Beginning entrepreneurs may encounter a huge number of different concepts and terms. It can be especially difficult to understand when you encounter unfamiliar abbreviations. For example, many businessmen do not know whether an individual entrepreneur has a checkpoint or not. And some have no idea what these letters even mean.

What is checkpoint

Every entrepreneur needs to know what a checkpoint is in the details of an individual entrepreneur and where to get it. The abbreviation stands for the reason for registration. It contains 9 characters:

- The first four encrypt the designation of the tax authority where the businessman was registered.

- The next two characters reflect the reason for registration (for Russian companies - from 01 to 50, for foreign companies - from 51 to 99);

- The last three digits are the serial number assigned to the organization at the registration stage.

Legal entities receive checkpoints at the place of their registration, location of their units, real estate or transport. This means that by using the counterparty’s code it is possible to find out exactly where it was registered and where its property is located, and whether the company has a branch network.

Details necessary for conducting business activities

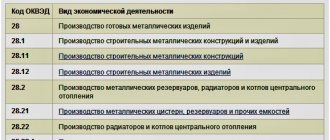

When filling out various documentation, persons registered as individual entrepreneurs should indicate a number of mandatory details. Such details include a tax identification number (TIN) and a code assigned by the All-Russian Classifier of Enterprises (OKPO). In addition, the required details are the number obtained in the All-Russian State Register of Individual Entrepreneurs (OGRNIP) and the OKATO code - containing the company location index. Small businesses also need to provide counterparties with general information about themselves as an individual.

Quite often, managers of individual entrepreneurs are asked to indicate the checkpoint code when filling out financial documents in credit institutions. In this case, a dash is placed in the column reserved for this code. This procedure is also followed when filling out agreements with business partners.

Please note that specifying zero values is prohibited. This fact is fixed by the Order of the Federal Tax Service number one hundred and forty-eight

In 9 signs of the checkpoint, unlike the TIN, information about the organization is encrypted

Does the IP have this code?

Do individual entrepreneurs have checkpoints? This IP code is not assigned; it is intended exclusively for legal entities. The code is given to the taxpayer at the stage of the registration procedure, along with the TIN. The company also has several checkpoints, all of which are registered in the tax certificate and confirm registration.

But entrepreneurs are entitled exclusively to an INN, and this is very simply explained. As mentioned above, the checkpoint reflects the reason for registration. An individual entrepreneur has only one such reason, and registration is carried out exclusively at the place of registration. Accordingly, they don’t need the code.

How to prove the absence of code

Large enterprises and financial organizations that have been in business for a long time have practically no problems with them due to the lack of code. Misunderstandings mainly arise with newcomers and contractors, who find it difficult to explain the reason for the absence of a checkpoint and why the requested data is not provided to the organization.

Due to the lack of legal literacy, a novice entrepreneur's business may suffer. In order to avoid misunderstandings, you have to explain the reason for the absence of a checkpoint, referring to the regulatory framework, tax legislation and regulations of the Russian Federation.

- Letter of the Ministry of Finance No. 03-02-08-14;

- Links that confirm and explain in detail the rules for assigning a state registration code;

- The additional Federal Law, which establishes rules on registration relationships between companies, is No. 129.

Important ! The tax authority has the right to assign a checkpoint only to those persons who have received the status of a legal entity and therefore it is illegal to request this code from a businessman.

So, checkpoint is an important value that provides information about the company, but legal entities have a checkpoint, but individual entrepreneurs do not have it.

What to do if you need to specify it

However, in documentation for individual entrepreneurs there is often a special field in which a checkpoint must be entered. This situation is associated with the use of uniform forms of documents for businessmen and companies.

In reports for tax authorities and extra-budgetary funds, businessmen should enter zeros or dashes in the checkpoint field. In forms, contracts, certificates and payment orders, this section may be left blank.

If business partners are interested in why the entrepreneur did not fill out the checkpoint field, the easiest way is to refer to the Tax Code, as well as the rules for registering legal entities and individual entrepreneurs and the explanations of the Ministry of Finance on this matter. However, some counterparties are not satisfied with such explanations, so businessmen resort to cunning. They draw up the checkpoint themselves, indicating the region code, then the encrypted designation of the Federal Tax Service where they were registered, and supplement all this with the code that is valid for registering legal entities - 01001.

Important! Such codes cannot be written in official documentation for government agencies.

The difference between a tax identification number and a checkpoint

Each individual entrepreneur must be assigned a TIN; it will have to be included in contracts with counterparties, reporting to control authorities, and when carrying out payment transactions. The number does not change, no matter what happens in the life of a businessman, including a change of surname. If an individual entrepreneur dies, the TIN becomes irrelevant and goes into the archive. But if you change your last name, address, or passport details, you should contact the Federal Tax Service to replace the certificate. The number will remain the same.

There are two cases in which the TIN changes. The first is to identify an error in the number made at the registration stage. The second is a significant restructuring of the company in the form of a merger, division of the company and other similar changes. Then the TIN of the legal entity is declared invalid, this is recorded by the tax authorities, and the company receives a new number.

The TIN can be easily found on the Federal Tax Service website or the State Services portal. To do this, you just need to enter the person’s full name, place and date of birth, and passport details. The TIN of an organization is found out in the same way, but if the company has branches, another checkpoint may be required.

The indicator consists of 12 digits:

- The first two mean region.

- The next two indicate the division of the Federal Tax Service that assigned this number to the individual.

- The fifth to tenth digits are the numbering in the registration list, which encrypts basic information about the payer.

- The last pair of digits is the check number. It is calculated using a special formula and confirms the accuracy of the TIN.

It takes up to 5 days from the date of application to obtain a TIN at your place of residence. After the expiration of this period, the applicant receives a certificate, and the taxpayer number is entered into the passport on page 18. This may include information about the tax authority that provided the certificate and the date of issue.

Important! When a citizen registers as an individual entrepreneur, his TIN becomes the number of a business entity.

Legal entities are assigned a TIN consisting of 10 characters. Having a number simplifies tax accounting and ensures correctness when doing business. During the entire period of operation of the company, the TIN is not adjusted.

The TIN is assigned to a person at his own request or on the initiative of the tax authorities. To voluntarily obtain a TIN in 2020, you need to provide a passport and fill out an application in the prescribed form. To obtain a taxpayer number for children under 14 years of age, a parent or guardian must submit an application to the documentation. A copy of the applicant’s passport and the child’s birth certificate is attached to the documents. If the last document does not indicate the place of registration of the minor, you need to add more paper from the passport office.

A certificate of assignment of a number is issued by the Federal Tax Service at the place of registration. If a person does not have permanent registration, he should contact the tax authority at the place of temporary residence or the region where the real estate owned by the applicant is located.

It is possible to obtain a completed certificate:

- on a personal visit;

- through a proxy;

- by post;

- via the Internet.

When the applicant approaches the tax authorities in person, he provides original documentation and uncertified copies. If a trusted person comes to pick up the certificate, he will need notarized copies of all papers, as well as a power of attorney, which is also issued by a notary. The power of attorney must state that the citizen has the right to represent the interests of the applicant in tax and other government bodies. To obtain a certificate, you must take your passport with you.

To receive a document via the Internet, you need to register on the Federal Tax Service website. The corresponding electronic form is filled out on the website, after which a document in PDF format is sent to the email address specified by the applicant, available for certification with an electronic signature. To obtain a certificate, you can also use the State Services service.

A TIN is required in different situations. The number is requested by lawyers, notaries, and officials when performing various transactions. It is needed to conclude transactions, participate in tenders on contracts, and perform any actions related to tax authorities. Taxpayer Identification Number (TIN) is usually required upon employment; this simplifies the process of paying taxes for employees.

It is almost impossible to register an individual entrepreneur without a tax identification number, since the number must be indicated when submitting the documentation. The number, along with other information about the entrepreneur, is entered into the Unified State Register of Entrepreneurs.

Individual entrepreneur payments: which status of the originator should be indicated?

In most cases, an order for the payment of funds issued on behalf of a private merchant must reflect the status of the originator - an individual entrepreneur.

We tell you what code values are allocated for this category of payers in 2020 and what, according to the rules, they mean. Entrepreneurs indicate their status as an individual entrepreneur in 2020 in accordance with Appendix No. 5 to Order of the Ministry of Finance No. 107n of 2013. By the way, we draw your attention to the fact that since the end of April 2020, this regulatory document has been in effect in a new edition.

The reason is amendments to the tax legislation, where from 01/01/2017 most of the rules on insurance contributions to extra-budgetary funds (except for the Social Insurance Fund for injuries) were transferred.

Also see "". Field 101 that interests us - the status of the originator - individual entrepreneur in the 2020 payment order is seen in the upper right corner.

If the payment is addressed to the Russian budget system (including extra-budgetary funds), then a two-digit numeric code must be entered.

When the payment occurs between private individuals and is not related to public finances, field 101 is left empty. Thus, the status of the originator in individual entrepreneurs’ payments is indicated when transferring:

- taxes;

- fees;

- contributions to extra-budgetary funds;

- state fees;

- other payments (arrears, penalties, fines, interest, etc.).

The table below shows all possible values of compiler status for individual entrepreneurs in 2020.

Status of the compiler - individual entrepreneur: codes CodeSituation 02Tax agent (for income tax, VAT) 08Situation: transfer of money to the budget system (here - insurance contributions for injuries to the Social Insurance Fund, etc.). Exception: taxes, fees, insurance premiums and other payments supervised by tax authorities.

09IP: · tax payer; · fees; · insurance contributions (to the Pension Fund of Russia, FFOMS); · other payments supervised by tax authorities. 15Entrepreneur – payment agent Situation: draws up a payment order for the total amount with a register for the transfer of money received from individuals.

17A merchant - a participant in foreign economic activity 18Individual entrepreneur is obligated by law to transfer customs payments to the treasury, but at the same time he is not a declarant 20Entrepreneur - paying agent Task: draws up orders for the transfer of money for each payment by individuals 26Businessman - founder or participant of the debtor IP as a third party Situation: draws up an order to pay off claims against the debtor for mandatory payments included in the register during bankruptcy 28IP - recipient of international mail within the framework of foreign trade activities As can be seen from this table, the most popular status of the compiler - individual entrepreneur - has the indicator “09”, since it is he who accumulates the most common deductions from entrepreneurs to the state treasury. If for an individual entrepreneur his duties to the budget system are performed by a legal/authorized representative or a third party, then the status of the payer when making a payment is indicated as if the entrepreneur himself had done it. Also see "". If you find an error, please select a piece of text and press Ctrl+Enter.

Filling out a new payment order form. Checkpoint of an individual entrepreneur in a payment order

2020 is a year of surprises for individual entrepreneurs.

Another innovation concerns insurance premiums. Now they are accepted by the Federal Tax Service, and not by the Pension Fund of the Russian Federation, which has entailed a change in the payments themselves.

The form remains the same, but some fields can be filled out according to improved rules.

Thus, the status of an individual entrepreneur payer in a payment order to the Pension Fund of Russia in 2020 became outdated, and the BCC also changed. Fields in which zeros were written are now filled in. Read on for all this and much more.

The transfer of administration of fees to the federal tax office is not surprising. Even before the introduction of insurance premiums, it was this body that accepted payments for the unified social tax, which individual entrepreneurs and organizations paid for their own insurance and the insurance of their employees.

When insurance premiums began to be used instead of the unified social tax, it was decided to form extra-budgetary funds, which began collecting them.

These are the familiar Pension Fund of Russia, FFOMS, and FSS. They failed to cope with their task, which is confirmed by statistics - since 2011.

the debt on pension contributions exceeded 200 billion. So, the idea of returning the collection of contributions under the control of the tax office suggested itself.

Now, according to the decree of the Government of the Russian Federation, a payment order for insurance contributions to the Pension Fund in 2020 for individual entrepreneurs does not need to be drawn up for themselves. Now the collection of fixed payments is the responsibility of the tax service. The Federal Tax Service will accept the following fixed insurance premiums:

- Medical;

- Social (optional for the entrepreneur).

- Pension;

Chapter number 34 has been added to the Tax Code of the Russian Federation, which sets out both the amount of contributions and the procedure for their payment.

Therefore, apart from filling out the clause taking into account the changes, individual entrepreneurs will not encounter any unpleasant innovations. As for the payment, now in the “Recipient” field you should write the short name of the federal treasury and the short name of your tax office. The second is in parentheses. For example, the UFC for the city.

Moscow (Inspectorate of the Federal Tax Service of Russia No. 56 for Moscow). You need to choose an inspectorate at your place of residence or registration, and not the one that works somewhere nearby. You can find out the payment details of your treasury on the Federal Tax Service website at https://service.nalog.ru/addrno.do.

To find it yourself, click on the orange button labeled “Services” and select “Address, inspection payment details” from the drop-down list.

Check the box for individual entrepreneur and enter the registration address of your business. If you know your inspection number, please indicate it.

Then click “Next” and the window will display all the details of your Federal Tax Service that are currently relevant. Through the same service you can find out OKTMO. We are talking about fixed annual fees here.

That is, those that entrepreneurs must pay only once a year.

It is true that it is better to transfer such payments quarterly in order to reduce the amount of advance transfers by them.

Pension, medical and, if the entrepreneur decided to pay them of his own free will, social fees for 2020 should be paid according to the new BCC. For the previous one - according to the old ones. You can clearly compare the BCC in the table:

How to find out the checkpoint

The checkpoint of a legal entity can be found by TIN. Please note that the individual number is the same for the entire organization. The checkpoint is assigned separately to each branch.

If necessary, you can view the checkpoint on the Federal Tax Service website. To do this you need:

- Load site.

- Select a menu item with a list of services.

- Find a section dedicated to checking business risks.

- Enter your Taxpayer Identification Number (TIN) in the field that appears.

- Enter the code from the picture.

- Click the search button.

After this, a page will open containing information about the company’s registration code. The information is provided free of charge, but the advanced mode with more detailed data is available for a fee.

The legal entity checkpoint is not a unique code; the code may be the same for different companies. This happens when structures are registered with the same Federal Tax Service and for the same reasons. It is possible to accurately identify a legal entity only by a combination of TIN and KPP. It is possible to find out the code through third-party Internet services.

Important! The same check can be carried out according to OGRN.

In addition to the simple code, there is also a KIO organization code, which is used for tax authorities to record foreign companies operating in the Russian Federation. Offshore structures are assigned a special code, which is part of the Taxpayer Identification Number (TIN). The digital designation is indicated when carrying out any taxable transactions. The KIO will be the same for all departments.

To obtain such a code, a foreign company must provide statutory documentation and several certificates: confirmation of address, director, shareholder. Additionally, a certificate from the tax authority issued no more than 3 months ago is provided.

Important! Documents are submitted after being certified by a notary, translated into Russian and issued with an apostille.

KIO is necessary for foreign companies to open bank accounts in Russia, carry out activities through a branch network, purchase transport and real estate. Without such a code, it is prohibited to conduct activities for more than 30 days.

General details

We also note that the checkpoint does not apply to general details even for legal entities. For most operations, the following information will help to fully identify the individual entrepreneur:

- Your brand name (if any).

- Legal structure for conducting business activities.

- Head structure.

- Information from your individual entrepreneur registration certificate: the number of this document, the date of registration, the Federal Tax Service authority that issued the document.

- Actual address.

- Contact number.

- Own website address.

- Electronic mailbox.

It is also considered standard for individual entrepreneurs to provide the following information about themselves and their activities:

- FULL NAME.

- Bank account.

- Checking account.

- Legal address.

- TIN.

- OGRNIP.

- OKPO.

- OKATO.

- Contact phone number.

If the form requires indicating a personal category code, then you just need to put a dash in this column.