Legislation on the use of cash registers

The procedure for using cash registers (cash registers) is regulated in Federal Law No. 54. This act determines that an individual entrepreneur is obliged to use a cash register when selling goods, performing work or selling services, including through the use of an online store. In this case, payment is made in cash or by payment cards. The legislator makes an exception to this rule, which will be analyzed below, when penalties for the absence of KMM are not applied.

Responsibility and fines for non-use of cash registers are approved by the Code of Administrative Offenses of the Russian Federation.

Who needs to install an online cash register and is it possible to work without using it?

According to the current version of the law “On the use of cash registers” dated May 22, 2003 No. 54-FZ (Article 1.1, 1.2):

- All companies and individual entrepreneurs are required to use cash registers when making payments not only in cash, but also by bank transfer;

IMPORTANT! Cash register systems do not need to be used for non-cash payments between organizations among themselves or with individual entrepreneurs (with the exception of settlements using an electronic means of payment with sight). This is provided for in paragraph 9 of Art. 2 of Law 54-FZ).

- There may be exceptions to the above requirement (if such situations are provided for by law 54-FZ).

Moreover, it is necessary to use cash register systems not only when receiving payment or advance payment for goods, work, or services. In some cases, it is necessary to punch a check when paying out money, for example, when returning goods by the buyer or for refundable prepayment amounts.

The bulk of sellers had to purchase and begin using cash registers by July 1, 2020.

For a table with transition deadlines for different groups of sellers, see here.

Administrative liability is established for violating the procedure for using cash registers or failing to use an online machine in cases established by law. As a rule, these are fines. Moreover, sanctions can be imposed on both legal entities and officials. ConsultantPlus experts explained in detail what fines are established for violating the procedure for using cash register systems and whether sanctions can be reduced or avoided altogether. Get trial access to the K+ system and upgrade to the Ready Solution for free.

We will tell you further about who does not need to use online cash registers.

Legality of working without a cash register

In accordance with Federal Law No. 54, it is legally possible to make payments without a cash register in the following cases:

- provision of services to individuals, subject to the provision of BSO according to the rules approved by the Government of the Russian Federation;

- payers of UTII and PSN, subject to the transfer, at the request of the client, of documentation (receipt, sales receipt, etc.) confirming the fact of receipt of funds for valuables;

- carrying out certain types of activities or due to the specific location.

What is an online cash register?

Organizations and individual entrepreneurs conducting retail trading activities must use cash registers. This helps government services monitor the flow of funds earned by individual entrepreneurs, maintain order in online stores and protect consumers from fraudulent actions of sellers.

Online equipment differs from conventional equipment in that it is connected to the Internet and transmits fiscal data to the Federal Tax Service. New devices make it possible to inform the buyer online via SMS about the purchase made (issuing an electronic receipt).

The operating principle of an online cash register is no different from an ordinary one. An innovation is the fiscal drive. Its function is to transmit information via the Internet to the tax authority.

Features of the new type of cash register equipment:

- The receipt contains a QR code.

- The device sends fiscal data to the tax authority without the participation of a cashier.

Types of activities for individual entrepreneurs without a cash register

You can work without a cash register when conducting business as follows:

- Sale of periodicals and press in specialized kiosks. The share of sales of these goods must be at least 50%, and the range of related products is approved by the government agency. In this case, accounting for profits received after the sale of the press and other goods is determined separately.

- Sale of shares, bonds and other securities.

- Sales of lottery tickets.

- Trade in travel tickets, as well as coupons for using city public transport.

- Supplying meals to students and staff of educational institutions during classes.

- Selling goods at markets, fairs and other outdoor trade in places of this type. An exception is kiosks, pavilions, tents, auto shops and other equipped premises that ensure the safety of goods. Beer or alcoholic beverages cannot be sold in this way without a cash register.

- Portable retail trade from baskets, food trays (with the exception of alcohol) and certain categories of non-food products.

- Sale of products in an assortment approved by the relevant government agency on trains.

- Sale of ice cream and non-alcoholic drinks in kiosks.

- Trade from tanks (beer, milk) or waddling food products.

- Reception of waste materials (except for scrap metal) and glass containers.

- Sales of religious items, religious ceremonies, etc.

- Sale of postage stamps and other signs indicating payment for postal services.

Individual entrepreneurs who operate in remote or hard-to-reach areas can accept cash and payments using payment cards without using cash registers. Local authorities approve a list of such areas. Thus, only those entrepreneurs who conduct business in a certain locality will be able to take advantage of the opportunity to work without a cash register.

The Federal Tax Service will check

We will, of course, carry out control work: compare the information we have on registered cash registers with information about who should have registered the cash register before 07/01/2018, and check. So don't wait for the tax inspector to come to you. If you violated the procedure for using cash registers, buy, register the cash register and generate a correction check.

In accordance with the note to Art. 14.5 of the Administrative Code, a person who voluntarily eliminates the offense and notifies the tax service about this in writing cannot be held administratively liable for violating the procedure for applying the cash register system. This rule applies to parts 2–4 and 6 of Art. 14.5 Code of Administrative Offences.

For individual entrepreneurs on PSN and UTII, who must start using cash registers from 07/01/2019, there is additional motivation not to delay registering cash registers. They can receive a tax deduction in the amount of 18 thousand rubles for each cash register registered within the period established by law.

You punched the wrong check - our cheat sheet will help you: “Which check to punch if the cashier made a mistake.”

Lychagina Svetlana Mikhailovna , Deputy Head of the Federal Tax Service of Russia for the Stavropol Territory

Cash desk for the sale of alcohol and beer

The regulation on the sale of alcohol and beer without cash registers is interpreted ambiguously. In accordance with the previous regulations, the sale of low-alcohol products without a cash register, for example, beer with a strength of up to 5 degrees, was allowed.

This provision was in effect until 2013, when all sellers of beer and alcohol were required to use a cash register. The only exceptions were those entrepreneurs who chose UTII.

Until 2014, such sellers could sell beer and alcohol without a cash register. But the Supreme Arbitration Court and the Federal Tax Service provided official clarifications on this issue.

Government departments have clearly stated that the sale of alcohol and beer without a cash register is illegal.

Before purchasing a cash register

Before purchasing a cash register, you should familiarize yourself with the basic steps you will need to perform:

- Select the appropriate cash desk

- Choose a fiscal storage device

- Create an electronic signature

- Connect to the fiscal data operator

- Register equipment

After completing these steps, you can use the cash register.

Do you need help choosing an online cash desk for a lawyer?

Don’t waste time, we will provide a free consultation and select an online cash register that suits you.

A legal way to work without a cash register

Federal Law No. 54 clearly states cases of using a cash register - cash payments. Thus, non-cash payments can be made without using a cash register.

We are not talking about payments with payment cards, but about transferring funds to the current account of an individual entrepreneur.

To legally use this method, you need to follow these steps:

- Open a current account in any credit institution;

- Issue receipts to clients for payment at the bank;

- Receive funds to your current account.

The disadvantage of working with a current account is that it is difficult to implement the method with a large number of clients and small amounts.

What benefits does an online cash desk provide to lawyers?

Modern cash registers are no longer the same as their older models, so despite the fact that they are not mandatory for lawyers, using them is still very profitable. Progressive engineering developments have made the online cash register an effective tool with which a lawyer can:

- manage the client base;

- automate settlement transactions with clients;

- increase the speed of customer service;

- attract new clients;

- supervise the work of the office staff;

- keep records of services provided;

- identify the most productive and ineffective employees;

- plan work;

- control payments to clients;

- receive analytical information for any period of time necessary for making management decisions;

- keep statistical records, calculate the profitability of the services provided;

- distribute advertising, etc.

BSO as an alternative

For individual entrepreneurs, the UTII does not establish the obligation to use the cash register. But such businessmen issue BSO to their clients. These forms are called receipts, tickets, subscriptions, etc. Until 2008, the BSO form was uniform. After the adoption of Government Resolution No. 359, entrepreneurs can independently develop the form. Exceptions are transport tickets, vouchers, deposit tickets, receipts for veterinary services.

The legislator clarifies that the BSO must contain a list of mandatory details:

- document name, number and series;

- IP name, TIN;

- address;

- type of service, name of product;

- price;

- payment amount according to BSO;

- date and time of formation;

- position and full name of the person responsible for issuing the BSO, signature.

If at least one detail is missing, the document can be considered invalid. Documentation can be purchased ready-made or ordered from a printing house.

How to choose an online cash desk for a lawyer

The choice of a cash register model directly depends on the client flow and status of the legal organization. In principle, any of the new generation cash register models can be suitable, but it is worth considering that the wider its functionality, the more benefits it will bring.

In total, all modern cash registers can be divided into four types:

Autonomous cash registers are devices that can function independently, without the help of a PC. Outwardly, they are very similar to the push-button models of old cash registers, but they are able to connect to the global Internet and support work with FN. Since a lawyer does not need to have an expensive and fast online cash register, this option may be the best.

The fiscal registrar is a kind of modification of the receipt printer in which the FN is installed. Since such a cash register does not have its own keyboard and display, it can only work in tandem with a computer, laptop or other control device. This is one of the most affordable categories of cash register devices, capable of meeting the minimum requirements of 54-FZ.

Smart terminal - “smart technology”. Its name speaks for itself. Such devices look prestigious and have the capabilities of a mini-computer. Thanks to the support of a variety of software products, you can use them to realize the most daring ideas in business management. Some models can even accept bank cards for payment, which is important in the modern world.

A POS system is a whole set consisting of a set of several pieces of equipment: a computer, a keyboard, a fiscal recorder, a box for storing money, etc. Considering its cost, it will be the most effective for medium and large law firms with an extensive structure of offices and departments.

Responsibility for non-use of CCP

Responsibility for non-use of cash registers is provided for in the Code of Administrative Offenses of the Russian Federation. This provision provides for sanctions in the form of a fine for the offender. Liability arises in the event of using an unregistered cash register or using a cash register in violation of established rules.

Working without a cash register has the following advantages:

- no costs for the purchase of cash registers (price - more than 8 thousand rubles);

- no costs for cash register maintenance (price - more than 10 thousand rubles for 1 year);

- there is no need to go through the registration procedure of a cash register with the tax service.

Despite this, most individual entrepreneurs, including when working through an online store, are required, in compliance with the norms of Federal Law No. 54, to buy cash registers and make calculations with its help. Exceptions are cases provided for by law.

Otherwise, there is a fine:

- legal entities – up to 40 thousand rubles;

- Individual entrepreneur – up to 2 thousand rubles.

Fines for the absence of a cash register at an individual entrepreneur in 2020

From July 1, 2020, in accordance with 54-FZ, most entrepreneurs are required to switch to online cash registers. In addition to the fact that individual entrepreneurs and organizations must purchase, install and register online cash registers, they are required to comply with all legal requirements. There are many nuances that an individual entrepreneur needs to know in order to avoid any fines in 2020.

Many businessmen have long started using online cash registers. For many individual entrepreneurs with a patent, the mandatory installation of cash registers has been delayed until July 1, 2021, thanks to Federal Law 129 of June 6, 2019. This list includes the following activities:

- sale of printed periodicals;

- Shoe repair;

- trade in lottery tickets;

- sale of various religious paraphernalia in the church and in its vicinity;

- retail sale of milkshakes or ice cream;

- soft drinks in barrels;

- various machines, nursing, childcare, rental of residential premises (if they are owned);

- sports services;

- gardening services;

- educational services;

- services of houses of creativity, culture, etc.

Most of this list relates to preferential activities under Art. 2 54-FZ, and in this case the simplified taxation system is applied - a simplified taxation system, with a special procedure for paying taxes. This system is mainly used by entrepreneurs who have less than 100 employees and an income of less than 150 million rubles per year.

Important! Violation of the rules for working with online cash registers is regulated by the administrative code of the Russian Federation.

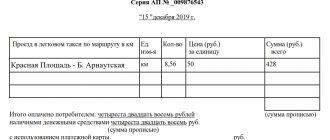

But identifying obvious violations in the work of an entrepreneur is often difficult. In order to detect and record violations, strong arguments are needed; a complaint from a consumer is one of the most compelling arguments. For example, if a taxi does not have an online cash register, a passenger can file a complaint - from July 1, carriers are required to comply with 54-FZ.

At the moment, obvious violations in work, in addition to the complete absence of cash registers, include:

- using an online cash register that is not registered in the tax and state registers;

- if a check with an amount less than the cost of the goods or services of the individual entrepreneur is punched, you will have to pay a fine;

- use of cash registers without fiscal memory, with less fiscal memory, with a failed fiscal storage device;

- bad check.

The amount of the fine for working without a cash register for individual entrepreneurs in 2020 for non-use of cash registers, penalties for failure to issue a cash receipt for individual entrepreneurs and other violations of working with online cash registers are described in detail in the administrative code of the Russian Federation:

- For the absence of an online cash register at an individual entrepreneur, the fine will currently be 5-10 thousand rubles in accordance with Part 4 of Art. 14.5 Code of Administrative Offenses of the Russian Federation. If an outdated device is used, this will also be considered a complete lack of online cash register and the fine will not be reduced. The fine for the absence of a cash register at an individual entrepreneur in 2020 cannot be called insignificant. In case of a primary violation, it will amount to 75-100% of the profit, but not less than 30,000 rubles in accordance with Part 2 of Art. 14.5 Code of Administrative Offenses of the Russian Federation.

- In case of repeated violation and in the case where the settlement without cash register exceeds 1 million rubles, the administrative penalty is suspension of activities for up to 90 days.