What are the new forms of cash checks?

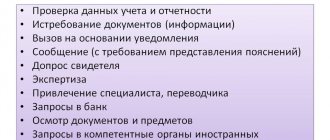

In terms of the use of cash registers, control and supervision have the following forms:

- Monitoring . This is control over payments through online cash registers and analysis of data received by the Federal Tax Service.

- Remote verification . This involves checking how business entities use cash registers and how fully they reflect their revenue. This also includes checking the activities of the OFD based on the information available to the tax authority. As part of a remote inspection, inspectors can request the necessary explanations, certificates, documents, and so on.

- Observation . A type of control that involves activities at the point of sale. Inspectors monitor how a business entity uses cash register equipment when dispensing goods. In this case, witnesses and attesting witnesses may be involved.

- Test purchase . It is used to determine how correctly the seller draws up a cash receipt or a strict reporting form.

- Checking the completeness of revenue accounting . It can be carried out both at the tax authority based on all available data (that is, be remote), and at the location of the company or entrepreneur.

Audit report of funds in the cash register

Let us note that the standard form with the title “Cash Audit Report” has never been approved by the financial department. The State Statistics Committee has put into effect the primary form INV-15 “Cash Inventory Act”, and although it is not mandatory today, it is still used in work, documenting the results of the audit, which does not contradict the law, since audit and inventory are the procedures are similar, and the purpose of both is to verify that the amount of cash in the cash register matches the accounting information.

We emphasize that each company has the right to develop and apply its own cash audit act. Often, the INV-15 form serves as a high-quality template. We will focus on the INV-15 form, as it is universal and most frequently used.

How do inspectors request cash register documents when conducting an inspection at the location of an object?

Law 54-FZ provides for document flow between users and the Federal Tax Service through the Personal Account of the user of cash register equipment. three working days from the moment they are requested to provide documents How do inspectors request cash register documents when conducting an inspection at the location of an object? When should they be submitted?

The mentioned norms of the law on cash register equipment do not apply to checking cash register systems at the location of the subject. There is an order of the Federal Tax Service dated May 29, 2020 No. ММВ-7-20 / [email protected] , which establishes a list of cases when document flow occurs through the cash register office. It also states that the requested documents and information can be presented not only electronically, but also on paper.

As for the procedure and deadlines for requesting information or documents when conducting inspections at the place of business, as well as the timing and procedure for taxpayers to respond to these requests, they are determined by the inspection regulations . Currently it has not yet been fully developed.

What should the act drawn up based on the results of the inspection look like?

Upon completion of the audit, employees of the Federal Tax Service are required to draw up a report in two copies. This document must be issued on paper, in Russian and have continuous page numbering. Blots, erasures and corrections are permissible only if they are certified by the signatures of the inspector and the person being inspected.

If the inspection reveals violations, representatives of the organization or individual entrepreneur have the right to give written explanations, make comments and objections. Having accepted them, the auditor is obliged to put a corresponding mark in the act.

In the event that the person being inspected avoids signing the act, this document will be sent by registered mail to the location or place of residence. Let us add that the commented regulations list the information that should appear in the act (see Table 2). It is possible that the lack of necessary details will allow you to challenge the results of the audit in court.

table 2

Information that must be indicated in the inspection report

| 1 | Date of drawing up the act |

| 2 | Full name or full name of the inspected object, its tax identification number and checkpoint |

| 3 | Full name of the inspection specialists who carried out the inspection, their positions, indicating the name of the inspection |

| 4 | Date and number of the order to conduct the inspection |

| 5 | List of documents received by the inspection during the inspection |

| 6 | The period for which the inspection was carried out |

| 7 | Start and end dates of the review |

| 8 | Address of the location or place of residence of the inspected object |

| 9 | Documented facts of violations identified during the inspection, or a record of the absence of such. The description of the violations must indicate the provisions of the regulatory legal acts that were violated |

By what parameters do tax authorities select applicants for inspection?

A risk-based approach has now been adopted for this . There are a number of parameters on the basis of which an algorithm for assessing a company or entrepreneur has been developed. Based on the information available to the tax authority, an analysis of the taxpayer is carried out. It uses, among other things, fiscal data, as well as signals from buyers, information received from other authorities, and so on. Based on this information, the subject is assigned a certain risk level . If it is high, then the probability of verification increases sharply.

Now, when the process of switching to online cash registers has not yet been completed, tax authorities are more focused on outreach work with taxpayers than on inspections and fines.

How to independently assess the level of risk?

Are there any criteria by which a company can independently assess the likelihood of an audit? For example, what if sometimes there is a communication failure and fiscal information is transferred to the Federal Tax Service irregularly?

The likelihood that inspectors will come to a company to inspect it largely depends on the company itself. If the subject sins by periodically not punching checks, sooner or later one of the clients may report this to the tax authority. This may be a signal to conduct an inspection.

But the irregularity of the receipt of data from the online cash register in itself is not a reason for verification. After all, it can be caused by activity. For example, in the case of distribution trade, the Internet may not be available in some areas. When selecting candidates for inspection, various parameters are taken into account, including the specifics of the types of activities.

Do not forget that even if the subject committed a violation, he can be released from liability. At the end of Article 14.5 of the Administrative Code, in accordance with which fines are imposed for failure to use cash register equipment, there is a note. It specifies the conditions under which liability for violators can be lifted.

What is the frequency and duration of such checks?

The law does not provide for any frequency. As for the duration, there are regulations No. 132n and No. 133n , which define the timing of inspections:

- a check on cash registers cannot last more than 5 working days from the moment the order is issued to carry it out until the day the report on the results is drawn up;

- verification of the completeness of revenue accounting cannot last more than 20 days from the date of presentation of the order to carry it out until the day the act is drawn up.

Please note that the mentioned regulations were developed for the use of cash registers came into force They are currently being revised. Until new ones are approved, we should focus on these deadlines.

How to check the completeness of accounting for cash proceeds

Tax inspectorates have the right to check the completeness of revenue accounting in organizations and entrepreneurs who conduct cash payments and payments using payment cards (clause 1, article 7 of Law No. 943-1 of March 21, 1991, clauses 5 and 6 of the regulations , approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

The basis for conducting an inspection is the decision of the head (deputy head) of the inspection (clause 22 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

As part of checking the completeness of revenue accounting, inspectors:

— present an order to conduct an inspection;

— review documents submitted by an organization or entrepreneur;

— check the completeness of revenue accounting in the organization (entrepreneur);

— draw up the results of the inspection.

This procedure is provided for in paragraph 20 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

The inspection period cannot exceed 20 working days from the date of presentation of the order to conduct the inspection (clause 19, 51 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n, letter of the Federal Tax Service of Russia dated September 12, 2012 No. AS-4- 2/15195).

Situation: can tax inspectorates conduct audits of the completeness of revenue accounting in relation to one organization (entrepreneur) several times a year?

Answer: yes, they can.

The number of checks of the correctness of revenue accounting in relation to one organization (entrepreneur) is not limited by law. Therefore, the tax office can conduct audits several times a year. This conclusion follows from paragraph 58 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n. The validity of this conclusion is confirmed by the letter of the Federal Tax Service of Russia dated September 12, 2012 No. AS-4-2/15195.

Inspection order

The inspector who comes for the inspection must have:

— instructions to conduct an inspection; - official identification card.

A representative of the organization (entrepreneur) signs the order. However, if he refuses to do this, the check will not be canceled. The inspector will make a note in the order indicating the refusal to sign the document.

This conclusion follows from paragraphs 23–26 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

Advice: if you have doubts about the authenticity of the order to conduct an audit, call the tax office and clarify the powers of the inspectors who came to the audit.

Situation: can tax inspectorates send instructions to verify the completeness of revenue accounting by fax?

It will be difficult for inspectors to prove that the organization (entrepreneur) actually received the fax. This conclusion follows from arbitration practice in similar situations (see, for example, the resolution of the FAS of the North Caucasus District dated March 26, 2010 No. A53-9772/2008-C5-44). Therefore, the organization (entrepreneur) may not respond to a fax message.

Most often, such messages are sent to speed up execution; at the same time, the order will be sent by mail, or the inspection staff themselves will come to the organization (to the entrepreneur) with the original order.

Providing documents for verification

For verification, the organization (entrepreneur) provides documents related to the acquisition and registration, commissioning and use of cash register equipment (CCT) (clause 28 of the regulations approved by Order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Such documents, in particular, include:

— KKT passport; — registration card; — act in form No. KM-1; — journal of the cashier-operator according to form No. KM-4; — contract for maintenance of CCP; — journal in the KM-8 form.

These documents must bear the marks of the tax inspectorate (clauses 70, 72 of the Administrative Regulations approved by Order of the Ministry of Finance of Russia dated June 29, 2012 No. 94n, Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132, Clause 15 of the Regulations approved by the Government Resolution RF dated July 23, 2007 No. 470).

During the inspection, organizations and entrepreneurs may also be asked to:

— acts on the return of funds to buyers (clients) for unused cash receipts;

— a journal for recording the readings of summing cash and control counters of cash registers operating without a cashier-operator;

— printouts of reports from the fiscal memory of cash registers and used fiscal memory drives;

— CCT control tapes on paper or printouts of the control tape made on electronic media;

— incoming and outgoing cash orders;

— journal of registration of incoming and outgoing cash documents;

— advance reports in form No. AO-1;

— cash book according to form No. KO-4;

— certificate-report of the cashier-operator;

— information about cash register meter readings and revenue in form No. KM-7;

— order on the cash balance limit;

— other primary documents necessary for verification.

If an organization (entrepreneur) applies a special tax regime, inspectors may require:

— book of accounting of income and expenses during simplification;

— book of income accounting for entrepreneurs using the patent tax system;

— a book of accounting of income and expenses of entrepreneurs using the Unified Agricultural Tax.

This is stated in paragraph 29 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

An organization (entrepreneur) can carry out cash payments (settlements using payment cards) without using cash register systems. For example, when providing services to the public with the issuance of strict reporting forms (clause 2 of Article 2 of the Law of May 22, 2003 No. 54-FZ). In this case, she must submit documents related to the production, acceptance, accounting, storage, issuance, inventory and destruction of strict reporting forms. Namely:

— strict reporting forms, their copies, document spines;

— information from the automated system about issued documents;

— act of acceptance of strict reporting forms;

— book of accounting of strict reporting forms;

— act on writing off strict reporting forms;

— order on the cash balance limit;

— other primary accounting documents and accounting registers necessary for verification.

This is stated in paragraphs 28 and 29 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

An organization (entrepreneur) can carry out cash payments without using cash registers also when conducting activities subject to UTII. At the same time, at the request of the buyer, the taxpayer issues a document confirming the receipt of funds (clause 2.1 of Article 2 of the Law of May 22, 2003 No. 54-FZ).

In this case, the organization (entrepreneur) must submit documents confirming the receipt of funds for the relevant product, work or service (clause 28 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Such documents may be sales receipts, receipts, statements related to their accounting, and other documents that the seller draws up when selling goods.

Please provide the documents required for verification in the form of originals or copies. Certify the copy with the signature of the manager (other authorized person) and seal (if available). Below the “Signature” detail you must indicate: the certification inscription “True”; position of the person who certified the copy; personal signature; decryption of the signature (initials, surname); certification date. The inspector does not have the right to require notarization of copies of documents. This procedure is provided for in paragraph 30 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n, and paragraph 3.26 of GOST R 6.30-2003, approved by resolution of the State Standard of Russia dated March 3, 2003 No. 65-st.

Situation: can a tax inspector, as part of checking the completeness of revenue accounting, request invoices or other documents justifying the amount of taxes?

Answer: no, it cannot, if they are not relevant to the verification.

Tax inspectors do not have the right to demand documents and information not related to the subject of the audit. This is stated in paragraph 30 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

Deadline for submitting documents

The organization (entrepreneur) must submit documents on the same day when it is presented with an order to conduct an inspection, or during the next working day (clause 31 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

Situation: what liability is provided for refusal to provide documents necessary for inspectors to verify the completeness of revenue accounting?

Responsibility for failure to provide information (information) at the request of inspectors in accordance with Article 19.7 of the Code of the Russian Federation on Administrative Offenses.

For non-fulfillment (untimely fulfillment) of the requirements of the tax inspectorate, the violator faces liability on the basis of Articles 126 of the Tax Code of the Russian Federation or 15.6 of the Code of the Russian Federation on Administrative Offenses. However, these articles deal with documents necessary for tax control.

Forms of tax control are tax audits, obtaining explanations from taxpayers, tax agents and fee payers, checking accounting and reporting data, inspecting premises and territories used to generate income (profit), as well as other forms of control provided for by the Tax Code of the Russian Federation (Article 82 Tax Code of the Russian Federation). Verification of the completeness of revenue accounting is not indicated in this list.

At the same time, this violation can be equated to failure to provide information (information) at the request of inspectors. The fine is:

— for officials and entrepreneurs – 300–500 rubles; — for organizations – 3000–5000 rubles.

This is stated in Article 19.7 of the Code of the Russian Federation on Administrative Offenses.

Procedure for checking CCP

If an organization (entrepreneur) uses a cash register, as part of checking the completeness of revenue accounting, inspectors recalculate the cash in the cash register cash drawer. Based on the results of the inspection, they draw up a report in two copies.

Before the check begins, the cashier draws up a receipt:

— about the absence or presence of personal money in the cash register cash drawer; — on the presentation of all receipts, cash receipts for the revenue handed over; — on the submission of certificates (reports) of the cashier-operator; — on the provision of information on cash register meter readings and revenue; — on the submission of acts on the return of funds to customers for unused (returned) cash receipts for the day of inspection.

The receipt is drawn up in the act of checking the cash in the cash register cash drawer.

Inspectors will compare the amount of cash in the cash register cash drawer with the data reflected in the fiscal report; CCT control tape; cashier-operator's journal. Entries in the cashier-operator's journal, in turn, are verified with cash receipts; cash reports; data from the cash book, book of income and expenses.

Before issuing fiscal reports and shift cash register reports, inspectors will check the serial (registration) numbers of these machines, the taxpayer’s INN with the data entered in the cash register registration card. The control tape checks the presence of all serial numbers of cash receipts, and checks the numbers and amounts of cash receipts with the numbers and amounts of available cash receipts.

Using the cash register fiscal report, the cashier-operator's journal, acts on the return of money to customers, and cash receipts, inspectors will check the number of returns, as well as the amounts returned to customers using unused cash receipts.

This procedure is provided for in paragraphs 35–39 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

Accepting money without cash register

If an organization (entrepreneur) provides services to the public without the use of cash registers, the following will be checked:

— actual availability of strict reporting forms;

— the number of strict reporting forms used for the audited period based on the book of document forms, acts of acceptance of strict reporting forms and acts of inventory of strict reporting forms;

— copies of used forms (document spines): the amount of revenue reflected in the accounting will be compared with the amounts reflected in copies of used forms.

A UTII payer who does not use cash registers will be checked for documents confirming the receipt of funds for the relevant product (work, service).

This procedure is provided for in paragraph 41 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

For each fact of discrepancy, written explanations will be taken from the organization (entrepreneur) (clauses 37, 40 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Written explanations will be included in the inspection report (clause 49 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Therefore, submit them before drawing up the act.

Situation: can tax inspectors use witness testimony when checking the completeness of revenue accounting?

Answer: yes, they can.

Paragraph 6 of paragraph 35 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n, states that, if necessary, experts are invited to participate in the inspection. The regulations do not indicate the involvement of witnesses in the verification. At the same time, there is no prohibition on bringing witnesses.

During the inspection, the inspector has the right to demand the necessary written explanations, certificates and information on issues arising during the inspection (subclause 5, clause 7 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Witnesses can also provide such information on issues arising during the inspection.

Registration of inspection results

The inspectors will document the results of checking the completeness of accounting for cash proceeds in two copies (clauses 44, 46 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). Blots, erasures and other corrections are not allowed in the act, with the exception of corrections agreed upon and certified by the signatures of the parties (clause 47 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

If the inspected organization (entrepreneur) refuses to sign the act, the act will be sent by registered mail to the location of the organization (residence of the entrepreneur) (clause 50 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

If violations are detected, inspectors draw up a protocol on an administrative offense (Part 1 of Article 28.2 of the Code of Administrative Offenses of the Russian Federation).

Based on the protocol, a resolution will be issued in the case of an administrative offense (Article 29.10 of the Code of Administrative Offenses of the Russian Federation, paragraph 54 of the regulations approved by Order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). An organization (entrepreneur) can appeal this resolution to the regional tax department (UFTS of Russia) or to the arbitration court (clause 3, part 1, part 3, article 30.1 of the Code of Administrative Offenses of the Russian Federation, clause 11 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation of January 27, 2003. No. 2).

The deadline and procedure for appealing must be indicated in the resolution itself in the case of an administrative offense (clause 7, part 1, article 29.10 of the Code of Administrative Offenses of the Russian Federation). A complaint against a decision in a case of an administrative offense can be filed within 10 days from the date of delivery or receipt of a copy of the decision (Part 1 of Article 30.3 of the Code of Administrative Offenses of the Russian Federation).

Attention: an organization (individual entrepreneur) may be held liable for violating the procedure for handling cash and the procedure for conducting cash transactions.

Such violations include:

— making cash payments with other organizations in excess of the established amounts;

— non-receipt (incomplete receipt) of cash to the cash desk;

— failure to comply with the procedure for storing available funds (accumulation of cash in the cash register in excess of established limits).

This procedure is provided for in Part 1 of Article 15.1 of the Code of the Russian Federation on Administrative Offenses.

For violation of the procedure for handling cash and the procedure for conducting cash transactions, the organization and (or) its officials, as well as the entrepreneur, face a fine. The fine is:

— for an organization – from 40,000 to 50,000 rubles;

- for officials (chief accountant, and in the absence of the position of chief accountant for the head of the organization), entrepreneurs - from 4,000 to 5,000 rubles.

Cashiers (cashiers-operators) are not considered officials. This follows from the definition of the category “officials”, which is given in Article 2.4 of the Code of the Russian Federation on Administrative Offenses. The responsibility of citizens for such an offense is not provided for by law (Article 15.1 of the Code of Administrative Offenses of the Russian Federation). This conclusion is confirmed by paragraph 14 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated October 24, 2006 No. 18.

Appeal against inspectors' actions

If an organization (entrepreneur) does not agree with the actions (inaction) of inspectors (not related to the decision on an administrative violation), it has the right to appeal them pre-trial (clause 67 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n) . An organization (entrepreneur) can contact the regional tax department (FTS of Russia) (clause 68 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).

The legislation does not provide for a unified form of complaint, but there are details that must be indicated:

— name of the tax department to which the complaint was sent (or full name or position of the relevant official);

— the name of the applicant, postal address to which the response or notification of forwarding of the complaint should be sent;

— the essence of the complaint;

- signature and date.

If necessary, the applicant may attach documents (or copies thereof) to the complaint in support of his arguments.

This procedure is provided for in paragraphs 70 and 71 of the regulations, approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n.

The deadline for filing a complaint with the Federal Tax Service of Russia is one year from the moment the organization learned (should have known) about the violation of its rights (clause 2 of Article 139 of the Tax Code of the Russian Federation).

The complaint must be considered within 30 days from the date of its registration (clause 72 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n). In exceptional cases, this period can be extended by no more than 30 days (clause 73 of the regulations approved by order of the Ministry of Finance of Russia dated October 17, 2011 No. 133n).