In 2014, for the first time, entrepreneurs were able to change the tax regime, choosing instead of UTII any other that suited their parameters. This type is no longer mandatory. There was talk that it could be canceled altogether in 2020, but this did not happen. Some entrepreneurs for whom it is convenient can continue to use this tax regime.

There is no upper limit on income, as in the simplified tax system (150 million rubles). For UTII, it is only important in which field the entrepreneur works. We remember that it can be used by individual entrepreneurs providing socially significant services (household, repair, veterinary, trade and catering).

There have been noticeable changes here in 2020

- Control by the Federal Tax Service has increased. Late salary will cost the individual entrepreneur a fine of 10–20 thousand rubles. Previously, a warning was issued. A 10-day delay in tax payment means the current account is blocked.

- The tax amount will increase because... The deflator coefficient was set in 2019 and is equal to 2.063, which is 2.5% higher than last year.

- Employee contribution amounts are retained. An individual entrepreneur with an income of up to 300 thousand rubles will pay 29,354 rubles.

- An increase in the minimum wage by 117 rubles will entail an increase in the minimum wage.

- The health insurance contribution is 6,884 rubles.

- Entrepreneurs will be able to save money when installing a cash register. Cash registers are required from 07/01/2019. Installation costs will be deducted from tax. The maximum savings will be 18 thousand rubles (the price of a device equipped with settings at a basic level, installation and maintenance). To receive a deduction, register the device with the Federal Tax Service before 07/01/2019, but most importantly, the cash register must be used for those transactions on which tax is calculated.

Back to contents

Accounting for UTII

Individual entrepreneurs using UTII are not required to submit financial statements and keep records. Organizations on UTII, in addition to filing a tax return and recording physical indicators, are required to maintain accounting records and submit financial statements. Accounting statements for different categories of organizations vary.

In general, it consists of the following documents:

- balance sheet (form 1);

- statement of financial results (form 2);

- statement of changes in capital (form 3);

- cash flow statement (form 4);

- report on the intended use of funds (form 6);

- explanations in tabular and text form.

For small enterprises, financial statements consist of two mandatory documents in a simplified form:

- balance sheet (form 1);

- statement of financial results (form 2).

Accounting statements for UTII are submitted once at the end of each year, but to two authorities: the Federal Tax Service and Rosstat). The deadline for submitting reports is no later than March 31. For late submission of financial statements, a fine of 200 rubles is provided. for each document not submitted. Officials of the organization may be fined in the amount of 300 to 500 rubles + from 3,000 rubles. up to 5000 rub. for failure to submit reports to Rosstat.

What kind of reporting is provided?

The possibility of switching from mandatory to voluntary UTII did not lead to the abolition of reporting on it. As before, when working in this tax regime, you need to submit a declaration once a quarter, and if an individual entrepreneur combines it with other forms, then the number of reports increases.

Submitting a declaration will require taking into account the tax base, i.e. the cost or other physical characteristics of the object for which the tax will be paid. A form for recording the physical indicators of a business has not yet been drawn up, so the individual entrepreneur keeps records in no particular order.

Back to contents

Fines in accordance with tax laws

The powers of the tax authorities to resort to punitive measures are provided for in Article 119 of the Tax Code of the Russian Federation. The amount of the fine will be determined not only by the amount of days of delay, but also by the fact of payment of the Unified Tax to the state treasury:

| Type of violations | Amount of fine |

| If the tax was transferred to the state budget in accordance with the established deadlines, but the calculation was not provided on time. | From 1,000 rubles |

| The “zero” UTII declaration was not submitted on time | From 1,000 rubles |

| If both the tax and the report were submitted to the tax authorities late | · 5% of the amount of unpaid tax for each full and partial month of delay · 30% of the amount of unpaid tax (but not less than 1,000 rubles), if the duration of the delay exceeds 6 months |

| If the Single Tax was paid on time, but not in full, and the individual entrepreneur delayed submitting the UTII declaration | The fine is calculated similarly to the previous paragraph, however, the amount of unpaid tax will be the difference between its full amount and the part already paid. Article 75 of the Tax Code of the Russian Federation provides that pennies will be added to the balance of underpaid tax for each month of delay. |

Article 76 of the Tax Code of the Russian Federation warns that the current account of an irresponsible taxpayer may be blocked if the declaration is not submitted to the Federal Tax Service within 10 working days from the date established by law as the day of reporting.

Important! The tax office does not have the right to hold the taxpayer accountable if errors were made when filling out the declaration forms if it was submitted on time.

When and how to submit reports

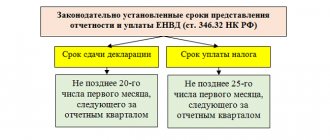

Reports must be submitted by the 20th day of the month following the reporting period. If this is the first quarter (January - March), then until April 20. Remember the deadlines for filing quarterly reports: April 20, June 20, October 22, January 21. The number may change: if 20 falls on weekends or holidays, then the individual entrepreneur can do this on Monday (clause 7 of Article 6.1 of the Tax Code). The declaration form is on the appendix. No. 3 to the order of the Federal Tax Service dated July 4, 2014 No. MMV-7-3/ [email protected]

Tax authorities accept declarations in three forms; an individual entrepreneur can choose the most convenient option for him: submit it in person to the Federal Tax Service, or send the document in electronic or paper form by mail.

Back to contents

UTII for individual entrepreneurs without employees in 2020: reporting

An individual entrepreneur who uses imputation and at the same time carries out his activities without hiring employees, based on the results of the reporting periods, submits to the tax authorities only a declaration on UTII.

Its form was approved by Order of the Federal Tax Service dated July 4, 2014 No. ММВ-7-3 / [email protected] (as amended on October 19, 2020). The same order contains information about the format for submitting the declaration electronically, as well as the procedure for filling it out.

According to Article 346.30 of the Tax Code of the Russian Federation, the tax period for UTII is a quarter. You will find the formula for calculating tax on imputed income and coefficients for 2020 in our article.

There are three ways to submit a declaration:

- 1. In paper form - in person or through a representative with a notarized power of attorney.

- 2. By registered mail, making an inventory of the attachment.

- 3. Electronically via TKS.

Separately, I would like to mention the zero declaration. Typically, UTII payers submit it only in case of termination of business activities. This is due to the peculiarity of this tax system: imputation is calculated based on estimated income, and not actually received. Consequently, entrepreneurs and organizations have no reason to file a zero declaration.

But the Federal Tax Service explained that there is a case when you can submit a zero declaration on imputation. This is possible if the possession or use of property necessary for conducting UTII activities is terminated.

Let's give an example. An individual entrepreneur is engaged in retail trade through a rented pavilion. He had to suspend his activities, and therefore the landlord terminated the lease agreement with him. In this case, the entrepreneur does not have a physical indicator (pavilion area). But it is used in the formula for calculating tax. This means that such an entrepreneur has the right to submit a zero return to the tax office.

Single tax for individual entrepreneurs in 2020

You must pay the UTII after submitting the declaration, before the 25th. In 2019, it will be April 25, July, October and January 27 of the new year - 2020. The tax amount is calculated without taking into account profit, but you need to know the tax base.

The accountant calculates the tax amount independently - this is the product of five components, of which one indicator is stable - the tax rate is 15%. The other four are constantly changing: K1 depends on the inflation rate and is set by the state, in 2020 = 2.063; the size of K2 determines the region in which the individual entrepreneur operates; it can only be lowered; for different types of activities, the value of K2 is reduced individually.

A change in each component leads to an increase or decrease in tax. K1 in 2020 increased by 2.5%; it is unknown whether this increase will be compensated by regional authorities.

Back to contents

Bank account blocking

According to Article 76 of the Tax Code of the Russian Federation, if the “imputed” entrepreneur does not submit a reporting document to the tax office within 10 working days from the date established by law, the Federal Tax Service has the right to contact the bank that services the individual entrepreneur in order to block his bank accounts.

In this case, account blocking only affects expense transactions. Funds may be transferred to the taxpayer’s personal account in the same manner, however, he will not be able to dispose of them. The following points are also taken into account:

- Blocking of a bank account occurs without prior warning to the entrepreneur in accordance with Letter of the Federal Tax Service of Russia dated July 28, 2016 N AC-3-15/ [email protected]

- The blocking applies not only to the amount of funds in a bank account, but also to all forms of deposits, regardless of the amount of the taxpayer’s debt (letter of the Ministry of Finance dated April 15, 2010 No. 03-02-07/1-167)

The Ministry of Finance also defines a number of cash write-offs excluded from the overall picture:

- alimony, compensation and other forms of obligations assigned in court;

- remuneration of hired personnel and calculated insurance premiums;

- payments under other executive documents.

Other payments, including taxes, cannot be made from a blocked bank account.

Submitting reports to beginning entrepreneurs

It will be difficult for a novice entrepreneur to draw up his first declaration and calculate the amount of tax. If you don’t want to hire an accountant at the first stage of business development, then invite him to work for a short period of time - draw up the first report and make the first payment. You can then work on the model yourself.

In the future, try to draw up the document and tax calculation in advance, not at the last minute - you will make fewer mistakes and have time to submit everything on time without incurring fines and penalties.

Back to contents

Compliance with tax payment deadlines

Compliance with deadlines for submitting returns and paying taxes is a norm of financial discipline for individual entrepreneurs. In cases of violation, sanctions from the tax service are inevitable: blocking the current account of an individual entrepreneur; if there is none, an audit and a fine. Remember that after paying the fine, you will still have to file a return and pay taxes.

An individual entrepreneur who delays submitting a report will be fined 5% of the tax amount (minimum 1 thousand rubles). If you are late with payment for a long time, the fine will be up to 30%. The Federal Tax Service may apply additional penalties.

An additional expense for undisciplined payers will be the accrual of penalties: debt up to 30 days - 1/300 of the refinancing rate, from 31 days - 1/150.

Keep track of deadlines, avoid debt, draw up documents in advance - this will save your nerves and time, and your business from ruin.

Back to contents

Fine for late payment

Delay in filing a UTII return even by 1 business day threatens the taxpayer with a fine, but its size is determined by the period of delay. But tax legislation establishes a fine of 5% of the amount of tax payable to the budget based on the results of the declaration, but not less than 1000 rubles. The maximum penalty threshold also exists; it is equal to 30% of the amount of tax payable to the budget based on the results of the declaration.

The amount of the fine is assigned to the individual entrepreneur or the enterprise as a whole, but the official may also be subject to punishment (a fine of 300 to 500 rubles or a warning).

In addition to fines, a delay of more than 10 days can lead to another punishment, this is the blocking of the current accounts of an organization or individual entrepreneur (Article 76 of the Tax Code of the Russian Federation). Only payment of budget fees and taxes is allowed. Please note that the requirement to block accounts applies to all banking organizations. After filing the declaration, tax inspectors withdraw their demand, but the accounts remain frozen for some time (usually from 10 to 14 days).

Accounting statements for UTII in 2019

Federal Law No. 402-FZ “On Accounting” in 2011 introduced changes to the procedure for maintaining accounting documents, but did not determine the mandatory nature of their maintenance. Individual entrepreneurs find themselves in a situation where the law does not oblige them to keep accounts, but running a business forces them to do so. Without tracking income and expenses, keeping records of activities, contacts with partners and other work, business planning is impossible. There are no prospects, so individual entrepreneurs keep accounts, but do not register them with the Federal Tax Service.

Accounting is necessary when calculating the tax base, and without it it is impossible to determine the amount of tax that an individual entrepreneur pays once a quarter. Accounting data is also needed to prepare the declaration.

Back to contents

What kind of reporting does an individual entrepreneur submit to UTII?

The list of UTII reporting for 2017-2018 for individual entrepreneurs on imputation may change depending on some factors characterizing the features of its activities:

- if an individual entrepreneur does not have employees, then he only needs to submit a UTII declaration to the tax authority;

- if an individual entrepreneur has employees, then in addition to the UTII declaration, he needs to send to the Federal Tax Service information about the average number of employees, 2-NDFL, 6-NDFL, and also submit the necessary reports on insurance premiums within the same time frame and in the same order as and organizations.

At the same time, despite the fact that the application of the UTII regime frees individual entrepreneurs from the obligation to report on VAT, property tax and personal income tax, sometimes the “imputed” individual entrepreneur may still encounter VAT - for the same reasons as companies: if the individual entrepreneur performs functions of a tax agent when importing or issuing a VAT invoice to the buyer.

In addition, it is important to note that if there are objects of taxation for other taxes, the individual entrepreneur must also send the relevant declarations to the Federal Tax Service, for example, for water tax. But the entrepreneur pays transport tax or property tax on individuals based on a notification from the tax authority, so there is no need to independently calculate these taxes and submit reports on them.

Regarding the question about the need to maintain individual accounting records when working on UTII, we recommend that you go to the material , which contains the answer to it.