KBK is a 20-digit digital code that determines the type of payment and the direction of its transfer. This code is entered into the payment documentation when paying taxes, arrears and recalculation amounts, accrued penalties, interest and penalties for various violations. In order for the payment to go in the right direction, it is necessary to correctly enter the current BCC into the payment documentation.

ATTENTION! Starting with reporting for the fourth quarter of 2020, a new form of tax return for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

What is KBC?

This abbreviation stands for budget classification code. This classification divides all payments by codes for more convenient and efficient tracking of the direction of their movement. BCCs allow you to control the movement of taxpayers' funds, separate them by type of tax obligations, and separate tax payments from the payment of fines and penalties.

Each entity making tax payments is required to enter the BCC into payment forms. A company on UTII is no exception. When paying a tax, fine, penalty, or interest, the person responsible must indicate the codes corresponding to the applicable tax regime, as well as the type of payment.

If the code is entered incorrectly, the payment may go in the wrong direction and get lost, and the payer will encounter problems returning it and waste time. Every time you transfer any amount of money to the budget, it is necessary to track the actual BCC values at the current moment for specific payments.

The BCC for each year is established by the Russian Ministry of Finance, which approves a special order for this. Not the entire 20-digit digital code can change, but its last four digits – from 14 to 17.

The specified 4 digits are accepted as the following values when making various payments in the imputed mode:

- 1000 – for tax payments;

- 2100 – for payment of penalties;

- 2200 – by percentage;

- 3000 – for fines.

Where to get a receipt for payment of UTII

Tax authorities can help in providing details, but it is up to economic entities themselves to generate a payment document (in electronic or paper form). There are resources on the Internet that can help you create a receipt for paying UTII.

The technology for transferring money to the budget is varied, and the transfer can be done in several ways, such as:

- transfer from a bank account (available for individual entrepreneurs and companies);

- through the bank's cash desk in cash (only available to individual entrepreneurs);

- using Internet resources such as online banking (available to individual entrepreneurs and organizations that have the appropriate capabilities);

- on the Federal Tax Service portal, where you can first prepare a payment document and then make a transfer (available to individual entrepreneurs);

Separately, we note the method in which a payment receipt is created on the Federal Tax Service portal. There is appropriate software here that will allow you to enter all the data correctly and avoid errors. The taxpayer, by entering, for example, data on tax address, automatically fills in the fields where OKTMO is indicated, and also enters other details.

NOTE! In order for the payment to go through, it is necessary to indicate the TIN.

***

To pay UTII, you must enter the details in the receipt or payment slip. KBK occupies a special place in their composition, since it allows you to direct money exactly to the desired treasury account. To avoid mistakes, it is recommended to issue a payment document on the Federal Tax Service portal or by printing out the receipt offered by the tax authorities at bank cash desks.

Similar articles

- Latest changes in the Tax Code of the Russian Federation on UTII

- KBK for UTII in 2016-2017 for individual entrepreneurs

- How is UTII calculated for passenger transportation?

- How to switch to UTII in 2020

- Application form for termination of activities under UTII

KBK for UTII

For the imputed tax regime in relation to the payment of a special tax, the BCC is provided for the transfer of the single tax itself, penalties for late payment, as well as various types of fines for violation of the law.

KBK for payment of a special tax of the imputed regime: 182 1 05 02010 02 1000 110 (current for 2020).

According to the specified BCC, not only the calculated special tax payable for the quarter is transferred, but also arrears, tax debt, and recalculation amounts.

Where to pay UTII

Payment of taxes to the budget according to imputation, as well as payment of fines, interest and penalties, should be made according to the details of the tax office where the entrepreneur or organization is listed as a UTII payer. However, this condition does not apply to certain types of activities:

- transportation of passengers or cargo;

- placement of advertising materials on transport;

- trade that is carried out through delivery or distribution.

Individual entrepreneurs or organizations engaged in the listed types of activities can pay UTII at their place of residence or the address of the organization’s main office. Also, according to paragraph 3 of Art. 346.28 of the Tax Code of the Russian Federation, the Federal Tax Service to which the tax must be paid will be indicated in the notification immediately after registration as a UTII payer.

BCC for penalties for UTII

Penalties in the imputed regime are accrued if the single tax is not transferred on time. The deadline for transfer is the 25th day of the month following each quarter. If this deadline is violated, penalties should be charged for each day of delay in payment.

The calculated penalties must be paid by filling out a payment document, for example, an order. The payment slip indicates the BCC corresponding to the payment of penalties for UTII. From 2020 There are different classification codes for interest and penalties.

BCC for payment of penalties for UTII: 182 1 0500 110 (this value is relevant for 2020)

The interest on the special tax is paid separately; the KBK is entered into the payment documentation: 182 1 0500 110.

Use our fine calculator in Excel

Deadlines for paying UTII in 2020

According to Article 346.32 of the Tax Code of the Russian Federation, taxes are transferred to the budget for individual entrepreneurs and organizations using UTII until the 25th day of the month following the tax period (quarter). Deadlines for paying UTII in 2020:

- April 27, 2020;

- July 27, 2020;

- October 26, 2020;

- January 25, 2021.

Payment of tax to the budget is possible earlier than the specified deadlines, and the listed dates are the deadlines for making payments. As for fines and penalties, they should be listed as they are recognized. If the tax office requires payment of fines and penalties, be guided by the date indicated in the requirement.

KBC on fines for UTII

A monetary fine may be imposed on the person imputed if he did not submit a UTII declaration in a timely manner, if the tax was calculated incorrectly, as a result of which the base for calculating the tax was underestimated.

The amount of monetary penalty for a declaration not submitted on time is from five to thirty percent of the outstanding tax burden for each month of delay. At the same time, the lower limit of the fine is 1000 rubles.

BCC for payment of a fine for UTII: 182 1 0500 110 (for 2020).

BCC table for UTII in 2020.

| Payment type | KBK |

| Single tax UTII | 18210502010021000110 |

| Penalty | 18210502010022100110 |

| Interest | 18210502010022200110 |

| Fines | 18210502010023000110 |

NEWS

Since 2020, many BCCs (budget classification codes) have changed. See the table for which BCCs to use in 2017.

Table 1. New BCCs for contributions for 2020

| Payment type | KBK | ||

| contributions for December 2016 | fees for January, February, etc. | ||

Contributions from employee benefits | |||

| Pension contributions | |||

| Contributions | 182 1 0200 160 | 182 1 0210 160 | |

| Penalty | 182 1 0200 160 | 182 1 0210 160 | |

| Fines | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions for temporary disability and maternity | |||

| Contributions | 182 1 0200 160 | 182 1 0210 160 | |

| Penalty | 182 1 0200 160 | 182 1 0210 160 | |

| Fines | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions for injuries | |||

| Contributions | 393 1 0200 160 | 393 1 0200 160 | |

| Penalty | 393 1 0200 160 | 393 1 0200 160 | |

| Fines | 393 1 0200 160 | 393 1 0200 160 | |

| Contributions for compulsory health insurance | |||

| Contributions | 182 1 0211 160 | 182 1 0213 160 | |

| Penalty | 182 1 0211 160 | 182 1 0213 160 | |

| Fines | 182 1 0211 160 | 182 1 0213 160 | |

Contributions from entrepreneurs for themselves | |||

| Pension contributions | |||

| Fixed contributions to the Pension Fund based on the minimum wage | 182 1 0200 160 | 182 1 0210 160 | |

| Contributions at a rate of 1 percent on income over RUB 300,000. | 182 1 0200 160 | 182 1 0210 1601 | |

| Penalty | 182 1 0200 160 | 182 1 0210 160 | |

| Fines | 182 1 0200 160 | 182 1 0210 160 | |

| Medical fees | |||

| Contributions | 182 1 0211 160 | 182 1 0213 160 | |

| Penalty | 182 1 0211 160 | 182 1 0213 160 | |

| Fines | 182 1 0211 160 | 182 1 0213 160 | |

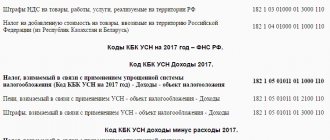

Table 2. Current tax codes for 2017

| Tax | KBK |

Income tax | |

| Tax to the federal budget | 182 1 0100 110 |

| Tax to the regional budget | 182 1 0100 110 |

| Penalties on taxes to the federal budget | 182 1 0100 110 |

| Penalties for tax to the regional budget | 182 1 0100 110 |

| Federal tax penalties | 182 1 0100 110 |

| Tax fines to the budget of subjects | 182 1 0100 110 |

Personal income tax | |

| Employee income tax | 182 1 0100 110 |

| Penalties on employee income tax | 182 1 0100 110 |

| Employee income tax penalties | 182 1 0100 110 |

| Tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Penalties on the tax paid by entrepreneurs on the general system | 182 1 0100 110 |

| Tax penalties paid by entrepreneurs on the general system | 182 1 0100 110 |

VAT | |

| Sales tax in Russia, including for tax agents | 182 1 0300 110 |

| Penalties for sales tax in Russia, including for tax agents | 182 1 0300 110 |

| Penalties for sales tax in Russia, including for tax agents | 182 1 0300 110 |

simplified tax system | |

| Advances and tax for the object “income” | 182 1 0500 110 |

| Penalties for the object “income” | 182 1 0500 110 |

| Fines for the object “income” | 182 1 0500 110 |

| Advances, tax and minimum tax for the object “income minus expenses” | 182 1 0500 110 |

| Penalties for the object “income minus expenses” | 182 1 0500 110 |

| Fines for the object “income minus expenses” | 182 1 0500 110 |

UTII | |

| Tax | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

| Fines | 182 1 0500 110 |

Transport tax | |

| Tax | 182 1 0600 110 |

| Penalty | 182 1 0600 110 |

| Fines | 182 1 0600 110 |

Property tax | |

| Tax | 182 1 0600 110 |

| Penalty | 182 1 0600 110 |

| Fines | 182 1 0600 110 |

Entering BCC into payment documentation

The current value of the BCC must be entered in field 104 of the order, where you must enter 20 digits corresponding to the current value of the code for the current year.

In addition to the KBK, the payment order must also include the purpose of the payment, briefly explaining the purpose for which the funds are transferred.

An example of filling out an order when transferring UTII for the second quarter of 2016.

An example of filling out an order when transferring UTII for the second quarter. 2020

Imputation for individual entrepreneurs

UTII is one of the special tax regimes that replaces calculations for several main taxes.

Both legal entities and individual entrepreneurs can switch to the UTII regime (since 2013 on a voluntary basis). The transition is possible if the conditions set out in paragraph 2 of Art. 346.26 Tax Code of the Russian Federation. Read more about these conditions here.

IMPORTANT! Starting from 2021, UTII will lose force throughout the entire Russian Federation. See here for details.

The main feature of the tax is that its amount depends not on actual income, but on estimated income. The amount of estimated income is established by the state and presented (imputed) to the payer-entrepreneur or organization.

The imputation exempts individual entrepreneurs from paying basic taxes paid on OSN (clause 4 of Article 346.26 of the Tax Code of the Russian Federation), but does not exempt from paying insurance premiums for themselves and for their employees.

The amount of UTII for the quarter is sent to the budget by the 25th day of the month following the expired quarter. To correctly credit contributions to the budget, you must indicate the BCC on your payments.

You can see a sample payment form for transferring UTII, as well as comments from K+ experts on how to fill it out, in the UTII Guide. Get free trial access to ConsultantPlus.

Read about the procedure and deadlines for paying UTII here.

KBK for payment of VAT for legal entities (and individual entrepreneurs)

| TAX | KBK |

| VAT on goods (work, services) sold on the territory of the Russian Federation | 182 1 03 01000 01 1000 110 |

| VAT on goods imported into the territory of the Russian Federation from countries participating in the Customs Union (from the Republics of Belarus and Kazakhstan) | 182 1 04 01000 01 1000 110 |

| VAT on goods imported into the Russian Federation at customs | 153 1 04 01000 01 1000 110 |

Results

The BCC for VAT did not change in 2020-2021: the codes themselves depend on whether the goods were sold in the Russian Federation or imported from abroad, as well as on the type of payment: current payment, fine or penalty. An error in indicating the KBK is not critical for the company, but it is better to check our article when indicating the KBK, so as not to worry about whether the payment was received to the budget on time, and not to argue with the tax authorities.

You can read about the BCC for other taxes in our articles:

- “Deciphering the KBK in 2020-2021 - 18210102010011000110, etc.”;

- “KBK for payment of personal income tax on dividends in 2020”;

- “CBC for land tax in 2019-2020 for legal entities”;

- “KBK for insurance premiums for 2020 - 2020 - table”;

- "KBK for payment of UTII in 2020 - 2020 for individual entrepreneurs."

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

BCC for VAT in 2020 for legal entities

The picture below shows cases in which it is necessary to file a VAT return, as well as make a transfer to the budget.

Payments should indicate the KBK VAT 2020. directly for legal entities 09/23/2016

With established BCC for VAT in 2020. can be found in the table below.

KBK for VAT in 2020 (table)

When should simplifiers pay VAT?

If a company/organization operates under the simplified tax system, it is not a VAT payer in accordance with Article No. 346.11, paragraph 2.3 of the Tax Code of the Russian Federation. For this reason, VAT should only be paid in certain situations, such as:

- If the company/organization issued an invoice to the buyer/customer including VAT (this is stipulated in Article No. 173, paragraph 5, subparagraph 1 of the Tax Code of the Russian Federation).

- If the company/organization performed the duties of a tax agent (for example, registration of lease/purchase of property owned by municipal/federal property, sale of confiscated property, purchase of goods/work/services from foreign persons not registered for tax purposes in the Russian Federation, mediation with such persons ). This paragraph is approved by Article No. 161 of the Tax Code of the Russian Federation.

- If the company/organization conducted business in accordance with a simple/investment partnership agreement (based on Article No. 174.1 of the Tax Code of the Russian Federation).

- If the company/organization conducted general business as a concessionaire in accordance with the concession agreement (based on Article No. 174.1 of the Tax Code of the Russian Federation).

- If the company/organization performed duties as a trustee under a trust management agreement for one or another property (based on Article No. 174.1 of the Tax Code of the Russian Federation).

In all the situations described above, the company/organization is required to file a VAT return, as well as transfer the tax to the budget. Payments should indicate the KBK VAT 2017 directly for legal entities. Among other things, the company/organization needs to pay VAT when importing goods (based on Article No. 346.11, paragraph 2.3 of the Tax Code of the Russian Federation). The payment form must indicate the KBK VAT 2020 (in field 104).

To which BCC should VAT be transferred in 2020? (example)

LLC "Melnitsa" applies the simplified tax system. In October 2020 The company, at its own request, issued an invoice to the potential buyer in the amount of 118 thousand rubles. including VAT of 18 thousand rubles. Experts propose to consider in detail what consequences may arise for Melnitsa LLC.

Due to the fact that this company issued an invoice including VAT, it needs to submit a VAT return for the fourth quarter of 2016. The declaration should indicate the KBK VAT code for the 4th quarter of 2017, which is the following combination of numbers: 182 1 0300 110.

This document should be submitted no later than the deadline, namely before 01/25/2017. (according to Article No. 174, paragraph 5, paragraph 1 of the Tax Code of the Russian Federation).

Here you should pay attention to the fact that the declaration of LLC “Melnitsa” must be submitted electronically. Also, the company will need to transfer the VAT that was indicated in the invoice to the budget no later than January 25, 2017. (this is indicated in article No. 174, paragraph 4 of the Tax Code of the Russian Federation), and in the payment slip indicate the KBK VAT 2020. A fragment of the payment can be found below.

Experts recommend paying attention to the following point. If a particular company/organization needs to transfer VAT, but did not manage to do it on time, then it will have to pay additional funds in the form of a late fee (according to Article No. 75 of the Tax Code of the Russian Federation). In this case, the payment order must indicate the KBK penalty for VAT 2020.

The payment for the penalty must be completed according to the sample presented below:

Field 104 is filled in by the KBK for VAT penalties. Field 105 of the payment slip is filled in with “AP” if the penalty is paid in accordance with the act, or with “AR” if the penalty is transferred in accordance with the executive document. Field 107 is filled with the symbol “0”, field 108 – with the document number for the amount of the penalty. Field 109 must contain the date of the document being drawn up.

We remind you that the amount of the penalty can be calculated using the following formula:

Finally, it is worth noting that from 01/01/2016. The Bank of Russia made a decision regarding the equation of the refinancing rate to the key rate (based on Directive No. 3894-U of the Central Bank of the Russian Federation dated December 11, 2015). And from June 14, 2016 The key rate is 10.5%.

Post: