Individual entrepreneurs, after registering their status with the Tax Inspectorate, must take a number of actions to ensure that their work is legal.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Otherwise, the state has the right to apply punishment against the individual entrepreneur as determined by the Code of Administrative Offenses of the Russian Federation.

These actions include registering a businessman in:

- Pension Fund;

- Federal Statistics Service;

- Social and health insurance funds;

- regulatory government agencies.

The latter need to be contacted only if the entrepreneur plans to engage in certain types of activities.

Actions of the entrepreneur after opening

Each individual entrepreneur, according to the laws of the Russian Federation, must apply to extra-budgetary funds, which include Pension, medical and social insurance.

In addition, he should obtain statistics codes and open a bank account.

In some cases, an entrepreneur should also contact regulatory government bodies, one of which is Rospotrebnadzor.

Legislative regulation

The creation of individual entrepreneurs is generally regulated by the Civil Code of the Russian Federation and Federal Law No. 129 “On state registration of legal entities and individual entrepreneurs.”

Issues related to contacting Rospotrebnadzor are determined by the Federal Law “On the protection of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control.”

In addition, a complete list of areas of activity requiring application to regulatory authorities is indicated in the Decree of the Russian Government of 2009 (No. 584).

Do I need to contact Rospotrebnadzor later?

It is necessary to submit an application to Rospotrebnadzor not only after the actual registration of an individual entrepreneur, but also in other situations when some information about the applicant changes. Among them:

- change of place of registration at the place of residence;

- changing other data about an individual entrepreneur, for example, his last name (read more about changing the last name of an individual entrepreneur in our article >>);

- change in the place of actual business activity.

If a person does not provide the specified information to Rospotrebnadzor, he may be held accountable.

Read: Registration of an individual entrepreneur through a representative by proxy

Registration with funds

Registration in mandatory funds is carried out automatically after registration with the Tax Inspectorate, since its employees send information to other government agencies.

In some cases, an entrepreneur must do this independently, for example, when hiring workers or after deciding to start work in a certain direction.

Pension Fund (if not issued by the tax office).

Registration is carried out at the Pension Fund Office of your district at the place of registration (see addresses of branches) and is mandatory. If there are no employees, then pay into the pension fund only for yourself; if someone does work for you, then you will have to pay for them too.

You will have to pay fixed payments to the Pension Fund, regardless of whether you are engaged in business or not, whether you have income or not. Payments to the pension fund must be made from January 1 to December 31 of the current year. You can pay for the whole year at once, or in installments. You can also make payments from the entrepreneur’s current account, if you have one.

It is possible to pay for the entire year at the end of the year. And paid receipts must be saved and presented (and their photocopies) to the regional Pension Fund office for reporting in the period from January 10 to March 1.

If, after registering an individual entrepreneur, you were not given a notice of registration with the Pension Fund, then 2 options are possible.

- Wait until the letter arrives in your mail. This usually takes from 2 to 4 weeks. Confirmation of registration (for yourself) will be the “Notification of registration of an individual in the territorial body of the Pension Fund of the Russian Federation at the place of residence.” You don’t actually need a letter, you just need a registration number and details for paying taxes. Therefore, you can find them out more quickly using the following option.

- Call the branch of your PFRF by phone or go to the branch in person.

Registration of individual entrepreneurs in Rospotrebnadzor

In order to start certain types of activities, an individual entrepreneur must notify Rospotrebnadzor about this.

In this case, one should take into account the fact that it is necessary to submit documents before starting work and making a profit, since otherwise the entrepreneur will have to pay a fine.

Why is it needed?

It is necessary to notify Rospotrebnadzor so that an individual entrepreneur can carry out activities legally.

If registration with this government body is not carried out, then penalties may be applied to the individual entrepreneur in accordance with the Code of Administrative Offences.

Is it required?

Registration of an individual entrepreneur with state control authorities is mandatory only if he plans to engage in certain types of activities that relate to these institutions.

In this case, it is necessary to notify Rospotrebnadzor in advance, before starting work and receiving profit from it.

If an individual entrepreneur has included in his statistics codes a type of activity that requires sending documents to regulatory authorities, but does not plan to engage in them in the near future, then in this case it is also not necessary to register.

Now you know whether registration of an individual entrepreneur with Rospotrebnadzor is mandatory and in what cases it must be carried out, so you can begin to study what needs to be done to carry out this procedure.

Registration of individual entrepreneurs on the Internet through the Tax Office website allows you to save time. What is the procedure for registering an individual entrepreneur? Read here.

Does it depend on the type of activity?

The application of an individual entrepreneur to Rospotrebnadzor depends entirely on what type of activity he plans to engage in.

If this direction is included in the decree of the Government of the Russian Federation of 2009, then notification of the regulatory authority is the responsibility of the individual entrepreneur.

Currently, you need to contact Rospotrebnadzor if you plan to engage in the following in the near future:

- providing temporary accommodation for people, that is, the hotel business;

- repairing shoes, furniture and other things, that is, providing household services;

- organization of public catering;

- trade (wholesale) of food and non-food products;

- production of textiles and clothing;

- production of various leather products;

- wood processing;

- publishing activities;

- maintenance of computer equipment;

- food production (milk, bread, sugar, juices, soft drinks);

- manufacturing of furniture and building materials;

- activities related to the tourism business.

Main conditions

At the time of starting any activity, a businessman must find out whether registration of an individual entrepreneur with Rospotrebnadzor is necessary in accordance with the line of activity. If the procedure is necessary, the entrepreneur must provide the organization with a certain package of documents.

When it is necessary

After deciding to create your own business, it is important to familiarize yourself with the list of activities that involve accessing and submitting data to Rospotrebnadzor.

The procedure is carried out if the entrepreneur is engaged in:

- transportation of goods and passengers;

- publishing activities or provision of printing services;

- social work;

- information technology and work with computer technology;

- production of confectionery and flour products, dairy products;

- consumer services for the population;

- business related to catering establishments;

- trade.

These types of activities are the most common. But the list is far from complete.

You can find out exactly whether a business requires registration with Rospotrebnadzor by referring to Russian Government Decree No. 584, which contains complete information about all areas of activity indicating OKVED codes

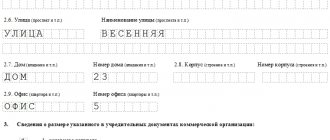

Required documents

To register with Rospotrebnadzor, a certain package of documents is required.

It consists of:

- certificate of registration of a person as an individual entrepreneur indicating the state registration number;

- taxpayer identification number;

- extracts from the Unified State Register of Individual Entrepreneurs;

- notification sent to Rospotrebnadzor about the commencement of activities included in the list of Decree of the Government of the Russian Federation No. 584;

- notification submitted to the Federal State Statistics Service about the assignment of codes according to the activities of the entrepreneur.

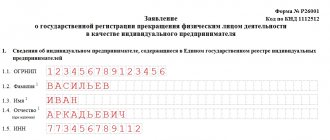

Example of a registration notice

The notification document contains information about the entrepreneur and the nature of the person’s activities.

This includes:

- personal data (full name);

- state registration number of a person as an individual entrepreneur;

- address where professional activities are carried out;

- date of compilation;

- list of activities about which Rospotrebnadzor is notified;

- date of commencement of business.

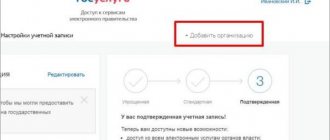

Registration of an individual entrepreneur in the ESIA is possible only after registering in the same system as an individual and passing the identification procedure.

A list of types of activities without individual entrepreneur registration can be found in the article at the link.

At the end of the document, the signature of the individual entrepreneur and the official seal (if available) are placed.

Procedure

Registration of an individual entrepreneur with Rospotrebnadzor occurs quickly and does not require the collection of a large package of documents, so an entrepreneur can easily cope with it on his own.

Currently, you can submit documents in two ways:

- by contacting the Rospotrebnadzor office in person;

- by submitting an application through the State Services website.

In the first case, the individual entrepreneur must provide written notification in two copies. The electronic document is submitted in 1 copy.

List of required documents

In order to register with Rospotrebnadzor, an entrepreneur needs to collect a package of documents.

Currently it includes the following papers:

- certificate of establishment of an individual entrepreneur containing information about the state registration number of the entrepreneur;

- certificate with taxpayer identification number;

- extract from the state register;

- notification from Rospotrebnadzor that a businessman is starting business activities in areas related to the work of this organization;

- FSRS notification about statistics codes assigned to individual entrepreneurs.

These are the main documents that are needed for registration and registration with regulatory government agencies. Evidence must be submitted in the form of copies.

A sample application for registration of individual entrepreneurs in Rospotrebnadzor is here,

A sample certificate of registration of individual entrepreneurs is here.

The notice must contain the following information:

- last name, first name and patronymic of the individual entrepreneur;

- registration number;

- actual address of the place of provision of services;

- date of document preparation;

- a list of those types of activities for which a notification is submitted to Rospotrebnadzor;

- date of expected start of work in selected areas.

This document must be signed by the individual entrepreneur and, if he has a seal, sealed with it.

Registration of an individual entrepreneur as an employer is carried out in the Pension Fund and the Social Insurance Fund. What to do when changing the place of registration of an individual entrepreneur? See here.

Is registration of cash register required at the place of business of the individual entrepreneur? Detailed information in this article.

Registration procedure step by step, package of documents

The requirement to notify Rospotrebnadzor does not apply to all individual entrepreneurs, but only to those that plan to conduct types of activities specified by law. Such entrepreneurs are required to contact the service department with the appropriate notification. This should be done after registering an individual as an individual entrepreneur with the tax service, Pension Fund, Social Insurance Fund and Compulsory Medical Insurance.

Additional Information! The procedure for registering individual entrepreneurs in trust funds may differ slightly. As a rule, this depends on whether the entrepreneur plans to use hired labor when running a business or not.

The initial stage of the registration procedure with Rospotrebnadzor is the collection and preparation of the necessary documents.

A standard package should contain the following materials:

- copy and original OGRN IP, Unified State Register of Individual Entrepreneurs;

- copy and original individual entrepreneur tax number;

- notification in a prescribed format. 2 copies will be required;

- applicant's internal passport.

The notice is drawn up in accordance with the established rules. The document must contain the following information:

- the name of the department to which the notification is submitted;

- document submission date;

- the name of the individual entrepreneur (full name), his tax and registration number;

- the area of activity that, in accordance with the Resolution, is subject to registration with Rospotrebnadzor, and the place of its operation;

- information indicating that the territory occupied by the individual entrepreneur, as well as premises, transport and hired workers, meet the requirements for the registered type of activity;

- IP signature with transcript, seal.

It is better to enter information on the form in block letters. Mistakes should be avoided when filling out the document. The information presented in the document must be true.

When the documents are ready and the notification has been drawn up, you can proceed to the next stage, which involves submitting materials to the territorial office of Rospotrebnadzor. At the moment, the notification is submitted at the place of the proposed actual activity.

The fact of registration of a notification by service employees is confirmed by a mark that is placed at the top of the form after the name of the document.

Note! Starting from 2020, individual entrepreneurs will have the opportunity to submit a notification to a Rospotrebnadzor office located in any region of the Russian Federation.

You can submit a document:

- personally;

- via mail;

- through a proxy;

- online, on the government services website.

If a representative acts on behalf of an entrepreneur, a power of attorney must be attached to the main package of documents. The document must contain a list of powers of the trustee, as well as other details established by the rules of notarial legal acts.

According to the law, a power of attorney is subject to notarization.

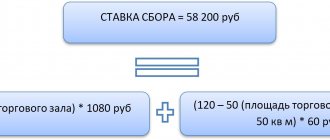

Fines

In 2020, individual entrepreneurs will be subject to administrative punishment for failure to notify, in accordance with the Code of Administrative Offenses of the Russian Federation.

In the event that an individual entrepreneur has begun work that is included in the list of the Government of the Russian Federation No. 584 of 2009, but has not notified the controlling organization about this, he will be subject to punishment in the form of a fine.

The amount of this penalty ranges from three to five thousand rubles.

If an individual entrepreneur submitted a notification with knowingly false information, then in this case the fine will be greater.

The payment will range from five to ten thousand rubles.

Who should submit the notification and where?

Until 2008, it was impossible to register an activity without first obtaining permission from the authorities. After the approval of 294-FZ, aimed at protecting business, the obligation to obtain permits was canceled. This has been replaced by the requirement to notify control authorities about the start of activities. The main one is the federal service for supervision of consumer rights and human well-being in Russia - Rospotrebnadzor.

The main functions of the service are control over the provision of sanitary and epidemiological standards, monitoring compliance with legislation in the field of the consumer market, and defending the interests of buyers.

A newly created entrepreneur is required to submit information to regulatory organizations before starting the declared type of activity, i.e. before receiving income.

The list of works and services that have the obligation to notify Rospotrebnadzor includes, for example:

- retail trade;

- catering;

- household services to the population;

- production of bread, dairy, confectionery products;

- travel agencies;

- production of packaging materials;

- publishing and printing;

- production of goods from textiles, clothing, footwear;

- areas related to computing and informatics.

The full list of OKVED is contained in Decree of the Government of the Russian Federation No. 584 of July 16, 2009. The notification sent does not exempt you from complying with the norms and requirements of the law. There are often cases when a businessman’s plans include covering several areas of activity at once, thereby creating the obligation to notify the responsible regulatory authorities.

Reception of notifications about the start of certain types of activities is carried out by the represented government agencies:

- Rostransnadzor – passenger and cargo transportation.

- Ministry of Emergency Situations of Russia - the obligation to notify the authority arises for an individual entrepreneur engaged in the manufacture of fire-fighting technical products.

- Rosstandart informs entrepreneurs planning the production of measuring instruments and low-voltage equipment.

- Rostekhnadzor - when providing services for the operation of explosive and chemically hazardous facilities.

- Rostrud – social services to the population.

- Rosselkhoznadzor – production of animal feed.

The functions of Rospotrenadzor in some regions of the country are assigned to the Federal Medical and Biological Agency (FMBA).

An individual entrepreneur needs to register with Rospotrebnadzor only if the OKVED code of the activity actually carried out is included in the list of the Resolution. If the OKVED code specified during registration is fixed in the list, but the entrepreneur does not actually conduct business in this direction, registration of the individual entrepreneur with Rospotrebnadzor is not carried out.

Registration of individual entrepreneurs and LLCs in the Pension Fund, Federal Insurance Fund, Federal Insurance Fund, Rospotrebnadzor 2020

The process of registering an LLC is described in detail in the Civil Code of the Russian Federation, Article 51. In the process of creating a company, it goes through several stages:

- A decision is made to conclude an agreement with the founders.

- State duty is paid.

- The head of the LLC is selected.

- An application for registration is submitted.

- The size of the company's capital is determined.

After completing the LLC registration, a number of more steps need to be taken:

- Get statistics codes.

- Conclude a lease agreement at a legal address.

- Pick up the certificate from the FSS.

- Receive a notification from the Pension Fund.

- Create a current account for the company.

- Make a stamp (optional, but recommended).

Our lawyers know the answer to your question

If you want to find out how to solve your particular problem, then ask our duty lawyer online.

It states that first, information about the newly formed company is entered into the register of legal entities, and after that the organization receives a state registration certificate.

- St. Petersburg and region: +7-812-467-37-54

- Moscow and region: +7-499-938-54-25

According to the law, all companies that have passed the registration procedure are automatically registered with extra-budgetary structures.

It's fast, convenient and free!

Registration issues are regulated by the following regulations:

- “On compulsory insurance” (Federal Law No. 255).

- “On compulsory pension insurance (Federal Law No. 167).

- “On insurance premiums” (Federal Law No. 212)

Registration is carried out within 30 days from the date of receipt of the certificate from the Federal Tax Service.

The funds register the LLC, after which they send them a notice with a registration number and current account.

In addition, it is required to inform the authorized body about opening an account within a week.

How to compose

The Appendices to Government Decree No. 584 contain a notification form for starting a business activity (this is Appendix No. 2). The form is quite simple; you need to fill out the following lines:

- the name of the specific Rospotrebnadzor Department where the application is submitted (at the place where the type of business is carried out);

- date of application;

- full and abbreviated name;

- TIN and ORGN (or OGRNIP);

- place of implementation of the declared type of business;

- name of the type of business in accordance with OKVED and OKVED number;

- start date of its implementation;

- signature of managers or individual entrepreneurs with transcript.

There are several ways to submit a notification of the start of activities to Rospotrebnadzor:

- provide in person to the Department in two copies (one for the applicant, so that a mark of provision is affixed);

- by registered mail with a list of contents and notification of delivery;

- in electronic form with a certificate with an enhanced qualified signature and through the public services portal;

- through MFC.

Rospotrebnadzor recommends sending through government services, which guarantees quick receipt of the form to the addressee and saves the applicant’s costs.

Registration and withdrawal of individual entrepreneurs in the Social Insurance Fund. Required documents.

FSS will be required only in a couple of cases:

- concluding an employment contract with an employee (when you become an employer),

- concluding a civil contract with the obligation to pay contributions to the Social Insurance Fund.

To register with the Social Insurance Fund, an individual entrepreneur is given a period of 10 days after signing the first employment contract with an employee. Failure to comply with this deadline will result in a fine of 5,000 rubles. To register, you must submit an application and the necessary documents (submitted in originals and copies or notarized copies):

- application for registration as an insurer;

- copy of passport (employer);

- a copy of the certificate of state registration of an individual as an individual entrepreneur (OGRN certificate);

- a copy of the certificate of registration with the tax authority (TIN certificate);

- copies of work records of hired workers;

- copies of civil law contracts if they contain conditions that the policyholder is obliged to pay insurance premiums for compulsory social insurance against industrial accidents and occupational diseases for the specified persons

If at the time of submitting the application a bank account was opened with a credit institution, you must provide a certificate from the credit institution about the specified account.

Registration takes no more than 5 working days and a Notification is issued. If an individual entrepreneur carries out his business activities without using the labor of hired workers (does not enter into labor or civil contracts with individuals), then such an entrepreneur is not required to register with the Fund.

Always check the current list of documents. You can find out this in your FSS branch (the coordinates are presented on the website in the lower right menu “Regional branches”).

On a quarterly basis, individual entrepreneurs must submit reports to the branches of the Fund at the place of registration in form 4-FSS RF or 4a-FSS RF (for those paying voluntary insurance contributions to the FSS RF) no later than the 15th day of the month following the expired quarter.

Violation of the established deadline will result in a fine:

- 5% of the amount of insurance premiums subject to payment (surcharge) on the basis of this reporting, for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 100 rubles;

- 30% of the amount of insurance premiums payable on the basis of this reporting if reporting is not submitted for more than 180 calendar days;

- 10% of the amount of insurance premiums payable on the basis of these reports for each full or partial month starting from the 181st calendar day, but not less than 1,000 rubles.

Deregistration occurs upon dismissal of employees, expiration of employment contracts, or corresponding civil law contracts concluded with employees.

To be deregistered, policyholders must provide the following documents to the territorial body of the Federal Social Insurance Fund of the Russian Federation:

- Application for withdrawal (you can download it here);

- certified copies of documents confirming the occurrence of circumstances that are the reason for deregistration.