When is an application for deregistration of UTII required?

The application of the taxation regime called UTII is voluntary, however, in order to start working on it, it is necessary to register with the tax authorities. Therefore, when a taxpayer decides to leave UTII, he must also notify the tax authorities about this and go through the procedure of deregistration with the Federal Tax Service.

Voluntary departure from UTII may be due to the following factors:

- termination of activities on the UTII - this happens, for example, if the payer has ceased to provide services transferred to UTII, or territorial authorities have removed its activities from the list of services falling under this regime;

For more details, see: “What is the procedure for deregistering a UTII payer who has ceased activity?”

- switching to another mode.

You can learn more about what else can affect leaving UTII from this material.

Pay attention to one more situation: the taxpayer does not fall under any of the above grounds, but simply moved the place of business. Does this entail the obligation to deregister with the Federal Tax Service?

Look for the answer to this question in the publication “The Ministry of Finance explained how to pay UTII when moving a store to a new location .

See also the article: “Deregistration of UTII in 2018–2019: conditions and terms.”

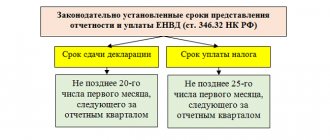

Deadlines in connection with the abolition of the single tax in 2021

The UTII system will be abolished from 01/01/2021. The Federal Tax Service will automatically transfer all payers to other modes on December 31, 2020. There is no need to submit a separate application. But it is important to choose another taxation system instead of imputation. Taxpayers who do not do this will be transferred to the general regime, and they will not be able to change it for the entire 2021. If you want to choose a simplified or patent taxation system, notify the Federal Tax Service about this before the end of December (Letter of the Federal Tax Service of Russia No. SD-4-3 / [email protected] dated 08/21/2020).

for individual entrepreneurs

for LLC

What deadlines must be met to submit an application for withdrawal from UTII?

When leaving the UTII, the payer must submit an application for deregistration within 5 days from the moment he stopped working for UTII. At the same time, the procedure for calculating the period for deregistration of UTII is different:

- if the activity is terminated by the taxpayer himself, then the countdown begins from the moment of its actual completion;

- if deregistration is due to reasons beyond the payer’s control, then the 5 days are counted differently.

How - you will learn from this material .

Having received such an application, the tax authorities, in turn, are obliged to remove the payer from the register within 5 days from the date of its submission. After deregistration, the Federal Tax Service sends a corresponding notification.

You can find out more about it here .

It also happens that the “imputed” person does not meet the deadline specified for filing the application. Then the tax office will not comply with it within the 5-day period allotted by law.

When the Federal Tax Service will deregister such a payer, this material .

Having withdrawn from tax registration, it is important not to forget to submit a UTII return.

Which inspectorate should you submit your latest report to, is described in the material “Deregistered under UTII? . ”

Reasons for stopping the application of imputed tax

Termination of registration as a UTII payer is carried out in the presence of one of the grounds listed in paragraph 3 of Article 346.28 of the Tax Code of the Russian Federation:

- cessation of “imputed” activities or complete closure of the business;

- voluntary transition to another tax regime;

- non-compliance with the single tax limits - the average number of employees of 100 people or 25% of the participation share of another organization (other organizations) in the authorized capital of the LLC on UTII.

If the limits established by the Tax Code of the Russian Federation for the imputed system are violated, filing an application with the Federal Tax Service is mandatory. In its absence, the taxpayer will be fined 200 rubles.

To correctly deregister under UTII, use free instructions from ConsultantPlus experts.

How to fill out an application for deregistration of UTII for an LLC

In the UTII-3 form, companies must indicate the following data:

- information about the reason for refusal of UTII; at the same time, it is important to reflect the correct details that characterize it, depending on the termination of one of several types of activity;

- Name;

- Kind of activity;

- place of business;

- other data.

“UTII Form 3: application for deregistration of an organization” will help you fill out UTII-3 accurately .

Step-by-step instructions for closing an individual entrepreneur on UTII

According to the law, every entrepreneur can, if necessary, close his own business. You can either resolve all issues related to closing your business yourself, or entrust the matter to qualified legal companies that will quickly resolve all issues.

Let's consider how to correctly carry out the procedure for closing an individual entrepreneur on UTII. In fact, the procedure is no different from the usual liquidation of an individual entrepreneur.

Paying off all debts

If you have decided to stop working as an entrepreneur, then the first thing you need to do is pay off all debts. You can find out the amount on the official website of the tax service or on State Services.

Dismissal of employees

If you did all the work yourself, then this closing stage is skipped. If employees helped you, then you must notify them of your decision at least 2 months in advance. Notification is made exclusively in writing, addressed to each employee.

For an employee who is forced to leave their main place of work, you must pay:

- Salary for the last month of work;

- Vacation pay, if any;

- Severance pay, not less than the employee’s average monthly salary.

Payment of state duty

The closure of any activity is subject to tax. The cost of the state duty in 2020 is only 160 rubles.

You can make the payment at any bank branch or on the official website of the tax service. After payment, be sure to keep the receipt; you will need it later when submitting documents.

If you submit documents electronically through the official tax website or government services portal, you do not have to pay the fee. These changes to the Tax Code of the Russian Federation were introduced by Law No. 234-FZ of July 29, 2018.

Preparation of a package of documents

To properly close an individual entrepreneur under UTII, be prepared to prepare a list of required documents:

- Closing Statement;

- Payment order for payment of state duty;

- Passport.

The application is filled out strictly according to the approved form P26001.

- .

You can also obtain the application form in person at the tax office.

Please note that all fields of the application must be filled out correctly. Corrections and blots are not allowed. A sample of correct filling can also be found on the Internet, or requested from the tax service.

When choosing the second option, it is worth considering that such certificates can be published in a special consumer corner.

It is important to take into account that you do not need to sign the application in advance - this is a serious mistake. The application can only be signed in the presence of a tax expert.

Destroying the seal

There are two options thanks to which you can destroy the seal and be sure that no one else can use it:

- On one's own;

- Through the organization.

If you decide to save personal funds, you can destroy the seal yourself. If you choose this option, be prepared to fill out an application and pay the state fee for destroying the seal. The application is filled out using a special form.

When the matter is entrusted to professionals, the entrepreneur will need to provide stamps and seals to a specialized company and receive a document confirming that the seals have been destroyed.

Submission of documents

At this step, many entrepreneurs make the biggest mistake - they contact the wrong tax service. According to the requirements, you can submit documents for the purpose of liquidating an individual entrepreneur only to the governing body in which you received registration to open an activity.

It turns out that where the individual entrepreneur was opened, it should be closed there. Otherwise, all the work done will be in vain.

You can submit documents:

- Personally;

The prepared package is given to the tax inspector against receipt. From now on, you have 5 days to wait until your business is completely closed.

- Through a proxy;

In this case, you will need to make a notarized power of attorney for the representative. A certified copy and passport of the authorized representative is attached to the complete package of documents.

- Send by mail;

If you choose this option, you can send the documentation by registered mail with acknowledgment. But not everything is so simple, since the documents must first be certified by a notary and an inventory drawn up. The day of submission of documents will be considered the day when the authorized tax officer receives the letter.

- Through the official website of the Federal Tax Service.

This is the most popular option for providing documents, as it significantly saves time and allows you to control the closing process in real time. To submit documents, you must go to the official website of the tax service. The electronic package of documents is certified by an electronic signature.

Obtaining a certificate of closure of an individual entrepreneur

The last thing you need to do is get official confirmation that your individual entrepreneur is closed. On the sixth day, after submitting the documents, you need to contact the tax office and receive an extract from the Unified State Register of Individual Entrepreneurs.

In practice, it happens that on the specified day you receive not documents about closure, but a refusal. In this case, an official document is also provided, which clearly states the reason for the refusal.

In most cases, a negative report is received by:

- If an incomplete package of documents is provided;

- There are errors in the documentation;

- If the documents are not transferred to the relevant tax service.

As soon as the error is corrected, the documents are resubmitted.

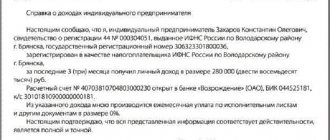

How an individual entrepreneur should fill out an application for deregistration of UTII

In the application, the individual entrepreneur indicates the following information:

- about yourself - last name, first name, patronymic;

- the reason for termination of activity on the imputation, indicated by codes from 1 to 4.

What else needs to be reflected in this form is discussed in the article “UTII Form 4: application for deregistration of individual entrepreneurs.”

So, deregistration must be accompanied by mandatory notification of this fact to the tax authorities. “Withdrawal from UTII” will help you understand how to do this correctly .

Application form for termination of registration of a single tax payer

The Federal Tax Service of Russia approved the application form by Order No. ММВ-7-6/ [email protected] dated 12/11/2012. Form No. 4 is used by the individual entrepreneur and is contained in the annex to the order. For 2020, no changes were made to it, and entrepreneurs use it to notify tax authorities of their intention to stop applying the imputed tax. Form No. 3 is an LLC’s application to withdraw from UTII in 2020; it is practically no different from the form for entrepreneurs. They have the same filling principle. This is what the title page of the form for organizations looks like:

The filing deadlines are also the same for legal entities and individuals.