A tax notice allows us, ordinary citizens, to pay taxes on time and in full. Having received the receipt, know that in a month the payment deadline for the amount indicated in the document will come. If you never received a receipt, this does not mean that you were suddenly exempt from paying tax. This means that you will have to find the information you need on your own.

If there was no notification for a long time and you did not bother with the issue of payment, then the penalty, most likely, did not just accumulate, but overflowed like a spring stream. There is only one way out - to deal with the tax office. Maybe even before the trial. When entering into a dispute with the Federal Tax Service, it is better not to hesitate and contact a qualified lawyer who will help defend your rights.

New right

If an organization has several separate divisions on one municipal territory or its location with separate divisions together on this territory, starting from 2020, you can pay personal income tax and submit reports on it in one of 2 ways:

- at the location of one of these sections;

- at the location of the parent organization.

This is regulated by the new paragraph of paragraph 7 of Art. 226 of the Tax Code of the Russian Federation from January 1, 2020 (introduced by Law No. 325-FZ of September 29, 2019).

The tax agent himself chooses a separate office or head office (this is his right , not an obligation), taking into account the procedure established by clause 2 of Art. 230 Tax Code of the Russian Federation.

Let us note that until 2020, such tax agents paid personal income tax and submitted reports at the place of registration of both the parent organization and each separate division.

Failures

How to write a notice correctly? A sample refusal, for example, to receive a tax deduction, is presented below. Such a document is usually sent by an organization that provides certain services. There is nothing special or difficult.

In general, the document drafting scheme remains the same. The refusal might look something like this:

“Notice of refusal to provide a tax deduction for an apartment. We notify you, Ivan Ivanovich Ivanov, that the Tax Service of the Leningrad District of Moscow refuses to provide a tax deduction for an apartment purchased under agreement No. 7777 dated March 5, 2015 due to the lack of a complete package of documents and details for transferring funds. We kindly request you to provide the missing documentation within a month.”

Accordingly, notifications about refusal of any services and actions have a similar form. Are there any other features that a citizen should be aware of?

Submission deadline

As a general rule, the company must notify the Federal Tax Service of its choice no later than January 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Taking into account the New Year holidays from January 1 to 8, this document had to be sent to the inspection no later than January 9 .

KEEP IN MIND

cannot be changed during the year . Exceptions:

- the number of sections has changed;

- There are other changes that affect the procedure for submitting information about the income of individuals and personal income tax amounts.

However, due to the rather late approval of the notification form in 2020, the Federal Tax Service issued a special clarification. According to it, tax agent organizations planning to apply the new procedure for transferring personal income tax and submitting reports from 2020 can submit to the inspectorate a notification about the choice of a tax authority until January 31, 2020 (Friday).

If the tax agent plans to submit a notification after the transfer of personal income tax, then in order to avoid arrears and overpayments, these tax amounts should be transferred from January 1, 2020 according to the payment details of the selected separate division .

At the same time, the tax agent has the right to submit an application for clarification of the payment if it is necessary to adjust certain details (payer’s checkpoint, tax identification number, checkpoint and name of the payee).

Registration of a document with the fiscal authority

Sample letters to the tax office are drawn up as follows:

Reference! Indicating the date is important, as it will be evidence of the subject's compliance with the established deadlines.

You can send an explanation with the necessary documentation by registered mail with acknowledgment of receipt or hand it over in person. But in the second case, you need to have 2 copies of the document. One of them will be returned to the taxpayer with an acceptance mark. The explanatory letter is assigned coding 1777.

If reporting to the fiscal authority was sent through online resources (for example, the Federal Tax Service website), then the request from the Federal Tax Service will be received using the same method. In this case, the answer can also be submitted online. The functionality of the portal allows you to create an electronic clarification form and send it to the required department. If specialists find any shortcomings, a corresponding notification will be sent to the taxpayer in his personal account.

Sending explanations to the tax office may be required in many situations, some of which are presented below.

Which form to use

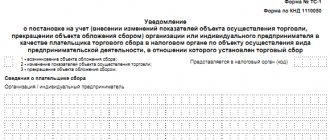

For this purpose, the form for notification of the selection of a tax authority, the procedure for filling it out and the electronic format for submission were approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11/622.

According to the order, the new form of notification of the selection of a tax authority for a separate division comes into force on January 1, 2020. Her KND is 1150097.

The notification form consists of 2 sheets - a standard title page and a sheet with a list of the organization/its divisions entered by the checkpoint and the corresponding Federal Tax Service codes.

Further, you can use the direct link for free notifications 2020:

NOTICE ABOUT CHOICE OF TAX AUTHORITY 2020

Results

From now on it is clear how to write a notification correctly. A sample of this paper was presented in several quantities. The process of drawing up a document does not take much time and effort. The main thing is to correctly describe all the features and nuances of the case, as well as the reason for notifying the citizen about something.

Notifications are extremely common in practice. This document is far from the most complex form of letters. If you carefully think through the main part of the paper, then no difficulties will arise with the formation of the notification.

How to fill out a notification

In general, the rules are no different from filling out other tax forms. This can be done both on paper and electronically. The same applies to sending it to the Federal Tax Service.

So, in the absence of any indicator, a dash is placed in all familiar places in the corresponding field. The same applies to the situation when, to indicate any indicator, it is not necessary to fill out all the information.

| Notification field | How to fill out |

| Checkpoint of an organization/separate unit | The checkpoint of the parent organization or the selected separate branch, through which the calculated and withheld tax amounts will be transferred, as well as 2-NDFL certificates and 6-NDFL calculations will be submitted |

| OKTMO code | Code of the municipality on the territory of which the organization or the selected separation is located, as well as separate divisions for which the tax will be transferred, presentation of 2-NDFL and 6-NDFL. If the OKTMO code has 8 characters, the empty spaces on the right are not filled. |

| Reason for presenting notification (code) | “1” – if you submit a notification in connection with a decision to switch to paying tax to the regional budget at the location of the organization or selected division “2” – if you submit a notification in connection with a change in the number of units “3” – if you submit a notification in connection with the refusal to switch to paying tax to the regional budget at the location of the organization or selected division “4” – if you submit a notification in connection with other changes affecting the procedure for submitting 2-NDFL and 6-NDFL |

| (indicate other changes that affect the procedure for submitting certificates in form 2-NDFL and calculations in form 6-NDFL) | Indicates changes that affect the presentation of these reports. Fill in if the number “4” is indicated in the “Reason for notification (code)” field. |

In the last section of the notification, checkpoints are provided for the organization and all separate divisions located on the territory of one municipality, in respect of which the organization or its chosen separate division will pay personal income tax and report.

Please note: the number of fields “Checkpoint of organization/separate subdivision” and “Tax authority code” must correspond to the number of separate subdivisions located on the territory of the same municipality with the organization or selected subdivision.

Main types

First, you should understand that the type of notification plays an important role. A lot will depend on him. The general rules of writing remain the same, but some features will still appear in one case or another.

How to write a notice correctly? A sample of this document will be presented a little later. Before doing this, you should study all the relevant information on creating it.

The main types of notifications include:

- on termination of the contract/agreement;

- tax;

- about changes to the contract;

- about debts;

- on the provision of services;

- informational.

These are not all types of documents being studied. But they are the ones that occur most often in practice. There is one more point that it is recommended to pay attention to.

Explanations for taxpayers on the execution of tax notices sent in 2020

15.09.2020 16:28

1. What is a tax notice and how to comply with it

The responsibility for the annual calculation of transport tax, land tax, personal property tax and personal income tax for individual taxpayers (in relation to a number of incomes for which the tax agent did not withhold the personal income tax amount) is assigned to the tax authorities (Article 52 of the Tax Code of the Russian Federation, hereinafter referred to as the Tax Code of the Russian Federation).

In this regard, the tax authorities, no later than 30 days before the due date for payment of the above taxes, send tax notices to individual taxpayers for payment of taxes.

The tax notice form was approved by Order of the Federal Tax Service of Russia dated September 7, 2016 No. ММВ-7-11/ [email protected] (as amended) and includes information for paying the taxes specified in it (QR code, bar code, UIN, bank payment details) .

Taxes payable by individuals in relation to real estate and vehicles owned by them are calculated for no more than three tax periods preceding the calendar year of sending the tax notice.

If the total amount of taxes calculated by the tax authority is less than 100 rubles, a tax notice is not sent, except in the case of sending a tax notice in a calendar year, after which the tax authority loses the opportunity to send a tax notice.

A tax notice can be handed over/sent to an individual (his legal or authorized representative):

— personally against signature on the basis of an application received from him for the issuance of a tax notice, including through the multifunctional center for the provision of state and municipal services (the application form was approved by order of the Federal Tax Service of Russia dated November 11, 2019 No. ММВ-7-21 / [email protected] );

— by registered mail (in this case, the tax notice is considered received after six days from the date of sending the registered letter);

— in electronic form through the taxpayer’s personal account (for individuals who have access to the taxpayer’s personal account). In this case, the tax notification is not duplicated by mail, except in cases where the user of the taxpayer’s personal account receives a notification about the need to receive documents on paper (the notification form is approved by Order of the Federal Tax Service of Russia dated February 12, 2018 No. ММВ-7-17 / [email protected] ).

The tax notice for the 2020 tax period must be executed (taxes paid) no later than December 1, 2020.

2. Main changes in taxation of property of individuals from 2020

Tax notices sent in 2020 contain property tax estimates for the 2020 tax year. At the same time, compared to the previous tax period, the following main changes occurred:

1) for transport tax

— the tax deduction for the tax in the amount of payment for the damage caused to federal roads by heavy trucks - cars with a permissible maximum weight of over 12 tons (Part 4 of Article 2 of the Federal Law of July 3, 2016 No. 249-FZ) has been cancelled;

— an application-free procedure for granting benefits has been introduced: if an individual entitled to a tax benefit has not submitted an application for a tax benefit or has not reported a refusal to apply a tax benefit, the tax benefit is provided on the basis of information received by the tax authority in accordance with federal laws. This procedure is used to provide tax benefits, in particular, to pensioners, pre-retirement people, disabled people, persons with three or more minor children (Clause 66, Article 2 of Federal Law No. 325-FZ of September 29, 2019);

— when calculating the tax, the new List https://minpromtorg.gov.ru/docs/#!perechen_legkovyh_avtomobiley_sredney_stoimostyu_ot_3_millionov_rubley_podlezhashhiy_primeneniyu_v_ocherednom_nalogovom_periode_2019_god of passenger cars with an average cost of 3 million rubles will be applied. for 2020, posted on the website of the Ministry of Industry and Trade of Russia (the new List includes more than 1,100 brands and models of cars, for example, the updated List includes Audi Q8, Cadillac CT6 and XT5, Chevrolet Traverse, Volvo XC40);

— changes in the system of tax rates and benefits are applied in accordance with the laws of the constituent entities of the Russian Federation at the location of the vehicles. Information on tax rates and benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/).

2) for land tax

— a tax deduction is introduced that reduces the tax on the cadastral value of 600 sq. m. m each of one land plot for pre-retirement pensioners - persons who meet the conditions necessary for the assignment of a pension in accordance with the legislation of the Russian Federation in force as of December 31, 2018 (Article 1 of the Federal Law of October 30, 2018 No. 378-FZ);

— new results of the state cadastral assessment of land, which came into force in 2020, are applied. These results can be viewed by receiving an extract from the Unified State Register of Real Estate;

3) for personal property tax

— a benefit is introduced that exempts pre-retirees from paying tax in relation to one object of a certain type (residential building, apartment, room, garage, etc.), which is not used in business activities (Article 1 of the Federal Law of October 30, 2018 No. 378- Federal Law);

— in the Moscow region, when calculating tax for the tax period of 2019, a coefficient of 10 percent limitation on tax growth is applied compared to the previous tax period (with the exception of objects included in the list determined in accordance with clause 7 of Article 378.2 of the Tax Code of the Russian Federation, and also objects provided for in paragraph 2 of clause 10 of article 378.2 of the Tax Code of the Russian Federation);

— new results of the state cadastral valuation of real estate, which came into force in 2020, are applied. These results can be viewed by receiving an extract from the Unified State Register of Real Estate.

Since the calculation of property taxes is carried out based on tax rates, benefits and the tax base determined at the regional and municipal levels, the reasons for changes in the amount of taxes in a specific situation can be clarified by the tax office or by contacting the contact center of the Federal Tax Service of Russia (tel. 8 800 – 222 -22-22).

Information on tax rates and benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/).

3. Why property taxes changed in 2020

The reasons for changing the amount of taxes in a specific situation can be clarified at the tax office or by contacting the contact center of the Federal Tax Service of Russia (tel. 8 800 – 222-22-22).

Transport tax. The tax increase may be due to the following reasons:

1) change in tax rates and (or) cancellation of benefits. Information on tax rates and benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/);

2) the use of increasing coefficients when calculating the tax for passenger cars with an average cost of 3 million rubles. according to the List of passenger cars with an average cost of 3 million rubles for the tax period 2020 posted on the website of the Ministry of Industry and Trade of Russia;

3) the presence of other grounds (for example, as a result of tax recalculation, loss of the right to apply benefits, receipt of updated information from registration authorities, etc.).

Land tax. The tax increase may be due to the following reasons:

1) changes in tax rates and (or) abolition of benefits, the authority to establish which falls within the competence of representative bodies of municipalities. Information on tax rates and benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/);

2) a change in the cadastral value of a land plot, for example, in connection with the entry into force of new cadastral valuation results, or the transfer of a land plot from one category of land to another, a change in the type of permitted use, or clarification of the area. Information on cadastral value can be obtained on the Rosreestr website;

3) the presence of other grounds (for example, as a result of tax recalculation, loss of the right to apply benefits, receipt of updated information from registration authorities, etc.).

Property tax for individuals. The tax increase may be due to the following reasons:

1) in the Moscow region, where the cadastral value is applied for the third and subsequent tax periods, the coefficient of a ten percent limitation on tax growth will be used when calculating the tax;

2) a change in the cadastral value of a property, for example, due to the entry into force of new results of a cadastral valuation, or a change in the type of permitted use or purpose of the property. Information on cadastral value can be obtained on the Rosreestr website;

3) changing tax rates or canceling benefits, the authority to establish which falls within the competence of representative bodies of municipalities. Information on tax rates and benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/).

4. How to check the tax rates and benefits indicated in the tax notice

Tax rates and benefits (including tax deductions from the tax base) are established by regulations at various levels:

— for transport tax: Chapter 28 of the Tax Code of the Russian Federation. On the territory of the Moscow Region, transport tax is calculated and paid in accordance with the Law of the Moscow Region dated November 16, 2002 No. 129/2002-OZ “On transport tax in the Moscow Region” (hereinafter referred to as Law 129/2002-OZ).

According to Article 3 of Law No. 129/2002-OZ, tax benefits for categories of taxpayers are provided in accordance with the Law of the Moscow Region dated November 24, 2004 No. 151/2004-OZ “On preferential taxation in the Moscow Region”;

— for land tax and property tax for individuals: Chapters 31, 32 of the Tax Code of the Russian Federation and regulatory legal acts of representative bodies of municipalities at the location of real estate.

Information on tax rates, tax benefits and tax deductions (for all types of taxes in all municipalities) can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service /tax/), or by contacting the tax inspectorates or the contact center of the Federal Tax Service of Russia (tel. 8 800 – 222-22-22).

5. How to take advantage of a benefit not included in the tax notice

Step 1. Check whether the benefit is included in the tax notice. To do this, study the contents of the columns “Amount of tax benefits”, “Tax deduction” in the tax notice.

Step 2. If benefits are not applied in the tax notice, it is necessary to find out whether the taxpayer belongs to the categories of persons entitled to benefits for the items in the tax notice.

Transport tax

Tax exemption is provided for by the Moscow Region Law No. 151/2004-OZ dated November 24, 2004 “On preferential taxation in the Moscow Region” for certain preferential categories of taxpayers (disabled people, veterans, families with many children, etc.).

Information on tax benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/), or by contacting the tax inspectorates or the Federal Tax Service contact center Russia (tel. 8 800 – 222-22-22).

Land tax

There is a federal benefit that reduces the tax base by the cadastral value of 600 square meters of one land plot. The benefit can be used by land owners belonging to the following categories: pensioners; pre-retirees; disabled people of groups I and II; disabled since childhood; veterans of the Great Patriotic War and military operations; large families; other categories of citizens specified in paragraph 5 of Art. 391 Tax Code of the Russian Federation.

Additional benefits may be established by regulatory legal acts of representative bodies of municipalities at the location of the land plots.

Information on tax benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/), or by contacting the tax inspectorates or the Federal Tax Service contact center Russia (tel. 8 800 – 222-22-22).

Property tax for individuals

Benefits for 16 categories of taxpayers (pensioners, pre-retirees, disabled people, veterans, military personnel, owners of household buildings up to 50 sq.m., etc.) are provided for in Art. 407 Tax Code of the Russian Federation. The benefit is provided in the amount of tax payable in respect of an object not used in business activities.

The benefit is provided at the choice of the taxpayer in relation to one object of each type: 1) apartment or room; 2) residential building; 3) premises or structures specified in subparagraph 14 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation; 4) economic building or structure specified in subparagraph 15 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation; 5) garage or parking space.

Additional benefits may be established by regulatory legal acts of representative bodies of municipalities at the location of the taxable property.

Information on tax benefits can be found in the section “Reference information on rates and benefits for property taxes” (https://www.nalog.ru/rn50/service/tax/), or by contacting the tax inspectorates or the Federal Tax Service contact center Russia (tel. 8 800 – 222-22-22).

Step 3. Having made sure that the taxpayer belongs to the categories of persons entitled to a tax benefit, but the benefit is not taken into account in the tax notice, it is recommended to submit an application in the prescribed form (order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21 / [email protected ] ) on providing benefits for transport tax, land tax, and property tax for individuals.

If an application for a tax benefit was previously sent to the tax authority and it did not indicate that the benefit would be used for a limited period, there is no need to resubmit the application.

You can submit an application for a tax benefit to the tax authority in any convenient way: through the taxpayer’s personal account; by postal message; by personally contacting any tax office; through an authorized MFC.

6. What to do if the tax notice contains incorrect information

Information about taxable property and its owner (including characteristics of the property, tax base, copyright holder, period of ownership) is submitted to the tax authorities by bodies carrying out registration (migration registration) of individuals at the place of residence (place of stay), registration of acts of civil status of individuals, bodies carrying out state cadastral registration and state registration of rights to real estate, bodies carrying out registration of vehicles, guardianship and trusteeship bodies, bodies (institutions) authorized to perform notarial acts, and notaries, bodies carrying out the issuance and replacement of identity documents of citizens of the Russian Federation Federations on the territory of the Russian Federation.

Responsibility for the accuracy, completeness and relevance of the specified information used for property taxation purposes lies with the above-mentioned registration authorities. These bodies provide information to the tax service based on information available in their information resources (registers, cadastres, registries, etc.).

If, in the opinion of the taxpayer, the tax notice contains outdated (incorrect) information about the property or its owner (including the period of ownership of the property, tax base, address), then in order to check and update it, you must contact the tax authorities using any in a convenient way:

1) for users of the “Taxpayer’s Personal Account” - through the Taxpayer’s Personal Account;

2) for other persons: by personally contacting any tax office or by sending a postal message, or using the Internet service of the Federal Tax Service of Russia “Contact the Federal Tax Service of Russia.”

As a general rule, the tax authority requires an audit to confirm the presence/absence of grounds established by law for recalculating taxes and changing tax notices (sending a request to the registration authorities, checking information about the availability of a tax benefit, determining the start date of application of the current tax base, etc. .), processing the information received and making the necessary changes to information resources (databases, budget payment cards, etc.).

If there are grounds for recalculating the tax(s) and generating a new tax notice, the tax inspectorate no later than 30 days (in exceptional cases, this period can be extended by no more than 30 days): will reset the previously accrued amount of tax and penalties; will generate a new tax notice indicating the new tax payment deadline and send you a response to the appeal (will post it in the taxpayer’s Personal Account).

Additional information can be obtained by calling the tax office or the contact center of the Federal Tax Service of Russia: 8 800-222-22-22.

7. What to do if the tax notice is not received

Tax notices to owners of taxable objects are sent by tax authorities (posted in the taxpayer’s Personal Account) no later than 30 days before the tax payment deadline: no later than December 1 of the year following the expired tax period for which taxes are paid.

Thus, tax notices for the 2019 tax period are sent no later than November 1, 2020, subject to the requirements established by Art. 52 of the Tax Code of the Russian Federation grounds for their direction. However, tax notices are not sent by mail on paper in the following cases:

1) the presence of a tax benefit, tax deduction, other grounds established by law that completely exempt the owner of the taxable object from paying tax;

2) if the total amount of taxes reflected in the tax notice is less than 100 rubles, with the exception of the case of sending a tax notice in a calendar year, after which the tax authority loses the opportunity to send a tax notice;

3) the taxpayer is a user of the Internet service of the Federal Tax Service of Russia - Personal Account of the Taxpayer and has not sent a notification to the tax authority about the need to receive tax documents on paper.

In other cases, if a tax notice for the period of ownership of taxable real estate or a vehicle has not been received by November 1, the taxpayer must contact the tax office or send information through the “Taxpayer Personal Account” or using the Internet service of the Federal Tax Service of Russia “Contact the Federal Tax Service of Russia.”

Owners of real estate or vehicles who have never received tax notices for the past tax period and have not claimed tax benefits in relation to taxable property are required to report the presence of these objects to any tax authority (the message form was approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-11/ [email protected] ).

8. Your video assistant:

1) Find out about tax rates and benefits;

2) Tax calculator for individuals on property taxes;

3) The procedure for providing tax benefits for property taxes;

4) Property tax for individuals based on cadastral value;

5) Tax deduction for land tax;

6) Taxpayer’s personal account for individuals;

7) New tax notice.

9. Where to contact for other questions

Information about taxable property and its owner (including characteristics of the property, tax base, copyright holder, period of ownership) is submitted to the tax authorities by bodies carrying out registration (migration registration) of individuals at the place of residence (place of stay), registration of acts of civil status of individuals, bodies , carrying out state cadastral registration and state registration of rights to real estate (currently - bodies of Rosreestr), bodies carrying out registration of vehicles (divisions of the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of Russia, state technical supervision inspections, GIMS of the Ministry of Emergency Situations of Russia, etc.), guardianship and trusteeship authorities , bodies (institutions) authorized to perform notarial acts, and notaries, bodies that issue and replace identity documents of a citizen of the Russian Federation on the territory of the Russian Federation (hereinafter referred to as registration bodies).

Responsibility for the accuracy, completeness and relevance of the specified information used for property taxation purposes lies with the above-mentioned registration authorities. These bodies provide information to the tax service based on information available in their information resources (registers, cadastres, registries, etc.).

Reception of citizens on issues arising in connection with sent tax notices is carried out:

- in the MFC and tax inspectorates - on issues regarding the taxation of income and property of individuals (with consideration of appeals to the tax authorities);

- in the divisions of registration authorities - on issues regarding the characteristics of property items recorded (registered) with the specified authorities.

You can submit an appeal regarding the contents of a tax notice to the tax authority in any convenient way: through the “Personal Account of the Taxpayer”; by postal message; by personally contacting any tax office; through an authorized MFC. Additional information can be obtained from the contact center of the Federal Tax Service of Russia by calling 8-800-222-22-22.

About changes to the contract

The employer, in accordance with the Labor Code of the Russian Federation, is obliged to notify the employee 2 months in advance of changes in the terms of the contract.

Only written form is allowed, with personal delivery against signature. The document must contain:

- 1) Reasons for making the change (usually the order number is indicated); 2) What is changing.

Next, a written agreement is drawn up to accompany the concluded employment contract if the employee agrees to the new conditions. If not, employers are required to offer other vacancies or dismissal.

The document is printed in 2 copies, one of which remains with the employer, the other is issued to the employee against personal signature.