What applies to fixed assets

It is established by law that fixed assets can be called property that is used in business activities for a long time and its value exceeds a given limit.

For accounting purposes, the limit is limited to the cost of 40,000 rubles. That is, an enterprise or individual entrepreneur can consider property a fixed asset if it is used for more than one year and its price is more than 40,000 rubles.

Tax legislation sets a higher limit for the division of objects between fixed assets and materials. It is determined by the amount of 100,000 rubles and above.

This means that fixed assets in accounting and tax accounting may or may not be such. First of all, this applies to intermediate property from fixed assets, the price of which is from 40,000 rubles to 100,000 rubles. After all, in accounting an object from this group will be an asset, but for tax accounting it will not.

Attention! The main feature of these assets is that they transfer their value to the created product in parts. This process is called depreciation of fixed assets.

Account 01 “Fixed assets” and what is recorded on it

Accounting account 01 “Fixed Assets” is intended to collect and summarize information about the company’s fixed assets, put into tangible form and used for production, commercial and management purposes.

Accounting is carried out in accordance with PBU 6/01. According to the chart of accounts, approved. By order of the Ministry of Finance dated October 31, 2000 No. 94n, generalized cost information on account 01 of accounting is fixed assets (hereinafter referred to as fixed assets), not only actively exploited, but also mothballed, in reserve, and also transferred to trust management or lease. As stated in paragraph 4 of PBU 6/01, the main distinguishing feature of OS is that they are not an object of resale and will be used for longer than 12 months.

OS according to clause 5 of PBU 6/01 includes:

- structures and buildings;

- production machines and mechanisms;

- regulating and measuring instruments;

- computers;

- transport;

- tools, equipment and work supplies;

- livestock and perennial plantings;

- roads on the balance sheet of economic entities;

- land;

- capital investments made to improve the quality of land;

- capital investments in leased operating systems;

- objects for using natural resources.

Fixed assets are accepted for accounting at their original cost, and if they cost less than 40 thousand rubles, they should be reflected in the inventory account. All cases of exceptions must be specified in the company's accounting policies.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Conditions for recognition of OS

In addition to the cost delineation of objects, there are a number of criteria defined in the PBU. These include:

- Objects must be used in the entrepreneurial activity of the subject to manufacture products, perform work, perform services, or manage a company.

- The useful life of an asset must be more than 1 year for it to be called a fixed asset.

- Such objects are not intended for further implementation.

- The use of the object will create income for the enterprise.

Attention! From the classification it follows that the main assets are buildings, structures, equipment, vehicles, tools, inventory, etc., the cost of which exceeds 40 thousand rubles.

Analytics and subaccounts

Account 51 is used for synthetic accounting, that is, to present general information about the enterprise. Analytics is carried out in the context of each open current account. This may be an account of a branch, department, etc. A company can also have several current accounts (permitted by law).

Based on the specifics of the enterprise’s accounting policy, additional sub-accounts may be opened to account 51. Accounting for them is carried out only in national currency - in rubles. To account for funds in foreign currency, account 52 is used.

Which accounts does it correspond with?

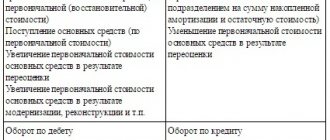

To account for fixed assets, the Chart of Accounts provides for account 01. On it, funds are recorded at their original cost. The account is active, so an increase (receipt of fixed assets) is recorded as a debit, and a decrease (disposal) is recorded as a credit. Analytical accounting is carried out by types of OS objects.

By debit, account 01 can correspond with the credit of accounts:

- sch. 03 - shows the return of a fixed asset from an income-generating investment (for example, a return from a tenant).

- sch. 08 – reflects the arrival of fixed assets, an increase in their price as a result of re-equipment, completion and reconstruction.

- sch. 76 - receipt of fixed assets from other debtors, when its installation and modification are not required.

- sch. 79 - receipt of fixed assets for intra-business settlements (for example, from the parent company)

- sch. 83 — increase in the cost of fixed assets due to revaluation.

For a loan, account 01 can correspond with the debit of the following accounts:

- sch. 02 - disposal of fixed assets is reflected

- sch. 11 — transfer of fattening animals to the main herd

- sch. 76 - write-off of the cost of fixed assets due to other settlements (for example, due to insurance payments)

- sch. 79 - transfer of fixed assets through the system of intra-business settlements (between branches, parent company, etc.)

- sch. 83 - decrease in the cost of fixed assets as a result of their revaluation

- sch. 91 - disposal of fixed assets

- sch. 94 — the cost of missing OS is shown

- sch. 99 - write-off of fixed assets as a result of emergency circumstances.

You might be interested in:

Account 60 “Settlements with suppliers and contractors” in accounting: what it is intended for, characteristics, postings

conclusions

Account 51, according to which any movements in the current bank account are reflected in the accounting of a legal entity, is of great importance, since the majority of monetary transactions of a business entity are carried out today in non-cash form.

Transactions of receipt and debit of non-cash funds are recorded on 51 accounts on the basis of an official statement provided daily to the bank account holder by the servicing financial institution.

Each movement of non-cash money must be confirmed (justified) by an appropriate primary document that correctly reflects the essence and amount of the transaction.

The receipt (receipt) of funds is recorded by a debit entry, the write-off (expense) of money is reflected by a credit.

Postings to account 01 in accounting

Attention! See the complete chart of accounts for 2020 with explanations and entries here.

Receipt of fixed assets

The receipt of an object can occur in different ways - as a result of a purchase, a contribution to the authorized capital, under a donation agreement, etc.

When purchasing an operating system, all costs for its acquisition and preparation for use are collected on account 08, after which the entire amount is transferred to account 01, where accounting is performed. The receipt of fixed assets is accounted for using the following transactions:

| Debit | Credit | Content |

| 08 | 60 | The purchase of an asset has been completed (the amount is indicated excluding VAT) |

| 19 | 60 | Registered for VAT on the purchased OS |

| 08 | 60, 76 | Work to prepare the object for use, transportation, etc. is taken into account (the amount is indicated excluding VAT) |

| 19 | 60, 76 | VAT on preparation for use is taken into account |

| 01 | 08 | The OS object is registered |

| 68 | 19 | VAT credited |

OS construction

The object can be obtained as a result of capital construction. Moreover, its initial price includes payment for the contractor’s services and the cost of materials for construction.

| Debit | Credit | Content |

| 08 | 60, 76 | The price of contract work is shown in the accounting |

| 08 | 10 | Raw materials and supplies given for work on the facility are shown in the accounting |

| 08 | 60, 76, 23, 25, 26 | Other costs for building the OS are shown in accounting |

| 19 | 60, 76, 23, 25, 26 | Input VAT on construction work has been taken into account |

| 01 | 08 | The completed OS object has been accepted for operation |

| 68 | 19 | VAT credited |

OS upgrade

The main feature of modernization is that its result changes the original characteristics of the OS object. As a result, its cost, period of use, etc. change. When accounting for expenses, it is advisable to open a sub-account on account 08, in which to collect all costs incurred for modernization.

| Debit | Credit | Content |

| 08 | 10 | Material costs written off for modernization |

| 08 | 23 | Auxiliary production costs written off |

| 08 | 60, 76 | A third-party contractor was involved in the modernization |

| 08 | 70 | The salaries of employees involved in the work were written off for modernization |

| 08 | 69 | Social contributions of employees were written off for modernization |

| 01 | 08 | Increased OS cost due to modernization costs |

Sale

When selling, proceeds are recorded in the amount established by the contract. In this case, expenses must include sales costs, as well as accrued depreciation. All transactions are shown in account 91.

| Debit | Credit | Content |

| 62 | 91 | Reflected revenue from the sale of operating systems |

| 91 | 68 | Determined VAT on the sale of fixed assets |

| 01/Disposal | 01 | The original cost of the object is transferred |

| 02 | 01/Disposal | Depreciation calculated over the operating period is transferred |

| 91 | 01/Disposal | The residual value is transferred to other expenses |

| 91 | 60, 76 | Costs for preparation for sale, dismantling, delivery, etc. are indicated. |

| 19 | 60, 76 | The amount of VAT for delivery, dismantling, etc. services has been determined. |

| 68 | 19 | VAT credited |

| 91 | 99 | The financial result of the sale of the OS is reflected |

You might be interested in:

Income tax calculation: main types of transactions in 2020

Liquidation

Liquidation of an asset can be carried out in a situation where it is no longer profitable to use it and it is not possible to sell it. In this case, the decommissioned OS can be disassembled, and the resulting materials can be used for other purposes.

| Debit | Credit | Content |

| 01/Disposal | 01 | The original cost of the object is transferred |

| 02 | 01/Disposal | Accrued depreciation is transferred |

| 91 | 01/Disposal | Residual value is transferred |

| 19 | 68 | The tax amount was restored based on the residual value |

| 91 | 60, 76 | Expenses include the costs of hiring a third party for the disassembly operation |

| 19 | 60 | VAT charged by the contractor has been taken into account |

| 10 | 91 | Materials received during disassembly of the OS object were capitalized |

Revaluation

This operation is not considered mandatory. However, if its necessity is established by local acts, the revaluation must be performed on the last day of the year. At the same time, the revaluation itself can be of two types - revaluation or markdown

| Debit | Credit | Content |

| If there is an overestimation | ||

| 01 | 83 | An additional valuation of the fixed asset was made at the expense of additional capital |

| 83 | 02 | The amount of depreciation was adjusted due to additional capital |

| If a markdown occurs | ||

| 91 | 01 | The amount of depreciation of the asset was written off to other expenses |

| 02 | 91 | Depreciation is adjusted against other income |

Unaccounted assets based on inventory results

In order to ensure the reliability of accounting, a business entity must periodically make an inventory of its property, which includes fixed assets. If, as a result of the procedure, unaccounted for objects were discovered, they must be accepted for accounting in the same month. This is done at the current market value of a similar object.

| Debit | Credit | Content |

| 08 | 91 | An object that was discovered as a result of an inventory was registered |

| 01 | 08 | The facility is put into operation |

OS shortage based on inventory results

Another result of the inventory may be the identification of the absence of some OS object. In such a situation, the damage from its absence should be written off to the responsible person, or, if there is no such person, to losses. This happens in the amount of the actual residual value.

| Debit | Credit | Content |

| 01/Disposal | 01 | The cost of the asset is written off |

| 01/Disposal | Accrued depreciation is written off | |

| 94 | 01/Disposal | The residual value of the operating system is written off for shortages. |

| 83 | 94 | The amount of the revaluation carried out is written off |

| If the culprit is identified | ||

| 73/2 | 94 | The total amount of the shortfall is written off to the guilty person |

| 73/2 | 98/4 | The difference between the residual value and the current market value of a similar object is reflected |

| 50, 51, 70 | 73/2 | The deficiency is repaid by the person at fault |

| 98/4 | 91 | The difference between the residual value and the market value is written off to other income. |

| If the culprit is not identified | ||

| 91 | 94 | The amount of the shortage on the fixed asset item is written off as other expenses |