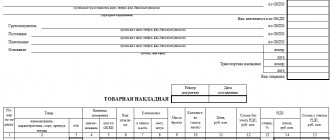

When moving materials from one organization to another, or between its departments, an M-15 invoice is issued for the release of materials to the outside . It is also compiled when transferring customer-supplied raw materials for processing.

forms M-15: Excel

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Invoice M-15 for outsourcing of materials: fill out the form (Excel)

Write out Form M-15 in two copies. Based on one, materials are released from the warehouse, the second is transferred to the recipient. You can get a free M-15 invoice in Excel using the button above. Fill out your details, save and then simply enter information about the products - you will save time.

Don't know what to write? Let's take a closer look at what the M-15 form is used for and how to compile it. The main thing is to provide all the necessary details. A sample of filling out the M-15 and instructions are below on the page. Be sure to include in the document:

- date and number of the invoice,

- the full name of those who issue and receive inventory items (materials and materials),

- on the basis of which materials are transferred (order, work order, etc.),

- name and quantity of the goods being transferred.

The document must have four signatures - the chief accountant, the employee who authorized the release of goods and materials, the recipient and the one who released the materials from the warehouse.

Next on the page is the M-15 consignment note: sample filling and instructions.

In what form is it formatted?

The release of inventory items to a third party can be formalized by a document developed within the organization, or the enterprise can use the unified form M-15. If an enterprise uses its own form, then the form must be approved by order and contain the required details :

It is more rational to use your own form within one organization ; you can add columns with internal accounting information or data not intended for third parties.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

When moving material assets between different organizations, it is appropriate to use the unified form M-15, thus the third-party organization will not have claims against the releasing party regarding the documentation of the operation. If a carrier organization is involved in the movement of material assets, it is recommended to issue an invoice in the form 0504205 according to OKUD. It indicates not only the data of the issuing organization and the organization receiving the goods and materials, but also the data of the carrier.

Invoice M-15 for outsourcing of materials: sample filling

You can fill out the M-15 document either manually or on a computer. The invoice numbering is continuous; as a rule, starting from the new year, it starts with one. Form M-15, fill in your data and use it as a template.

Sample of filling out form M-15

Get a sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Put a dash if you leave a line or cell empty - then you won’t be able to enter false information there.

If you made a mistake, cross out the incorrect information with one line, write the correct data, indicate “Corrected to believe” and sign.

You can avoid corrections if you use the MyWarehouse service. Just enter the data on the website and print the finished document. More about this below.

Do I need to stamp it?

Forms of form M-15 and form 0504205 according to OKUD do not provide for stamping on them . Accordingly, these documents are valid even without a seal. However, it is customary for business rules to certify the signatures of both parties when exchanging documents between two different enterprises. Organizations can record this point in an appendix to the custody agreement or to the toll agreement. You can also affix stamps when moving materials between different structural divisions of the same organization, if this is provided for by an internal local document.

Consignment note M-15: fill out online

In the MyWarehouse service, you can fill out and print the M-15 demand invoice in a few seconds. Enter or select the previously entered divisions of the sender and recipient and indicate the name and quantity of the product. The system will automatically number and generate the document. Below is the M-15 invoice: a sample from MyWarehouse.

Fill out form M-15

Fill out the M-15 waybill online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

To fill out the M-15 form, you need to connect an additional template.

All documents created in MySklad are stored in the archive - you will have round-the-clock access to them, no matter where you are.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Signing the document

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Form M-15 is signed by the person who authorized the release of material assets (for example, director, chief engineer, deputy for production or head of a structural unit). In addition, the invoice must be signed by the organization’s chief accountant and the financially responsible person. The invoice in form 0504205 according to OKUD is certified by the responsible executor - this is, as a rule, the accountant of the material desk who issued the document. When releasing material assets, the invoice is endorsed by the materially responsible person shipping the materials.

Signatures of the manager and chief accountant are not provided here , because the release of material assets to third parties is carried out on the basis of an agreement concluded between two organizations and a power of attorney to receive goods and materials. From the receiving side, the invoice is endorsed either by the storekeeper, who accepts the materials into his warehouse, or by the head of the production workshop, who will transfer the received materials to production.

Use of customer-supplied materials.

Every year, the numbering of invoices starts from one. When filling out the form (outsourcing of goods and materials), in the first table you must indicate:

- Date of registration,

- Sender. You must indicate the name of the structural unit and the type of its activity,

- Code of the type of operation performed (if the organization uses a code system),

- Recipient. You must indicate the name of the department, its type of activity,

- Responsible for the supply of goods and materials. Contractor code, unit name, type of activity.

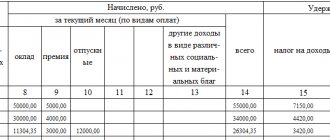

After this, the document that serves as the basis for issuing the invoice is indicated. In the “To” line, write the name of the recipient of the goods and materials (the business entity of its organization or a third-party organization). In addition, write down the full name of the recipient and details of the power of attorney provided by him. Column 3. Write the name of the goods and materials, their characteristics: brand, size, grade. Column 4. Nomenclature number (if not available, then put a dash). Column 5. The code of units of measurement according to OKEI is recorded. Column 6. The name of the units of measurement is indicated. Column 7. Write the amount of material required for shipment. Column 8. Filled out by the storekeeper, indicating the actual quantity of materials released. Column 9. The price of one unit of goods and materials in rubles and kopecks without VAT. Column 10. Price of issued inventory items without VAT. Column 11. Total VAT amount. Column 12. Total cost of goods including VAT. (in total columns 10 and 11). Column 13. The inventory number is recorded. Column 14. The passport number of goods and materials (precious metals) is recorded. Column 15. Entry number in a special materials accounting card.

In the conclusion, indicate the number of items of goods and materials issued, the total amount of the invoice and additionally VAT, which is included in the total amount.

The invoice form is signed by: the responsible employee who authorized the release of goods and materials, the employee who released the goods and materials, the chief accountant and the recipient of goods and materials.

Filling rules

Form M-15 is filled out by employees of the organization or structural unit that issues goods and materials. This could be an accountant who issues and transfers the invoice to the warehouseman or the directly responsible warehouse employee. It is drawn up in two copies - one each for the releasing and receiving parties.

The invoice must contain the serial number and date of preparation, as well as the name of the organization that issued the document. The sending structural unit and the receiving structural unit are required. For ease of accounting, it is advisable to indicate the type of activity of these structural units (storage or production).

The tabular part of the M-15 form indicates information about the transferred material assets:

- name of the material indicating the brand, grade and size;

- its item number;

- unit of measurement;

- the quantity of goods and materials that must be issued according to the basis document, and the actual quantity of materials issued;

- price, amount, VAT amount and final amount of material assets including value added tax;

- additional information about the transferred materials - inventory number (if fixed assets are transferred for safekeeping).

Read more: Tax deduction when buying an apartment without a mortgage

Data on the quantity, amount and VAT of sold goods and materials are summarized and indicated in words in separate columns.

Without data that allows one to sufficiently accurately identify the transferred goods and materials, their quantity and amount, and without data on the basis for such movement of materials, as well as without indicating the transferring and receiving parties, the invoice is invalid.

Below is the invoice form and an example of how to fill it out:

Forms 0504205 according to OKUD

The invoice in form 0504205 according to OKUD must also contain the number and date of registration . It indicates the name and tax identification number of the sender, recipient and organization transporting goods and materials.

In the “Bases” column, the details of the agreement between the sender and the recipient, the vacation order and the power of attorney to receive materials are indicated.

The tabular part of the document contains information about:

- material assets indicating the name, grade, brand and other necessary data;

- inventory number of goods and materials or passport number;

- unit of measurement and price;

- the amount of material assets that should be released and released in fact;

- cost of materials without VAT, the amount of VAT and cost of materials with tax.

- invoice in form 0504205 according to OKUD

- filling out the invoice according to form 0504205 according to OKUD

What documents need to be completed

To ensure that tax authorities do not recognize the transfer of tolling materials as a gratuitous transaction with all the ensuing consequences, it is necessary to correctly draw up the primary document.

Transfer of customer-supplied materials by the customer

There is no need to issue invoices, since there is no fact of sale of materials. In this case you can:

- draw up a transfer and acceptance certificate in any form. Then it must contain the details established for primary documents, and its form must be approved by order of the manager

- issue an invoice for the release of materials to the third party according to the form if the use of standardized forms of primary documents is enshrined in the accounting policy. The document is drawn up in two copies (one each for the customer and the contractor).