Main features of starting a business in Spain

Any foreigner, on an equal basis with citizens of the country, has the right to open a business in Spain

. In general, it is worth noting that the process of establishing a company and organizing its activities is not very different from the Russian one - it is simple, transparent and does not take much time. Plus, this does not require a special visa: it can be either a regular tourist or a visa for businessmen or investors. By analogy with Russia, in Spain a number of legal entities can engage in financial and economic activities, the most common of which are SL (Sociedad Limitada) - an analogue of the Russian Closed Joint Stock Company and SA (Sociedad Anónima) - Open Joint Stock Company.

What kind of business can you open in Spain in 2020?

The country has several profitable areas that are popular among Russian migrants.

Agriculture

The state is very warm and the warm sun shines almost all year round. There are no sudden changes in temperature - the maritime climate is ideal for many vegetables and fruits. With proper organization of the process, you can make a profit from sales all year round, without focusing on seasonality.

Tourist agency

Spain is one of the most popular holiday destinations. Here you can find warm seas, stunning landscapes, gentle and pleasant sun. Therefore, the tourism business will flourish. Discover new regions of the country for your compatriots.

Travel agency brings decent profits

You can also start renting real estate. Buy your apartment on the coast or a small hotel in a popular tourist area. The purchase will pay for itself in several seasons.

Restaurants and cafes

Due to the popularity of Spain for tourists, catering establishments are thriving here. You can open your own cafeteria with Mediterranean cuisine. Fortunately, products that are exotic for Russians are quite cheap here.

IT business

More and more talented computer scientists and programmers are fleeing closer to the warm sea shores. Therefore, you can open your own IT agency and work as an outsourcer.

Main differences

The only point that distinguishes a foreign businessman from a Spanish citizen is that non-residents - foreigners without a residence permit - do not have the right to be on the list of employees of their own or any other company, to receive an official salary and to make contributions to the pension fund and social security fund. insurance: instead, they can have the status of CEO and founder and receive profits in the form of dividends. The situation is different for resident foreigners, including participants in the Golden Visa program, which allows them to obtain a residence permit when investing in real estate or the Spanish economy. In this case, the same rules apply to them as to citizens of the country: they pay tax contributions on the same basis as Spaniards.

How to open your own business and what is needed for this?

The most popular organizational and legal forms (hereinafter referred to as OPF) that facilitate the conduct of your business:

- Individual entrepreneurship.

- Limited Liability Company.

- JSC.

- Different types of partnerships (different degrees of responsibility).

In order to open your own business, it is very important to stay legally in Spain, not have a criminal record and not commit other offenses.

Any public pension fund must be registered as a tax payer for economic activities: Impuesto de Actividades Económicos (IAE) in accordance with the classifier of economic activities. Only organizations and individuals whose annual turnover does not reach even 1 million euros do not pay this tax.

You will need to complete the registration process at the tax office or at the municipality at the location of the legal address of the organization or individual.

Individual entrepreneur

The exact cost of registration depends on a number of factors (specific type of activity, address of the organization, and so on).

Registration period: ten days for registration with the tax office and thirty days for registration with the Treasury Department of the Social Insurance Fund.

Required documents:

- In the tax office - form 036 or 037 (depending on the chosen taxation system), original and photocopy of a non-resident card, IAE registration certificate.

- In the Social Insurance Fund - form TA0521, original and photocopy of a non-resident card, IAE registration certificate, card with a social insurance number, insurance, additionally attached a college certificate if the appropriate type of activity has been selected that requires the provision of such a document.

Documents required to confirm premises:

- License document for opening activities and equipment.

- Technical design and licensing document for repairs (if repair work is planned for the premises).

Other conditions that are important to comply with:

- Registration with social insurance authorities and obtaining a payment account code. It is carried out using the TA6 form with the registration of an insurance organization that belongs to a company or an individual.

- Registration in the trade register. The procedure is not mandatory in this case, but can also be performed.

- Making a visit book. The document will be maintained for five years and can be obtained free of charge.

OOO

The exact cost of registration depends on a number of factors (specific type of activity, address of the organization, and so on).

Registration period: up to 30 days.

An LLC can be opened by one person, while the founder or founders are not responsible for the activities of the organization.

Conditions that are important to comply with:

- 3,005.06 € is the minimum amount for the authorized capital.

- Correctly completed and certified statutory documents containing information about the LLC.

- Number of LLC participants: from one person (minimum value).

- Having a current account in a Spanish bank (you can choose any bank).

- Paid tax fee.

- Official accounting books and seal.

Next, you will need to register your organization in the Tax Register of Legal Entities (to issue a tax identification number, which will subsequently be used by the organization).

If the activity is of a special type, then it may require purchasing a special license. To obtain a license, it is best to involve experienced specialists who can advise on the issue of obtaining a license.

Other organizational forms of business

Registration of another organizational form also requires legal presence in the country, absence of offenses, and is carried out under general conditions:

- Complete tax registration.

- Visiting the tax authorities and obtaining the necessary documents.

- Visit to social insurance authorities.

- Licensing of your activities, if required.

To successfully open your own business, it is important to follow all the points presented.

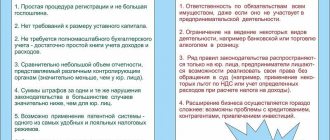

Main advantages

All processes associated with organizing your own enterprise in Spain are simple and do not take much time. Business in Spain for Russians

- this is more than realistic, especially if its opening is accompanied by a reliable company that will provide all the necessary consultations, help to correctly draw up constituent documents, hire specialists and ensure tax optimization of the process. The undoubted advantages of running your own business in Spain include the absence of numerous regulatory and supervisory structures, which actually means quiet work without the constant checks that Russian entrepreneurs are so accustomed to. If the company complies with Spanish legislation and regularly pays taxes, then no problems with official structures will arise.

Possible problems of starting a business

To conduct business activities you will need permission from the Spanish Ministry of Labor. Documents are submitted there that confirm your work at the enterprise.

You must obtain a special visa from the Spanish Embassy, which is only issued if you have a work permit from the Spanish Ministry of Labor. Go through all the formalities with local authorities - obtain a license to open your own business, as well as to carry out repair and construction work on the premises. If the type of chosen activity is subject to mandatory licensing, it is necessary to go through a complex process of checks and confirmation of professionalism and qualifications.

Main directions

The answer to what kind of business you can do in Spain

, very simple. As in any country in the world, there are simply no restrictions on the range of entrepreneurial activities that will generate a stable income. Often, businessmen “expand” or transfer their Russian business to Spanish territory: those who are used to engaging in agricultural activities master it here; those who specialize in catering open restaurants in Spain; those who know a lot about quality investments invest in liquid residential or commercial real estate. Let us remind you that you do not need a business visa to Spain for this: absolutely any foreigner with a tourist visa can become the founder of a company.

What documents are needed?

As for documents, in Spain, as in any other country, you will need a lot of papers to open your own business. This is, first of all, a foreign passport (but without it, in fact, they won’t be allowed into the country). It is also important to obtain a foreign citizen identification number or NIE. It is issued to those who plan to conduct some business in the country, and not only related to business and work.

international passport

You will also need an extract from the bank account, which will indicate the amount of funds lying on it - this will be the authorized capital of the organization. You will also have to obtain an extract from the Register in Spain about the uniqueness of the name chosen for the enterprise - there is no plagiarism here and cannot be. And, of course, you need an agreement that the company has been established, and you will also need its charter, certified by a notary.

Bank account statement

On a note! If the enterprise provides for the presence of jobs, then it is necessary to register with the Ministry of Labor.

Preparation of necessary documents

At the very start, even before the collection of documents to open a case begins, it is important to analyze several aspects and resolve a number of issues:

- decide what you want to do;

- have enough money to start a business;

- obtain a residence permit;

- know Spanish or study the language, otherwise you simply won’t be able to conduct business;

- take a closer look at different rooms and look for a suitable option;

- think about the name of the organization.

Residence permit in Spain

It is important to remember that you must love your business in Spain and enjoy every day spent in the office, otherwise you will not see success in this country. First you need to think about how to do your job well and efficiently, and only then with

Main steps

- 1. Checking the company name with the Chamber of Commerce.

- 2. Preliminary opening of a current account for a future company based on a certificate from the Chamber of Commerce reserving the name for future shareholders.

- 3. Preparation of the company’s statutory documents by a notary in the presence of a representative of the accompanying agency.

- 4. Contribution of the authorized capital (minimum €3,100 in the case of opening an SL and €51,000 in the case of opening an SA).

- 5. Notarized registration of a legal entity in the presence of a notary and shareholders (or by proxy from the shareholders). In the presence of all major shareholders, the notary registers the legal entity.

- 6. The accompanying agency registers the company with the tax authorities and receives a company identification number - the so-called NIF.

- 7. From this moment, the company can begin commercial activities, attract personnel, enter into contracts, rent offices, etc.

- 8. If the type of activity of the company requires a license (restaurant, hotel, etc.), then, in addition to NIF, it is necessary to obtain the appropriate license from the municipal authorities of a particular municipality.

- 9. To maintain accounting, timely pay taxes and submit reports, you must either register with the state or outsource an accountant (70% of cases in Spain). This activity in Spain bears the self-explanatory name Gestoria, and some companies providing it have been on the market for almost 100 years.

Order a consultation

Each type of business has its own characteristics. The service sector is traditionally considered to be very labor-intensive and with a low level of profitability. At the same time, it is characterized by sufficient stability. Hairdressers, restaurants, and workshops are open all year round, although with seasonal fluctuations in the number of clients. Design and printing studios, on the contrary, are little dependent on the seasons, and also allow you to hire remote staff.

When deciding to open a business in Spain, you should rely on marketing research, even if conducted independently. A luxury restaurant is unlikely to be in demand in a secondary resort of a medium or low price category, which is practically empty from November to May. And a bar-ice cream cafe in the area of the embankment and the beach can be very appropriate and bring good profit in the high season.

When thinking about the question of what kind of business is profitable in Spain, you also need to decide whether you want to open it yourself from scratch or prefer to buy a ready-made one. Buying a ready-made business in Spain is called “traspaso”. In this case, you buy the company itself, all operating equipment and machinery. You have the right to keep existing staff in the company. Together with the company, the clientele, company name (if you wish), reputation, licenses, suppliers, etc. are transferred to you. However, the premises where the company is located (bar, hairdresser, office, etc.), as a rule, belongs to a third party, for whom you will become a new tenant.

Another possibility is a franchise business, i.e. joining one of the international networks. Franchising has covered literally all areas of the economy: production, sales, service. McDonald's, Mango, Carrefour, BodyShop and thousands and thousands of other brands in Spain operate as franchises. In recent years, this type of business has been developing at a rapid pace, showing an average turnover higher than that of traditional retail outlets. The greater efficiency of franchising companies is due to the power of a well-known brand and a more rational systematization of work. For a minority company, participation in a large network is the key to high profitability and reduced risk of bankruptcy, and also provides the opportunity to receive advertising support that is not available to a traditional small business. If you don’t mind working under the control of the owner, with execution and compliance with all prescribed norms and requirements, it’s worth trying this business option in Spain.

Main taxes

Income declarations in Spain are submitted by both individuals and legal entities: quarterly and annually. The income tax for legal entities is 25%; for individuals it is calculated on a progressive scale: the higher the profit, the higher the taxes. You can submit a declaration with the help of an accountant in order to take into account all the details and correctly reflect income and expenses and, possibly, receive a certain discount (it is provided not only on the basis of expenses, but also in the presence of minor children, mortgage loans, etc.).

Corporate income tax of 25% is paid once a year. VAT (IVA) of 21% is paid (or compensated by the state) quarterly. Tax on dividends - personal income - is calculated on a progressive scale, and its rates range from 18% to 43%. In the event that a foreigner is not a fiscal resident of Spain (does not stay on its territory for more than 183 days a year), then his income tax is calculated at a flat rate of 24%. More details about taxes in Spain can be found in the article of the same name.

Attractiveness of Spain for foreign investment

According to the latest data, more than 9 out of 10 foreign investors recommend Spain as an ideal place to buy and start a business, while 96.6% of respondents have a positive perception of the local economy.

This is according to the report “Spain as an Investment Opportunity”, prepared by commercial consultants Kreab, which analyzed the opinions of 29 major international investment companies.

The most important reasons that make the Spanish market attractive to foreign capital are its size (the Spanish economy has been growing non-stop for the past four years) and the high returns on foreign direct investment.

There are currently more than 12,000 branches of multinational companies in Spain, employing approximately 1.3 million people.

Other positive factors are:

• Infrastructure development (second largest railway network among OECD countries; best motorway network in the European Union; third largest air passenger traffic in the EU). • High level of education plus a talented and accessible workforce, increasing the innovative potential of the economy. • Decent quality of life: Spain occupies a leading position in the efficiency of healthcare, life expectancy and the development of transplantation among EU member states. • The highest competitiveness indicators among OECD countries in terms of the ratio of business income and expenses.

Investments in Spain are one of the foundations of economic and social development, so local authorities are trying to be an ally for foreign companies.

According to the National Register of Foreign Investments, gross FDI in Spain increased by 22.2% in the first quarter of 2020 compared to the first quarter of 2020, amounting to 8.41 billion euros. Germany, China, Canada, Luxembourg and Holland were the main sources of foreign investment.

On the other hand, Spain itself is strongly associated with famous world brands.

The country's main assets are its cultural heritage, history, tourism sector, outstanding gastronomy, winemaking, fashion and now high technology.

The Brandz study ranks Spain fifth among EU countries with strong brands with a global presence: Zara, Mango, Manolo Blahnik, Santander, Telefónica.

Top tips for those wishing to open a business in Spain

Register a company and start doing business in Spain

for Russian entrepreneurs - as real as in Russia. Estate Barcelona real estate agency supports foreign businessmen at every stage of this process. If we are talking about commercial real estate, then, in addition to selecting a property with good profitability, if necessary, assistance will be provided in obtaining mortgage loans. And also - opening bank accounts, company registration and a full range of consulting services that may be needed at this stage

If necessary, our agency will act as a management company or select a management company that will defend the interests of your business projects in the field of commercial real estate and will take over all the processes of competent property management to obtain a stable profit. When deciding to “expand” into the territory of a stable European state, it is important to have a reliable partner. Estate Barcelona is proud of its client portfolio: their trust speaks for itself.

Share this article

Where to invest in Spain

Spain is one of the largest countries in Europe. Each autonomous community has its own characteristics and promising areas for investors. I’ll tell you about Catalonia, where I live and which I know well. However, I think this rule will be true in other parts of the country.

Foreign investors usually know one or two cities in the region. For us this is Barcelona. The first thing everyone does is look for business opportunities there. I don’t argue that the city is magnificent, but it is not suitable for all projects. Many areas are oversaturated, the entry barrier is high, and competition is fierce.

Therefore, I recommend that foreign entrepreneurs not limit themselves to popular locations. It is necessary to study the region more deeply, preferably with the help of local specialists. This way you can find the best opportunities to invest your capital.

For example, in our area I can recommend Cambrils, which is 100 kilometers from Barcelona. This is the gastronomic capital of the Costa Dorada. There are excellent Michelin-starred restaurants, wide sandy beaches, picturesque mountainous surroundings, parks with pink flamingos, a chic yacht club and a fishing port... In a word, beauty.

Cambrils is well known by the French and the Spaniards themselves. During the season, this region is visited by about 5 million people. At the same time, there is clearly a lack of premium quality housing here.

Several years ago we already implemented a project. We bought an old two-story house in the very heart of the city, in which the Gatel restaurant, awarded a Michelin star, was located. The owners retired, so they sold the business. In its place, a five-story building was built: the first two floors were also occupied by a restaurant, and the upper ones housed four apartments for short-term rental. These apartments have become the most expensive on the coast - and the most in demand. Already in November everything is booked for a year in advance.

An example of a completed investment project from Tidex. Redevelopment of a building in the center of Cambrils. The premises for the restaurant are leased for long-term, apartments on the upper floors are rented daily. The investor's income is 8% per year

We are currently building premium residential complexes in Cambrils. For example, the new Rubik project is modern small villas (155 sq. m) in the most prestigious area of the city, a two-minute walk from the beach. This is an option for those looking for a quality summer home in Spain.

Villas in the Rubik complex in Cambrils

Apartment in Alicante, Spain €231,800 Area 134 m2, 4 rooms OLE INTERNATIONAL HOMES…

Penthouse in Benidorm, Spain 390,000 € Area 150 m2, 4 rooms SPAINLUXINVEST

Residence permit upon purchase

Villa in Benitachell, Spain €790,000 Area 207 m2, 3 rooms Damlex Realty

Apartment in Alicante, Spain 307,000 € Area 136 m2, 4 rooms SPAINLUXINVEST

Residence permit upon purchase

Villa in Marbella, Spain €3,000,000 Area 849 m2, 4 rooms Damlex Realty

Residence permit upon purchase

Cottage on the Costa Brava, Spain 720,000 € Area 400 m2 Scat Realty

Apartment in Benidorm, Spain 418,000 € Area 106 m2, 4 rooms SPAINLUXINVEST

Apartment in Guardamar del Segura, Spain 132,500 € Area 72 m2, 3 rooms EspanaTour

Apartment in Benidorm, Spain €273,500 Area 99 m2, 3 rooms SPAINLUXINVEST

House in Marbella, Spain €685,000 Area 346 m2 Expertagent

Apartment in Campello, Spain 199,000 € Area 93 m2, 4 rooms SPAINLUXINVEST

Residence permit upon purchase

Villa in La Marina, Spain €498,680 Area 290 m2 Activa Investment SL

Apartment in Tenerife, Spain 183,750 € Area 140 m2 VYM Canarias

Residence permit upon purchase

Villa in Ciudad Quesada, Spain 517,200 € Area 255 m2, 4 rooms Evolventa Lux

Apartment in Torrevieja, Spain 59,000 € Area 69 m2, 3 rooms Planeta Spain

Villa in Benidorm, Spain €293,000 Area 117 m2, 3 rooms SPAINLUXINVEST

Residence permit upon purchase

Villa in Altea, Spain €559,000 Area 395 m2, 5 rooms SPAINLUXINVEST

Residence permit upon purchase

Apartment in Barcelona, Spain 838,000 € Area 106 m2, 2 rooms ESTATE BARCELONA

Residence permit upon purchase

Apartment in Barcelona, Spain 570,000 € Area 93 m2, 3 rooms ESTATE BARCELONA

Residence permit upon purchase

Villa in Alicante, Spain €939,000 Area 442 m2, 4 rooms Albamar Group

We see that the demand for such housing is enormous. And it would be possible to build much more: there are many promising options, and prices are three to four times lower than in Barcelona. All that remains is to find interested investors.

Where to begin?

To begin with, before cutting from the shoulder, you need to think carefully about everything. Oddly enough, there is no need to rush anywhere, because it is easy to get burned and lose your invested funds. People who know the language will not find it difficult to deal with all the necessary documents. Others will certainly turn to specialists. This is the first thing you need to decide on: solve bureaucratic problems yourself or let professionals do it.

Second question: “What business to open in Spain?” Here it is already necessary to throw all your efforts into establishing demand in the country. Much also depends on the locality where the entrepreneur will open the business. It is worth noting one feature: in Spain there are no premises with a huge area. There have been cases when a person has already chosen an idea, purchased equipment, documented his business and simply could not find the right premises.

Therefore, you should go there, analyze all the points, “test the waters” and only then open a business in Spain.

Search for an administrator

Business in Spain requires the presence of an owner and administrator. In the first case, everything is clear, it can be anyone. But the administrator must only be a Spaniard or a person officially registered in the country. This issue should be taken seriously, since this person will actually lead the organization.

Of course, you can put a person in a position so that there are no problems with the law, but in fact personally manage the enterprise. In some cases this is a pretty good solution. No one will appoint the first person they meet to the position of manager because of a Spanish passport. There have been cases when the administrator racked up a bunch of debts for the company and disappeared in an unknown direction. Of course, in the end he will be punished, but no one needs unnecessary proceedings.

Requirements for those who intend to promote business in the Kingdom of Spain

Like any other country, Spain considers each individual applicant for the role of resident of the country. Advantages go to people who have the means and experience in running a business and have no criminal record. It is necessary to prove and show that intentions are supported not by fantasies, but by real plans and developments. The country is waiting not for dreamers, but for those who can really contribute to the economy.

As a result, it will be possible to eventually become a legal citizen of Spain. But even a Spanish residence permit provides a lot of prospects. This is the opportunity to receive a prestigious education in Spain (pay as for residents), and the right to trade with the whole world under the Spanish trademark, and opening accounts in the country’s banks, etc. Spain deserves to become a second homeland. And this will be confirmed by everyone who already lives in Spain and is promoting their business there.

Bank account

Doing business in Spain is almost impossible without a bank account. If you open SL with a capital of 3,100 euros, it is not necessary to register an account immediately. However, sooner or later this will have to be done. If you have a foreigner identification number in your hands, any bank will be glad to see you among its clients.

To open an account, you will need a work contract or income certificate in Russian and Spanish. This document must be certified by an official translator. It is not recommended to do this in Russia, since in any case you will have to repeat it in Spain. After this, an account is opened, a book, details and a PIN code are issued.

Experienced entrepreneurs advise registering this account with the tax office and providing the Russian bank with all the details. This will facilitate the transfer of funds and reduce possible losses.

The main thing is to think through everything and prepare

A guarantee of success will be the basics prepared at home. These include:

- Knowledge of Spanish. It is important that at least one of the partners speaks the local language at a good level.

- A clear understanding of what exactly the new company will do.

- Having experience in the industry that you plan to develop.

Small business in Spain - Marketing research that gives an idea of the opportunities and prospects for business development.

- Knowledge of local laws.

You need to be prepared for the fact that in Spain the bureaucratic system sometimes reaches the point of absurdity. You will have to deal with many authorities and sign a lot of useless papers. In addition, you need to take into account the fact that the tax system in Spain is not as promising for businessmen as in other European countries. The minimum monthly fee for entrepreneurs is 250 euros. This is a relatively significant amount for beginning businessmen.

Return to contents

Documents for foreigners doing business in the Kingdom of Spain

The best way to develop your activities in Spain is to stay in the state on a business visa. It is not difficult to obtain the document. The Spanish authorities are not just loyal to foreigners, they are very interested in outside help, since the state's economy still leaves much to be desired. Opening a business means new injections into the treasury, as well as new jobs.

Prove that you can successfully develop in the Kingdom, and you will be welcomed with open arms.

A business visa to Spain is a good type of permit for anyone who wants to visit the country. In order to start processing it, you need to have an official invitation from your Spanish partners, which will describe the activities of the invitee in the Kingdom.

The document must indicate the position of the inviter, his first and last name, etc. In addition to the invitation to the embassy, a standard set of documents necessary for issuing a visa is provided. This:

- a foreign passport, the validity of which must be three months longer than the expiration date of the visa received + a copy;

- if you still have old, dated international passports, it is advisable to present them too;

- standard form questionnaire. The language of completion is English;

Sample of filling out the first page of the Spanish visa application form - Questionnaire;

- Two color photos. Size 3.5x4.5 cm. The face should occupy at least 70% of the entire photo. The background must be exclusively white;

- Document from the place of main activity. Only on company letterhead. The contacts of the company and all information about the applicant (position, salary, length of service, etc.) must be indicated;

- Bank confirmation of financial solvency;

- Air ticket reservation. This document must bear the seal of the company that made the reservation;

- honey. insurance;

- Russian passport + copy;

- hotel reservation;

- a copy of the passport of the official who signed the invitation.

Business immigration to Spain is a well-trodden path that many of our compatriots have followed.

Filling out the second page of the Spanish visa application form

The large number of required documents should not be intimidating. Spanish officials are very loyal to business expats and will not create any obstacles. The document will be issued within 6-7 days. The initial business visa is not multiple entry. To open a multiple-entry Schengen visa, you need to obtain at least two business visas.

In order to start doing business in Spain, you need to obtain a business permit in the state. This permit will cost approximately $30.

Return to contents

Legal nuances

Spain has its own subtleties of opening and running a business. The country has a fairly developed management and control apparatus consisting of officials. There are also a number of formal procedures that must be followed.

Business registration

The process of opening a business in Spain includes the following steps:

- Concluding an agreement with a manager (asesor), who must be a Spanish citizen or resident;

- Choosing a company name and verifying it with the registration authority in Madrid. You also need to decide on the form of ownership - LLC (Sociedad Limitada) or JSC (Sociedad Anonima). For a small business, the Autonomo status, that is, an individual entrepreneur, will be sufficient. To do this you need to be a resident;

- Opening a bank account to deposit authorized capital - about 3,000 euros for SL and 60,000 for SA;

- Development and notarization of constituent documents;

- Payment of tax in the amount of 1% of the authorized capital;

- Registration of the charter with the Spanish Chamber of Commerce, where it is entered into the register. The tax office issues a CIF tax number. Sometimes business activities require licensing;

- Payment of taxes levied by the municipality where the business is located, as well as the acquisition of relevant details - accounting books, seals, etc.

Taxation

The tax system in Spain is quite extensive. Main taxes paid by non-resident entrepreneurs:

- IVA (Value Added Tax). Currently the VAT rate is 21%;

- ITP (property transfer tax);

- AJD (tax on legal acts);

- IBI (real estate and transport tax on a general basis).

General information about business immigration in Spain

As a result of business immigration, the following occurs:

- The immigrant becomes an employer in the country of destination;

- Taxes are paid to the state budget;

- New jobs and trade relations are created, and the circulation of financial resources is stimulated.

Business activities are beneficial to the state, so many countries have simplified procedures for obtaining citizenship and residence permits for businessmen.

What is a business visa and what type of visa can you get in Spain?

A business visa is specifically provided for the implementation of business projects. The most advanced is known as the “golden visa”, and it is intended for large investors in the Spanish economy. Since 2015, the Kingdom has decided to provide the opportunity to live for a year on its territory with the possibility of extension.

Members of the investor's family are also granted a similar right, but for this they need to spend a substantial amount:

- Purchase real estate for 500 thousand euros;

- Acquire a share in a Spanish company in the amount of 1 million euros.

In this case, the further procedure for obtaining a residence permit, and then citizenship, is greatly simplified.

Those who do not have such an amount will have to apply for a regular single-entry business visa, allowing them to stay in the country for up to 90 days within six months. After obtaining two or more simple business visas, it will be possible to open a multiple-entry Schengen visa.

What type of business is more profitable to open in Spain?

Spain is quite promising for medium-sized businesses. Small-sized companies with staff from 10 to 50 people, with a moderately developed infrastructure, can most adequately occupy current niches in business. Small business is traditional for Spaniards: these are mainly industries related to various types of trade and public catering. But the risk for a foreign citizen in case of failure will be higher.

The most profitable ideas for business immigration to Spain among Russians is opening their own business. Good proposals for a ready-made business are very expensive, and besides, truly worthwhile ideas are quickly bought up by the “old-timers” of the market.

You may also like

1

Holidays in Spain: 5 main dangers for tourists

197

If you intend to develop your own startup, then when opening a business visa, the trade and economic department of the Spanish embassy can simplify the procedure if the proposed business is of interest to the Spanish economy.