Account 57 in accounting

In accordance with the norms of Order No. 94n dated October 31, 2000, this current account displays information on the organization’s transfers, that is, amounts intended for transfer in favor of the company; already deposited at the cash desk of a post office, credit institution or Sberbank, but not yet credited to the recipient’s account. The basis for reflecting such transactions in accounting are payment receipts of the Russian Post, Sberbank or other credit organizations, as well as accompanying statements (copies) for collection.

The main difference between transfers in transit from other facts of economic activity is their transit nature and the time interval between the moment of depositing funds and debiting (more than 1 day). Since account 57 in accounting is active, an increase in turnover occurs by debit in correspondence with accounts - , 91, , 50, 51, 79, , 62. And the write-off of transfer amounts is carried out on the credit account. 57 in correspondence with accounts – 52, 51, 50, 73, 62.

Note! Transfers in transit on account 57 (postings are shown below) may not be reflected in organizations with cash proceeds not exceeding the cash limit established for the day; enterprises using only non-cash payments; companies that spend cash proceeds for permitted purposes - paying wages, issuing travel expenses, paying off obligations to suppliers, etc.

Purposes of using account 57

Account 57 is one of the accounts in accounting. It is called “Transfers in transit” and is designed to store data on cash flows in the national currency of Russia and foreign countries, that is, money that is deposited and credited by payers to the accounts of organizations or savings banks. More often than not, all this money represents revenue from goods sold. The key feature of these funds is that they have not yet reached the final recipient.

Accounting is an important department of an enterprise for recording its property.

Important! Acceptance of funds occurs on the basis of a receipt, statement or document confirming the delivery of proceeds to the cash desk of savings institutions or collectors. It is worth noting that transfers of funds in foreign currency are carried out in account 57 separately.

Funds credited to cash desks are subject to transfer to bank accounts, and then to the accounts of organizations. This is regulated by the rules on money circulation on the territory of the Russian Federation. Also, funds can be handed over to the bank's collection services or other services licensed by the Bank of Russia.

Funds credited to account 57 are often and carefully checked by auditors, and this is understandable, since this allows you to control the development of the organization and its stability. If the accounting documents are reliable and provided in compliance with all standards, then cash accounting will be correct. This is especially true for account 57.

Accounting is based on storing information in accounts

The use of balance-57, based on the definition of the Ministry of Finance, occurs as a source of information on the movement of money in different currencies in cases where a transfer to a bank account takes longer than one day from the moment of sending.

Important! When posting, the availability of receipts from executors and accompanying papers from collectors for the delivery of proceeds must be taken into account. The "in transit" movement must occur separately from other transfers.

Subaccounts to account 57

- 57.01 “Funds deposited to the bank, but not yet credited to the account” - is used to reflect those funds that were deposited to the bank on the last reporting date of the period, but were not credited to the account in the same period.

- 57.02 “Funds used for foreign exchange transactions” – used by organizations to carry out transactions with foreign currency funds.

- 57.03 “Funds in rubles transferred through payment cards” - used to record acquiring transactions.

Thus, we can conclude that account 57 “Transfers in transit” is needed to ensure reliable accounting of the enterprise’s funds and timely reflection of the process of financial movement in ruble and currency equivalents.

Specifics of application of account 52 “Currency accounts”

Account 52 - Currency accounts The chart of accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n) is intended to reflect accounting transactions with non-cash foreign currency funds.

Read about the Chart of Accounts in the article.

Current accounts on which such transactions are carried out can be opened in both Russian and foreign banks. This circumstance determines the allocation of two sub-accounts on account 52, intended for accounting for funds in banks:

- Russian - subaccount 52-1;

- foreign - subaccount 52-2.

Just as for ruble accounts, for foreign currency accounts reflected in accounting account 52, the following are required:

- organization of separate analytics not only for banks, but also for each account opened in this bank;

- using bank statements and payment documents attached to them as a basis for carrying out an operation.

Features of accounting on account 52 are due to the fact that:

- a foreign currency account opened in a Russian bank is actually represented by two accounts: transit (in which the funds are kept until the recipient submits documents identifying the payment to the credit institution) and current;

- According to accounting rules, accounting transactions must be reflected in ruble equivalent, and this requires: keeping records in parallel in two currencies (foreign and rubles);

- mandatory recalculation of currency balances on the date of the transaction and on the reporting date;

At the same time, you should remember that there is a ban (clause 1 of Article 9 of the Law “On Currency Regulation...” dated December 10, 2003 No. 173-FZ) on carrying out currency transactions between residents of the Russian Federation (with some exceptions). However, this does not mean that account 52 will show only settlements with non-residents and the results of recalculation of the ruble equivalent of foreign currency amounts.

Read about the rules that govern currency transactions in the Russian Federation in the publication “Currency transactions: concept, types, classifications.”

How to close 57 account

The need to close account 57 arises when transfer amounts are written off, that is, when money is credited to a bank account (for example, during acquiring); in case of exchange rate differences during foreign exchange transactions. The operation will be considered transit if the money is received on one day and spent on another. When creating entries for currency movements, it is necessary to follow the requirements of PBU 3/2006, namely clauses 4-6, 20, that is, recalculate amounts from foreign currency into rubles. Accordingly, the differences that arise will be recognized as other income or expenses of the company (clause 7 of PBU 9/99, clause 11 10/99) and written off to 91 accounts.

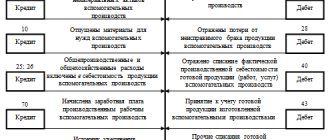

Correspondence of account 57 with other accounts

In accounting, there are active, passive (passive determines the movement within the enterprise) and active-passive accounts. SCH-57 is an asset account, which means recording any income in debit, and expenses in credit. At the end of the accounting month, either a debit balance is formed, or the register is closed if money successfully arrives at the bank. Based on this, it is possible to determine the interaction of “Transfers in transit” for debit and credit.

Account 57 corresponds (debits) with the following registers:

- 50, 51, 52, describing intra-economic needs;

- 62, 64, 67, describing settlements with clients;

- 78 as calculation of dependent companies;

- 45 and 46, describing goods sold;

- 99 how to profit and loss when buying currencies.

Type of postings according to SCh-57 in the 1C environment

When closing the Account. 57 interacts with accounts 50, 51, 52, 64, 73. When money is credited to the required account, a posting is made confirming this.

“Transfers on the way”: 57 accounting account – postings

- D 57.03 K 90.01.1 – reflects the amount of retail revenue paid for acquiring.

- D 51 K 57.03 – the crediting of money to the seller’s account is reflected.

- D 57.01 K 50 – on the last day of the month, the deposit of money from the cash register to the r/account is reflected.

- D 51, 52 K account 57.01 – the crediting of funds en route to the r/account is reflected.

- D 57.02 K 52, 51 – funds were transferred for the purchase of foreign currency.

- D 57.01 K 62, 76 – the transfer of a money transfer from the counterparty is reflected, but the funds have not yet been received into the r/account.

- D 51 K 57.01 – reflects the receipt of funds in the bank.

Conclusion - in this article we figured out what money transfers are; provided standard entries for account 57, and found out which organizations can operate without reflecting transit amounts.

Examples of transactions with transactions on account 57

Example 1. Receipt and transfer of funds to a bank account

As a result of the shift, the proceeds from the trade of the Premd LLC store, which went to the cash register, amounted to 110,000 rubles. An agreement for collection services was concluded between Premd LLC and Finance CJSC, the tariff is 0.2%. Also, Premd LLC has opened a settlement account with Nimex CJSC for payments on salary projects.

Table of transactions for account 57 – Receipt and transfer of funds to a r/account:

| Dt | CT | Amount, rub. | Wiring Description | A document base |

| 50 | 90.01 | 110 000 | Reflection of revenue | KO-1 |

| 57.02 | 50 | 110 000 | The funds were transferred to the collector | KO-2, receipt for bag |

| 51 | 57.02 | 110 000 | Funds are credited to the account | Bank account statement |

| 91.02 | 51 | 220 | Bank commission for receiving and transferring funds | Bank account statement |

| 57 | 51 | 100 000 | The funds were written off for transfer to an account at Nimex CJSC | Statement from the sending bank on the account |

| 51 | 57 | 100 000 | Reflection of cash receipts | Statement of the recipient bank on the account |

Example 2. Accounting for acquiring on account 57

Linden LLC is engaged in the sale of goods. At the end of the working day, the total amount of revenue is RUB 400,000.00, including VAT RUB 61,016.95:

- Cash payment – RUB 210,000.00, including VAT RUB 32,033.90;

- Cashless payment – RUB 190,000.00, including VAT RUB 28,983.05;

- Bank commission – 1.5%.

Table of entries for accounting for acquiring in accounting:

| Account Dt | Kt account | Amount, rub. | Wiring Description | A document base |

| 50 | 90 | 400 000,00 | Revenue receipt | Cash register |

| 57 | 90 | 190 000,00 | Reflection of revenue by bank transfer | Money orders |

| 90.03 | 68 | 61 016,95 | VAT charged on sales | Packing list |

| 51 | 57 | 187 150,00 | Receipt of funds by bank transfer, taking into account bank commission. | Bank statement |

| 91 | 57 | 2 850,00 | The bank's acquiring commission is reflected | Bank statement |

- Account 51 in accounting: postings, characteristics, examples

- Acquiring: postings in accounting

- Account 55 in accounting: Special accounts in banks

- Account 62 in accounting: postings, examples, subaccounts

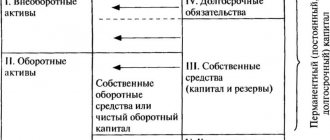

Accounting characteristics

57 accounting account is a way of modern description of the process of transferring funds to bank accounts. Almost every trading organization transfers amounts from the cash register and proceeds for the reporting period to the account. The use of account 57 begins with such operations, which allows for more reliable and continuous accounting.

In addition to the funds transferred by the organization, transfers in transit include amounts sent from buyers on account of goods or services received, but which did not manage to be credited to the current account before the end of the reporting period. Funds allocated for currency conversion are also debited in account 57.

Accounting for foreign currency sales

Foreign currency received from foreign buyers is subject to sale to authorized banks. How does this happen?

Until the moment of sale, currency funds are stored in the debit of account 52. At the time of sale, they are written off from the credit of account 52.

Please note: entries in all accounting accounts, including currency account 52, are made in Russian rubles. Transfers to rubles are carried out at the time of crediting funds to account 52 at the Central Bank rate.

At the moment of receiving payment from a non-resident buyer of the Russian Federation (foreign) in non-cash currency, they are credited to the debit of account 52 in rubles. The rate is taken by the official Bank of Russia on the day of enrollment.

At the time of sale of currency to the bank, the value is recalculated at the current official rate; if it differs from the rate on the day of enrollment, then a difference arises - positive or negative. The first is considered other income, the second is considered other expenses and is credited to account 91.

From a sales operation, a company can receive a certain financial result - income or expense. Income is observed if the company receives a benefit from the sale (the positive result of the difference between the amount in rubles received from the sale from the bank and the ruble valuation of the currency on the day of the sale at the official rate) or a loss (if the result of the subtraction is negative).

How to sell currency received as proceeds - step by step steps:

Step 1: We accept for accounting foreign exchange earnings from a foreign buyer at the rate of the Central Bank of the Russian Federation - posting D52 K62.

Step 2: We recalculate the value on the day of sale according to the Central Bank of the Russian Federation, in which case either a positive exchange rate difference arises if the official exchange rate is higher at the time of sale - posting D52 K91.1, or a negative difference if lower - posting D91.2 K52. That is, the exchange rate difference is shown among other income/expenses.

Step 3: We write off the currency for sale at the rate of the Central Bank of the Russian Federation on the day of sale - posting D57 K52 (you can take 76 instead of 57 account).

Step 4: We receive proceeds from the sale from the authorized bank in rubles (the bank buys and buys currency at its own rate) - posting D51 K57 (or 76, if such an account is used).

Step 5: We take into account the difference from the sale due to the difference in the selling rate from the official one - posting D 57 K91.1 (if the selling rate is higher) or D91.2 D57 (if lower).

If there is a commission retained by the authorized bank, then it is recognized as another expense.

Postings for currency transactions

Currency transactions are an important component of monetary accounting and settlements.

To transfer funds in foreign equivalents, organizations use accounting account 57. The transactions common in the process of conducting transactions are considered in the table: Currency transfers in transit

| Dt | CT | Characteristics of an accounting transaction |

| 57.3 | 52 | currency transferred for conversion into rubles |

| 91 | 57.1 | The total from the sale of foreign currency was written off in rubles |

| 76 | 57.2 | after transferring funds to a foreign branch, the currency in rubles was written off from the account |

| 57 | 91.1 | positive difference in the exchange rate is recognized |

| 91.2 | 57 | a negative difference in the exchange rate is recognized |

Correct preparation of correspondence accounts will reduce the risk of errors in accounting registers and financial statements.

Characteristics, features and subaccounts of accounting account 52 - accounting for currency transactions and postings

In the accounting of an organization, account 52 is used to reflect information about the organization’s non-cash funds presented in foreign (foreign) currency.

Account 52 has a characteristic name - Currency accounts. It records the balances of non-cash foreign funds and their movement through bank accounts belonging to the enterprise.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

It is often used by business entities engaged in foreign economic activity and entering into various transactions with non-resident companies.

The accounting features of non-cash settlement transactions with currency performed on account 52 should be studied in more detail.

Basic accounting entries with account 52

Foreign exchange transactions are strictly regulated by Russian legislation, so participants in transactions need to have a clear understanding of the current reporting procedure. All transactions and payments must be strictly recorded in the accounting records of the enterprise. The following entries will help simplify the process of generating a financial report:

| Debit correspondence | Loan correspondence | the name of the operation |

| 57 | 51 | Money is transferred in rubles for subsequent purchase of currency |

| 52 | 57 | Receipt of purchased currency |

| 57 | 52 | Currency listed for sale |

| 51 | 57 | Proceeds from the sale of the foreign currency amount were credited to the ruble account |

| 91.02 (57) | 57 (91.02) | Positive/negative difference when buying (selling) foreign currency |

| 60, 66, 67, 75, 76, 79 | 52 | Amounts written off as payment to the supplier as a loan repayment with interest or in the form of a transfer to other counterparties |

| 52 | 60, 66, 67, 75, 76, 79 | Funds received from counterparties as loan repayment + interest and payments from suppliers |

| 50 | 52 | Foreign currency was received from the bank to the cash desk of the enterprise |

| 71 (50) | 50 (71) | The currency was issued to an accountable employee of the company or the accountable person returned the balance of unused funds to the cash desk |

| 52 | 50 | Currency is handed over from the company's cash desk to the bank |

All currency manipulations are recorded only in rubles, since foreign exchange rates are constantly changing. During the recalculation, positive or negative exchange differences may arise, which in the future must be attributed to non-operating income or expenses.

General information

The auditee must adhere to the following aspects:

— provide reliable information on account 57 balance,

— transfer the profit received from the company’s activities within the established time limits,

— reliably display accounting of transactions in foreign currency.

The audit is based on a detailed study of the existing primary accounting registers, according to which entries are made on account 57.

When compiling cash flow statements, it is necessary to take into account account 57, including in the report debit turnover for “Transfers in transit”. It must be said that transactions in foreign currency must be converted into rubles (according to the procedure established by PBU 3/2006).

This accounting account is a modern method of describing the procedure for transferring funds to bank accounts. Almost all trading companies transfer cash from the cash register and the proceeds received for a certain reporting period of time to a current account. It is with these transactions that the use of the “Transfers in Transit” account begins, which makes it possible to maintain continuous accounting and obtain a reliable picture of the company’s activities.

In addition to the funds transferred by the company, account 57 includes money that clients send to pay for products or services received, but which did not manage to arrive in the current account before the end of the reporting period. Funds allocated for currency exchange (conversion) are also debited in account 57.

In accordance with the order of the Minister of Finance of Russia, account 57 is a source of information on cash flows both in ruble and foreign currency equivalent.

Typical transactions for account 52

In the description of account 52 in the Chart of Accounts, almost all accounts appearing in the Chart of Accounts are listed as accounting accounts in correspondence with which postings are allowed. This suggests that foreign currency funds can be used for the same types of transactions as money stored in ruble accounts (subject to the ban on settlements with residents), that is:

- for payment of travel allowances and salaries;

- saving and increasing funds using special accounts;

- settlements with counterparties and payment of taxes;

- issuing loans and obtaining borrowed funds;

- settlements with founders and divisions.

However, from this entire set you can select those correspondence that characterize typical transactions for account 52. These are, for example:

- Dt 52 Kt 62 - receipt of funds from a foreign buyer;

- Dt 60 Kt 52 - payment to a foreign supplier or bank for services;

- Dt 91 Kt 52 and Dt 52 Kt 91 - a reflection of negative or positive exchange rate differences;

- Dt 57 Kt 52 and Dt 52 Kt 57 - accounting for the amount of foreign currency when selling or buying foreign currency;

- Dt 50 Kt 52 - withdrawal of currency for issuance to a business traveler abroad;

- Dt 58 Kt 52 - issuing a loan in foreign currency;

- Dt 52 Kt 66 (67) and Dt 66 Kt 52 - receipt and repayment of a foreign currency loan, as well as payment of interest on it (if interest is paid in foreign currency);

- Dt 52 Kt 75 and Dt 75 Kt 52 - making a contribution to the capital company by a foreign founder and paying dividends to him.

Salary payments from a foreign currency account are possible for employees performing their functions abroad (Dt 70 Kt 52).

Read about the nuances of accounting for currency transactions in the material “Accounting for currency transactions (PBU, postings).”

Reflection of acquiring in accounting

Profit from the sale of goods or provision of services through payment through a POS terminal is transferred to the company’s account only after a bank verification and deduction of commission.

To correctly reflect accounting transactions, use “Transfers in transit” - account 57. The transactions that occur in this case can be seen in the table:

Acquiring Accounting

| Dt | CT | Characteristics of an accounting transaction |

| 57 | 90.1 | Profit from sales paid by bank card is recognized |

| 90.3 | 68 | VAT is charged on the amount received |

| 51 | 57 | the amount of profit is credited to the organization’s bank account |

| 91.2 | 57 | reflects the company's expenses for acquiring services |

Depending on the method of accrual of income, its recognition will be carried out at different times. The accrual method implies the use of posting Dt 57 Kt 90.1, regardless of the period in which the funds were received, and considers the date of receipt of income as the date of sale. If the company uses the cash method, the amount is written off to income when the money from the sale is credited to account 51.

Subaccount 57.02

Subaccount 57.02 “Purchase of foreign currency” is intended to reflect both positive and negative exchange rate differences between the official rate and the rate at which foreign currency assets were actually purchased (bank commission); takes into account funds in national currency transferred for the purchase of foreign currency, while the paid foreign currency has not yet been received into the organization’s account and cannot be credited.

After the purchased foreign currency is credited to the account, there should be no balance on this sub-account.

Analytical accounting can be carried out by type of currency.