What kind of primary documentation is there?

The purpose of primary documentation determines its classification into the following types:

- administrative (payment orders, powers of attorney);

- executive or exculpatory (acts, salary payment statements).

According to the type of design, the primary document can be:

- accounting (calculations, certificates) – prepared by an accountant;

- combined (advance reports, cash receipts) – more than one employee is involved in the preparation and execution of documents.

A separate group among all primary documentation are strict reporting forms: receipts, tickets, subscriptions, etc. The production, accounting and storage of these papers is carried out in strict accordance with the requirements of the legislation on SSR.

Primary documents can contain varying amounts of information, be one-time or cumulative registers (an example of the latter is fuel limit statements). Regarding the performer, the primary is divided into 2 categories:

- internal, drawn up within the organization (acts, invoices, cash orders, etc.);

- external (invoices from the supplier, bank statements, invoices, etc.).

Primary accounting registers can be drawn up on unified or specialized forms; this issue must be specified in the Accounting Policy of a business entity. Specialized forms are documents, the form of which was developed by the organization itself to record highly specialized operations.

The preparation of primary documents occurs upon completion of a business transaction. All information presented in these registers is processed and serves as input data for the preparation of consolidated reporting.

Calculation of shelf life

The periods for ensuring the safety of the primary units have been decided. Now let’s designate from what moment to start calculating this period. If you incorrectly determine the starting point, you can run into sanctions from controllers.

In accordance with paragraph 2 of Art. 21.1 of Law No. 127-FZ, the storage period for documentation should be calculated from January 1 of the year following the year in which they were completed.

For example, a cash order was issued in March 2020. Therefore, start calculating its shelf life only from January 1, 2020. Keep the cash order for at least 5 calendar years. That is, the document can be destroyed no earlier than January 1, 2025. But only on condition that an audit was carried out for the reporting period of 2020. If there has been no verification, we recommend saving the documentation longer.

Composition of primary documentation

There is a list of primary documents required for use in accounting:

| Name of the primary document | Unified form |

| Power of attorney | M2, M-2a |

| Material acceptance certificate | M-7 |

| Limit fence card | M-8 |

| Request-invoice | M-11 |

| Invoice for issue of materials to the side | M-15 |

| Receipt cash order | KO-1 |

| Account cash warrant | KO-2 |

| Cash book | KO-4 |

| Time sheet | T-12 |

| Payment statement | T-53 |

The primary accounting documents listed in the table are just a brief overview of all those used in the organization. Most primary registers are drawn up on unified forms, which are approved by the following regulations

- Resolution of the State Statistics Committee of the Russian Federation No. 1 of January 5, 2004. (accounting for wage transactions);

- Resolution of the State Statistics Committee of the Russian Federation No. 7 of January 21, 2003. (accounting for fixed assets);

- Resolution of the State Statistics Committee of Russia No. 88 of August 18, 1998. (cash transactions);

- Resolution of the State Statistics Committee of the Russian Federation No. 132 of December 25, 1998. (carrying out financial calculations using cash register);

- Resolution of the State Statistics Committee No. 71-a of October 30, 1997. as amended on January 21, 2003. (labor accounting), etc.

Information letter of the Ministry of Finance of the Russian Federation No. PZ-10/2012 “Information of the Ministry of Finance of Russia N PZ-10/2012 “On the entry into force on January 1, 2013 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” cancels mandatory maintenance of all primary accounting registers in the organization. An economic entity has the right to independently determine the list of “Mandatory primary documents”, securing it in its Accounting Policy.

A little about the design of the primary

When filling out primary accounting documents, care must be taken, and the information entered must be clear. You can fill out registers manually or typewritten. In the primary it is important to reflect the following points:

- the name of the document allowing its identification;

- Date of preparation;

- all necessary details (name of the economic entity, its TIN, OGRN or OGRNIP, signatures of authorized persons, etc.);

- calculation data in words and figures, etc.

Incorrect completion of primary accounting documents becomes the reason for the exclusion of this business transaction from the tax base when audited by regulatory authorities.

Any corrections in the primary account are possible before the information from these registers is reflected in the accounting records.

List of primary documents for individual entrepreneurs using the simplified tax system

The choice of taxation regime affects the composition and completeness of accounting in general and the list of primary documents used in particular. An individual entrepreneur who has chosen the simplified tax system “income” must take care of correctly filling out the Book of Income and Expenses (in the revenue part). Accordingly, data for KUDiR should be taken from primary documents:

- certificates of completed work confirming the provision of services to customers;

- invoices for the transfer of products.

Both of the above-mentioned documents confirm the fact of completion of the transaction for the sale of products or provision of services. Confirmation of payment by the customer or buyer is an extract from the current account received by the individual entrepreneur at the bank. When receiving cash from the customer, the following types of primary documents are drawn up:

- cash receipt order;

- Z-report (when using CCP).

If the tax base of an individual entrepreneur using the simplified tax system is “income reduced by the amount of expenses,” the list of primary documents expands. The entrepreneur will have to record in chronological order the expenses that reduce the income side of KUDiR. The following primary documents support these expenses:

- expense reports;

- expense cash orders;

- acts of write-off of materials;

- sales receipts for the purchase of goods and materials;

- pay slips for settlements with employees;

- other documents.

In paragraph 1 of Art. 346.16 of the Tax Code of the Russian Federation specifies a list of expenses that an individual entrepreneur has the right to include in KUDiR to reduce the taxable base under the simplified tax system.

Storage of documents after closure of individual entrepreneurs

If an individual entrepreneur decides to cease his activities, he must submit current documentation to the archives.

Personnel documents are submitted to the state or municipal archive at the individual entrepreneur’s place of residence. The remaining documents are sent to a private archival company.

There are no deadlines for transferring documents to the archive.

Important! The tax inspectorate has the right to check an individual entrepreneur after cessation of activity for four years. If the Federal Tax Service has requested documents that the individual entrepreneur has deposited in the archives, you will have to request copies.

What primary documentation does an individual entrepreneur prepare for UTII?

An individual entrepreneur who is a taxpayer of the single tax on imputed income must keep records of those physical indicators that determine the size of the tax base. These could be hired workers, square meters of area, etc. (depending on the chosen type of activity). Moreover, it is necessary to keep records of these physical indicators throughout the entire period of time, so that if they are adjusted, you can prove to the tax authorities the correctness of your calculations.

If an individual entrepreneur reduces the tax base by the amount of insurance contributions from the wage fund of hired personnel, it is necessary to keep primary records of the accrual and payment of wages to these employees. The primary forms in this case will be as follows:

- time sheet;

- work orders for piecework wages;

- payrolls;

- certificates of incapacity for work, etc.

Many individual entrepreneurs on UTII retain agreements with counterparties in case of a counter tax audit, but these documents do not belong to the category of primary documentation and are more of a reference nature.

Tax accounting documents

This group includes all documents that contain information for calculating tax (acts, invoices, checks, receipts, etc., as well as KUDiR) and tax payments that confirm the fact of its transfer. The general rule for storing such documents is established in the Tax Code (clause 8, clause 1, article 23): tax documents must be stored for 4 years . There are no other comments regarding the calculation of the document storage period, so it can be calculated from the next day the document is compiled.

Sometimes documents should be kept for more than 4 years. For example, if an acquired fixed asset is written off, then the storage period for documents should be counted from the moment this fixed asset is fully recognized as expenses. Also, when carrying forward losses to future periods, it is necessary to retain all supporting documents for the entire period when the loss will be taken into account when calculating tax.

When determining the document storage period, you must remember that on-site tax audits are carried out for the previous 3 years, so before destroying the document, make sure that it is no longer useful.

Primary documentation for OSNO

The main taxation system is the most labor-intensive in accounting and requires the accountant to have knowledge of current legislation not only in the field of accounting. If there is an individual entrepreneur on OSNO, he may not keep accounting records in full, this is indicated by paragraph 2 of Article 6 of Federal Law No. 402-FZ of December 6, 2011. (as amended on May 23, 2020). But in this case, the entrepreneur must maintain detailed KUDiR in chronological order. The primary documents, the information of which is entered into the Book, are determined by the businessman’s field of activity:

- certificates of services rendered;

- invoices for products;

- expense cash orders;

- expense reports;

- money orders;

- statements, etc.

If the organization is located on OSNO, the accountant, when drawing up the Accounting Policy, selects the necessary primary accounting documents and uses this list in his daily work. All commercial companies, based on Law No. 402-FZ, are required to keep accounting records in full. The primary documentation in this case is all supporting documents confirming the completion of a particular business transaction.

Procedure for storing accounting and tax documents

According to paragraph 3 of Art. 29 of Law N 402-FZ, the organization must ensure safe storage conditions for accounting and tax records and their protection from changes. According to paragraph 2 of Art. 13 of Law No. 125-FZ, organizations and citizens have the right to create archives for the purpose of storing archival documents generated in the process of their activities.

To organize the archive, a separate room must be allocated, equipped with special shelves (racks) or closed cabinets. If there are windows in the archive room, they should be curtained or blinds installed, otherwise it will not be possible to protect documents from exposure to light, and therefore they may fade. It is advisable to equip the windows of the first or basement floor with metal bars; in addition, it is better to install a metal door in the archive. Such measures will help to avoid unauthorized entry into the archive premises.

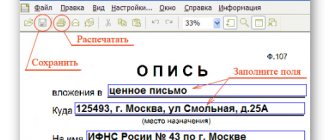

According to the Basic Rules for the Operation of Archives of Organizations, approved by the decision of the Board of Rosarkhiv dated 02/06/2002, inventories of files are compiled in the archive: permanent storage; temporary (over 10 years) storage; by personnel; as well as acts on the allocation for destruction of files that are not subject to storage. Cases with expired storage periods according to the List are included in the act of allocation for destruction and are subject to destruction.

The processed primary documents of the current month are compiled in chronological order and accompanied by an inventory for the archive. Cash orders, advance reports, bank statements with related documents must be collected in chronological order and bound. Certain types of documents may be stored unbound, but filed in folders to prevent loss or misuse.

The Russian Ministry of Finance notes that the storage of primary documents, accounting and tax accounting documents can be carried out in electronic form, unless otherwise provided by regulatory legal acts of the Russian Federation. At the same time, their storage on computer storage media should be carried out in accordance with the Federal Law “On Electronic Signatures” dated 04/06/2011 N 63-FZ using an electronic digital signature equivalent to a handwritten signature in a document on a paper medium.

The safety of primary documents, accounting and tax reporting, their execution and transfer to the archive is ensured by the chief accountant. The issuance of documents from the accounting department and from the archives of the organization to employees or other persons, as a rule, is not allowed, and in some cases can only be done by order of the chief accountant.

Seizure of documents can only be carried out by the bodies of inquiry, preliminary investigation, prosecutor's office and courts on the basis of a decision of these bodies in accordance with the current criminal procedural legislation. The seizure is documented in a protocol, a copy of which is handed over to an official of the organization against receipt. With the permission and in the presence of representatives of the authorities making the seizure, the accountant can make copies of the seized documents indicating the grounds and date of their seizure.

The procedure for storing personnel documentation is regulated by separate provisions of labor legislation in relation to various types of documentation.

So, for example, in Art. 87 of the Labor Code of the Russian Federation establishes the employer’s obligation to ensure the safety of the employee’s personal data. Employee personal data is information required by the employer in connection with employment relations and relating to a specific employee. Personal data includes information contained in a personal file.

The procedure for storing personal data of employees is established by the employer in compliance with the requirements of the Labor Code of the Russian Federation and other federal laws. The employer must control the storage and use of personal data, as well as ensure its protection from misuse or loss.

Separate requirements apply to the storage of work record forms. Forms of the work book and its insert, as strict reporting forms, must be stored in safes, metal cabinets or special rooms to ensure their safety.