Correspondence 20 accounting accounts

Let's look at typical wiring:

- DT20 KT10 – materials written off.

- DT10 KT20 - return of raw materials to the warehouse.

- DT20 KT10-2 - semi-finished products were released into production.

- DT20 KT10-3 - fuel written off for technological purposes.

- DT20 KT60 - the cost of electricity used in production is taken into account.

- DT20 KT70 – wages accrued to production workers.

- DT20 KT69 - insurance premiums are taken into account.

- DT20 KT23 – costs of auxiliary production are taken into account.

- DT20 KT69 - a reserve has been created to pay for private entrepreneurs and vacations.

- DT20 KT25 (26) - general production (household) expenses are written off.

- DT20 KT28 - losses from defects are displayed.

In the course of its activities, an organization can attract services (products) of its own production. In this case, accounting accounts 20 and 21 are used. Semi-finished products of own production are written off from KT21 to DT20. The ending balance shows the value of work in progress (WIP). Analytics is carried out by types of costs, products, divisions. Account 20 in accounting is reflected in the balance sheet in the second section of assets in the line “Inventories”.

Typical transactions for account 20

The debit of the account reflects the expenses that the enterprise incurs during the production of products. Simply put, expenses that form the cost of a product or service in the future. On the credit of the account, the cost of production is formed and the amount to be written off upon completion of the production process is indicated. Let's look at typical transactions for account 20 in the table:

| Debit accounts | Credit accounts | the name of the operation |

| 20 | 02, 04, 05, 10, 16, 19, 21, 23, 25, 26, 28, 40, 43, 41, 60, 68, 69, 70, 71, 73, 75, 76.2, 79, 80, 86, 91.1, 94, 96, 97 | Combination of all costs that arise during the production of goods or as a result of the provision of services |

| 10, 15, 21, 28, 40 (43), 45, 76.01, 76.02, 79, 90.02, 91.02, 94, 99 | 20 | Amounts that allow you to reduce the amount of expenses (defects, shortages), and then write off the balances |

When writing off, you must use the method specified in the accounting policy of the enterprise. Before closing account 20, be sure to allocate the balance of work in progress.

General production expenses

Indirect costs associated with servicing production are recorded on account 25. These include:

- depreciation of machinery and equipment;

- OS maintenance costs;

- remuneration of employees;

- insurance deductions;

- rent;

- utility costs for production premises;

- expenses for repairs of machines, buildings for general production purposes, etc.

During the month, actual costs are collected by DT from the credit of accounts for inventory, materials, settlements with personnel: DT25 KT02 (05, 10, 60), etc. Then they are written off to account 20 in accounting. This is reflected by the wiring of DT20 KT25. That is, the final balance on the account. 25 equals 0. Analytics is carried out by departments and expense items.

General running costs

Indirect costs associated with servicing the organization are displayed on account 26. These include:

- administration salary;

- social insurance contributions;

- communication costs;

- costs of maintaining security;

- administrative and management costs;

- depreciation of administrative operating systems;

- rental of office space, etc.

Expenses for the month are accumulated according to DT26. At the end of the month, these amounts are written off to account 20 in accounting or 90-2 in full.

Typical transactions for account 26 are presented in the form of a table.

| Operation | DT | CT |

| Accrued depreciation on fixed assets, intangible assets | 26 | 04, 02, 05 |

| Materials were transferred for general business needs | 10 | |

| Electricity costs included | 60 | |

| Salaries paid to workers involved in OS maintenance | 70 | |

| Insurance premiums accrued | 69 | |

| A vacation pay reserve has been created | 96 | |

| General production costs associated with auxiliary production were written off | 23 | 26 |

| General production costs associated with main production were written off | 20 | 26 |

Non-production organizations use account 26 to display information about operating expenses. Cost amounts at the end of the month are written off to DT90 “Sales”. Analytics for account 26 is carried out for each budget item, cost location, etc.

Description of account 20

Account 20, called “Main production” in the chart of accounts, includes all expenses of the organization that are associated with the production of products, performance of work or provision of services.

Production costs are distributed according to the following items:

- Material expenses - expenses for the purchase of raw materials, semi-finished products and components, electricity, water, fuel, tools, production equipment, work and services performed by third parties.

- Labor costs for workers involved in production.

- Expenses for social needs - accrued insurance contributions to extra-budgetary funds.

For more information about accounting entries when calculating insurance premiums, read the article “Insurance premiums have been calculated (accounting entry).”

- Depreciation charges for fixed assets used in production.

Read about the rules for calculating and reflecting depreciation in the article “Calculation of depreciation of fixed assets in 2016.”

- Other expenses - expenses for business trips of employees carried out for production purposes, shortages within the limits of natural loss, expenses for semi-finished products, deferred expenses and other reasonable expenses.

You can learn about writing off deferred expenses in the material “Procedure for writing off deferred expenses (nuances).”

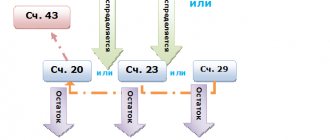

Auxiliary production

Account 23 is used to summarize information about auxiliary costs:

- service by types of energy;

- fare;

- OS repair;

- production of tools, building parts, structures.

DT23 reflects expenses directly related to the release of goods, indirect costs and losses from defects. In this case, the following transactions are generated:

- DT23KT10 – materials written off for auxiliary production.

- DT23KT70 – the wages of production workers are taken into account.

- DT23KT69 – insurance premiums have been calculated.

- DT23KT25, 26 – indirect costs are taken into account.

- DT23KT28 – losses from defects are written off.

KT23 reflects the actual cost of production. These amounts are then written off to account 20 in accounting, subaccounts “Crop production” (20-1), “Livestock production” (20-2), “Industrial production” (20-3), “Other production” (20-4). Account balance 23 reflects the cost of the work in progress. Analytics is carried out by type of production.

GLAVBUKH-INFO

Account 20 “Main production” is intended to summarize information about the costs of production, the products (works, services) of which were the purpose of creating this organization. Specifically, this account is used to record costs:for the production of industrial and agricultural products; for the implementation of construction and installation, geological exploration and design and survey work;

for the provision of services to transport and communications organizations; to carry out research and development work;

for the maintenance and repair of highways, etc. The debit of account 20 “Main production” reflects direct expenses related directly to the production of products, performance of work and provision of services, as well as expenses of auxiliary production, indirect expenses associated with the management and maintenance of the main production, and losses from defects. Direct expenses related directly to the production of products, performance of work and provision of services are written off to account 20 “Main production” from the credit of inventory accounts, settlements with employees for wages, etc. Expenses of auxiliary production are written off to account 20 “Main production” from the credit of account 23 “Auxiliary production”.

Indirect costs associated with the management and maintenance of production are written off to account 20 “Main production” from accounts 25 “General production expenses” and 26 “General expenses”. Losses from defects are written off to account 20 “Main production” from the credit of account 28 “Defects in production”.

The credit of account 20 “Main production” reflects the amounts of the actual cost of products completed by production, work performed and services performed. These amounts can be written off from account 20 “Main production” to the debit of accounts 43 “Finished products”, 40 “Product output (work, sales”, etc.

The balance of account 20 “Main production” at the end of the month shows the cost of work in progress.

Analytical accounting for account 20 “Main production” is carried out by types of costs and types of products (works, services). If the formation of information on expenses for ordinary activities is not carried out on accounts 20-39, then analytical accounting on account 20 “Main production” is also carried out by divisions of the organization.

Operation

| Source documents | Debit | Credit | |

| Materials entered main production | registration card M-17 | 20 | 10 |

| Expenses for services and work included in the cost: | |||

| — cost of services (excluding VAT) | agreement, act | 20 | 60 |

| — VAT on services | invoice | 19/Condition | 60 |

| Wages accrued to workers of main production: | |||

| - wages accrued | payslip | 20 | 70 |

| — social contributions based on wages are calculated | calculation | 20 | 69 |

| Accrued depreciation of fixed assets | accounting card OS-6 | 20 | 02 |

| Depreciation of intangible assets accrued | NMA-1 registration card | 20 | 05 |

| Deviations in the cost of materials written off | calculation | 20 | 16 |

| Semi-finished products of the main production entered production | invoice, account card | 20 | 21 |

| The cost of auxiliary production services has been written off | calculation | 20 | 23 |

| Losses from marriage written off | Act | 20 | 28 |

| A reserve has been created for future expenses | calculation | 20 | 96 |

| Deferred expenses are written off when the corresponding period begins | calculation | 20 | 97 |

| General production and general business expenses written off | reference | 20 | 25, 26 |

| Finished products were transferred to the warehouse | invoice | 40, 43 | 20 |

| Semi-finished products arrived from main production | invoice | 21 | 20 |

| Finished products are used for own needs | invoice | 10 | 20, 43 |

| The cost of work (services) performed has been written off. | calculation | 90-2 | 20 |

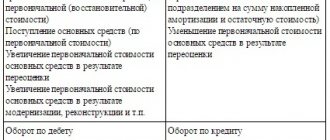

Account 20 “Main production” corresponds with the accounts:

| by debit | on loan |

| 02 Depreciation of fixed assets | 10 Materials |

| 04 Intangible assets | 11 Animals for growing and fattening |

| 05 Amortization of intangible assets | 15 Procurement and acquisition of material assets |

| 10 Materials | 20 Main production |

| 11 Animals for growing and fattening | 21 Semi-finished products of own production |

| 16 Deviation in the cost of material assets | 28 Defects in production |

| 19 Value added tax on acquired assets | 40 Release of products (works, services) |

| 20 Main production | 43 Finished products |

| 21 Semi-finished products of own production | 45 Items shipped |

| 23 Auxiliary productions | 76 Settlements with various debtors and creditors |

| 25 General production expenses | 79 On-farm settlements |

| 26 General expenses | 80 Authorized capital |

| 28 Defects in production | 86 Targeted financing |

| 40 Release of products (works, services) | 90 Sales |

| 41 Products | 91 Other income and expenses |

| 43 Finished products | 94 Shortages and losses from damage to valuables |

| 60 Settlements with suppliers and contractors | 99 Profit and loss |

| 68 Calculations for taxes and fees | |

| 69 Calculations for social insurance and security | |

| 70 Settlements with personnel for wages | |

| 71 Settlements with accountable persons | |

| 75 Settlements with founders | |

| 76 Settlements with various debtors and creditors | |

| 79 On-farm settlements | |

| 80 Authorized capital | |

| 86 Targeted financing | |

| 91 Other income and expenses | |

| 94 Shortages and losses from damage to valuables | |

| 96 Reserves for future expenses | |

| 97 Deferred expenses |

Source: Correspondence of accounts E. Kholodenko, A. Rostovtsev

| < Previous | Next > |

Accounting for losses

Products that do not meet quality standards or contracts are considered defective. If it is possible to bring the product to the required parameters, then such a defect is considered correctable. DT28 displays the cost of written-off products. According to KT28 - amounts to be withheld from the culprits, suppliers, valuation of the costs of restoring the product.

Let's look at typical transactions (for convenience, we will again present them in the form of a table).

| Operation | DT | CT |

| Materials were released to correct defective products | 28 | 10 |

| Salaries accrued to employees who corrected products | 70 | |

| Insurance premiums accrued | 69 | |

| The cost of rejected products has been written off | 20 | |

| The cost of the marriage was withheld from the salary of the guilty person | 70 | |

| Received defective parts | 10 | 28 |

| Claims filed with suppliers | 76-2 |

The cost of defective products is written off from DT28 to accounting account 20. Closing the account means that all losses from the barque are compensated. Analytics is carried out by departments, expense items, types of products, culprits and causes of defects.

Why is account 20 used in accounting?

The credit of account 20 shows the return of materials and semi-finished products from production, as well as the write-off of accumulated costs for finished products.

According to PBU 10/99, the costs of manufacturing and bringing products to the buyer are grouped by elements:

- Material costs.

- Wage.

- Social wage accruals.

- Depreciation of fixed capital.

- Other expenses.

The enterprise establishes a more detailed list of cost items independently.

Service farms

Account 29 is intended to display information on production costs not related to the manufacture of products or the provision of services:

- Housing and communal services (operation of houses, dormitories, bathhouses, etc.);

- workshops;

- buffets and canteens;

- children's institutions;

- holiday homes;

- research units.

DT29 reflects expenses associated with the performance of work, which are then written off to the account for auxiliary production. According to KT29 – the cost of work and goods.

| Operation | DT | CT |

| Materials taken into account | 10 | 29 |

| The costs of divisions-consumers of services of service industries are written off | 23, 25, 26 | |

| Products sold to third parties | 90-2 |

Account balance 29 reflects the cost of the work in progress. Analytics is carried out for each production and cost item.

Selling expenses

Account 44 displays information about costs associated with sales. Manufacturing businesses can use this account to show costs for:

- product packaging;

- delivery, loading of products;

- commission fees;

- maintenance of warehouse premises;

- advertising;

- entertainment expenses, etc.

Trade organizations on this account display expenses for:

- transportation of products;

- wages;

- rent;

- maintenance of buildings and equipment;

- storage of goods;

- product promotion;

- entertainment expenses, etc.

Amounts of expenses are accumulated according to DT44, and then written off to account 90-2. Analytics is carried out by product and expense items. In case of partial write-off, transportation and packaging costs are subject to distribution between months (in equal amounts, regardless of actual expenses). All other items are charged to the cost of production on a monthly basis in full.

Cost formation

The final stage is determining the cost of production, taking into account the balances of work in progress.

At the end of the month, the costs accounted for DT23 are distributed between basic and general production expenses. Then, overhead costs are written off to account 20 in accounting if reduced accounting is maintained, and all costs if full cost accounting is maintained. That is, this account displays the total amount of expenses. Formula:

S/S = WIP beginning. + Costs – WIP end.

The actual cost is reflected according to CT 20. Costs are written off depending on which valuation method is chosen. If products are accounted for at standard cost, all expenses are charged to account 40 by posting DT40 KT20. If actual cost is applied, the costs are written off to account 43. This is how account 20 is used in accounting.