Business processes and business operations

In the activities of a manufacturing enterprise or organization that performs work or provides services, three processes are distinguished:

- supply,

- production,

- implementation.

Processes consist of a set of business operations.

A business transaction in accounting is an action (fact), the result of which is changes in the composition, distribution of property and the sources of its formation. For example, the movement of cash, material assets, liabilities.

Business processes in accounting are reflected as business transactions are carried out - in this case, the subject of accounting becomes the fact of the transaction and the result.

Business operations and processes of the enterprise - diagram

When maintaining accounting records, the “double entry principle” is used. The essence of double entry is that for each transaction an entry is made simultaneously as a credit to one account and a debit to another.

That is, when performing a business transaction, we first determine the accounting accounts that participated in this operation, then the amount of the transaction is simultaneously entered as a credit to one account and a debit to another; this entry in accounting is called a posting. In traditional accounting, entries are used to record business transactions only in the ledger accounts. In the configuration, the posting functions are expanded: posting can also be used to reflect business transactions in the analytical accounting of property, settlements and obligations of the enterprise. This is achieved by using additional details in posting - subconto.

Subconto is an object of analytical accounting, and the type of subconto is a set of similar objects of analytical accounting from which the object is selected. Types of subcontos, in particular, are lists of the company's counterparties, warehouses, divisions, employees, a list of inventory items, settlement documents with counterparties, etc.

The interaction between accounting accounts is called correspondence, and the accounts participating in the recording are called corresponding.

Double entry principle:

In accounting, there is an important rule on which all transactions are based - this is the double entry rule. The existence of this rule must be accepted as a fact and used constantly.

The essence of double entry:

Double entry in accounting means that for each business transaction it is necessary to make a simultaneous entry for the debit of one account and for the credit of another.

That is, if some kind of transaction occurred, for example, money was received from a supplier into the current account, you need to not only enter 51 receipt amounts into the account, you need to identify two accounting accounts from the Chart of Accounts that are involved in this business transaction. In our example, this is account 62 “Accounting for settlements with customers” and account 51 “Current account”. Then, according to the rule, you need to simultaneously record the transaction amount in debit and credit. All that remains is to determine in which account the amount should be entered as a debit and in which as a credit.

Let's look at the operation: money comes from the buyer to the current account, while the buyer's receivables decrease and the amount of money in the current account increases.

It is logical that if money arrives in a current account, then there is more of it there, and we reflect the increase in funds (an asset of the enterprise) as a debit. That is, the amount must be entered into the debit of account 51.

Money comes from the buyer, while the buyer's receivables decrease; receivables are also an asset of the enterprise; the decrease in the asset is reflected in the loan. That is, the amount must be credited to account 62.

Everything is logical, the money came from account 62 to account 51 (from the buyer to the current account).

Here are some more examples of some wiring:

Account 50 Basic cash register entries:

| D-t | Kit | Operation |

| 50 | 51 | DS were received at the cash register from the account |

| 50 | 90/1 | To the cash register post the proceeds from the sale of goods. prod |

| 50 | 62 | Post to the cash register. DS from buyers. and customers |

| 50 | 75/1 | Fast. contribution from the founder |

| 50 | 71 | Fast. non-Spanish imprest |

| 51 | 50 | The money from the cash register was deposited into the account |

| 70 | 50 | Salaries issued to workers and employees |

| 71 | 50 | DS issued from the cash register for reporting |

| 73/1 | 60 | DS were issued under the loan agreement |

| 76/4 76 | 50 50 | The deposited salary was issued from the cash register The loan has been repaid from the cash register. debt (issued under the purchase and sale agreement) |

Account 68 Personal income tax (P)

| D-t | Kit | Operation |

| 70 | 68 | Tax accrued (withheld) from salary |

| 68 | 51 | Tax transferred to the budget |

And so on…

Types of business transactions

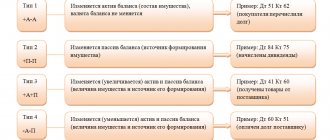

Accounting in the business accounting system distinguishes 4 types of transactions depending on their impact on the balance sheet.

Business transactions in accounting: classification table

| Impact on balance | Correspondence account sign | |

| by debit | on loan | |

| active | active |

| passive | passive |

| active | passive |

| passive | active |

Type I are transactions that reduce one asset item “at the expense” of another. Examples: arrival of finished products at the warehouse, receipt of funds from the current account to the cash register. There is a change in the composition of the organization’s property, but not its total amount:

Main types of business transactions in accounting

If something happens in business activities, it becomes mandatory to create a calculation. The concept of business transactions is needed to denote such calculations. They are also used to display changes associated with own and borrowed sources of budget formation, and the composition of property.

The calculations also indicate changes related to reserve capital. You can find out what it is in this publication.

Mandatory conditions include documents serving as confirmation of transactions. Otherwise, the wiring cannot be processed.

After any operation at the enterprise, changes occur in indicators. Either only one, or both at once:

- Capital is formed from sources. It is necessary to take into account their size and composition.

- Size of property holdings.

Reflection of data in the reporting system.

Based on one of the characteristics, it is possible to divide operations into four types.

- First type. Affect the composition of the property. This means that only the active part of the balance formation is affected by the influence. In this case, no changes occur to the currency.

A–A.

- Second type. When carrying out this type of operation, changes occur with the sources from which property in the enterprise is formed. This means that only the passive changes. This does not apply to the balance currency.

P–P.

- Third type. Simultaneous changes are assumed, associated both with property and its initial value, and with money forming capital. Changes are happening for the better. The balance sheet currency begins to increase by an equal amount, both for assets and liabilities.

A P.

- Finally, it all ends with the fourth type. This type is associated with a decrease in indicators simultaneously for the facts on the basis of which the property is formed, plus property with the original value. The balance associated with the asset and liability decreases by an equal amount.

-A–P.

How to prepare accounting entries correctly? All information for beginners with examples and tables is in this article.

It must be taken into account that the group of expenses associated with normal production activities is formed by costs that arise in connection with several phenomena:

- Inventories of material and production type.

- Volume of goods.

- Number of materials.

- Raw materials.

Some of them arise directly in the process of processing stocks for the purpose of:

- Provide services.

- Complete the work.

- Produce products.

- Sell your inventory.

When expenses are generated, they are usually grouped based on the following elements:

- Costs from the other group.

- Depreciation type deductions.

- For social needs.

- For wages.

- Material costs.

To learn how to use the reducing balance method when calculating depreciation, read the link.

Account number 20 usually accumulates groups of costs for the main production. In this case, an analytical type of accounting is carried out according to the types of items. Divisions, together with types of production costs, necessarily become the basis.

An example of a journal entry.

In this case, costs are distributed into groups depending on the types of items.

Indirect costs caused by the sale and production of goods and services and products are taken into account. This group includes:

- General production expenses group.

- Data related to finished products in the main production and their cost.

- Data on semi-finished products of own production, which are used during production.

- Cost of raw materials in practice. As well as materials that form the basis of manufactured goods or services.

For accounting purposes, so-called overhead costs play an important role. This group is much more extensive:

- A group of expenses that is expected to be incurred in future periods.

- Labor costs for personnel, together with insurance deductions.

- Information on third-party organizations, if the company uses their services and work.

- If production involves the use of purchased goods with materials, this includes them.

- Depreciation deductions for intangible assets.

- Depreciation on fixed assets.

- The cost of raw materials, and the actual one.

Accounting for inventories is one of the most important operations in the preparation of documents. You can find out more by following the link.

Postings upon disposal and revaluation.

There are three types of economic accounting:

- Statistical.

- Accounting.

- Operational.

In the procurement process, there are numbers of several accounts that are most widespread. These are accounts 60, 51, 10. Each area of spending has its own accounts.

Example - for implementation it is 99, 91, 90, and you can also use the account 43. It is necessary to take into account the occurrence of additional costs associated with these processes.

When collecting information about profits and costs, a ledger of purchases and sales may be required. What is it and how to conduct it correctly - read in this material.

Accounts debit and credit.

In accordance with the principle of double entry, accounting transactions cannot violate the identity of the amount of assets and liabilities. That is, any transaction can either change the total value of both sides of the balance sheet, or move funds within one of the sections.

The effects that transactions have on the balance sheet are of two types:

- modification, that is, an increase or decrease in the balance sheet currency, while the posting involves both an asset and a liability;

- permutation, that is, the absence of changes in the balance, while the operation is carried out within one of its sides.

This type is characterized by a simultaneous decrease in assets and liabilities. The cost of property and its sources decreases, but the balance sheet currency remains unchanged.

Most often, this type includes transactions related to the repayment of previously incurred obligations, for example, payment of loans or debts to suppliers.

A - I = P - I, where

- A - asset;

- P - passive;

- And - change in debit and credit accounts.

| Operation | Debit | Change | Credit | Change |

| Bank loan repaid | 51 | — | 66 | — |

| Paid to supplier for goods | 51 | — | 60 | — |

The essence of these operations is that the organization, in paying off its obligations, spends its own funds. For example, when paying debts to suppliers, the amount stored in the current account decreases, but at the same time the total amount of liabilities decreases.

A feature of this type is the increase in items simultaneously in the assets and liabilities of the balance sheet. At the same time, the equality of the currency is maintained, and the total value of property and liabilities increases.

Postings of this type are most often associated with the acquisition of materials, fixed assets, calculation of wages and similar actions.

| Operation | Debit | Change | Credit | Change |

| Loan received | 51 | 66 | ||

| Salary accrued | 20 (23, 25, 26, 44) | 71 | ||

| Materials purchased | 10 | 60 |

The essence of these operations is that the organization, by acquiring property, simultaneously increases the volume of its obligations. That is, for example, when purchasing materials, the debit balance of account 10 increases, as well as the balance on the credit side of account 60.

You can view the chart of accounts for 2020 with characteristics in this material. How to correctly fill out the business transactions journal - read here.

Permutation active

Transactions of this type affect only one side of the balance sheet. This type includes transactions that reduce a certain item of an asset while simultaneously increasing the value of another line. At the same time, the total value of all property ultimately remains unchanged.

A D - K = P, where

- D - change in debit;

- K - change on loan.

| Operation | Debit | Change | Credit | Change |

| Money has arrived at the cash register from the current account | 50 | 51 | — | |

| Payment received from debtors | 51 | 62 | — | |

| Return of unspent accountable amounts | 50 | 71 | — | |

| Materials released into production | 20 | 10 | — | |

| Finished products have arrived at the warehouse | 43 | 20 | — | |

| Finished products were shipped to the buyer | 45 | 43 | — |

Their essence is that when carrying out certain operations, one type of property is replaced by another. For example, when paying receivables, the amount in the current account increases and at the same time the amount of obligations of the counterparty company decreases.

This type is characterized by the fact that during operations, some liability item increases and another decreases. In this case, the source of property formation arises from one of the existing ones. These include entries recorded in connection with the withholding of taxes from employee salaries and redirection of profits.

The interaction of an asset and a liability can be expressed by the formula: A = P D - K.

| Operation | Debit | Change | Credit | Change |

| The debt to the supplier was repaid using a loan | 60 | — | 66 | |

| Personal income tax withheld from wages | 71 | — | 68 | |

| Reserve capital increased due to last year's profit | 84 | — | 82 |

The essence of the operations is that when one of the sources of property formation decreases, the other increases.

For example, if a company cannot currently fulfill its obligations to a supplier, it turns to a credit institution. The bank pays the required amount. At the same time, the enterprise's debt to the counterparty is reduced, but a new obligation is formed.

The current accounting legislation does not contain a definition of a business transaction. At the same time, the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” gives the concept of a fact of economic life.

A fact of economic life is understood as a transaction, event, operation that has or is capable of influencing the financial position of the organization, the financial result of its activities or cash flow (clause 8 of Article 3 of the Federal Law of December 6, 2011 No. 402-FZ). In essence, a business transaction is a fact of economic life and is the same object of accounting.