Changes that have taken place

In the spring of 2020, a draft Order of the Federal Tax Service was published on the official legal information portal regulation.gov.ru

1. Rules for reconciliation:

- on taxes;

- on contributions;

- on fines, penalties and interest.

2. The procedure for receiving a reconciliation report with the Federal Tax Service in electronic form.

3. Forms, as well as the format of such documents:

- act of reconciliation of calculations;

- applications for provision of a reconciliation report with the tax office.

In the summer of 2020, the Federal Tax Service of Russia, by its Order dated June 3, 2020 N ММВ-7-19/ [email protected] , made changes to the Order of the Federal Tax Service of the Russian Federation dated 06/13/2013 N ММВ-7-6/ [email protected] , which approved the “Methodological recommendations for organizing electronic document management..." and a request form as part of information services for taxpayers.

It is with this request that the taxpayer can contact the Federal Tax Service Inspectorate to receive one or more requested documents, one of which is a reconciliation report with the Federal Tax Service Inspectorate.

Reconciliation – a necessity or a taxpayer’s right?

Let us recall that the main document regulating the reconciliation procedure 1. Joint reconciliation of the taxpayer and the tax authority is regulated by Section 3 of the Regulations.

Please note that reconciliation with the tax authority is the right of the taxpayer. However, according to the above Regulations, the tax authority carries out a mandatory reconciliation with the taxpayer in the following cases:

– with the largest taxpayers – quarterly;

– at the initiative of the taxpayer.

Sometimes the reconciliation of calculations can also be initiated by the tax authority 2. As a rule, the tax inspectorate offers to reconcile calculations in cases of overpayment of taxes (penalties, fines) to the budget 3.

What does the 2020 application form look like?

The new application form for the 2020 tax reconciliation report is very similar to the appearance of the tax return. The document consists of only one sheet. Filling out the application will not cause any particular difficulties. Most importantly, indicate for which specific BCCs you need a reconciliation report. This could be KBK:

- for all payments;

- one type at a time.

The maximum period for which reconciliation can be carried out is the previous three years. The current year is not taken into account.

If the taxpayer indicated the TIN at the top of the application, then the following details are not necessary:

- document type code;

- series, as well as the number of the applicant’s passport;

- the day you receive your passport.

After the official approval of the new reconciliation form, a document drawn up by the taxpayer in free form will be accepted only when submitted in person or by mail. If you want to send a request via the Internet, then you must send exactly the form approved by the above-mentioned Order of the Federal Tax Service.

Reconciliation with the tax office: pitfalls and ambushes

According to clause 5.1 clause 1 art. 21 of the Tax Code of the Russian Federation, the taxpayer has the right “to carry out joint reconciliation of calculations for taxes, fees, penalties and fines with the tax authorities, as well as to receive an act of joint reconciliation of calculations for taxes, fees, penalties and fines.” This right of the taxpayer corresponds to the established clause. 11 clause 1 art. 32 of the Tax Code of the Russian Federation, the duty of the tax authorities “to carry out, at the request of the taxpayer <...> a joint reconciliation of calculations for taxes, fees, penalties, fines, interest. The results of the joint reconciliation of calculations for taxes, fees, penalties, fines, and interest are documented in a document. The act of joint reconciliation of calculations for taxes, fees, penalties, fines, interest is handed over (sent by registered mail) or transferred to the taxpayer <...> within the next day after the day of drawing up such an act.” In addition, the legislator (in the next paragraph) instructed the Federal Tax Service of Russia to develop and approve the Procedure for conducting reconciliation and the form of the Reconciliation Report.

Since the regulations for this procedure have not yet been officially put into effect, there is an opportunity to dream up in the style of the newspaper column “If I were the director.”

According to the literal meaning of the cited legal norms, the tax authority is obliged to organize a comparison of its accounting data with the taxpayer’s data on his tax obligations and issue the taxpayer a completed Certificate of Joint Reconciliation of Calculations.

Data reconciliation in any area is organized according to the principle “from simple to complex”: first, the final “balance” is compared; if it does not converge, the parties jointly check the source data and determine the source of the error.

Based on the mutual rights and obligations enshrined in the Tax Code of the Russian Federation (including “forcing” the parties to constructive cooperation), approximately the following algorithm should be included in the Procedure for reconciliation of calculations.

- First stage (preparatory): before starting the reconciliation, the “object” must be agreed upon - not only the specific tax itself, but also all the parameters of the tax liability under study in relation to clause 1 of Art. 17 of the Tax Code of the Russian Federation (main thing: tax period being reconciled). Otherwise, the parties will provide each other with incompatible data.

- Second stage: The tax authority issues the taxpayer a draft Reconciliation Report with his/her accounting data. The taxpayer compares them with his own, and if they are completely identical, he signs the Act. And the reconciliation is complete. If there are discrepancies, the reconciliation process continues.

- Third stage: The taxpayer presents to the tax authority primary documents and calculations that refute (in his subjective opinion) the tax authority’s accounting data. Each party verifies the accuracy of its accounting; Errors in accounting registers are identified and corrected - after which the parties draw up a Reconciliation Report (which also contains complete “consensus”). If after this the parties could not come to a “single denominator”, then -

- Fourth stage: a Reconciliation Report is drawn up, in which each party enters its own version of the balanced balances for the tax period. Based on the specifics of tax legal relations (a sub-branch of administrative law), it is the tax authority that is authorized to find a way out of such a “clinch”:

1) or the tax authority, as a result of an on-site tax audit (the legality of initiating other tax control measures is questionable; at the same time, the issues being inspected can be significantly narrowed) establishes facts of violations of the legislation on taxes and fees (including incorrect accounting) and, ultimately, the result of a tax audit (after the relevant decision has entered into force) obliges the taxpayer to bring his accounting data to the appropriate indicators (the taxpayer, during this procedure, has the right to appeal the actions of the tax authority in the prescribed manner);

2) or the tax authority, as a result of an internal official investigation, establishes facts of accounting violations (as well as the guilty employee) and corrects the errors.

Unfortunately, the real situation in the area under comment is by no means rosy.

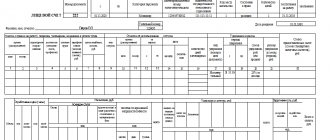

The legislator's order (paragraph 2, clause 11, clause 1, article 32 of the Tax Code of the Russian Federation) has currently only been partially fulfilled: Order of the Federal Tax Service of Russia dated December 16, 2016 N ММВ-7-17/ [email protected] approved the form of the Calculation Reconciliation Report .

This is what Section 2 looks like (more or less “adequate” part)

The procedure for conducting joint reconciliation of calculations exists so far only as a draft posted in the public domain for discussion. Not approved and, accordingly, “unofficial”. At the same time, territorial tax authorities, although behind the scenes, are strictly guided by it when reconciling settlements with taxpayers.

It is unfair not to mention one minor (at least for entrepreneurs and organizations) exception.

The procedure for reconciliation in relation to property taxes of individuals was approved by Order of the Federal Tax Service of Russia dated November 18, 2016 N ММВ-7-12/ [email protected] Note that reconciliation of settlements with individuals for property taxes is a very simple (from a technology point of view) procedure, since as a tax authority, firstly, has complete objective information about the objects of taxation (which comes from state information resources in real time), and secondly, it independently keeps records of both tax accruals (notifying taxpayers’ obligations) and those received in their repayment of payments.

Without going into details, we can note three global shortcomings of the Project, which make joint reconciliation of calculations almost impossible (those especially interested can personally familiarize themselves with the Project and thoroughly examine it).

The most important thing: the cardinal objective difference in the accounting policies of the parties was completely ignored.

As noted above, in order to conduct a joint reconciliation of tax calculations, the parties must have comparable data at the time of reconciliation.

The taxpayer, in pursuance of clause 1 of Art. 45 of the Tax Code of the Russian Federation independently keeps records of its tax obligations (tax accruals) and their execution (payments to the budget). Therefore, at any point in time (even an individual entrepreneur who literally keeps his tax records “on his knees”) has complete information about the state of his tax obligations (accruals and their execution). Accordingly, its data is always up to date. This also applies, by the way, to the current (unfinished) tax period.

In the accounting of the tax authority, the picture is exactly the opposite. Taxpayer payments received into the budget (in fulfillment of tax obligations) are reflected in the interactive information resources of tax authorities in an automated mode. In time, this is literally on the second or third day after the taxpayer’s banking transaction. Accordingly, in the “internal” accounting of the tax authority (hereinafter referred to as the “Settlements with the Budget” card, KRSB), these amounts constantly form a positive balance in favor of the taxpayer. But the tax liability (accrued tax) will be reflected in the KRSB and, accordingly, will “reset” the balance only at the end of the “declaration campaign” - that is, six months after the end of the tax period. Therefore, for a very long time, the KRSB reflects obviously unreliable (for objective reasons) information. To make the situation worse, the tax authorities completely groundlessly classify such a positive balance as an “overpayment.”

The Federal Tax Service of Russia and the Ministry of Finance of Russia are aware of this problem, but the state of affairs is perceived as quite normal. For example, the Ministry of Finance of Russia in letter dated 08/02/2019 No. 03-02-08/58397 states:

The procedure for reflecting tax receipts and insurance contributions to the budget system of the Russian Federation in the information resources of tax authorities and in the taxpayer’s personal account is regulated by the Federal Tax Service of Russia. At the same time, if the tax authority does not have tax returns (calculations for insurance premiums) and accruals of the amount of taxes (insurance contributions), the amount of taxes (insurance contributions) paid by the taxpayer (payer of insurance premiums) is reflected in information resources and the taxpayer’s personal account as an overpayment.

Thus, the tax authority will be able to provide objective data on the status of settlements with the taxpayer, firstly, only after the completion of a desk tax audit of the declaration received from this taxpayer. Secondly, only in relation to expired (and already verified) tax periods. However, the Project being commented on completely ignores this specificity.

The project does not provide for reconciliation by tax periods at all.

The Draft directly requires the tax authority to provide data for reconciliation by calendar years (“the tax period” is never mentioned in the text), and even provides for the possibility of reconciling calculations as of the current date.

The project as such does not provide for “reconciliation” at all (in the understanding of qualified specialists).

According to the Project, the reconciliation of calculations is considered completed immediately after the tax authority, within 5 days, “responds” to the taxpayer’s application (for reconciliation) and issues to the taxpayer (sends by mail or via electronic communication channels) an automatically generated one based on the KRSB data (note - obviously unreliable) Reconciliation report. That is, the elementary logic of the normal procedure for mutual reconciliation of the parties’ accounts was completely ignored.

It should be noted that some positive “signals” still “emanate” from the central office of the Federal Tax Service of Russia: the problem is clearly known.

Firstly, the criticized Project has not been approved to date (although more than 2 years have passed).

Secondly, the Federal Tax Service of Russia, in response to a request for information on the procedure for mutual reconciliation of calculations (Letter of the Federal Tax Service of Russia dated December 25, 2018 No. GD-03-19/10036) indicated the following:

Accrued tax payments (including advance payments) tied to specific dates, as well as tax payments made by the taxpayer tied to a specific tax/reporting period, are reflected in the reconciliation report.

Let us note that in one paragraph the optimal mechanism for reconciling calculations (comparing data registered in the accounting registers of the parties) is briefly and succinctly outlined.

However, it is far from a fact that such a progressive “opinion” of the Federal Tax Service of Russia will encourage employees of territorial tax authorities to “violate” the generally accepted Procedure. Moreover, such a data comparison algorithm cannot be “squeezed” into the officially approved form of the Reconciliation Report.

Conclusions.

The legitimate “interest” of the taxpayer is to carry out a real reconciliation of settlements with the tax authority in the context of a specific tax period with a comparison of data on all charges and payments. Reconciliation using this method allows you to identify not only the inconsistencies themselves, but their source. Which, for example, is often the unlawful actions of tax authorities to “offset overpayments” against “overdue” (and impossible to collect within the framework of the procedures established by the Tax Code of the Russian Federation) tax debts.

Unfortunately, the current (in fact) procedure for mutual reconciliation of calculations “systematically” violates the right of taxpayers enshrined in the Tax Code of the Russian Federation to implement this procedure.

Recommendations for taxpayers.

While the methodologists and legal experts of the Federal Tax Service of Russia “think,” I advise you to do something like this (when reconciling calculations).

In the application, indicate the specific tax period for which the calculations will be reconciled. It should be borne in mind here that the Application form is purely “recommended”. That is, the taxpayer has the right to submit an application in a “free” form, or enter additional information into the form provided for completion.

Upon receipt of a Certificate with clearly incorrect data, offer in writing to carry out a detailed reconciliation of calculations, attaching your calculation (with a list of charges and their payment) and payment documents to the objections. Referring to the above letter from the Federal Tax Service of Russia (attached to the article).

Continuation of the topic started in the articles: “Overpayment - a fundamental misconception of tax authorities, or a cunning trick?!” Legal nature of arrears: position of the Russian Ministry of Finance

What could be the reason for reconciliation?

In accordance with the new rules, the reason for reconciling settlements with the tax office may be an application from the taxpayer.

In this case, the document can be sent to the Federal Tax Service in various ways:

- in person when visiting the inspection;

- by Russian post;

- in electronic form (the presence of an enhanced electronic signature in this case is required).

We remind you that after the above changes come into force, a number of orders of the Federal Tax Service will lose their relevance, namely:

- Order No. ММВ-7-17/685 dated December 16, 2020 (valid from January 24, 2017);

- Order No. ММВ-7-8/781 dated December 29, 2010.

The approved reconciliation act looks like this:

In what cases is this procedure required?

In 2020, there is a list of situations when reconciliation of contributions and taxes is mandatory. In particular:

1. If the organization is subject to:

- liquidation;

- reorganization.

2. If a commercial organization is the largest taxpayer (every quarter).

3. In other cases established by the legislation on taxes and fees.

In addition, an organization or individual entrepreneur can undergo a reconciliation of taxes and contributions on his own initiative.

Mandatory reconciliation of calculations when moving from one tax office to another for taxpayers was canceled on the basis of Order of the Federal Tax Service of Russia dated February 13, 2020 No. ММВ-7-17/ [email protected]

In addition, an organization or individual entrepreneur can undergo a reconciliation of taxes and contributions on his own initiative.

Request for a reconciliation report

Having received your application, the Federal Tax Service Inspectorate, within up to five working days, is obliged to generate a reconciliation report with its data and invite a representative of the applicant organization to submit the report. She also has the right to send the act by mail.

After receiving the reconciliation report, if discrepancies between your data and tax data are identified, you must do the following:

1. In column 4 section. 1 act next to the data specified by the Federal Tax Service that you want to challenge, indicate your data. 2. Sign the act on the last page of section. 1, making the note “Agreed with disagreements.” 3. Submit the document to the Federal Tax Service. 4. Attach to the document certified copies of payment orders, data from which is not included in the reconciliation report received from the Federal Tax Service.

Having received an act with disagreements, the tax service must check its data using internal information resources. If a mistake was made by the tax authorities, then they must eliminate it (in accordance with clauses 3.1.5, 3.1.6 of the Federal Tax Service Regulations) within 5 days after receiving from you a reconciliation report agreed with the disagreements. If the reason for the discrepancies is your mistakes, made, for example, when filling out a declaration or payment order, then the Federal Tax Service will notify you of the exact error that led to the discrepancy in data (the inspector will call or send you a notification) (clause 3.4.6 of the Federal Tax Service Regulations) . You can eliminate the mistakes you made by submitting an updated declaration, clarifying tax payments, paying additional tax, etc.

After analyzing the discrepancies and eliminating them, the Federal Tax Service Inspectorate will prepare and send you a new reconciliation report and agree on the date for its signing (clauses 3.1.6, 3.1.7 of the Federal Tax Service Regulations).

Download the request for the reconciliation report

The article was edited in accordance with current legislation 12/06/2019

When the inspection refuses to carry out a reconciliation

The inspection may refuse to conduct a reconciliation if:

- you applied to the Federal Tax Service at a different place of registration;

- if the application for reconciliation does not contain the name of the organization (full name of the entrepreneur), its INN/KPP, or the signature of the manager (IP);

- if the application is submitted through a representative not authorized to do so by order or power of attorney.

Power of attorney to represent the interests of the company in relations with the Federal Tax Service

Read more…

If at least one of these grounds applies, the tax authorities will send you a letter of refusal to carry out a reconciliation within 5 days from the date of receipt of the application for reconciliation. And they will justify its reason.

This might also be useful:

- Payment order for VAT 2020

- Power of attorney for another person to receive salary

- New invoice details from 2020

- Payer status in the payment slip for insurance premiums in 2017

- Payment order for insurance premiums in 2020

- Declaration 3-NDFL 2020 for 2020

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!