Dollar exchange rate forecast for tomorrow and the next few days of the month.

Updated 09.10.2020 06:40

What is the dollar exchange rate forecast for tomorrow?

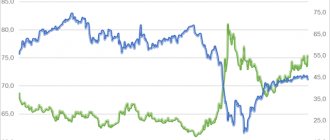

The dollar exchange rate forecast for tomorrow is 76.53 rubles, the minimum rate is 75.46, and the maximum is 77.60 rubles. The current dollar rate is 77.23. Today the rate is down by 0.01% compared to yesterday’s close of the day at 77.24.

Will the dollar rate rise or fall in a week?

Dollar exchange rate forecast in a week 77.19 rubles, minimum 76.11, maximum 78.27 rubles. Thus, over the week the dollar exchange rate will fall by 0.04 rubles. relative to the current exchange rate of 77.23 rubles. For more detailed forecast by day for the week, see the table below.

What is the dollar exchange rate forecast for October?

Dollar exchange rate forecast for October 74.48-80.97, at the end of October 79.85 rubles. At the beginning of October, the dollar exchange rate was 77.66, i.e. the change for the month will be +2.8%.

What dollar exchange rate is forecast for November?

Dollar exchange rate forecast for November - 82.44 rubles. at the end of November, the minimum rate during the month is 77.37, the maximum is 83.59. Monthly change +3.2%.

Euro exchange rate forecast for tomorrow, month, October, November and December 2020.

Dollar exchange rate online and exchange rate chart now.

The barometer is falling

The Russian currency began planning downward in June from 68 rubles/dollar. The “equilibrium” rate, according to the head of the Economic Expert Group, Yevsey Gurvich, is now approximately 72.5 rubles per dollar and 84.8 rubles per euro.

Peak values in September can be considered extreme. Even if the ruble tries to weaken again, such a period should be used to sell the currency, and not to hastily buy it, says Andrey Kochetkov, leading analyst at Otkritie Broker for global research. According to his assessment, under the existing order of things, the exchange rate should be in the range of 70-75 rubles per dollar, and even the price of oil does not play such an important role, since the budget can use the accumulated reserves for a long time. Moreover, despite the negative situation on the commodity markets, the current account of the Russian Federation remains positive. International reserves exceed the country's external liabilities by more than a third. Finally, the positive yield of the ruble greatly distinguishes it from other currencies with widespread negative yields, Kochetkov emphasizes.

“The possibilities for further weakening of the ruble are limited by the low risk of falling oil prices, as well as the launch of additional interventions by the Central Bank from October 1,” says Gurvich. “According to calculations by the Economic Expert Group, this will reduce the dollar exchange rate by about 2.5 rubles.” According to his expectations, the exchange rate in October will be at the level of 75 rubles per dollar and 88 rubles per euro. This is still above the equilibrium rate, which is due to sanctions risks.

The launch of additional interventions by the Central Bank from October 1, with stable oil prices, will reduce the dollar exchange rate by approximately 2.5 rubles

According to analysts from Bank St. Petersburg, in October the Ministry of Finance and the Bank of Russia will sell foreign currency for 7.4-7.9 billion rubles. per day, which is three times more than in September. In addition, the Ministry of Finance doubled the initial plan for borrowing on the domestic market - in the fourth quarter it intends to place OFZs worth more than 2.3 trillion rubles. (among the buyers of these securities there is a high proportion of non-residents), says Gennady Salych, Chairman of the Board of Freedom Finance Bank.

The deterioration of the situation in Belarus and Transcaucasia may work against the ruble. According to the chief economist of Alfa Bank, Natalia Orlova, since the end of August, the geopolitical risk premium in the ruble price has almost doubled and reached approximately 7-8 rubles/dollar. In 2018, when the United States imposed sanctions against RUSAL and threatened to impose sanctions against Russian government debt and state banks, the risk premium reached 10-15 rubles. This suggests that the ruble has room for further weakening, especially under the scenario of a Biden presidency. The most attractive scenario at the moment is to maintain the exchange rate at the level of 75-80 rubles/dollar, Orlova believes.

The key question is whether the Central Bank will decide to stop the panic in the market if the ruble comes under additional pressure.

Values of about 80 rubles per dollar and 93 per euro are the limit of the patience of the Russian authorities, Andrei Kochetkov believes. “Such a weak ruble increases the risk of rising inflation and falling incomes,” he says. “Accordingly, additional revenues from exports can no longer cover the lost revenues from the domestic economy.”

But unlike March, when the Central Bank began “proactive” currency sales after the collapse of oil prices, and unlike 2020, when it postponed currency purchases as part of the fiscal rule, now the Bank of Russia can only exit with direct foreign exchange interventions for financial reasons. stability. They have not been used since 2014, and their use in itself will be an alarming sign, notes Natalia Orlova.

But so far the situation does not look dramatic. The third quarter is traditionally a weak period for the ruble, and this year the pressure on it was increased by pent-up demand for imports and outbound tourism, conversion of dividends from Russian companies, large payments on external debt ($5.2 billion in September), new geopolitical challenges nearby borders of the Russian Federation, suppressed demand for federal loan bonds, notes investment strategist at BCS Premier Alexander Bakhtin. The market was also influenced by the traditionally increased demand for money and risk-free assets associated with the end of the financial year in the United States (the new one begins on October 1), says Gennady Salych. The worsening virus situation may make American congressmen more accommodating in terms of adopting a new $2.2 trillion stimulus package, in which case the entire group of risky assets, including the ruble, will receive support, Bakhtin calculates.

Dollar exchange rate forecast for each day in the table

| date | Day | Min | Well | Max |

| 09.10 | Friday | 75.46 | 76.53 | 77.60 |

| 12.10 | Monday | 75.65 | 76.72 | 77.79 |

| 13.10 | Tuesday | 75.50 | 76.57 | 77.64 |

| 14.10 | Wednesday | 75.46 | 76.53 | 77.60 |

| 15.10 | Thursday | 76.11 | 77.19 | 78.27 |

| 16.10 | Friday | 75.95 | 77.03 | 78.11 |

| 19.10 | Monday | 74.65 | 75.71 | 76.77 |

| 20.10 | Tuesday | 74.48 | 75.54 | 76.60 |

| 21.10 | Wednesday | 75.23 | 76.30 | 77.37 |

| 22.10 | Thursday | 76.62 | 77.71 | 78.80 |

| 23.10 | Friday | 76.90 | 77.99 | 79.08 |

| 26.10 | Monday | 77.42 | 78.52 | 79.62 |

| 27.10 | Tuesday | 77.31 | 78.41 | 79.51 |

| 28.10 | Wednesday | 78.08 | 79.19 | 80.30 |

| 29.10 | Thursday | 78.44 | 79.55 | 80.66 |

| 30.10 | Friday | 78.73 | 79.85 | 80.97 |

| 02.11 | Monday | 78.76 | 79.88 | 81.00 |

| 03.11 | Tuesday | 78.48 | 79.59 | 80.70 |

| 04.11 | Wednesday | 78.60 | 79.72 | 80.84 |

| 05.11 | Thursday | 78.62 | 79.74 | 80.86 |

| 06.11 | Friday | 78.17 | 79.28 | 80.39 |

| 09.11 | Monday | 77.37 | 78.47 | 79.57 |

| 10.11 | Tuesday | 77.97 | 79.08 | 80.19 |

| 11.11 | Wednesday | 78.24 | 79.35 | 80.46 |

What is the Dollar forecast for December?

The dollar exchange rate forecast for December is in the range of 82.44-86.94, at the end of December 85.74 rubles. Monthly change +4.0%.

What dollar exchange rate is predicted by the end of 2020?

Dollar exchange rate forecast for 2020 : the rate will trade in the range of 77.37-86.94. Exchange rate forecast at the end of December 2020 85.74 .

What will the dollar exchange rate be in 2021?

Dollar exchange rate forecast for 2021 : exchange rate at the end of December 2021 - 86.83 rubles. And throughout the year the rate will fluctuate in the range of 82.51-94.77.

General forecast

Even an inexperienced person understands that the current situation on the foreign exchange market does not yet give the Russian national currency a reason for optimism. Last week, the ruble reached yet another multi-month low, at one point exceeding 90 per euro and 75 per dollar, while the pound went beyond 100.

On a note! Dollar exchange rate in December 2020 by day

In the near future, according to experts, the fall of the ruble may be caused by geopolitical risks associated primarily with events around Belarus and the international resonance surrounding the case of opposition politician Alexei Navalny.

For reference

! According to currency analysts, external news of a non-economic nature, combined with a significant decline in Russian commodity exports, could deprive the ruble of its last points of support.

Thus, specialists of the banking group Raiffeisen Bank International emphasize that the current exchange rate of the ruble to the dollar could be considered equilibrium in the context of the current price of Brent oil (since the beginning of September, the decrease has been about 15%), if not for the risk that Russia would again be under this times tougher sanctions from Western countries.

The paradox is that the falling ruble is intended to discourage Russians from their last hopes for a “bright future.” But financially, the authorities benefit from a weak ruble - with a low exchange rate, you can earn more rubles for fewer petrodollars. In this simple way, the government intends to balance the budget deficit, which by the end of this year is expected to range from three to five trillion rubles.

Obviously, all this will cause quite significant damage to the Russian economy:

- inflationary surge through rising prices of imported goods and services;

- long-term decline in investment activity.

As economists note, taken together, this is a time bomb. Indeed, in the long term, the importance of oil and gas will decrease. By 2050, European countries plan to completely free themselves from hydrocarbons and switch to environmentally friendly sources of electricity.

In the future, this will hit suppliers of traditional energy resources, and primarily Russia. Domestic raw material exports will lose not only in price, but also in volume. In combination with sanctions, this promises dismal prospects.

As for devaluation, over the past twenty years in Russia the ruble exchange rate has decreased by more than one hundred percent. A dollar cost 30 rubles, then - 60, and now - more than 70 rubles.

Dollar exchange rate forecast for 2020, 2021 and 2022

| Month | Start | Min-Max | End | Total,% |

| 2020 | ||||

| Oct | 77.66 | 74.48-80.97 | 79.85 | +2.8% |

| But I | 79.85 | 77.37-83.59 | 82.44 | +6.2% |

| Dec | 82.44 | 82.44-86.94 | 85.74 | +10.4% |

| 2021 | ||||

| Jan | 85.74 | 84.54-86.94 | 85.74 | +10.4% |

| Feb | 85.74 | 85.74-90.42 | 89.17 | +14.8% |

| Mar | 89.17 | 89.17-92.07 | 90.80 | +16.9% |

| Apr | 90.80 | 85.95-90.80 | 87.17 | +12.2% |

| May | 87.17 | 82.51-87.17 | 83.68 | +7.8% |

| Jun | 83.68 | 83.68-88.25 | 87.03 | +12.1% |

| Jul | 87.03 | 87.03-91.78 | 90.51 | +16.5% |

| Aug | 90.51 | 90.51-94.77 | 93.46 | +20.3% |

| Sep | 93.46 | 88.66-93.46 | 89.92 | +15.8% |

| Oct | 89.92 | 89.05-91.57 | 90.31 | +16.3% |

| But I | 90.31 | 87.94-90.44 | 89.19 | +14.8% |

| Dec | 89.19 | 85.61-89.19 | 86.83 | +11.8% |

| 2022 | ||||

| Jan | 86.83 | 86.83-91.56 | 90.30 | +16.3% |

| Feb | 90.30 | 89.73-92.27 | 91.00 | +17.2% |

| Mar | 91.00 | 86.28-91.00 | 87.51 | +12.7% |

| Apr | 87.51 | 87.51-90.15 | 88.91 | +14.5% |

| May | 88.91 | 86.24-88.91 | 87.46 | +12.6% |

| Jun | 87.46 | 85.95-88.39 | 87.17 | +12.2% |

| Jul | 87.17 | 86.54-89.00 | 87.77 | +13.0% |

| Aug | 87.77 | 84.43-87.77 | 85.63 | +10.3% |

| Sep | 85.63 | 85.63-88.58 | 87.36 | +12.5% |

| Oct | 87.36 | 86.37-88.83 | 87.60 | +12.8% |

Forecast of the US dollar to ruble exchange rate for the year

| Month | At the beginning of the month | At the end of the month | Average | Minimum | Maximum |

| October | 73.14 ₽ | 73.15 ₽ | 74.91 ₽ | 71.55 ₽ | 76.18 ₽ |

| November | 72.86 ₽ | 73.68 ₽ | 75.64 ₽ | 71.38 ₽ | 75.53 ₽ |

| December | 73.2 ₽ | 73.65 ₽ | 75.79 ₽ | 71.8 ₽ | 76.03 ₽ |

| January | 74.12 ₽ | 74.4 ₽ | 75.31 ₽ | 73.08 ₽ | 77.78 ₽ |

| February | 74.45 ₽ | 74.79 ₽ | 76.93 ₽ | 73.31 ₽ | 78.39 ₽ |

| March | 75.26 ₽ | 74.82 ₽ | 76.56 ₽ | 73.24 ₽ | 77.8 ₽ |

| April | 75.67 ₽ | 75.51 ₽ | 76.88 ₽ | 73.16 ₽ | 78.85 ₽ |

| May | 75.68 ₽ | 76.74 ₽ | 78.61 ₽ | 74.47 ₽ | 79.65 ₽ |

| June | 76.58 ₽ | 77.22 ₽ | 77.83 ₽ | 74.63 ₽ | 79.28 ₽ |

| July | 75.82 ₽ | 76.56 ₽ | 79.59 ₽ | 74.45 ₽ | 79.46 ₽ |

| August | 76.82 ₽ | 77.88 ₽ | 79.67 ₽ | 75.34 ₽ | 80.46 ₽ |

| September | 77.35 ₽ | 78.05 ₽ | 79.67 ₽ | 76 ₽ | 80.53 ₽ |

According to financial experts and analysts, the dollar is expected to strengthen against the ruble over the coming year.

Estimated changes in the USD/RUB exchange rate by month:

- October: The selling rate will be 73.15 ₽

- November: The selling rate will be 73.68 ₽

- December: The selling rate will be 73.65 ₽

- January: Selling rate will be 74.4 ₽

- February: The selling rate will be 74.79 ₽

- March: The selling rate will be 74.82 ₽

- April: The selling rate will be 75.51 ₽

- May: The selling rate will be 76.74 ₽

- June: The selling rate will be 77.22 ₽

- July: The selling rate will be 76.56 ₽

- August: The selling rate will be 77.88 ₽

- September: The selling rate will be 78.05 ₽

Dependence on the political situation

Events in the domestic and foreign policies of the United States and other countries have an impact on the overseas currency. A good example is the events of 2014-2015 in Ukraine. Prior to this, the hryvnia showed a sharp devaluation in 1998, when it depreciated by half, and in 2008, when the dollar in Ukraine increased by 1.6 times. Both in 1998 and 2008 there was a global crisis, which naturally affected the Ukrainian currency.

But after the tragic events in February 2014, the outbreak of war in the east of the country, the hryvnia began to depreciate sharply, its exchange rate against the dollar fell by almost 3.5 times, reaching a value of 27 UAH. for 1$. Although in February 2020 this figure reached 45 UAH. for $1 and above.

Compared to the rate that was in Ukraine before all the tragic events of this period, which is 8.15 UAH. for $1, such a drop in the national Ukrainian currency is considered unprecedented for the country.

The devaluation of the hryvnia is also intensified by the populist decisions of the new government, which by its actions has closed the Russian market for Ukrainian heavy industrial goods.

As a result, 33% of exports to Russia fell sharply (almost 5 times) and the decline in exports continues. Europe refuses to buy goods that do not go to Russia. The influx of foreign currency into the country has decreased sharply, this has greatly increased the demand for it.

Considering that the country is 54% dependent on exports, its reduction makes the budget deficit. In order to pay off all state employees and send the required amount of money to all areas vital for the state, it is necessary to devalue the national currency.

The same scheme will be true for other countries that want to destroy economic ties for the sake of illusory interests. For example, another such example is Libya, which had a high level of social standards before the overthrow of Gaddafi.

But political events in the United States may also trigger the process of devaluation of the national currency in the near future. This is possible if the country's president announces a policy of eliminating some government debts. Such a policy could lead to the devaluation of the “green” currency, as a result of which the dollar will fall to 60 rubles and below in 2020.

Expert: The dollar can reach 80 rubles, and then there will be a correction

The Russian national currency may fall in price against the dollar to 80 rubles, after which a correction should begin. This opinion is expressed by Mikhail Dorofeev, Chairman of the Board of the Obnovlenie CPC.

He states that “the ruble continues to depreciate, reaching its lowest levels against the US dollar since March, while the euro is already on the verge of updating six-year highs.”

“By and large, given current levels, the risks associated with geopolitics, sanctions and oil have already been taken into account in the exchange rate of our currency. If so, a correction should begin soon, unless, of course, shocks occur that will send the ruble to even lower levels,” the expert’s review says.

In his opinion, “now the nearest target in the dollar/ruble pair is the round mark of 80 rubles, the achievement of which may lead to profit-taking.”

Let us remind you that earlier today, during trading on the Moscow Exchange, the single European currency for the first time since January 2020 overcame the 93 ruble mark, reaching 93.07 rubles, and the dollar exchange rate was aiming for 80 rubles.

At the same time, the head of the data analysis department at CEX.IO Broker, Yuri Mazur, believes that “the weakening of the Russian currency is associated with growing geopolitical risks and the possibility of a second wave of the COVID epidemic in Russia.” “Investors prefer to leave the ruble for more reliable assets, such as the dollar and the euro,” the expert’s review says.

We also note that the Russian national currency has depreciated significantly against the dollar and euro since the beginning of this year. The ruble was under strong pressure from the general panic in financial markets due to the rapid spread of the COVID-19 coronavirus pandemic and concerns about its impact on the global economy, as well as the collapse in oil prices.

Thus, a strong devaluation of the Russian national currency occurred on March 7 on the international Forex market, after the OPEC+ deal collapsed the day before - the alliance countries were unable to agree on either an additional reduction in oil production or an extension of the deal for a longer period (from April 1, 2020 ). After this, on March 9, 2020, “Black Monday” happened in the financial and oil markets, and on March 18, the market was engulfed by “Black Wednesday” with another collapse in oil prices - the Russian national currency, during trading on the Moscow Exchange, updated (at that time) anti-records to the dollar and euro from February 2020 - 81 and 88 rubles, respectively.

Let us add that the real effective exchange rate of the ruble (taking into account inflation) in August 2020 decreased by 5.2% against foreign currencies compared to the previous month. At the same time, the real exchange rate of the ruble against the dollar fell by 4% during this period, and against the euro - by 7%. Over the 8 months since the beginning of this year, the real effective exchange rate of the ruble has fallen by 11.8%.

Behavior in relation to other currencies

But the behavior of other currencies in relation to the American currency is also important. They are also influenced by different factors. For example, Russia's GDP is approximately 10% dependent on oil sales.

If its value rises on the world market, the influx of currency into the country increases, the demand for it decreases, the ruble strengthens and even increases in price relative to foreign monetary units. As soon as oil falls in price, the influx of currency into the country decreases, demand for it increases, and the dollar in Russia rises.

The situation is aggravated by the fact that the country’s budget is formed taking into account the forecast of world prices for export goods. If these prices decrease, the forecasts do not come true; in order to get the same amount in rubles, it must be devalued.

If the ruble quickly loses its position against the dollar under the influence of unfavorable factors, then it is not possible to regain these positions. Therefore, there is no point in expecting any serious drop in the overseas currency or hoping that the dollar will fall to 50 rubles or lower.

The dollar showed similar behavior in Kazakhstan, which is even more dependent on commodity exports.

The point is that each currency is influenced by the size of gold and foreign exchange reserves. As noted above, each country sought to form them, including at the expense of the American currency. This is the situation. If the dollar begins to depreciate, the gold and foreign exchange reserves of the world's leading countries begin to depreciate along with it.

This leads to the devaluation of their own currencies, causing the dollar to outperform those currencies. That is, a vicious circle emerges - the overseas currency depreciates, followed by the depreciation of other banknotes from different countries of the world.

It would be another matter if the gold and foreign exchange reserves were filled in such a way as to displace the American currency from them. But here again a mine is laid. Once one country begins to empty its reserves of this currency, others will follow suit.

What will happen to the ruble in 2020? Fresh dollar forecast

But the situation with the ruble remains ambiguous. Despite the risks for the dollar on the world market, the ruble is a developing currency, subject to commodity and geopolitical risks. And the situation in Russia may develop according to its own scenario.

Will the oil price be able to stay above $60 per barrel for a long time? The main risk for “black gold” is the increase in shale oil production in the United States

This will provoke an excess of oil on the market and will put pressure on prices. Although OPEC countries are taking measures to curb supply growth, their leverage may not be sufficient.

And let's say a few words about geopolitics. The Russian ruble is afraid not only and not so much of the sanctions themselves, but of the sanctions rhetoric. Threats of introducing new tough measures to influence Russia with the “pre-Docles sword” hang over the economy and harm the investment climate.

Even if there are no new sanctions this year, any harsh statements will hurt the ruble. There are plenty of reasons: interference in the US elections, the Skripal case and other open issues.

There is no ceiling that would restrain the growth of the dollar against the ruble from above this year. Under certain circumstances, we can see the dollar at 70, 80, and even 90

But there is a lower limit, and it is being carried out by the tandem of the Central Bank and the Ministry of Finance

The dollar is already at 78: what will happen to the ruble and to us?

The ruble is falling lower and lower.

Photo: Evgenia GUSEVA

The ruble is becoming cheaper again. On September 25, the dollar passed 78 rubles, something we haven’t seen since April of this year. On the one hand, in the second half of the year the ruble weakens almost always. But now there are more negative factors than usual. What is this connected with? And what will happen next? Komsomolskaya Pravda answers basic questions related to the exchange rate of our currency.

Why is the ruble depreciating again?

The main factor is that the second wave of coronavirus has arrived. Anti-records for morbidity are recorded in the USA, India, and Brazil. Quarantine is being announced again in some European countries. All this negatively affects the economy and stock exchanges. At such moments, capital prefers to flee to “safe havens”. Gold and the currencies of developed countries (dollar, euro, Swiss franc) have always been considered this way. And risky assets are any securities and currencies of developing countries, including Russia.

What most affects the exchange rate of our currency?

About five years ago, the Central Bank switched to a floating ruble exchange rate. This means that no one regulates it. Everything is determined by the supply and demand of currency on the Moscow Exchange. If large players (banks and companies) sell dollars, they fall, and if they buy, they rise. But there are certain factors that influence the relationship between supply and demand in the foreign exchange market.

What are these factors?

There are a lot of them. The most important ones are the price of oil, geopolitics, the key rate of the Central Bank, the behavior of foreign investors, inflation, the balance between exports and imports, and others. A rough example: if the price of oil falls, but the key rate of the Central Bank increases, then the ruble exchange rate may not change much. Because a higher rate will mean a higher yield on ruble bonds. This will attract foreign investors to the Russian market, compensate for the negative effects of cheap oil and create support for the ruble exchange rate.

The ruble depends on the price of oil.

Photo: RASYUK Tatyana Vitalievna

What is more now: good news or bad news?

For the ruble – more bad ones. Although the price of oil is stable, there is a risk that the prices of “black gold” will fall due to the second wave of the pandemic. Plus, over the past six months, the key rate of the Central Bank has dropped significantly - from 6.25% to 4.25% per annum. Although this reduces the cost of loans in the country, it also reduces the demand for our bonds, reducing the inflow of foreign currency into the country. Finally, geopolitics has a strong influence. Investors are afraid that Western countries will announce new sanctions against our country, and they will be tougher than before.

What will be the impact of possible sanctions in connection with the Navalny case?

Geopolitics has begun to greatly influence our economy. This has been noticeable in the last six years. Whatever structures the financial authorities build, one tweet from Donald Trump can change everything. For example, this happened in April, when the US President was the first to announce that oil exporting countries wanted to conclude a historic deal to reduce production.

Now everything will depend on the actual sanctions that Western countries will impose on our country. So far the matter is limited to accusations and threats. But the foreign exchange market takes into account the negative scenario, just in case. That is, investors fear that Western politicians may move from words to action, and then the Russian economy will be in trouble. The ruble exchange rate will definitely fall as a result. But how much is impossible to predict. Everything will depend on the specific sanctions and how investors will interpret them.

The Navalny case could have a negative impact on the Russian ruble.

Photo: REUTERS

So what, the Central Bank has no influence on the exchange rate at all?

It actually does, but indirectly. There is such a mechanism. It's called the "budget rule." Its essence is that excess oil revenues (at prices above $42 per barrel) go to our reserves – the National Welfare Fund. And if “black gold” is cheaper than this level, the reverse process occurs. The government is pulling money out of the box and covering the budget deficit.

This happened in the spring. Then the price of oil dropped to around $20–30 per barrel. Therefore, the Central Bank sold dollars on the stock exchange and sent the money to the Ministry of Finance. This made it possible to maintain the relative stability of the ruble. Although it fell, there was no catastrophic devaluation like in 2008 or 2014. Since the price of oil has now been in the range of $40–45 per barrel for the third month, sales of foreign currency from reserves have stopped. And with it, support for the ruble on the stock exchange disappeared.

Why can't you set a fixed rate?

On the one hand, this idea seems reasonable. It would seem that it would be simpler: just take it and say that a ruble today is worth one dollar and the ratio will not change. On the other hand, many countries made this mistake. And they paid for it. Firstly, because it is impossible to establish a fixed exchange rate in a market economy. This will sooner or later lead to systemic imbalance and other “delights”. For example, there will be a black market for the dollar. Secondly, a floating exchange rate allows the economy to adapt. If the price of oil falls, the ruble exchange rate immediately drops. And this allows the state to fulfill all budgetary obligations - for example, for the payment of pensions and salaries. What, for example, Greece and Spain, suffering from the economic crisis, which have switched to the euro, cannot do.

Another thing is that too sharp fluctuations in the foreign exchange market are also not needed. Because they negatively affect businesses and citizens. For example, a cheap ruble is more profitable for exporters, and an expensive one for importers. The most profitable thing is a relatively stable exchange rate. Which, although it changes, is not much or dramatically.

Photo: Nail VALIULIN

What is better now: the dollar or the euro?

It is impossible to give a definite answer. These are two world currencies. Each is good in its own way. But their course with each other is also constantly changing. The first half of this year was dominated by the single European currency. It rose by more than 10% against the dollar. This was due to the fact that the Americans printed too many dollars to support their economy, and the EU decided to limit itself to a small amount.

It’s difficult to say what will happen next. Currency swings between the euro and the dollar go both ways. There is one version that in the near future the dollar will regain lost ground. And the other is that the US currency will fall even further after the US presidential elections in November of this year.

So should I buy currency or not?

The question is complex. Firstly, it is impossible to give a clear forecast. Not even the smartest analyst knows what the exchange rate will be in the future. Because it cannot be predicted. Something like a pandemic can always happen. Secondly, everything very much depends on the financial situation of the person asking. The standard recommendation is that it is always better to keep part of your savings in foreign currency. You can't trust anyone these days. Even if politicians convince that the ruble is not in danger, they do not have much power in their hands to really influence its exchange rate.

Consider keeping part of your savings in foreign currency.

Photo: Evgenia GUSEVA

How much is part of the savings?

Here, too, it is impossible to give unambiguous advice. It all depends on your preferences and overall savings. If you have less than 100 thousand rubles in your stash, there is no point in thinking about foreign currency savings. You live in Russia and spend money within the country. Fluctuations in exchange rates should not interest you. Moreover, with each exchange you will lose a commission (on average 1% of the amount). And rates on foreign currency deposits are now zero. Unlike ruble ones, where they still give 4–4.5% per annum. If you have more than 100 thousand rubles, then it is better to keep at least a third of your savings in dollars or euros. At least it will make you feel better.

What do analysts think?

Despite the fact that the question regarding the dollar exchange rate still remains open, the Central Bank has already provided approximate data on how it will change.

| December 1, Tuesday | — | — | — |

| December 2, Wednesday | ▲ will increase | 75,01 | 75,82 (+0,81) |

| December 3, Thursday | ▼ will decrease | 75,82 | 75,63 (-0,19) |

| December 4, Friday | ▲ will increase | 75,63 | 76,39 (+0,76) |

| December 5, Saturday | ► will not change | 76,39 | 76,39 |

| December 6, Sunday | ► will not change | 76,39 | 76,39 |

| December 7, Monday | ▲ will increase | 76,96 | 77,38 (+0,42) |

| December 8, Tuesday | ▼ will decrease | 77,38 | 77,05 (-0,34) |

| December 9, Wednesday | ▼ will decrease | 77,05 | 76,07 (-0,97) |

| December 10, Thursday | ▼ will decrease | 76,07 | 75,55 (-0,52) |

| December 11, Friday | ▼ will decrease | 75,55 | 74,48 (-1,07) |

| December 12, Saturday | ► will not change | 74,48 | 74,48 |

| December 13, Sunday | ► will not change | 74,48 | 74,48 |

| December 14, Monday | ▼ will decrease | 72,53 | 72,16 (-0,37) |

| December 15, Tuesday | ▼ will decrease | 72,16 | 72,09 (-0,07) |

| December 16, Wednesday | ▼ will decrease | 72,09 | 71,82 (-0,27) |

| December 17, Thursday | ▼ will decrease | 71,82 | 71,43 (-0,39) |

| December 18, Friday | ▼ will decrease | 71,43 | 71,38 (-0,05) |

| December 19, Saturday | ► will not change | 71,38 | 71,38 |

| December 20, Sunday | ► will not change | 71,38 | 71,38 |

| December 21, Monday | ▲ will increase | 71,78 | 72,09 (+0,31) |

| December 22, Tuesday | ▲ will increase | 72,09 | 72,53 (+0,44) |

| December 23, Wednesday | ▲ will increase | 72,53 | 72,95 (+0,42) |

| December 24, Thursday | ▲ will increase | 72,95 | 74,74 (+1,8) |

| December 25, Friday | ▲ will increase | 74,74 | 75,28 (+0,53) |

| December 26, Saturday | ► will not change | 75,28 | 75,28 |

| December 27, Sunday | ► will not change | 75,28 | 75,28 |

| December 28, Monday | ▲ will increase | 77,56 | 78,37 (+0,81) |

| December 29, Tuesday | ▲ will increase | 78,37 | 78,68 (+0,31) |

| December 30, Wednesday | ▼ will decrease | 78,68 | 78,12 (-0,56) |

| December 31, Thursday | ▲ will increase | 78,12 | 79,35 (+1,22) |

According to Roberto Cobo Garcia, Banco Bilbao Vizcaya Argentaria SA strategy specialist in the foreign exchange markets of the Group of 10 countries, disagreements between America and China will still remain, which will contribute to the strengthening of the dollar in the future. Many foreign experts agree with this position.

At the same time, financial analyst at CEX.IO Broker Alexander Yanyuk believes that the stable price of hydrocarbons will soon be restored, which will help the ruble strengthen its position. Domestic experts have high hopes for an increase in the price of oil and petroleum products.

On a note! Dollar exchange rate in November 2020 by day

Analysts explained the weekly rise in price of the dollar by 3 rubles.

Analysts assessed the contribution of the threat of sanctions to the weakening of the ruble Finance

“The first reason for the fall of the ruble is the further rise of the dollar against the currencies of developed countries, which also spurred a decline in oil prices. All this puts pressure on the currencies of developing countries, and the ruble is no exception,” points out Dmitry Polevoy, investment director at Loko-Invest. According to the ICE commodity exchange, futures for Brent crude oil for delivery in November are trading at around $41.7 per barrel.

Read on RBC Pro

Out of spite Kawasaki: how loyalty defeated competence in Russia Billionaire downshifter: how a mortgage seller got rich by comparing prices So says Gref: there are few people with a “nuclear engine” inside Hiring with a demotion: is it worth hiring a former manager for a linear position

“The most obvious reason for the decline in risk appetite in global markets is fears of a second wave,” says Dolgin from ING. According to him, strict quarantine is realistic only in small economies, and in large ones, healthcare systems had to adapt to the pandemic. Moreover, not all governments are ready to financially afford a second round of non-working days, he suggests.

“Is this the second wave in the professional sense or a continuation of the first - a question for specialists, but the deterioration in the dynamics of new cases of infection in Russia and Moscow with new recommendations on working from home and self-restrictions for the elderly does not add confidence to investors,” notes Polevoy.

Sobyanin recommended returning to remote work in Moscow Society

In addition, investors are closing positions in the ruble against the background of the expected payment of record dividends by Sberbank, Polevoy notes. Expectations of their partial conversion into foreign currency by non-residents (their share is traditionally high among state bank shareholders) could become an additional trigger for the weakening of the ruble, the economist explains.

The risks associated with coronavirus are superimposed on external threats. The Russian currency has been weakening since August due to geopolitical risks caused by Russia’s position on the situation in Belarus and the poisoning of politician Alexei Navalny. In early September, when the dollar rose to 76 rubles, analysts told RBC that without these factors it could have been worth 3-5 rubles. cheaper.

Another factor is a drop in confidence in the rapid recovery of the global economy, Dolgin continues. The Fed announced that the period of low rates will be longer. “Initially, the market reaction was positive, but then, apparently, the realization came that low rates were a reaction to a lower economic growth trajectory,” the expert says. At the end of August, US Federal Reserve Chairman Jerome Powell announced that the American regulator would allow inflation to go above the target for “some time” and would not respond by raising rates to support economic activity.

In relation to the ruble, we should talk about increased volatility, and not about protracted structural weakening, says Sofya Donets, chief economist at Renaissance Capital for Russia and the CIS: “Structural factors have not changed that much, and the price of oil remains at a level closer to $40. Factors such as closed international traffic have been and continue to operate.” The stability of the ruble is also influenced by the traditionally weaker balance of payments in the third and fourth quarters, Donets notes.

“The coincidence of the lack of strong positive news in Russia, investor sentiment and a weak balance of payments determines the weak exchange rate,” the expert concludes.

Should we wait for strengthening?

It is clear that without an improvement or at least stabilization of the external background, one should not expect a significant strengthening of the ruble, says Polevoy from Loko-Invest: “However, fundamentally, the current levels look unstable on the horizon of two to three months. I still believe that the ruble will likely strengthen from these levels by the end of 2020 - beginning of 2021 after increased volatility in October-November.” Renaissance Capital maintains its forecast, according to which the dollar will trade at the level of 73–74 rubles. with oil above $40 at the end of the year, Donets said. From the beginning of October, the start of currency sales by the Central Bank will begin to play in favor of the ruble. The volume of foreign currency for sale in the fourth quarter is 185 billion rubles, the regulator previously reported.

The Central Bank named the volume of additional foreign currency sales in the fourth quarter Finance

According to Raiffeisenbank analyst Denis Poryvay, in the first half of the year the ruble exchange rate was “much below the equilibrium value”: due to the slowdown in economic activity, the effect of “exchange rate freezing” was observed. “In the second half of the year, the exchange rate was above the equilibrium value, companies returned to paying dividends, there are signs of a revival in economic activity, the supply of foreign exchange liquidity in the banking sector has also been exhausted, and the export of capital abroad has increased,” Poryvai lists. Fundamental factors are playing against the ruble and the rate is up to 80 rubles. per dollar with current oil - “this is normal.” According to Poryvay, the course does not yet contain a “significant premium for sanctions.”

Based on fundamental indicators (balance of payments, deferred foreign currency sales), we can count on some strengthening in the fourth quarter, all other things being equal, Dolgin suggests. “The completion of the renewal of the political cycle in the United States was also associated with a reduction in risks - after November (when the US presidential elections will take place - RBC), the intensity of foreign policy rhetoric may decrease,” he says. But now external and internal factors of uncertainty have been added, so we can talk about an increase in volatility, the economist concludes: “If previously there was a narrower trading range - 70-75 rubles, now it is expanding.”

What does the exchange rate depend on?

Every year, Russian viewers and readers are convinced of the collapse of the overseas currency, that it will soon fall greatly, but not only does it not collapse, but it is also strengthening. A few months before the end of 2018 and the onset of the New Year holidays, analysts of various stripes were convincingly arguing when the dollar would fall in 2020.

It is enough to ask thirty different financial analysts for their opinion on the future exchange rate of the American currency, and there will be those who will claim that in a few months they will give 100 rubles for $1. There is also the opposite opinion that the ruble is undervalued, its value in relation to the American currency will certainly increase.

These forecasts are born due to the fact that such experts take as a basis one economic model and several factors. If we consider them, then in accordance with the laws of economics, the American currency should really become cheaper or soon turn into simple paper.

But it happens differently for the reason that not several factors operate simultaneously, but much more, and any economic model does not exist in isolation, constantly being influenced and distorted.

For example, negative factors that weaken the currency include:

- excessive issue of unsecured banknotes;

- high level of public debt;

- the relationship of the dollar to other world currencies;

- if imports exceed exports.

On all these points, the United States occupies a leading position. The country has the highest level of public debt, its dollar is so issued that no other currency that belongs to any developed state can compare with this. Finally, it is the states that import the most, with a persistently negative foreign trade balance.

However, countries prefer to fill their gold and foreign exchange reserves with dollars, and until recently this was the most purchased currency for these purposes.

Settlements on the world market are predominantly carried out in American currency.

Russia supplied Iran with military equipment, and Iran paid it off in dollars.