Account 71 in accounting: what is it used for

At the enterprise, by order of the manager, a list of accountable persons is introduced to whom money can be issued for established purposes. Since it is mandatory that after the activities for which employees were allocated money are carried out, a report is required to be submitted to the accounting department with documents confirming the expenditure attached, these persons are accountable.

The current rules for settlements with accountants are regulated by the procedure for conducting cash transactions. In addition to company employees, citizens engaged under contract agreements can also act as accountable persons.

The chart of accounts provides that account 71 must be used to account for settlements with accountable persons.

It reflects information about the occurrence of the employee’s debt to the organization for the amounts issued to him, as well as its repayment by submitting expenses according to the advance report.

The company’s debt to the accountable person is also reflected here if he spent his own funds for production purposes. By order of the manager, it is reimbursed in the approved amount upon acceptance of the advance report.

Important! Loans issued to employees cannot be taken into account in this account. For this purpose, a separate account 73 is used. Many business entities try to disguise loans provided to employees for short periods under the issuance of accountable amounts. However, this is a violation of the law.

Accountable amounts must be issued only for the purposes established in the order and the employee must report for them within a certain time frame or return the money. During inspections, the Federal Tax Service may identify these cases and assess additional taxes and fines.

To record settlements with accountable persons, you need to use journal order No. 7, which reflects during the month all expenses made by the accountable person, amounts issued for reporting, etc.

The role and significance of 71 positions for accounting

71 accounts are needed to keep track of issued and unspent accountable amounts. The latter are issued from the organization’s cash desk and provided that the employee has reported by submitting an advance slip on previously received advance funds.

In order to receive money on account, the employee must write an application addressed to the company management. After the period for which the designated amounts were issued has expired, the employee is required to submit reports on the purpose and amount of expenses within 3 days. That part of the resources that remains unused must be given to the organization's cash desk.

By nature, 71 positions are active. However, at the time of reporting, both a debit and a credit balance may be formed. In the latter case, we are talking about the organization’s debt to the employee due to the fact that the resources received under the report were not enough to cover the expenses incurred. The debit balance indicates the employee’s debt to the employer.

Analytics on the position is carried out for each issued accountable amount. Controlling such expenses makes it possible to reduce ineffective expenses of the organization.

Account characteristics

Synthetic accounting of settlements with persons to whom accountable amounts have been issued is organized on account 71. To answer whether this account is active or passive, you need to remember that its balance can be located either as a debit or as a credit. Thus, account 71 is an active-passive account with a double balance.

The balance at the beginning of the period in the debit of the account reflects the debt of the company's accountable persons for the money issued to them for established purposes. The account credit balance records the company's debt to the employee for expenses incurred at his own expense in the interests of the organization.

The debit of account 71 reflects the issuance of money for the purposes established by the enterprise or reimbursement to the employee of expenses approved by management that were previously made at his expense.

The credit of the account reflects the approved expenses of the accountable person, which are accepted by management, as well as the return of unspent funds to the cash desk or withholding them from the salary of the accountable person, if they are presented with an application for this method of repaying the debt.

To determine the ending balance, you must use the following algorithm:

- If the opening balance on account 71 is in debit, then you need to add the debit turnover on the account to it and subtract the amounts for the selected period on the loan. If you get a positive value, then the balance at the end will be a debit. Otherwise, it is reflected in the credit of the account.

- If the opening balance on account 71 is located in the credit of the account, then the turnover on the credit of the account should be added to it and subtract the total amount of movement on the debit of the account for the period under review. If the total value is greater than zero, it must be reflected as a credit to the account. A negative amount must be reflected in the debit of the account.

You might be interested in:

Account 03 in accounting “Profitable investments in material assets”, what is taken into account, correspondence of accounts, postings

Correspondence

Account 71 can participate in transactions with many accounts.

According to the debit of account 71, he can correspond to the credit of accounts:

- Account 50 - when issuing imprest amounts from the cash register;

- Account 51 - when transferring accountable amounts from a current account to a card;

- Account 52 - when issuing accountable amounts in foreign currency (for example, when traveling abroad);

- Account 55 - when issuing a report from special accounts;

- Account 76 - when issuing money, reporting according to the bank register;

- Account 79 - when issuing the account at the expense of the branch, separate division;

- Account 91 - when writing off exchange rate differences if the funds were issued in foreign currency.

By crediting the account, it can enter into transactions with the debit of the following accounts:

- Account 07 - when registering equipment for further installation purchased through accountable amounts;

- Account 08 - when reflecting costs (business trips, other costs) associated with the acquisition of non-current assets;

- Account 10 - when purchasing materials using imprest amounts;

- Account 11 - when purchasing animals for fattening using accountable amounts;

- Account 15 - when purchasing materials, if the accounting policy stipulates accounting using account 15;

- Account 20 - when writing off accountable amounts for the main production;

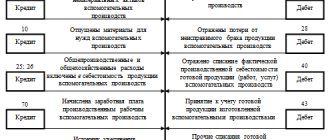

- Account 23 - when writing off accountable amounts for auxiliary production;

- Account 25 - when writing off accountable amounts for general production expenses;

- Account 26 - when writing off accountable amounts for administrative expenses;

- Account 28 - when writing off accountable amounts to correct a previously committed defect;

- Account 29 - when writing off accountable amounts for the costs of service and subsidiary farms;

- Account 41 - when reflecting the acquisition of goods through reporting;

- Account 44 - when writing off accountable amounts for the costs of selling products;

- Account 45 - when writing off accountable amounts for the purchase of goods that have not yet arrived at the organization;

- Account 50 - when returning unused imprest amounts to the cash desk;

- Account 51 – when returning unused imprest amounts to the current account;

- Account 52 – when returning unused imprest amounts to a foreign currency account;

- Account 55 – when returning unused imprest amounts to a special bank account;

- Account 70 - when deducting unreturned accountable amounts from wages (one-time deduction);

- Account 73 – when deducting unreturned accountable amounts from wages (multiple deduction);

- Account 76 - when closing a debt to a supplier for previously written off work or services;

- Account 79 - when transferring debt between branches and parent organizations;

- Account 91 - when reflecting a shortage of purchased materials within the limits of natural loss, when reflecting exchange rate differences when issuing a report in foreign currency;

- Account 94 - when reflecting a shortage, if the expenditure of the accountable amount is not confirmed by documents and it is not returned to the cash desk;

- Account 97 - when reflecting accountable costs that will be written off in future periods;

- Account 99 - when writing off accountable funds for liquidation of emergency situations and natural disasters.

Correspondence with other accounts

Account 71 is debited when money is issued to the employee on account. For this purpose, they mainly use account 50 if the money was issued from the cash register, and account 51 if the funds were transferred from the current account.

Account 71 is credited with the following accounting accounts:

- non-current assets;

- production process inventories;

- production process costs;

- goods and products;

- funds in cash equivalent;

- settlements with employees and other transactions;

- financial result.

Accounts I–IV of sections of the standard chart of accounts are used in correspondence with the credit of account 71 in the case of issuing accountable amounts for the purchase of materials, inventories and other material assets related to the non-current assets of the organization or the production and sales process.

Accountable amounts not paid on time are written off to the financial result of the enterprise (“Shortages and losses”). In the future, the accountant can reflect the amount of the employee’s debt to the organization in account 70 and write it off from the salary.

The procedure for issuing money for reporting

The issuance of funds to an employee can be carried out in several ways.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

The simplest and most common way is to issue money from the cash register. In this case, the cashier, at the time of issue, formalizes the operation with an expense cash order.

Until mid-2020, when issuing money, the employee must fill out an application for the issuance of the amount. This had to be done by any employee of the organization, including the director. Applications were allowed not to be filled out when reimbursing excess reporting and issuing daily allowances for business trips.

Since 2020, changes have been made to this procedure. The company can continue to use statements, or issue an order from the manager, which will indicate the full name. accountants, amounts and deadlines for reporting on funds received.

Attention! If there is no application or order, or if they are drawn up incorrectly, fines of up to 50 thousand rubles may be imposed on the company and responsible persons.

The application for the director should differ from the forms of ordinary employees - in it he does not ask for a report, but gives an order to perform this action.

The latest amendments to the procedure for cash transactions allow the issuance of a new amount if the employee has not yet reported the old one. Previously, such a step was prohibited.

In addition to cash, reports can also be issued by transferring from a current account to an employee’s card. For this step, he fills out an application and includes in it the bank details for making the payment.

If the application is not completed, the tax authority, upon inspection, will decide that income (salary) was transferred and will charge additional personal income tax on the amount. Also, the payment order must indicate that it is the issuance of the report.

If the issue is made to a card, then the employee can attach a receipt from the terminal, ATM, bank statement and similar forms as a supporting document. If the employee is on a business trip and an additional daily allowance is transferred to him, then there is no need to fill out another application. But you will need to report all amounts at the same time.

Attention! If the employee has not spent the accountable amount in full, then after completing the advance report, he must return the unused balance back to the cashier

What expenses can you give money for?

The legislative framework contains instructions for what purposes accountable amounts can be issued, these include:

- Payment for business trips and similar trips;

- Payment for services or work;

- Purchase of materials and goods;

- Incurring entertainment expenses;

- Other similar expenses.

An organization can establish the areas on which accountable persons have the right to spend the amounts issued to them by issuing an Accountability Regulation.

Important! The law prohibits the issuance of accounting funds for the acquisition of fixed assets. Also, accountable amounts cannot be used to make one-time transactions with organizations and entrepreneurs, the amount of which exceeds 100 thousand rubles.

Typical accounting entries

Let's look at how, in typical situations, accounting entries are made for reporting for dummies.

Purchasing materials through reporting

| Debit | Credit | Name of the situation |

| 71 | 50/1 | Money issued, report from the cash register |

| 71 | Materials were purchased for accountable amounts | |

| 19 | 71 | Accepted for VAT accounting on purchased materials |

| 10 | Purchased materials were released into production | |

| 50/1 | 71 | The person handed over the unspent balance of the accountable amount to the cashier |

| 71 | 50/1 | The accountable person was issued an overexpenditure on the accountable amounts from the cash register |

Travel expenses

| Debit | Credit | Name of the situation |

| 71 | 50/1 | Money was issued according to the cash register for a business trip |

| 20 | 71 | Expenses for purchasing travel tickets have been written off |

| 19 | 71 | Accepted for VAT accounting on purchased tickets |

| 44 | 71 | Hotel expenses and daily allowances written off |

| 19 | 71 | Accepted for VAT accounting for hotel stays |

| 50/1 | 71 | The accountable person returned the remaining funds to the cash desk |

Examples of typical transactions for account 71

| No. | Household contents operations | Debit | Credit | Foundation documents |

| 1 | Payment of cash to the account | 71 | 50 | Cashier's report, expense order |

| 2 | Transferred to the travel allowance report on a bank card | 71 | 51 | Bank statement, payment order |

| 3 | Funds were transferred to the corporate card account | 71 | 55 | Statement from special accounts |

| 5 | Accepted expenses for the advance report for the purchase of fixed assets | 08 | 71 | Certificate of acceptance of works and services |

| 6 | Materials purchased by the accountable person were capitalized | 10 | 71 | Invoices, transportation documents, acceptance certificate |

| 7 | The amount of expenses for production and economic needs is reflected | 20/26/44 | 71 | Advance report, job assignment, business trip report |

| 9 | Goods for resale purchased by an accountable person were capitalized | 41 | 71 | Advance report and invoices |

| 11 | Return of unspent funds to the cash desk | 50 | 71 | Cashier's report, receipt order |

| 12 | Debt accrued for amounts not returned on time by the accountable person | 73 | 71 | Advance report |

Let's look at practical examples with postings to account 71 for the issuance, expenditure and return of accountable funds.

Example 1. Reimbursement of overexpenses according to the advance report - postings

Employee of Romashka LLC Ivanov I.I. funds were allocated to the report in non-cash form in the amount of 2,500 rubles. (to a bank card) to purchase stationery. In fact, Ivanov I.I. spent 2,840 rubles. An advance report was drawn up for actual expenses and supporting documents (sales receipt) were attached to the report. The overexpenditure of funds on the advance report amounted to 340 rubles. The funds were credited to Ivanov I.I. to a bank card.

Romashka LLC has generated entries for account 71:

| Dt | CT | Description | Amount, rub. | A document base |

| 71 | 51 | To the bank card of Ivanov I.I. funds transferred for household needs | 2 500 | Payment order |

| 10 | 71 | The stationery purchased by I.I. Ivanov has arrived. by check without VAT | 2 840 | Advance report, sales receipt |

| 71 | 51 | To the bank card of Ivanov I.I. overspending amount credited | 340 | Payment order |

Example 2. Return of imprest amounts on an advance report - postings

Romashka LLC and Vasilek LLC concluded an agreement for the provision of transport services in the amount of 7,200 rubles, incl. VAT. To pay for services under the contract, employee of Romashka LLC Ivanov A.B. received a report for the amount of 7,500 rubles. After making settlements with Vasilek LLC, Ivanov A.B. I submitted the advance report and returned the remaining funds to the cashier.

The accountant of Romashka LLC generated the following entries:

| Dt | CT | Description | Amount, rub. | A document base |

| 26/44 | 60 | reflected in costs (RUB 7,200 - RUB 1,098) | 6 102 | Certificate of completion |

| 19 | 60 | The amount of VAT on the cost of transport services has been allocated | 1 098 | Certificate of completion |

| 68/2 VAT | 19 | The amount of VAT on the cost of transport services is accepted for deduction | 1 098 | Certificate of completion of work, invoice |

| 71 | 50/1 | From the cash register of Romashka LLC Ivanov A.B. received funds for reporting | 7 500 | Expense cash order, statement of the accountable person |

| 60 | 71 | The accounting reflects the payment for services made by Ivanov A.B. on behalf of Romashka LLC | 7 200 | Advance report, certificate of completion of work |

| 50/1 | 71 | The balance of unspent funds was returned to the cash desk of Romashka LLC (7,500 rubles - 7,200 rubles) by A.B. Ivanov. | 300 | Expense cash order, advance report, act of completed work |