Bookmarked: 0

According to the Regulations approved by Decree of the Government of the Russian Federation No. 359 of May 6, 2008 (hereinafter referred to as the Regulations), legal entities and individual entrepreneurs (IP) can use strict reporting forms instead of a cash register when paying in cash for the provision of services to citizens. These persons need to organize their records in accordance with legal requirements.

The document with which payments are made in cash, as well as payment cards for the provision of services to citizens, is called a strict reporting form (SRF). It is equivalent to a cash register receipt.

Basic rules for storing strict reporting forms

The rules according to which Russian organizations must store BSO are set out in the Regulations on cash settlements without the use of cash registers (hereinafter referred to as the Regulations), approved by Decree of the Government of the Russian Federation No. 359 of 05/06/2008.

Read more about other important provisions of Resolution No. 359 in the article “What applies to strict reporting forms (requirements).”

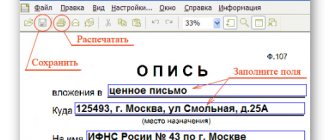

The traditional method of producing BSO is to contact a printing house (clause 4 of the Regulations). The legislation of the Russian Federation also allows for the issuance of forms when automated systems are used (clause 11 of the Regulations).

As for BSOs produced by printing methods, they should be placed in safes or in special premises of the enterprise, where the safety of the forms is guaranteed. Every day, the place where BSO is stored must be sealed or sealed (clause 16 of the Regulations).

The functions of ensuring the safety of strict reporting forms must be performed by a financially responsible person (hereinafter referred to as the MOL) - an employee of the organization, with whom the employer must sign an agreement on full financial responsibility (clause 14 of the Regulations).

The MOL begins to perform its functions from the moment the BSO becomes available to the organization (for example, from a printing house). His tasks at the time of receipt of the forms are to:

- check the number of forms, their series and numbers with the data specified in the accompanying documents;

- issue an act of acceptance of forms;

- enter information about the accepted forms into the book of strict reporting forms.

All three actions of the MOL must be carried out in the presence of a commission, which is created on the basis of an order from the head of the company (clause 15 of the Regulations).

As a BSO accounting book (or the basis for its creation), commercial companies can use a form corresponding to number 0504045 according to OKUD. For state and municipal organizations, its use is mandatory (Order of the Ministry of Finance of the Russian Federation No. 52n dated March 30, 2015).

The acceptance certificate (a little later we will look at the basis on which form it should be drawn up) must be signed by all members of the commission. It must also be approved by the supervisor. The book of records of strict reporting forms should be stitched and numbered. It must be signed by the head of the company, the chief accountant, and also sealed.

You can learn about filling out the book from the article “How to fill out the book of strict reporting forms.”

Maintaining a ledger of forms

In the case where forms are issued using a printing method, the Regulations require that you have a BSO accounting book to record them. A commercial enterprise or individual entrepreneur has the right to develop a model of this book itself, since there is no approved form. In this case, the book must be bound, numbered, sealed, and signed. Accounting in the book of forms must be kept by name, number and series of the form. In most cases, the book contains columns indicating the date of receipt of the forms, their quantity, and details of the corresponding form.

A prerequisite is the publication of an act at the local level, where the rules for maintaining this book will be fixed and a person responsible for accounting for forms, including maintaining the book, will be appointed. An agreement on full individual financial responsibility is concluded with this responsible person. In this case, the head of the organization (IP) must create all the necessary conditions for the safety of the forms.

The features of maintaining the accounting book are described in more detail in the Regulations.

When forms are issued using automated systems, they are recorded using special software. There is no need to keep a ledger. At the same time, access to this system should be limited to unauthorized persons. Each form must have its number and series. Such forms must be stored in an automated system for at least 5 years.

Storing forms using automated systems

The “innovative” scenario for manufacturing BSO - using automated systems (AS) - significantly simplifies the task of organizing the storage of forms for the company’s management. If the corresponding system meets the criteria contained in clause 11 of the Regulations (is protected from unauthorized access, identifies and records transactions with BSO for five years or more, stores data on the form in memory), then there is no need to carry out the above procedures, because:

- BSO from a third party is not accepted;

- copies of the BSO remain in the memory of the computer and other devices as part of the system;

- Suppliers of modern AS for organizing the circulation of BSO, as a rule, include in the software package solutions that allow you to maintain a book of records of strict reporting forms in electronic form.

At the same time, once printed using AS, but for one reason or another damaged, BSOs should, like those created by printing, be stored in the organization’s safes or in other safe places.

The functions of the MOL in the case of using an automated system are most often assigned to an accountant trained in working with the appropriate software, and less often to a system administrator managing the automated system.

Attention! In connection with the transition to online cash registers, the taxpayer is obliged from 07/01/2018, and in some situations from 07/01/2019, to form a BSO using automated systems for strict reporting forms capable of transmitting information about mutual settlements to the Federal Tax Service online. For more details, see the material “Law on online cash registers - how to apply BSO (nuances)”. The BSO is issued to the buyer on paper or sent by email or to the client’s phone number.

Tax authorities control the completeness of revenue accounting. Find out what rights they have when checking the cash balance in the cash register, the BSO machine and generated forms from the materials of ConsultantPlus experts, having received trial access for free.

How to prepare and reflect strict reporting forms in accounting and taxation

Prepared on the basis of materials from the BSS "System Glavbukh"

| How to prepare and reflect strict reporting forms in accounting and taxation | Head of the Department of Budget Control and Audit Methodology of the Department of Budget Policy and Methodology of the Ministry of Finance of Russia |

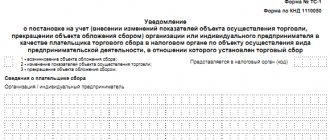

When providing paid services to the population, an institution can, instead of using cash register systems, draw up calculations using a strict reporting form (SSR) (clause 2 of article 2 of the Law of May 22, 2003 No. 54-FZ, clause 167 of the Instructions to the Unified Chart of Accounts No. 157n). Use the BSO only if the form is approved specifically for the type of activity that the institution carries out. The list of documents approving strict reporting forms is given in the table.

Situation: is it necessary to apply the instructions approved by the protocol of the State Interdepartmental Expert Commission on Cash Registers (GMEC) dated June 29, 2001 No. 4/63-2001 when organizing the accounting and storage of strict reporting forms

Yes need.

Minutes of the GMEC dated June 29, 2001 No. 4/63-2001 have not been canceled to date. Therefore, it can be applied to the extent that does not contradict the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

The head of the institution must, by order, appoint someone responsible for the storage and issuance of strict reporting forms. An agreement on full financial responsibility must be concluded with this employee and conditions must be created for him to store BSO. Strict reporting forms must be stored in metal cabinets, safes or specially equipped rooms, which are sealed or sealed daily. Such rules are established by paragraphs 14 and 16 of the Regulations, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Submit the received BSO on the same day with an act of acceptance of strict reporting forms. The act must be approved by the head of the institution and signed by members of the commission for the receipt and disposal of assets. The commission may include the chief accountant, materially responsible persons and other employees appointed by the manager.

Such rules are provided for in paragraph 15 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Make a note about the receipt of forms in the book of strict reporting forms (f. 0504045). The sheets of this book must be numbered, laced, signed by the manager, chief accountant and sealed. Such rules are established by paragraph 338 of the Instructions to the Unified Chart of Accounts No. 157n, paragraph 13 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Strict reporting forms are printed or generated using automated systems (clause 4 of the Regulations approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359).

When generating strict reporting forms in an automated way, the institution must comply with the following requirements:

- the automated system must be protected from unauthorized access, identify, record and store all operations with the document form for at least five years; When filling out and issuing a document form, the automated system stores the unique number and series of this form.

This is stated in paragraph 11 of the Regulations, approved by Decree of the Government of the Russian Federation of May 6, 2008 No. 359.

Reflect the receipt of strict reporting forms in the context of persons responsible for their storage and (or) issuance, storage locations in off-balance sheet account 03 “Strict reporting forms”. Account for BSO on the balance sheet in a conditional valuation (1 ruble per form) or at the cost of acquisition (if this is enshrined in the accounting policy for accounting purposes). This is stated in paragraph 337 of the Instructions to the Unified Chart of Accounts No. 157n.

Keep analytical accounting for off-balance sheet account 03 in the ledger of strict reporting forms (f. 0504045):

- by types, series and numbers of BSO; by places of their storage (divisions, responsible persons).

This procedure is established by paragraph 338 of the Instructions to the Unified Chart of Accounts No. 157n, Methodological Instructions approved by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n.

Write off used or damaged strict reporting forms on the basis of the act of writing off strict reporting forms in form No. 0504816 (clause 337 of the Instructions to the Unified Chart of Accounts No. 157n).

The procedure for reflecting receipts and disposals of strict reporting forms in accounting (budget) accounting depends on the type of state (municipal) institution.

In the accounting of government institutions

Costs for the purchase of strict reporting forms should be reflected in subsection KOSGU 226 “Other work, services” (Section V of the instructions approved by Order of the Ministry of Finance of Russia dated December 21, 2011 No. 180n).

Reflect the purchase of strict reporting forms with the following entries:

Debit KRB.0.401.20.226 (KRB.0.109.61.226, KRB.0.109.71.226...) Credit KRB.0.302.26.730

– the costs of purchasing strict reporting forms are reflected;

Debit 03

– strict reporting forms were capitalized in a conditional valuation (at the cost of acquisition).

Reflect the movement of strict reporting forms with the following entries:

Debit 03 sub-account “BSO in the department” Credit 03 sub-account “BSO in accounting”

– strict reporting forms were handed over to the department employee for reporting;

Credit 03 subaccount “BSO in the division”

– strict reporting forms in off-balance sheet accounting were written off.

This procedure is established by paragraph 102 of Instruction No. 162n, Instruction to the Unified Chart of Accounts No. 157n (off-balance sheet account 03).

In accounting for budgetary institutions

Budget institutions - recipients of budget funds reflect the receipt and disposal of strict reporting forms in accounting in the manner established for government institutions (clause 4 of Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n).

In accounting for a budgetary institution that receives subsidies from the budget (in accordance with clause 1 of Article 78.1 of the Budget Code of the Russian Federation), reflect the costs of purchasing strict reporting forms under subarticle KOSGU 226 “Other work, services” (Section V of the instructions approved by order of the Ministry of Finance Russia dated December 21, 2011 No. 180n).

Reflect the purchase of strict reporting forms with the following entries:

Debit 0.401.20.226 (0.109.60.226, 0.109.80.226...) Credit 0.302.26.730

– the costs of purchasing strict reporting forms are reflected;

Debit 03

– strict reporting forms were capitalized in a conditional valuation (at the cost of acquisition).

Reflect the movement of strict reporting forms with the following entries:

Debit 03 sub-account “BSO in the department” Credit 03 sub-account “BSO in accounting”

– strict reporting forms were handed over to the department employee for reporting;

Credit 03 subaccount “BSO in the division”

– strict reporting forms in off-balance sheet accounting were written off.

This procedure is established by paragraph 128 of Instruction No. 174n, Instruction to the Unified Chart of Accounts No. 157n (off-balance sheet account 03).

In the accounting of autonomous institutions

Acceptance of obligations to pay the costs of purchasing strict reporting forms should be reflected in account 0.302.26.000 “Settlements for communication services” (clause 138 of Instruction No. 183n).

Reflect the purchase of strict reporting forms with the following entries:

Debit 0.401.20.226 (0.109.60.226, 0.109.80.226...) Credit 0.302.26.000

– the costs of purchasing strict reporting forms are reflected;

Debit 03

– strict reporting forms were capitalized in a conditional valuation (at the cost of acquisition).

Reflect the movement of strict reporting forms with the following entries:

Debit 03 sub-account “BSO in the department” Credit 03 sub-account “BSO in accounting”

– strict reporting forms were handed over to the department employee for reporting;

Credit 03 subaccount “BSO in the division”

– strict reporting forms in off-balance sheet accounting were written off.

In 24–26 digits of the account number, indicate the code for the type of disposals (receipts) corresponding to the data structure approved by the Financial and Economic Activity Plan.

Get full text

This procedure is established by paragraphs 3, 138 of Instruction No. 183n, Instruction to the Unified Chart of Accounts No. 157n (off-balance sheet account 03).

In addition to the forms issued to customers instead of a cash register receipt, on off-balance sheet account 03, consider:

- receipt books; certificates; diplomas; work books; holograms; other similar forms.

This is stated in paragraph 118 of the Instructions to the Unified Chart of Accounts No. 157n.

Situation: is it necessary to include student cards and grade books in the strict reporting forms (SRF)

The legislation does not contain a clear answer to this question. There are no official explanations from regulatory agencies on this matter.

As a general rule, strict reporting forms (SSR) include forms that simultaneously meet the following conditions:

- the form of the form is approved by the regulatory legal act; the form contains the registration series and number, degree of protection (for example, forms of diplomas, certificates); State authorities have established a special procedure for recording and storing the form (for example, the procedure for recording and storing work book forms is established by Section VI of the Rules, approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

This is stated in paragraph 118 of the Instructions to the Unified Chart of Accounts No. 157n.

Student cards and record books (of the established form) are issued to students of higher and secondary vocational educational institutions (clause 1 of article 16 of the Law of August 22, 1996 No. 125-FZ, clause 38 of the Model Regulations approved by the Decree of the Government of the Russian Federation of July 18, 2008 No. 543). The forms of the grade book and student ID are approved by orders of the Ministry of Education of Russia (for example, for students of educational institutions of secondary vocational education, the forms are approved by orders of December 24, 2002 No. 4571 and of November 18, 1996 No. 339). However, such forms do not contain an accounting series and number; in addition, no special accounting and storage procedure is established for them. Therefore, there is no need to include student ID cards and grade books as part of strict reporting forms. Treat them like regular blank products.

The procedure for reflecting the costs of purchasing strict reporting forms when paying taxes depends on the taxation system that the institution uses.

The institution applies a general taxation system

VAT on purchased strict reporting forms can be deducted if the following conditions are met:

- the tax is presented by the supplier; strict reporting forms were purchased for transactions subject to VAT; strict reporting forms are accepted for registration; there is an invoice for them.

This procedure is established in Article 171 of the Tax Code of the Russian Federation.

For more information about this, see When “input” VAT can be deducted.

The exception to this rule is when:

- the institution enjoys VAT exemption; The institution carries out VAT-free transactions.

In these cases, take into account the “input” VAT in the cost of strict reporting forms. This follows from paragraph 2 of Article 170 of the Tax Code of the Russian Federation.

Situation: how to take into account the costs of purchasing strict reporting forms when calculating income tax. Forms purchased and used as part of income-generating activities

The procedure for tax accounting of strict reporting forms is not clearly established in the legislation.

On the one hand, the costs of purchasing strict reporting forms can be classified as material costs on the basis of subparagraph 2 of paragraph 1 of Article 254 of the Tax Code of the Russian Federation. This is explained by the fact that these costs are associated with payments for services rendered, that is, the purchased forms are used for production needs. For more details, see How to take material expenses into account when calculating income tax.

On the other hand, these costs can be taken into account as part of office expenses and attributed to other expenses (subclause 24, clause 1, article 264 of the Tax Code of the Russian Federation). A similar point of view is expressed by the Russian Ministry of Finance in a letter addressed to organizations using the simplified system (letter dated May 17, 2005 No. 03-03-02-04/1/123). The conclusions of the financial department can be extended to state (municipal) institutions that apply the general taxation system (clause 2 of article 346.16 of the Tax Code of the Russian Federation). For more information on how to take into account the costs of office supplies when calculating income tax, see How to reflect office supplies in accounting and taxation.

Thus, the institution must independently decide whether to classify such expenses as material or other (clause 4 of Article 252 of the Tax Code of the Russian Federation). Fix your choice in your accounting policy for tax purposes (Article 313 of the Tax Code of the Russian Federation).

To find out whether it is possible to take into account when calculating income tax the costs of purchasing strict reporting forms if they are used both in income-generating activities and in activities related to the implementation of state (municipal) tasks, see How to maintain separate tax accounting on profit if the institution receives targeted funding (targeted revenues).

An example of reflection in accounting and taxation of receipts and use of strict reporting forms. The institution takes into account strict reporting forms in the conditional assessment (1 rub. per form)

The budgetary institution "Alpha", as part of its income-generating activities, conducts advanced training courses (not subject to VAT) and uses strict reporting forms.

On August 23, Alpha purchased 10 strict reporting forms (certificates of advanced training), the total cost of which was 236 rubles, including VAT - 36 rubles. On August 24, eight forms were issued. On an off-balance sheet account, strict reporting forms are taken into account in the conditional valuation of 1 rub.

Alpha determines income and expenses using the accrual method. Due to the fact that the procedure for accounting for expenses on strict reporting forms is not established in Chapter 25 of the Tax Code of the Russian Federation, the accounting policy for tax purposes of Alpha stipulated that these costs are taken into account as office expenses, and the expenses are included in other expenses.

The accountant reflected the purchase of forms in accounting with the following entries:

Debit 2.109.60.226 Credit 2.302.26.730

– 236 rub. – expenses for the purchase of strict reporting forms are reflected;

Debit 03 subaccount “BSO in accounting”

– 10 rub. – strict reporting forms have been capitalized;

Debit 03 sub-account “BSO in the department” Credit 03 sub-account “BSO in accounting”

– 8 rub. – strict reporting forms were transferred to departments;

Credit 03 subaccount “BSO in the division”

– 8 rub. – strict reporting forms issued to participants in advanced training courses were written off.

In tax accounting, the cost of eight issued forms (236 rubles/piece: 10 pieces × 8 pieces = 188.80 rubles) was taken into account in expenses in the third quarter.

The institution pays UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, the cost of purchasing strict reporting forms does not affect the calculation of the tax base.

The institution applies the general taxation system and pays UTII

Strict reporting forms can be used both in the activities of an institution subject to UTII, and in activities on the general taxation system. As a rule, it is known what type of activity the calculations for which a strict reporting form is drawn up, used instead of cash registers, are related to. Accordingly, the costs of purchasing forms and the amount of VAT paid can be determined on the basis of direct calculation. This procedure follows from paragraph 4 of Article 149, paragraph 9 of Article 274 and paragraph 7 of Article 346.26 of the Tax Code of the Russian Federation.

In some cases, it is impossible to determine in what type of activity BSOs are used. Therefore, the costs of their acquisition cannot be directly allocated. In this case, distribute them in proportion to the share of income from each type of activity (clause 9 of Article 274 of the Tax Code of the Russian Federation).

VAT, which can be deducted on distributed expenses for social security, is calculated according to the methodology established in paragraph 4 of Article 170 of the Tax Code of the Russian Federation. For more information about this, see How to deduct “input” VAT on property (work, services) that will be used in both taxable and non-taxable transactions.

To the received share of expenses for the activities of the institution, subject to UTII, add the amount of VAT that cannot be deducted (subclause 3, clause 2, article 170 of the Tax Code of the Russian Federation).

Autonomous institution applies simplification

If an autonomous institution pays a single tax on income using a simplified system, then the costs of purchasing strict reporting forms do not affect the tax base. Such institutions do not take into account any expenses (clause 1 of article 346.14, clause 1 of article 346.18 of the Tax Code of the Russian Federation).

Situation: how can an autonomous institution take into account the costs of purchasing strict reporting forms in a simplified manner? The institution pays a single tax on the difference between income and expenses

According to strict reporting forms used instead of cash registers, the tax accounting procedure is not clearly established in the legislation.

On the one hand, the costs of purchasing strict reporting forms can be classified as material costs (subclause 5, clause 1 and clause 2, article 346.16, subclause 2, clause 1, article 254 of the Tax Code of the Russian Federation). This is explained by the fact that these costs are associated with payments for services rendered, that is, the purchased forms are used for production needs.

On the other hand, these expenses can be classified as office expenses (subclause 17, clause 1, article 346.16 of the Tax Code of the Russian Federation). A similar point of view is expressed by the Russian Ministry of Finance in letter dated May 17, 2005 No. 03-03-02-04/1/123. For more details, see How to reflect office supplies in accounting and taxation.

If an autonomous institution pays a single tax on the difference between income and expenses, include the “input” VAT presented by the supplier when purchasing strict reporting forms as expenses (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Prepared on the basis of materials from the BSS "System Glavbukh"

Transfer of forms to the organization's employees

If the calculations in which the BSO is used are carried out not by the MOL, but by another employee of the company, then the transfer of the relevant forms to his disposal is carried out by the financially responsible person on the basis of a written application. Data on issued BSOs are entered by the MOL in the book of records of strict reporting forms.

Copies of the BSO issued to the organization's clients, or the counterfoils of the forms (depending on which specific form of the BSO is used) are transferred by the employees to the financially responsible person. Data about this is also recorded in the BSO accounting book. If any of the previously issued forms is damaged, it is crossed out and then attached to the accounting book.

Accounting for settlements with accountable persons - a new subsystem

The document “ Application for advance payment ” is intended for filling out an application for an advance payment to an accountable person. Based on the document, you can enter a Cash Order or a Statement for issuing money from the cash register to accountable persons .

The document “ Advance report ” is intended for processing settlements with accountable persons in terms of travel expenses, payment for work (services) of third-party organizations, and posting fixed assets, intangible assets, materials, and food products received from accountable persons to the warehouse.

Do GMEC protocols have legal force?

Some provisions of the legislation regulating the circulation of BSO are contained in the minutes of the meeting of the State Interdepartmental Expert Commission (GMEC) No. 4/63-2001 dated June 29, 2001. Do they have legal force that applies to all Russian organizations?

Despite the fact that GMEC ceased to exist on 08/09/2004, its decisions, which were made during the period when this institution exercised its powers, are generally binding (letter of the Federal Tax Service of the Russian Federation No. ED-18-2/947 dated 06/17/2014).

So, with regard to the form of the BSO acceptance certificate, you should use the form that corresponds to number 070000 according to OKUD. The order to use this form includes clause 18 of the GMEC protocol No. 4/63-2001.

Similarly, other provisions of the GMEC Protocol No. 4/63-2001 retain legal force. In particular, those that regulate BSO accounting.

Accounting for strict reporting forms

BSO turnover is recorded in off-balance sheet account 006, which is called “Strict Reporting Forms”. BSO accounting is carried out through entries reflecting the amount of costs for the production of forms (clause 22 of the minutes of the GMEC meeting No. 4/63-2001). As a rule, these are the postings:

- Dt account 26 “General business expenses”;

- Kt account 60 “Settlements with suppliers and contractors.”

In some cases, BSO accounting involves the creation of subaccounts for account 006. This is possible if the forms capitalized by the accounting department are subsequently issued to other employees who actually manage the BSO (we examined a similar scenario above). In this case, subaccount 006-1 “BSO in accounting”, as well as subaccount 006-2 “BSO from executors” can be formed.

How to correctly write off BSO in accounting and what documents to prepare? The answer to this question was given by 2nd class State Civil Service Advisor I. O. Gorchilina. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Criteria for correct numbering of strict reporting forms

An important criterion characterizing the accounting and storage of BSO is the correct numbering of the relevant forms.

The main requirement for a BSO is the presence of a unique 6-digit serial number and a series consisting of 2 letters. At the level of federal legislation, the noted criteria are not fixed, but they are regularly found in departmental legal acts regulating the production of BSO (for example, in the letter of the Ministry of Culture of the Russian Federation No. 2344-01-39/03-E4 dated April 13, 2009). These provisions can be applied by subjects of legal relations in other industries on the principle of legal analogy.

The relevant details of the forms - series, number - will need to be recorded in the marked forms (BSO acceptance certificate, BSO accounting book).

As we noted at the beginning of the article, BSOs must be produced using the printing method or using automated systems. In the first case, the organization, as a rule, orders the production of forms from a third-party contractor who has the necessary printing equipment. If such an order is being made for the first time, then you can start producing BSO with series AA and number 000001. But in subsequent orders, printed forms must begin with the number following the one that was present on the last BSO of the previous edition.

The use of automated systems for issuing forms assumes that the correct numbering of the BSO (in correlation with entering the necessary information into the system registers) will be carried out automatically by the corresponding software.

Strict reporting documents in accounting

BSO includes not only receipts intended for making cash payments for services provided to the population. These can be lottery tickets, sick leave forms, work books, vouchers, coupons for fuel and food, travel and transportation documents and other forms used by enterprises depending on the specifics of production.

There are rules governing the procedure for issuing, recording, ensuring the safety and destruction of these documents. All of them are contained in Resolution No. 359 of May 6, 2008. The method of manufacturing BSO is mandatory: by printing, or using automated systems that meet modern requirements, i.e. having effective protection from outside access, assigning a number and series when issuing or issuing a form, and storing information about transactions for five years.

More often, specialized enterprises produce forms, and companies act as customers. BSO printing houses produce 2, less often 3, copies, since the form of the document necessarily provides for the presence of tear-off spines or copies of the main sheet. When completing a transaction, the first copy is given to the client, the second remains at the cash desk and is filed with the cashier’s report. When purchasing forms made by a printing house, a company employee, or more often a competent commission, carefully checks the presence of all the necessary details, draws up acceptance certificates indicating the name of the BSO, their quantity, numbers, series.

Inventory and write-off of BSO

The tasks that the process of storing strict reporting forms includes includes inventory. This procedure involves reconciling existing copies of the BSO, as well as their counterfoils, with the data contained in the book of strict reporting forms. The inventory of BSO must be carried out simultaneously with a similar procedure established in relation to cash at the cash desk (clause 17 of the Regulations).

After five years of storage of forms (including damaged or incomplete ones) in the organization, it is necessary to write off the BSO. This procedure is carried out by drawing up a separate act (you can use the form corresponding to OKUD number 0504816, and for state and municipal structures its use is mandatory). This document is drawn up with the participation of a commission created on the basis of an order from the head of the company.

For more information about the act, see “Act on the write-off of strict reporting forms - sample.”

The structure of modern automated systems, as a rule, contains solutions that make it possible to issue the necessary acts on inventory and write-off of BSO in electronic form. Also, the corresponding systems provide algorithms for excluding decommissioned digital BSOs from hardware registers.

For more information about other types of inventory provided for by the legislation of the Russian Federation, read the article “How to conduct an inventory before annual reporting.”

Rules for storage and destruction

To prevent damage and theft, forms should be kept in safes or other special rooms that are sealed or sealed every day. Any form must be duplicated (or have a tear-off part). A copy or tear-off part is stored for at least 5 years.

In order to identify shortages of forms or their improper storage, a periodic inventory is carried out. It is carried out during the inventory of the cash available at the cash desk. Control over the use of forms cannot be imposed on the person responsible for issuing them.

When the five-year storage period has passed and at least another month from the date of the last inventory, the spent forms must be written off and destroyed. The act of destruction of forms serves as the basis for this. The act is drawn up by a special commission acting on the basis of an order from the head of the enterprise (IP). The forms are destroyed in the presence of all members of the commission.

The procedure for writing off lost forms has its own specifics. The loss of BSO is mainly detected during inventory, when the data in the BSO accounting book and their actual availability with the responsible person are verified.

Thus, from all of the above we can conclude that a commercial entity has the right to replace the cash register with the use of BSO. But this is only in the case of providing services to citizens. At the same time, the use of forms obliges this entity to organize their correct accounting, strictly complying with all legal requirements. Because the slightest violation of them can lead to undesirable consequences.

Results

BSO are equivalent to cash receipts and must be generated using automated systems capable of transmitting information to the Federal Tax Service online. In this case, the forms are also recorded using such systems. Some taxpayers are legally allowed to switch to using online devices from 07/01/2019. Before this, they have the right to use printed forms. The purchase of such forms is carried out on cost accounting accounts (25, 26, 44 - depending on the department), and subsequent accounting is carried out using balance sheet account 006.

Sources:

- Decree of the Government of the Russian Federation No. 359 of 05/06/2008

- minutes of the meeting of the State Interdepartmental Expert Commission (GMEC) No. 4/63-2001 dated June 29, 2001

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.