the balance sheet - this concept (in accordance with another concept) contains a set of the following indicators:

- authorized, additional, and reserve capital;

- own shares purchased from shareholders;

- the firm's retained earnings;

- the result of the revaluation of the organization’s non-current assets.

It may be noted that these items correspond to lines 1310-1370 of the balance sheet.

Many experts consider this concept traditional. A similar approach is used not only in the Russian Federation, but also in other countries of the world (in this case, foreign economists may use indicators similar to those present in the lines of the Russian balance sheet).

The use of 1 or 2 approaches depends on the specific purpose of calculating equity capital. In particular, the company's management may be given a recommendation to use one or another method by investors, banks making decisions on loans, or the owners of the company. The choice of one approach or another may depend on the subjective preferences of management, the influence of a particular management or scientific school on the development of appropriate decisions by the company’s management.

The approach to defining the concept of equity capital is also predetermined by the traditions that have developed in the legal and expert environment of a particular state. In Russia, in principle, both approaches are common. We outlined possible factors for choosing 1 or 2 above.

Authorized capital upon liquidation of the company

Liquidation of an LLC is a complex process that occurs in several stages.

Before liquidation, the company must pay off all debts and obligations to:

- hired employees;

- tax inspectorate and extra-budgetary funds for taxes and contributions;

- banks for loans, loans;

- partners, creditors, and other organizations.

Only after all debt payments are made, the authorized capital is distributed among the founders in proportion to their shares. That is, each owner will receive the actual value of the share, which is not equal to the initial contribution to the authorized capital.

Answers on questions

How to find out the size of the authorized capital of any organization?

The authorized capital of the LLC and the distribution of its shares between the owners of the organization can be seen:

- in the Unified State Register of Legal Entities;

- in open sources, for example on the website www.rusprofile.ru

You must indicate the TIN, OGRN or name of the organization. You will be provided with information about the management company and a lot of other useful information.

Does an individual entrepreneur have an authorized capital?

No, only organizations have authorized capital, since it is a guarantor of payment of obligations to counterparties and partners.

An individual entrepreneur is liable for obligations with all his personal property. Therefore, it does not have a Criminal Code as such.

LLC or OJSC: main differences

An LLC is a business entity that can be established by both ordinary citizens and entities with the status of a legal entity. This organizational form is more suitable for small and medium-sized organizations with a maximum number of participants of up to 50 people.

The distribution of the profit received among the participants is carried out without reference to the volume of investment in the organization's management company. Persons receiving profit are determined by the Charter of the business entity.

Video about the authorized capital of LLC:

Each participant has the right to sell his share. But the legislation determined the pre-emptive right to acquire it by other shareholders.

The main differences between an OJSC and an LLC are the following features:

- Dividing the capital into shares. Moreover, some owners of securities may have an impressive block of shares, while others may own small percentage shares of the management company.

- No possibility of expelling shareholders through the courts.

- The voting results are determined by the block of shares, and not by shares.

- An annual audit is mandatory for JSCs.

Currently, JSCs are represented in the Civil Code of the Russian Federation in two categories:

- public joint-stock companies (formerly OJSC), characterized by the openness of the circulation of securities and the possibility of their purchase by an indefinite circle of citizens without the consent of other shareholders

- non-public joint-stock companies (formerly closed joint-stock companies), this organizational and legal structure provides for the rotation of shares in a predetermined circle of participants with a maximum number of up to 50 people. The owner can resell shares to other participants only after their permission

An LLC is a simpler form of company. While public joint-stock companies are characterized by a complex organizational structure.