Which organizations are required to conduct a mandatory audit of reporting: 6 cases under Law No. 307-FZ

Which organizations are required to conduct audits? In Art. 5 of the Law “On Auditing Activities” dated December 30, 2008 No. 307-FZ lists cases of conducting a mandatory audit. The law describes the criteria for organizations subject to mandatory audit, as well as other conditions taken into account when deciding when to conduct a mandatory audit:

In fact, the list of cases of mandatory audit is open. This means that companies not listed there may also be subject to mandatory audit if such a requirement is established by other federal laws.

Next, we will consider the main cases of mandatory audit under Law No. 307-FZ (in the figure these are cases 1-5). Case 6 does not require special decoding, since the law lists specific organizations. They are required to conduct an audit annually, regardless of the fulfillment/non-fulfillment of other mandatory audit criteria.

Find out how to pass a mandatory audit in the Typical Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

Which organizations are subject to mandatory audit?

The list of grounds that oblige a company to conduct a mandatory audit of accounting (financial) statements is given in Article 5 of Law No. 307-FZ.

1) All JSCs without exception are subject to mandatory audit (regardless of the type - CJSC, OJSC, PJSC and JSC).

The current legislation of the Russian Federation provides for a special procedure for conducting a mandatory audit in a joint stock company, in the authorized capital of which there is a certain share of state participation (clause 4 of article 5 of Law No. 307-FZ). An agreement to conduct a mandatory audit of the accounting (financial) statements of an organization in the authorized (share) capital of which the share of state ownership is at least 25%, as well as to conduct an audit of the accounting (financial) statements of a state corporation, state company, state unitary enterprise or municipal unitary enterprise is concluded based on the results placing an order through bidding in the form of an open competition in the manner prescribed by Federal Law No. 44-FZ dated April 5, 2013 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.”

MANDATORY AUDIT WITH THE ROSCO COMPANY! EASILY!

2) Carrying out certain types of activities.

Credit, insurance, clearing organizations, mutual insurance companies, organizations that are professional participants in the securities market, funds (non-state pension funds (with the exception of state extra-budgetary funds), mutual funds, AIFs) are subject to mandatory audit.

3) Compliance with certain criteria of financial and economic activity.

The following companies are subject to mandatory audit:

- with the volume of revenue from the sale of products (goods, works, services) for the previous reporting year exceeding 400 million rubles (with the exception of state and local government bodies, state and municipal institutions, state unitary enterprises and municipal unitary enterprises, agricultural cooperatives and their unions) or

- with the amount of balance sheet assets at the end of the previous reporting year exceeding 60 million rubles.

4) Carrying out certain actions by companies.

The following organizations are subject to mandatory audit:

- whose securities are admitted to organized trading;

- presenting and (or) publishing summary (consolidated) accounting (financial) statements. Exceptions include bodies of state power and local self-government, state extra-budgetary funds, as well as state and municipal institutions.

5) Other cases established by federal laws.

INTERNAL FINANCIAL AUDIT

In a number of cases, the obligation to conduct an audit is enshrined in federal law. For example, for organizers of gambling, the obligation to conduct an audit is established by clause 12 of article 6 of the Law of December 29, 2006 No. 244-FZ “On state regulation of activities for the organization and conduct of gambling and on amendments to certain legislative acts of the Russian Federation”, for political parties - Federal Law of July 11, 2001 No. 95-FZ “On Political Parties”, for the Russian Science Foundation - Federal Law of November 2, 2013 No. 291-FZ “On the Russian Science Foundation and Amendments to Certain Legislative Acts” RF". Also, regardless of the indicators of financial and economic activity (in terms of revenue volume and the amount of assets), the financial statements of municipal unitary enterprises and state unitary enterprises are subject to mandatory audit in cases determined by the owner of the property.

PREPARATION OF AUDIT

PJSC or JSC: who needs to audit the statements

Legislators have singled out the obligation to conduct audits by joint-stock companies as a separate case. As soon as the phrase “joint stock company” appears in the legal name of a company, it automatically has an obligation to conduct an audit. It does not matter whether this form was chosen by the owners when the company was founded or whether it acquired this status after a transformation or change of organizational and legal form. The form does not matter: PJSC or JSC.

Which companies are recognized as joint stock companies and what types of them exist are shown in the figure:

Are you allowed to participate in organized trading? Get ready for the audit!

If an issuing company wishes to include its securities in the quotation list, it must submit an application of a certain form to the auction organizer and provide detailed information about itself. The standards for admission of securities to public placement, circulation and listing are given in Art. 14 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ and in the Regulations on the admission of securities to organized trading (approved by the Bank of Russia dated February 24, 2016 No. 534-P).

The fact that the issuing company's securities are admitted to organized trading places it in the category of persons obligated to audit the financial statements.

The intricacies of accounting and taxation of transactions with securities will be revealed in the following materials:

- “Is the sale of securities subject to VAT?”;

- “Accounting for securities in accounting (nuances).”

Rules for selecting an auditor

If the question no longer arises as to whether the organization is subject to mandatory audit, then you can proceed to choosing an inspector.

You should not rely only on the experience of an auditor or audit company. It is better to give preference to an organization that specializes in a specific area of business activity or conducts audits in a related industry. Be sure to read reviews about the selected company; it is best to personally talk with the heads of enterprises who cooperate with a particular auditor.

Naturally, check the documents: all certificates must be in hand, valid and in the register. If the cost of services is not scary, then you can pay attention to companies that provide a range of services - not only conducting audits, but also providing legal and accounting assistance. This means that the organization has practicing specialists on its staff, and this is a huge plus.

How the type of reporting prepared affects the obligation of an audit

If a company presents and/or publishes summary (consolidated) financial statements, it automatically falls under mandatory audit (Clause 5, Article 5 of Law No. 307-FZ).

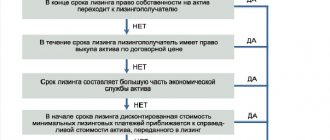

The requirements for consolidated reporting (its preparation, presentation and disclosure) are established by the Law “On Consolidated Financial Reporting” dated July 27, 2010 No. 208-FZ. The main provisions of this law, which help to understand the nuances of consolidated reporting, are presented in the figure:

Presentation and disclosure of consolidated financial statements is a process monitored by the Central Bank of the Russian Federation (with the exception of certain categories of reporting companies).

Find out more about the specifics of preparing consolidated financial statements here.

Revenue exceeded the criterion of 400 million by 1 ruble - an audit is inevitable

The number of persons required to conduct an audit may include companies that have never encountered an audit. To do this, it is enough to exceed the threshold level for one or both financial indicators specified in paragraph 4 of Art. 5 of Law No. 307-FZ.

The specific cost criteria in question are shown in the figure:

Who should conduct a statutory audit if the specified financial indicators are exceeded? Does the legal form of the company or its types of activities matter? In this case, exceeding one or both financial indicators is a separate criterion based on which a mandatory audit is assigned.

Example

The production structure of TekhnoStroyProekt LLC has been designing and manufacturing specialized electrical installations for the last 10 years. Thanks to a large contract in 2019, sales revenue amounted to RUB 401,331,120. The amount of assets at the end of this period is RUB 20,678,455.

Of the two criteria, only one was exceeded, however, TekhnoStroyProekt LLC is obliged to conduct an audit for 2020 and submit an audit report.

It does not matter that revenue exceeded the threshold level by only 0.3%. For any excess of the established criterion (even by 1 ruble), the law requires an audit.

The considered cases of conducting a mandatory audit in accordance with the requirements of Law No. 307-FZ are not a complete list. We will tell you further who else is required to audit the annual financial statements.

Find out what is the responsibility for failure to conduct a mandatory audit in ConsultantPlus. If you don't have access to the system, get a free trial online.

What happens if an organization does not carry out its mandatory audit?

Russian legislation does not contain measures of liability for failure to perform a mandatory audit for organizations whose financial statements are subject to mandatory audit. However, according to the amendments made to the Federal Law of December 6, 2011 No. 402-FZ and Art. 23 of the Tax Code of the Russian Federation, starting from reporting for 2020, organizations must indicate in their financial statements whether they are subject to mandatory audit. In addition, the audit report is submitted to the tax authority.

For failure to submit annual financial statements to the tax authorities, organizations are liable under clause 1 of Art. 126 of the Tax Code of the Russian Federation. According to this norm, failure to submit documents required for tax control within the prescribed period entails a fine of 200 rubles for each unsubmitted document.

And on the basis of Art. 15.11 of the Code of Administrative Offenses of the Russian Federation, for the absence of an audit report, the tax authority may hold the official responsible for filing it administratively liable. The amount of the fine ranges from 5,000 to 10,000 rubles.

In case of repeated violation, the fine will be from 10,000 to 20,000 rubles or disqualification will follow for a period of one to two years .

Results

Cases when a mandatory audit is needed are described in Law No. 307-FZ and many other federal laws. This category includes joint-stock companies, organizations with a certain amount of revenue and amount of assets, as well as many other business entities (whose securities are admitted to organized trading, publish consolidated statements, etc.).

Sources:

- Federal Law of July 27, 2010 No. 208-FZ

- Federal Law of December 30, 2008 No. 307-FZ

- Federal Law of April 22, 1996 No. 39-FZ

- Regulation of the Bank of Russia dated February 24, 2016 No. 534-P

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Kind of activity

Depending on the type of activity, organizations subject to audit include:

- The organization is a professional participant in the securities market;

- Credit organizations;

- Credit Bureau;

- Insurance organization;

- Clearing organization;

- Mutual Insurance Society;

- Trade organizer;

- Non-state pension or other fund;

- Joint Stock Investment Fund;

- Management company of a joint-stock investment fund, mutual investment fund or non-state pension fund (except for state extra-budgetary funds);

- Organizations whose securities are admitted to organized trading.