Is it possible not to draw up a wage regulation and can they be punished for this?

The wage regulations are one of the employer’s internal documents.

It is necessary not only to describe the applied system of calculation and remuneration for labor, but also to consolidate the system of material incentives and rewards for employees in the organization. This provision justifies the legality of including salary costs in tax expenses. Its absence sharply reduces the chances of proving to tax authorities the legality of reducing the tax base for income tax or the simplified tax system for bonuses, additional payments, compensation and other similar payments.

Find out whether the employer is obliged to pay a bonus by following the link.

Given these advantages of the provision, taxpayers in most cases spare no time and effort in developing it.

You can do without such a document only in one case - if all the terms of remuneration are described in employment contracts with employees or in a collective agreement, or all employees of the company work under conditions that exclude any deviations from the usual (do not work overtime, at night and on holidays ). In this case, there is no need to draw up a separate provision.

The legislation of our country does not contain an unconditional requirement to develop and apply wage regulations for each employer. There are no requirements for the form, type and content of this document. Therefore, there will be no punishment for the arbitrary form of the provision or its absence as a separate document.

And if changes are made to working conditions, disputes may arise with both employees and workers. Find out how to correctly approve the wage regulations and avoid claims from a consultation with an expert from the Ministry of Labor. To do this, go through a quick registration in the ConsultantPlus system and get trial access for free.

Regulations on remuneration and bonuses for employees: is it necessary to combine

Since there are no legal requirements on this issue, in different companies you can find a variety of options for drawing up internal documents related to the calculation and payment of wages to employees.

For example, the regulations on wages are drawn up as a separate document, and the conditions for bonuses are prescribed in another local act - the regulations on bonuses and material incentives for employees. It is possible to provide for other salary provisions: on wage indexing, summarized recording of working hours, etc.

Some employers are limited to approving only one document - a collective agreement, which stipulates all the necessary aspects of the salary policy.

Read about the purpose and features of a collective agreement in the material “Collective agreement as a form of social partnership.”

The decision on whether to prescribe all the necessary salary nuances in one document or formalize each significant issue in separate provisions remains with the management of the company or the employer-individual entrepreneur. If a decision is made to combine the issues of the payment system and the features of bonuses in a single provision, it is necessary to spell out all the nuances in this document as scrupulously as possible.

To learn about what bonuses and rewards can be for employees, read the article “What are the types of bonuses and rewards for employees?” .

Who should make the position

Existing rules establish that the Regulation on remuneration or other local act in the field of regulating the calculation of wages becomes mandatory for development and adoption if a business entity has concluded employment contracts.

In general, the Regulations may also be an optional document if issues related to the regulation of wages are reflected in the Internal Regulations, the Collective Agreement and other regulatory documents.

Due to the fact that labor law provisions provide for several options for resolving issues, it must be established which of them is applied in a given organization. This can only be done by issuing an appropriate local regulatory act valid within the company.

Attention: the importance of specifying payroll is of particular importance when the working conditions of employees differ from normal ones.

The company administration makes the decision on which specific regulatory act and how many should be issued independently.

In addition, it is typical for small businesses to combine several in one act. For example, such an entity may have a Regulation on remuneration and bonuses for employees, which includes both the Regulation on payment and the Regulation on bonuses.

In large enterprises with a significant number of workers, similar regulations are issued separately. Therefore, a large company can simultaneously have a significant number of local regulatory documents.

Attention: in these cases, the rules of law for regulating wages may be contained in several acts at once. Therefore, when compiling them, it is important to check their consistency, since in case of contradiction, the documents may be declared invalid.

The development of the Regulations is carried out by specialists from the economic department, after which the project is agreed upon with the trade union bodies, etc.

Main sections of the regulations on remuneration and bonuses for employees

The regulations on wages and bonuses for employees may include, for example, the following sections:

- general terms and definitions;

- description of the current form and wage system in the company;

- terms and forms of salary payment;

- employer's liability for delayed wages;

- duration of the provision;

- “Additional payments” table;

- “Compensation” table;

- table "Allowances";

- “Premiums” table;

- table “Other employee benefits”.

The general section provides a link to the regulatory documents in accordance with which this provision was developed. Then a decoding of the basic concepts and terms used in the provision is given, so that any employee, when reading it, would not have difficulty understanding the contents of the document. The same section indicates who this provision applies to (employees under an employment contract, part-time workers, etc.).

The second section is devoted to a description of the wage system (WRS) adopted by the employer (time-based, piece-rate, etc.). If different SOTs are provided for different categories of workers and employees, a description of all applicable systems is given.

The section intended to describe the terms and forms of salary payment indicates the dates for the payment to employees of their earned remuneration (advance payment and final payment). You cannot limit yourself to a one-time payment of salary income.

See also “Advance payment – what percentage of salary?” .

IMPORTANT! Remuneration for labor must be paid at least 2 times a month (Part 6 of Article 136 of the Labor Code of the Russian Federation, letter of Rostrud dated May 30, 2012 No. PG/4067-6-1). Violators of this requirement may face administrative liability under clause 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (fine from 30,000 to 50,000 rubles for a company, from 10,000 to 20,000 rubles for its officials and from 1,000 to 5,000 rubles for individual entrepreneurs). Also keep in mind that the payment period must be determined by a specific date; you cannot create a “fork” of dates.

However, paying wages more than 2 times a month will not violate any norms. Read more about this in the material “Salaries can be paid more than twice a month .

The same section reveals the form of remuneration: in cash through a cash register or by transfer to employees’ bank cards, as well as the percentage of possible payment of part of salary income in kind.

A separate paragraph reflects information related to the employer’s responsibility for delayed wages.

IMPORTANT! The employer's financial liability for delayed wages is provided for in Art. 236 of the Labor Code of the Russian Federation, which sets the minimum interest rate (not lower than 1/150 of the refinancing rate of the Central Bank of the Russian Federation from amounts not paid on time for each day of delay).

The regulations may establish an increased amount of compensation.

The main text part of the provision ends with a final section, which indicates the period of its validity and other necessary conditions.

Tabular part of the position

In the structure of the position from the example considered, all additional payments, compensations and bonuses are placed in separate tabular sections. This is not necessary - the text form of presentation can also be used. In this case, this method of structuring information was used for the purpose of clarity and ease of perception.

For information about what payments form the remuneration system, read the article “Art. 135 of the Labor Code of the Russian Federation: questions and answers" .

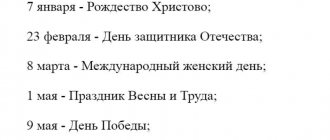

The “Additional payments” table contains a list of those salary supplements that are applied by the employer. For example, these could be additional payments related to overtime work, for night work or the employee’s work on a holiday, and other additional payments.

For each type of additional payment, the corresponding interest rates are indicated in the table. For example, for night work the surcharge is 40% of the hourly rate (for hourly workers). The necessary explanatory data is indicated in a separate column of the table (it may be called “Note”). For example, for additional payment for night work, this column shows the period considered night: from 22:00 to 6:00.

The structure of the “Compensation” table is similar to that described above. The listed compensations (for example, for harmful and dangerous working conditions, upon dismissal, reduction, etc.) are supplemented with the corresponding amount or calculation algorithm.

The “Additions” table is present in the regulations only if this type of monetary supplement to the employer’s salary exists. An example is the bonus for length of service. In this case, it is necessary to explain in detail for what period what amount of the premium is due. For example, for work experience from 4 to 7 years, the salary increase will be 12%, from 7 to 10 - 15%, and over 10 years - 18% of the accrued salary.

The remaining tables are filled in the same way.

You can see a sample regulation on wages and bonuses for employees - 2020 on our website.

General provisions

The “General Provisions” section establishes the subject composition, that is, those persons to whom it applies. A large company may adopt separate payment provisions for employees of branches and the central office, for managers and blue-collar employees. For example, the regulation on the remuneration of truck drivers, the regulation on the remuneration of dental clinic workers.

Examples:

2.3. This Regulation applies to employees who are in an employment relationship with the Company on the basis of concluded employment contracts both at their main place of work and those working part-time.”

2.6. For the purposes of these Regulations, all positions of the Company’s employees are differentiated in accordance with the Regulations on the distribution by categories and levels of positions of LLC “Senior Management” - levels 11 - 9;

2) Category “Middle management” - levels 8 - 6;

3) Category “Senior professional workers” - levels 5 - 4;

4) Category “Professional workers” - levels 3 - 2;

5) Category “Administrative and technical personnel” - level 1.

The regulations indicate the documents - the legal basis for the adoption of the regulations on remuneration in a particular company. In municipal and budgetary institutions, such documents are decrees of the government, legislative bodies of constituent entities and municipalities. Approved standard samples of wage provisions developed specifically for employees of budgetary institutions are often used. For example, regulations on the labor of healthcare workers, regulations on remuneration of municipal employees.

The basis for developing regulations on remuneration for employees of educational institutions are also the legislative acts of the subject and industry recommendations.

Example:

1.1. These Regulations have been developed on the basis of:

1.1.1. Labor Code of the Russian Federation;

1.1.2. Decree of the Government of the Moscow Region No. 483/23 dated July 3, 2007. “On remuneration of employees of municipal healthcare institutions of the Moscow region” (as amended as of December 30, 2014)

1.1.3. Decree of the Government of the Moscow Region No. 385/17 of May 26, 2014. “On amendments to the Decree of the Government of the Moscow Region No. 483/23 of 07/03/2007”

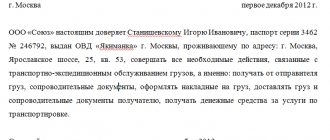

The regulations on remuneration are approved not only by the head of the company, but also by other executive bodies, in the manner prescribed by the charter. Local regulations establishing remuneration systems are adopted by the employer taking into account the opinion of the representative body of employees (Article 135 of the Labor Code of the Russian Federation).

As a rule, an order is issued approving the wage regulations, which indicates the validity period of the document, responsible persons, and the procedure for application and revision.

The “General Provisions” section also defines the terms used in the normative act, excluding their inaccurate or double interpretation.

Is it necessary to review the wage regulations every year?

The wage regulations can be approved by the employer once and be valid without a time limit (indefinitely). The legislation does not establish any specifics for the validity period of such a document.

The need for an annual review of the regulations may arise in cases where the employer is developing new types of activities involving workers of various professions, for which a revision or addition of existing SOT and incentive payments is necessary, or working conditions are changing.

The employer and employees are interested in keeping their internal local acts up to date and must promptly initiate their revision, including the provisions under consideration.

We will tell you what to indicate in the order approving the wage regulations here.

Features of compilation

When drawing up wage regulations, it is necessary to take into account the following features:

- it may include the procedure and features of paying bonuses to employees, and therefore there is no need to adopt a provision on bonuses;

- the document is drawn up by employees of the personnel service or accounting department, taking into account the opinion of the representative body of employees and approved by the head of the company (IP);

- if the wage provision contains norms that contradict current labor legislation, the employer faces a significant fine;

- The validity period of the provision, as well as the procedure for its mandatory revision, is not determined by law, therefore there is no need to draw up a new document unless necessary.

What nuances are provided for in the provision for piecework wages?

Piece wages are one of the forms of remuneration in which the amount earned depends on the number of units of product produced by the employee or the amount of work performed. This takes into account the quality of the work performed, the complexity of execution and working conditions.

There are several types of piecework wages:

- simple;

- piecework-bonus;

- chord.

It is based on piece rates, and other salary supplements (for example, a bonus for absence of defects) are set as a fixed amount or as a percentage of the amount earned.

Depending on the types of piecework wages used, the regulations provide for the specifics of calculating and paying wages, taking into account all the nuances of a given SOT for a particular employer.

Read more about the piece-rate and bonus payment system in the material “The piece-rate and bonus payment system is...” .

Find out how an organization can switch to a new remuneration system in the ready-made solution ConsultantPlus.

Results

Regulations on wages are necessary for both employees and the employer. With the help of this internal document, it is easier for the taxpayer to defend to the tax authorities the validity of reducing the tax base for income tax or the simplified tax system for various salary payments. And employees will be confident that they will not be deceived when calculating their salaries and they will be able to receive legal bonuses and compensation (including through legal proceedings).

This document does not have a legally established form; each employer has its own form.

Its validity period is set by the employer independently. The provision may be revised as necessary or remain in effect indefinitely. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What it is

Regulations on remuneration of workers - a local regulatory act that includes the features, procedure and terms of payment of wages, wage systems established in the organization, mechanisms for calculating wages, the procedure for indexing and other significant issues related to the calculation and payment of all types of employees benefits, financial assistance, compensation, etc.

The wage regulation is not a mandatory document and its absence does not threaten the employer in any way, but in general it significantly makes life easier for both the employer and his employees.

The regulations do not have a unified form and are drawn up by each employer independently, taking into account legal norms and the specifics of the organization’s activities (IP).