Drawing up a Statement of Reconciliation of Mutual Settlements is usually necessary in the case when two legal entities need to certify transfers made between each other. Most often, such reconciliations are made for specific contracts or invoices; reconciliations are also possible for contracts for a certain time period. It is worth noting that despite the fact that this document is not binding and is created only by mutual agreement of the parties, it is widespread in all areas of activity and is used by most organizations.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

How is reconciliation carried out?

This procedure can be carried out only for one of the following items: name or number of the product, contract, specific delivery, certain period of time. For this document to be reliable, it should be drawn up either after the last transfer or from the moment of delivery. In addition, it is convenient to carry out reconciliation during the annual inventory of the company’s funds and property. Quite often, the results of such checks reveal debts: receivables or payables. If such facts are confirmed, you need to immediately make a reconciliation report and send it to the partner organization.

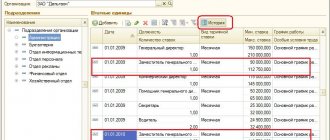

Act of reconciliation of mutual settlements in 1C Accounting

In our age of information technology, it is much easier to draw up a mutual settlement act using the 1C: Accounting program. To do this, you need to follow a certain procedure.

- To begin, go to one of the “Purchase” or “Sale” sections (depending on the purpose of the reconciliation).

- Select the “Settlements with counterparties” item, and then the “Reconciliation report” sub-item.

- In the journal that opens, click “Create”. After that, on the “Reconciliation report with counterparties” tab, you can choose two ways to fill out this document: manual and automatic, choose a method that is convenient for you.

- After this, you need to carry out a certain procedure. The items are selected in order: “According to the organization’s data”, “Fill out”, “Fill out according to accounting data”.

If everything is done correctly, a list of all operations that have been performed will appear on the screen. If necessary, they can be divided into contracts; to do this, you need to tick the appropriate checkbox. At the end, select the “Advanced” item, where the responsible persons are indicated. All that remains is to sign and send to the counterparty.

Rules for drawing up the act

There is no unified, standard form for drawing up an act, so it can be written in free form or according to a template developed at the enterprise. A regular A4 sheet is suitable for filling.

The act must be printed in two copies - one for each of the interested parties.

Both signed and completed copies are sent to the counterparty, whose specialists compare the information from the sent report with the data they have. If there are no objections to the financial transfers specified in the act, all the information matches, then the counterparty signs the documents and returns one copy and keeps the second one.

If necessary, the act can be certified with a seal, but since 2020, the presence of a seal for legal entities is not a legal requirement (however, without a seal, in the event of legal proceedings, the document may be considered invalid).

To ensure that the process of signing the reconciliation report does not drag on, when sending the document you should indicate the time frame within which it must be returned.

What is a reconciliation report in accounting and why is it needed?

Any commercial enterprise keeps records of its payments to suppliers and receipt of payments from counterparties.

In the course of business activities, various inaccuracies or even errors are possible, which can be eliminated during periodic reconciliation of accounting documentation. The results of the checks are documented in a special act of reconciliation of calculations.

What is a reconciliation report?

Reconciliation of mutual settlements is reflected in a special document called a reconciliation report, which records:

— transfer to counterparties of products in the form of goods or services provided, as well as amounts of money over a certain period;

- the amount of debt generated during this period for payments for supplies or the absence of debt.

The reconciliation report does not confirm the very fact of receipt of payment for services rendered or goods supplied. Reconciliation is not mandatory and is purely voluntary.

This is a technical document that allows you to avoid the accumulation of errors and inaccuracies regarding mutual settlements with regular partners and counterparties.

When is it necessary to use a reconciliation report?

It is recommended to draw up statements of reconciliation of calculations when:

— long-term cooperation with a company or organization, consisting of regular deliveries of goods or provision of services;

— several existing contracts with one partner or the presence of additional agreements to existing contracts;

— receipt by the debtor of deferred payments;

— receiving large advance amounts for regular deliveries;

— operations with expensive goods;

— supplies of a wide range of products.

In all these cases, the possibility of errors is quite high, so from time to time it is necessary to reconcile documents to clarify the real state of affairs. In addition, reconciliations are carried out during an inventory of settlements, which can be either planned, once a year, or situational.

Reconciliation is not mandatory, except in cases specified in the contract. The company is not obliged to distribute the results of the reconciliation to its counterparties, nor can it require them to carry out a reconciliation.

Therefore, it is advisable to fix the need and frequency of reconciliations, as well as sanctions for evading them, when concluding an agreement with the counterparty.

How is a reconciliation report drawn up?

The execution of the reconciliation report is undertaken by any party to the concluded agreement. The right to sign the reconciliation act, according to the law, can be granted to:

- registered individual entrepreneur;

— manager (director, general director, president, etc.);

- the employee in whose name the power of attorney is issued.

The second signature on the act usually belongs to the chief accountant of the enterprise. If the reconciliation is done only for internal use, one signature of the chief accountant is sufficient, but in this case the act cannot be used to resolve disputes between counterparties. In addition to signatures, the act is sealed with the official seal of the enterprise.

The reconciliation report contains data on the actual state of mutual settlements, which are obtained from the accounting documents of the enterprise as of the date specified in the document. The act is drawn up in two copies, one of which can be sent to the counterparty.

If sent, the second party checks its accounting documentation with the received act and, in turn, sends the act back, putting its seal and signatures of the manager and chief accountant on it. If discrepancies are found in the data, they are included in the same act or are documented as a separate application.

The counterparty is not required to sign the reconciliation report if this obligation is not specified in the contract. However, in the event of mutual claims, the absence of a signature on the act may be interpreted as a refusal to acknowledge the debt.

The role of the reconciliation act in a legal dispute

If a lawsuit arises regarding arrears in payment for supplies, the reconciliation document can be used as an argument for one of the parties. At the same time, the existing practice of judicial disputes shows that the court can make different decisions when it is provided with a reconciliation report.

It can be recognized as a document confirming the state of current settlements, but not confirming the recognition of debt by the debtor. The court may recognize in the reconciliation act indirect evidence of the debt if the act was signed by the debtor, or evidence of a refusal to recognize the existence of the debt if the act was not signed by the debtor.

Despite the differences in court decisions, it is still better to stock up on a reconciliation report, especially in cases where business relationships are complex and multifaceted. In addition, reminding the debtor about his debt is never superfluous in commercial relationships.

Purpose of drawing up the act

If the information in the document drawn up by the initiator of the reconciliation does not coincide with that available from its counterparty, then the existing discrepancies should be recorded at the end of the document. The same applies to debts: if such facts are revealed, it is necessary to indicate the period during which they should be repaid. Otherwise, the court, if a claim arises, will not be able to take into account the argument regarding the violation of the terms of money transfers.

According to the law, an act of reconciliation of mutual settlements may be grounds for interrupting the three-year limitation period. That is, in cases where the debtor signs a reconciliation report within three years, he is considered to have recognized his debt obligations and is obliged to repay them within the established time frame.

It happens that during the period that has elapsed since the signing of the contract and the fulfillment of obligations, the counterparty has been declared bankrupt. In such situations, accounts payable after a certain time can be written off as expenses of the organization.

What is it for?

The act of reconciliation of mutual settlements is an accounting document that reflects:

- movement of products (works, services) and funds between two counterparties for a certain period;

- the presence or absence of debt of one party to the other on a certain date.

The act is not a primary document because it does not confirm the fact of payment of funds to another person, and its use does not in any way change the financial position of the parties. Essentially, this is a technical document, the use of which in most cases is a voluntary initiative of the accountant.

It is recommended to be used in the following situations:

- long-term cooperation with regular supplies of goods or services;

- concluding several contracts with one partner or drawing up additional agreements to existing contracts;

- provision by the supplier of deferred payment;

- transfer by the buyer of a large amount of prepayment (advance payment) in conditions of regular deliveries;

- very high cost of goods;

- The subject of the contract is a wide range of products.

It is also compiled during the annual or situational inventory of calculations.

In this situation, it is important to understand that debts to debtors and creditors are reflected in the accounting in the amount that is recognized by the enterprise itself as correct on the basis of contracts, orders of managers and primary documents confirming the movement of goods and money. There is no need to send reconciliation statements to all your debtors and creditors to ensure that the amounts match. Moreover, on their basis it will not be possible to make any accounting entries, including adjusting the amount of debt.

An exception is made only for settlements with the budget and banks, which need to be confirmed (clause 74 of the Accounting Regulations).

If for management purposes it is extremely important to oblige your partner to exchange such acts, this procedure, its frequency and penalties for non-compliance must be spelled out in the contract.

If you are interested in how to create a shift schedule, check out this material. Why is it necessary and how is an agreement for the provision of paid services with an individual concluded? Read here.

Instructions for filling out the reconciliation report

In the “header” you need to enter information about the period for which the reconciliation report is being carried out, and also indicate the agreement that served as the basis for the creation of this document. Here you should enter the name of the companies in accordance with the constituent documents (you can without such details as KPP, INN, OGRN, etc.).

The second part of the document includes a table in which each party enters information contained in its accounting records for transfers under the agreement in question or for a certain period of time. They must match completely. Under the table, each company enters its existing debt. This data must also be the same. If there are no debts, this must be noted in writing.

In conclusion, the document must be signed by the heads of the enterprises, with the obligatory indication of positions and a transcript of the signatures. A document drawn up in accordance with all the rules of office work, if signed by the directors of the enterprises, acquires legal force.

When a document is useless

Above we looked at what a reconciliation act is and why it is needed. Next, let's look at the cases in which this paper will be of no use. The court will not accept it for consideration if:

- It does not indicate the reasons for which the debt arose. For example, if the document does not indicate the number of the agreement under which the transaction was made, then the debtor allegedly admits the existence of a debt, but it is not clear in what case.

- The act is the only document that confirms the existence of a debt, it will not be considered. It should be accompanied by other primary documents, for example, invoices, invoices, etc.

- In the document, the parties did not agree on the amounts and there is a discrepancy. Also, if one of the parties does not sign the document, it is considered invalid.

- The act was signed by persons who did not have the right to do this. For example, if the paper was signed by an accountant who does not have the right to do so.

Entrepreneurs must understand that the reconciliation report is one of the significant tools for protecting the party providing the installment plan or loan under the current agreement. Therefore, periodically draw up these documents, taking into account the statute of limitations and the conduct of operational activities.

Attention:

We recommend that you include provisions on drawing up acts in the text of the contract. Specify in the contract not only that the document needs to be drawn up, but also the frequency of its preparation, for example, once a month.

Application for a tax reconciliation report

In case of reconciliation with the Federal Tax Service Inspectorate (IFTS), a request for sending a reconciliation report is also required. If the contents of the reconciliation report correspond to the accounting data of the enterprise, the tax authority is obliged to send the report within 10 days. Often, the organization receives a reconciliation report with the Federal Tax Service within 24 hours via communication channels. If there are discrepancies regarding taxes, penalties and fines, then a reconciliation report is issued within 15 working days with the note “Agreed with discrepancies”.

Who is responsible for the act of reconciling settlements with counterparties?

Either party can initiate debt reconciliation with the counterparty. The legislation of the Russian Federation does not oblige organizations to carry out reconciliation with partners, but gives them such a right. Accordingly, it is advisable to regulate the process of reconciliation and establish the frequency of its implementation in agreements between counterparties.

The responsibility for drawing up AS calculations and sending them to counterparties does not always fall on employees of the organization’s accounting department. The manager can delegate these powers to other employees, for example, those who directly work with the firm's partners.

Often, accounting in companies is carried out using specialized programs. In them, settlements with counterparties are recorded on separate sub-accounts ─ cards. If all transactions are entered into the program on time, then unloading turnover for each card is not difficult. Accordingly, the question of who should draw up the AS of calculations does not give rise to controversy.