Companies, corporations and other business entities strive to improve their operations and increase profitability. Profit is the main goal of an organization. In order to grow and develop, enterprises establish close ties with each other. Joint efforts help achieve great heights and prosperity.

Providing a decent meeting for business partners requires significant financial costs. This expense item involves a fairly extensive list of activities. In tax accounting they are classified as “Representation expenses”. Every accountant knows that such expenses attract the greatest attention of the State Tax Service. This is due to the fact that the article reduces the amount of taxable net profit of a business unit.

Entertainment expenses maintenance

Organizational expenses apply to guests and representatives of the welcoming company. The place where the meeting or reception of business partners is held can be a restaurant, cafe, or the meeting can take place in the company’s office. It all depends on the preferences of the receiving party and the nature of the already established partnerships. A business reception is defined by the Tax Code of the Russian Federation as measures to ensure a comfortable environment for negotiations or meetings. Maintenance involves the following costs:

- car delivery;

- support of foreign partners;

- translation services;

- restaurant service;

- payment for the services of a hired driver.

What's safer?

In principle, a sample expense report and expense report should be sufficient to substantiate expenses for the event. However, for companies wishing to completely minimize risks, it is better to take care of drawing up all documents according to the previous list of the Ministry of Finance.

Entertainment expenses are expenses of an organization aimed at developing relationships with counterparties: buyers, suppliers, investors. If expenses are documented and are within 4 percent of labor costs, then they can be taken into account when calculating income tax (clause 2 of Article 264 of the Tax Code of the Russian Federation).

When drawing up a report on entertainment expenses, for example, on a meeting with business partners, you need to indicate:

- goals and results of the event;

- date and location of the event;

- composition of meeting participants (both host and invited parties);

- costs incurred to organize the event.

Regardless of what expenses are formed?

There are a number of factors that do not play a role in the process of creating a costly item in accounting that relates to establishing partnerships during personal meetings.

These include:

- Time of receipt. It doesn’t matter what time of day the meeting takes place, whether it’s working time or not. Expenses also apply to entertainment expenses in the case of events or meetings outside the working week.

- Place of organization of the meeting. The choice of enterprise is limited to an office or a restaurant. If the format of the establishment does not correspond to the importance of the reception, then such expenses cannot be classified as entertainment expenses.

- Participants in negotiations can be officials and private individuals, as well as clients of companies.

- If the amount of spending does not exceed the norm, the number of participants does not matter.

- The outcome of the meeting cannot affect the amount of spending. Whether cooperation was established or not, payments were made. This means they are recognized as representative.

Compliance with the norms and rules of keeping records of entertainment expenses, how to register them, an example is presented in the article.

Things to consider

Only certain types of expenses can be taken into account as part of entertainment expenses (clause 2 of Article 264 of the Tax Code of the Russian Federation):

- official reception of representatives of counterparties by officials of the organization (costs for a restaurant, purchase of products and preparation of refreshments by the welcoming organization);

- delivery of representatives of counterparties and persons representing the host organization to the meeting place and back (within the locality);

- buffet service for representatives of business partners and their officials during negotiations (payment for catering services or organization of coffee breaks by the host organization);

- payment for the services of external translators.

Especially for readers, we have prepared a sample 2020 report on entertainment expenses. You can download the document via a direct link on the website.

If you find an error, please select a piece of text and press Ctrl+Enter.

Place of expenses in tax accounting

Representation expenses in tax expenses are reflected in Article No. 264 of the Tax Code of the Russian Federation; it presents a complete list of types of expenses for the purposes of representation. Compliance with legislative acts when writing off expenses is necessary in order to tax the profits of enterprises and organizations. The cost of organizing meetings is included in other costs of selling products and producing them.

Expenses indicated in letters of the Ministry of Finance dated 10/09/2012 No. 03-03-06/1/535, dated 12/01/2011 No. 03-03-06/1/796 are called entertainment expenses. And they are subject to strict control. All definitions are indicated without modifications or deviations. Each type of expense for meetings and negotiations is subject to strict control, so we draw up documents for entertainment expenses correctly.

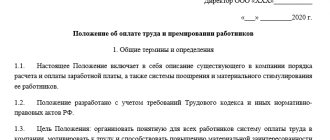

Drawing up a regulation on entertainment expenses - sample

Even if the organization of the event actually required costs that are not included in entertainment expenses by the Tax Code, they cannot be included in these costs to reduce the tax base. FOR EXAMPLE. Kassandra LLC organized a meeting with representatives of other organizations to discuss the terms of cooperation. 140 thousand rubles were spent on this event. Of these funds, 70 thousand rubles were spent on the reception and lunch, 25 thousand rubles on buffet service, 20 thousand rubles on transportation of participants to the lunch place and back to the company, 10 thousand rubles on attending a performance in the theater. . rub., for a tour of memorable places of the city - 15 thousand rubles, for flowers and souvenirs for participants - 45 thousand rubles. In this case, only 115 thousand rubles can be written off for hospitality expenses, that is, the amount of expenses for reception, catering and transport. The remaining funds are in the amount of 25 thousand rubles.

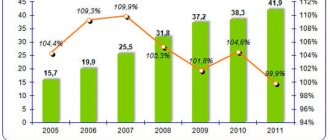

Rationing of part of other expenses

There is a clear definition of the amount of costs for organizing meetings and receptions. This figure may not exceed 4% of the wage fund for employees of the enterprise for the reporting period. The amount of expenses for representation is reflected on an accrual basis in the annual report.

The date when the advance report for entertainment expenses is approved is considered the exact time of their implementation. If a business unit uses the accrual method, then expenses are classified as indirect within the reporting period.

The cash method of recording expenses reflects payments made only upon provision of documentation confirming their implementation. These are checks, certificates of work performed.

Conclusion

Entertainment expenses relate to business meetings, negotiations and meetings of the company's governing bodies. The Tax Code of the Russian Federation establishes a list of them for calculating income tax and a norm of 4% of the wage fund. When using special tax regimes, entertainment expenses cannot be written off.

Some wordings of the Tax Code of the Russian Federation in this area allow for ambiguous interpretation, which is why businessmen often have disputes with tax authorities regarding entertainment expenses.

VAT on entertainment expenses can be deducted only in the part that was accepted for calculating income tax.

In accounting, the write-off of entertainment expenses is not limited. Therefore, companies that apply PBU 18/02 may encounter differences between accounting and tax accounting.

VAT in accounting for hospitality expenses

It is very important to write off the amounts of value added tax for enterprises organizing receptions and meetings with partners. A mandatory tax is charged for all goods and services used by representatives of the organization. The amount can be deducted from the event organizer's taxable income. Such calculations are regulated by Articles 171-172 of the Tax Code of the Russian Federation. It is possible to reduce the amounts withdrawn in certain cases:

- if there is an invoice indicating the VAT amounts;

- expenses for representation belong to the type of activity of the enterprise that is subject to tax;

- expenses are properly recorded in the accounting department.

When a number of events are carried out when organizing negotiations and meetings, those in charge have an idea of how costs may affect the further taxation of profits. Therefore, orders are placed only from those contractors who can provide an invoice. For example, retail stores do not always issue receipts with a separate VAT amount allocated. This means that it cannot be deducted for future income tax purposes.

How to account for VAT on hospitality expenses

Often, hospitality expenses include VAT. For example, an organization might receive an invoice from a restaurant or shipping company. VAT can be deducted only on those entertainment expenses that are taken into account for income tax (Clause 7, Article 171 of the Tax Code of the Russian Federation).

But often entertainment expenses include both taxable and non-VAT-taxable expenses. The procedure in which it is necessary to write off entertainment expenses if the limit is not enough is not specified in the Tax Code of the Russian Federation.

Therefore, a businessman here can act with maximum benefit for himself. He has the right to believe that first of all he writes off that part of the entertainment expenses that is subject to VAT.

Example of calculation of hospitality expenses

It is important that only the VAT amount of standardized entertainment expenses is taken into account. If expenses occur in excess of the norm, then they are classified as other non-operating expenses and do not affect the amount of profit for tax purposes. Reflected on account 91, subaccount 2 “Other expenses”. In tax accounting, VAT amounts for entertainment expenses in excess of the norm are not reflected in any way.

It is possible that the difference in accounting and tax accounting will be the amount of VAT on excess expenses, which is taken into account in the permanent tax liability.

In accounting for VAT on entertainment expenses, how to prepare an example:

Products of Rost LLC are subject to VAT. In March 2020, a meeting with partners was organized at the enterprise.

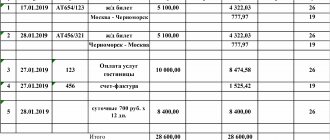

| № | Amount of entertainment expenses, rub | VAT, rub | Payroll fund for the period, rub | The rate of entertainment expenses, 4% of the full salary, rub |

| 1 | 5950 | 907 | 140000 | 5600 |

As a result, 5950-5600 = 350 rubles - they switch to writing off other expenses.

Example: income tax and entertainment expenses

Vesna LLC uses OSNO. In the 2nd quarter of 2020, the company received business partners to conclude a new contract for the supply of products. A total of 250,000 rubles were spent on the event, including:

- transportation costs for delivering guests to the event venue - 20,000 rubles, including VAT - 4,000 rubles;

- catering (breakfast, coffee break, gala lunch, dinner) - 100,000 rubles, VAT - 20,000 rubles;

- services of buffet staff - 30,000 rubles;

- tickets for the theater premiere - 10,000 rubles, VAT - 2,000 rubles;

- accommodation for guests in a luxury hotel - 40,000 rubles;

- excursion by boat to local attractions - 50,000 rubles.

The amount of VAT on all costs for the event is 26,000 rubles.

The wage fund for the 2nd quarter of 2020 amounted to 7,000,000 rubles. 4% of payroll - 280,000 rubles.

Consequently, the company, according to the established limit, has the right to offset entertainment expenses in the 2nd quarter in the amount of no more than 280,000 rubles. But the entire cost of holding events cannot be taken into account! Since not all expenses are representative.

Vesna LLC can accept for tax accounting only the amount of costs for transport delivery of guests, buffet services and meals - 150,000 rubles. But expenses for theatrical performances, boat excursions and hotel rooms cannot be taken into account. These expenses must be paid from the company's net profit. That is, from the money that will remain in the company after income tax.

Input VAT can only be refunded in the amount of 24,000 rubles. That is, only from hospitality expenses (transportation services and food). But you cannot get a deduction from theater tickets.

Accounting for entertainment expenses in accounting

Unlike tax, in accounting, expenses for representation do not have a separate item of reflection. They include:

- for deductions for depreciation;

- material costs;

- for wages;

- social payments;

- other expenses.

Clause 8 of PBU 10/99 states that the enterprise independently distributes expenses in internal accounting. Most often they are classified as other; at industrial enterprises this count is 26, and at retail enterprises it is 44.

We'll show you how to arrange entertainment expenses. An example of an accounting entry when writing off amounts for services.

| Debit | Credit |

| 26 “General business expenses” | 60 “Settlements with suppliers and contractors” |

Accounting for material assets (products, etc.)

| Debit | Credit |

| 44 “Sales expenses” | 10 “Materials” |

How to process entertainment expenses: examples 2018-2019

In order to classify a company’s expenses as entertainment expenses in 2020, it is necessary not only that they fall within the permitted list, but also that there is a justification for their economic feasibility. To do this, the representative purposes of the event must be documented. The following documents will help you do this:

- order from the head of the company to hold a business meeting;

- cost estimate for the event;

- business meeting program;

- primary documents that confirm expenses (checks, invoices, etc.).

- report on entertainment expenses.

Tax authorities have the most complaints about the last document from the above list. Therefore, we will analyze this document in more detail. The report does not have a unified form. The employee writes it in free form. The main thing you need to indicate in the document is:

- event title;

- participants;

- the purpose of the meeting and its results;

- date and place of negotiations;

- list of costs.

How to file a report on entertainment expenses

Negotiations with counterparties are often carried out in the evening, that is, outside working hours. To ensure that inspectors do not have any complaints, the report should indicate the time and duration of the meeting. In addition, overtime work must be reflected in the time sheet. This way, tax officials will not suspect that employees were working and not having fun.

Make sure that the time of negotiations with counterparties indicated in the report coincides with the time of the issued check. Inspectors will deduct expenses if it becomes clear from the documents that the money was spent on entertainment lunches and dinners after official negotiations (Resolution of the North-Western District Administration of June 14, 2018 No. F07-6203/2018)

In addition, auditors will compare the amount of entertainment costs with the economic benefits of the event. For example, it is risky to attribute payment for a 5-course meal to entertainment expenses if the delivery dates for products worth 10 thousand rubles were discussed at the meeting.

Ready-made sample documents to justify hospitality expenses:

Order from the head of the organization on holding a representative eventDownload for freeSample estimate Download for freeReportDownload for free

Carrying out operations in accounting programs

How to process entertainment expenses, example in 1C.

The 1C accounting program allows you to create advance reports, on the basis of which expenses for the representative office are written off. In 1C Accounting 8, registration of entertainment expenses follows a similar algorithm as in earlier versions of the program.

The essence of accounting is to create a bank statement or issue money from a cash register, and then, based on these documents, an “Advance report” is created, which indicates all expenses. You can find out more in the video below.

Instructions for processing entertainment expenses

Procedure for processing entertainment expenses:

- Drawing up estimates for entertainment events for the reporting year. At this stage, management, as part of the board of directors, agrees on budget documentation, which indicates the estimated cost of expenses for entertainment events for the reporting year.

- After agreeing on the estimate, organizational and administrative documents are issued containing a list of persons who will keep track of expenses, as well as regulations for issuing accountable papers.

- The next stage is related to the preparation of documents for specific celebrations. In addition to the order to hold meetings and negotiations, the manager must issue an order to send invitations to the meeting.

- Submitting an order to the accounting department to issue the necessary funds for events. It also contains a list of employees who are allowed to spend money.

- After all business activities have been completed, the responsible person prepares a separate report on the costs incurred, which is submitted to the accounting department.

On a note! Tax authorities closely study the financial statements of organizations, so any action related to a decrease in taxable profit is considered with numerous checks.

To ensure that entertainment expenses are not included in the tax base, it is recommended that you report in detail about business events.

How to determine the calculation standard

To ensure that representatives of legal entities do not abuse tax benefits, the legislator established a rule for rationing representation expenses. The basis for determining the standard is labor costs. Here you will find out what benefits an individual entrepreneur is entitled to by law and how to get them.

In paragraph 2 of Art. 264 of the Tax Code states that the amount of expenses should not exceed 4% of the amount of wages for the reporting period. Moreover, this position applies to those entities that calculate the fee according to the general taxation scheme.

If an organization operates under the simplified tax system, then representative deductions do not apply at all. You can find out what the limit on income and revenue under the simplified tax system is in the article at the link.

Order for holding a formal meeting and expenses.

Calculation example

Spetsstroy LLC held an official meeting with representatives of Garant-Service LLC about the construction of an additional office for the sale and maintenance of commercial equipment.

As a result of the meeting, Spetsstroy LLC spent the following funds:

- Organizing lunch in a restaurant – 8,000 rubles.

- Transport services – 2,000 rubles.

To calculate the standard, you need to add up the data on labor costs and the 4% indicated as the maximum deduction amount.

During the first quarter of activity, Spetsstroy LLC spent 150,000 thousand rubles on labor costs. Accordingly, to calculate the standard you need: 150,000x 4% = 6,000 rubles.

Despite the fact that the actual costs are 10,000 rubles, tax preferences will apply only in the amount of 6,000 rubles.