Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

In accordance with the amendments to Articles 286 and 287 of the Tax Code of the Russian Federation, in 2020, organizations whose sales income during the previous four quarters did not exceed an average of 15 million rubles per quarter can refuse monthly advances on income tax and count payments according to results of the quarter.

What are the types of advance payments for income tax?

Increasing the limit allowed a larger number of organizations to calculate advance payments for income tax based on the results of the quarter. Why this is good for taxpayers - let's look at an example, but first let's remember what advance payments for income tax are.

Based on the results of each reporting (tax) period, taxpayers calculate and pay advance payments in one of the following ways:

- based on the results of the 1st quarter, half a year and 9 months, as well as advance payments in each month of the next quarter, calculated taking into account the profit for the previous quarter (clause 2 of Article 286 of the Tax Code of the Russian Federation).

- based on the results of the 1st quarter, half a year and 9 months without paying monthly advance payments. This method is clause 3 of Art. 286 of the Tax Code of the Russian Federation is allowed to apply only to organizations whose revenue for the previous four quarters did not exceed an average of 15 million rubles for each quarter.

In addition, the organization can switch to monthly advance payments based on the actual profit received. This can be done voluntarily from the beginning of the calendar year; to do this, you need to notify the tax authority before December 31 of the previous year. In this case, the calculation of the amounts of advance payments is made by taxpayers based on the tax rate and the actual profit received, calculated on an accrual basis from the beginning of the tax period until the end of the corresponding month.

Let us calculate advance payments for the conditional Pineapples in Champagne LLC using each method, and then compare the results. Income and expenses for tax purposes are determined using the accrual method. The tax base for income tax is presented on an accrual basis from the beginning of the year.

| 2019 | 2020 | |||

| Income from sales | Tax base for income tax | Income from sales | Tax base for income tax | |

| 1st quarter | 8.5 million rubles. | 160 thousand rubles. | 10.5 million rubles. | 90 thousand rubles. |

| 2nd quarter | 9.5 million rubles. | 350 thousand rubles. | 8 million rub. | 50 thousand rubles. |

| 3rd quarter | 10.75 million rubles. | 620 thousand rubles. | 13 million rubles. | 150 thousand rubles. |

| 4th quarter | 11.75 million rubles. | 900 thousand rubles. | 13.5 million rubles. | 370 thousand rubles. |

What happens to the advance if there is a loss in the quarter?

In one quarter of the tax period, a taxpayer may receive less profit than in the previous one, or a loss. But these circumstances do not exempt the taxpayer from paying monthly advance payments in the current quarter. In such cases, the amount or part of the monthly advance payments paid in the current quarter will be recognized as an overpayment of income tax, which, according to clause 14 of Art. 78 of the Tax Code of the Russian Federation is subject to offset against upcoming payments for income tax or other taxes; for repayment of arrears, payment of penalties or refund to the taxpayer.

If the calculated amount of the monthly advance payment turns out to be negative or equal to 0, then monthly advance payments in the corresponding quarter are not paid (paragraph 6, paragraph 2, article 286 of the Tax Code of the Russian Federation). A similar result obtained based on the results of the third quarter leads to the absence of payment of advances in the fourth quarter of the current year and the first quarter of the next.

How to calculate advance payments based on quarterly results

The amount of the quarterly advance payment at the end of the reporting period is determined by the actual profit, calculated on an accrual basis from the beginning of the tax period to the end of the reporting period - quarter, half-year, nine months. In this case, advance payments previously paid in the tax period are taken into account.

Example 1: let’s calculate quarterly advance payments for 2020 for Pineapples in Champagne LLC:

- based on the results of the 1st quarter: 90 thousand rubles × 20% = 18 thousand rubles.

- Based on the results of the first half of the year, a loss of 40 thousand rubles was received, therefore, in accordance with clause 8 of Art. 274 of the Tax Code of the Russian Federation, the tax base is zero, as is the quarterly advance payment. Nothing is transferred to the budget, and the amount of the quarterly advance payment based on the results of the first quarter is considered an overpayment of taxes.

- based on the results of 9 months: 150 thousand rubles × 20% = 30 thousand rubles. If the overpayment resulting from the results of the six months is not offset against the payment of other taxes and is not returned to the organization, it is offset against the payment of the quarterly advance payment based on the results of 9 months (clause 1 of Article 287, clause 14 of Article 78 of the Tax Code of the Russian Federation). Therefore, the amount to be paid additionally to the budget: 30 thousand rubles − 18 thousand rubles = 12 thousand rubles.

We pay quarterly

If your company has the right to calculate and pay quarterly advance payments for income tax in 2020, then when making calculations you should take into account specific features.

First, you need to determine the amount of tax liability for the reporting period. Calculate using the formula:

Where:

- APotch.pr. - this is an advance transfer of money for the reporting period;

- NBotch.pr. — tax base, calculated on an accrual basis for the period;

- St – tax rate provided for by the Tax Code of the Russian Federation.

Now we calculate the amount of the advance payment to be transferred to the state budget:

Where:

- AP to pack — the amount of funds required to be paid to the Federal Tax Service for the advance of income tax in 2020 for the quarter;

- APotch.pr. — the amount of the advance transfer for the reporting period, calculated on an accrual basis;

- APpredsh.pr. — advances paid for previous quarters within one reporting period.

Thus, the tax payable to the budget is reduced by the advance amounts paid. If the result of the company’s activities for the year was a loss, then the tranche for the 4th quarter of the year is zero.

Use ConsultantPlus instructions for free to correctly fill out tax payments. Forms and samples are attached.

How to calculate monthly down payments

Unlike the advance payment based on the results of the quarter, the monthly advance payment is determined not from the actual, but from the estimated profit, which is determined based on the results of the previous quarter. An exception is the monthly payments of the first quarter of the current tax period: they are equal to the payments that were paid in the fourth quarter of the previous tax period. The calculation is described in detail in paragraph 2 of Art. 286 Tax Code of the Russian Federation.

Important: if during the current quarter an organization receives less profit or even a loss, this does not exempt it from paying monthly advance payments. They are recognized as an overpayment, which can be returned to the current account, offset against future payments, or used to pay off other taxes (in the federal and regional parts).

Example 2: let’s calculate the advance payments that Pineapples in Champagne LLC will transfer in 2020, taking into account monthly advance payments:

- payments in January, February and March 2020 are equal to the monthly advance payment that was paid in the fourth quarter of the previous year:

(620 thousand rubles × 20% − 350 thousand rubles × 20%) / 3 = 18 thousand rubles per month.

- The advance payment based on the actual results of the first quarter amounted to 18 thousand rubles. There was an overpayment of tax: (18 thousand rubles × 3 − 18 thousand rubles) = 36 thousand rubles.

The monthly advance payment in the 2nd quarter of the current year is equal to: 18 thousand rubles / 3 = 6 thousand rubles. The organization counted the overpayment against these payments, but even taking this into account, at the end of the 2nd quarter there remained an overpayment:

(36 thousand rubles − 6 thousand rubles × 3) = 18 thousand rubles.

- in July, August and September, the organization did not transfer payments, since the difference between the quarterly and advance payments for the half year and 1st quarter of 2020 was negative.

The quarterly advance payment for 9 months amounted to 30 thousand rubles. The organization closed part of it by overpayment, and paid the rest to the budget:

(30 thousand rubles − 18 thousand rubles) = 12 thousand rubles.

- For this option, you can already calculate payments due in October, November and December 2020 and the 1st quarter of the next year:

(30 thousand rubles − 0 rubles) / 3 = 10,000 rubles.

Algorithm for determining the amount of monthly advance payment

On a quarterly basis, the taxpayer calculates the amount of the advance on profits based on data obtained from the actual results of work for the period from the beginning of the year.

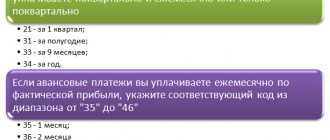

However, at the same time (if he does not use the right to pay advances only quarterly), he must make payments ahead of this calculation, made monthly on time. IMPORTANT! Taxpayers who pay regular monthly advances in 2020 have the right to switch to paying monthly advances based on the actual profit from the payment for January-April and in subsequent periods until the end of 2020 (Clause 2.1 of Article 286 of the Tax Code of the Russian Federation, introduced by law dated 22.04. 2020 No. 121-FZ). In this case, they will be able to determine the amount of advances taking into account previously accrued advance amounts. To make such a transition, a change in the procedure for paying advances must be reflected in the accounting policy, and a notification must be submitted to the tax office using the form from the Federal Tax Service letter dated April 22, 2020 No. SD-4-3/ [email protected] To start paying advances upon delivery from April, notify inspection is required by May 8th. For subsequent periods, the notification period is the 20th day of the month from which it was decided to change the order (if from May, then until 05/20/2020, from June - until 06/20/2020, etc.).

You can view and download a sample of filling out a notice of the transition to paying monthly advance payments based on the actual profit received from April 2020 in the Ready-made solution from ConsultantPlus. Just get a free trial access to the system and proceed to the material.

K+ experts also made a detailed analysis of all the April innovations in the procedure for paying advances on income tax in their Review:

For the full text of the Review, see the ConsultantPlus system and get full trial access for free.

To determine the amount of such payments, clause 2 of Art. 286 of the Tax Code of the Russian Federation establishes the following dependencies:

- the monthly advance payment in the first quarter of the current year is equal to the monthly advance payment in the fourth quarter of the previous year;

- the monthly advance payment paid in the second quarter is equal to 1/3 of the quarterly advance payment for the first quarter of the current year;

- the monthly advance payment paid in the third quarter is equal to 1/3 of the difference between the advance payment for the six months and the advance payment for the first quarter;

- The monthly advance payment paid in the fourth quarter is equal to 1/3 of the difference between the advance payment for 9 months and the advance payment for six months.

Trade tax payers can reduce advance payments of income tax by the amount of trade tax actually paid in relation to the consolidated budget of a constituent entity of the Russian Federation (clause 10 of Article 286 of the Tax Code of the Russian Federation).

Payment schedule and withdrawals

Taking into account the deadlines specified in paragraph 1 of Art. 287 of the Tax Code of the Russian Federation, we will draw up a payment schedule for Pineapples in Champagne LLC:

| Advance payments only at the end of the quarter | Advance payments based on quarterly results with monthly payments | |

| until 01/28/2020 | 2 thousand rubles additional payment for 2020 + 18 thousand rubles | |

| until 02/28/2020 | 18 thousand rubles | |

| until 30.03.2020 | 56 thousand rubles (based on the results of the fourth quarter of 2020: 900 thousand rubles × 20% - 124 thousand rubles) | 18 thousand rubles |

| until 04/28/2020 | 18 thousand rubles | overpayment credited |

| until 05/28/2020 | overpayment credited | |

| until June 28, 2020 | overpayment credited | |

| until July 29, 2020 | — | — |

| until 08/28/2020 | — | |

| until 09/28/2020 | — | |

| until 28.10.2020 | 12 thousand rubles | 12 thousand rubles + 10 thousand rubles |

| until 30.11.2020 | 10 thousand rubles | |

| until 12/28/2020 | 10 thousand rubles |

It is more profitable for the taxpayer to pay advance payments based on the results of the past quarter: in fact, they are paid according to real profits, and not “in advance.” Monthly advance payments are really a payment in advance from the money that could be put into circulation. This is especially felt when there was a good result for 9 months, and then a decrease in profit or even a loss: the organization still must transfer advance payments, moreover, calculated for “profitable” periods.

Returning to the news under discussion: whether the organization will make monthly advance payments or may limit itself to quarterly payments depends on the average revenue for the past 4 quarters. Let's remember how to calculate it.

Payment deadlines

According to the current fiscal legislation (Article 287 of the Tax Code of the Russian Federation), payment of advance payments for income tax is made no later than the established deadlines. Otherwise, the taxpayer will be punished. The last dates for transferring funds to the treasury depend on the method of calculation.

Current table for calculating advance payments for income tax in 2020 (payment deadlines):

| Calculation method | Deadline for transfer | Note |

| Quarterly | No later than the 28th day of the first month following the reporting quarter | If the last payment deadline falls on a non-working day, holiday or weekend, the date is moved to the first working day |

| Monthly with quarterly additional payment | No later than the 28th day of each month of this reporting period | |

| Monthly according to actual indicators | No later than the 28th day of the month following the month based on the results of which the tax liability is calculated |

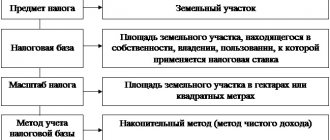

The procedure for calculating average income

The calculation takes into account income from the sale of goods, works, services and property rights specified in Art. 249 of the Tax Code of the Russian Federation. Non-operating income and income listed in Art. 251 of the Tax Code of the Russian Federation are not taken into account. Sales proceeds are taken without VAT and excise taxes.

The average sales revenue for the previous four quarters is the sum of sales revenue for each of the previous four consecutive quarters divided by four. If it exceeds the limit, the organization will make monthly advance payments from the next quarter. This limit was raised back in 2020 from 10 to 15 million rubles.

Example 3: Let's see if Pineapples in Champagne LLC is required to pay monthly advance payments during 2020.

- For the first quarter, income received in the 1st – 4th quarters of 2019 is taken: (10.5 million rubles + 8 million rubles + 13 million rubles + 13.5 million rubles) = 45 million rubles.

45 million rub. / 4 = 11.25 million rubles. This is less than 15 million rubles, which means that in the first quarter the organization is not obliged to make monthly advance payments.

Calculation for simplified taxation system Income

Tax base, i.e. The amount on which the tax is calculated for the simplified tax system Income is the income received. No expenses under this regime reduce the tax base; tax is calculated on the received sales and non-sales income. But due to the contributions paid, the payment to the budget itself can be reduced.

As an example of calculations, let’s take an individual entrepreneur without employees, who received income in the amount of 954,420 rubles in 2020. Insurance premiums for individual entrepreneurs in 2020 consist of a fixed minimum amount of 40,874 rubles. plus 1% of income exceeding RUB 300,000. We count: 40,874 + (954,420 – 300,000 = 654,420) * 1% = 6,544) = 47,418 rubles.

Pay additional fees in the amount of 6,544 rubles. possible both in 2020 and after its end, until July 1, 2021. Our entrepreneur paid all fees in 2020. Individual entrepreneurs paid insurance premiums for themselves every quarter in order to immediately be able to reduce payments to the budget:

- in the 1st quarter - 10,000 rubles;

- in the 2nd quarter - 10,000 rubles;

- in the 3rd quarter - 17,000 rubles;

- in the 4th quarter - 10,418 rubles.

| Month | Income per month | Reporting (tax) period | Income for the period on an accrual basis | Contributions of individual entrepreneurs for themselves on an accrual basis |

| January | 75 110 | First quarter | 168 260 | 10 000 |

| February | 69 870 | |||

| March | 23 280 | |||

| April | 117 200 | Half year | 425 860 | 20 000 |

| May | 114 000 | |||

| June | 26 400 | |||

| July | 220 450 | Nine month | 757 010 | 37 000 |

| August | 17 000 | |||

| September | 93 700 | |||

| October | 119 230 | Calendar year | 954 420 | 47 418 |

| November | 65 400 | |||

| December | 12 780 |

An important condition: we count the income and contributions of individual entrepreneurs for themselves not separately for each quarter, but as a cumulative total, i.e. year to date. This rule is established by Article 346.21 of the Tax Code of the Russian Federation.

Let's see how to calculate an advance payment under the simplified tax system Income based on these data:

- For the first quarter: 168,260 * 6% = 10,096 minus paid contributions of 10,000, 96 rubles remain to be paid. Payment deadline is no later than April 27th.

- For half a year we get 425,860 * 6% = 25,552 rubles. We subtract the contributions for the half-year and the advance for the first quarter: 25,552 – 20,000 – 96 = 5,456 rubles. You will have to pay extra no later than July 27th.

- For nine months, the calculated tax will be 757,010 * 6% = 45,421 rubles. We reduce by all paid fees and advances: 45,421 – 37,000 – 96 – 5,456 = 2,869 rubles. They must be transferred to the budget before October 26th.

- At the end of the year, we calculate how much the entrepreneur needs to pay extra by April 30: 954,420 * 6% = 57,265 – 47,418 – 96 – 5,456 – 2,869 = 1,426 rubles.

As we can see, thanks to the ability to take into account payments to funds, the tax burden of individual entrepreneurs on the simplified tax system Income in this example amounted to only 9,847 (96 + 5,456 + 2,869 + 1,426) rubles, although the calculated single tax is equal to 57,265 rubles.

Let us remind you that only entrepreneurs who do not use hired labor have this opportunity; individual employers have the right to reduce the tax by no more than half. As for LLCs, the organization is recognized as an employer immediately after registration, so legal entities also reduce payments to the treasury by no more than 50%.

Newly created organizations

Newly created organizations pay advance payments for the corresponding reporting period, provided that sales revenue does not exceed 5 million rubles per month or 15 million rubles per quarter. Accordingly, many more companies enjoy the right to quarterly payments.

Calculate your income tax using the online service Kontur.Accounting. Here you can easily do accounting, calculate salaries, pay taxes, automatically generate reports and send them online.

Who pays

The obligation to pay and calculate advance tranches for income tax falls on all economic entities that have chosen OSNO as the main tax regime.

In simple words, those who pay advances on income tax are the same organizations that do not have the right to switch to preferential (simplified) SSS. Depending on the category of taxpayer, officials have identified three methods for calculating advance amounts.

Method 1. Quarterly. Only the following categories of subjects are entitled to use this method:

- commercial companies whose revenue for the previous 4 quarters did not exceed 15 million rubles for each quarter. Either the revenue did not exceed 60 million rubles for the previous 12 months;

- budgetary institutions. It is important to note that libraries, theaters, museums, and concert organizations are excluded from this list;

- foreign companies that operate in Russia through permanent representative offices;

- beneficiaries under trust management agreements;

- economic entities participating in simple partnerships, but only in relation to income received from participation in simple partnerships;

- other categories of entrepreneurs and organizations named in paragraph 3 of Article 286 of the Tax Code of the Russian Federation.

Method 2. Monthly with additional payment per quarter. This option for calculating advance payments from the Federal Tax Service is used by all other economic entities that are not included in the above list (clause 3 of Article 286 of the Tax Code of the Russian Federation). For example, a company pays monthly advances on income tax if revenue exceeded 60 million in 2020 or over the previous 4 quarters exceeded 15 million rubles in each of four periods.

Method 3. Monthly, based on actual profit. Any organization on OSNO has the right to apply this calculation. To switch to this system of settlements with the budget, you will have to submit an application to the territorial office of the Federal Tax Service.

Now let's look at how to calculate advances on income tax and pay them to the budget for each calculation option.

Advance payment calculation

Determine the amount of the quarterly advance payment for income tax using the formula:

| Advance payment at the end of the reporting period | = | Tax base for the reporting period | × | 20% (or lower if established by regional legislation) | – | Advance payments accrued during the reporting period |

This procedure for calculating advance payments is established by paragraph 2 of Article 286 of the Tax Code of the Russian Federation.

An example of calculating and paying advance payments for income tax. The organization makes advance payments quarterly

JSC Alfa makes advance payments quarterly.

At the end of the first quarter of 2020, the organization received a profit of 100,000 rubles. The advance payment at the end of the first quarter was: 100,000 rubles. × 20% = 20,000 rub.

It was transferred to the budget on April 28, 2020.

For the first half of 2020, profit was received in the amount of RUB 120,000. The advance payment was: 120,000 rubles. × 20% – 20,000 rub. = 4000 rub.

It was transferred to the budget on July 28, 2020.

For the nine months of 2020, profit was received in the amount of RUB 110,000. Taking into account the previously transferred advance payments, the tax amount for this period is subject to reduction: 110,000 rubles. × 20% – 24,000 rub. = -2000 rub.

Since the accrued tax amount for nine months is less than what was actually paid, at the end of this reporting period, Alpha does not transfer an advance payment of income tax to the budget.

Payments from actual profits

We decided to switch to a monthly method of calculations based on actual profit indicators - we will have to notify the Federal Tax Service in the prescribed manner. Any institution or commercial company has the right to use this option for mutual settlements with the budget. In this case, monthly advances for income tax are calculated based on the actual profit received for the reporting period.

The company will have to submit monthly income tax returns to the Federal Tax Service. Reporting periods are recognized as one month, two months, three months and beyond. The amount payable to the treasury is calculated as the taxable base multiplied by the tax rate. The advance payment amount is calculated as the difference between the accrued payment for the period from the beginning of the year and the amounts already paid.