Does the organization have the right to withhold and transfer to the budget personal income tax amounts from wages for the first half of the month? In what order is income taxed in the form of the actual value of a share in the authorized capital of a company received by a participant upon leaving it? Is an organization recognized as a tax agent when paying an employee income for performing remote work abroad? What conditions are provided for the exemption of financial assistance amounts from taxation? How are daily allowances paid in foreign currency in excess of the established limit taxed? What is the procedure for reducing personal income tax by the amount of trade tax paid by individual entrepreneurs? You will learn about the opinion of the regulatory authorities on these issues from the presented article.

Is it legal to transfer personal income tax from wages for the first half of the month?

According to the rules of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective and labor agreements.

Based on paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which the taxpayer received income are required to calculate, withhold from the taxpayer and pay personal income tax.

Employers are usually interested in the question of whether it is necessary to withhold and transfer personal income tax from wages for the first half of the month. The position of the controllers is clear: when paying wages for the first half of the month (advance), there is no need to withhold personal income tax (letters from the Ministry of Finance of the Russian Federation dated April 10, 2015 No. 03-04-06/20406, dated July 10, 2014 No. 03-04-06/33737). In practice, a situation is possible when an employee, having worked the first half of the month and received a salary, goes on unpaid leave or sick leave. In this case, there is nothing to withhold personal income tax from, calculated but not withheld from wages for the first half of the month.

In this regard, some employers issue an advance minus personal income tax.

Let us turn to Letter No. 03‑04‑06/42063 dated 07/22/2015, in which the Ministry of Finance considered the issue of the deadline for transferring personal income tax to the budget from salaries paid to employees twice a month (for hours worked in both the first and second half of the month is withheld by personal income tax).

The Ministry of Finance drew attention to clause 3 of Art. 226 of the Tax Code of the Russian Federation, according to which tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income in respect of which the tax rate established by paragraph 1 of Art. 224 of the Tax Code of the Russian Federation, accrued to the taxpayer for a given period, with the offset of the amount of tax withheld in previous months of the current tax period. Taking into account the above, on the last day of the month for which the taxpayer was accrued income in the form of wages, the tax agent calculates the tax amount. Before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Accordingly, the tax cannot be calculated until the end of the month.

Tax agents are required to withhold the calculated amount of tax directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). Thus, the tax agent withholds the amount of tax calculated at the end of the month from the taxpayer only when it is actually paid after the end of the month for which this amount of tax was calculated.

By virtue of para. 1 clause 6 art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or (on his instructions) to the accounts of third parties in banks.

The date of actual receipt by the taxpayer of income in the form of wages is the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement (contract) (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Based on the foregoing, the Ministry of Finance came to the conclusion: when an employer pays wages for the previous month, it is necessary to withhold the tax calculated for the previous month and, depending on the method of making payments to employees, transfer it to the budget either on the day of receipt of cash from the bank, or on the day actual transfer of income from the tax agent's bank account to taxpayers' accounts. Transfer of personal income tax by a tax agent in advance, that is, before the date the taxpayer actually receives income, is not allowed.

Invalid payer status: procedure

All people make mistakes. They can also be done while filling out this document. What to do in this situation was clarified by the Federal Tax Service, which issued an explanatory letter No. SA-4-7/19125 dated October 10, 2016.

Based on the Tax Code of the Russian Federation, it describes in detail the procedure for the actions of a person paying tax in the event of an error when filling out a payment order. This point deserves special attention, since if an error is made, the recipient, represented by a government body, may not receive the funds intended for him, while the funds are written off from the taxpayer’s current account in full.

Late payment of taxes or delay beyond the established period leads to penalties and interest. To avoid this, you need to perform the following procedure, regulated by Art. 45 of the Tax Code of Russia:

- Before submitting a payment order, you must carefully study it again for any errors.

- If an error is detected, you must contact the tax authority office at the place of registration with an application to clarify the payer’s status. In addition to the set of documents, a copy of the original document is attached.

- It is recommended to reconcile tax payments with the Federal Tax Service, at the end of which a report should be drawn up and certified by both parties.

Withholding personal income tax from the actual value of the share when a participant leaves the company.

In the event of a participant leaving the company in accordance with Art. 26 of Federal Law No. 14-FZ[1], his share passes to the company (clause 6.1 of Article 23 of this law). The company is obliged to pay the participant who submitted the application to leave the company, the actual value of his share in the authorized capital of the company, determined on the basis of the company’s financial statements for the last reporting period preceding the day of filing the application to leave the company, or, with the consent of this participant, to issue it to him in in kind property of the same value.

According to paragraph 1 of Art. 26 of Federal Law No. 14-FZ, a participant in a company has the right to leave it by alienating a share to the company, regardless of the consent of its other participants or the company, if this is provided for by the charter of the company.

The right of a participant to leave the company may be established by the charter of the company upon its establishment or amendments to its charter by decision of the general meeting of participants of the company, adopted by all participants unanimously, unless otherwise provided by federal law.

The issue of taxation of personal income tax on income in the form of the actual value of a share in the authorized capital of a company received by a participant upon leaving it was considered by the Ministry of Finance in Letter No. 03-04-06/40675 dated July 15, 2015.

Financial department specialists recalled that, by virtue of Art. 41 of the Tax Code of the Russian Federation, income is recognized as economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed, and determined for individuals in accordance with Chapter. 23 “Tax on personal income” of the Tax Code of the Russian Federation.

The rules of paragraph 1 of Art. 210 of the Tax Code of the Russian Federation provides that when determining the tax base, all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation.

For income taxed at a rate of 13% established by paragraph 1 of Art. 224 of the Tax Code of the Russian Federation, the tax base is defined as the monetary expression of such income subject to taxation, reduced by the amount of tax deductions provided for in Art. 218 – 221 of the Tax Code of the Russian Federation (clause 3 of Article 210 of the Tax Code of the Russian Federation).

At the same time, in the current version of Ch. 23 of the Tax Code of the Russian Federation there is no provision that, when determining the tax base in the event of a participant leaving the company, reducing the income received by him in the form of the actual value of the share by the amount of the contribution to the authorized capital of the company.

Thus, when a participant leaves the company, the actual value of the share paid to him is subject to personal income tax on a general basis on the full amount of income paid.

In addition, the Ministry of Finance drew attention to the provisions of paragraphs 1 and 2 of Art. 226 of the Tax Code of the Russian Federation: Russian organizations from which or as a result of relations with which the taxpayer received income, with the exception of income for which tax is calculated and paid in accordance with Art. 214.3 – 214.6, 226.1, 227, 228 of the Tax Code of the Russian Federation, are obliged to calculate, withhold from the taxpayer and pay the amount of tax calculated in accordance with Art. 224 Tax Code of the Russian Federation. These organizations are tax agents. Since the taxpayer’s income in the form of the actual value of the share, received upon his withdrawal from the company, does not relate to the income provided for by the above-mentioned articles of the Tax Code of the Russian Federation, in relation to such income of the taxpayer, the organization is recognized as a tax agent and is obliged to calculate, withhold from the taxpayer and pay personal income tax in the generally established manner from the full amount of income paid, as well as submit the relevant information to the tax authority.

How to pay personal income tax

The employer must transfer the personal income tax withheld from the employee to the budget of the tax authority with which he is registered. You can find out the bank details of your tax authority using this service.

Organizations that have separate divisions must remit withheld income tax, both to the location of the main office and to the location of each of the divisions.

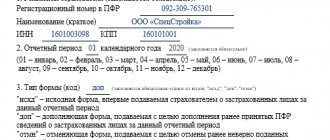

In 2020, employers must use the same BCC to transfer personal income tax as in 2020:

KBK 182 1 0100 110.

Please note that payment of personal income tax at the expense of the employer is not allowed.

Taxation of income in a situation where the employee’s place of work is another state.

Based on clause 2 of Art. 209 of the Tax Code of the Russian Federation, the object of personal income tax taxation is income received:

- for tax residents of the Russian Federation - both from sources in the Russian Federation and from sources outside its borders;

- for individuals who are not tax residents - only from sources in the Russian Federation.

For tax purposes, remuneration for the performance of labor or other duties, work performed, service provided, action performed outside the Russian Federation refers to income received from sources outside the Russian Federation (clause 6, clause 3, article 208 of the Tax Code of the Russian Federation).

The Ministry of Finance, in Letter No. 03-04-06/40525 dated July 15, 2015, considered the issue of an organization fulfilling the duties of a tax agent for personal income tax when paying income to citizens of the Republic of Belarus for performing remote work on its territory.

Officials pointed out: since in this case individuals perform work on the territory of a foreign state, the remuneration they receive for performing labor duties relates to income from sources outside the Russian Federation.

As for the duties of the tax agent, financiers drew attention to clause 2 of Art. 226 of the Tax Code of the Russian Federation: calculation of amounts and payment of tax are carried out in relation to all income of the taxpayer, the source of which is a tax agent (except for income in respect of which calculation of amounts and payment of tax are carried out in accordance with Articles 214.3, 214.4, 214.5, 214.6, 226.1, 227 and 228 of the Tax Code of the Russian Federation).

If individuals who receive income are tax residents of the Russian Federation, the provisions of paragraphs. 3 p. 1 art. 228 of the Tax Code of the Russian Federation, according to which individuals - tax residents of the Russian Federation, receiving income from sources located outside the Russian Federation, calculate, declare and pay personal income tax independently at the end of the tax period.

Taking into account the above standards, the Ministry of Finance concluded: with regard to the income of the organization’s employees in the form of wages received from sources outside the Russian Federation, the employing organization is not recognized as a tax agent. Such an organization cannot be assigned the responsibilities provided for tax agents in Art. 226 Tax Code of the Russian Federation. Moreover, if such persons are not tax residents of the Russian Federation in accordance with Art. 207 of the Tax Code of the Russian Federation, then their income from sources outside the Russian Federation in the form of remuneration under employment contracts for remote work, taking into account clause 2 of Art. 209 of the Tax Code of the Russian Federation are not recognized as subject to personal income tax in the Russian Federation.

Let us note that the Ministry of Finance previously held a similar opinion (see letters dated June 28, 2012 No. 03-04-06/6-183, dated May 10, 2012 No. 03-04-06/6-132, dated October 15, 2012 No. 03-132 04‑06/4-302, dated November 23, 2011 No. 03‑04‑06/6-317, etc.).

Similar clarifications were presented by the financial department regarding the taxation of personal income tax on the income of non-residents of the Russian Federation working under civil contracts, in particular, remuneration of individuals - citizens of the Republic of Belarus, performing work under such contracts on its territory.

In Letter No. 03-04-06/42985 dated July 27, 2015, the Ministry of Finance considered a situation where an organization entered into a civil contract with a citizen of the Republic of Belarus to perform work on the territory of the Republic of Belarus. Officials confirmed: if a person is not recognized as a tax resident of the Russian Federation, his income from sources outside the Russian Federation in the form of remuneration under a civil law agreement is not subject to personal income tax.

Also, issues of taxation of personal income tax on the income of citizens of the Republic of Belarus performing remote work on its territory, including in the form of average earnings saved for the period of business trips and vacations, compensation for early termination of an employment contract, temporary disability benefits, are considered in letters from the Ministry of Finance of the Russian Federation dated 04.08. .2015 No. 03‑04‑06/44849, 03‑04‑06/44852, 03‑04‑06/44855, 03‑04‑06/44857.

Tax agents

Tax agents are persons who are entrusted with the responsibility for calculating, withholding taxes from taxpayers and their further transfer to the state budget.

In Russia, tax agents are recognized as:

- Russian organizations;

- individual entrepreneurs;

- notaries engaged in private practice;

- lawyers who have established law offices;

- separate divisions of foreign companies.

The vast majority of tax agents in Russia are individual entrepreneurs and organizations that are employers.

Employers, acting as tax agents, are required to calculate, withhold and transfer personal income tax to the budget from income paid to their employees.

At the same time, employers must withhold income tax (NDFL) in full from both payments to employees working under employment contracts and from payments to individuals under civil contracts.

Features of taxation of material assistance.

Clause 8.3 of Art. 217 of the Tax Code of the Russian Federation provides for an exemption from personal income tax for amounts of payments (including in the form of material assistance) made to taxpayers in connection with a natural disaster or other emergency, as well as to taxpayers who are family members of persons who died as a result of natural disasters or other emergencies circumstances, regardless of the source of payment.

In Letter No. 03‑04‑06/44861 dated 08/04/2015, the Ministry of Finance considered the issue of taxation of material assistance issued by an organization to an employee in connection with the loss of property in a fire.

According to officials, for the purposes of applying clause 8.3 of Art. 217 of the Tax Code of the Russian Federation, a fire can be classified as a natural disaster or emergency circumstance if its occurrence was not intentional and was not associated with deliberate actions or inaction of individuals affected by the fire claiming exemption from paying personal income tax on the amount of a lump sum payment.

To confirm the fact of a fire that occurred in connection with a natural disaster or emergency, you should contact the relevant authorities to obtain a certificate (in particular, the State Fire Service of the Ministry of Emergency Situations). At the same time, exemption from taxation of lump sum payments received in connection with the loss of the taxpayer’s property in a fire requires confirmation of the relevant fact.

In what cases is personal income tax not paid?

Not subject to income tax:

One-time financial assistance, including at the birth or adoption of a child, if the amount does not exceed 50,000 rubles.

Maternal capital. In some regions, capital is additionally financed from local budgets. You need to file a declaration and pay tax on part of the regional budget.

Income from the sale of agricultural products grown on your own farm. Such income includes income from poultry, wild animals and livestock, crop production, beekeeping and floriculture, nutria and rabbit farming.

Gifts from close relatives and inheritances, sports prizes and tuition fees (if, for example, you received a grant or scholarship). All other gifts and prizes are tax-free if their value does not exceed 4,000 rubles. For example, if a company gives an employee a car, personal income tax must be paid on its cost. And if you gave a watch case for 2500, you don’t need to pay.

Cash assistance for disability from the employer and contributions to the funded labor pension.

For a complete list of tax-free income, see Article 217 of the Tax Code of the Russian Federation.

Personal income tax taxation of excess daily allowances paid in foreign currency.

When the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include daily allowances paid in accordance with the legislation of the Russian Federation, but not more than 700 rubles. for each day of a business trip in the Russian Federation and no more than 2,500 rubles. for each day of being on a business trip abroad (clause 3 of Article 217 of the Tax Code of the Russian Federation).

Amounts of daily allowance paid to an employee in excess of the amounts established by clause 3 of Art. 217 of the Tax Code of the Russian Federation are subject to personal income tax.

In Letter No. 03-04-06/44919 dated 04.08.2015, financiers considered the issue of taxation of daily allowances paid when sent on a business trip abroad in rubles at the exchange rate of the Central Bank of the Russian Federation on the date of payment, if the amount of daily allowances is established in a local regulation in foreign currency.

Officials pointed out: since daily allowance payments are made in rubles and not in foreign currency, the exchange rate of the Central Bank of the Russian Federation on the date of payment of daily allowances does not matter for personal income tax purposes.

Earlier, in the Letter of the Ministry of Finance of the Russian Federation dated April 24, 2015 No. 03-04-08/23689, it was explained that income subject to taxation, taking into account the provisions of clause 3 of Art. 217 of the Tax Code of the Russian Federation is determined by the tax agent organization at the time of approval of the employee’s advance report. When a tax agent determines the tax base for daily allowances paid in foreign currency, amounts in foreign currency are recalculated into rubles at the rate of the Central Bank of the Russian Federation effective on the date of approval of the advance report.

The same conclusions are contained in letters of the Federal Tax Service of the Russian Federation dated 04/07/2015 No. BS-4-11/5737, and the Ministry of Finance of the Russian Federation dated December 29, 2014 No. 03-04-06/68074.

From January 1, 2020, for the purpose of personal income tax assessment, excess daily allowances will be recalculated at the rate of the Central Bank of the Russian Federation on the date of their receipt. This is due to amendments to clause 3 of Art. 226 of the Tax Code of the Russian Federation, adopted by Federal Law No. 113-FZ of May 2, 2015 “On amendments to parts one and two of the Tax Code of the Russian Federation in order to increase the responsibility of tax agents for non-compliance with the requirements of the legislation on taxes and fees.”

Accounting and reporting of employers for personal income tax

The sliders below list the types of reporting that must be submitted for personal income tax employees.

Employers are required to keep internal records of income paid, tax deductions provided, as well as calculated and withheld personal income tax amounts for each employee. This must be done in tax registers.

The tax register form is not approved by law, so organizations and individual entrepreneurs must independently develop their own form of this document (download a sample).

Every year, before April 1, employers are required (based on data filled out in tax registers) to compile and submit to the Federal Tax Service a certificate in form 2-NDFL for each of their employees. 2-NDFL certificates for employees with income that could not be withheld by personal income tax in 2019 must be submitted before March 2, 2020.

Employers must submit 6-NDFL calculations quarterly. The deadline for submission is the last day of the first month of the next quarter.

- 22.06.2017

- Starting a business

- Reporting

Personal income tax is a direct tax of 13% of total income. Paid on all income, wages, benefits, winnings and fees. But there are a number of exceptions when tax is not charged.

Types of tax deductions

All working citizens have standard deductions. These deductions are provided by employers at the beginning of each calendar year. The date of application is not important.

For the first and second child under the age of 18 - 1,400 rubles per month. For the third and further - up to 3,000 rubles for each parent. Single parents are given a double deduction.

Disabled people from childhood, groups 1 and 2, Heroes of Russia and the USSR, holders of the Order of Glory 3rd degree - 500 rubles.

Social deductions are provided after filing a declaration and verifying information. According to Article 219 of the Tax Code of the Russian Federation, all taxpayers have the right to social deductions for expenses on education, charity and treatment.

Property deductions are provided when selling property, purchasing or constructing a house or apartment. When purchasing real estate, the maximum deduction amount does not exceed 2,000,000 rubles, and the deduction is provided once. If the deduction is not used in full, it can be used to purchase another property.

Along with the application to the tax office the following is submitted:

- real estate purchase agreement;

- certificate of ownership or deed of transfer of ownership of real estate;

- payment documents.

The declaration and supporting documents are submitted at the end of the reporting period.

Professional deductions are assigned to persons conducting professional or entrepreneurial activities without forming a legal entity. These are lawyers, notaries, entrepreneurs and specialists conducting private practice in accordance with the established procedure. Documentation confirming the costs of conducting such activities is added to the declaration and application for deduction.

Insurance. Four years ago Sergei bought a car. This year he had an accident, the car was broken into scrap metal. Sergei received an amount from insurance that covered the cost of the car. Now the tax inspectorate requires Sergei to declare and pay personal income tax, since insurance is also income.

Housing. Lisa and Pavel had a dorm room, decorated ½ each. They bought a second room and registered it for a minor child. Then they sold both rooms and bought an apartment. A third of it belongs to the baby. Lisa and Pavel fill out a declaration on behalf of the child for the purchase of a third of the apartment and immediately submit an application for a tax deduction.

According to Chapter 23 of the Tax Code, for sales transactions, all citizens of any age must submit a declaration. The minor child is represented by the parents.

If the income from the sale of a dorm room is greater than the deduction for the cost of purchasing a new home, this amount is subject to tax at a general rate of 13%. The deduction is provided if the new property is purchased in the same year in which the old one is sold.

Last update 2019-06-12 at 12:33

Who is the payer of personal income tax in Russia? How much do different categories of citizens pay personal income tax and is it possible to reduce or return the amounts paid?