Account 70: active or passive (and what is it used for in accounting)?

Account 70 is used to account for payroll settlements with personnel.

But first of all, let’s answer the question: is account 70 active or passive, so that we know what types of objects are accounted for on it and how they are related to the corresponding accounts.

The account in question is a passive account, since it reflects the company's obligations to pay salaries as a liability. Account credit 70 shows salary accruals. That is, the loan reflects the amount of liabilities. As liabilities increase, credit increases (this is one of the characteristics of a passive account).

The debit of account 70 shows:

- repayment of obligations reflected on the credit side of accruals (that is, reflects salary payment transactions);

- repayment of obligations related to salary deductions (tax, alimony, compensation for damage) - the employer fulfills these obligations as the final “collector” of the debt.

You can learn more about the essence of debit and credit and the criteria for classifying an account as passive or active in the article “Rules for making entries in accounting.”

Let's take a closer look at exactly which entries are recorded in the debit and credit of account 70 in practice.

Let's start with the credit side of account 70 of accounting.

Interaction with other accounts

Based on the extensive classification of payments and wage deductions, a large number of items of settlements with employees are distinguished. That is why account 70 corresponds with the vast majority of other accounts. We list the main ones:

- By loan — 20, 23, 25, 26, 28, 29, 44, 69, 84, 96;

- By debit — 50, 51, 52, 55, 68, 69, 71, 73, 76, 79, 94.

Receipt of wages by employees in kind is documented by posting to accounts 70 and 90. From the debit of account 70 to the credit of account 90 “Sales”, the amount of wages equal to the amount of goods issued is written off. And also from the debit of account 90 to the credit of account 43 “Finished products”, the transfer of goods (materials, products) to employees is registered.

What does account credit 70 show: salary postings

Payroll in an organization includes, in fact, the only group of operations that are shown in account 70 - those related to the payroll itself on the basis of employment or civil contracts (vacation pay, sick pay at the expense of the employer).

Salary accrual is shown by posting Dt 20 (23, 25, 26, 44...) Kt 70. On account 70, the liability increases - by the amount of the obligation to pay wages. An asset increases in the expense account—in the form of payroll expenses.

The posting amount corresponds to the total amount of wages including personal income tax. This is due to the fact that de jure tax is paid on the income of the employee himself. Personal income tax may not be charged if the employee receives a tax deduction during the billing period.

The following accounts can be used to account for labor costs:

- 08 (if wages are accrued to employees involved in the construction (creation) of an OS facility);

- 23 (if calculations are carried out at auxiliary production);

- 25 (if salaries are paid to employees of service departments);

- 26 (if salaries are paid to management and managers);

- 44 (if the salary is paid to the sales department or in a trading company);

- 96 (if vacation pay is paid from the reserve).

Note that transactions related to the calculation of insurance premiums are not shown in account 70, despite the fact that the very fact of calculating these contributions is associated with the payment of wages. The fact is that the employer pays the contributions de jure at his own expense, without deducting them from the employee’s salary itself.

Basic entries for contributions:

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

- Dt 20 (23.25...) Kt 69 (contributions accrued);

- Dt 69 Kt 51 (contributions transferred to the budget).

In this case, correspondence between accounts 70 and 69 is possible. For example, if there is a payment of sick leave on account of subsequent compensation from the Social Insurance Fund, then this is shown by posting Dt 69 Kt 70.

Now let's look at the postings to account 70 by debit.

Examples of postings to account 71

Next, using the example of several standard transactions, we show how we write off 71 accounts and what happens to the account balance 71.

| On the day of issue of money for reporting | |

| Issuing money against a report from the cash register | Dt 71 – Kt 50-1 |

| Transferring money to an employee’s bank card for reporting | Dt 71 – Kt 51 |

| As of the date of approval of the advance report | |

| Payment made by an accountable person for goods, work, services | Dt 60, etc. – Kt 1 |

| Daily allowances for the time spent on a business trip are recognized as an expense | Dt 20 (91-2, etc.) – Kt 71 |

| As of the date of final settlement of outstanding amounts issued | |

| The overexpenditure was paid according to the advance report from the cash register | Dt 71 – Kt 50-1 |

| Overspending on the advance report is transferred to the accountant’s bank card | Dt 71 – Kt 51 |

| The unspent balance of accountable amounts was returned to the cash desk | Dt 50-1 – Kt 71 |

| The unspent balance of accountable amounts is transferred from the accountable person’s bank card to the organization’s current account | Dt 51 – Kt 71 |

What does the debit of account 70 show: postings

On the debit side of account 70 the following are recorded:

- Withholding personal income tax from wages.

The posting used here is: Dt 70 Kt 68 (13% (or 30% if the physicist is a non-resident) of the amount reflected in the accrued wages). The amount of salary payable on account 70 decreases, because the employer, being a tax agent, withholds the calculated personal income tax, increasing the credit balance on the account. 68 (personal income tax subaccount).

The subsequent transfer of personal income tax to the budget is reflected by posting Dt 68 Kt 51. Other deductions from wages are also possible. For example, alimony under a writ of execution:

- Dt 70 Kt 76 - alimony withheld;

- Dt 76 Kt 51 - alimony is transferred to the recipient.

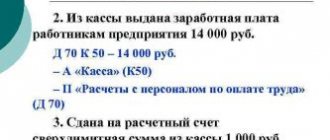

- Payment of wages.

Posting Dt 70 Kt 51 (if the salary is issued to the current account) or Dt 70 Kt 50 (if the salary is issued in cash from the cash register). The amount to be issued is the one that remains on the credit of account 70 (credit balance), i.e. minus personal income tax (and other deductions, if any).

In practice, debit and credit entries can be visualized using the account balance sheet. Let's consider its specifics.

How debits and credits are displayed

The debit includes paid amounts of bonuses, wages, benefits, accrued taxes, as well as deductions under writs of execution, income from participation in the capital of the company, and others. If the accrued amount is not paid to the employee on time, then it begins to be reflected in the debit of account 70 “Settlements with personnel for wages” and in the credit of account 76 “Settlements with various debtors and creditors.”

Debit

Corresponds by debit with the accounts:

- related to cash accounting;

- taking into account settlement transactions. These include 66-69, 73, 76 and 79;

- employees for the formation of financial results 90, 91, 93, 94.

All debit movements mean reducing the company's debt to employees or collecting amounts for taxes or fines.

The following amounts are included in the credit of account 70:

- Payments assigned to employees in correspondence with the accounts of production costs or sales expenses, depending on the activities of the organization.

- Remuneration generated from the reserve for vacation pay and remuneration for long service, if this is provided for at the enterprise. This payment is made once a year in correspondence with account 96 “Reserves for future expenses”.

- Social insurance benefits pensions and other similar amounts. Reflected in correspondence with account 69 “Calculations for social insurance and security”.

- Income from participation in the capital of the company. Accrued in correspondence with account 84 “Retained earnings”.

All entries in which account 70 is listed for the loan show the accrual of salaries to employees, the payment of bonuses and benefits. The loan corresponds with the accounts:

- taking into account production costs;

- keeping records of finished products and goods, 44;

- cash accounting, 50;

- social insurance contributions, which include 69, 76, 77, 79;

- reflecting financial results, 90, 91, 96, 97;

- capital accounting, 84.

How is the balance sheet for account 70 (and the account card) used?

One of the main tasks of using turnover is to summarize information about payroll settlements with employees (according to the debit and credit of account 70 of accounting) during the billing period (for example, a month). To consider the “analytics” of the account both for the organization as a whole and for settlements with each employee, you should use the account card.

A typical balance sheet for account 70 reflects:

- The balance (debit or credit) of the account at the beginning of the billing period.

- Debit and credit turnover during the billing period.

- Balance at the end of the billing period.

To calculate the balance at the end of the period, you need to add the credit turnover for the period to the opening balance and subtract the debit turnover for the period under consideration.

Example of a balance sheet for account 70:

Many accounting programs, for example 1C, implement the function of generating an account card 70. It shows all correspondence on account 70 during the month (with analytics for each corresponding account - for example 20, 51).

***

Account 70 in the accounting department reflects transactions on accruals and payments of wages. For credit - accruals, for debit - payments and deductions.

Characteristics of account 71

71 accounting accounts are considered active-passive accounts. This means that account balances can have both a debit and a credit balance at the end of the reporting period. This means that at the end of the month the debt may be registered with the employee. For example, a subordinate has just received an advance and has not yet had time to report.

The debt may also be attributed to the company. For example, if an employee spent his own funds to provide for business needs or on a business trip. Overexpenditure is reflected in accounting after the employee has provided an advance report and documented his expenses.

Postings to account 70 for payroll

There are basic and additional wages. Depending on the type of remuneration, accounting entries are generated.

- Calculation of wages to employees and attribution to production costs: time-based and piece-rate wages, etc.

Dt 20;25;26;44 Kt 70

Let’s say wages have been accrued to employees of the main production of a bakery in the amount of 800,000 rubles, to storekeepers in the amount of 30,000 rubles, to salespeople in a production store in the amount of 40,000 rubles, and to administrative and management personnel in the amount of 200,000 rubles.

The bakery accountant will make the following entries in account 70:

| Dt | CT | Amount, rub | A document base | |

| 20 | 70 | Salaries accrued to bakery employees for main production | 800 000 | Payroll |

| 25 | 70 | Salaries paid to storekeepers | 30 000 | Payroll |

| 44 | 70 | Salaries accrued to store salespeople during production | 40 000 | Payroll |

| 26 | 70 | AUP salary accrued | 200 000 | Payroll |

- Accrual of vacation pay at the expense of the previously created reserve: Dt 96 Kt 70 – amount of vacation pay.

- Calculation of temporary disability benefits from the social insurance fund: Dt 69.1 Kt 70.

- Financial assistance was accrued from net (retained) profit: Dt 84 Kt 70.

- Accrued to the salaries of employees for the construction of an OS facility and attributed to the costs of capital implementation. investments: Dt 08 Kt 70.

- Accrued to wages of employees for dismantling fixed assets and charged to other expenses: Dt 91 Kt 70.

Postings to account 70 for salary deductions

The accounting department of an enterprise not only carries out salary calculations, but also deductions and deductions from it. Let's look at the main types of deductions.

Personal income tax – personal income tax

The object of taxation is the income received by the taxpayer. When determining the tax base, all taxpayer income received both in cash and in kind, as well as income in the form of mat. benefits. Posting Dt 70 Kt 68 - withheld from salary personal income tax for payment to the budget.

Let's say a salary is accrued in the amount of 30,000 rubles. The employee has two minor children.

This means that, according to current legislation, an employee has the right to standard tax deductions in the amount of 1,400 rubles. for 1 child. Let's do the calculation: (30,000 – (1400 *2))* 13% = 3,536 rubles.

The posting will take the following form: Dt 70 Kt 68 amount 3,536 rubles.

Withholding of alimony under writs of execution

The basis for withholding alimony is writs of execution, as well as a written statement from the employee about the voluntary payment of alimony. The amount of alimony depends on the number of minor children: for one child – 25%, for two children – 33%, for three or more – 50%

Collection of alimony is made from all types of income and remuneration, both from the main and part-time work, as well as from dividends.

A posting is generated: Dt 70 Kt 76 – withheld from salary according to writs of execution in favor of the claimant.

Compensation for material damage

The basis is acts and decisions of judicial authorities. For example, if an employee is found guilty of committing an accident and, by a court decision, is obliged to pay the victim a certain amount of damage, then the following entry is generated: Dt 70 Kt 73.2 - withheld from salary to compensate for mat. damage.

Repayment of debt on accountable amounts

The basis is advance reports and data from railway station No. 7. If an employee has not reported for the amount previously given to him on account, then the accountant has the right to deduct it from the salary by posting Dt 70 Kt 71 - the balance of the accountable amount is withheld from the salary.

Prepaid expense

Some enterprises issue advance payments to employees in the middle of the current month. The advance amount should not exceed 50% of the salary minus personal income tax. The advance is issued from the cash register according to the payroll, on the basis of which a cash receipt order is drawn up. Reflected by posting Dt 70 Kt 50 - salary issued from the cash register to employees. When paying wages for the month, the accounting entries are repeated, only the amount changes.

Payment of wages in kind

In this case, the following transactions are generated:

- Dt 70 Kt 90 (91) – PO was paid for the amount of products, goods, materials issued in kind at sales prices, including VAT;

- Dt 90 (91) Kt 43 (41, 40) – reflects the sale of goods, products, etc. employees towards their salaries.

If it is impossible to pay wages on time

If it is impossible to pay wages on time, they must be deposited, that is, deposited by posting Dt 70 Kt 76.4 – salary deposited.

On the payroll, opposite the full name of those who did not receive wages, it is stamped or handwritten “deposited”. The cashier closes the payroll with two amounts: rubles paid and rubles deposited. This entry is certified by the cashier’s signature, after which the payroll is transferred to the accounting department.

The accountant, having checked it for the amount of the paid salary, issues a cash order, its number is recorded in the payroll. And for the amounts of deposited wages he writes out a register of unpaid wages. Then the data is transferred from the register to the ledger for recording deposited amounts.

The enterprise must deposit the deposited wages into a current account indicating the purpose of the contribution “Deposited wages”.

The procedure for calculating and accounting for deductions from wages

— D 70 K 71 – accountable amounts that were not returned in a timely manner were withheld from wage accruals;

- D 70 K 73 - amounts for material damage caused were withheld from wage accruals.

To account for the amounts of taxes withheld from citizens in favor of the state budget, account 68 “Settlements with the budget” is used. This account is passive. The account balance reflects the amount of debt the enterprise owes to the budget, debit turnover - the amounts transferred to the budget to repay the debt; loan turnover - the amount of taxes withheld from the wages of workers and employees.

2.5. Accounting for contributions to social protection funds and their use

The rights of citizens to various types of social protection (material support for illness, old age, disability, etc.) are enshrined in the Constitution of the Russian Federation. In accordance with the Labor Code and regulatory documents of the Ministry of Finance of the Russian Federation and the Ministry of Labor of the Russian Federation, social protection funds are created without deductions from employees’ wages. Currently, the following social protection funds have been created in the Russian Federation: a pension fund, a social insurance fund, a compulsory health insurance fund and an employment fund.

Contributions to these funds are mandatory for all enterprises, institutions and organizations that are legal entities.

The procedure for the formation and use of contributions to the Pension Fund of the Russian Federation.

Insurance contributions to the organization's pension fund are charged on all types of payments accrued to workers, as well as accrued to individuals under civil contracts, the subject of which is the performance of work and provision of services, and under copyright contracts.

Payers of contributions to the Pension Fund are:

— enterprises, organizations and institutions, regardless of their form of ownership, carrying out business or other activities on the territory of Russia;

— farms and tribal and family communities engaged in traditional economic sectors;

- citizens, including foreigners, who use hired labor in their private households and act as employers;

— citizens, including foreigners, registered as entrepreneurs and carrying out their activities without forming a legal entity;

- citizens working under direct contracts with foreign enterprises that do not have permanent representative offices in Russia and are registered as entrepreneurs without forming a legal entity.

If a citizen is employed, then contributions for him are obliged to be calculated and paid by the employer.

Public organizations of disabled people and pensioners, as well as enterprises, associations and institutions owned by them, created to implement the statutory goals of public organizations, are exempt from paying contributions to the Pension Fund. The exemption must be confirmed by a decision of the manager of the Pension Fund branch at the payer’s location.

Contributions to the Pension Fund of the Russian Federation are charged by payers for all types of remuneration for work in cash or in kind for all reasons that are included in the calculation of pensions.

Currently, contributions amount to 28% of the taxable base and are included in production costs (distribution costs).

Contributions are calculated before deduction of all taxes and withholdings, that is, from the accrued amount. When accruing debt on contributions to the Pension Fund from taxable wages, the following entry is made in the accounting:

For April 2004:

D 20.1.1 K 69-2 - 2819.04 rubles.

D 20.1.2 K 69-2 - 5790.40 rub.

D 25.1 K 69.2 – 2310.84 rub.

D 96.1 K 69.2 – 2664.09 rub.

Insurance premiums for payments included in the cost (costs) are also included in the cost and are accrued from the same sources as the payments themselves.

Transfers of contributions to the Pension Fund of the Russian Federation are made only through non-cash payments and are reflected in the accounting records as follows:

Dt 69-2 Kt 51 15881.6 rubles.

Quarterly, before the 30th day of the month following the reporting quarter, the payer’s accounting department compiles and submits to the Pension Fund of the Russian Federation branch at the location of the enterprise a “Settlement sheet for insurance contributions to the Pension Fund of the Russian Federation.”

The basis for drawing up the “Payment Sheet” is the data from the general ledger and primary accounting.

Go to page: 3

Accounting for transactions on account 70

Account 70 records transactions for all types of remuneration carried out by the enterprise in favor of its employees, including:

- salaries, bonuses, bonuses;

- sick leave, vacation pay, benefits;

- pensions for working pensioners, etc.

Depending on the department in which the employee is involved, wages and other payments may be reflected in the following records:

| Dt | CT | Description |

| 20 | 70 | Reflects the calculation of wages for workers in the main production |

| 23 | 70 | Reflects the calculation of wages for workers in auxiliary production |

| 29 | 70 | Reflects the calculation of wages for service production workers |

| 44 | 70 | The calculation of salaries for employees providing the sales process (sales division, sales department, etc.) is reflected. |

Payments to employees are recorded in the following records:

| Dt | CT | Description |

| 70 | 50 | Payment through the cash register is reflected based on the expense order and payslip |

| 70 | 51 | The transfer of funds to employee card accounts is reflected (based on a bank statement) |

| 70 | 55 | The transfer of funds from a special bank account is reflected (based on a bank statement) |

What is account 70 used for in accounting?

Account 70 “settlements with personnel for wages” is used according to the Chart of Accounts to reflect on it all wage settlements for both employees carrying out activities under employment contracts, and under contracts for the provision of services with individuals.

This account accumulates information on salary calculation in all its components:

- salary payment;

- bonuses;

- additional payments;

- vacations;

- compensation;

- payment of benefits and financial assistance, etc.

With the help of this information, the administration can make the necessary decisions on labor costs. This account summarizes the salaries of employees in all departments of the company. On the other hand, depending on the corresponding account, it is possible to establish labor costs for each structural unit.

This reflects information about the existence of existing debts, both of the employee for overpaid wages, and of the enterprise itself for wages that were not paid on time.

Attention! Account 70 also reflects settlements with the founders, who are also employees of the company, for dividends accrued to them.

Payment of salaries to branch employees

On September 30, 2015, the branch of Metallurg LLC paid salaries to employees:

- workers of the metal rolling shop - 412,500 rubles;

- economists of the financial department - 194,300 rubles.

On October 3, 2015, the branch received funds from Metallurg LLC to make payments.

The accountant of the head office of Metallurg LLC made the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 20 | 79.2 | Salaries accrued to employees of the branch's metal rolling shop | 412,500 rub. | Payroll |

| 26 | 79.2 | Salaries accrued to employees of the financial department of the branch | 194,300 rub. | Payroll |

| 79.2 | 51 | Funds for paying salaries were transferred to the branch (RUB 412,500 + RUB 194,300) | 606,800 rub. | Payment order |

In the accounting of the branch of Metallurg LLC, salary payments are reflected by the following entries:

| Dt | CT | Description | Sum | Document |

| 20 | 70 | Salaries accrued to employees of the branch's metal rolling shop | 412,500 rub. | Payroll |

| 26 | 70 | Salaries accrued to employees of the financial department of the branch | 194,300 rub. | Payroll |

| 79.2 | 20 | Expenses for paying wages to employees of the metal rolling shop are included in settlements with the head office | 412,500 rub. | Payroll |

| 79.2 | 26 | Expenses for paying salaries to employees of the financial department are included in settlements with the head office | 194,300 rub. | Payroll |

| 51 | 79.2 | Funds have been credited from the head office to pay salaries | 606,800 rub. | Bank statement |

| 50 | 51 | Funds were withdrawn from the current account to pay salaries | 606,800 rub. | Bank statement, cash receipt order |

| 70 | 50 | Salaries were paid to employees of the metal rolling shop and financial department through the cash register | 606,800 rub. | Account cash warrant |

Calculation of salaries for employees of various departments

LLC "Rukodelnitsa" is engaged in the production of equipment for sewing workshops. Workers of Rukodelnitsa LLC are busy constructing a building that is planned to be used as a warehouse. Employees of Rukodelnitsa LLC have the opportunity to visit the swimming pool for free, which is listed on the company’s balance sheet.

In August 2020, a fire occurred in one of the production workshops of Rukodelnitsa LLC.

Based on the results of August 2020, employees of Rukodelnitsa LLC received the following salaries:

- workers of production workshops – 418,500 rubles;

- sales department employees – 212,300 rubles;

- workers involved in the construction of a building for a warehouse - 77,400 rubles;

- employees servicing the pool - 32,000 rubles;

- workers who eliminated the consequences of the fire - 88,200 rubles;

- employees of management departments – 133,800 rubles.

The accountant at Rukodelnitsa LLC reflected the salary calculation transactions with the following entries:

| Dt | CT | Description | Sum | Document |

| 20 | 70 | Reflects the calculation of wages for workers in production workshops | 418,500 rub. | Payroll |

| 44 | 70 | Reflects the calculation of salaries for sales department employees | 212,300 rub. | Payroll |

| 08 | 70 | Reflects the calculation of wages for workers involved in the construction of a building for a warehouse | 77,400 rub. | Payroll |

| 91.2 | 70 | The calculation of wages for workers who eliminated the consequences of the fire, as well as for employees servicing the pool (RUB 32,000 + RUB 88,200) is reflected. | 120,200 rub. | Payroll |

| 26 | 70 | Reflects the calculation of salaries for employees of management departments | RUB 133,800 | Payroll |