In this article we will look at UTII for cargo transportation. Let's look at an example of calculation for transport services and learn about the rate table.

In the Russian Federation, activities such as cargo transportation fall under a taxation system such as single income on imputed income (UTII). This article will discuss all the most pressing issues relating to the peculiarities of taxation of cargo carriers in the Russian Federation.

ATTENTION! Starting with reporting for the fourth quarter of 2020, a new form of tax return for the single tax on imputed income will be used, approved by Order of the Federal Tax Service of Russia dated June 26, 2018 N ММВ-7-3/ [email protected] You can generate a UTII declaration without errors through this service , which has a free trial period.

UTII for cargo transportation in the Russian Federation

A single tax on imputed income can be applied by individual entrepreneurs or organizations engaged in road transportation and having in their possession (ownership or lease) no more than 20 vehicles used for their intended purpose (clause 2 of Article 346.26 of the Tax Code of the Russian Federation). It is necessary to clearly understand that this type of taxation can only apply to the provision of cargo transportation services on a reimbursable basis.

In order to switch to UTII, individual entrepreneurs need to register as a taxpayer with the tax authority at their place of residence, and organizations - at the location of the organization. Based on the Letter of the Federal Tax Service of Russia dated June 10, 2016 No. SD-4-3/ [email protected] allows entrepreneurs to assess the possibility of their transition to conducting activities that allow them to apply UTII. The letter provides an explanation from the tax authorities about who can take advantage of this taxation system. If an entrepreneur or organization has the right of ownership or other right (use, possession and (or) disposal) of no more than 20 vehicles, then in this case it is quite appropriate to use the UTII taxation system.

UTII passenger transportation calculation

The received tax must be paid for a month, in the case of reporting for a quarter (3 months), then the tax will naturally need to be multiplied by 3. Currently, many entrepreneurs use this Internet accounting to switch to UTII, calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office. The procedure for state registration of an individual entrepreneur or LLC has now become even simpler. If you have not yet registered your business, prepare documents for registration completely free of charge without leaving your home through the online service I have tested: Registration of an individual entrepreneur or LLC for free in 15 minutes. All documents comply with the current legislation of the Russian Federation.

When should UTII not be used for cargo transportation?

There are cases when UTII cannot be used even when using road transport:

| Activity | A comment |

| Transportation of cargo from office to office using a vehicle owned by the organization and a driver who is a full-time employee of the enterprise | In this case, the pure cargo transportation service is not provided, so the activity does not fall under UTII. |

| Delivery of goods to buyers under a sales contract | A purchase and sale agreement is not a transport services agreement, therefore, if these services are not paid separately, UTII cannot be applied. |

Thus, only entrepreneurs who receive monetary remuneration for the transportation of goods accompanied by relevant documents can take advantage of the right to work for UTII.

Calculation of UTII for the transportation of goods and passengers.

Unlike other types of activities on UTII, transportation is subject to taxes not at the place of business, but at the place of registration of the individual entrepreneur or transport company. Therefore, in order to find out the data necessary to calculate UTII (tax rate, values of the K2 coefficient, whether this type of activity falls under UTII), you will need to familiarize yourself with the decisions of the local authorities at the place of registration of your business. Otherwise, the calculation of UTII for the transportation of goods and passengers is carried out according to the same formula as for other types of activities.

Calculation of UTII tax for cargo transportation

To calculate UTII for cargo transportation, it is necessary to determine:

- Object of taxation – imputed income of the taxpayer

- Tax base – the amount of imputed tax.

- Physical indicator - the number of vehicles used to transport cargo.

- Basic income - 6,000 rubles.

First you need to determine the tax base for the reporting period:

| Tax base for UTII for the reporting period | = | Basic profitability per month (6000.00) | * | ( | Physical indicator for 1 month of the quarter | + | Physical indicator for the 2nd month of the quarter | + | Physical indicator for the 3rd month of the quarter | ) |

If municipalities do not apply a reduced UTII rate, then the UTII tax rate of 15% is used.

After calculating the UTII tax base, you can obtain the amount of tax payable to the budget using the following formula:

UTII = Tax base for UTII for the quarter * 15% – Insurance premiums

Individual entrepreneurs or organizations have the right to reduce tax payments by the amount of insurance premiums (Article 346.32 of the Tax Code of the Russian Federation):

| Taxpayers | A comment |

| Individual entrepreneurs | · When paying insurance premiums for employees participating in activities regulating UTII. The amount calculated may be more than 50% of the tax paid. · When paying insurance premiums for yourself (there are no employees) - reduce the amount of UTII for compulsory health insurance and compulsory health insurance payments without the 50% threshold. |

| Legal entities | · When paying insurance premiums for employees participating in activities regulating UTII. The amount of the calculation cannot be more than 50% of the tax paid. |

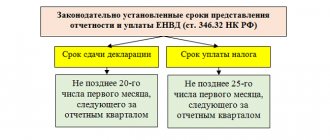

Tax payment must be made before the 25th day of the month following the reporting period (Article 346.30 of the Tax Code of the Russian Federation): (click to expand)

| Taxable period | Deadline for payment of UTII |

| 1st quarter | until April 25 |

| 2nd quarter | until July 25 |

| 3rd quarter | until October 25 |

| 4th quarter | until January 25 |

How to calculate the value of tax payable

The calculation is made using the formula:

BD x Physical indicator x K1 x K2

DB –

Profitability by type of activity, determined in accordance with the Tax Code of the Russian Federation

Physical indicator is also determined separately for each type of activity

K1 – deflator coefficient for 2020 for UTII – 1.798

K2 - established by local authorities to adjust the amount of tax payable for certain types of activities

Please note that, starting from 2020, individual entrepreneurs on UTII will be able to reduce the amount of tax payable not only on contributions for employees (no more than 50% of the amount of tax payable), but also on contributions for themselves. For organizations and individual entrepreneurs engaged in cargo transportation or providing transport services, choosing a special tax regime is considered the most convenient

This is nothing more than the possibility of paying a single tax on imputed income (UTII) to the budget, replacing a number of charges. All issues that arise are regulated in the relevant articles of Chapter 26.3 of the Tax Code of the Russian Federation. Since 2013, UTII has moved from mandatory to voluntary status - entrepreneurs can independently switch to this taxation regime. UTII report – quarterly

For organizations and individual entrepreneurs engaged in cargo transportation or providing transport services, choosing a special taxation regime is considered the most convenient. This is nothing more than the possibility of paying a single tax on imputed income (UTII) to the budget, replacing a number of charges. All issues that arise are regulated in the relevant articles of Chapter 26.3 of the Tax Code of the Russian Federation. Since 2013, UTII has moved from mandatory to voluntary status - entrepreneurs can independently switch to this taxation regime. The UTII report is quarterly.

Responsibility for violation of tax laws

In case of violation of tax laws, penalties are provided:

| Violation | Collection |

| Lack of payment or incomplete payment of tax (if the act is not intentional) | Fine: 20% of the unpaid amount |

| Failure to pay or incomplete payment of tax (the act is intentional) | Fine: 40% of the unpaid amount |

| Activities without registration as a taxpayer | 10% of income (at least 40 thousand rubles) |

| The application for registration was not submitted on time | 10 thousand rubles |

Formula for calculating UTII for the transportation of goods and passengers.

Nenvd = BD x (FP1 + FP2 + FP3) x K1 x K2 x Nst.

This formula is suitable for cases where activities were carried out on UTII for all three months of the quarter. However, since 2013, the rule on the proportionality of the calculation of UTII has been in force. Therefore, if not the entire period falls under UTII (for example, the transition to UTII occurred only in the 2nd month of the quarter), then UTII is calculated in proportion to this time. We have already written about how to do this, including calculating tax for less than a full month, here.

Using online cash registers

Online cash registers will undoubtedly take their rightful place in doing business. This innovation will allow tax authorities to receive up-to-date information about completed trading transactions online. An online cash register requires slightly different equipment:

- no need for ECLZ;

- no need for fiscal memory;

- A fiscal accumulator is required.

The fiscal drive is a replaceable unit that serves as storage, protection, and transmitter of information to the tax authorities. Once the fiscal drive is full, it will have to be replaced. Each copy must be registered electronically with the Federal Tax Service.

Payment rules and terms

How to pay taxes on vehicles is described in detail on the website of the Federal Tax Service of the Russian Federation. The conditions for withholding money from owners are published taking into account the region. What is common to all subjects of the Russian Federation is:

- Tax assessment by territorial inspectorates. Entrepreneurs should not independently calculate their budget obligations.

- Payment term. Money from the vehicle owner must be received no later than December 1 of the year of accrual.

- Notification of payers. Entrepreneurs receive a written request from the regulatory inspection with payment details. The procedure for delivering notifications is determined by Article 54 of the Tax Code of the Russian Federation.

The question of when to pay is decided at the federal level. Regions have the right to give a merchant a deferment or approve an individual schedule (Article 64 of the Tax Code of the Russian Federation). To do this, the applicant will need to submit an appropriate application and document the reasons for receiving the preference. You can transfer money from a current account, card or cash. There are no restrictions on methods.

When will the special regime be lifted?

For entrepreneurs and organizations conducting their activities in accordance with UTII, the special regime will be canceled on June 30, 2020. It is from July 1, 2020 that they will be required to start using online cash registers.

Until July 1, 2020, UTII taxpayers have the right, on their own initiative, to start working with online cash registers - no sanctions by the tax authorities will be applied in relation to this initiative.

| Term | Explanation |

| Until July 01, 2020 | Voluntary use of the online cash register |

| From July 01, 2020 | Mandatory use of online cash register |

Before starting to use an online cash register, entrepreneurs need to carry out preparatory work:

- purchase cash register equipment directly;

- organize connection of the cash register to the Internet;

- determine fiscal data with the operator and formalize a contractual relationship with him (at the cash desk it is indicated to indicate the operator’s IP);

- register an online cash register with the Federal Tax Service and receive a registration card.

After the preparatory work has been completed, the online cash register will be ready for use.

For non-compliance with the law and the lack of an online cash register, significant fines are provided (for legal entities at least 30,000 rubles, for individuals at least 10,000 rubles).

A single tax on imputed income

Entrepreneurs will also have to pay transport tax on UTII in full. Unlike its colleagues, it will not be possible to take expenses into account using the simplified system. A single tax will not replace car owner contributions.

Example. A businessman from Perm is engaged in cargo transportation and provision of transport services to passengers. In the name of the businessman, 5 trucks with a lifting force of less than 1 ton (240 hp each), as well as 2 twenty-seater buses with 210 hp each are registered. With. In addition, the entrepreneur has a personal car with an engine power of 250 hp. With.

| Costing stage | UTII | Transport tax |

| Determination of the tax base | The profitability of a business under Article 346.29 of the Tax Code of the Russian Federation is: cargo transportation - 6 thousand rubles per unit of transport; passenger transportation – 1500 per seat. The calculation of the base will take into account physical indicators. 6000 × 5 trucks = 30,000, 1500 × 2 buses × 20 seats = 60,000. The entrepreneur’s personal car is not used in commercial activities. There is no need to accrue UTII on it | The basis of the calculation will be the power of the motors and the number of months of ownership. In our case, transport tax will be charged throughout the year. In the example there is no data on the disposal of machines. So, the businessman has: 6 trucks with a capacity of 240 hp. With.; 2 buses with 210 hp engines. With.; 1 passenger car 250 l. With. Transport tax will be charged by the territorial inspection for all three groups of objects |

| Determining the rate | In the Perm region, a UTII rate of 15% is applied. The regional coefficient K2 was approved by decision of the City Duma No. 200 of November 29, 2015. For freight transportation on vehicles with a capacity of less than 1 ton, it is 0.9. For passenger transportation, the regulatory act prescribes the use of a coefficient equal to one. The K1 value is approved at the federal level - 1.915 | A special service has been launched on the official website of the Federal Tax Service of the Russian Federation. The program automatically determines the amount of transport tax. It is offered to use free of charge and around the clock. The formula is simple: Engine power in hp. With. × (number of months of ownership ÷ 12) × regional rate. In the Perm Territory, the following tariffs apply, related to the number of years of ownership (Law No. 589-PK dated December 25, 2015). Let's assume that our entrepreneur purchased cars more than 9 years ago: * passenger cars up to 250 liters. With. inclusive – 70 rubles; * trucks up to 250 l. With. – 65 rubles; * buses over 200 l. With. – 85 rubles. In 2020, transport tax rates in the Perm region approximately doubled |

| Tax calculation | You will need to pay monthly for trucks and buses: 30,000 × 15% × 0.9 × 1.915 = 7,755.75, 60,000 × 15% × 1 × 1.915 = 17235, 7755.75 + 17235 = 24,990.75 rubles Amount subject to rounding according to standard mathematical rules. The annual tax for all cars will be: 24991 × 12 = 299,892 rubles | The annual tax for all transport is: 240 × 65 × 6 trucks = 93,600, 200 × 85 × 2 buses = 34,000, 250 × 70 × 1 car = 17,500. 93,600 + 34,000 + 17,500 = 145,100 rubles Note that excluded from the calculation position “number of months of ownership ÷ 12”, since when calculating for the whole year the value is equal to one. For the purity of the calculation, increasing coefficients are not included in the formula. Let us remind you that from 2019 their use in calculating taxes for expensive passenger cars will cease. Thus, when taxing cars worth 3–5 million rubles, it is necessary to use an indicator of 1.1. Owning a vehicle for more than 3 years becomes a condition for reducing the fiscal burden. |

Important! The procedure for calculating transport tax will be the same for all special regime holders and individuals. Whether a merchant has hired employees does not affect the accrual procedure. Registration of transport in the name of the entrepreneur has legal significance. Owners of cars worth more than 3 million rubles will have to apply increasing factors. The list of such vehicles is published on the website of the Ministry of Industry and Trade of the Russian Federation.

Common mistakes in maintaining UTII

The table describes common mistakes in maintaining UTII:

| Common mistakes | Explanation |

| The start date of business activity is incorrectly determined | An application to the tax office must be submitted within 5 days from the date of commencement of activities falling under UTII. If an application is submitted earlier, entrepreneurs will have to pay tax for the period when no activity was actually carried out. The date of the first economic fact can be considered the beginning of activity and only from this date a 5-day report must be kept when it is necessary to submit an application to the tax authorities. |

| Freight carriers take into account all vehicles as a physical indicator | As a physical indicator, it is necessary to take into account only those vehicles that are directly involved in generating income. Those vehicles that were under repair, conservation, etc. at the time of tax calculation. are not taken into account as a physical indicator. The consequence of this error is an incorrect calculation of the tax base. |

| Incorrect calculation to reduce the amount of UTII | Individual entrepreneurs working independently have the right to reduce UTII by fixed contributions paid for themselves. But if an individual entrepreneur hires workers, then this right is lost, but the tax amount can be reduced through insurance payments for employees, even if these payments exceeded 50% of the tax amount. Legal entities can also reduce the size of UTII at the expense of insurance payments for employees, but not more than 50%. |

| Lack of activity when applying UTII | UTII is a tax that does not depend on the income received, so even if there is no actual activity of the company or entrepreneur, the tax will still have to be paid. This explains the lack of point in switching to UTII in advance. If an activity falling under UTII is suspended for any reason, it is better to deregister with the tax office. In this case, the tax will be charged on the number of days of the quarter when the activity was carried out. |

Conditions for applying UTII: transport services

A company or individual entrepreneur that carries out such type of activity as transport services (transportation of goods or passengers using vehicles) can use UTII. To become a presumptive tax payer, you must meet a number of criteria. Here are some of them:

- a type of activity such as transport services must be allowed for the use of UTII in your region (the fact is that UTII is a municipal tax, and each region itself determines what types of activities on its territory are subject to imputation);

- the number of vehicles owned or leased and used for profit should not exceed 20 units (this may include cars, trucks, and buses);

at the end of the tax period, the enterprise should have no more than 100 employees (including those who work part-time);- the organization’s activities are not joint and do not imply equity participation;

- the share of other companies in the organization’s capital should not exceed 25% (the exception is companies with an average number of disabled workers of more than 50%, and they account for 25% or more in the wage fund).

The physical indicator when calculating UTII for transportation is the number of vehicles, and in the case of transporting passengers, the number of passenger seats in the transport. Vehicles that are under repair or in storage, i.e. do not participate in economic activities and do not generate income; they are not taken into account when calculating UTII for transport services.

Are there any questions from the tax authorities?

Of course they can! You own two trucks, and you, for example, show only one in the declaration as part of the physical indicators - naturally, the tax office will want to know why you are underestimating the physical indicator, and with it the tax base and the UTII tax itself.

What's the answer here?

Non-use of a car for “valid” reasons will have to be proven, and documented. For example, the fact that it was being repaired will be confirmed by an agreement with a car service center, an act of acceptance and transfer of completed work to it, and finally, you can make an order from the head of a legal entity to carry out repairs on the car. It is better to collect all possible documents here. Because if your car was being repaired “at Uncle Vasya’s garage”, and “Uncle Vasya”, naturally, did not enter into any agreement with you for vehicle repair services, then prove to the tax authorities the non-use of the car and the legality of its exclusion from the physical indicator It will be very, very problematic.