Who can initiate

Today, the initiative to transfer wages to a bank card can come from both the company’s management and subordinates. Moreover, if the decision is made by the directorate, then it is obliged to notify employees about this in writing in advance. In turn, employees of the organization must write appropriate statements.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Who can pay salary via card?

Salaries can be transferred to a bank card to any person officially working in an institution, regardless of the type of employment (for temporary or permanent work, full-time or part-time).

If an employee of an institution has announced his desire for the company’s accounting department to transfer his salary to a bank card, he is obliged to formalize his intention by sending a corresponding petition, displaying the details of his bank card. The administration is obliged to accept his request, i.e. refusal in this case is not possible. Also, the transfer does not depend on the type of ownership of the employer (legal entity or individual entrepreneur).

If an employee of an institution does not want his salary to be transferred to the card, he is obliged to notify the boss about this so that he issues an order from the accounting department to pay the employee’s salary at the company’s cash desk.

Why do you need an application to transfer wages to a card?

The legislation of the Russian Federation enshrines the right of an officially employed employee to decide for himself the method of payment of wages.

If the employee has not decided on this point, then management is obliged to issue funds at the company’s cash desk by issuing a cash amount. The employee is also given the right to choose the bank in which he wishes to be serviced. He has the right to change the bank card details at his own discretion. The only responsibility of the subordinate in this case is to timely notify management of his intention to receive a method of receiving his salary and display the bank details in the submitted application, no less than 5 days in advance.

An application for salary transfer to a bank card is required in order to:

- The head of the company issued an order to the accounting department on the method of payment for the work performed by the employed person.

- There were no complaints from the employee regarding the method of issuing wages (the employee has the right to express a desire to receive wages, either in cash (at the company’s cash desk) or by transfer to a card).

- To avoid errors in transferring wages to the card (the employee must clearly display the details of his bank account and card number in the application).

Such a petition must be submitted even if this method of remuneration is reflected in the employment contract.

Note. The request to transfer salary to a bank card is regulated by Art. 136 of the Labor Code of the Russian Federation and plays an important role in the process of mutual settlements between an employer and a subordinate, therefore it is recommended not to neglect this provision.

Why write a statement?

The management of the enterprise does not have the right to impose terms of labor relations on subordinates that were not initially specified in the employment contract. All changes must occur only with the mutual consent of both parties.

Thus, a written application for the transfer of wages to a bank card will indicate that the company employee expresses his voluntary will to do so. In this case, there is no need to draw up an additional agreement to the employment contract regarding the changes that have occurred, since the application itself will be an integral annex to it.

In this case, the money must be transferred strictly according to the details specified in the application. If suddenly funds are used for other purposes, the responsibility for this lies with the employee who made a mistake when processing the payment (i.e., a specialist in the accounting department).

conclusions

An officially employed citizen has the right to independently choose how he will receive his salary.

If it becomes necessary to replace the cash payment method with a non-cash one, he must provide the employer with a special application.

The latter is obliged to satisfy the employee’s request.

In the document, the applicant must indicate all the necessary information and also attach accompanying papers. You can only get a refusal from management if you violate these rules.

Advantages of transferring salary to a card

Transferring wages to an employee’s bank card has its obvious advantages over issuing funds in cash.

Firstly, you don’t need to stand in line at the cash register twice a month - money is transferred almost instantly, and secondly, you don’t have to carry large amounts of cash with you (which can be dangerous). Thirdly, with the help of a salary card it is easier, if necessary, to obtain a loan from a servicing bank (at the same time, the interest may be slightly lower than usual, and a deposit can be opened on more favorable terms).

Advantages and disadvantages

The advantages of the non-cash method of receiving wages are obvious:

- there is no need to stand in line for money and waste your time;

- the employee does not have to keep a large amount of money with him;

- Credit organizations often provide special conditions for salary clients, for example, a lower interest rate on the loan.

As for the disadvantages of this method, they are very subjective. For example, many older people are suspicious of new technologies; due to their age, they cannot understand the nuances of wire transfers or withdrawing funds from ATMs.

Is it possible to change the card

In most cases, employers independently choose a bank credit institution in which staff accounts will be opened to transfer salaries.

However, every company employee who receives monetary remuneration for work on a bank card has the right to change the credit institution in which he is served at any time.

The accounting department of the employing enterprise is obliged to accept the new details and subsequently transfer wages using them. The exception is those cases when the conditions on the form of payment of wages are specified in local regulations - an employment or collective agreement.

Basic conditions

Cash or non-cash forms of payment of remuneration for labor is a condition that is necessarily specified in the employment contract. Sometimes it is indicated in a collective agreement.

IMPORTANT!

The nature of the amounts that will be transferred to the employee’s account from the employer, as a rule, is not indicated. For example, transferring travel allowances to a salary card is carried out without any special reservation.

As a rule, an organization chooses one bank in which it conducts a salary project for all employees. But, according to the mentioned Article 136, each employee has the right to change the credit institution upon application.

The employer has no right to refuse, nor does it have the right to oblige the use of non-cash payments. But some managers are trying to get around this provision: they include a clause in the employment contract about receiving payments through a specific bank. It is illegal and permissible to challenge such a condition in court.

Is it allowed to transfer salary to a card belonging to another person?

The legislation of the Russian Federation does not prohibit the transfer of wages to the card of another person (for example, one of the employee’s relatives).

In this case, the procedure for registering the transfer of monetary reward to a bank card occurs in the same order, only when specifying the details, data from a third party’s card is entered. In addition, the applicant must also attach to the application a notarized power of attorney on behalf of the person to whose card the money will be transferred.

At the same time, you should understand the difference between the desire of an employee of an enterprise to transfer funds to another person’s card and his obligation to do so. The latter arises in the case of payments in the form of compensation for moral and material damage, payment of alimony, as well as fines or loan debts.

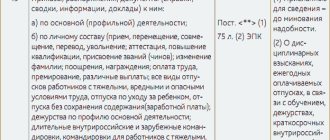

Sample of writing an application for transfer of salary to a bank card

This application can be completed on a computer or written by hand. If the document is printed, the employee will have to sign in person.

You might be interested in:

Payroll taxes: what does the employee pay and what does the employer pay in 2020, the timing of their payment to the budget

The application must be completed from the top of the sheet, its right corner. First, it is written down there - for whom the document is being drawn up, you need to indicate the name of the company, the position of the manager and his full name. This information is entered in the dative case.

In the same part of the sheet, but a little lower, you also need to write down who the author of the application is - the position of the employee and his full name. This is written in the genitive case.

Next you need to step back a little and write the name of the document - “Application”.

The text of the application is written on the red line. Usually it begins with the following phrase: “Please transfer my wages using the following details.” It is advisable, but not strictly necessary, to make a reference to the regulating article. 136 Labor Code of the Russian Federation.

Next, put a colon and list the necessary details:

- Checking account;

- Correspondent account;

- Bank's name;

- BIC;

- TIN and checkpoint;

- Card number;

- FULL NAME. card holder.

If these details exist in the form of a printout (for example, from a bank or online account), then you do not need to rewrite them, but indicate “according to the attached details.” In this case, just below you need to indicate that the attachment to the application contains the details of the employee’s bank card.

The application is signed by the employee and then submitted to the manager for approval.

Sample application

If you want to receive your salary on a bank card and you need to write a corresponding application, look at his example - taking it into account and reading the comments, you can easily create the form you need.

- First of all, write in the application to whom it is intended: the name of the organization (full or abbreviated - it does not matter), then the position and full name of the manager (or the employee temporarily performing his functions).

- Next, enter your own data in the same way.

- After this, proceed to the main part - here, first make your actual request to transfer money to the card.

- Then indicate from what date you would like your salary to be transferred by bank transfer.

- Then enter your card details.

- In conclusion, indicate your position, sign (be sure to include a transcript of the signature) and date the document.

Structure and requirements

The application form for transferring earned funds to a card must comply with the following structure:

- First of all, the head of the application indicates the official of the employer's organization to whom it is intended (name of the enterprise, surname and initials of the manager or employee performing his duties, as well as his position).

- Here in the header the information of the applicant (position, surname and initials) is indicated.

- After this, the main part of the application is filled out. It is necessary to indicate a specific request, namely, the transfer of wages in non-cash form. The text must indicate information about the legality of the request, namely a link to Article 136 of the Labor Code of the Russian Federation.

- The bank account details must then be listed.

- Date of application and signature of the applicant.

After receiving the application, the employer must certify that the document was received and put on it an incoming number with the date of receipt.

There is no unified application form, so if the employer does not provide a sample or template, it must be filled out in any form. The document can be either handwritten or printed.

Documents for download (free)

- Sample application for transfer of salary to card

There are no strict requirements for when to submit an application. It can be drawn up either at the very beginning of your working life or at any other time. The main thing is that the employer and employee need to have this statement.

If the employee does not want to receive wages in cash, there is no need for the document in question.

Who pays for the translation

Bank transfers require payment of a transaction fee. The employer is obliged to pay it himself, without in any case deducting from the employee’s salary.

Even if the banking organization chosen by a working citizen is not included in the company’s salary project system, the law prohibits imposing the obligation to pay a commission on an employee. Accounting allows such expenses to be classified as non-operating expenses.

Attention! Salary indexation calculator (Article 134 of the Labor Code of the Russian Federation)

Application when changing bank

The credit organization involved in transferring wages can be replaced by another employee. Federal Law No. 333 of November 4, 2014 allows such actions.

To avoid erroneous transfers, the employer should be notified in writing in time about the change of bank - no later than 5 days before the payment is calculated.

This procedure prevents incorrect transfer of salaries to outdated details.

If a timely notified employer nevertheless makes such a mistake, the following consequences are possible for him:

- payment of interest for failure to pay wages;

- punishment according to the Code of Administrative Offenses of the Russian Federation.

Important! If the employer was notified of a change in payment details later than 5 days, he has the right to make the nearest transfer using previously known data, and take into account the new details when making the next payment.