To maintain accounting records, entrepreneurs undertake the responsibility of drawing up established reporting forms for a certain period. Among them is the balance sheet.

Many authorized state and regulatory bodies consider it one of the main documents, so every accountant must clearly understand what the procedure for drawing up is and whether individual entrepreneurs submit a balance sheet as a whole.

The submission of balance sheets by entrepreneurs is indicated in the Letter of the Ministry of Finance No. 66n

What is a balance sheet

Before the changes were made, the balance sheet was called Form 1. In 2020, the document is considered one of the most significant during the preparation of annual reporting.

Important! When compiling a balance sheet, individual entrepreneurs enter into it data regarding the financial position as of December 31 of the reporting calendar year.

This must be done in order to provide reporting upon request to authorized state regulatory authorities, including the regional representative office of the tax service. Moreover, the reporting in question is used additionally:

- individual entrepreneur;

- management of the company - if a legal entity;

- TOP managers.

The balance sheet provides an opportunity to get acquainted with the full picture of the work done for the reporting calendar year, and in financial equivalent. It is for this reason that many Russian individual entrepreneurs prefer to create a balance sheet for complete control during the development of their own business (it does not matter whether the simplified form is used or UTII).

Balance sheet - reporting form

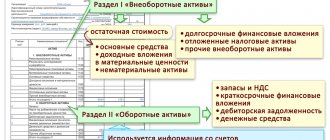

The balance sheet, regardless of whether the simplified tax system is used or another taxation regime, necessarily includes the assets and liabilities of the company. Assets mean a display of all resources, without exception, that are available on the balance sheet of an individual entrepreneur’s company. In this case, it is worth talking about all assets and non-current assets, including:

- existing real estate;

- operating equipment;

- financial investments.

Everything that cannot be returned within at least one calendar year is taken into account.

Additional Information! Balance sheet liabilities are considered to be any sources for financing assets. Do not forget that the main feature of the document is the need for sections to match in full.

The procedure for maintaining reports in individual entrepreneurs

When maintaining records, an individual entrepreneur must take into account that he is an individual. The main condition for accounting for the property of an entrepreneur is its isolation, as well as its inseparability from personal obligations. However, such factors cannot be taken into account in the financial statements, and they cannot be indicated in the KuDiR. Therefore, full-fledged accounting of individual entrepreneurs is not possible.

For individual entrepreneurs on a patent, the tax amount is fixed and maintaining any kind of reporting is not required. It can be compiled at the entrepreneur’s own request. But you need to submit reports to the Pension Fund, which is maintained for the purpose of pension savings. Reporting on insurance premiums is carried out by individual entrepreneurs independently.

When drawing up a balance sheet for the year, an individual entrepreneur can be guided by the following rules:

- the balance sheet must reflect the state of the entrepreneur’s finances, as well as assets and liabilities;

- the balance sheet is supposed to be drawn up taking into account the property used in business activities;

- property of an individual entrepreneur that does not relate to economic activity can be taken into account in a separate article;

- if the individual entrepreneur is married without a prenuptial agreement or gets divorced, then the balance sheet should contain half of the property, that is, the part of his wife should be displayed separately, in the form of passive funds or losses.

We should not forget that accounting’s main purpose is to assess the financial condition of an entrepreneur. The property of an individual entrepreneur is his private property, which means that he has the right to take into account everything that he considers necessary to assess profits or losses. At the same time, there are no mandatory requirements for the content of accounting compiled by individual entrepreneurs. So the credibility of such reporting is minimal and cannot be used for tax or audit purposes.

On video: Income and expenses in accounting and tax accounting. Latest changes in legislation

Objectives of its delivery

LC IP - what it is and why an individual entrepreneur needs it

It is necessary to understand that the balance sheet is one of the basic elements of annual reporting used by legal entities. There are no mandatory conditions for use for individual entrepreneurs. Moreover, according to federal legislation, they are completely exempt from the need to register.

Despite this, most individual entrepreneurs use the form in question for the purpose of maintaining internal control. Thanks to this financial information, the individual entrepreneur has the opportunity to:

- evaluate the profitability of previously developed and already used projects - perhaps some of them will need to be closed or modified in order to increase income levels, issue bonuses to employees for successful development, etc.;

- analyze the effectiveness of management decisions made - as a rule, this is manifested in total annual income. Based on the results of the data obtained, you can assess your strengths, for example, when making a decision to purchase a home with a mortgage.

The Tax Code of the Russian Federation determines the goals and objectives of the balance sheet

When figuring out whether individual entrepreneurs submit their balance sheet or not, it is worth saying that submitting the document is advisable when using the general taxation regime. In fact, for individual entrepreneurs, reporting is considered a comprehensive analysis of available resources and assigned obligations. Surrender is not required under federal law.

What kind of reporting does an individual entrepreneur submit instead of him?

All entrepreneurs, without exception, who use the simplified taxation system, in accordance with federal legislation, are not required to keep accounting records, which is why there is no need to submit reports. Legal entities that use the simplified tax system and are classified as small businesses reserve the legal right to use a simplified version of accounting, including the formation of a simplified balance sheet.

In order to organize a simplified accounting method, each entrepreneur has the right to use specially developed appropriate Standard Recommendations, which are approved by the Order of the Ministry of Finance of December 1998. At the same time, the developed and approved forms of accounting statements are fixed by the norms specified in the Letter of the Ministry of Finance of Russia dated July 2020 No. 66n.

Individual entrepreneur reporting in 2020

The answer to the question “Do individual entrepreneurs submit a balance sheet?” - will be negative. But legal entities are forced to do this without fail, otherwise it entails a violation of federal legislation with all the ensuing consequences.

At the same time, individual entrepreneurs undertake the obligation to submit reports:

- to the Pension Fund;

- to the Social Insurance Fund.

Additionally, it is required to provide a report, and, if necessary, an appendix to it regarding the percentage of income tax withheld from the employee (subject to signing an employment contract).

Entrepreneurs who work independently (without using labor) are exempt from preparing and submitting salary reports for verification. In this case, you can limit yourself to contributions for yourself and submit a declaration under the simplified tax system for the reporting calendar year for verification.

In case of ignoring the norms of federal legislation, individual entrepreneurs are held administratively liable, which entails a fine in the prescribed amount.

Balance example

The norms of federal legislation establish that the balance sheet form 1 and 2 report on profits and losses, including other mandatory types of documents, must be transferred to:

- to the regional representative office of the tax service - reporting is submitted to the place of registration of the company or individual entrepreneur. If there are separate structural divisions or branches, only general reporting of the parent company. This must be done at the place of tax registration;

- to the statistics service - in 2020, reporting to Rosstat is considered a mandatory requirement. If the deadlines for delivery are ignored, an administrative fine in the prescribed amount will be issued to authorized officials;

- owners of companies (relevant for legal entities) - the annual report is submitted to them for approval and further transmission to the authorized bodies;

- other authorized state regulatory authorities - in order to comply with federal legislation.

Registration number in the Pension Fund of the Russian Federation for individual entrepreneurs - how to find out and why it is needed

The document must be completed by authorized accounting employees (for legal entities) or individual entrepreneurs.

Additional Information! Many large enterprises, when signing a contract for the supply or provision of services, first require the provision of a balance sheet. However, this is not considered a requirement of federal law, but solely the personal desire of the administration.

There are a huge number of services on the Internet, using which you can check online the individual entrepreneur or company you are interested in using the Taxpayer Identification Number (TIN), OGRN. All these services are obtained from reports, including the balance sheet.

According to the rules of federal legislation, the balance sheet must be transferred to a tax specialist:

- by personal contact;

- by registered mail with a description of the contents and notification of receipt.

Sample balance sheet

If you have an electronic digital signature (EDS), the document can be transferred remotely. Just go to the official website of the Federal Tax Service and use the appropriate form. The rule is relevant if there are more than 100 employees.

To eliminate the possibility of making mistakes, it is advisable to use a form.

Accounting statements of individual entrepreneurs and LLCs on the simplified tax system

An individual entrepreneur using the simplified tax system is not required to keep accounting records (Clause 1, Clause 2, Article 6 of Federal Law No. 402-FZ dated December 6, 2011), and therefore he does not prepare financial statements.

LLCs that apply the simplified tax system and are small businesses can use simplified methods of accounting, including the preparation of simplified accounting (financial) statements (clause 4 of article 6 of the Federal Law of December 6, 2011 No. 402-FZ). You can organize “simplified” accounting using the Standard Recommendations for organizing accounting for small businesses (approved by Order of the Ministry of Finance of the Russian Federation dated December 21, 1998 No. 64n). Simplified forms of the balance sheet, statement of financial results, report on the intended use of funds are given in Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n.

The remaining organizations maintain accounting records and prepare financial statements in full.

Does an individual entrepreneur need to submit a balance sheet?

Declaration of individual entrepreneur - what it is, how and when it is submitted, rules for registration

It is advisable to maintain full accounting records and prepare the reports in question for individual entrepreneurs under the general taxation regime. Under the simplified tax system, a similar need arises when there is a stable increase in the price of fixed assets.

According to the rules of tax legislation, the right to use the special regime remains relevant for owners of assets whose valuation does not exceed 150 million rubles. Regarding the standards that are relevant for individual entrepreneurs, the Ministry of Finance indicated in detail in the relevant Letter. From its content it follows that all simplifiers, without exception, take upon themselves the responsibility to control the value of existing property.

You can submit your balance online

Additional Information! Individual entrepreneurs have the right to keep accounting records on UTII in order to eliminate the possibility of theft of personal property and assess the profitability of their business. At the same time, the specifics of the regime used do not have any significant impact on the established procedure for processing information.

How to maintain accounting records for individual entrepreneurs

Having decided to conduct accounting, an individual entrepreneur falls under the above-mentioned law and other regulations of the Ministry of Finance of the Russian Federation. To comply with them, he must fulfill the following requirements:

- Develop accounting policies. The contents of this document are set out in p. 8 FZ-402, it reflects the accounting method - general or simplified, and is approved by the person responsible for it. There is no need to register it anywhere - this is an internal regulation. It is approved and signed by the businessman himself. But, during verification, the Federal Tax Service and Rosstat have the right to demand it.

- Assign a person in charge. The individual entrepreneur himself acts as a leader. He approves all completed forms, is responsible for storing primary documentation and organizing accounting as a whole, subject to the subject’s compliance with Part 3 of Art. 7 Federal Law “On Accounting”. Upon reaching the status of a large entrepreneur with a staff of more than 250 employees and an annual income of over 2 billion, he is obliged to hire an accountant or enter into an agreement with an outsourcing company. This can be done immediately after registering an individual entrepreneur.

- Approve the chart of accounts used. It may be reflected in the accounting policy or drawn up as a separate application, certified by a signature and seal (if available).

- Prepare financial statements. For yourself personally, you can keep detailed records in accordance with all PBUs. This information is not provided to the Federal Tax Service. Interim quarterly forms are not necessary, but basic reports will have to be prepared at the end of the year.

Should an individual entrepreneur keep accounting records from the first days of activity? Many entrepreneurs come to him as their business develops. Provisions part 3 part. 6 Federal Law-402 oblige you to do this from the moment of registration. If the decision to organize accounting is made later, then you will need to calculate the opening balance for all accounts used.

“Salary” taxes under the simplified tax system in 2020

The organization submits reports on insurance premiums to the Federal Tax Service and the Social Insurance Fund, and reports to the tax office on withheld personal income tax from the income of its employees. The same is true for individual entrepreneurs who engage employees under employment contracts or enter into GPA.

Individual entrepreneurs who work “alone” are exempt from “salary” reporting; they are limited only to paying contributions for themselves. That is, the reporting of an individual entrepreneur on the simplified tax system without employees is only a declaration under the simplified tax system for the year.

This is important to know: Calculation of advance payments according to the simplified tax system for income

Legislation on record keeping

On December 6, 2011, a special law “On Accounting” No. 402-FZ came into force. Subparagraph 4 of paragraph 1 of Article 2 of this law determines that its effect also applies to entrepreneurs. That is, individual entrepreneurs are required to keep accounting records. However, Article 6 of this law clarifies: the obligation does not arise if income and/or expenses or necessary physical indicators are taken into account in accordance with the law.

What does it mean? We explain: if an entrepreneur does not fill out books of income and expenses (KUDIR), which are required to be maintained by the chosen taxation system, he must organize full-fledged accounting for all documents.

Reporting under the simplified tax system in 2020

Based on the results of the tax period (calendar year), individual entrepreneurs and LLCs submit to the tax office a tax return for the tax paid in connection with the application of the simplified taxation system (approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3 / [email protected] ) . The deadlines for submitting reports under the simplified tax system are as follows:

- for LLC – no later than March 31. That is, reporting under the simplified tax system for 2020 is submitted no later than 03/31/2020;

- for individual entrepreneurs – no later than April 30. That is, reporting under the simplified tax system for 2020 is submitted to individual entrepreneurs no later than 04/30/2020.

Individual entrepreneur reporting on OSNO with hired employees

If an individual entrepreneur has employees , then the entrepreneur is required to submit the entire “package” of personnel reports, similar to an employer who is a legal entity

In addition to the 3-NDFL declaration, which is filled out “for oneself”, individual entrepreneurs at OSNO also report on personal income tax withheld from staff.

The entrepreneur submits Form 6-NDFL with general information quarterly, for which he is given a month after the reporting period (Federal Tax Service order No. ММВ-7-11 dated October 14, 2015/ [email protected] ). The annual 6-NDFL must be submitted by April 1.

Also, once a year, before April 1, the individual entrepreneur submits “personal” information on income tax for each individual in the form of 2-NDFL certificates (order of the Federal Tax Service of the Russian Federation dated October 2, 2018 No. ММВ-7-11 / [email protected] ). If it was not possible to withhold tax from any income, then data on such employees must be sent before March 1.

Individual entrepreneur on OSNO also reports on all accruals made on wages. Calculation of insurance premiums (DAM) must be submitted to the Federal Tax Service every quarter, no later than 30 days after its end (Federal Tax Service order No. ММВ-7-11 dated October 10, 2016/ [email protected] ).

The DAM form does not include only one type of mandatory charges - contributions “for injuries”. The report on them (form 4-FSS) must be sent not to the tax authorities, but to the fund itself. 4-FSS must also be submitted quarterly: within 20 days after the reporting period on paper (allowed only if the number of employees is less than 25 people), and within 25 days - in electronic form (Order of the FSS of the Russian Federation dated 06/07/2016 No. 381 ).

The rate of contributions “for injuries” depends on the type of activity of the employer. Legal entities must annually confirm the right to use a particular rate by submitting a special form to the Federal Social Insurance Fund of the Russian Federation. Individual entrepreneurs on OSNO are exempt from such obligations. For them, the main type of activity “by default” is the one indicated in the state register (clause 10 of the rules approved by Decree of the Government of the Russian Federation of December 1, 2005 No. 713).

Individual entrepreneurs will have to send reports to the Pension Fund monthly, 15 days are allotted for this. The short form SZV-M was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

The annual form of SZV-experience must be submitted to the Pension Fund of the Russian Federation before March 1 (Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Another report related to personnel - information on the average number of employees - must be sent annually to the tax office. The form, which reflects only one indicator, is submitted before January 20 (order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25 / [email protected] ).

If an individual entrepreneur works at OSNO “alone”, without employees, then he only needs to submit mandatory tax reporting. Such an entrepreneur should not fill out any of the reports listed in this section.