How to calculate the simplified tax system “income”

To calculate the simplified tax system, the taxpayer who has selected the “income” object should perform the following steps:

- calculate the tax base;

- determine the amount of the advance payment;

- determine the final amount of tax to be paid.

The rules and formulas that apply at each stage do not allow for ambiguity. The peculiarities may only affect the rate of this type of tax, since regions are given the right to set rates other than 6%. True, only in the direction of decrease. The reduced rate cannot be lower than 1% (with the exception of the 0% rate for individual entrepreneurs carrying out entrepreneurial activities in the production, social and (or) scientific spheres and registered for the first time after the law on “tax holidays” came into force in a constituent entity of the Federation). However, the most widely used rate remains 6%, and we will focus on it in our article.

Get free trial access to ConsultantPlus and find out how to calculate taxes if you are switching from the simplified tax system to OSNO.

Determine the amount of tax to be paid additionally

Your further actions will be the same regardless of your taxable object. So, calculate the amount of tax you need to pay extra for the year, taking into account the previously paid advance payments for the first quarter and half of the year. The formula is:

| The amount of “simplified” tax to be paid additionally for the year if the advance payment for 9 months is not transferred | = | The amount of “simplified” tax for the year (or the amount of the minimum tax, if the minimum tax is higher than usual for the object of income minus expenses) | – | The amount of the transferred advance payment for the first quarter (due no later than April 25) | – | The amount of the transferred advance payment for the six months (due no later than July 25) |

Next, you need to figure out how much to transfer to the budget so that there are no arrears or overpayments. Therefore, let's move on to the next step.

How is the simplified tax system calculated: determining the tax base

Before calculating the 6% simplified tax system, you need to find the value of the tax base. Determining the tax base for this object of taxation does not present any great difficulties, since it does not involve the deduction of expenses and, accordingly, work to establish the composition of the latter for tax purposes.

In order to find out the tax base for the tax period, the actual income received is calculated quarterly on an accrual basis. At the end of the tax period (year), the overall result of income for this period is summed up.

Deadlines for paying advances under the simplified tax system in 2020

According to the deadlines established by the Tax Code of the Russian Federation, advances under the simplified tax system are paid no later than the 25th day of the month following the reporting period (clause 7 of Article 346.21 of the Tax Code of the Russian Federation).

If the 25th falls on a weekend, the payment deadline is postponed to the next working day. The generally established deadlines for paying advances under the simplified tax system are:

- for the first quarter of 2020 - on April 27 (the 25th is a Saturday, a day off);

- for the half-year - on July 27 (25th - Saturday, day off);

- for 9 months – on October 26 (the 25th is Sunday, a day off).

KBK for payment of simplified tax system in 2020

Read more…

How to calculate the 6% simplified tax system: determine the amount of advance payments

The advance payment corresponding to the tax base calculated from the beginning of the year to the end of the reporting period is determined by the following formula:

AvPr = Nb × 6%,

Where:

Nb is the tax base, which represents the taxpayer’s income on an accrual basis from the beginning of the year.

However, the amount of the advance payment payable at the end of the reporting period will be calculated using a different formula:

AvPu = AvPr – Nvych – Ts – AvPpred,

Where:

AvPr is an advance payment corresponding to the tax base calculated from the beginning of the year to the end of the reporting period;

Nvych - a tax deduction equal to the amount of insurance premiums paid to the funds, temporary disability benefits paid to employees, transferred payments for voluntary insurance in favor of employees;

How to calculate a tax deduction under the simplified tax system was explained in detail by experts in the ConsultantPlus ready-made solution. Get trial access and study the material for free.

Тс - the amount of the trade fee paid to the budget (if the type of activity carried out by the taxpayer falls under this fee);

AvPpred. - the amount of advances paid based on the results of previous reporting periods (such deduction is provided for in paragraphs 3, 5 of Article 346.21 of the Tax Code of the Russian Federation).

The amount of tax deduction for individual entrepreneurs who work for themselves and do not have employees is not limited (paragraph 6, clause 3.1, article 346.21 of the Tax Code of the Russian Federation), i.e. this deduction for individual entrepreneurs can reduce the amount of accrued tax to 0. An entrepreneur who there are hired employees, they have the right to apply a tax deduction only in the amount of 50% of the tax amount calculated from the tax base (paragraph 5, clause 3.1, article 346.21 of the Tax Code of the Russian Federation).

This limitation applies only to insurance premiums, temporary disability benefits and payments for voluntary insurance. It does not apply to the trade fee (clause 8 of Article 346.21 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 7, 2015 No. 03-11-03/2/57373). And even when the maximum possible deduction amount is reached due to the amount of contributions, benefits and payments for voluntary insurance, the accrued tax can be further reduced by the amount of the trade tax.

In this case, the taxpayer must be registered as a payer of such a fee.

Read about the specifics of calculating the trading fee in this section.

How to calculate the advance tranche of the simplified tax system 6%

The rules for calculating advance transfers of the simplified tax system have not changed in 2020. To do this, follow the step-by-step instructions on how to calculate the advance payment according to the simplified tax system “Income”.

Step 1. We sum up all types of income of an economic entity from the beginning of the year to the end of the quarter for which we plan to transfer the advance tranche. For example, to pay for the first half of 2020, we include all income in the calculation, in accordance with Art. 249 and 250 of the Tax Code of the Russian Federation, from 01/01/2020 to 06/30/2020 - until the last day of the second quarter.

Step 2. We apply a tax rate of 6% to the received amount of income. We take into account regional relaxations: the authorities of the constituent entities of the Russian Federation can reduce the rate to 1%.

Step 3. Reduce the payment by the amount of insurance coverage paid:

- If the payer is an individual entrepreneur without employees, then the advance payment of the simplified tax system can be reduced by insurance premiums paid for oneself in full.

- For employers (individual entrepreneurs and organizations), the advance amount under the simplified tax system can be reduced to 50%. Include in your calculations payments for employee insurance and sick leave paid by the employer.

Step 4. We complete the calculation of the advance payment according to the simplified tax system “Income”. Now, paid advances for earlier periods of the reporting year should be subtracted from the amount received. For example, when calculating the advance for the 1st half of 2020, subtract the advance of the simplified tax system for the 1st quarter of 2020 from the amount received.

USN: formula for calculating the final payment

At the end of the year, the last calculation of the simplified tax system for the tax period is carried out at 6%, subject to additional payment to the budget. Please keep in mind that there may be an overpayment. This amount will either be offset against future payments or returned to the taxpayer's account.

The formula by which the simplified tax system is calculated - income is established by paragraphs. 1, 3, 5, 8 tbsp. 346.21 of the Tax Code of the Russian Federation and looks like this:

N = Ng – Nvych – Ts – AvP,

Where:

Ng - the amount of tax, which is the result of multiplying the tax base calculated for the entire year by 6%;

AvP - the amount of advance payments that are calculated during the reporting periods of the reporting year.

For more information about what a single tax is, which is paid under the simplified tax system, read the article “What taxes does the simplified tax system replace?”.

If you apply the simplified tax system “income minus expenses”, the procedure for calculating tax will be different. ConsultantPlus experts told us how to correctly calculate the tax payable and what the minimum tax is. Get trial access and study the materials for free.

What are advance payments on the simplified tax system?

Let us repeat, the tax period for the simplified system is a calendar year, so the final payment to the state occurs at the end of the year. But in order for budget revenues to be uniform throughout the year, the Tax Code of the Russian Federation established the obligation of simplified taxpayers to pay tax in installments, based on the results of the reporting periods. In essence, this is how the budget is advanced using earlier revenues.

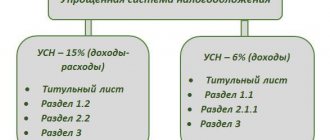

The reporting periods for calculating advance payments under the simplified tax system are the first quarter, half a year and nine months of the year. If a businessman received income during the reporting period, then within 25 days following it, he must calculate and pay 6% (for the simplified tax system Income) or 15% (for the simplified tax system Income minus expenses) of the tax base. If no income was received, then there is no need to pay anything.

Advance payments are called that way because the tax is paid as if in advance, in advance, without waiting for the end of the year. At the same time, all advance payments under the simplified tax system are taken into account in the declaration and accordingly reduce the total annual amount.

For the convenience of paying taxes and insurance premiums, we recommend opening a current account. Moreover, now many banks offer favorable conditions for opening and maintaining a current account.

Example conditions for calculating the simplified tax system “income” for 2020

Let's consider step by step how to calculate tax under the simplified tax system - income. To do this, we will give an example of how to calculate the simplified tax system of 6%.

Example

Omega LLC, which uses the simplified tax system with the object “income” in its activities, received income in the amount of 3,200,000 rubles in 2020. Broken down by month it looks like this:

- January - 280,000 rubles;

- February - 310,000 rubles;

- March - 260,000 rubles;

- April - 280,000 rubles;

- May - 260,000 rubles;

- June - 250,000 rubles;

- July - 200,000 rubles;

- August - 245,000 rubles;

- September - 220,000 rubles;

- October - 285,000 rubles;

- November - 230,000 rubles;

- December - 380,000 rub.

At the end of the quarter, income amounted to 850,000 rubles, half a year - 1,640,000 rubles, 9 months - 2,305,000 rubles, year - 3,200,000 rubles.

During the tax period, Omega LLC paid to insurance premium funds:

- for the 1st quarter - 21,000 rubles;

- for the six months - 44,300 rubles;

- for 9 months - 66,000 rubles;

- for the whole year - 87,000 rubles.

There were also payments of temporary disability benefits. Their total amount was 24,000 rubles, including:

- in the 2nd quarter - 17,000 rubles;

- in the 3rd quarter - 7,000 rubles.

From the 2nd half of the year Omega LLC began to carry out trading activities and in the 4th quarter paid a trading fee in the amount of 12,000 rubles.

When to pay tax according to the simplified tax system for 2020

The deadline for payment of the simplified tax system for 2020 was postponed by Decree of the Government of the Russian Federation of April 2, 2020 No. 409.

The maximum transfer for organizations is from March 31 to September 30, 2020, for individual entrepreneurs - from April 30 to October 30, 2020.

This maximum deferment does not apply to everyone, but only to:

- those who are listed in the register of small and medium-sized businesses as of March 1, 2020;

- those operating in industries that have been most affected by the spread of coronavirus.

Who is a small business?

Read more…

New deadlines for paying the simplified tax for 2020 have also been established for those who did not work in April 2020 by presidential decree (Clause 7, Article 6.1 of the Tax Code of the Russian Federation):

- for organizations - as of May 6, 2020;

- for individual entrepreneurs - as of May 6, 2020

If simplified workers continue to work in April 2020, that is, non-working days were not established for them by presidential decrees, then for them the deadlines for paying taxes for 2020 have not changed (clause 4 of Decree of the President of the Russian Federation No. 239 of April 2, 2020) .

For simplified workers who continue to work in April 2020, the tax payment deadlines for 2020 have not changed. Organizations had to pay the simplified tax system for 2020 on March 31, individual entrepreneurs should prepare to pay the simplified tax system for 2020 on April 30.

Calculation of simplified tax system for 2020

Omega LLC will calculate tax at a simplified tax rate of 6% as follows.

Before calculating the simplified tax system (USN) - income for the year, the accountant should determine the amounts of all advance payments.

- How to calculate the simplified tax system: determining the amount of the advance payment based on the results of the 1st quarter.

First, according to the simplified tax system of 6%, the calculation of the advance payment attributable to the tax base of this reporting period is made:

850,000 rub. × 6% = 51,000 rub.

A deduction is then applied to the amount received. That is, it is reduced by insurance premiums paid in the 1st quarter. Since the organization has the right to make such a reduction by no more than half of the accrued amount, before this reduction it is necessary to check the fulfillment of the condition on the possibility of applying the deduction in full:

51,000 rub. × 50% = 25,500 rub.

This condition is met since contributions are equal to 21,000 rubles, and the maximum deduction is 25,500 rubles. That is, the advance can be reduced by the entire amount of contributions:

51,000 rub. – 21,000 rub. = 30,000 rub.

The advance payment due at the end of the 1st quarter will be equal to 30,000 rubles.

- How to calculate tax according to the simplified tax system 6%: determining the amount of the advance payment based on the results of the six months.

First, the advance payment attributable to the tax base of a given reporting period is calculated. The tax base is determined on an accrual basis. As a result we get:

RUB 1,640,000 × 6% = 98,400 rub.

The amount received should be reduced by insurance premiums paid for the first half of the year and by the amount of temporary disability benefits paid to employees for the first 3 days of illness in the 2nd quarter. The total amount of contributions and benefits for the half-year is:

RUB 44,300 + 17,000 rub. = 61,300 rub.

However, subtract this amount from 98,400 rubles. will not work, since the maximum deduction amount is less than it and is only 49,200 rubles. (RUB 98,400 x 50%). For this reason, the advance payment can only be reduced by RUB 49,200. As a result we get:

RUB 98,400 – 49,200 rub. = 49,200 rub.

Now we determine the advance payment based on the results of the six months, subtracting the advance payment based on the results of the first quarter from this amount:

RUB 49,200 – 30,000 rub. = 19,200 rub.

Thus, at the end of the six months, the amount of the advance payment will be 19,200 rubles.

- How to calculate the simplified tax system 6%: determining the amount of the advance payment based on the results of 9 months.

First, the advance payment attributable to the tax base of this reporting period is calculated. As a result we get:

RUB 2,305,000 × 6% = 138,300 rub.

The amount received should be reduced by insurance premiums paid for 9 months and by the amount of temporary disability benefits paid to employees for the first 3 days of illness in the 2nd and 3rd quarters. The total amount of contributions and benefits for the period is:

66,300 rub. + 17,000 rub. + 7,000 rub. = 90,300 rub.

However, this amount cannot be deducted from 138,300 rubles, since the maximum deduction amount is less than it and is only 69,150 rubles. (RUB 138,300 × 50%). For this reason, the advance payment can only be reduced by 69,150 rubles. As a result we get:

RUB 138,300 – 69,150 rub. = 69,150 rub.

Now let’s determine the advance payment based on the results of 9 months, subtracting from this amount the advances accrued for payment based on the results of the first quarter and half of the year:

RUB 69,150 – 30,000 rub. – 19,200 rub. = 19,950 rub.

Thus, at the end of 9 months, the amount of the advance payment will be 19,950 rubles.

- How to calculate the simplified tax system 6%: determining the final amount of tax paid at the end of the tax period.

It is necessary to calculate the simplified tax system of 6% for the advance payment attributable to the tax base of the tax period (year). As a result we get:

RUB 3,200,000 × 6% = 192,000 rub.

The amount received should be reduced by the insurance premiums paid for the entire year and by the amount of temporary disability benefits paid to employees for the first 3 days of illness for the entire year. The total amount of contributions and benefits for the period is:

87,000 rub. + 17,000 rub. + 7,000 rub. = 111,000 rub.

However, this amount cannot be deducted from 192,000 rubles, since the maximum deduction amount is less than it and is only 96,000 rubles. (RUB 192,000 × 50%). For this reason, the payment can only be reduced by RUB 96,000 related to contributions and benefits. However, in the 4th quarter there was also a payment for the trading fee (RUB 12,000). The deduction can be increased by this amount. As a result we get:

192,000 rub. – 96,000 rub. – 12,000 rub. = 84,000 rub.

Now, according to the simplified tax system, the tax payable for the year is calculated by subtracting from this amount all advances accrued for payment based on the results of the 1st quarter, half a year and 9 months:

84,000 rub. – 30,000 rub. – 19,200 rub. – 19,950 rub. = 14,850 rub.

Thus, at the end of the year, the amount of tax to be transferred to the budget will be 14,850 rubles.

Our 6% simplified tax system calculator will help you calculate advance payments and taxes based on your data.

The calculated amounts of advance payments and simplified taxation at the end of the year are reflected in the tax return.

You can download the current form and example of filling out a declaration under the simplified tax system “income” here.

The declaration is submitted to the INFS:

- legal entities - no later than March 31;

- individual entrepreneurs - no later than April 30.

In 2021, these are working days, which means the deadlines will not be shifted. Submitting a declaration at a later date will entail the accrual of a fine under Art. 119 of the Tax Code of the Russian Federation.

Penalties for non-payment of advance payments under the simplified tax system

Describe why you are complaining about this answer

Complaint Cancel

In practice, it is not so rare for “simplifiers” to transfer advance payments to the budget after the due date.

If taxes (advance tax payments) are paid later than the deadlines established by the legislation on taxes and fees, penalties will be charged on their amount. These are calculated in the manner established by Art. 75 of the Tax Code of the Russian Federation. According to fiscal officials, the accrual of penalties stops on the day following the day of actual payment of tax debts (clarifications of the Federal Tax Service of Russia dated December 28, 2009). The Supreme Arbitration Court of the Russian Federation believes that the accrual of penalties should be carried out on the day of actual repayment of the arrears (paragraph 3, paragraph 57, paragraph 3, paragraph 61 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57 “On some issues arising when arbitration courts apply part first of the Tax Code of the Russian Federation").

It turns out that if the company did not pay advances at all under the simplified tax system, then penalties must be calculated for the period from the date on which the deadline for making advance payments expired until the day on which the tax for the year was paid. At the same time, with the object “income” there is no possibility to adjust the amount of penalties.

But a company on the simplified tax system with the object “income minus expenses”, if the tax calculated at the end of the year was less than the amount of advance payments, has the right to adjust the amount of penalties (the Ministry of Finance of Russia gave in Letter dated October 27, 2015 N 03-11-09/61543).

In the commented Letter, the Russian Ministry of Finance indicated that the amount of penalties accrued for late transfer of advances that exceed the amount of tax calculated for the year is subject to a commensurate reduction. This approach corresponds to the legal position set out in paragraph 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 N 57. It states that if, at the end of the tax period, the amount of calculated tax was less than the amount of advance payments, penalties accrued for non-payment of advances are subject to commensurate reduction. According to financiers, this procedure should also be used if advance payments turned out to be more than the amount of the minimum tax paid for the tax period.

The Ministry of Finance of Russia said earlier that penalties are subject to adjustment (Letters dated 02/24/2015 N 03-11-06/2/9012, dated 05/12/2014 N 03-11-11/22105). However, the financiers did not explain in any of the Letters how a proportionate reduction in penalties should occur. There is no judicial practice on this issue, since back in 2007 the Plenum of the Supreme Arbitration Court of the Russian Federation gave similar explanations (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 26, 2007 N 47) and tax authorities were ordered to take them into account (Letter of the Federal Tax Service of Russia dated October 31, 2007 N ShS- 6-14/ [email protected] ). In Letter dated November 11, 2011 N ED-4-3/18934, the Federal Tax Service of Russia, in relation to income tax, indicated that if at the end of the tax period an organization incurred a loss, then penalties accrued on the amount of late paid advance payments for corporate income tax for reporting periods are subject to reversal.

Thus, penalties accrued on advance payments must be reversed at the end of the year based on the amount of tax calculated at the end of the year according to the simplified tax system.

Example. A company using the simplified tax system (income minus expenses) in 2015 listed:

— advance payment for the first quarter in the amount of 10,000 rubles. - April 24;

— advance payment for six months in the amount of 15,000 rubles. — July 30;

— advance payment for nine months in the amount of 5,000 rubles. - November 2.

The tax at the end of 2020 is 25,000 rubles.

The delay in payment of advance payments was: for six months - three days, and for nine months - seven days. Penalties are calculated based on 1/300 of the refinancing rate of the Bank of Russia (clause 4 of article 75 of the Tax Code of the Russian Federation). During the period under review, the rate was 8.25%.

The amount of accrued penalties for late payment of advance payments will be equal to: for the six months - 12.38 rubles. (RUB 15,000 x 8.25%: 300 x 3 days), and for nine months - RUB 9.63. (RUB 5,000 x 8.25%: 300 x 7 days).

The amount of advance payments amounted to 30,000 rubles. (10,000 rub. + 15,000 rub. + 5,000 rub.), which is 5,000 rub. (16.67%) more than the tax calculated for the year (RUB 25,000). Accordingly, penalties accrued on advance payments are subject to reversal by 16.67%. Their size will be: for half a year - 10.31 rubles. , and for nine months - 8.03 rubles. .

Deadlines for payment of taxes and advance payments

Advance payments are made based on the results of each reporting period:

- for the 1st quarter - no later than 04/26/2021 (April 25 - Sunday);

- for the 2nd quarter - no later than July 26, 2021 (July 25 - Sunday);

- for the 3rd quarter - no later than October 25, 2021.

At the end of the year, tax is paid:

- legal entities - no later than March 31;

- individual entrepreneurs - no later than April 30.

Let us repeat, in 2021 these are working days, so there will be no postponements of the payment deadline.

A sample payment form for payment of the simplified tax system “income” can be viewed here.

If payers fail to pay taxes and advance payments on time, penalties will be assessed.

Our penalty calculator will help you calculate penalties for legal entities.

Advance simplified tax system: to pay or not to pay

First, let’s define what an advance payment is under the simplified tax system. This is part of the tax liability credited to the Federal Tax Service as an advance payment. The listed advances are counted when calculating the final transfer according to the simplified tax system.

Advance payments must be paid to the budget no later than the 25th day of the month following the reporting period. Transfer amounts should be calculated on an accrual basis. Pay the annual payment to the Federal Tax Service no later than March 31 of the year following the reporting year.

Deadline for making advance payments under the simplified tax system for 2020:

| For 2020 | 31.03.2020 |

| For the 1st quarter of 2020 | 27.04.2020 |

| For the first half of 2020 | 27.07.2020 |

| For 9 months of 2020 | 26.10.2020 |

| For 2020 | 31.03.2021 |

IMPORTANT!

There are two exceptions in which the payment deadline for the simplified tax system for 2020 is shifted to a period earlier than the established deadlines.

- Termination of the activities of an individual entrepreneur or company: then you need to pay the Federal Tax Service no later than the 25th day of the month following the month of liquidation.

- If the taxpayer has lost the right to use the simplified tax system. Then transfer the payment by the 25th day of the month following the quarter in which the subject lost the right to apply the simplification.

If the last day of payment falls on a holiday, weekend or other non-working day, then the budget should be paid on the first working day. But representatives of the Federal Tax Service do not recommend postponing settlements until the last day. Make payments in advance to avoid interest and penalties.

Results

The calculation of the simplified tax system for the object “income” is done quarterly: the amounts of advances are calculated 3 times, and at the end of the year the final tax amount is determined. The calculation base is the income received for the period (each time determined on an accrual basis), which is multiplied by the rate (usually 6%, but in the regions it can be reduced).

The amount of tax obtained from this calculation can be reduced by insurance premiums, disability benefits and voluntary insurance payments paid for the corresponding period. For employers, the amount of such a deduction cannot exceed 50%, and for individual entrepreneurs who do not have employees, it is possible to reduce accruals by 100%. The amount that supplements the deduction (in excess of 50%) will be the amount of the trading fee paid during the period.

In all periods except the 1st quarter, the amount calculated in this way is additionally reduced by the amount of advances accrued in previous reporting periods.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

In what cases are advance payments made under the simplified taxation system?

As already mentioned, when applying the simplified taxation system, tax is paid. It must be paid after the tax period. However, advance payments must also be made during the reporting period . The difference between the tax period and the reporting period is clear from the table.

| Taxable period | Reporting period |

| year | first quarter |

| half year | |

| nine month |

This information is contained in paragraphs 1 and 2 of Article 346.19 of the Tax Code of the Russian Federation.

Advance payments are calculated differently depending on what object of taxation is used in an organization or an individual entrepreneur, “income” or “income minus expenses.” If the tax base is “income”, then advance payments are calculated according to the following scheme:

- the tax base for the reporting period is determined;

- The amount of the advance is determined by the formula:

Advance payment = cumulative income from the beginning of the year x tax rate (6%)

- The amount of advance payment that must be paid is calculated:

Advance payment payable = Advance payment – Social contributions – Advance payments paid for previous reporting periods

Social contributions include:

- disability benefits;

- contributions to compulsory pension insurance;

- health insurance contributions;

- compulsory social insurance in case of temporary disability and in connection with maternity;

- insurance premiums against accidents and occupational diseases.

Such a “deduction” cannot be more than 50% of the amount of the accrued advance (tax) for organizations; for individual entrepreneurs it can be taken into account in full.

If the object of taxation is “income minus expenses,” then the calculation of advance payments is as follows:

- the tax base for the reporting period is determined using a formula;

tax base = income – expenses (both indicators are cumulative from the beginning of the year)

- The amount of the advance is determined by the formula:

Advance payment = tax base x tax rate (15%)

- The amount of advance payment that must be paid is calculated:

Advance payment due = Advance payment – Advance payments paid for previous billing periods

Please note that social contributions are included in expenses here and are therefore not highlighted separately.