Dismissal

Denis Pokshan

Expert in taxes, accounting and personnel records

Current as of July 2, 2018

The Labor Code does not provide for a separate procedure for dismissing the chief accountant at his own request. Work in the case of the chief accountant is assigned to a standard duration.

The procedure for preparing personnel documentation involves following the usual chain of “application - order - processing - calculation - issuance of a work book and other documents.” On the eve of the last working day, the accountant must transfer the affairs and material assets under the act to his successor. Read about the dismissal of the chief accountant at his own request and work under the Labor Code of the Russian Federation.

Features of the dismissal of the chief accountant

The dismissal of a chief accountant is an event that is significantly different from the termination of an employment relationship with an ordinary employee.

After all, an accountant solves all the main financial issues of the organization, and also accompanies the procedures for receiving income and making expenses, and is responsible for paying taxes. No one but him knows all the intricacies of accounting work and business management in the organization, not even the manager. Therefore, upon dismissal, the chief accountant is obliged to provide all the necessary information about his work to the boss or the new employee. Providing this information is called referral.

All chief accounting employees are required to transfer their affairs - the further work of the entire enterprise depends on these matters.

The responsibility of the chief accountant remains with him upon dismissal for all his decisions made during his work.

How to fire a chief accountant at your own request

In this situation, they are guided by the dismissal procedure under Article 80 of the Labor Code of the Russian Federation. The accountant must notify the director and write a written statement two weeks before leaving. This period begins to apply from the next day after the employer receives it. After the specified time, the specialist has the right to dismiss. If the chief accountant is employed under an employment contract, then this agreement can be terminated early. The manager does not have the right to prevent an employee from leaving, for example, under the pretext of submitting a report or preparing an annual plan. Within a two-week period, authority is transferred to the new employee.

Reasons

Since the chief accountant is the same employee as other personnel in the organization, there are no separate grounds for his dismissal.

Therefore, a person can leave this position and his workplace on the same grounds as other employees of the organization:

- in case of liquidation of the company;

- on their own initiative;

- in case of gross violation of the provisions of the employment contract;

- when making an unlawful decision, as a result of which the company suffered material losses;

- in case of inconsistency with the position held;

- in case of expiration of the fixed-term employment contract;

- when the owner of the organization changes, etc.

In addition, the dismissal of a person from the position of chief accountant can be carried out on the grounds specified in the company’s charter and employment contract.

Responsibility after dismissal

The chief accountant bears a certain share of responsibility , like other employees. However, in relation to a profession of this type, the level of job responsibilities to the employer may turn out to be higher. The employee will have to be responsible for:

- Gross violations in accounting, resulting in a reduction in taxes.

- Late payment of taxes.

- Violation of reporting deadlines.

- Abuse of official position.

- Material damage due to the direct fault of the chief accountant.

The statute of limitations can range from 1 year to several years from the date of discovery.

When transferring cases according to the act, a deficiency may be discovered. In this case, the new employee may refuse to sign the document. Information about violations in accounting must be placed in a separate section and management must be notified. Management determines who will correct errors and how they will be paid for it. If the cases were not transferred according to the act, then whoever discovered the violations, responsibility will fall on the resigned chief accountant.

Dismissal of the chief accountant

The chief accountant reports directly to the head of the company.

This is also important to know:

The dismissal procedure under the Labor Code

He is responsible for the creation and maintenance of accounting records, as well as for the timely submission of reports.

It is not advisable for the company’s management to dismiss a person from this position until all the organization’s debts have been cleared. In addition, it makes sense to appoint an independent audit of the state of reporting.

Dismissal of the chief accountant at his own request

When leaving the organization of your own free will, you must write a letter of resignation addressed to the director. The document should be given to your superiors 2 weeks before the expected date of dismissal.

The management of the company, according to the law, does not have the right to keep the accountant at his place of work. However, in reality, everything can turn out differently.

In the case when the boss does not want to let go of the chief accountant, the latter must send a letter of resignation by mail with notification of receipt.

Alternatively, you can register the application at the office.

At the initiative of the employer

The dismissal of a chief accountant at the initiative of the employer due to personal hostility is considered illegal. Grounds for dismissal are required from the Labor Code.

Labor legislation includes an extensive list of grounds on which the chief accountant can be dismissed: from disciplinary violation to inadequacy for the position held.

If the grounds are applied unlawfully, the dismissed person has the right to appeal to the court.

If the court sides with the plaintiff, the person must be reinstated at the enterprise as chief accountant.

By agreement of the parties

When dismissing by agreement of the parties, the initiative can be taken by both the employer and the accountant himself.

In the latter case, the employee must submit a resignation letter, after which the parties can discuss the aspects and nuances of the process.

Once an agreement is reached, it is advisable to record the results on paper in the form of a document. It must indicate:

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Ask a Question

- the subject of the agreement;

- date of dismissal;

- the conditions under which the procedure will be performed;

- possible consequences of violating the agreement.

The document is maintained in free form. Its presence is not necessary, however, it will help to understand if any aspects of the agreement are violated by one of the parties.

Upon change of owner

When there is a change of ownership, dismissal can be made if the accountant does not intend to cooperate with the new employer. In such a situation, he must write a letter of resignation, where the reasons will indicate the change of owner.

In this case, the employer does not have the right to refuse and must carry out the standard dismissal procedure.

Pensioner

Like other employees, an accountant can write a letter of resignation due to reaching retirement age. In this case, he receives the right to be released from service.

In addition, the local regulations of some companies additionally indicate the payments that an employee can receive in connection with leaving for this reason.

This is also important to know:

The employer does not sign the resignation letter: what should the employee do?

But it is worth noting that a citizen can submit an application for retirement due to retirement age only once.

This means that if a pensioner has already quit one job on this basis, then when leaving again, he cannot indicate the same reason.

Upon liquidation of an enterprise

In the event of liquidation of the company, accountants must be notified of the dismissal two months before it is carried out. This will allow workers to find new jobs.

At the same time, on the day of dismissal they must also receive the required compensation in the form of wages and payment for unused vacation days.

In addition to basic payments, all employees are entitled to additional severance pay in the amount of average monthly salaries.

Such payments are made in the first month after dismissal. In the second, they are received by those who have not yet found an official place of work.

You can receive payments in the third month, but to do this you need to contact the employment authorities and you cannot find a suitable job for this period.

What should the work be?

The Labor Code of the Russian Federation does not directly indicate that an employee’s work after filing a resignation letter must necessarily be two weeks. Chapter 13, which deals with the termination of an existing employment contract, states that at least two weeks must pass between the filing of an application to dismiss an employee and the date of termination of the contract, unless a different decision is made by the employer and employee by agreement of the parties.

In 2 weeks, the employer must not only prepare all the documents that will indicate the termination of the employment contract and make payments to the employee, but also, if possible, find the employee who will perform the duties of the resigning employee, and will also be able to take his position in the future.

Thus, a period of two weeks is quite justified. However, in some cases it can be shortened, namely:

- if an employee retires (due to age or health status with assignment of a disability group), the dismissal order must be prepared on the day the corresponding application is received;

- if the employee’s spouse changes his place of work and, accordingly, his place of residence to another region or state , the employment contract is also terminated without work on the day the application is submitted;

- if an employee holding the position of chief accountant has enrolled in full-time study , the employment contract with him is also terminated on the day the resignation is submitted;

- if an employee in the position of chief accountant submits a resignation letter while on a probationary period , then the termination of the employment contract with him will occur within no more than three days from the date of filing the resignation letter at his own request.

If the termination of the employment contract occurs on the day of filing the application, as for the reasons listed above, then settlements with the payment of all funds due will be made according to a slightly different scheme than with traditional dismissal.

Is it possible to fire a chief accountant for loss of trust?

As a rule, the majority of accountants are deprived of their powers due to lack of trust.

However, this cannot be done without compelling reasons. Firstly, the manager is obliged to provide evidence of theft of the company's property or deliberate waste of material resources. For this purpose, you must contact the police. Please note that you can only rely on proven actions of an accountant, and not on indirect suspicions.

The owner of an enterprise does not have the right to fire a specialist when he is on sick leave, on vacation or during pregnancy. In a situation where a failure to fulfill job duties has been discovered, the manager usually requires explanations in writing, and if he receives a refusal, he draws up an appropriate order.

Before dismissing a chief accountant for lack of confidence, the employer must levy a disciplinary fine within 30 days after the misconduct was discovered. In this case, the employee is not only fired, but additional sanctions are applied to him. For example, he is not paid unemployment benefits for the first three months after leaving the company, and may be prohibited from holding a leadership position for a specific period of time.

How to formalize the dismissal of a chief accountant at the initiative of the employer

The employer can also initiate the dismissal of the chief accountant. In Art. 81 provides the reasons why the latter has the right to dismiss an employee. They can be general, i.e. affecting all personnel, for example: liquidation of a company, reduction of staff, being under the influence of alcohol or drugs, theft by an employee, inadequacy of the position held, disclosure of confidential information about the organization.

If the liquidation of the company is an objective reason and nothing can affect the upcoming dismissals, then all the other listed facts must be established and documented. Otherwise, the dismissal can be challenged in court.

A reference in the work book is made to that paragraph of Art. 81 of the Labor Code of the Russian Federation, according to which dismissal occurs.

Reduction of staff and liquidation are grounds for payment of severance pay.

Also, the reasons for dismissal may concern exclusively the managers of the company, including the chief accountant. These include:

- making an unmotivated (unfounded) decision that caused damage to the organization;

- change of ownership of company property.

Let's look at each of these reasons in more detail.

Dismissal for an unreasonable decision

An unjustified decision is perhaps one of the most difficult grounds for dismissal under clause 9 of Art. 81 Labor Code of the Russian Federation. This provision applies only to management positions.

In order to dismiss employees on this basis, it is necessary to prove that the adverse consequences occurred precisely because of the decision made by the manager, and there were alternative options. If it is established that adverse consequences would have arisen under any set of circumstances, then dismissal on the specified grounds is impossible. The organization must prove the unfoundedness of a particular decision of the chief accountant.

Dismissal upon change of ownership

The new owner of the company's property may terminate employment contracts within three months on the basis of clause 4 of Art. 81 of the Labor Code of the Russian Federation with a management team - a director (other manager), his deputies and a chief accountant. If three months expire, then the management team cannot be dismissed on this basis. The change of ownership does not affect the work of other employees.

The chief accountant is notified of the upcoming dismissal by sending him a written notice.

Termination of the employment relationship when there is a change of ownership is accompanied by the payment of severance pay or other compensation. In some cases, the Labor Code regulates its maximum size.

The chief accountant will also have to transfer the affairs to a new person and on the last day receive the calculation and all the necessary documents.

In what cases can you not work out

If there is a good reason

According to Art. 80 of the Labor Code of the Russian Federation, in special cases, the employer is obliged to dismiss an employee from the organization (including the chief accountant) without any work. There must be a good reason for this:

- admission of an employee to an educational institution;

- retirement;

- violation by the employer of labor legislation (for example, delay of wages);

- other cases.

This is also important to know:

Characteristics from the place of work to the court: how to write correctly, document structure, sample

“Other cases” include:

- the need to move to another locality;

- a situation when the wife (husband) of an employee is transferred to work in another city or country;

- loss of the opportunity to work at a given workplace due to health problems (in this case, the employer must be presented with a medical report confirming this fact);

- the need for constant care for a sick relative.

If a person has a legal reason not to work for 14 days, he must write a statement indicating the reason for the urgent dismissal. In this case, the boss must dismiss the employee on the day indicated in the application.

If the employee is on probation

Also, special rules for terminating a contract at will apply to employees on a probationary period.

According to Art. 71 of the Labor Code of the Russian Federation, the period within which it is required to notify the manager of the decision made is reduced for the employee to 3 days.

The countdown of working hours begins on the next day after the director receives a resignation letter from the employee. The employee will receive payments and a work book after three days.

Peculiarities

It should be noted that the dismissal of the chief accountant at his own request, just like, for example, the general director, is regulated by federal law. That is, it is not the labor code that is taken into account here. Only the head of the enterprise can fire an accountant, since he, in turn, is the financially responsible person, and, therefore, the procedure becomes somewhat more complicated.

In order for an accountant to leave his position at his own request, he must be transferred to the accountant. This procedure is mandatory. In this case, you are required to undergo a reporting audit. The transfer procedure must be formalized in a special act, which, in turn, is signed by the head of the enterprise.

It is worth considering that the dismissal of the chief accountant at his own request has some features:

- An employee expresses a desire to leave work. That is, he is not fired due to violations or professional incompetence.

- The chief accountant has the right to resign absolutely at any time he wishes. The main thing here is to notify your manager about your dismissal in time.

- Dismissal is possible even during a probationary period. In this case, it does not matter how long the employee has already worked in the company. A person who quits cannot be refused.

It is the chief accountant who is responsible for the financial transactions that occur in the enterprise. That is, he is the second main person of any company after the immediate manager. That is why the dismissal of an accountant from a company can significantly complicate the company’s affairs, because it will be quite difficult to find a replacement. In addition, before leaving, the person must transfer his powers to the manager or to a new accountant, if one can be found before the first one leaves.

Dismissal of a financially responsible person is also difficult because it affects the work of the enterprise. That is, various kinds of important checks are slowed down. Also, in some cases, it is necessary to conduct a full inventory with an inventory, which requires a significant amount of time and effort.

Dismissal procedure

The dismissal of an accountant is carried out according to the standard scheme with changes made to it in connection with the employee’s position.

The procedure is carried out in several stages:

- Submitting an application or drawing up an agreement.

- Registration of orders. The first will be responsible for transferring cases to a new employee, and the second will be responsible for the dismissal procedure.

- Transfer of cases from the old accountant to the new one.

- Receipt by the old employee of all documents, as well as payments due to him in accordance with the law.

Each stage has its own nuances and requires the necessary documents, so some of them can be examined in a little more detail.

Submitting an application

An application is submitted on behalf of the employee in case of dismissal at his own request.

This document does not have a legal form, but there are still several rules for its preparation:

- the document is drawn up on A4 paper and can be printed or handwritten;

- the paper must be addressed directly to the head of the organization;

- the text with the reasons for dismissal should be as brief as possible and outline the essence of the decision;

- At the end there must be the date of completion and the signature of the employee.

The application is submitted to the manager or the human resources department. The paper must be accepted in any case.

The transfer of cases

In the event of the dismissal of an employee such as a chief accountant, the employer is obliged to carry out not only a standard dismissal scheme, but also issue an order.

It must indicate the transfer of all responsibilities and affairs from the resigning employee to a new person:

- the order in which all documentation will be completed, as well as the acceptance certificate for office work (the work can be performed jointly with a new employee);

- list of persons involved in the transfer of cases.

The document must also contain information about the date on which the transfer period will end. It is usually established based on the dates on which tax and accounting reporting documents are provided.

Since, when applying for a job, the chief accountant signs an agreement on financial liability, upon his dismissal it is necessary to additionally conduct an inventory of both the company’s cash registers and inventory items.

To carry out an inventory, it is necessary to issue another order, according to which a commission must be assembled.

This is also important to know:

Dismissal at will: article of the Labor Code

After recounting all valuables, the inventory results must be entered into a special inventory of the organization’s property.

Order

The dismissal order is drawn up on a standard form known as “T-8”. It is also used when dismissing regular employees.

The order specifies:

- information about the accountant;

- date of dismissal;

- the grounds on which he leaves his workplace.

The order must be signed by the manager and handed over to the accountant for review. If he agrees with its provisions, he must also leave his signature.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

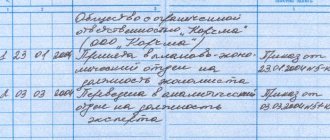

Entry in the work book

An entry in the accountant’s work book is left by an employee who has the right to do so, or by the employer himself. It must contain an article of dismissal with an exact repetition of the grounds specified in the act.

The entry must be certified by the seal of the company, as well as the signature of the person who entered it into the book.

The work book is issued to the accountant on the day of dismissal. If he agrees with the entry and has no complaints about its content, then he needs to put his signature under it.

If there are inaccuracies or errors, the entry must be rewritten to avoid problems with getting a job in the future.

Features and procedure

Although the law does not impose any restrictions on the chief accountant, the procedure for his departure will not be as simple as in the case of a full-time employee. After all, he is in charge of serious documents related to the activities of the organization. Therefore, in this case, the enterprise undergoes a procedure for transferring cases to a new employee. So, how can a chief accountant resign of his own free will? His dismissal consists of the following stages:

- The chief accountant draws up a letter of resignation of his own free will. The statement indicates: to whom and from whom it is being written, the name of the document, a request to dismiss at one’s own request, the reason (if required), date and signature. If they refuse to accept the document, it can be sent by registered mail with a list of attachments (we wrote more about what to do if the management does not accept or sign the application, here).

- The manager issues an order to conduct an inspection and transfer cases to a new employee. The law does not contain clear requirements regarding the act of acceptance and transfer of cases. Its details can be specified in the manager’s order.

The order may include the following items:- Full name and position of persons participating in the procedure. Cases can be accepted by the new chief accountant, the head of the organization, or any other employee.

Reason for the transfer of affairs : dismissal of the chief accountant.

- Start and end date of the procedure. The period should not exceed two weeks as specified in the Labor Code.

- Division of responsibility: it is determined until what period the former employee reports, and from what period responsibility passes to another person.

- Issues that will be checked: balance sheet, account balances, breakdown of receivables and payables, etc.

- List of documents and other valuables that will be kept by the new head of the accounting department: seals and stamps, keys to safes, etc.

- Details of employees who will be present during the transfer. If it is an audit company, this is also stated in the document.

- Deadline for drawing up the transfer and acceptance certificate.

- Full name of the person responsible for executing the order.

- An accounting audit procedure is being carried out. The inventory procedure is carried out if the accountant was assigned not partial, but full financial responsibility. Then inventory is mandatory.

If the enterprise is young, then an inventory is taken for the entire period of its existence. If the organization has existed for many years, it is necessary to determine the period that will be inventoried.This period may be 3 years, since the tax authorities can check the documentation for the last 3 years. If an inspection was carried out during this period, then the new employee should study the report drawn up based on its results. Then documents can be checked only those that were drawn up after this check. The resigning accountant transfers only those documents that were transferred to him for safekeeping or are under his jurisdiction.

- The procedure for transferring cases and drawing up a transfer and acceptance certificate takes place. Based on the procedure for transferring cases, a corresponding act is drawn up, which includes the following points:

- Full name of the giving and receiving party.

- Number of the order on the basis of which the act is drawn up.

- List of persons present at the transfer.

- List of transferred documentation.

- The period for which the documentation was transferred.

- Errors and shortcomings that were identified during the transfer of cases.

Date and place of compilation.

Important! The act is signed by the transferring and receiving parties, as well as by persons who were present at the transfer, and approved by the head of the organization.

Possible list of transferred documentation:

- Constituent and registration documents: registration certificate, certificate of registration with the tax authority, extract from the Unified State Register of Legal Entities.

- Accounting registers and accounting turnover sheets.

- Accounting financial and tax reporting.

- Accounting for tangible assets. Dates and results of the latest inventory.

- Acts of reconciliation with tax authorities.

- Incoming and outgoing documents for material assets.

- Cash documents and reports, bank statements and payment orders. It indicates who carries out financial transactions (for example, a cashier), the conditions for storing cash, and the balance of funds are reflected.

- Cost accounting. Accounts payable and receivable.

- Staffing table, tax cards, payroll. Statements of accrual and payments to employees.

- Expense reports.

- Other documents related to accounting and tax accounting.

During the transfer, the new chief accountant is also familiarized with the job description. The deadlines for compliance with reporting, execution and storage of documents are checked. The period during which the papers are stored at the enterprise, as well as the department where they are located (archives, accounting) is indicated.

It will be simply unrealistic for the new chief accountant to check all the documents. You can check randomly. The criterion may be transactions involving large amounts. Signing the acceptance certificate means acceptance of all papers and valuables for storage and use.

This can only be done by a person who is already an employee of the enterprise. This means that on the date of signing the act, an employment contract must be concluded with the new employee. Because There cannot be two chief accountants; a new employee is accepted as a deputy and only upon dismissal of the previous one is transferred to the vacant post.

To avoid these hassles, the act can be signed by the head of the organization. But then the manager will have to transfer the affairs to the new chief accountant.

- Name of the organization;

- Salary.

This is what the entry in the work book about voluntary dismissal looks like:

From our separate publications you can find out in what situations a resignation letter can be withdrawn, as well as what to do and how to behave if you are forced to resign of your own free will.

Payments

In 2020, an accountant is entitled to standard payments in the form of compensation for unused vacation days, as well as wages.

In addition to them, there may be additional payments specified in local regulations or collective agreements of companies. Their presence may also be specified in the agreement of the parties.

It is possible to receive severance pay, but only in a few cases. These may include dismissal due to the liquidation of the company or due to a reduction in the number of its employees. In such cases, benefits will not go to only those who worked on the basis of a fixed-term contract.

Table: types of compensation payments provided for by law depending on the reason for dismissal

| Reason for dismissal | Compensation payment |

| Change of owner of the organization's property | Compensation in the amount of not less than three average monthly earnings - Art. 181 Labor Code of the Russian Federation |

| Liquidation of an organization | Severance pay in the amount of average monthly earnings and preservation of average monthly earnings for the period of employment, but not more than two months from the date of dismissal - Art. 178 Labor Code of the Russian Federation |

| Reduction in the number or staff of an organization's employees | Severance pay in the amount of average monthly earnings and preservation of average monthly earnings for the period of employment, but not more than two months from the date of dismissal - Art. 178 Labor Code of the Russian Federation |

| Inconsistency of the employee with the position held or the work performed due to a health condition that prevents the continuation of this work (if the dismissal is initiated by the employer) | Severance pay in the amount of two weeks' average earnings - Art. 178 Labor Code of the Russian Federation |

This is also important to know:

Dismissal of an employee of pre-retirement age

So, from the point of view of economic feasibility, a chief accountant who voluntarily resigns is much better than someone who is fired “without guilt.”

Briefly about employee responsibilities after leaving

After making a notice of dismissal in the work book, the accountant still does not say goodbye to his former employer forever. Especially if during the entire period of work at the enterprise there was not a single documentary check.

Based on the results of control measures or an annual inventory, a number of violations may be revealed that were committed through the fault of a former employee or with his participation. Then, within the limitation period for each case, the already dismissed accountant may be held liable:

- material - within a year from the date of discovery, Article 392 of the Labor Code;

- administrative - within two months from the date of commission or from the date of discovery of a continuing event, Chapter 15 of the Code of Administrative Offenses;

- criminal - from 2 years for minor crimes to 15 years for especially serious crimes involving large-scale losses, Article 78 of the Criminal Code of the Russian Federation.

More details about the responsibility of the chief and ordinary accountant after dismissal are discussed in a separate article.

The dismissal of an ordinary accountant does not cause complications and is not much different from the termination of an employment relationship with an ordinary employee. Another thing is the calculation of the chief accountant, in this case you need to take care not only of a good article in the work book, but also of favorable recommendations from the former superiors.

Responsibility after dismissal

The procedure for receiving and transferring cases is quite capacious and does not always fit within the two-week work period. Therefore, the accountant may be held liable even after the day of dismissal.

If such an employee does not submit the acceptance and transfer certificate, then the employer, within a year after the termination of the employment contract, has every right to file a lawsuit against such an accountant.

The management can file a claim even if there is an act, but in this case it will be very difficult to prove the guilt of the former employee, because the fact that he did his job efficiently will be documented.

Article of dismissal

It is important for the employer to know that the labor code contains some amendments regarding working with chief accountants.

- Both fixed-term and open-ended employment contracts can be signed with accountants. There are no restrictions here, everything depends solely on the employer himself.

- The probationary period for this group of employees may not be three months, but as much as six. The fact is that this position requires special responsibility and qualifications. However, this does not mean that the employer must necessarily appoint a trial period that will last as long as six months. It can be only two months, if the employer decides so.

- If the company has a new co-owner, the chief accountant may be fired. At the same time, his work qualities and qualifications are not taken into account. All this is legal and cannot be challenged in court.

Financial liability to the employer

The opportunity to recover material damage from an employee, provided for in Article 238 of the Labor Code of the Russian Federation, provides only for cases of direct calculable financial harm. The favorite topic of some employers about lost profits is completely excluded from the Labor Code of the Russian Federation.

Since Article 241 of the Labor Code of the Russian Federation limits the amount of liability to the average salary, and the chief accountant is not included in the list of positions with which a separate agreement on full financial liability can be concluded, the obligation to compensate for damage can only be prescribed in an employment contract (Article 243 of the Labor Code). But even then, the employee retains the right to refuse to deduct material damage from his salary. In such circumstances, the employer will be forced to prove the need for compensation and the amount of damage in court (Article 248 of the Labor Code).

If there is no one to delegate matters to

If the chief accountant’s own desire has become an unpleasant surprise for the employer, difficulties may arise with the search for a new specialist and the smooth transfer of affairs. The boss will simply sabotage the process by not appointing a successor and not signing the act himself. And although his actions can be indirectly regarded as an attempt to detain a specialist, it will be problematic to prove this in the same court. After all, the Labor Code does not say a word about how exactly this process should be organized; the enterprise is given complete freedom in this matter (Article 8 of the Labor Code of the Russian Federation).

You can partially try to protect yourself with the help of your subordinates, because the position of chief accountant most often implies the presence of several more accountants in the company. Each of them is responsible for their own area of work, and, if these employees are loyal, you can try to sign with each of them your own copy of the act on the integrity of documents for the current and previous periods.

If the enterprise is large enough and has an archival service in its structure, then it is best to hand over the papers to the archivist. In any case, it is better to spend the two-week warning period for the chief accountant to check and put all the files in order, even if there is no one to hand them over to.

Unlike the retiring manager, it will be difficult for the chief accountant to transfer the archive for storage to a third-party organization or take the documents with him for self-storage.

Dismissal at your own request

The chief accountant may terminate the employment relationship with the employer at any time, but with prior notification to the head of the enterprise. No later than 2 weeks before termination of the employment contract, you will need to fill out an application addressed to the employer. The document must be registered with the human resources department or the office of the enterprise.

There may be situations where the general director or other authorized officer avoids registering an application. Then it is recommended to send it by registered mail with acknowledgment of delivery. After the two-week period has been completed, the accountant has the right to stop working.

Based on Art. , 140 of the Labor Code of the Russian Federation, on the last day of work the chief accountant must be given:

- calculation;

- work book;

- certificate of accrued salary.

Labor legislation does not establish a procedure for transferring cases, but according to generally accepted rules, the employer must appoint a specialist ready to replace the chief accountant. To do this, it is recommended to employ the relevant person in advance, including for a probationary period of up to 6 months. If at the time of dismissal of the chief accountant another specialist has not been found, then the director himself can accept the documentation.

Expert commentary

Kamensky Yuri

Lawyer

The law does not oblige the chief accountant to transfer cases without fail. But in case of violations in work - when statistical, tax reporting, etc. are not submitted on time, the official may be subject to a fine under Art. 15.5 Code of Administrative Offenses of the Russian Federation. The amount of recovery is up to 20 thousand rubles. The company also has the right to recover material damages from an unscrupulous specialist in court. The limitation period for such cases, according to Art. 4.5 of the Code of Administrative Offenses of the Russian Federation, is 1 year from the date of discovery of the offense.

Before issuing a dismissal order, it is taken into account that the chief accountant is responsible for the content of the affairs. The transfer of documentation must be carried out on the basis of an act signed by the parties: the general director and the chief accountant. If the corresponding document is not drawn up, then the chief accountant, if there are disagreements with the employer, will find it difficult to prove that the cases were transferred in full order. A specialist may be accused of loss or even theft of valuable information, including that constituting a trade secret.

If the cases are transferred properly and documented in an acceptance certificate, then the head of the enterprise issues an order to dismiss the chief accountant. The document provides the following information:

- name of the enterprise – its name, organizational and legal form, legal address;

- information about the head of the company - full name, position. If an authorized specialist is acting, then the data on the notarized power of attorney must be indicated;

- date of hire of the employee, information about the employment contract;

- date and reasons for the employee’s dismissal.

The order must be signed by an official and certified by a seal (if any). The employer gets acquainted with the document against signature and receives a copy of it. The chief accountant must be provided with the calculation and other due payments in full. The work book is also issued to the employee on the last day of work.

How to transfer cases?

The main problem when parting with an accountant, both voluntarily and on the initiative of the organization’s administration, is the issue of transfer of affairs. After all, the stability of the company’s work depends on the completeness, timeliness, and quality of fulfillment of this seemingly formal requirement.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

It is important to remember that all accounting responsibilities are assigned to Art. 7 of Law No. 402-FZ for the manager. He has the right to keep records himself or delegate this function to an accountant.

Therefore, all issues of transfer of cases must be carried out according to the procedure defined in the organization itself. The legislation does not contain any special requirements for this issue.

The chief accountant has the right to transfer affairs to the following persons:

- And. O. chief accountant, appointed from among the company's employees;

- a new chief accountant appointed to this position;

- if the first two persons are not available, only the director of the company can accept the documents.

As a rule, an act on the acceptance of cases is drawn up and signed by both parties. The document must be prepared carefully and must reflect all the nuances (including shortcomings) of the transferred cases. If possible, it is best to dismiss the chief accountant at the end of the reporting period - this is the best insurance against troubles.

The question often arises: can an accountant intentionally or through negligence fail to transfer cases in full or transfer them in an inappropriate form? To avoid this situation, a detailed report is drawn up. Nevertheless, the accountant’s responsibility for the work performed will remain after leaving the organization.

It can be administrative, according to Art. 15.11 Code of Administrative Offenses of the Russian Federation. For example, for distortion of financial statements, lack of primary documents, recording of imaginary facts of economic activity, etc. And in some cases, if there are significant consequences, criminal charges.

Features of application of Art. 81 of the Labor Code of the Russian Federation to the chief accountant

It is worth remembering that any violations of discipline must be recorded. If we are talking about being late, absenteeism, absence, or failure to fulfill instructions, then appropriate acts must be drawn up recording these violations.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The fact of theft is not established at all by the administration of the organization, but by the relevant bodies and officials, whose decisions should form the basis for dismissal.

When applying grounds such as loss of trust or the commission of unreasonable actions that resulted in damage, the organization's administration also needs to have documentary evidence. Otherwise, the dismissal can be successfully appealed in court with subsequent reinstatement at work.

As for lack of qualifications and inadequacy for the position, the use of this basis is often difficult. The head of the organization and other responsible employees often do not have knowledge of accounting, and hiring employees subordinate to the chief accountant to carry out certification is completely incorrect. Therefore, the only way out of this situation is to involve third-party specialists.

It should be remembered that certification must be carried out in accordance with the documents available at the enterprise regulating its procedure, duration, frequency, etc. Violation of this requirement is a failure to comply with the rules of Part 2 of Art. 81 Labor Code of the Russian Federation. And the administration’s decision to dismiss, made without taking this requirement into account, will be illegal.

Disclosure of secrets is the most difficult and rarely used in practice basis for parting with the chief accountant. Clause 11 Art. 13 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ indicates that the organization’s reporting and all information defining it should not be classified as a trade secret. Therefore, it is impossible to fire an accountant for disclosing such information.

How to prepare an order - sample

When dismissing any employee, and the chief accountant is no exception, the administration of the organization must be guided by the algorithm specified in Art. 84.1 Labor Code of the Russian Federation.

Part 1 of this article determines that the termination of an employment agreement with an employee is formalized by order. For the order, there is a special form of form No. T-8, which is approved by the Decree of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for recording labor and its payment” dated January 5, 2004 No. 1.

The form already has all the necessary details, so when dismissing you only need to indicate the employee’s details and the reason for dismissal.

The employee must be notified of the existence of such an order and, if necessary, has the right to receive a copy, as indicated by Part 2 of Art. 84.1 Labor Code of the Russian Federation. There is no need to create a special statement for the employee’s signature, since the corresponding column is already on the form, and the employee’s signature will remain on his original.

On the day of termination of the agreement (also the last day of work), the dismissed accountant must be issued a work book, and the final payment must also be made to him. After which the employment relationship with the chief accountant is considered terminated.