Current account is a special bank account for entrepreneurs. The bank opens it for the entrepreneur to make payments, pay taxes, contributions and transfer salaries to employees.

Entrepreneurs who have a small store, a vegetable stall or a household appliance repair service can do without cash settlement services. They work for cash and pay taxes by bank transfer. But if buyers pay by card or via the Internet, then RKO is necessary.

How to open a current account

To serve a business in a financial institution, an individual entrepreneur selects a bank, submits documents and waits for a decision. The manager checks the documents and makes a decision.

To choose a bank, you need to check its reliability, tariffs and level of service.

Reliability is indicated on the Deposit Insurance Agency website. When a financial institution's license is revoked, the state returns deposits to clients - if it participated in the insurance program. The agency monitors the return of money and maintains a register of participants. To insure money, an entrepreneur only needs to become a client of an organization that participates in the program.

Each financial institution has its own service rates. In order not to overpay, you need to compare the list and cost of services. Find a bank Find out the cost of services that you don’t plan to use in case you need them in the future.

To avoid wasting time traveling to branches, you can call customer support and ask questions. It’s bad when you have to go to the branch for a simple service, for example, to renew a contract. It's good when the problem is solved over the phone.

Before going to the branch, check with the manager what documents are needed to open an account. Organizations have their own list of documents. Most often, you need a passport, OGRNIP, TIN and an application for opening - this is filled out by the entrepreneur at the bank. If the manager has suspicions about the reliability of the company, he will ask for additional documents or refuse the service.

Step-by-step instruction

To open a bank account, an individual entrepreneur must follow the instructions:

- A financial institution is selected for ongoing cooperation. The individual entrepreneur must approach this issue with all responsibility. He needs to independently monitor the local financial sector in order to choose a bank that offers services to business entities on the most favorable terms.

- After the issue with the financial institution has been resolved, the individual entrepreneur must start collecting documents. He can obtain a complete list at a bank branch, on its official website or from a hotline operator.

- With a complete package of documents, the individual entrepreneur goes to the bank branch closest to his office.

- On site, the manager will ask you to fill out an application, in which you should enter data from your personal and registration documentation.

- If the individual entrepreneur has not certified copies of documents in advance at the notary’s office, then this is done by a bank employee on the spot. A card of signatures and seals is also filled out and certified on site.

- The individual entrepreneur will be given an agreement for review, on which he must put his signature and seal (if any). You need to read this document very carefully, especially paying attention to points regarding tariffs, liability, etc.

- A fee for opening a current account is paid to the cashier, after which a corresponding certificate is received.

- Regulatory authorities are notified about the opening of an individual entrepreneur account.

How many accounts can an individual entrepreneur have?

Individual entrepreneurs and companies can operate without a current account or open several. Without service, a financial institution can operate a rural store or a farmer who sells goods for cash.

If the company’s transactions are carried out by bank transfer or exceed 100,000 rubles, then cash services are needed. A financial institution may refuse service if it suspects the company of dishonest transactions. Entrepreneurs hire an accountant to handle the accounts and open a second current account. If a bank or tax office blocks one, the company will continue to work and find out why it was blocked.

How to choose the right one?

To choose a bank for permanent cooperation, an individual entrepreneur must pay attention to the following nuances:

- The number of ATMs of a financial institution in the region where the individual entrepreneur operates.

- Tariffs established for settlement and cash services.

- The amount of commission that is charged when cashing out funds.

- Convenience of replenishing your current account.

- The distance between the office of the financial institution and the place of residence or business of the individual entrepreneur.

- The reliability of the bank, which can be evidenced by positive customer reviews and the amount of personal assets.

- The range of services that a financial institution can offer to an individual entrepreneur.

You can open multiple current accounts

A current account is required for companies and optional for individual entrepreneurs. The company has four months from the date of registration to open a bank account and deposit the authorized capital into it.

There are restrictions for cash payments by legal entities - Article 861 of the Civil Code

For individual entrepreneurs, there is no requirement to open a current account: you can work without an account and pay suppliers in cash if the payment does not exceed 100,000 rubles. But with cash, the tax office may think that the individual entrepreneur does not pay additional taxes. To avoid any questions, it is better to open a current account.

The law has no restrictions on the number of current accounts: you can open several in one or different banks.

Reporting and maintenance costs

An individual entrepreneur has the right to open and use several current accounts simultaneously in his activities. Moreover, they can be located in completely different regions, so the place of registration does not matter. When opening a second current account, it is not at all necessary to close the first one. It is also not necessary to carry out all financial transactions exclusively from the new account.

To protect yourself from blocking under 115-FZ

Vladimir Stepanov, Avtotransstroy LLC

— We use accounts in two banks for security purposes. In case something happens to the first account, there is a second one. Do not store all eggs in one basket.

Konstantin Orekhov, Parus LLC

— We have accounts in two banks: if one account is blocked, you can quickly transfer money to counterparties from the other.

Banks are required to verify all receipts and transfers of clients - this is a requirement of the Central Bank. If the bank blocks the account and asks for documents for verification, and the company does not have another account, work stops.

In some banks, document verification takes up to a week. All this time, the company cannot transfer money to suppliers and accept payments from clients. But when a company has accounts in different banks, it continues to operate, even if the account is blocked in one of the banks.

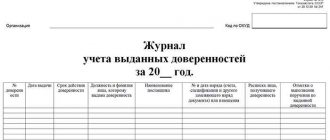

Opening a bank account by proxy

If an individual entrepreneur does not have the opportunity to personally contact the bank and go through the entire procedure of opening a current account, he can entrust it to his representative.

To do this, he needs to draw up a power of attorney at a notary’s office in the name of a relative, colleague or friend, in which all powers must be defined.

If the document does not indicate that the individual entrepreneur’s representative has the right to open a bank account on his behalf, then the bank will refuse to accept a package of documents from him. In general, the procedure for opening a current account through a proxy is standard, with the exception of the identity of the applicant.

Keep money in one bank and undergo currency control in another

Ivan Radaev, Mercury Ekb LLC

— Somewhere I work for import, somewhere for export.

One bank may have a high interest rate on deposits, while another may have convenient currency control. Then the company opens accounts in two banks: in the first it stores money, and in the second it works with foreign partners.

To pass currency control faster, companies open accounts with banks that:

- accept scans of documents;

- help to draw up a foreign exchange agreement;

- carry out control according to simplified rules. For example, Modulbank has simplified currency control for Apple, Google, Air BBC, Upwork and four other services;

- money is credited to the account in a couple of hours;

- they take a fixed payment rather than a percentage of the transfer;

- fill out forms and select currency transaction codes for the client.

If it seems safe to store money in a bank, but it is inconvenient to go through currency control, you can open a second account in another bank for transactions with foreign partners.

Bank selection

To choose the most suitable bank in terms of parameters, individual entrepreneurs need to study the offers of the most popular financial institutions.

Sberbank

Individual entrepreneurs can open an account with Sberbank remotely in just 5 minutes, after which they will be able to accept payments from their counterparties.

Clients are offered the following conditions:

- There are several packages to choose from.

- Standard package of documents for opening.

- "Internet banking".

- Opening cost from 3,000 rubles.

- The bank makes 5 monthly payments for free.

- The cost of service is from 1,700 rubles per month.

- Additional services are paid separately.

Tinkoff

Individual Bank Tinkoff opens a bank account for free. Clients do not have to leave their offices, since employees of the financial institution independently go to the specified addresses with contracts and bank cards.

IP service is carried out under the following conditions:

- "Internet Banking" and SMS notification, application for "IOS".

- Two months of free service, then the individual entrepreneur will have to pay 490 rubles per month.

- The first three payments are made free of charge, for each subsequent operation you need to pay 49 rubles.

Opening

Bank Otkritie opens free accounts for free. for individual entrepreneurs at the Lowcost tariff.

They were offered the following conditions:

- The monthly service fee is 950 rubles.

- A salary project for Rocketbank debit cards has been proposed.

- “Internet Banking”, application for “IOS”, “SMS” notification are available.

- The first 5 payment orders are carried out free of charge, for each subsequent commission is 50 rubles.

VTB 24

This financial institution is among the top 5 best Russian banks.

For individual entrepreneurs r./account. at VTB are opened on the following conditions:

- The opening fee is 2,500 rubles.

- Individual entrepreneurs can choose the minimum package tariff, which provides a 50% discount.

- The monthly service fee is 1,100 rubles per month.

- Internet Banking is available.

- Registration of current accounts is carried out at a bank branch, in the personal presence of the individual entrepreneur.

Alfa Bank

Today, for individual entrepreneurs, this financial institution offers the “StartUp” package tariff. Various services are available to customers; there are a large number of ATMs and branches.

R./account for individual entrepreneurs in Alfa Bank are opened free of charge under the following conditions:

- The monthly subscription fee is 850 rubles; for individual entrepreneurs doing business in the capital and St. Petersburg, this amount increases to 1,090 rubles.

- Every month the bank processes 5 payment orders free of charge.

- For individual entrepreneurs working in SMS regions, information is provided free of charge; for the capital and St. Petersburg, the cost of the service is 59 rubles per month.

- It is proposed to issue a corporate card, for the issue and maintenance of which you will have to pay only 299 rubles.

- Individual entrepreneurs have access to applications for iOS and Internet Banking, for the installation of which you will have to pay a one-time fee of 990 rubles.

- As an additional service, a code is provided to receive free advice from a highly qualified lawyer and submit free advertising on Yandex. Direct.

- For cashing out funds from a current account, a commission is charged, the amount of which ranges from 2.20% to 11.00%.

Rosselkhozbank

Opening current accounts for individual entrepreneurs at Rosselkhozbank is carried out under the following conditions:

- The opening cost is 2,200 rubles.

- The cost of monthly maintenance is set at 600 rubles.

- The cost of a valid completed payment is 30 rubles.

- The cost of opening Internet Banking is 2,000 rubles, mobile banking is free.

- information per month will cost 45 rubles.

- A fee of 0.30% of the amount is charged for accepting cash.

- A commission of 0.50%-10.00% is charged for cashing out funds.

- The individual entrepreneur is offered a salary project, acquiring.

- An application for opening a current account can be submitted online.

- When carrying out operations regularly remotely, individual entrepreneurs can count on discounts.

Vanguard

Avangard Bank offers to open an individual entrepreneur for 1,000 rubles per account. with a basic tariff under the following conditions:

- Monthly maintenance – 900 rubles.

- Making one payment costs 30 rubles.

- An application for opening a current account can be submitted online (in this case, the cost of opening will be 3,000 rubles).

- Avangard clients have access to Internet Banking, SMS information, and offers designed for iOS.

- Individual entrepreneurs can link a Cash Card to their current account.

- A salary project is proposed.

Promsvyazbank

At Promsvyazbank, individual entrepreneurs can open a personal account for free. under the following conditions:

- The cost of monthly maintenance is 1,050 rubles.

- Carrying out one payment – 45 rubles.

- Clients are offered Internet Banking and IOS applications.

- information (per month 199 rubles).

Raiffeisenbank

This financial institution, which uses capital received from foreign investors, offers business entities high-quality services in various areas.

When opening current accounts with Raiffeisenbank, individual entrepreneurs can choose any of the proposed tariff plans.

They should pay attention to the “Start” package, which provides the following conditions:

- The monthly subscription fee for service is 990 rubles (if an individual entrepreneur decides to pay for several years at once, the amount will drop to 743 rubles).

- Internet Banking is offered.

- Corporate cards are available (90 rubles per month).

- You can connect mobile banking (190 rubles).

- Carrying out one payment – 25 rubles.

- You can reserve your account online.

- A bank employee will visit the client’s address with a full package of documents.

Binbank

In B&N Bank, individual entrepreneurs can open a bank account. under the following conditions:

- Accounts are opened free of charge.

- Individual entrepreneurs receive as a gift the first 50 operations free of charge (up to 1,000,000 rubles).

- Internet Banking is available.

- "SMS" information.

- Wide range of services and options.

- Online account reservation.

Today, several packages are offered for individual entrepreneurs, each of which has its own advantages:

- Basis. Under the terms of this tariff plan, individual entrepreneurs do not receive checkbooks and cannot withdraw funds from their current accounts. The allowed number of transfers to other financial institutions is 10. There are no limits on money transfers within B&N Bank.

- Standard. Individual entrepreneurs are issued a checkbook, and a cash withdrawal limit is set at 20,000 rubles. The permissible number of transfers to other banks is 20 pcs. per month. There are no restrictions on intrabank transactions.

- Progress. One checkbook is given to the individual entrepreneur. The cash withdrawal limit is 50,000 rubles. There are no restrictions on conducting financial transactions within the bank. The permissible number of transfers to other financial institutions is 20.

- Trade. Individual entrepreneurs can make payments within the bank without restrictions. This tariff plan does not provide for cash withdrawals. Checkbooks are not given to individual entrepreneurs. You can make transfers to other financial institutions no more than 15 times per month.

- Strategy. Individual entrepreneurs are given the opportunity to transfer funds to other financial institutions up to 500 times. When opening a bank account. One checkbook is issued. You can withdraw cash up to 1 million rubles.

- There are no restrictions on conducting outgoing and incoming transactions within the bank. Clients can independently choose additional services.

Transfer money to partners on holidays and without commissions

Andrey Gavrilov, Atlas LLC

— We have accounts in several banks for transfers to different partners. It is more convenient to transfer to a counterparty who has an account in the same bank: fewer questions, faster transfers.

Dinara Kasimova, entrepreneur

— We optimize the costs of transfers to counterparties in other banks for our and their convenience. It is cheaper to transfer to partners from the same bank.

On New Year's and May holidays, transfers between different banks do not work. But transfers from account to account within the same bank always work. If you need to transfer money on any day, companies open an account with a partner’s bank.

For the convenience of the accountant and employees

Alexey Duzinkevich, entrepreneur

— Income from different types of activities in different banks, this makes it more convenient to conduct business and accounting. You don’t need to pour all your income into one bank: it’s confusing.

Oleg Rimaruk, entrepreneur

— We carry out postpayments from clients on one account, and prepayments on the other, so it’s more convenient to maintain internal statistics.

Some banks have integration with accounting programs and CRM systems. For example, an accountant can download a salary statement from 1C accounting and calculate salaries faster.

The sales department works in Bitrix. If the bank does not have integration with it, managers do not know whether the money has been received for the goods - they have to constantly call the accountant with the same question. The accountant gets angry and is distracted from important matters, and the manager wastes time on calls.

If the bank has integration with Bitrix, then as soon as the client pays, the manager will see in the CRM that the money has arrived and the goods can be shipped.

There are banks that offer company employees a reduced mortgage rate. This can be an advantage for a company when hiring workers.

Employees have the right to receive their salary on a bank card that is convenient for them. But some banks have increased commissions for salary transfers to other banks, and this is already inconvenient for the company. There are three options here: pay a commission, negotiate with employees, or find a bank without increased commissions. For example, in Modulbank, transferring a salary to a card of any bank costs 19 rubles.

The legislative framework

An individual entrepreneur who decides to work on a non-cash basis must be guided by the following regulations:

- Starting from January 10, 2016, changes made to Federal Law No. 115 are in effect. Financial institutions have received more powers to control the work of business entities, in particular the income they receive.

- The bank may refuse to open a current account for an individual entrepreneur if it doubts the “transparency” of his commercial activities. After this, the entrepreneur may be added to the “stop list”, due to which he will not be able to open a personal account. not at any financial institution.

- Starting from June 23, 2016, Federal Law No. 191 is in force, which amends Article 5 of the Tax Code of the Russian Federation. Now the procedure for opening a current account is significantly simplified for individual entrepreneurs who are allowed to provide an extract from the Unified State Register of Individual Entrepreneurs and a certificate of state registration. registration and registration with the Federal Tax Service in electronic form. An individual entrepreneur may not be personally present when opening an account if he is already a client of this bank and has all the necessary data on him.

- Starting from May 1, 2016, Federal Law No. 130 is in force, which amends Article 76 of the Tax Code of the Russian Federation. Now financial institutions have expanded capabilities for blocking individual entrepreneurs’ accounts.

Withdraw money without commissions or deposit cash

Alexey Ivanov, entrepreneur

— I withdraw cash from different banks to reduce the risk of account blocking. I work in rural areas and it is not always possible to pay by bank transfer. Plus, there are counterparties who have an account in another bank.

Roman Begiashvili, SDS-group

— I work in construction, I need two accounts to withdraw cash from two banks without high commissions.

Banks set limits on cash withdrawals and card transfers to individuals. To withdraw money without commissions, entrepreneurs open accounts in different banks.

The bank has a cash withdrawal limit of 500,000 rubles per month, and the entrepreneur has a contract for a million, but he wants to cash out this million and go on vacation with his family. Then you can agree with your partner: half to an account in one bank, and half to a second.

Another reason for the two accounts is the proximity of the offices of one of the banks to the offices and retail outlets of the company. This is important if the company needs to deposit cash from customers into its account without fees.

Let's go in order:

1. An individual entrepreneur, an individual, and a legal entity, regardless of their legal form and form of ownership, can have several accounts in one or different banks. No one can prohibit choosing a bank (except for cases established by federal law)

2. Of course, this happens rarely, but technical failures can still occur in the bank . And not everyone likes to be responsible for this. Tinkoff Bank, for example, in a long 70-page message to the client with its tariffs, writes in one of the paragraphs that in the event of a technical failure in the operation of the equipment, it is not responsible for the damage caused by this circumstance to its clients. If you want, swallow it, if you want, go and look for another bank. Therefore, in order to avoid technical problems or to minimize them, I consider it advisable to have a couple of accounts in different banks. This may be especially important when it is very important for your business to strictly adhere to payment deadlines to your suppliers. The reasons for such rigidity may be different and there is no point in discussing them, but they can exist.

3. The second account as a means of protection against bank bankruptcy and/or revocation of a license under 115-FZ. Of course, if you have an account in the TOP-11, then the Central Bank is unlikely to allow such a sad outcome of the bank’s activities. However, several years ago, when Otkritie Bank encountered difficulties, a number of clients from it migrated to other banks, although the story ended happily.

You can, of course, take risks, but you don’t need to. Especially where the risk can be avoided. Therefore, in order to protect your business from possible bank bankruptcy, it is advisable to open a second account.

4. Tariffs. Eight rubles for a payment card and 200 rubles for cash settlement services per month is a long-gone memory of the super-loyalty of banks to their clients. Then, in the late 90s, banks in general made money on other operations, so our 8 rubles. for them, paying for a payment was more like checking a box than real income. Now some entrepreneurs, in pursuit of cheaper tariffs, forget about what is behind them. And behind the choice is your own reliability, the confidence that tomorrow the bank will not go bankrupt and its license will not be revoked.

5. Limits. Almost all individual entrepreneurs are hunting for this sweet word (in terms of restrictions on cash withdrawals). The question of why cash is needed will be left behind the scenes, but the size of the commission from 0 to the prohibitive 10% can play a significant role in the process of choosing a bank. And it can be very useful when you have an account in one bank, where you have the best conditions for currency control or a salary project for payments to employees, and the second bank has the best conditions for withdrawing funds to a personal card.

6. 115-FZ.

What can I say here...it seems to me that everything has already been said more than once. However, let me remind you that even in the TOP 11 there are banks that, before you have time to open an account, they immediately block transactions, and there are those that even allow refuseniks to work. Therefore, in order to protect your business, if non-cash turnover is at least 1 million per month, it makes sense to keep this million in two banks.

Of course, if you yourself understand what kind of fluff you are in (sorry, but you understand me), then even at the start of such a business you need to be puzzled by accounts in at least two banks. I understand that the first money is often earned not entirely environmentally, but you can extract maximum efficiency and safety from the earning process. In addition, if you have reasonable or not so serious problems with the bank’s security service and are accused of aiding terrorism and laundering proceeds from crime, and then are asked to leave the bank, then opening a current account with such baggage will be much more difficult. That is, if by that time another account is opened, then you can transfer the balance of funds there, and then, slowly, have fun trying to whitewash yourself by submitting an application to the interdepartmental commission at the Central Bank.

Get a loan or overdraft

Alexey Lapenko, entrepreneur

— Another bank approved a loan and an overdraft for us.

Vladislav Yakovlev, Konstruktelectroservice LLC

— We opened an additional account in Modula due to a loan. And there are clients who also have an account in the Module.

Anzhelika Larionova, Real House LLC

— There was already an account in the first bank, they didn’t close it, in the second they opened it for the sake of an overdraft. We keep another one in case they take away the license of one of the banks or close our account.

Some banks ask to transfer money to the account if the owner wants to get an overdraft or loan. This is how banks estimate how much money a company has and calculate the credit limit.

It is not necessary to do this in Modulbank. You can simply connect accounts of other banks to your current account - without transferring money. Modulbank will look at how much money is in the accounts and calculate the loan amount.

There is a nuance with accounts in different banks: payment of taxes. The bank sees that the company has an account and transactions on it, but it does not pay taxes, salaries and fees - this is suspicious. To avoid problems, you need to pay tax at each bank in which the company has a current account.

Current or current account - what's the difference?

Is it possible to have two current accounts for an individual entrepreneur? Many people confuse the concepts. current account is opened for maintaining and accounting for transactions related to commercial activities. The current one is opened by individuals for personal needs, i.e. not related to business. Therefore, there is a significant difference between a current account and a current account.

Is it possible to use a current account as a current account during the year? In practice this happens.

By using a current account instead of a current account, individual entrepreneurs receive the following benefits:

- Cheaper maintenance costs.

- Moderate restrictions (limits, etc.) or their absence.

Otherwise, both options are similar, including remote maintenance. The use of a current account within the framework of commercial activities does not contradict current legislation, but does not comply with the instructions of the Central Bank and banking agreements concluded in accordance with them.

According to the law, an individual entrepreneur and an individual are one and the same entity. His property is inseparable like that of legal entities. At the same time, tax legislation does not distinguish between the concepts of current and current accounts.

However, banks suggest that when using a current account for settlements with counterparties, the purpose of payment should indicate “not related to commercial activities.” Otherwise, the bank will be liable to the Central Bank of the Russian Federation, and the entrepreneur - to the Federal Tax Service and funds, if he does not notify them about the use of the current account for commercial purposes. If such a fact is discovered, a fine of 5,000 rubles will be imposed on the entrepreneur. (as of 2017).

Can an individual entrepreneur have 2 current accounts in different banks?

An individual entrepreneur can have as many current accounts as he wants in different banks. This may be a safety net in case an account is blocked in one of the banks. In this case, you do not need to waste time opening a new account.

Your business continues to operate as before. Moreover, when you contact another bank in a blocking situation, many banks may refuse to open you.

It is especially profitable to issue accounts on free tariff plans. You will not have to pay the bank for service, and you will be able to use free limits for non-cash and cash transactions in several banks simultaneously.

Choose a bank

Do funds need to be notified about a current account?

As for whether an individual entrepreneur can have several current accounts, it is worth noting that an individual entrepreneur has the right not to open one at all, or to use several accounts in his work. Whether it will be convenient and whether there will be any confusion in this case, everyone decides for himself.

Previously, every account that a businessman opened for business had to be reported to all regulatory organizations. Since May 2014, this rule has been abolished. Now entrepreneurs who decide to link a bank account to their individual entrepreneurs do not need to report this to the tax office, the Pension Fund of Russia and the Social Insurance Fund. Similarly, there is no need to inform these services that the account was closed.

But this rule only applies to new accounts. That is, in the case where the entrepreneur’s account was opened before May 2, 2014, all regulatory organizations will have to be informed about its closure. To do this, you must send a letter with a notification and a certificate from the bank to the address of the territorial branch of the service. The shipment must be registered and with a mandatory description of the contents.

If an entrepreneur has time, he should personally visit each organization. This will be more reliable, because the individual entrepreneur can be sure that the documents have been accepted and information about the closed account has been recorded. In order to inform organizations that the individual entrepreneur has closed his account, it is necessary to transfer the data 7 days in advance. If the entrepreneur does not do this on time, he may be issued a fine of 5 thousand rubles from the tax service, pension and social fund. The amount is considerable, so there is no need to delay submitting the papers.

Why does an individual entrepreneur need several current accounts - pros and cons

Opening a second current account for an individual entrepreneur gives you a number of advantages:

- Do not depend on the terms of service. If the bank's tariffs no longer suit you, you can start using another current account with more attractive conditions. At the same time, it is not necessary to close a current account in that bank. Many banks do not charge fees for maintaining an account if there is no movement on the account.

- You can make the most of advantageous offers from several banks at once. For example, one bank may offer good conditions for lending or acquiring, while another may offer interest on the balance.

- It is easier for you to control the movement of your account if your business activity is divided into several areas or if you have several branches.

- Reduce the risk of payment delays as a result of a technical failure at the bank. This is relevant for entrepreneurs who carry out a large number of translations.

- You can conduct business with foreign counterparties by opening an additional current account in a different currency.

Procedure for opening a current account

Binbank RKO tariffs for individual entrepreneurs - how to open a current account

There are several ways to open a current account for an individual entrepreneur:

- through the bank’s online resource;

- when visiting a financial company in person.

If the applicant has already chosen the institution that will manage his financial affairs, then he can submit an application via the Internet. This method is called a reservation. Then you will have to come to the department, but only to sign documents. To do this, you need to go to the official resource of the financial company, register and apply for a current account.

On the website, personal data of a private entrepreneur, contact information, and information about the company are filled out. You need to independently choose a convenient tariff and confirm the request. You need to upload all the necessary documentation into the system, which confirms the identity of the businessman and the legality of his activities. By choosing a package of services, the applicant agrees to the formation of an agreement, which will later need to be signed at a bank branch.

Registration of account online

If a person immediately contacts the office, then the paperwork must be filled out on the spot, as well as the provision of all necessary documents. Employees will require copies in addition to the originals. The application must be signed not only by the owner, but also by the chief accountant of the company. It is advisable to immediately provide copies of documents certified by a notary office.

Important! Opening a bank account through pre-booking is the fastest way. It significantly reduces registration time.

You need to immediately choose a reliable bank, so that later there will be no difficulties with maintaining a bank account and an unexpected increase in tariffs. A cheap plan may have hidden fees.

Why does an individual entrepreneur need several current accounts?

You can open a second account with benefits for your individual entrepreneur if you:

- you are afraid of blockages from the tax office and want to have a reserve account just in case;

- keep separate records for several tax regimes;

- divide cash flows across several areas of activity;

- have several points of sale;

- open representative offices in other cities;

- want to reduce commissions for transfers to counterparties whose accounts are opened in other banks;

- received favorable offers from several banks (for example, one has cheap acquiring, and another has loans on preferential terms);

- reduce the risk of losing money as a result of the revocation of a license from one of the banks.

Advantages and disadvantages of opening multiple accounts

Opening several accounts by an organization or entrepreneur inevitably leads to additional costs for cash settlement services and complicates financial management. But this is where the list of disadvantages for business ends. The advantages of having several current accounts are much greater:

- Reducing the risk of losing all funds due to financial problems of a particular bank. This point is especially relevant for organizations, since their funds are not insured.

- Increased efficiency in calculations. If necessary, you can always make an urgent payment from another account, even if technical problems arise with one of the banks.

- Increasing the level of business information security. It will be more difficult for raiders and unscrupulous competitors to obtain information on turnover and other information from several banks.

- Access to additional credit resources from different banks.

How to pay taxes if an individual entrepreneur has two current accounts

You decide from which account you will pay taxes. For example, if a second account is opened to separate accounting for different taxation systems.

If accounts were issued to save costs on banking services, pay tax from the cheaper account. At the same time, keep in mind that if the bank does not have data on payments to the budget, it may have doubts about your trustworthiness. Therefore, alternate paying taxes and contributions from different accounts if you have several of them.