Simplified financial statements are prepared on special forms. It includes significantly fewer forms compared to regular reporting. Which forms should be included in simplified reporting and which should not be included? Who can take advantage of this relief? What's new in accounting legislation? In our article you will find answers to these questions, as well as forms and samples of simplified financial statements for 2019, which can be downloaded for free.

Also see:

- How to submit accounting reports in 2020: composition, forms and deadlines

What's New in Accounting Laws 2020

In 2020, further amendments were made to the legislation, which also affected the presentation of financial statements. Some of them did not affect simplified financial statements, others are directly related to it.

IMPORTANT!

Changes to the accounting forms were introduced by Order of the Ministry of Finance of Russia dated April 19, 2019 No. 61n.

Information about the audit organization

This innovation does not apply to simplified accounting, since those who have the right to use the simplified method of preparing a balance sheet are not subject to mandatory audit. We will tell you below about who can apply the simplified balance sheet. And in the regular balance sheet it is now necessary to include information (name, tax identification number, registration number) about the organization that conducts the statutory audit.

Changes to PBU

PBU 18/02 has also undergone changes. As a result, amendments were made to the financial results statement to reflect changes in PBU 18/02. This also does not apply to simplified accounting, since small enterprises may not apply PBU 18/02, which is what they usually use. Namely, small businesses usually draw up a simplified balance sheet.

Units of measurement are unified

The balance must be drawn up only in thousands of rubles. The ability to enter data in millions is no longer available.

Submission to Rosstat

A pleasant innovation - from 2020 there is no need to submit a copy of the accounting report to Rosstat. But, in contrast to this, they introduced the obligation to submit balance sheets to regulatory authorities only in electronic form.

IMPORTANT!

Small businesses can report for 2020 on paper in 2020. The requirement for electronic submission for them will come into force only in 2021 (clause 4 of article 2 of the Federal Law of November 28, 2018 No. 444-FZ).

Small Business Criteria for 2019-2020

Every company is required to prepare a balance sheet.

But not everyone has the right to choose the form - traditional or simplified - for this report. In particular, small enterprises have this opportunity (subclause 1, clause 4, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). The criteria for small enterprises are specified in the law “On the development of small and medium-sized enterprises...” dated July 24, 2007 No. 209-FZ. For 2019-2020, the criteria for a small enterprise are set as follows:

| № | Criteria for recognition as a small business entity | Limit value |

| 1 | Total share of participation in the authorized capital of an organization of the Russian Federation, constituent entities of the Russian Federation, municipalities, public, religious organizations, foundations | 25% |

| 2 | Total share of participation in the authorized capital of foreign organizations | 49% |

| 3 | Total share of participation in the authorized capital of other organizations that are not small and medium-sized businesses | 49% |

| 4 | Average number of employees for the previous calendar year | 100 people |

| 5 | Income received from business activities for the previous calendar year, which is determined in the manner established by the legislation of the Russian Federation on taxes and fees | 800 million rub. |

Read more about the criteria in the material “Small enterprise - criteria for inclusion in 2020 - 2020”.

What types of simplified reporting are there?

Inexperienced accountants or people who are far from accounting, but are forced to deal with it, may be confused about the terminology.

The following diagram will help them understand and not confuse different concepts:

As you can see, the above reports have completely different purposes and specific presentation.

Now we analyze in detail the simplified financial statements for 2019.

Concept

Lightweight financial statements differ from ordinary financial statements mainly in their size. The structure of regular reporting includes, in addition to the balance sheet and financial results statement, appendices: cash flow statements, changes in capital, as well as explanatory notes. For those who use lightweight accounting, all that is needed are two forms: a balance sheet and a financial results report.

Organizations that receive trust funds must also complete a Trust Fund Report form. An organization that has the right to use lightweight reporting can provide reports in regular forms if this method is more convenient for it. In any option, those who have the right to facilitated accounting must establish the accounting rules - the usual or simplified method that they will use.

The second difference between lightweight and simple reporting lies in the reporting forms themselves. They have fewer lines to fill out, and all characteristics are reflected in the increase in the group without specifying specific items.

For those who present simplified financial statements, the accounting forms that were approved by the Ministry of Finance dated 02/07/2010 No. 66n (as amended on 04/04/2015) are of great importance.

Who is given the right to submit simplified accounting reports?

It is established by law who submits simplified financial statements and can conduct simplified accounting, and who does not have such a right (Article 6 of the Federal Law of December 6, 2011 No. 402-FZ). We emphasize that simplified accounting and reporting is the right of the organization, and not an obligation.

IMPORTANT!

Individual entrepreneurs may not keep accounting records at all and not submit financial statements (Clause 2, Article 6 of Federal Law No. 402-FZ).

Analysis of the structure and dynamics of property and sources of financing

An assessment of the structure and dynamics of property (assets) gives an idea of the ratio of fixed and working capital, the share of inventories in current assets, as well as changes in their value for the analyzed period.

The structure and dynamics of sources of financing (liabilities) shows the shares of own, borrowed and borrowed funds, as well as their changes over the analyzed period, which is a well-known technique for analyzing financial statements.

However, this information is not particularly important when assessing the activities of a small enterprise. The authorized capital of a small enterprise is usually small. They carry out their current activities mainly from their own funds and accounts payable. Trade and purchasing activities and settlement operations, as a rule, are carried out on an advance payment basis or through obtaining a commercial (commodity) loan. Therefore, a very important factor is maintaining liquidity and solvency, which characterize the ability of an enterprise to timely and fully make payments on current obligations.

What does simplified accounting consist of?

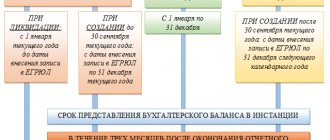

Simplification of reporting refers both to its composition as a whole and to the number of indicators in the forms themselves. But there are no concessions in the deadlines for submitting simplified reporting. It must be submitted, like a regular one, by March 31 of the next year (in 2020, it is postponed to 05/06/2020 inclusive due to coronavirus, quarantine and non-working days).

Accounting statements generally consist of the following documents:

As can be seen from the diagram, simplified accounting lives up to its name: when used, it is enough to report for the year in just two forms (clause 85 of Order No. 34n of the Ministry of Finance of Russia dated July 29, 1998).

Non-profit organizations with any set of reporting must submit a report on the intended use of funds.

The current simplified financial statements forms for 2020 are presented below.

Who submits the simplified balance sheet form and where?

The right to use form 0710001 is granted to small businesses, companies not involved in commercial activities and organizations operating within Skolkovo. This benefit does not apply to business entities with mandatory audit.

The balance is provided to the Federal Tax Service and Rosstat. Deadline: until the end of the first quarter of the next reporting year. Missing the deadline is fraught with fines from each authority - 200 rubles. for each form not submitted on time to the Federal Tax Service and up to 5,000 rubles. for being late with the report to Rosstat. Submitting reports that are completely completed or blank does not play a role in imposing a fine.

Forms for simplified accounting

The forms of the simplified balance sheet and simplified statement of financial results were approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n in Appendix No. 5.

Further, using a direct link you can download simplified accounting statements 2020 for free:

Let's look at these forms in more detail. In the header of each form you must indicate general information about the organization.

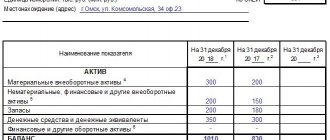

The balance sheet contains data for the last 3 years, including the reporting year. In the financial results report – for the last 2 years, including the reporting year.

Simplified balance sheet

In a simplified balance sheet, the indicators are enlarged, but the principle remains the same - the presence of assets and liabilities that are equal.

In column 2 of the balance sheet indicate the code in accordance with Appendix No. 4 to Order No. 66n. Since the simplified balance sheet gives aggregated indicators, one line includes several positions. For example, in line 1170 - intangible assets and long-term financial investments. In a regular balance sheet, different codes are provided for this data.

In a simplified balance sheet, you should select the code of the indicator that has a greater share in the line.

Let's consider how the lines of the balance sheet and the accounting accounts relate. When calculating, it is necessary to use the balance at the end of the reporting year in the accounting accounts. In the general case, we take not the total balance, but the expanded balance - according to subaccounts. We take this scheme as a basis, since each specific case may have its own nuances.

Income statement

Similarly with indicating the code in the balance sheet, in the statement of financial results in the line you must select the code that corresponds to the indicator with the highest specific weight.

EXAMPLE

In line 2120, the cost price is 5 million rubles, commercial expenses are 1 million. rub., management expenses – 600 thousand rubles. Thus, the code in the line “Expenses for ordinary activities” will be 2120, relating to cost.

Let us present the ratio of the lines of the financial results statement and the balance of the accounting accounts. Here we take the turns on accounts 90 and 91.

The parentheses mean "-". For example, the result obtained at line 2400:

- negative (loss) – put in brackets;

- positive (profit) – write without brackets.

Rules for filling out Section III

You can list the key indicators used when filling out the section and the accounts for which they are used:

- Authorized capital – account 80. This category also includes the authorized capital or contributions of the participants of the partnership.

- Own shares that the company buys back from shareholders – account 81.

- Revaluation of non-current assets. The score used for this is 83.

- Additional capital – account 83.

- Reserve capital – account 82.

- Retained earnings and uncovered losses - accounts 84 and 99.

If participants contributed additional financial resources to increase the authorized capital, then before their registration in the Charter, such funds must be recorded in a separate line. Information about this is present in the special Letter of the Ministry of Finance No. 07-04-06/5027, published in 2020. It is also necessary to separately indicate interim dividends that were paid during the year.

In the third section of the balance sheet, it is necessary to indicate information indicating three dates. This is the reporting date, as well as the last day of the previous year and the last day of the earlier year. Thus, the report displays changes in information over the last three years, which makes it possible to judge changes in the enterprise’s own sources of financing.

Example of filling out simplified financial statements

Let’s assume that LLC “Princip” is a small business entity, therefore it has the right to maintain simplified accounting and prepare simplified accounting reports.

Let's look at the balance sheet compiled by the accountant of Princip LLC based on the results of 2020 after the balance sheet reformation and fill out a simplified balance sheet for 2020 on its basis. For simplicity, we will not show the balance at the beginning of the period and turnover for the period; we will leave only the balance at the end of the year.

SAMPLE OF SIMPLIFIED BALANCE FOR 2020

To fill out the financial results report, we will show part of the balance sheet in terms of accounts 90 and 91 before the reformation of the balance sheet with turnover for the period and balance at the end of the year.

SAMPLE OF SIMPLIFIED FINANCIAL RESULTS REPORT FOR 2020

Columns 4 and 5 of the balance sheet, and column 4 of the financial results statement are filled out based on the reporting of previous years.

Calculation of coefficients characterizing financial stability

To assess financial stability, the following relative indicators can be used to characterize the state of working capital, the structure of funding sources, and the financial independence of the enterprise:

| Name | Recommended value | Formula |

| Coefficient of provision of current assets with own working capital (Kss) | greater than or equal to 1.0 | Kss = SOS/OA, SOS = Capital and reserves - Non-current assets; |

| Coefficient of provision of inventories with own working capital (Kmz) | from 0.6 to 0.8 | Kmz = SOS/W |

| Equity capital agility ratio (Kmsk) | 0,5 | Kmsk = SOS/KR |

| Long-term borrowing ratio (Kdz) | less than or equal to 1.0 | Kdz = Long-term borrowed funds / Equity funds |

| Autonomy coefficient (Ka) | greater than or equal to 0.5 | Ka = SC/WB |

| Financial activity ratio (financial leverage) (Kfa) | Kfa = (DZS+KZS)/KR | |

| Financial stability coefficient (share of long-term sources of financing in assets) (Kfu) | from 0.5 to 0.7 | Kfu = (KR+DZS)/VB |

| where, SOS - own working capital; OA - current assets; Z - reserves; KR - capital and reserves; SK - equity capital; VB - balance sheet currency (total cost of funding sources); DZS - long-term borrowed funds; KZS - short-term borrowed funds | ||

Let us summarize the procedure for calculating the considered coefficients using the corresponding balance sheet line codes:

Kss = (line 1300-(line 1150+line 1110)) / (line 1210+line 1250+line 1230) Kmz = (line 1300-(line 1150+line 1110)) / line .1210 Kmsk = (p.1300-(p.1150+p.1110)) / p.1300 Kdz = p.1400 / p.1300 Ka = p.1300 / p.1700 Kfa = (p.1410+p. 1510) / line 1300 Cfu = (line 1300+line 1410) / line 1700

When using the indicated indicators of financial stability in analytical practice, it is necessary to keep in mind that they reflect the financial condition as of a date that has already passed. Therefore, it is advisable to consider them in dynamics over several reporting periods, which will indicate a certain consistency in the activities of the enterprise. In addition, the recommended values of these coefficients are conditional and depend on the characteristics of financial and economic activities, on internal and external economic factors.

Concept of capital and reserves

Capital should be understood as the sum of the enterprise's own and borrowed funds.

Equity is the monetary value of a company's assets that are owned by it.

Capital and reserves in the balance sheet is an information block that consists of 7 lines.

When calculating equity capital, the difference between the value of all property on the balance sheet (the company's assets) and the company's liabilities is obtained.

Any financial and economic activity requires constant investment of capital. Investments are required to maintain and expand the production process and improve its efficiency and introduce innovation. One of the main tasks of financial management is the development of the investment budget, support and optimization of investments to attract financial resources, and optimization of the capital structure.

The choice of sources of financing is influenced by various factors, including the industry and scale of the enterprise’s activities, technological features of the production process, specifications of products, work with banking structures, reputation in the market, etc.

The structure of the “Capital and Reserves” section of the balance sheet used by the enterprise is determined by all financial assets that have an active impact on the final result of the company’s activities. It affects the profitability of assets and funds, forms the ratio of profit and risk in the process of enterprise development.

The financial structure of capital and reserves on the balance sheet is the structure of the main sources of funds, i.e. the ratio of equity and debt capital.

The financial capital of an enterprise consists of its own and borrowed capital.

The balance sheet item “Capital and reserves” in the form of equity capital consists of the value of authorized, reserve and additional capital. In addition, it includes the value of retained earnings received from the operation of the enterprise. Debt capital is an enterprise's accounts payable to individuals and legal entities, including banks.

Provisions are an estimate and explanation of individual items in a business's accounting records aimed at covering expenses and payments due.

Who's leading?

N 402-FZ “On Accounting” Art. 20 clause 3) simplification of accounting methods, including simplified accounting (financial) reporting, for small businesses (businesses) and certain forms of non-profit organizations (comes into force in 2013)

Organizations (not individual entrepreneurs) can report under simplified reporting under any tax regime related to small businesses (number of employees up to 100 people, revenue from sales of goods - no more than 400 million rubles / year, from 2020 - 800 million)

https://www.youtube.com/watch?v=ytcreatorsru

Using this online service for individual entrepreneurs and small companies or this online service for organizations, you can conduct tax and accounting on the simplified tax system and UTII, generate payment slips, 4-FSS, SZV, Unified Settlement 2020 and submit any reports via the Internet, etc.( from 250 rubles/month). 30 days free. For newly created individual entrepreneurs, now the first year on the Premium tariff is a gift (free).

A small business will have a choice: use simplified forms or fill out a traditional (large) balance sheet and income statement.

You can report using simplified forms for small businesses as early as 2012.

Table 1. Account balances of Class LLC as of December 31, 2015

| Account, sub-account | Balance as of December 31, 2015, rub. | |

| debit | credit | |

| 01 "Fixed assets" | 600 000,00 | — |

| 02 “Depreciation of fixed assets” | — | 100 000,00 |

| 04 "Intangible assets" | 120 000,00 | — |

| 05 “Amortization of intangible assets” | — | 23 000,00 |

| 10 "Materials" | 23 000,00 | — |

| 20 "Main production" | 50 000,00 | — |

| 43 “Finished products” | 90 000,00 | — |

| 50 "Cashier" | 10 000,00 | — |

| 51 “Current accounts” | 205 000,00 | — |

| 58 “Financial investments” | 150 000,00 | — |

| 60 “Settlements with suppliers and contractors”, 60-1 “Settlements for purchased goods and services” (short-term debt) | — | 150 000,00 |

| 62 “Settlements with buyers and customers”, 62-1 “Settlements for sold inventory items” (short-term debt) | 100 000,00 | — |

| 62 “Settlements with buyers and customers”, 62-2 “Advances received” (short-term debt) | — | 606 000,00 |

| 68 “Calculations for taxes and fees” (short-term debt) | — | 9000,00 |

| 69 “Calculations for social insurance and security” (short-term debt) | — | 80 000,00 |

| 70 “Settlements with personnel for wages” (short-term debt) | — | 170 000,00 |

| 80 “Authorized capital” | — | 10 000,00 |

| 84 “Retained earnings (uncovered loss)” | — | 200 000,00 |

Let's comment on filling out individual lines in the balance sheet assets.

The cost of fixed assets is 500,000 rubles. (600,000 rubles - 100,000 rubles) should be reflected in the item “Tangible non-current assets”.

Intangible assets in the amount of RUB 97,000. (120,000 rubles - 23,000 rubles) - according to the line “Intangible, financial and other non-current assets”. This should also include financial investments (provided that they are all long-term) in the amount of 150,000 rubles. The final line indicator is RUB 247,000. (97,000 rub.

In the “Inventories” line, you need to write down an indicator that includes data on materials, work in progress and finished products. It is equal to 163,000 rubles. (RUB 23,000, RUB 50,000, RUB 90,000).

The line “Cash and cash equivalents” includes cash on hand and in the current account. The total amount is 215,000 rubles. (10,000 rub. 205,000 rub.).

And now the balance sheet liability. The authorized capital, as well as retained earnings, are reflected in one line “Capital and reserves”. The line amount is 210,000 rubles. (10,000 rub. 200,000 rub.). The line code is assigned to the indicator that has the largest share in the aggregated indicator. This is retained earnings. Therefore, the line code is 1370.

Next, it remains to reflect accounts payable (short-term) debt. Its amount is 1,015,000 rubles. (RUB 150,000. RUB 606,000. RUB 9,000. RUB 80,000. RUB 170,000).

See below for a sample of filling out a balance sheet.

The financial results report is filled out by the accountant based on the data given in table. 2.

| Account turnover | Amount, rub. |

| Dt 62 Kt 90 subaccount “Revenue” | 427 000,00 |

| Dt 90 subaccount “Cost of sales” Kt 43 | 136 000,00 |

| Dt 90 subaccount “Cost of sales” Kt 44 | 43 000,00 |

| Dt 90 subaccount “Cost of sales” Kt 26 | 22 000,00 |

| Dt 99 Kt 68 (single tax accrued according to the simplified tax system - the organization operates on this taxation system) | 25 800,00 |

In the “Revenue” line, you must record the amount of revenue.

https://www.youtube.com/watch?v=ytdevru

For the line “Expenses for ordinary activities,” the indicator is calculated by summing three indicators: cost, selling expenses and administrative expenses. The total amount is 201,000 rubles. (RUB 136,000, RUB 43,000, RUB 22,000). Since cost of sales is higher than other expenses, the item should be assigned code 2120, which is reserved for cost.

The “simplified” tax is reflected in brackets in the line “Profit taxes (income)” with code 2460.

The financial result (profit) is 200,200 rubles. (RUB 427,000 – RUB 201,000 – RUB 25,800).

See below for a sample of filling out a financial results report.

We fill out the balance sheet asset in a simplified form

You must enter data in the following 5 lines:

- "Tangible non-current assets."

This shows the residual value of assets (balance of accounts 01 and 03 minus balance of account 02) and adds expenses for construction in progress (account 08).

- “Intangible, financial and other non-current assets.”

The residual value of intangible assets is reflected (together with “work in progress” and R&D expenses associated with these assets), deposit balances (account 55), long-term financial investments (account 58), as well as long-term debts reflected in settlement accounts (60, 62 , 68, 69, 70, 71, 73, 75 and 76).

- When filling out the “Inventories” line, you will need information about the balances of materials, goods, finished products (accounts 10, 41, 44, 45), costs in work in progress (account 20), including the balance on account 97 (for expenses with a write-off period of less than 12 months).

- Information about cash and cash equivalents, which must be reflected in line 4, is collected from all “cash” accounts (50, 51, 52, 55, 57) excluding subaccount 55 “Deposit accounts”.

- The line “Financial and other current assets” contains information about short-term financial investments (account 58), the amount of short-term debts reflected in the settlement accounts, as well as all other assets of the company that do not find a place in this section of the report.

NOTE! Financial investments, accounts receivable and inventories in the balance sheet assets must be shown without taking into account reserved amounts (account balances 59, 63, 14), that is, in a net valuation (PBU 4/99).