The accrual of taxes and their payment is reflected in account 68 “Calculations for taxes and fees”. For more convenient accounting, account 68 is divided into several sub-accounts, each of which takes into account different taxes. Such a division will make accounting more transparent and make it clear which tax is owed to the budget, and which tax the organization owes. Similarly, account 69 “Calculations for social insurance and security” is divided into subaccounts. In the article we will talk about the features of accounting for account 68, and also consider typical transactions and examples of transactions with taxes and fees.

Count 68: features of use

Account 68 is used to reflect transactions for the calculation and transfer of taxes and fees that the organization pays to the budget of the federal and regional levels. As a rule, in account 68, enterprises post the amounts of obligations for value added tax (VAT), income tax (INP), property tax, etc.

The accrual of tax amounts is reflected in K68; when transferring funds to the budget and when accepting tax for deduction, D68 is used.

Let's look at typical wiring:

| Debit | Credit | Description | Document |

| 68 | 19 | The tax amount is written off as a credit (for the purchase of goods, services, works) | Consignment note, act |

| 68 | 50, 51, 55 | The tax amount is transferred to the budget | Payment order, cash order |

| 10, 15 | 68 | Inclusion in the cost of materials (stocks) is the amount of non-refundable tax | Packing list |

| 20, 23, 29 | 68 | The amount of accrued tax is taken into account in production expenses | Acts, invoices, limit-fence cards |

| 44 | 68 | Accrued tax is included in sales expenses | Acts, invoices, expense reports |

Key VAT transactions

When interacting with counterparties, for example, during the shipment of goods or the purchase of services, companies are faced with VAT calculations. In this case, accountants identify the following as basic operations for this payment:

- calculation of the amount of the designated type of obligatory payment;

- maintaining records of entry fees;

- deductions;

- adjustment of the amount of obligations for this type of payment;

- reimbursement of paid amounts from the state budget;

- transfer of funds as part of settlements for the designated payment to the treasury.

Video lesson: Account 68 in accounting.

Video lesson on basic operations on accounting account 68, key entries, practical examples. The lesson is taught by consultant and expert of the “Accounting for Dummies” website, chief accountant N.V. Gandeva. ⇓

You can download the presentation for the video lesson from the link below.

Download the presentation “Account 68 in accounting” in PDF format

| Buy ★ bestselling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Reflection of transactions with VAT

Depending on the type of activity, an enterprise can carry out various VAT transactions. We will consider the main such operations using examples.

VAT when making a contribution to the authorized capital of another organization

In January 2020, Yantar JSC purchased from Rubin LLC a batch of construction and repair materials worth 48,350 rubles, VAT 7,375 rubles. In March 2020, Yantar JSC acquired a stake in the authorized capital of Amethyst JSC. The cost of the share is 54,280 rubles. Construction materials previously purchased from Rubin LLC were transferred to pay off the debt on the contribution to the authorized capital of Amethyst JSC.

These transactions were reflected in the accounting of Yantar JSC with the following entries:

| Debit | Credit | Description | Sum | Document |

| 10 | 60 | Construction materials purchased from Rubin LLC have been received (RUB 48,350 – RUB 7,375) | RUB 40,975 | Packing list |

| 19 | 60 | The amount of VAT on purchased building materials is reflected | RUR 7,375 | Invoice |

| 68 VAT | 19 | VAT on the cost of building materials is accepted for deduction | RUR 7,375 | Invoice |

| 58 | 76 | The acquisition of a stake in Amethyst JSC was taken into account | RUR 54,280 | Contract of sale |

| 76 | 10 | Reflected the transfer of construction materials to pay off the debt on the contribution to the authorized capital of Amethyst JSC | RUB 40,975 | Transfer and Acceptance Certificate |

| 19 | 68 VAT | The amount of VAT on purchased building materials, previously accepted for deduction, has been restored | RUR 7,375 | Certificate of acceptance and transfer of construction materials, Invoice |

| 58 | 19 | The amount of VAT recovered when making a contribution to the authorized capital of “Amethyst” is taken into account | RUR 7,375 | Certificate of acceptance and transfer of construction materials, Invoice |

| 76 | 91.1 | The amount of income from the transfer of building materials is taken into account (RUB 54,280 – RUB 40,975) | RUB 13,305 | Certificate of acceptance and transfer of construction materials, Invoice |

| 68 Income tax | 99 PNO | The amount of permanent tax asset is taken into account (RUB 13,305 * 20%) | RUB 2,661 | Accounting certificate-calculation |

VAT on sales of goods

In April 2020, JSC Everest sold LLC Kazbek a batch of goods - 12 inflatable boats for fishing:

- selling price of one boat – 94,350 rubles, VAT 14,392 rubles;

- unit cost of goods – 73,150 rubles.

The accountant of Everest JSC reflected these transactions with the following entries:

| Debit | Credit | Description | Sum | Document |

| 45 | 43 | The cost of a batch of boats sold by Kazbek LLC was taken into account (RUB 73,150 * 12 units) | 877.800 rub. | Costing |

| 76 | 68 VAT | The amount of VAT is reflected on the cost of sales (RUB 14,392 * 12 units) | RUB 172,704 | Invoice |

| 51 | 62 | Funds have been credited from Kazbek LLC as payment for a batch of inflatable boats (RUB 94,350 * 12 units) | 1,132,200 rub. | Bank statement |

| 62 | 90.1 | The amount of revenue from the sale of boats is taken into account | 1,132,200 rub. | Packing list |

| 90.2 | 45 | The cost of boats sold is written off as expenses | 877.800 rub. | Costing |

| 90.3 | 76 | The amount of VAT on revenue is taken into account | RUB 172,704 | Invoice |

VAT on the amount of advances received

An agreement was concluded between JSC Stimul and LLC Rubikon for the supply of cabinet furniture worth RUB 1,143,850, VAT RUB 174,486. On January 12, 2016, the supplier JSC Stimul received an advance payment in the amount of 100% of the cost of furniture delivery. On January 15, 2016, furniture was shipped from the warehouse of Stimul JSC to Rubicon LLC.

In the accounting of Stimul JSC, the accountant made the following entries:

| Debit | Credit | Description | Sum | Document |

| 51 | 62.2 | Funds have been credited from Rubikon LLC as an advance payment for the supply of cabinet furniture | RUB 1,143,850 | Bank statement |

| 76 Advances received | 68 VAT | The amount of VAT on the prepayment received is taken into account | RUR 174,486 | Invoice |

| 62.1 | 90.1 | Furniture was shipped from the warehouse of Stimul JSC to Rubikon LLC. | RUR 174,486 | Packing list |

| 90.3 | 68 VAT | The amount of tax on the sale of furniture is reflected | RUR 174,486 | Invoice |

| 62.2 | 62.1 | The repayment of the debt of Rubicon LLC with the previously transferred advance is reflected | RUB 1,143,850 | Bank statement, delivery note |

| 68 VAT | 76 Advances received | The VAT amount is accepted for deduction | RUR 174,486 | Invoice |

VAT upon termination of the contract

In June 2020, JSC Europe entered into an agreement with LLC Asia to carry out work to repair the production line of workshop No. 2. The cost of the work (327,350 rubles, VAT 49,934 rubles) was transferred as an advance to the bank account of Asia LLC. In August 2020, the contract with Asia LLC was terminated, the work was not completed, and the funds were returned to the account of JSC Europe.

When recording transactions, the accountant of Asia LLC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 51 | 62 Advances received | Funds have been credited as an advance payment from JSC Europe for the repair of the production line of workshop No. 3 | RUR 327,350 | Bank statement |

| 62 Advances received | 68 VAT | The amount of VAT accrued on the advance received from JSC “Europe” | RUR 49,934 | Invoice |

| 68 VAT | 51 | The amount of VAT transferred to the budget is 1/3 of the amount of quarterly obligations (RUB 49,934 / 3 months) | RUR 16,644 | Tax return |

| 62 Advances received | 51 | Funds were transferred to JSC “Europe” as a return of a previously received advance | RUR 327,350 | Payment order |

| 68 VAT | 62 Advances received | The VAT amount is accepted for deduction | RUR 49,934 | Tax return |

VAT on free transfer of property

JSC “Mecenat” carried out a free transfer of diagnostic equipment to the “Health Center”:

- cost of equipment - 874,650 rubles;

- the price of diagnostic equipment according to the assessment report is RUB 1,112,420.

JSC “Mecenat” made the following postings:

| Debit | Credit | Description | Sum | Document |

| 91.2 | 41 | Transferred equipment is reflected in expenses | RUR 874,650 | Packing list |

| 91.2 | 68 VAT | The amount of VAT is taken into account (RUB 1,112,420 * 18% / 118%) | RUR 169,691 | Transfer and Acceptance Certificate |

What does account credit 68 show?

The debit reflects information on transferring taxes to the budget or reducing tax liabilities in another way, for example, by deducting VAT. So, the debit accumulates the VAT amounts written off from account 19. The debit of account 68 shows (or rather, the final balance) that there is an overpayment of taxes.

The credit balance of account 68 shows that the taxpayer has arrears in paying taxes. The credit balance is reflected in the liability side of the balance sheet in line 1520 (clause 20 of PBU 4/99).

According to the credit of account 68, all mandatory taxes and fees paid by this taxpayer are calculated. Thus, in correspondence with account 99 the amounts of income tax are credited, with account 70 - income tax, etc.

Postings on the credit of account 68 look like this:

- Dt 08 Kt 68 - tax assessment on land acquired for construction;

- Dt 15 Kt 68 - expenses for paying taxes when procuring materials are reflected;

- Dt 20 (23, 26, 29, 41, 44) Kt 68 - taxes and fees have been accrued;

- Dt 51 (55) Kt 68 - return of overpayment/reimbursement of taxes to the taxpayer’s account;

- Dt 70 (75) Kt 68 - income tax on employee earnings (dividends of founders) is withheld;

- Dt 90 Kt 68 - calculation of VAT and excise tax on the sale of inventory items;

- Dt 91 (98) Kt 68 - assessment of taxes on types of activities that are not the main ones;

- Dt 99 Kt 68 - calculation of income tax.

Accounting for income tax transactions

Let's look at an example of calculating and paying income tax (IPT).

Based on the results of the 3rd quarter of 2020, Topaz JSC received a profit of 1,941,800 rubles. Reflecting transactions with income tax in the 3rd quarter of 2015, the accountant of Topaz JSC made the following entries:

| Debit | Credit | Description | Sum |

| 99 | 68 NnP | The amount of conditional income tax is reflected in expenses (RUB 1,941,800 * 20%) | RUR 388,360 |

| 99 | 68 NnP | The amount of PNO is reflected in expenses | RUR 33,750 |

| 68 NnP | 77 | The resulting deferred tax liability was taken into account | 4,350 rub. |

| 77 | 68 NnP | Repayment of deferred tax liability is reflected | 2,150 rub. |

| 09 | 68 NnP | The resulting deferred tax asset was taken into account | 9,120 rub. |

| 68 NnP | 09 | The repayment of the deferred tax asset is reflected | RUR 3,430 |

To determine the amount of NNP, the accountant of Topaz JSC made the following calculation:

the amount of the current NNP is 425,600 rubles. ((388,360 rub. + 33,750 rub. – (4,350 rub. – 2,150 rub.) + (9,120 rub. – 3,430 rub.)).

This indicator corresponds to the information specified in the tax return.

Payment for NNP was reflected in the following entries:

| Debit | Credit | Description | Sum | Document |

| 68 NnP | 51 | The amount of NnP for the 3rd quarter of 2020 was transferred to the federal budget | RUB 42,560 | Payment order |

| 68 NnP | 51 | The amount of NnP for the 3rd quarter of 2020 was transferred to the local budget | RUR 383,040 | Payment order |

Subaccounts of account 68

68.1 – intended to reflect calculations for personal income tax.

68.2 – reflects information on the calculation and payment of VAT.

68.3 – intended for accounting for excise taxes.

68.4 – for the calculation and payment of income tax.

68.7 – the subaccount can be used by owners of vehicles paying transport tax.

68.8 – data on the calculation and payment of property tax is reflected.

Depending on the specifics of the activity and the applied tax regime, additional sub-accounts may be opened, for example:

68.11 – UTII

68.12 – simplified tax system

The debit of account 68 is intended to record paid amounts of taxes and fees transferred to the budget. The debit also indicates the VAT presented by suppliers and sent for deduction (reimbursement from the budget).

The debit of account 68 corresponds with the credit of accounts, which reflect the movement of funds (cash, non-cash), as well as with the credit of account 19 “VAT on purchased assets”.

The credit of account 68 is intended to reflect the amounts of accrued taxes that are subject to payment to the budget.

The credit to account 68 corresponds with the debit of various accounts, the choice of which depends on the type of tax.

Count 68 – active or passive?

All organizations, regardless of their status, are recognized as taxpayers. The status of settlements with the budget is reflected in account 68 “Calculations for taxes and fees”. Analysis of records gives an idea of accrued and fulfilled obligations, the presence of credit or debit taxes.

Based on the results of their economic activities, organizations and entrepreneurs must transfer part of their funds to the budget. The same responsibilities apply to individuals.

Tax accrual for legal entities reflects account 68 in the accounting department. Transactions for the payment of budget obligations are also formed by accounting account 68.

The records contain data on accrued and paid tax liabilities of the organization itself, reflect the status of taxes withheld from employees, and provide data on indirect taxes, including those declared for deduction.

Account 68 in accounting can have both a debit and a credit balance, depending on the nature of the debt. In case of overpayment of tax liabilities, the balance becomes a debit. If there is debt, on the contrary, the amount that needs to be transferred to the budget is located on credit balances.

Analytical accounting for account 68 is carried out separately for each type of tax. The final result is summed up, while for some payments the balance can take on a debit value, for others - a credit value.

Thus, account 68 belongs to the group of active-passive accounts. The balance for these entries is expanded, that is, the debit balance is reflected in the asset balance, while the credit balance is included in the liability.

Tax liabilities based on the results of economic activity are calculated using account 68. Each type of tax that an organization must transfer has its own subaccount.

According to the methods of calculation, the following types of taxes are distinguished:

- Property. They are paid for the ownership of any object - transport, land, property on the organization’s balance sheet. Taxes are calculated based on the value of the taxable base and do not depend on the results of the company’s activities.

- Indirect taxes are included in the cost of goods or services provided (VAT, excise taxes, customs duties). The final payer is considered to be the direct consumer.

- Taxes based on the results of economic activity. Calculated based on the profit received.

The credit of account 68 shows the accrued amounts that must be transferred to the budget. The data must coincide with the results of tax reporting - declarations, calculations. Debit 68 of account shows transactions to pay off debt or reduce the amount of tax liabilities.

Analytical accounting is carried out for all types of taxes. The correspondence of account 68 depends on the nature of the operation, as in some cases account 68 is characterized - active or passive. So, debit account. 68 is formed in the following cases:

- When paying to the budget - Dt 68 - Kt 51.

- If there is “input” VAT - Dt 68 - Kt 19 - deduct VAT for goods and services received.

For a loan, account 68 in accounting entries can generate the following:

- Dt 99 - Kt 68 - calculation of income tax;

- Dt 91 - Kt 68 - reflected VAT on sales for other (non-core) activities;

- Dt 90 - Kt 68 - VAT is included in the cost of the goods;

- Dt 70 - Kt 68 - personal income tax is charged when calculating wages, account 68 is used. 1.

When offsetting tax liabilities, the posting will look like this:

- Dt 68 ― Kt 68, according to count. 68 subaccounts will correspond to the types of taxes that are involved in the transaction. Tax crediting is carried out if there is confirmation from the tax inspectorate within the budgets of one type (federal, regional, local).

Example 1

Salary accrued in the amount of 45,000 rubles. Withheld and transferred to the personal income tax budget in the amount of 5850 rubles. To reflect personal income tax in transactions, account 68 1 is used:

- Dt 26 - Kt 70 - 45,000 rubles - wages accrued;

- Dt 70 - Kt 68 1 - 5850 rubles - personal income tax withheld;

- Dt 68 1 - Kt 51 - 5850 rubles - personal income tax is transferred to the budget.

Example 2

Goods were purchased for the amount of 47,200 rubles, including VAT 18% 7,200 rubles. Products worth 88,500 rubles were manufactured for sale, including 18% VAT of 13,500 rubles. It is necessary to transfer tax in the amount of 6,300 rubles to the budget. VAT is reflected as 68 subaccounts 2.

- Dt 26 - Kt 60 - 40,000 rubles - goods from the supplier have been received;

- Dt 19 - Kt 60 - 7200 rubles - “input” VAT is reflected;

- Dt 62 - Kt 90 - 88,500 rubles - sales of products to the buyer;

- Dt 90 - Kt 26 - 75,000 rubles - reflects the cost of goods sold excluding VAT;

- Dt 90 - Kt 68 2 - 13,500 rubles - VAT is charged when selling goods to customers;

- Kt 68 2 - Dt 19 - 6300 rubles - the amount of VAT payable.

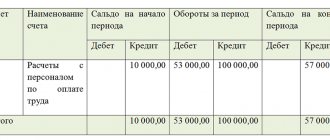

Analysis of account 68

The status of tax payments for an enterprise can be seen in more detail by analyzing the subaccounts to account 68. Each tax or fee corresponds to a separate subaccount, and calculations are also carried out separately from each other. The current list is fixed in the accounting policy of the subject; the chart of accounts 68 account can be divided as follows:

- 68 01 accounting account reflects the status of personal income tax payments for employees;

- 68 02 - invoice reflecting accrued VAT;

- 68 03 - excise taxes;

- 68 04 - income tax;

- 68 06 - land tax;

- 68 07 - transport tax;

- 68 08 - tax on property of organizations;

- 68 10 - other payments to the budget;

- 68 11 - UTII;

- 68 12 - tax paid in connection with the application of the simplified tax system.

Subaccounts 68 of the accounting account are used depending on the type and nature of the activity of the economic entity. The presented list can be expanded or shortened.

The balance sheet for account 68 contains summary information and can be considered both as a whole for the organization’s obligations, and separately for each type.

Account 68 is used to summarize data on payments of an enterprise/individual entrepreneur to the state budget for taxes and mandatory fees. Accrued and payable amounts of taxes are reflected in the credit of the account, and the amounts of transfers to the budget are reflected in the debit.

Based on this, the question arises, is account 68 active or passive? Since it can have both a credit and a debit balance at the end of the reporting period, the account is active-passive. Let us further understand in detail what the turnover on the debit and credit of the account shows and what conclusion can be drawn about the final balance that is formed at the end/beginning of the reporting period.

Business operations in account 68 are reflected in the context of emerging tax obligations. Accounting for compulsory insurance premiums, which are paid to the state budget and controlled by the tax authorities, is made on account 69.

All organizations, regardless of their status, are recognized as taxpayers.

The status of settlements with the budget is reflected in account 68 “Calculations for taxes and fees”.

Analysis of records gives an idea of accrued and fulfilled obligations, the presence of credit or debit taxes.