Zero reporting is standard reporting forms that reflect the absence of activity. For example, when there is a company, but there is no activity. In this case, the organization is already registered and is listed as a taxpayer, depending on the chosen regime. Let's figure out what kind of reporting an individual entrepreneur needs to submit if there is zero reporting and how to report to legal entities?

In this situation, a number of questions arise: what constitutes zero reporting, its composition, how to submit zero reporting to the tax office, what sanctions are provided for delay or failure to submit. I’m also concerned about the process of submitting reports: do I need to fill out all the forms or is one sufficient? For example, does an individual entrepreneur on the OSN need to submit a balance sheet with zero reporting? Can the form be submitted by email or must it be submitted on paper? We figured it out and are ready to answer these and other questions.

Zero reporting on OSNO

For firms and entrepreneurs using the common system, the composition of declaration forms and other documents is as follows:

- VAT return must be submitted quarterly by the 25th day following the end of the tax period.

- Income tax return - the document must be submitted quarterly by the 28th day following the end of the tax period.

- Property tax returns must be submitted quarterly by the 30th day following the end of the tax period.

- A single calculation for insurance premiums is to submit reports quarterly by the 20th day following the end of the tax period. Even zero.

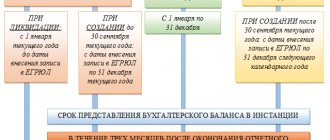

- Accounting statements are required to be submitted once a year by March 31.

In the absence of cash flows and the emergence of taxable objects, you can fill out a single simplified declaration, which will replace income tax and VAT reports. It must be sent to the Federal Tax Service by the 20th after the end of the quarter. Individual entrepreneurs that do not have employees do not submit reports to the funds. Thus, the answer to the question “do I need to submit a zero VAT return?” - positive.

When to take zeros and how to fill them out

Zero balance sheet

For small businesses, it is enough to submit a balance sheet and profit and loss account in an easier form. The report is called “Accounting (financial) reporting for small businesses.” The form and procedure for filling out are approved in Appendix 5 to Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66N.

The report must be submitted by March 31 of the year following the reporting year. You can submit electronic or paper forms in person or by mail. Don't forget to send a copy of your accounting reports to Rosstat. You need to fill out the title page.

In fact, there is no such thing as a zero balance. At a minimum, indicate the authorized capital.

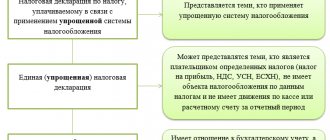

Single simplified tax return

The form and procedure for filling out the report are approved by Order of the Ministry of Finance of the Russian Federation dated July 10, 2007 No. 62N

A single simplified tax return is submitted quarterly by the 20th day of the month following the quarter. You can submit it electronically, in paper form, or by mail with a list of attachments.

The report consists of two pages. Organizations fill out only the first page. It contains standard data (TIN, adjustment number, year, tax, OKTMO, etc.). Of interest, a table is filled out listing the taxes that are replaced by a single simplified declaration, in the order of the articles of the Tax Code. Articles are listed in the columns on the right.

Zero VAT return

The VAT return is submitted electronically by the 25th day of the month following the quarter. It looks like regular VAT, approved by Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 No. ММВ-7-3/ [email protected] If no activity was carried out at all, you only need to fill out the title page and section 1.

Zero income tax return

Available every quarter, until the 28th of the month following the quarter. The annual declaration is due by March 28 of the following year.

You can submit it electronically or in paper form in person or by mail. The form and procedure for filling out were approved by Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3/ [email protected]

Section 1 (KBK and dashes) and section 2 (dashes) are filled out on the title page, as usual.

If there were income and expenses during the year, we fill out the declaration as usual. Profit and calculated tax will be equal to zero.

Zero declaration according to the simplified tax system

Organizations submit reports by March 31 of the year following the reporting year. IP - until April 30.

You can forward the report to the Federal Tax Service either electronically or in paper form in person or by mail.

The title page and section 1 (KBK, OKTMO) are filled out.

Zero declaration on UTII

The UTII does not provide for a zero declaration. This is due to the fact that tax calculation does not depend on whether the organization or entrepreneur actually received income in the reporting period. The tax is calculated based on the physical indicator owned by the organization and the statutory rate of return per unit of the indicator.

The Ministry of Finance considers the absence of a physical indicator as a reason for deregistration of the UTII payer, and not as a reason to pass zero and not pay taxes. Therefore, if you did not work for some time and did not have a physical indicator, but were not deregistered, then you need to submit a declaration. Yes, not zero, but filled out according to the rules - calculate the amount of tax based on the physical indicator, which is indicated in the last non-zero declaration submitted.

Zero RSV in the Federal Tax Service

Insurance premium reports are submitted four times a year, before the 15th of the second month of the quarter - in paper form or before the 20th - in electronic form.

The report is submitted in form RSV-1. The filling procedure was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 16, 2014 No. 2P.

You need to fill out the title page, sections 1 and 2.

If your employees were on leave without pay (or on other types of leave, where the code is ADMINISTER), on maternity leave, or on parental leave, then in addition to RSV-1, individual information with completed length of service and zero amounts is also submitted.

Zero reporting on the simplified tax system

Firms and entrepreneurs using the simplified tax system with employees need to submit a zero tax return under the simplified system once a year:

- until March 31 - for companies;

- until April 30 - for individual entrepreneurs.

Zero reporting to the Pension Fund (SZV-M) - until the 15th day of each month and the Social Insurance Fund (4-FSS) - until the 20th day of the month following the quarter. By the way, you can also fill out a single simplified declaration form. This is stated in the letter of the Ministry of Finance dated 08.08.2011 No. AS-4-3 / [email protected] Therefore, zero reporting of individual entrepreneurs on the simplified tax system in 2020 does not have any peculiarities.

The rules for filling out zero reporting on the simplified tax system (for LLC or individual entrepreneur) depend on the selected taxation object. In the simplified mode, there are only two options: income or income minus expenses. Each option has its own nuances for filling out a tax return.

Features for the simplified tax system “Income”:

- It is mandatory to fill out the title page of the zero declaration, as well as sections 1.1 and 2.1.

- Enter information about the taxpayer according to the general rules.

- Submit a zero declaration to the Federal Tax Service at the location of the economic entity.

Features for the simplified tax system “Income minus expenses”:

- The title page, as well as sections No. 1.2 and 2.2 of the zero form, are required to be filled out.

- If the company has separate divisions, then there is no need to file a separate declaration under the simplified tax system.

- If a company has no income, this does not mean that information about the costs incurred need not be included in the zero declaration. Provide information about expenses incurred in accordance with accounting data and/or supporting documents.

Is it necessary to submit “zero” reporting?

The definition of “zero” reporting itself is not within the legal framework. The apt name was invented and picked up by members of the business and accounting communities. In essence, “zero” reporting is a declaration for the reporting period, which confirms that there is no movement of funds in the entrepreneur’s accounts . And since there are no monetary transactions, there is no financial basis for paying taxes. To confirm this information, a declaration is filled out. This process is called “net reporting.”

But this does not mean at all that you need to put zeros in all columns of the document . The requirements for filling out the declaration remain the same, regardless of whether the enterprise operated with a profit or received continuous losses. Thus, when using the “income minus expenses” scheme, the reporting must indicate the amount of loss received in the reporting period. If the loss occurred last year and was carried forward, indicate it. Filing “zero” reporting in this case is very problematic, because a loss is still a certain figure other than zero.

Please note that you will have to pay tax on any income you had in the reporting period if you use the income minus expenses scheme. The tax rate will be 1% of any income. If you pay tax specifically on income, then you won’t have to pay it, since there is no tax base at all. But we remind you that the lack of income does not exempt you from reporting . In other words, whether your company made a profit or suffered losses, you will have to submit a declaration, even if you submit “zero” reports. Otherwise, the fiscal authorities will fine you.

Zero reporting for UTII

As for sending a report without data to UTII, everything is not so simple. The tax office does not accept blank imputed tax reports. On imputation, tax calculation does not depend on income received and expenses incurred. Even if no activity was carried out and the taxpayer was not deregistered, he is required to pay tax and prepare reports.

Therefore, it is unacceptable to take “zero” marks for UTII. Fill out the tax return according to the general rules:

- On the title page of the zero declaration, indicate information about the taxpayer. Indicate the code of the Federal Tax Service to which you are submitting reports.

- Start filling out from the second section. If the company is engaged in several types of activities at once, fill out the section separately for each type.

- If activities are carried out at different registration addresses, then section No. 2 must be filled out separately for each OKTMO.

- Enter the activity code in line 010, according to Appendix No. 5.

- We enter OKTMO in line 030. You can find out the code on the official website of the Federal Tax Service.

- Lines 040–110 are filled with information about the calculation of UTII.

- Column 3 on lines 070–090 should be filled out if the economic entity has just switched to imputation or withdrawn from this taxation regime.

- Fill out Section 3 with the amounts of tax payable. In this case, take into account the amounts of insurance premiums and benefits reflected in section No. 2. Reduce the tax payable by these amounts.

- Please fill out Section 1 at the very end.

The deadline for sending the report is the 20th day of the month following the end of the quarter. Accounting statements and reporting to funds can be submitted as zero.

How to fill out a zero report according to the simplified tax system

There are no special provisions for filling out a zero declaration under the simplified tax system. But some features are:

- put dashes in all cells with cost indicators;

- do not forget to indicate the tax rate for the simplified tax system: it is 6% (for the object “Income”) and 15% for “Income minus Expenses”;

- provide the OKTMO inspection of the Federal Tax Service of Russia at the location of your LLC (place of residence of the individual entrepreneur).

When filling out a zero declaration according to the simplified tax system using software when printing it on a printer, it is permissible to have no frames for familiar signs and dashes for unfilled cells (clause 2.4 of the General requirements for the procedure for filling out a simplified tax declaration).

Also note that all text data is written in CAPITAL letters and symbols.

Lack of business activity does not exempt merchants on the simplified tax system from transferring fixed insurance premiums for themselves. But in Section 2.1.1 of the zero declaration of individual entrepreneurs on the simplified tax system without employees for 2018, they are not given. The fact is that it is incorrect to reflect contributions that exceed the calculated (and it is zero) tax (clause 6.9 of the Procedure for filling out a declaration under the simplified tax system, approved by order of the Federal Tax Service dated February 26, 2016 No. ММВ-7-3/99).

In general, filling out a zero declaration under the simplified tax system for individual entrepreneurs in 2020 coincides with how LLCs do it.

If at least 1 person worked for an individual entrepreneur in 2020, then the declaration must be filled out according to the same rules as for organizations. If the simplified individual entrepreneur did not hire anyone in 2020, then in line 102 “Taxpayer Identification” of Section 2.1.1, the code “2” is needed, which symbolizes the tax inspectorate about an individual entrepreneur without staff.

Zero accounting statements

The composition of the financial reporting forms is approved by Order of the Ministry of Finance No. 66n. key forms:

- Balance sheet.

- Income statement.

- Cash flow statement.

- Statement of changes in equity.

- Report on the intended use of funds.

- Appendixes to the balance sheet.

An important point: when preparing financial statements, you also cannot leave all balance sheet columns empty. The organization has an authorized capital, possibly funds in an account or in the cash register, and some property. If there are no business transactions during the reporting period, these figures should be reflected in the financial statements.

Zero balance of LLC: sample 2020

→ → Current as of: July 1, 2020

We talked about the composition of LLC financial statements in ours. The obligation of an LLC to submit financial statements does not depend on whether the organization actually carried out its activities or not. This means that even if there are no business transactions, you will still have to submit financial statements.

We will tell you about the zero balance of an LLC in our material and give an example of how to fill it out.

Despite the fact that the balance sheet in the absence of activity is called “zero”, you will still have to fill in individual indicators in it. First of all, we are talking about information identifying the person submitting the reports.

So, you will need to indicate the name of the organization and its location, TIN, type of activity, unit of measurement, reporting date and other details. And in the form of a balance sheet, you can’t do without indicators at all. After all, an LLC cannot be registered without indicating in the Charter information about the size of its authorized capital (,). Therefore, at least one business transaction in the accounting of the organization at the time of drawing up the financial statements will be (): Debit of account 75 “Settlements with founders” - Credit of account 80 “Authorized capital” - approved authorized capital The authorized capital of an LLC can be paid within 4 months from the date of state registration (). Therefore, if the LLC was registered on September 1 or later and the organization did not have any other operations other than approving the amount of the authorized capital, only the following lines will be filled in the balance sheet as of December 31:

- 1230 “Accounts receivable”;

- 1310 “Authorized capital (share capital, authorized capital, contributions of partners).”

The size of the indicator will depend on the size of the approved authorized capital.

Let us remind you that it cannot be less than 10,000 rubles (). If the authorized capital of the LLC is paid by the reporting date, instead of the indicator in line 1230 “Accounts receivable”, other asset accounting lines can be filled in. Eg,

Filling out Form 1 of the balance sheet (sample)

> > > June 03, 2020 Form 1 of the balance sheet is the main and, perhaps, the most important component of financial statements.

It is used to judge the financial position of the organization. All companies fill it out without exception. Therefore, every self-respecting accountant should know how the balance sheet is filled out.

In this article we will tell and show how to do it correctly. Documents and forms will help you: Form 1 balance sheet was officially called until 2011, while reporting forms approved by order of the Ministry of Finance of the Russian Federation dated July 22, 2003 No. 67n were in effect. In the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n, which approved the accounting forms that are currently relevant, the concept of “form 1” is not used.

Now the forms are coded according to OKUD - the All-Russian Classifier of Management Documentation (OK 011-93), approved by Decree of the State Standard of Russia dated December 30, 1993 No. 299. And according to it the balance sheet code is 0710001.

However, most of us continue to call the balance sheet in the old way - out of tradition or for the sake of convenience. After all, any accountant understands what the one who requires form number 1 from him wants to receive.

For information about the forms in which the balance sheet form exists, see the article. Read about the features of filling out a simplified balance sheet form.

ATTENTION! From 06/01/2020, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2020 No. 61n. The key changes to it (and other reporting) are:

- OKVED in the header has been replaced by OKVED 2;

- now reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art.

Features for Entrepreneurs

Individual entrepreneurs are required to pay insurance premiums for themselves. Even if the business activity of a merchant is suspended, fees will still have to be paid.

Amount of insurance premiums paid by individual entrepreneurs for themselves:

| Type of insurance coverage | Total income from the entrepreneur's activities | |

| With annual income up to 300 thousand rubles | With annual income of more than 300 thousand rubles | |

| Pension contributions for individual entrepreneurs in 2020 or payments for compulsory pension insurance | 2020 — 29,354 rubles 2020 — 32,448 rubles | In the amount of mandatory payments and an additional 1% of the amount of income exceeding RUB 300,000. There are restrictions. The maximum amount of additional contribution for 2020 is 205,478 rubles, the maximum total amount of contributions to compulsory pension insurance for 2020 is 234,832 rubles. |

| Individual entrepreneur insurance premiums for yourself 2020, in terms of compulsory health insurance | 2020 — 6,884 rub. 2020 — 8,426 rub. | There are no restrictions on compulsory health insurance coverage. |

| Compulsory social insurance | Not paid | |

Important! Insurance premiums paid by individual entrepreneurs for themselves can be taken into account when taxing the simplified tax system or UTII. Accrued contributions reduce taxes payable to the budget.

Deadline for submitting a zero declaration under the simplified tax system for 2020

Zero statements according to the simplified tax system are submitted within the same time frame as reporting with the following indicators:

- until March 31 - organizations;

- until April 30 - individual entrepreneur.

If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). The deadline for submitting reports under the simplified tax system for 2020 does not fall on a weekend and therefore will not be postponed.

Thus, organizations must submit a zero declaration under the simplified tax system for 2020 by 03/31/2020, and individual entrepreneurs by 04/30/2020.

Zero reporting to the Pension Fund

Pension reporting for 2020 consists of only two forms. These are the monthly SZV-M form and the annual SZV-STAZH report. Information from pension reports discloses information about the insured persons: working citizens, as well as their insurance experience.

According to the rules for filling out reporting forms, pension forms should include information about all employees of the company who are in labor or civil relations with the employer. In other words, the reports include those employees with whom employment or civil law contracts have been concluded.

The latest recommendations from officials have adjusted the procedure for filling out forms. Now it is necessary to include in the report all working citizens, regardless of whether a contract has been concluded with them or not. Thus, Article 16 of the Labor Code of the Russian Federation states that labor relations arise from the moment an employee is allowed to perform duties. That is, with actual permission to work. Therefore, the presence of a well-drafted contract does not matter. Information about such an employee should be included in the report.

The opinion of officials towards employees who do not receive wages has also changed. For example, an employee took a long unpaid leave. Information about it is still included in pension reporting. After all, the employment relationship is not interrupted, and the contract is not terminated during the vacation.

IMPORTANT!

If the company’s activities are temporarily suspended, and there are not a single employee on staff, then submit “zeros” in the SZV-M form. In the report, fill in information about the policyholder, indicate the reporting period, but leave the tabular part empty. Submit SZV-M monthly, no later than the 15th day of the month following the reporting month.

Balance sheet 2020.

Download free form and sample

A balance sheet is a document characterizing the financial position of an enterprise as of a specific date.

Displays the company's assets and liabilities in the short and long term. Rent by all enterprises without exception.

The balance sheet is of interest not only to government agencies, but also to the company’s management, as it gives an honest assessment of the enterprise in monetary terms. The balance is submitted no later than 3 months after the end of the reporting period. The reporting period is taken to be one year.

An exception is situations when the owners or managers of the company decide to conduct interim reporting.

Accounting uses Form 1 of the balance sheet - OKUD code 0710001. It was approved by Order of the Ministry of Finance of Russia N 66n dated July 2, 2010. The latest changes to this order came into force in June 2020.

Note! The company’s balance sheet form is allowed to be supplemented with its own lines, i.e.

e. detail at your discretion. Form 2 is a completely different document - a statement of financial results.

Some filling features that take into account recent changes

- Data is provided for the last reporting year and the two previous ones.

- The balance sheet must contain net valuation indicators, for example, depreciation of fixed assets.

- The filling unit is thousands of rubles; recently it has been impossible to measure the size of values in millions.

- Companies subject to mandatory audit must necessarily indicate information about the audit organization in their balance sheet.

Small businesses (SMB) have the right to submit their balance sheet in a simplified form if:

- and a share in the capital of foreign enterprises or legal entities that are not considered small and medium-sized entities

- their annual income from business is less than 800 million

rubles; - the number of employees for the previous year does not exceed 100 people;

- the total share of participation in the authorized capital of municipalities, the Russian Federation, and religious foundations is equal to or less than 25%;

Can a director not receive a salary?

Since mandatory insurance contributions are calculated from wages, the question arises: is the company registered, has one director, but there is no salary? Many organizations in which the founder is a director do not pay wages in the absence of activity.

If claims arise from regulatory authorities, you can refer to the letter of the Ministry of Finance dated 09/07/2009 No. 03-04-07-02/13, which states that if an employment contract has not been concluded with the director, then the responsibilities for calculating wages there is no charge. According to Art. 273 of the Labor Code of the Russian Federation, the sole founder cannot conclude an employment contract with himself. Subsequent payments, subject to profit, will be considered dividends. In addition, the Russian Pension Fund believes that submitting a blank SZV-M report in this case is also not necessary.

However, already in 2020, the opinion of officials changed - see Letter of the Ministry of Labor of Russia dated March 16, 2018 N 17-4/10/B-1846. Now in SZV-M a director without a salary must be submitted to the Pension Fund. Consequently, if the company had only the founder, who is also the director, who did not receive a salary, then until 2020 zero reporting was submitted. Now information about the sole founder-director must be sent to the Pension Fund. Moreover, it makes no difference whether an employment or civil contract has been concluded with him and whether there are wages accrued.

IMPORTANT!

SZV-M for the founder - director without salary must be submitted to the Pension Fund. Also include information about the founder if an employment or civil law contract has not been concluded with him.

Sample zero balance sheet

- /

- /

June 4, 2020 0 Rating Share A zero balance sheet is an unofficial name for a balance sheet that reflects only data on the authorized capital, since they cannot be omitted even in the absence of activity.

Let's look at how the relevant information is presented in the report.

An organization's balance sheet is a source of data on the volume of its assets and liabilities at a certain point in time. Typically recorded at the end of the quarter or year. ATTENTION! From June 1, 2020, an updated balance sheet form is in effect as amended by Order of the Ministry of Finance dated April 19, 2020 No. 61n.

Read about the main changes to the form. Thus, it is a document certifying that the company has any assets or debts.

Logically, a zero balance sheet should be understood as a source of data reflecting the fact that the company has nothing - neither assets nor liabilities.

But could it turn out that the company has neither property nor liabilities? In practice this is impossible. The fact is that a business company must have, at least in a minimal amount (in the case of an LLC - 10 thousand rubles).

From an accounting point of view, the authorized capital consists of:

- The asset is in the form of a debt obligation of the owners to form the authorized capital, if the capital has not yet been formed at the time of drawing up the balance sheet.

- An asset is in the form of funds that the company has the right to dispose of as a result of converting the authorized capital into these funds, if the authorized capital is formed by the time the balance sheet is drawn up.

- Liability - in the form of an obligation to the owners to use the received authorized capital.

Moreover, since assets are formed at the expense of liabilities, the value of the former must be equal to the value of the latter.

Let's consider how this is recorded in a zero balance sheet.

Zero reporting on the SZV-STAZH form

We will separately outline the requirements for submitting the SZV-STAZH pension form. Does the Pension Fund need zero?

To answer the question, let's look at the structure of the form itself. In general, the report is not intended to send an empty table. For example, when filling out SZV-STAZH electronically, the filling program will not allow you to generate a report without information about the insured persons.

Consequently, the answer to the question “is it necessary to register an annual SZV-STAZH if there is no information” is unambiguous. There is no need to pass zeros. A completely different question is how a company functions without employees or even a founder. Controllers are skeptical about such circumstances.

Officials came to the conclusion that an economic entity cannot function without leadership. Consequently, SZV-STAZH will have to include a founder or director working without salary or contract. The rules are the same as for SZV-M.

We fill out reports in Form No. 1 “Balance Sheet”

Not a day without instructions × Not a day without instructions

- Services:

Form No. 1 is the fundamental form of accounting for organizations.

Let's look at the key features of drawing up and submitting a balance sheet in 2020 and provide a sample for filling it out. January 28, 2020 Author: Natalya Evdokimova All Russian organizations, as well as official representative offices of foreign companies in our country, are required to report on their financial and economic situation for the reporting year. This obligation is regulated by the Law “On Accounting” No. 402-FZ.

The law also provides “indulgences” for certain categories of economic entities that have the right to keep accounting records in a simplified form. However, regardless of the method of accounting, basic or simplified, Form No. 1 is mandatory for all economic entities: organizations, individual entrepreneurs and private individuals.

This year you will have to generate reports for 2020. The current form was approved by order of the Ministry of Finance of Russia No. 66n dated 07/02/2010.

We recommend reading: Registration of a newborn child at the mother’s place of residence automatically

When filling out form No. 1, you should be guided by section 4 of the order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n (ed.

dated 08.11.2010). Let's define the key rules for filling out the reporting document:

- if a company has a branch network, then at the end of the year a single balance sheet should be formed (parent company plus branches);

- include indicators that exist for no more than 12 months as short-term assets and liabilities, and indicators that exist for more than one year as long-term assets;

- Transactions made in foreign currency are recalculated at the exchange rate established on the day of the transaction;

- reflect the indicators in monetary terms in the currency of the Russian Federation - in rubles, in thousands of rubles or in millions of rubles;

- fill out the report indicators in accordance with the actual account balances as of the reporting date, formed taking into account the requirements of PBU and the company’s accounting policies;

- property and fixed assets should be reflected

Liquidation balance (final) in 2020

The liquidation balance sheet is a balance sheet that is compiled in the process in order to determine the actual property state of affairs of the liquidated enterprise. The liquidation balance can also be final. The final liquidation balance sheet is drawn up after repayment of all debts to counterparties, employees and the state (, etc.).

It contains information about those assets of the company that remain and must be distributed among the founders and participants of the LLC. Please note that the amount of assets in the final balance sheet should not be greater than in the interim balance sheet, otherwise the tax office may request clarification and even refuse to liquidate the company.

This is done in order to identify unscrupulous liquidators who temporarily withdraw their assets from the LLC in order not to pay debts to creditors. Preliminary preparation of data and the preparation of the liquidation balance sheet itself, due to its certain specifics, usually falls on the shoulders of accounting workers.

Although, formally, according to the law, this procedure must be carried out by the liquidation commission. For 2020, there is no established form of the final liquidation balance sheet for commercial organizations (except for banks and budgetary institutions). At the same time, in October 2020, the tax office officially explained that the liquidation balance sheet can be prepared in the form of a balance sheet, approved by the founders (participants) of the LLC or the person who made the decision to liquidate it.

Form No. 1 “Balance Sheet”, recommended in such cases, is usually taken as a basis. You can download the developed form for the final liquidation balance sheet for free at. After the final liquidation balance sheet has been compiled, it must be approved by the persons who accepted it.

To do this, they need to issue or put down the appropriate marks directly on the balance sheet.

Together with the final balance sheet, the liquidation commission places at the disposal of the founders (participants) all the property remaining after settlements with creditors. These assets

Zero reporting to Social Security

It is necessary to submit a quarterly report to the Social Insurance Fund in Form 4-FSS. Also, policyholders are required to annually confirm the main type of economic activity in order to receive tariff discounts.

In both cases, reporting may be zero. That is, if the company did not conduct business, did not receive income, did not make contributions to employees, then there is nothing to reflect in the 4-FSS and confirmation. But even if there is no information, you need to submit zeros to the FSS. There are no exceptions.

We fill out the zero form according to the general rules. We indicate information about the policyholder; the remaining tables and sections of the 4-FSS calculation remain empty.

Submission of blank (zero) tax and accounting reports

| Type of legal entity | Simplified (STS 6%) | Simplified (STS 15%) | General system (OSN) |

| Limited Liability Company (LLC) | 2000 rub./quarter Add to cart | 2000 rub./quarter Add to cart | 3000 rub./quarter Add to cart |

| Individual entrepreneur (IP) | 1000 rub./year Add to cart | 1000 rub./year Add to cart | 2000 rub./year Add to cart |

*If it is necessary to submit reports, there is an additional charge for submitting reports via the Internet - 500 rubles per report.

What happens if you do not send zero reporting?

If the taxpayer does not report on time, he will be fined. Zero reporting of an LLC or individual entrepreneur is no exception. Failure to submit reports will entail sanctions from the tax inspectorate in the form of monetary penalties:

- from the organization - 1000 rubles;

- from officials - from 300 to 500 rubles.

In addition, the Federal Tax Service has the right to block the company’s current account if reports are not submitted within 10 days after the due date.

For failure to submit a zero calculation 4-FSS, Social Insurance provides for similar penalties (Article 15.33 of the Administrative Code):

- the organization will be fined in the amount of 1000 rubles;

- for a responsible official, the fine will be from 300 to 500 rubles.

There are no administrative penalties for failure to provide confirmation of the main type of economic activity. However, you should not count on a reduction in the rate of contributions for injuries. If the company resumes its activities, then contributions from accidents and occupational diseases will be calculated at the maximum rate of 8.5%.

Penalty for failure to submit zero reports to the Pension Fund:

- the form for submitting the report is not followed (the report is submitted on paper, not electronically) - 1000 rubles;

- for an unsubmitted report - 500 rubles for each insured person on the form;

- liability for officials from 300 to 500 rubles.

What to choose: simplified taxation system or EUD declaration?

Based on clause 2 of Art. 80 of the Tax Code of the Russian Federation, every simplifier who did not conduct business formally has a choice:

1. Submit a zero declaration of the simplified tax system in 2020.

2. Submit a single simplified declaration (approved by order of the Ministry of Finance dated July 10, 2007 No. 62n):

However, in the second case, you need to do it before January 20 of the year that follows the reporting year.

Therefore, in terms of timing, it is more profitable to submit a zero declaration on the simplified tax system on the “native” form, which was approved by order of the Federal Tax Service of Russia dated February 26, 2020 No. ММВ-7-3/99:

Also see “Declaration under the simplified tax system” (you can download the current form).

Let us remind you of the deadlines for submitting a zero report under the simplified tax system. They are exactly the same as a regular declaration with calculated indicators for 2020. Namely:

- for individual entrepreneurs - no later than April 30, 2020 inclusive (note that officially this is a short day!);

- for LLC – no later than April 1, 2020 inclusive (postponement from March 31).

Also see “Deadline for submitting a declaration under the simplified tax system for 2020 in 2020.”

How to create and send blank reports?

In the general taxation system, in order to report income tax and VAT, you can fill out a single simplified declaration (SUD). Therefore, when asked whether it is necessary to submit a zero VAT return, we answer that it can be submitted in the EUD form. Organizations and individual entrepreneurs on the simplified tax system can use the same form. The report form and the method of filling it out were approved by letter of the Ministry of Finance dated July 10, 2007 No. 62n, taking into account the standards prescribed in letter dated October 17, 2013 No. ED-4-3/18585. Zero reporting to the Social Insurance Fund is submitted on the updated 4-FSS report form. Only the title page and codes are filled in. Accounting reports can be compiled in abbreviated form: balance sheet and income statement.

Starting from 2014, all VAT reporting must be submitted electronically. Since in order to send reports the company must still purchase software and digital signature, there is no point in submitting the remaining reports in paper form. It's easier to send everything by email. For VAT evaders, zero reporting can be submitted to the tax office and Rosstat both in paper and electronic form, at the discretion of the respondent. You can also use the services of authorized representatives to submit zero reports.

You can generate zero reports in any accounting program or online accounting. For software, zeroing is the simplest task. It is conveniently implemented, for example, in the “My Business” service.

What are the consequences for an organization if it fails to provide zero reporting?

Lack of transactions is not a reason not to submit reports to the Federal Tax Service. For forgetfulness, taxpayers are subject to penalties:

- for organization - 200 rubles. for each form submitted late (Clause 1.Article 126 of the Tax Code of the Russian Federation);

- per manager - 300-500 rubles. (Clause 1, Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

To avoid problems with the tax authorities, it is necessary to report on the results of each reporting period as long as the organization formally exists, regardless of its actual activities. If, due to the absence of responsible employees, there is no one to do this, this function should be taken over by the founders of the organization.

The deadlines for submitting zero reporting are similar to the deadlines for submitting regular reports. For 2020, you must report no later than March 31, 2020. In 2020, accounting reports are submitted only to the Federal Tax Service; you no longer need to submit a copy to Rosstat.

Thus, if for some reason the organization formally exists but does not operate, the founders should ensure that reporting continues to be regularly submitted to the Federal Tax Service. Zero reporting provides for the reflection in it of at least the authorized capital and its placement (in the form of money, fixed assets, etc.). The remaining lines of the balance sheet and income statement are filled with zero indicators.

Simplified balance sheet zero report (filling example for a company that has not operated in the last 3 years):

Special services for preparing zero reporting

There are many special services for preparing and submitting zero reports electronically. Almost all accounting programs provide this opportunity. Some of them have special tariffs for such a service, some offer to do this completely free of charge, such as 1C: Nulevka. This service will be especially appreciated by individual entrepreneurs who work without an accountant. After all, not only will they not have to spend even a small amount of money for submitting reports without having any income, but they will also not have to delve into what exactly needs to be submitted and when. If you register in the program, it itself will remind you what zero reporting needs to be submitted and will offer to generate the necessary documents. All that is required from the individual entrepreneur is simply to enter your data, IIN, registration address and OKVED code.

After the reports have been generated, they can be sent to recipients directly via the Internet (this service is paid for by all operators, including 1C), or they can be printed and sent to all recipients by mail or delivered in person. In any case, the use of special services significantly saves time and can help not only an individual entrepreneur, but also an experienced accountant who manages several companies and entrepreneurs, some of whom need to pass the “zero” mark. After all, in this case they also will not have to monitor the deadlines of all reports, and also spend extra effort on filling out forms on their own. The service allows you to do this in literally three clicks.

COST OF PREPARING AND SUBMISSION OF ZERO REPORTING FOR THE 3rd QUARTER OF 2020

The cost of preparing zero reporting for the 3rd quarter. 2020 depends on the taxation system and the service package you choose. The consulting company Consensus has been providing services for the preparation and submission of reports to LLCs registered in Moscow for more than 17 years, and using digital signatures and programs for electronic submission of reports, we resolve the issue of submitting reports throughout Russia.

If you use the simplified taxation system (STS) or the basic taxation system (OSNO) and want to submit a zero report, then the cost of our services will be:

| Name of service | USN cost, rub. | BASIC cost, rub. | |

| 1. | Set of zero report for 3 quarters. 2020 “Turnkey” , includes preparation and submission of reports (connection to electronic reporting is not included in the price) | 3 000 | 3 500 |

| 2. | Set of zero report for 3 quarters. 2020 for self-delivery , includes preparation and reporting | 1 000 | 1 500 |

| Connection to electronic reporting for 12 months. (VAT can only be submitted online!) | 5 000 | ||

| 3. | Preparation of zero reporting for the 2nd, 3rd and 4th quarters of 2020, as well as 1st quarter. 2021 "Turnkey" includes: - preparation and submission of reports; — connection to electronic reporting for 1 year. | 10 000 | 13 000 |

| Preparation of a zero VAT return for the quarter | 500 | ||

The cost of services for preparing zero reporting for the 3rd quarter of 2020 includes:

— oral consultation with an accountant;

— preparation of zero reporting for the 3rd quarter. 2020;

— accountant’s calendar;

— uploading data from the 1C database to your electronic media;

— submission of reports (only for the “Turnkey” package).

| The price is valid for companies connected to the electronic reporting service. If you do not have an electronic digital signature and a license to submit reports, then Pconnection to electronic reporting for 12 months – |

Please note: if you use the main tax system, i.e. with VAT (for OSNO), you can submit VAT reports only electronically

through the Internet!

To speed up the procedure for ordering a zero report, you need to fill out an application on our website:

Why might activities be suspended?

There are many reasons. Eg:

- The company has only recently registered. She has no orders yet, and therefore there is no movement on her accounts.

- The manager or founder has changed, and the company is temporarily unable to operate due to the fact that any organizational issues have not been resolved.

- There are no financial resources, which is especially important for companies involved in the sale or production of something. There are no goods (raw materials, contracts), so there are no sales.

- The company is simply temporarily closed for some reason. Well, he doesn’t want to, for example. In this case, the procedure is not much different from the usual one.

Important: in terms of time and labor intensity, the process of filling out and submitting zero reporting is practically no different from the same processes for regular reporting. All information about the company (or individual entrepreneur) is also filled in and the necessary codes are entered. The only difference is that you do not need to calculate the amounts of taxes and deductions.